Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsComputation

Computation

Uploaded by

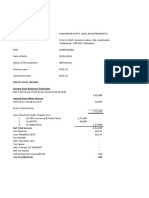

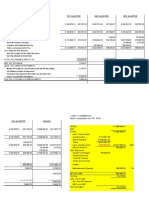

sneh.officialworkNiwas Kumar Verma's income tax return for AY 2023-24 shows a total income of Rs. 3,78,635 consisting of a salary of Rs. 2,50,000 and other income of Rs. 1,28,635. After deductions, the net total income is Rs. 3,78,635 on which the tax liability is Rs. 6,432. However, with TDS of Rs. 2,182, there is a tax refund of Rs. 2,180.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 2023 Individual Tax ReturnDocument31 pages2023 Individual Tax Returnc4tkq8p99g100% (4)

- Marketing Plan For Red BullDocument12 pagesMarketing Plan For Red Bullnirav100% (1)

- International Financial Management - Assignment 1Document2 pagesInternational Financial Management - Assignment 1Ziroat ToshevaNo ratings yet

- FD ReceiptDocument2 pagesFD ReceiptManjit Debbarma100% (1)

- Various Stages of Venture Capital FinancingDocument68 pagesVarious Stages of Venture Capital Financingjoy9crasto91% (11)

- Shukla - AY 2023-24 - COIDocument1 pageShukla - AY 2023-24 - COIankit goenkaNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- G.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.Document8 pagesG.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.JomongNo ratings yet

- 8 Computation of Total Income - AY 2019 20Document1 page8 Computation of Total Income - AY 2019 20karthikkarunanidhi180997No ratings yet

- AY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationDocument3 pagesAY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationGST BACANo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Capital Gain (Gross-Exemption) : Circle Zone Residential StatusDocument16 pagesCapital Gain (Gross-Exemption) : Circle Zone Residential StatusKhadimulHasanTarifNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- ACCT2006 AssignmentDocument17 pagesACCT2006 Assignmentalgiak94No ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Tax On CompensationDocument26 pagesTax On Compensationtyrone inocenteNo ratings yet

- Thormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077Document8 pagesThormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077sudhakar ShakyaNo ratings yet

- Manishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Document3 pagesManishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Sanjay ThakkarNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Computation of Income For The Year Ended As On 31St Mar 2018Document1 pageComputation of Income For The Year Ended As On 31St Mar 2018sanjay kumarNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONprateek gangwaniNo ratings yet

- SampleDocument2 pagesSampleHarue LeeNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and Lossradhika100% (1)

- Statement of Profit and LossDocument2 pagesStatement of Profit and LossradhikaNo ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- C.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. LukesDocument16 pagesC.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. Lukes0506sheltonNo ratings yet

- 10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010Document13 pages10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010AlexandraSoledadNo ratings yet

- FS - G.P Tech - 2079-80Document11 pagesFS - G.P Tech - 2079-80ANISH KAFLENo ratings yet

- Taxable Income: Credit", As FollowsDocument13 pagesTaxable Income: Credit", As FollowsSuzette VillalinoNo ratings yet

- 2017-18 CoiDocument2 pages2017-18 CoiAshok ShahNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Nicc0 23-24Document2 pagesNicc0 23-24tejasgauba1989No ratings yet

- Company: Computation Type: Final Return Tin: Number of Months Accounting DateDocument13 pagesCompany: Computation Type: Final Return Tin: Number of Months Accounting DateHassan OmaryNo ratings yet

- 2017 - 2018 Supreme Court DecisionsDocument1,412 pages2017 - 2018 Supreme Court DecisionsJerwin DaveNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- FS NvidiaDocument22 pagesFS NvidiaReza FachrizalNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Lecture 5 - Corporate Tax 2022Document23 pagesLecture 5 - Corporate Tax 2022Jasne OczyNo ratings yet

- Antonio, Jury - 2019Document4 pagesAntonio, Jury - 2019Rosevie Anne GabayNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Taxation - Management-Cia 1BDocument7 pagesTaxation - Management-Cia 1BAdityansh AbhinavNo ratings yet

- Computation Sheet Income TaxDocument1 pageComputation Sheet Income TaxcaprajwalshettyNo ratings yet

- CA Inter - Advanced Accoounting - Chapter 8 & 9 - AKDocument4 pagesCA Inter - Advanced Accoounting - Chapter 8 & 9 - AKSaraswathi ShanmugarajaNo ratings yet

- E.kedarnath Computation FormatDocument1 pageE.kedarnath Computation FormatCA Anil SahuNo ratings yet

- 16 17 ComputationDocument3 pages16 17 Computationpayal PrajapatiNo ratings yet

- M/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiDocument10 pagesM/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiMadhav Prasad KadelNo ratings yet

- 2018 University - Physicians - Services20210505 13 12cju04Document15 pages2018 University - Physicians - Services20210505 13 12cju04Bluei FaustoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Project 2-Embezzlement of FundsDocument6 pagesProject 2-Embezzlement of FundsabhiramNo ratings yet

- En Casa 2023 q4 Slides-VdefDocument78 pagesEn Casa 2023 q4 Slides-VdefRockyBloomNo ratings yet

- Korzan IC NoteDocument4 pagesKorzan IC NoteMo El-KasarNo ratings yet

- Aim High 4 Second term Model Answer.pdf · إصدار ١Document10 pagesAim High 4 Second term Model Answer.pdf · إصدار ١majidalbadawi6870% (1)

- M.M. Polytechnic, Thergaon, Pune-33: Cloud ComputingDocument14 pagesM.M. Polytechnic, Thergaon, Pune-33: Cloud ComputingaishwaryawaghmaleNo ratings yet

- Brealey 9 e IPPTCh 07Document44 pagesBrealey 9 e IPPTCh 07haidarNo ratings yet

- Onecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilDocument3 pagesOnecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilAbhijeet PatilNo ratings yet

- MGT211 Assignment 1 Solution Spring 2021Document5 pagesMGT211 Assignment 1 Solution Spring 2021Beaming Kids Model schoolNo ratings yet

- FAQ For ISO 20022 March 6Document33 pagesFAQ For ISO 20022 March 6Krishna TelgaveNo ratings yet

- Office: of The SecretaryDocument56 pagesOffice: of The SecretaryRvBombetaNo ratings yet

- LogisticsDocument15 pagesLogisticsAbdiNo ratings yet

- Overview of AuditingDocument7 pagesOverview of Auditingharley_quinn11No ratings yet

- Video - Ice CreamDocument2 pagesVideo - Ice CreamRosy HernandezNo ratings yet

- ExecutivelistDocument132 pagesExecutivelistChinki MathurNo ratings yet

- 2012 Coca-Cola HBC Integrated ReportDocument68 pages2012 Coca-Cola HBC Integrated ReportFrank Hayes100% (1)

- MSB A Office PackageDocument2 pagesMSB A Office Packageanara.aidNo ratings yet

- Why Business FailDocument25 pagesWhy Business Failstevo677No ratings yet

- The Impact of Brand-Related User-Generated Content On Social Media On Online Purchase IntentionsDocument26 pagesThe Impact of Brand-Related User-Generated Content On Social Media On Online Purchase IntentionsPham Thi Yen Vi (K15 CT)No ratings yet

- Empirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaDocument112 pagesEmpirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaAman PeterNo ratings yet

- ResearchDocument41 pagesResearchAbubeker KasimNo ratings yet

- Week 9 Logistics Management - Ch-8 Materials HandlingDocument41 pagesWeek 9 Logistics Management - Ch-8 Materials HandlingImmortal 909No ratings yet

- A Research Proposal On: C.K.Pithawala Institute of Management, SuratDocument4 pagesA Research Proposal On: C.K.Pithawala Institute of Management, SuratDharmesh88No ratings yet

- Test Bank For Understanding Economics 7th Edition by LovewellDocument36 pagesTest Bank For Understanding Economics 7th Edition by Lovewelldianalaglyarw7u4100% (39)

- 9.1 Management of Financial ResourcesDocument22 pages9.1 Management of Financial Resourcesanshumalviya230504No ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- Right of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawDocument86 pagesRight of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawAnirban ChakrabortyNo ratings yet

- Group 2 KitabisaDocument28 pagesGroup 2 KitabisaDIKY RAHMANNo ratings yet

Computation

Computation

Uploaded by

sneh.officialwork0 ratings0% found this document useful (0 votes)

9 views1 pageNiwas Kumar Verma's income tax return for AY 2023-24 shows a total income of Rs. 3,78,635 consisting of a salary of Rs. 2,50,000 and other income of Rs. 1,28,635. After deductions, the net total income is Rs. 3,78,635 on which the tax liability is Rs. 6,432. However, with TDS of Rs. 2,182, there is a tax refund of Rs. 2,180.

Original Description:

Income tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNiwas Kumar Verma's income tax return for AY 2023-24 shows a total income of Rs. 3,78,635 consisting of a salary of Rs. 2,50,000 and other income of Rs. 1,28,635. After deductions, the net total income is Rs. 3,78,635 on which the tax liability is Rs. 6,432. However, with TDS of Rs. 2,182, there is a tax refund of Rs. 2,180.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageComputation

Computation

Uploaded by

sneh.officialworkNiwas Kumar Verma's income tax return for AY 2023-24 shows a total income of Rs. 3,78,635 consisting of a salary of Rs. 2,50,000 and other income of Rs. 1,28,635. After deductions, the net total income is Rs. 3,78,635 on which the tax liability is Rs. 6,432. However, with TDS of Rs. 2,182, there is a tax refund of Rs. 2,180.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

AY 2023-24

Income Tax computation of Niwas Kumar Verma for the A.Y 2023-2024

I Income From Salary 2,50,000

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000) -

Let Out Property

Rent Received

Less: Municipal Taxes

GAV -

Less:30% deduction -

Less: Interest paid (No limit) - -

III Income from Business/Profession

Net surplus -

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses -

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition - -

V Income From other sources

Bank Interest

Any other 1,28,635 1,28,635

Gross Total Income 3,78,635

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments

U/s 80 D

Mediclaim

Other 80G, 80E, 80U -

Net Total Income 3,78,635

Rounded of Income 3,78,640

Tax on Short term gains - -

Tax on Long term gains (with Indexation) - -

Tax on Normal Income 3,78,640 6,432 6,432

Rebate u/s 87A 6,432

Add: education Cess

Total Tax Liability -

Less: TDS 2,182

Advance Tax

Self assesment Tax 2,180

Tax Payable/ (refund) (2,180)

You might also like

- 2023 Individual Tax ReturnDocument31 pages2023 Individual Tax Returnc4tkq8p99g100% (4)

- Marketing Plan For Red BullDocument12 pagesMarketing Plan For Red Bullnirav100% (1)

- International Financial Management - Assignment 1Document2 pagesInternational Financial Management - Assignment 1Ziroat ToshevaNo ratings yet

- FD ReceiptDocument2 pagesFD ReceiptManjit Debbarma100% (1)

- Various Stages of Venture Capital FinancingDocument68 pagesVarious Stages of Venture Capital Financingjoy9crasto91% (11)

- Shukla - AY 2023-24 - COIDocument1 pageShukla - AY 2023-24 - COIankit goenkaNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- G.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.Document8 pagesG.R. No. 205955 University Physicians Services Inc. - Management, Inc., Petitioner Commissioner of Internal Revenue, Respondent Decision Martires, J.JomongNo ratings yet

- 8 Computation of Total Income - AY 2019 20Document1 page8 Computation of Total Income - AY 2019 20karthikkarunanidhi180997No ratings yet

- AY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationDocument3 pagesAY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationGST BACANo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Capital Gain (Gross-Exemption) : Circle Zone Residential StatusDocument16 pagesCapital Gain (Gross-Exemption) : Circle Zone Residential StatusKhadimulHasanTarifNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- ACCT2006 AssignmentDocument17 pagesACCT2006 Assignmentalgiak94No ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Tax On CompensationDocument26 pagesTax On Compensationtyrone inocenteNo ratings yet

- Thormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077Document8 pagesThormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077sudhakar ShakyaNo ratings yet

- Manishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Document3 pagesManishkumar Kumudchandra Dhruve AY 2021-2022: Computation of Income (ITR2)Sanjay ThakkarNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Computation of Income For The Year Ended As On 31St Mar 2018Document1 pageComputation of Income For The Year Ended As On 31St Mar 2018sanjay kumarNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONprateek gangwaniNo ratings yet

- SampleDocument2 pagesSampleHarue LeeNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and Lossradhika100% (1)

- Statement of Profit and LossDocument2 pagesStatement of Profit and LossradhikaNo ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- C.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. LukesDocument16 pagesC.3. G.R. No. 203514-2017-Commissioner - of - Internal - Revenue - v. - St. Lukes0506sheltonNo ratings yet

- 10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010Document13 pages10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010AlexandraSoledadNo ratings yet

- FS - G.P Tech - 2079-80Document11 pagesFS - G.P Tech - 2079-80ANISH KAFLENo ratings yet

- Taxable Income: Credit", As FollowsDocument13 pagesTaxable Income: Credit", As FollowsSuzette VillalinoNo ratings yet

- 2017-18 CoiDocument2 pages2017-18 CoiAshok ShahNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Nicc0 23-24Document2 pagesNicc0 23-24tejasgauba1989No ratings yet

- Company: Computation Type: Final Return Tin: Number of Months Accounting DateDocument13 pagesCompany: Computation Type: Final Return Tin: Number of Months Accounting DateHassan OmaryNo ratings yet

- 2017 - 2018 Supreme Court DecisionsDocument1,412 pages2017 - 2018 Supreme Court DecisionsJerwin DaveNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- FS NvidiaDocument22 pagesFS NvidiaReza FachrizalNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Lecture 5 - Corporate Tax 2022Document23 pagesLecture 5 - Corporate Tax 2022Jasne OczyNo ratings yet

- Antonio, Jury - 2019Document4 pagesAntonio, Jury - 2019Rosevie Anne GabayNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- Taxation - Management-Cia 1BDocument7 pagesTaxation - Management-Cia 1BAdityansh AbhinavNo ratings yet

- Computation Sheet Income TaxDocument1 pageComputation Sheet Income TaxcaprajwalshettyNo ratings yet

- CA Inter - Advanced Accoounting - Chapter 8 & 9 - AKDocument4 pagesCA Inter - Advanced Accoounting - Chapter 8 & 9 - AKSaraswathi ShanmugarajaNo ratings yet

- E.kedarnath Computation FormatDocument1 pageE.kedarnath Computation FormatCA Anil SahuNo ratings yet

- 16 17 ComputationDocument3 pages16 17 Computationpayal PrajapatiNo ratings yet

- M/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiDocument10 pagesM/S Goladi Khola Multipurpose Agriculture Firm: Pokhara-33, KaskiMadhav Prasad KadelNo ratings yet

- 2018 University - Physicians - Services20210505 13 12cju04Document15 pages2018 University - Physicians - Services20210505 13 12cju04Bluei FaustoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Project 2-Embezzlement of FundsDocument6 pagesProject 2-Embezzlement of FundsabhiramNo ratings yet

- En Casa 2023 q4 Slides-VdefDocument78 pagesEn Casa 2023 q4 Slides-VdefRockyBloomNo ratings yet

- Korzan IC NoteDocument4 pagesKorzan IC NoteMo El-KasarNo ratings yet

- Aim High 4 Second term Model Answer.pdf · إصدار ١Document10 pagesAim High 4 Second term Model Answer.pdf · إصدار ١majidalbadawi6870% (1)

- M.M. Polytechnic, Thergaon, Pune-33: Cloud ComputingDocument14 pagesM.M. Polytechnic, Thergaon, Pune-33: Cloud ComputingaishwaryawaghmaleNo ratings yet

- Brealey 9 e IPPTCh 07Document44 pagesBrealey 9 e IPPTCh 07haidarNo ratings yet

- Onecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilDocument3 pagesOnecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilAbhijeet PatilNo ratings yet

- MGT211 Assignment 1 Solution Spring 2021Document5 pagesMGT211 Assignment 1 Solution Spring 2021Beaming Kids Model schoolNo ratings yet

- FAQ For ISO 20022 March 6Document33 pagesFAQ For ISO 20022 March 6Krishna TelgaveNo ratings yet

- Office: of The SecretaryDocument56 pagesOffice: of The SecretaryRvBombetaNo ratings yet

- LogisticsDocument15 pagesLogisticsAbdiNo ratings yet

- Overview of AuditingDocument7 pagesOverview of Auditingharley_quinn11No ratings yet

- Video - Ice CreamDocument2 pagesVideo - Ice CreamRosy HernandezNo ratings yet

- ExecutivelistDocument132 pagesExecutivelistChinki MathurNo ratings yet

- 2012 Coca-Cola HBC Integrated ReportDocument68 pages2012 Coca-Cola HBC Integrated ReportFrank Hayes100% (1)

- MSB A Office PackageDocument2 pagesMSB A Office Packageanara.aidNo ratings yet

- Why Business FailDocument25 pagesWhy Business Failstevo677No ratings yet

- The Impact of Brand-Related User-Generated Content On Social Media On Online Purchase IntentionsDocument26 pagesThe Impact of Brand-Related User-Generated Content On Social Media On Online Purchase IntentionsPham Thi Yen Vi (K15 CT)No ratings yet

- Empirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaDocument112 pagesEmpirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaAman PeterNo ratings yet

- ResearchDocument41 pagesResearchAbubeker KasimNo ratings yet

- Week 9 Logistics Management - Ch-8 Materials HandlingDocument41 pagesWeek 9 Logistics Management - Ch-8 Materials HandlingImmortal 909No ratings yet

- A Research Proposal On: C.K.Pithawala Institute of Management, SuratDocument4 pagesA Research Proposal On: C.K.Pithawala Institute of Management, SuratDharmesh88No ratings yet

- Test Bank For Understanding Economics 7th Edition by LovewellDocument36 pagesTest Bank For Understanding Economics 7th Edition by Lovewelldianalaglyarw7u4100% (39)

- 9.1 Management of Financial ResourcesDocument22 pages9.1 Management of Financial Resourcesanshumalviya230504No ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- Right of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawDocument86 pagesRight of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawAnirban ChakrabortyNo ratings yet

- Group 2 KitabisaDocument28 pagesGroup 2 KitabisaDIKY RAHMANNo ratings yet