Professional Documents

Culture Documents

Financial Mathematics and Derivatives Chapter 6: Loans

Financial Mathematics and Derivatives Chapter 6: Loans

Uploaded by

Felicia PriskillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Mathematics and Derivatives Chapter 6: Loans

Financial Mathematics and Derivatives Chapter 6: Loans

Uploaded by

Felicia PriskillaCopyright:

Available Formats

SIQ2003

Financial Mathematics and Derivatives

Chapter 6: Loans

Lecturer: Nadiah Zabri

Institute of Mathematical Sciences

Faculty of Science

University Malaya

Outline

Amortizing a loan

1 Loan

Varying series of payments

Equal Principle repayments

Final Payments (Baloon and drop payments)

Sinking fund Method of loan repayment

Loan refinancing

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 2

• Loans can be paid by any payment schedule. It will still follow the

basic relationships for loan amortization

𝐼! = 𝑖𝐵!"# 𝑃! = 𝑅! − 𝐼! 𝐵4 = 𝐵456 − 𝑃4

𝐵"

𝐼! = 5%709.19 𝑃! = 200 − 35.46 = 709.19 − 164.54

= 35.46 = 164.54

=544.65

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 6

Another useful relationship:

Especially useful when 𝐵! is harder to compute and when you are given

the 𝑃! 𝑎𝑛𝑑 𝑅! info directly

• You can derive this by doing 𝑃! − 𝑃!"# :

𝑃! − 𝑃!"# = (𝑅! − 𝐵!"# 𝑖) − (𝑅!"# − 𝐵!"$ 𝑖)

= 𝑅! − 𝑅!"# + (𝐵!"$ − 𝐵!"# )i

= 𝑅! − 𝑅!"# + (𝑃!"# )i

𝑃! = (𝑅! − 𝑅!"# ) + 𝑃!"# (1 + 𝑖)

• So for the first repayment of RM200, the following is the

breakdown:

35.46 200

164.54

interest

principal Payment

payment,

repaid, 𝑃! in t=1, 𝑅!

𝐼!

• Over time, the proportion of interest and principle within the

RM200 level payment changes:

-Interest due, 𝐼! reduces

-Principle paid off, 𝑃! increases

Loan Amortizing a Loan

Outstanding balance

§ After some payment(s), there is 2 ways to compute outstanding

balance (OS) or principal at time t, 𝐵# , (after payment at time t is

made)

Ways of evaluating

Outstanding

balance

Retrospective Prospective

method method

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 10

1. Retrospective method. Looking backward considering all payments made

Loan=709.19

t=0 t=1 t=2 t=3 t=4

200 200 200 200

OS balance(t)

=Original principle− 𝐴𝑙𝑙 𝑝𝑟𝑖𝑛𝑐𝑖𝑝𝑙𝑒 𝑝𝑎𝑖𝑑 𝑢𝑝 𝑡𝑜 𝑡𝑖𝑚𝑒 𝑡

= 𝐴𝑉 𝑎𝑡 𝑡𝑖𝑚𝑒 𝑡 𝑜𝑓 𝑙𝑜𝑎𝑛 − 𝐴𝑉 𝑎𝑡 𝑡𝑖𝑚𝑒 𝑡 𝑜𝑓 𝑎𝑙𝑙 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑒𝑑 𝑏𝑒𝑓𝑜𝑟𝑒 𝑎𝑛𝑑 𝑎𝑡 𝑡.

OS balance(t=1)=709.19 − (200 − 709.19 ∗ 0.05) = 709.19 1.05 − 200 = 544.65,

If the periods involve varying interest rate, need to allow for the varying interest.

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 11

Loan Amortizing a Loan

2. Prospective method. Looking forward considering PV at time t of all

remaining payments

Loan=709.19

t=0 t=1 t=2 t=3 t=4

200 200 200 200

OS balance(t=1) = 200𝑎# ⃧ =544.65

If the period involve varying interest rate, need to allow as such

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 12

• Lets make sense of the convenient formula used for 𝐼# and 𝑃# when

loan payments are level:

• 𝐼# = 𝑖𝐵#%"

• If the retrospective method is used to compute 𝐵"$! :

!$' () *)+

𝐵"$! = 200𝑎#$("$!) ⃧ = 𝑅"

(

*n-(t-1) is the number of payments remaining at the beginning of the payment

period

!$' () *)+

So 𝐼" = 𝑖𝐵"$! = 𝑖 ∗ 𝑅" = 𝑅" 1 − 𝑣 #$ "$! .

(

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 13

• So here is an example. A loan is paid with 5 level payment of 1000,

interest rate is 5%.

t 𝐼! 𝑷!

1 1000 1 − 𝑣 " . 1000 𝑣 !

2 1000 1 − 𝑣 # . 1000 𝑣 "

3 1000 1 − 𝑣 $ . 1000 𝑣 #

4 1000 1 − 𝑣 % . 1000 𝑣 $

5 1000 1 − 𝑣 & . 1000 𝑣 %

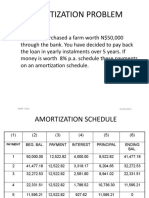

Loan Amortization schedule

1) Interest Content of

Payment at time t = OS

balance at time t-1*i

2) Capital repaid= payment

(1)- interest content of

payment

3) OS balance at time t

Garrett, S. J. (2013)

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 15

Loan for a mthly annuity

§ Loans can also be paid in mthly installments. It is very common

that loans is paid monthly like home /car loan etc.

§ The loan schedule is best derived using mthly effective interest

) (")

rate, j = * .

§ The schedule wont differ from annual schedule but now the time

unit is a portion of the year.

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 16

Varying series of Payments

§ Sometimes payment is less than interest due resulting in negative

amortization which will “capitalizes the interest shortfall”

§ A 3-year loan for $10,000 at 10% annual interest but the payments

are 600, 5000 and 7084. Build the amortization schedule:

Time, t Payment, 𝑹𝒕 Interest Paid, 𝑰𝒕 Principal repaid, 𝑷𝒕 Outstanding

Balance, 𝑩𝒕

0 10,000

1 600 1000 -400 10400

2 5,000 1040 3960 6440

3 7,084 644 6440 0

Total 12,684 2,684 10,000

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 18

Exercise

§ A loan is being repaid by a series of annual non-level payments at

10% effective. The t-th payment is $2,000 and the principal paid

from this payment is $1,000. The next payment is $3,000. How

much principal is contained in this payment?

𝐼# = 𝑅# − 𝑃# =2000-1000=1000

𝐵#%" 10% = 1000

𝐵#%" = 10,000

𝐵# = 𝐵#%" − 𝑃# = 10,000 − 1000 = 9000

Next Payment is

𝑅#+" = 𝐼#+" + 𝑃#+" =3000= 𝐵# ×10%+ 𝑃#+" =900+ 𝑃#+"

𝑃#+" = 3000 − 900 = 2100

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 19

Equal principal repayments (special case of

Varying payments)

When principle payments is level, how will the monthly payments

be?

Increasing Or Decreasing

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 20

Exercise

A loan of $10,000 is being repaid over 10 years by equal principal

payments plus interest on unpaid balance at an effective rate of i. If

the total interest paid in the 3rd to 8th years, inclusive is 2541,

determine i.

8000i+7000i+….3000i=2541

Arithmetic progression formula:

n(,$+ ,%) 6(.///)+ 0///))

= =33,000i=2541

- -

i=7.7%

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 21

Final Payment ( Baloon or drop payments)

§ For a level payment, usually the Payment is not a nice round number.

§ Common way is to choose a good round number as payment and then

adjust the final payment accordingly to settle the last OS balance.

1. A final payment larger than the

regular amount. This is called a balloon

payment.

2. A final payment smaller than the

regular amount. This is called a drop

payment.

§ To calculate the last payment, first need to: determine OS balance after

the last regular payment, then allow of interest earned between 2nd last

and last payment

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 22

Example

§ A loan of $10,000 is to be repaid at 5% effective by payments of

$1,000 at the end of each year until the loan is repaid.

n is supposed to be 14.2

Option 1: A final payment with larger than regular, at time 14

(balloon payment)

𝐵"! = 𝐴𝑉 𝑙𝑜𝑎𝑛 𝑎𝑡 𝑡𝑖𝑚𝑒 14 − 𝐴𝑉 𝑎𝑙𝑙 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑚𝑎𝑑𝑒 𝑎𝑡 𝑡𝑖𝑚𝑒 14

= 10,000*(1.05)"! − 1000 𝑠"! ⃧ =200.68

So payment at time 14 is 1000+200.68=1200.68

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 23

§ Option 2, A final payment smaller than regular at time 15.(drop

payment)

If the drop payment is paid following normal payment interval, then the

last payment will be:

AV of loan balance after last regular payment, to last payment time=

𝐵#, a(14,15)=200.68*(1.05)

As usual, last payment will include=

1) Interest= 𝐵!"# *i=200.68*0.05

2) Principle=200.68

Sem 1 2022/23 Nadiah Zabri (SIQ2003) 24

You might also like

- FA DCF Modelling Test 1Document17 pagesFA DCF Modelling Test 1honeymakrani220% (1)

- 4-35 Model ProblemDocument18 pages4-35 Model Problemcherishwisdom_997598100% (1)

- Oracle Loans PresentationDocument29 pagesOracle Loans PresentationSridhar MamidipallyNo ratings yet

- Lecture 6 Loan (Auto-Saved)Document48 pagesLecture 6 Loan (Auto-Saved)Felicia PriskillaNo ratings yet

- Lecture 8 Determinants of Interest RatesDocument35 pagesLecture 8 Determinants of Interest RatesFelicia PriskillaNo ratings yet

- Chapter 4Document8 pagesChapter 4Aqilah Nur15No ratings yet

- The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010Document31 pagesThe Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010Kefira SlackaNo ratings yet

- Chapter 6 - Amortization and Sinking FundsDocument10 pagesChapter 6 - Amortization and Sinking FundsAreeba AhsanNo ratings yet

- Lesson 3 - Personal LoanDocument45 pagesLesson 3 - Personal Loanrara wongNo ratings yet

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneyThu PhươngNo ratings yet

- Long-Term Debt FinancingDocument53 pagesLong-Term Debt FinancingGaluh Boga KuswaraNo ratings yet

- HaftaDocument38 pagesHaftahasansekercioglu03No ratings yet

- Time Value of Money: Cash Flow DiagramDocument23 pagesTime Value of Money: Cash Flow DiagrambasitNo ratings yet

- Lecture No. 6Document17 pagesLecture No. 6Mohsin IqbalNo ratings yet

- Ch1 Lecture NotesDocument44 pagesCh1 Lecture NotesSarfraz AhmedNo ratings yet

- Financial Analyst G&M - Real Estate Test & Case StudyDocument19 pagesFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahNo ratings yet

- 16.interest CalculationDocument27 pages16.interest Calculationpugal3232No ratings yet

- Track 7 Financial CalculationsDocument30 pagesTrack 7 Financial CalculationsGreg EzeiloNo ratings yet

- LM02 Fixed-Income Cash Flows and Types IFT NotesDocument13 pagesLM02 Fixed-Income Cash Flows and Types IFT NotesClaptrapjackNo ratings yet

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDocument6 pagesLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNo ratings yet

- Chapter 3 - Cash Flow, Interest and EquivalenceDocument9 pagesChapter 3 - Cash Flow, Interest and EquivalenceSandip100% (1)

- Promissory NotesDocument5 pagesPromissory NotesAmirul SyafiqNo ratings yet

- TAIFEX Interest Rate Derivatives Valuation in Modern World 20201204Document61 pagesTAIFEX Interest Rate Derivatives Valuation in Modern World 20201204Yassine ZAROUINo ratings yet

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneySơn Đặng TháiNo ratings yet

- FINA2322 Tutorial 6Document5 pagesFINA2322 Tutorial 6华邦盛No ratings yet

- Intro To BondsDocument35 pagesIntro To BondsTahaNo ratings yet

- Fra 3Document7 pagesFra 3Subhajyoti MukhopadhyayNo ratings yet

- Engineering Economics Lecture 3 PDFDocument44 pagesEngineering Economics Lecture 3 PDFNavinPaudelNo ratings yet

- Time Value Ch6Document37 pagesTime Value Ch6anower.hosen61No ratings yet

- Chapter 2 - Interest RatesDocument52 pagesChapter 2 - Interest Ratesnguyennhatminh111975No ratings yet

- AmortizationDocument7 pagesAmortizationCornelius NamuloNo ratings yet

- BMA5008 - Tutorial 1 (SF1 Group 5)Document10 pagesBMA5008 - Tutorial 1 (SF1 Group 5)Mohammed SahilNo ratings yet

- Session 3-Summary PDFDocument4 pagesSession 3-Summary PDFRajAt D Everaj EverajNo ratings yet

- Engineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)Document21 pagesEngineering Economics: Lectures 3 Topics: 1) Time Value of Money 2) Interest Concepts 3) Cash Flow Diagram (CFD)Lahiru Kosala Bandara LindamullaNo ratings yet

- Day 13 and 14 Liabilitiessec1 2024Document35 pagesDay 13 and 14 Liabilitiessec1 2024Kit KatNo ratings yet

- Teknologi Keuangan: Manajemen Rekayasa Fakultas Teknologi Industri IT DelDocument35 pagesTeknologi Keuangan: Manajemen Rekayasa Fakultas Teknologi Industri IT DelNatasya Romauli SilitongaNo ratings yet

- Lecture 2Document28 pagesLecture 2ChatGeePeeTeeNo ratings yet

- Quantitative Techniques For Management: Aditya K BiswasDocument31 pagesQuantitative Techniques For Management: Aditya K BiswasAnamica BhartiNo ratings yet

- Lecture 3 V2Document28 pagesLecture 3 V2Arsalan AhmadNo ratings yet

- BBA2K20: Principles of Business FinanceDocument19 pagesBBA2K20: Principles of Business FinanceMurtaza bhuttoNo ratings yet

- Time Value of MoneyDocument73 pagesTime Value of MoneyZeenat NoorNo ratings yet

- Emgt6225 M1Document70 pagesEmgt6225 M1Vatsal PrakashNo ratings yet

- Banking, Inflation and Exchange Rates Notes and QuestionsDocument22 pagesBanking, Inflation and Exchange Rates Notes and QuestionsKelvinNo ratings yet

- Key Concepts and Skills: Discounted Cash Flow ValuationDocument4 pagesKey Concepts and Skills: Discounted Cash Flow Valuationnida younasNo ratings yet

- Lecture 3Document28 pagesLecture 3sandhurstalabNo ratings yet

- Financial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)Document24 pagesFinancial Analyst G&M - Real Estate Test & Case Study (SUMAN SAURABH)sourabh sinhaNo ratings yet

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022Document38 pagesBCO126 Mathematics of Finance: 3 Ects Spring Semester 2022summerNo ratings yet

- Chapter - 4 - Cash Flow and InterestDocument19 pagesChapter - 4 - Cash Flow and InterestAhmed freshekNo ratings yet

- Forward & Futures Print OutDocument52 pagesForward & Futures Print OutAshish MalhotraNo ratings yet

- WN 1: Computation of FRA RateDocument5 pagesWN 1: Computation of FRA RateBharat GudlaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- Module 2Document60 pagesModule 2lizNo ratings yet

- TTF Engecon ch4Document9 pagesTTF Engecon ch4Tewelde WorkuNo ratings yet

- SDO Imus City LeaP ABM Business Finance Week 7Document4 pagesSDO Imus City LeaP ABM Business Finance Week 7Kate Denzel ApolinarioNo ratings yet

- Quantitative Techniques For Management: Aditya K BiswasDocument22 pagesQuantitative Techniques For Management: Aditya K BiswasAnamica BhartiNo ratings yet

- AmortizationDocument41 pagesAmortizationrichmond buquingNo ratings yet

- Chapter 3 Time Value of MoneyDocument21 pagesChapter 3 Time Value of Moneyndc6105058No ratings yet

- © 2013 Mcgraw-Hill Ryerson LimitedDocument19 pages© 2013 Mcgraw-Hill Ryerson LimitedSandraNo ratings yet

- MA170 Chapter 4 & 5Document15 pagesMA170 Chapter 4 & 5ishanissantaNo ratings yet

- Feedback and Warm-Up Review: - Feedback of Your Requests - Cash Flow - Cash Flow Diagrams - Economic EquivalenceDocument30 pagesFeedback and Warm-Up Review: - Feedback of Your Requests - Cash Flow - Cash Flow Diagrams - Economic EquivalenceSajid IqbalNo ratings yet

- PR 1 Punya TyoDocument1 pagePR 1 Punya TyoFelicia PriskillaNo ratings yet

- Ags 23 - A10Document4 pagesAgs 23 - A10Felicia PriskillaNo ratings yet

- Theory of InterestDocument3 pagesTheory of InterestFelicia PriskillaNo ratings yet

- Lecture 8 Determinants of Interest RatesDocument35 pagesLecture 8 Determinants of Interest RatesFelicia PriskillaNo ratings yet

- 5mfz SampleDocument46 pages5mfz SampledutersNo ratings yet

- Bank of The Philippine Islands vs. Sarabia Manor HotelDocument23 pagesBank of The Philippine Islands vs. Sarabia Manor Hotelpoiuytrewq9115No ratings yet

- Print Amortization Schedule CalculatorDocument1 pagePrint Amortization Schedule Calculatorsbb anbwNo ratings yet

- 120619ER63130633Document2 pages120619ER63130633Prakalp TechnologiesNo ratings yet

- Financial Mathematics For ActuariesDocument62 pagesFinancial Mathematics For ActuariesbreezeeeNo ratings yet

- Case 3 - Huston, CDocument24 pagesCase 3 - Huston, CCaden HustonNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet

- 3 - Loan Repayment Methods - 0 PDFDocument30 pages3 - Loan Repayment Methods - 0 PDFPremium ProductsNo ratings yet

- 200 249 PDFDocument50 pages200 249 PDFSamuel0% (1)

- Implementing Rules and Regulations of The Bayanihan ActDocument4 pagesImplementing Rules and Regulations of The Bayanihan ActArya PadrinoNo ratings yet

- Mortgage Paper For Math 1030 Final DraftDocument6 pagesMortgage Paper For Math 1030 Final Draftapi-192510247No ratings yet

- (Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamDocument51 pages(Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamMuhammad Ramiz AminNo ratings yet

- BB202 Lecture 5 (New) PDFDocument18 pagesBB202 Lecture 5 (New) PDFUyên PhạmNo ratings yet

- Loan Amortization Schedule - LDocument8 pagesLoan Amortization Schedule - Lrizwan6261No ratings yet

- Monthly Annual: Effective Interest Rate (Eir)Document26 pagesMonthly Annual: Effective Interest Rate (Eir)GilbertGalopeNo ratings yet

- Amortization Schedules: Creating An Amortization ScheduleDocument2 pagesAmortization Schedules: Creating An Amortization ScheduleJemuel Villareal GuillermoNo ratings yet

- Materi TVM 1 Dan TVM 2 PDFDocument73 pagesMateri TVM 1 Dan TVM 2 PDFamirah muthiaNo ratings yet

- Loan Amortization ScheduleDocument5 pagesLoan Amortization SchedulemeetleoNo ratings yet

- Toyota Financial Calculate InterestDocument6 pagesToyota Financial Calculate InterestShashank BelvadiNo ratings yet

- Time Value of Money Illustrations UpdatedDocument51 pagesTime Value of Money Illustrations Updatedveer_sNo ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-317485992No ratings yet

- AmortizationDocument2 pagesAmortizationSonuBajajNo ratings yet

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNo ratings yet

- Loan Amortization Schedule ABC LoanDocument8 pagesLoan Amortization Schedule ABC LoanThalia SandersNo ratings yet

- Discounted Cash Flows and ValuationDocument31 pagesDiscounted Cash Flows and ValuationkamranNo ratings yet

- FinanceDocument81 pagesFinanceAyesha GuptaNo ratings yet

- The Mathematics of Finance: (Reference: Chapter 11 of Mathematical Excursions by Aufmann)Document55 pagesThe Mathematics of Finance: (Reference: Chapter 11 of Mathematical Excursions by Aufmann)Gil John Awisen100% (1)

- Course: BSAIS-1 Instructor: Engr. Danilo F. Sindac, JR.: Economic Development The Amortization ScheduleDocument3 pagesCourse: BSAIS-1 Instructor: Engr. Danilo F. Sindac, JR.: Economic Development The Amortization ScheduleAj LontocNo ratings yet