Professional Documents

Culture Documents

Summarised-Structure of Entities Covered in PE in DTAA's

Summarised-Structure of Entities Covered in PE in DTAA's

Uploaded by

NEHA SHARMAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summarised-Structure of Entities Covered in PE in DTAA's

Summarised-Structure of Entities Covered in PE in DTAA's

Uploaded by

NEHA SHARMACopyright:

Available Formats

Summarised Research with respect to Article 5 (PE) in the below mentioned DTAAs with India

S.

Particulars Denmark Germany Singapore UK USA Cyprus

No.

The definition of PE is similar in all these treaties.

1. Meaning/Definition Any fixed place of business through which the business of an enterprise is wholly or partly carried on.

The Treaties have a narrower definition than the definitions mentioned in respective nation’s taxation laws.

Major Components mentioned in inclusive definition of PE under Article 5(2) of all treaties:

Yes Yes Yes Yes Yes Yes

Place of Management

Yes Yes Yes Yes Yes Yes

Branch or Office

Yes Yes Yes Yes Yes Yes

Factory or workshop

Fixed place solely for the No No No No No No

purpose of purchasing goods

or merchandise

Fixed place solely for the No No No No No No

purpose of maintenance of a

stock of goods

Yes Yes Yes Yes Yes Yes

(If duration more (If duration more (If duration more (If duration (If duration (If duration

Building site or construction

than 183 days) than 6 months) than 183 days in more than 6 more than more than 6

any fiscal year.) months) 120 days) months)

Witholding Tax Rates

(tax charge for Companies/ tax charge for individuals and all other cases)

10% (standard rate is 15%/10% 15%/25%

Dividend

given)

10% 10%/15% 10%/15%

Interest

10% 15%/10% 10%/15%

Royalty

Fee for Technical Services 10% 15%/10% Not covered

(FTS) under DTAA

You might also like

- QuizprelimDocument73 pagesQuizprelimGoal Digger Squad Vlog100% (5)

- 5Document11 pages5mariyha PalangganaNo ratings yet

- DTTL Tax Holdco Matrix EuropeDocument56 pagesDTTL Tax Holdco Matrix EuropeAnton KoublytskiNo ratings yet

- MASTER Web Guide For Diplomats in DK 12062020Document59 pagesMASTER Web Guide For Diplomats in DK 12062020Haendel Sebastian RodriguezNo ratings yet

- One Ibc United Arab Emirates Local Company Commercial Trading or Professional License Ratecard 1702440147Document2 pagesOne Ibc United Arab Emirates Local Company Commercial Trading or Professional License Ratecard 1702440147duvan CasteblancoNo ratings yet

- One Ibc United Arab Emirates Local Company General Trading Ratecard 1702440266Document2 pagesOne Ibc United Arab Emirates Local Company General Trading Ratecard 1702440266duvan CasteblancoNo ratings yet

- AC ComparativeDocument2 pagesAC ComparativeAbhishek KumarNo ratings yet

- Motor Trade Road Risks Quote FormDocument5 pagesMotor Trade Road Risks Quote Formiacovbns1No ratings yet

- Botswana Withholding Tax RatesDocument4 pagesBotswana Withholding Tax Ratesjiwon leeNo ratings yet

- GSS Sheet SAMPLEDocument9 pagesGSS Sheet SAMPLERakesh BehuriaNo ratings yet

- One Ibc Delaware Corporation Ratecard 1702438429Document2 pagesOne Ibc Delaware Corporation Ratecard 1702438429duvan CasteblancoNo ratings yet

- One Ibc Delaware Limited Liability Company Ratecard 1702438342Document2 pagesOne Ibc Delaware Limited Liability Company Ratecard 1702438342duvan CasteblancoNo ratings yet

- MT RR CG PresentationDocument10 pagesMT RR CG PresentationDave KilbrideNo ratings yet

- Gss Sheet SampleDocument9 pagesGss Sheet Sampledr.kabirdevNo ratings yet

- GEM Package 2024Document1 pageGEM Package 2024murali972No ratings yet

- AIMA Salary Cert - 2019Document1 pageAIMA Salary Cert - 2019Pauhgf MuloNo ratings yet

- Divya Designo Tiles 201920 ItrDocument61 pagesDivya Designo Tiles 201920 ItrSuman jhaNo ratings yet

- GSS To Be BuyDocument9 pagesGSS To Be BuyRakesh BehuriaNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document64 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- Eicher MotorsDocument74 pagesEicher MotorsKiranNo ratings yet

- Twenty Mile Contractors Supplemental 052720Document6 pagesTwenty Mile Contractors Supplemental 052720marNo ratings yet

- 1 Equity Analysis and ValuationDocument93 pages1 Equity Analysis and ValuationrishavNo ratings yet

- Titan CompanyDocument74 pagesTitan CompanyKiranNo ratings yet

- Page IndustriesDocument74 pagesPage IndustriesKiranNo ratings yet

- LABP0306Document12 pagesLABP0306Mr. JalilNo ratings yet

- Set Up A Car Showroom: Requirements Estimate of BusinessDocument4 pagesSet Up A Car Showroom: Requirements Estimate of Businessraviharsha19884495No ratings yet

- Pidilite IndsDocument73 pagesPidilite IndsKiranNo ratings yet

- Tax RatesDocument2 pagesTax RatesSalma GurarNo ratings yet

- Relaxo FootwearDocument74 pagesRelaxo FootwearKiranNo ratings yet

- 2pipsfx SOA 05.03.2024 1 3Document2 pages2pipsfx SOA 05.03.2024 1 3Mathias Salazar GutierrezNo ratings yet

- One Ibc Switzerland Stock Corporation Ratecard 1702436730Document2 pagesOne Ibc Switzerland Stock Corporation Ratecard 1702436730duvan CasteblancoNo ratings yet

- GST Unit 2 ADocument46 pagesGST Unit 2 AMukul BhatnagarNo ratings yet

- 2023 - 09 - 15 3 - 12 PM Office LensDocument2 pages2023 - 09 - 15 3 - 12 PM Office Lensbharani.mudomsNo ratings yet

- Nestle IndiaDocument74 pagesNestle IndiaKiranNo ratings yet

- MAT Smart Notes - Yash KhandelwalDocument7 pagesMAT Smart Notes - Yash Khandelwalfamnas RahmanNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Franchise - ModelDocument4 pagesFranchise - ModelLokesh JainNo ratings yet

- Ghana - Corporate - Withholding TaxesDocument3 pagesGhana - Corporate - Withholding TaxesFrancisNo ratings yet

- Catering Liability Proposal FormDocument4 pagesCatering Liability Proposal FormmxtimsNo ratings yet

- Doing Business in MoroccoDocument11 pagesDoing Business in Moroccobh adviserNo ratings yet

- Form PDF 297846460200321Document63 pagesForm PDF 297846460200321anupam soniNo ratings yet

- Tax Considerations On Transfers of Unlisted Shares of StockDocument3 pagesTax Considerations On Transfers of Unlisted Shares of StockCarmel LouiseNo ratings yet

- Form PDF 168391951200919Document62 pagesForm PDF 168391951200919ashokbehera708No ratings yet

- Scenario Testing SR Ekspsi V2Document17 pagesScenario Testing SR Ekspsi V2ikhsanhaikal2399No ratings yet

- WIRC Basics TPDocument84 pagesWIRC Basics TPCA Hiralal ArsiddhaNo ratings yet

- Heavy Engineering Corporation Limited: Ancillary & Contract DepartmentDocument1 pageHeavy Engineering Corporation Limited: Ancillary & Contract DepartmentShaswat HECNo ratings yet

- Tax TreatyDocument54 pagesTax TreatyDevin WinataNo ratings yet

- Tax Questionnaire For General InvestmentsDocument10 pagesTax Questionnaire For General InvestmentsJhonatanMedinaNo ratings yet

- Yield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsDocument1 pageYield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsChimmy ParkNo ratings yet

- Sample Acca Compliance QuestionnaireDocument10 pagesSample Acca Compliance QuestionnaireEmily YeeNo ratings yet

- Notes PFA 12th BK Partnership Final Accounts Digital Notes PDFDocument40 pagesNotes PFA 12th BK Partnership Final Accounts Digital Notes PDFTanya SinghNo ratings yet

- Arrowhead Supplemental Application - Full VersionDocument11 pagesArrowhead Supplemental Application - Full Versionerikwilliams0627No ratings yet

- One Ibc United Arab Emirates Dubai Free Zone Ratecard 1702439904Document2 pagesOne Ibc United Arab Emirates Dubai Free Zone Ratecard 1702439904duvan CasteblancoNo ratings yet

- Taxation of Business Profits & The Concept of PE: Ifm - Faculty of Economics and Management Sciences (Fems) Lecture FourDocument19 pagesTaxation of Business Profits & The Concept of PE: Ifm - Faculty of Economics and Management Sciences (Fems) Lecture FourGeorgeNo ratings yet

- A General FCFF Valuation Model An N-Stage ModelDocument17 pagesA General FCFF Valuation Model An N-Stage Modelapi-3763138No ratings yet

- Floor Cleaning Daily RegisterDocument15 pagesFloor Cleaning Daily RegisterSudhir PatelNo ratings yet

- Roofing Contract 16Document5 pagesRoofing Contract 16Navinn SomaalNo ratings yet

- Usli Restaurant and Bar AppDocument8 pagesUsli Restaurant and Bar AppGsu InimaNo ratings yet

- Asian PaintsDocument74 pagesAsian PaintsKiranNo ratings yet

- Finance Act 2023 - UpdatedDocument8 pagesFinance Act 2023 - UpdatedAnnapoorani SNo ratings yet

- Investment Gyan G1 - 9Document22 pagesInvestment Gyan G1 - 9ayub18290No ratings yet

- Practice - Exam AnswersDocument1 pagePractice - Exam Answers甜瓜No ratings yet

- Introduction To IPDocument11 pagesIntroduction To IPNEHA SHARMANo ratings yet

- Compounding of Offences - Law Times JournalDocument6 pagesCompounding of Offences - Law Times JournalNEHA SHARMANo ratings yet

- 5 Theories of PunishmentDocument10 pages5 Theories of PunishmentNEHA SHARMA100% (1)

- Research ConvictionsDocument7 pagesResearch ConvictionsNEHA SHARMANo ratings yet

- It Act Sec. 67Document5 pagesIt Act Sec. 67NEHA SHARMANo ratings yet

- Legal Maxims (Crimes)Document10 pagesLegal Maxims (Crimes)NEHA SHARMANo ratings yet

- Unit1-Indirect TaxDocument4 pagesUnit1-Indirect TaxMd MisbahNo ratings yet

- Correcting Erroneous Information Returns, Form #04.001Document144 pagesCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)

- Starting A Business in The UK As A ForeignerDocument8 pagesStarting A Business in The UK As A ForeignerThe SmartMove2UkNo ratings yet

- ImpactDocument6 pagesImpactYagnesh VaghasiyaNo ratings yet

- Ostensible Ownership The Bone of ContentDocument5 pagesOstensible Ownership The Bone of ContentDarling Pavan KingNo ratings yet

- Reply For Hashim KhanDocument2 pagesReply For Hashim Khanhamza awan0% (1)

- Chapter 1Document22 pagesChapter 1bawarraiNo ratings yet

- Revised BGM On GST Vol2 PDFDocument503 pagesRevised BGM On GST Vol2 PDFJAINo ratings yet

- Macro-NIA NumericalDocument6 pagesMacro-NIA NumericalyashNo ratings yet

- 06 Donors TaxDocument4 pages06 Donors Taxpatburner1108No ratings yet

- Isla Lipana & Co., ITAD BIR Ruling No. 041-21 Dated September 29, 2021Document8 pagesIsla Lipana & Co., ITAD BIR Ruling No. 041-21 Dated September 29, 2021Carlota VillaromanNo ratings yet

- Butuan Sawmill vs. CTADocument2 pagesButuan Sawmill vs. CTARhea CagueteNo ratings yet

- Application Form - One Ilocos SurDocument2 pagesApplication Form - One Ilocos SurPhauline Mhae Sinco BacligNo ratings yet

- Day 3 Lecture SlidesDocument25 pagesDay 3 Lecture SlidesyebegashetNo ratings yet

- Divya Raunak (2119) HistoryDocument10 pagesDivya Raunak (2119) HistoryDivya RounakNo ratings yet

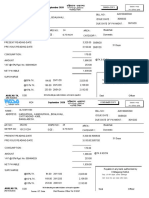

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Functions of Federal Board of Revenue.Document6 pagesFunctions of Federal Board of Revenue.Kamran Khan75% (4)

- Tax Law Assignment Final DraftDocument5 pagesTax Law Assignment Final DraftTatenda MudyanevanaNo ratings yet

- Sem 4 Tax Planning MCQDocument1 pageSem 4 Tax Planning MCQTushar HandeNo ratings yet

- Nahiyan PDFDocument1 pageNahiyan PDFAfzal MahmudNo ratings yet

- Module 15 Assignment 1Document3 pagesModule 15 Assignment 1Bea De ChavezNo ratings yet

- Tax Ordinance Sub Section 114 and 115Document4 pagesTax Ordinance Sub Section 114 and 115faiz kamranNo ratings yet

- Allocation HCS 2022 16.10.2023Document5 pagesAllocation HCS 2022 16.10.20231700168No ratings yet

- Tamil Nadu Government Gazette: ExtraordinaryDocument4 pagesTamil Nadu Government Gazette: ExtraordinaryNelson XavierNo ratings yet

- PRIVILEGE and DraftresoDocument3 pagesPRIVILEGE and DraftresoMarielle CorpuzNo ratings yet

- LLB Business Law 2 LG6Document35 pagesLLB Business Law 2 LG6samaratian12No ratings yet

- BIR Ruling 02-07 (Retroactive Application)Document3 pagesBIR Ruling 02-07 (Retroactive Application)Jerwin DaveNo ratings yet