Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 views04-01 - Financial Analysis (Dragged) 9

04-01 - Financial Analysis (Dragged) 9

Uploaded by

Salsabila AufaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KELOMPOK 8 - Business Plan Part 1 (Dragged) 2Document3 pagesKELOMPOK 8 - Business Plan Part 1 (Dragged) 2Salsabila AufaNo ratings yet

- Black and Red Geometric Technology Keynote PresentationDocument15 pagesBlack and Red Geometric Technology Keynote PresentationSalsabila AufaNo ratings yet

- 06 - Time Value of Money - 2Document77 pages06 - Time Value of Money - 2Salsabila AufaNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- 07-01 - An Introduction To Risk and ReturnDocument69 pages07-01 - An Introduction To Risk and ReturnSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 31Document3 pages04-01 - Financial Analysis (Dragged) 31Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 20Document3 pages04-01 - Financial Analysis (Dragged) 20Salsabila AufaNo ratings yet

- B. Intro To Business ValuationDocument4 pagesB. Intro To Business ValuationSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 26Document3 pages04-01 - Financial Analysis (Dragged) 26Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 15Document3 pages04-01 - Financial Analysis (Dragged) 15Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 14Document3 pages04-01 - Financial Analysis (Dragged) 14Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 8Document3 pages04-01 - Financial Analysis (Dragged) 8Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 19Document3 pages04-01 - Financial Analysis (Dragged) 19Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 11Document6 pages04-01 - Financial Analysis (Dragged) 11Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 16Document3 pages04-01 - Financial Analysis (Dragged) 16Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 18Document3 pages04-01 - Financial Analysis (Dragged) 18Salsabila AufaNo ratings yet

- Assignment HM5.34 - CHDocument3 pagesAssignment HM5.34 - CHSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 4Document3 pages04-01 - Financial Analysis (Dragged) 4Salsabila AufaNo ratings yet

- 04-01 - Financial AnalysisDocument98 pages04-01 - Financial AnalysisSalsabila AufaNo ratings yet

- Latihan UAS Soal 01Document3 pagesLatihan UAS Soal 01Salsabila AufaNo ratings yet

- Ass 10 01aDocument1 pageAss 10 01aSalsabila AufaNo ratings yet

- Assignment Week 1 - CHDocument2 pagesAssignment Week 1 - CHSalsabila AufaNo ratings yet

- Ass 10 03BDocument1 pageAss 10 03BSalsabila AufaNo ratings yet

- Ass 10 02DDocument2 pagesAss 10 02DSalsabila AufaNo ratings yet

- Ass 10 02CDocument1 pageAss 10 02CSalsabila AufaNo ratings yet

04-01 - Financial Analysis (Dragged) 9

04-01 - Financial Analysis (Dragged) 9

Uploaded by

Salsabila Aufa0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views3 pages04-01 - Financial Analysis (Dragged) 9

04-01 - Financial Analysis (Dragged) 9

Uploaded by

Salsabila AufaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

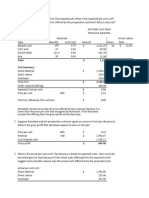

Current Ratio (2 of 2)

• What is the current ratio for 2016 for Boswell?

Current Ratio = $643.5m ÷ $288.0m = 2.23 times

• The firm had $2.23 in current assets for every $1 it

owed in current liability. It is better than peer group

average of $1.80.

Acid Test (Quick) Ratio (1 of 2)

• Acid-Test (Quick) Ratio excludes the inventory

from current assets as inventory may not be very

liquid.

Acid-Test Current Assets Inventory

=

(or Quick) Ratio Current Liabilities

Acid Test (Quick) Ratio (2 of 2)

• What is the quick ratio for Boswell?

• Acid Test (or Quick) Ratio

= ($643.5m $378m) ÷ ($288.0m) = 0.92 times

• The firm has only $0.92 in current assets (less

inventory) to cover $1 in current liabilities. This

ratio is worse than peer average of $0.94

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KELOMPOK 8 - Business Plan Part 1 (Dragged) 2Document3 pagesKELOMPOK 8 - Business Plan Part 1 (Dragged) 2Salsabila AufaNo ratings yet

- Black and Red Geometric Technology Keynote PresentationDocument15 pagesBlack and Red Geometric Technology Keynote PresentationSalsabila AufaNo ratings yet

- 06 - Time Value of Money - 2Document77 pages06 - Time Value of Money - 2Salsabila AufaNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- 07-01 - An Introduction To Risk and ReturnDocument69 pages07-01 - An Introduction To Risk and ReturnSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 31Document3 pages04-01 - Financial Analysis (Dragged) 31Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 20Document3 pages04-01 - Financial Analysis (Dragged) 20Salsabila AufaNo ratings yet

- B. Intro To Business ValuationDocument4 pagesB. Intro To Business ValuationSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 26Document3 pages04-01 - Financial Analysis (Dragged) 26Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 15Document3 pages04-01 - Financial Analysis (Dragged) 15Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 14Document3 pages04-01 - Financial Analysis (Dragged) 14Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 8Document3 pages04-01 - Financial Analysis (Dragged) 8Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 19Document3 pages04-01 - Financial Analysis (Dragged) 19Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 11Document6 pages04-01 - Financial Analysis (Dragged) 11Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 16Document3 pages04-01 - Financial Analysis (Dragged) 16Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 18Document3 pages04-01 - Financial Analysis (Dragged) 18Salsabila AufaNo ratings yet

- Assignment HM5.34 - CHDocument3 pagesAssignment HM5.34 - CHSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 4Document3 pages04-01 - Financial Analysis (Dragged) 4Salsabila AufaNo ratings yet

- 04-01 - Financial AnalysisDocument98 pages04-01 - Financial AnalysisSalsabila AufaNo ratings yet

- Latihan UAS Soal 01Document3 pagesLatihan UAS Soal 01Salsabila AufaNo ratings yet

- Ass 10 01aDocument1 pageAss 10 01aSalsabila AufaNo ratings yet

- Assignment Week 1 - CHDocument2 pagesAssignment Week 1 - CHSalsabila AufaNo ratings yet

- Ass 10 03BDocument1 pageAss 10 03BSalsabila AufaNo ratings yet

- Ass 10 02DDocument2 pagesAss 10 02DSalsabila AufaNo ratings yet

- Ass 10 02CDocument1 pageAss 10 02CSalsabila AufaNo ratings yet