Professional Documents

Culture Documents

Audit of SHE (Part 2)

Audit of SHE (Part 2)

Uploaded by

lemisahirine0 ratings0% found this document useful (0 votes)

3 views3 pagesThe document outlines the audit procedures for SHE (Part 2). It lists the items that will be examined, including articles of incorporation, bylaws, minutes of meetings, stock transfer books, beginning retained earnings, dividends authorization and payments. It provides a sample income statement that will be audited, including revenue, costs, expenses and net income. It also includes an example of how operating expenses will be scoped based on materiality thresholds.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the audit procedures for SHE (Part 2). It lists the items that will be examined, including articles of incorporation, bylaws, minutes of meetings, stock transfer books, beginning retained earnings, dividends authorization and payments. It provides a sample income statement that will be audited, including revenue, costs, expenses and net income. It also includes an example of how operating expenses will be scoped based on materiality thresholds.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views3 pagesAudit of SHE (Part 2)

Audit of SHE (Part 2)

Uploaded by

lemisahirineThe document outlines the audit procedures for SHE (Part 2). It lists the items that will be examined, including articles of incorporation, bylaws, minutes of meetings, stock transfer books, beginning retained earnings, dividends authorization and payments. It provides a sample income statement that will be audited, including revenue, costs, expenses and net income. It also includes an example of how operating expenses will be scoped based on materiality thresholds.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Audit of SHE (Part 2)

SHE Section Audit Procedures

Examine the Articles of Incorporation, Bylaws,

Ordinary Shares Minutes of Meeting (held monthly or as needed) of

the company.

-Authorization is commonly discussed in the

Preferred Shares Minutes of Meeting

Share Premium (Who holds the Stock Transfer Books?)

- Internal (Examine the STB);

Subscribed Share Capital - External (Confirmation)

Beginning (PY) + Net Income – Dividends

Retained Earnings - Dividends: Authorization – Examine bank transfers

or statements or Cancelled Checks (to check if paid)

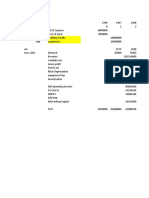

Net Income (Proforma)

Audit of AR; (PSA: Significant Risk)

Revenue XX Audit of Inventory/ies

Cost of Sales (XX)

Gross Profit Selling and Admin. Expense

XX

- w/ Invoice

Operating Expenses (XX) - Depreciation (Audit of PPE)

Risk Assessment: less than high

Operating Income XX

a.) Create lead schedule for OpEx

Non-operating Income XX b.) Perform scoping

(individual OpEx vs. Performance Materiality)

Non-Operating Expenses (XX)

Income Before Interest and Taxes (EBIT) XX

Interest Expenses (XX)

Earnings Before Tax (EBT) XX

Tax (XX)

Net Income XX

Example of Scoping

Invoice Perf. Materiality: 750,000.00

Applicable to: OPEX/NOE/NOI In Out

Supplies Expense 550,000.00 ✓* ✓

Advertising Expense 1,500,000.00 ✓

Fuel & Oil 230,000.00 ✓

Salaries 5,430,000.00 ✓ Please refer to Payroll Testing

Depreciation 2,450,000.00 ✓ Please refer to Depreciation Testing

Utilities 2,120,000.00 ✓

Salaries and Depreciation shall be done separately (PT and DT).

Supplies Expense, Advertising Expense, and Utilities Expense shall be tested thru

the request of invoices.

As per Individual line item, Supplies Expense and Fuel & Oil should be Scope

OUT. BUT as per aggregate amount (780,000 vs. 750,000) - *Supplies Expense

(HIGHER) should be tested.

You might also like

- Solution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument38 pagesSolution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDarla Lambe100% (41)

- Intermediate Financial Accounting Part 1b by Zeus MillanDocument174 pagesIntermediate Financial Accounting Part 1b by Zeus MillanRheu Reyes73% (75)

- Bubble and Bee Lecture TemplateDocument2 pagesBubble and Bee Lecture TemplateMavin JeraldNo ratings yet

- Enterp7a Financial MGMTDocument17 pagesEnterp7a Financial MGMTVanessa Tattao IsagaNo ratings yet

- Chapter 03 Without NarrationDocument63 pagesChapter 03 Without NarrationSu EdNo ratings yet

- Chapter 3-Consolidated Statement of Profit and LossDocument11 pagesChapter 3-Consolidated Statement of Profit and LossSheikh Mass JahNo ratings yet

- DCF Valuations NotesDocument35 pagesDCF Valuations NotesChantell KatlegoNo ratings yet

- 1capital and Revenue TransactionsDocument11 pages1capital and Revenue Transactionsdilhani sheharaNo ratings yet

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- PFRS 10, Consolidated Financial StatementsDocument32 pagesPFRS 10, Consolidated Financial Statementsjulia4razoNo ratings yet

- Kaplan Chapter 2: IAS 16 Property, Plant and EquipmentDocument11 pagesKaplan Chapter 2: IAS 16 Property, Plant and EquipmentRaihan SirNo ratings yet

- Lecture 4-PostDocument40 pagesLecture 4-PostcoolirlbbNo ratings yet

- Lecture 1-Financial Statements I-SDocument75 pagesLecture 1-Financial Statements I-SjamesbinstrateNo ratings yet

- Project Cost Management April 2021Document189 pagesProject Cost Management April 2021bharathiNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- Ummary of Study Objectives: 198 Financial StatementsDocument5 pagesUmmary of Study Objectives: 198 Financial StatementsYun ChandoraNo ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- Strategic Financial Management-84-97-8Document1 pageStrategic Financial Management-84-97-8joko waluyoNo ratings yet

- Introduction To Corporate FinanceDocument18 pagesIntroduction To Corporate FinanceGauri SinglaNo ratings yet

- DFM - AssignmentDocument9 pagesDFM - AssignmentHein Zaw Zaw NyiNo ratings yet

- Multiple Choice Questions: Profit and Loss Statements 161Document8 pagesMultiple Choice Questions: Profit and Loss Statements 161MOHAMMED AMIN SHAIKHNo ratings yet

- HI5020 Corporate Accounting: Session 4b Statement of Comprehensive Income & Statement of Changes in EquityDocument27 pagesHI5020 Corporate Accounting: Session 4b Statement of Comprehensive Income & Statement of Changes in EquityFeku RamNo ratings yet

- Chapter Fourteen Business Valuation & AcquisitionsDocument28 pagesChapter Fourteen Business Valuation & Acquisitionskuttan1000No ratings yet

- Corporate Unit 3Document497 pagesCorporate Unit 3bhavu aryaNo ratings yet

- Statement of Cash FlowsDocument3 pagesStatement of Cash FlowsAntonette Marie LoonNo ratings yet

- Chapter-01 Property, Plant & Equipment (IAS-16)Document21 pagesChapter-01 Property, Plant & Equipment (IAS-16)muhad.prvtNo ratings yet

- Financial Statements Point PresentationDocument34 pagesFinancial Statements Point PresentationRabie Haroun100% (1)

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- CAPBUDDocument10 pagesCAPBUDVitany Gyn Cabalfin TraifalgarNo ratings yet

- Interpreting Financial StatementsDocument2 pagesInterpreting Financial StatementsSharen HariNo ratings yet

- The Income StatementDocument48 pagesThe Income StatementtheresourceshelfNo ratings yet

- FM 1 Unit 3 TheoryDocument3 pagesFM 1 Unit 3 TheorySimranNo ratings yet

- SOCF SBRDocument3 pagesSOCF SBR2024542215No ratings yet

- Project Cash FlowsDocument28 pagesProject Cash FlowsNandhini NallasamyNo ratings yet

- Financial Statements AnalysisDocument5 pagesFinancial Statements AnalysisSAQIB SAEEDNo ratings yet

- Chapter 2-The Accounting EquationDocument132 pagesChapter 2-The Accounting EquationAmr HassanNo ratings yet

- The Statement of Profit or Loss and Other Comprehensive IncomeDocument6 pagesThe Statement of Profit or Loss and Other Comprehensive IncomePam CayabyabNo ratings yet

- Chap 5 PDFDocument22 pagesChap 5 PDFHiren ChauhanNo ratings yet

- Section C Answer Student'sDocument7 pagesSection C Answer Student'sAmir ArifNo ratings yet

- 02 08 PPE CapEx Depreciation BeforeDocument6 pages02 08 PPE CapEx Depreciation BeforeShaheer AhmedNo ratings yet

- Ncome: Components of Profit or LossDocument3 pagesNcome: Components of Profit or LossJonathan VidarNo ratings yet

- Ch.7.Corporate Valuation - Explanations and SolutionsDocument67 pagesCh.7.Corporate Valuation - Explanations and SolutionsabhiNo ratings yet

- Valuation of Goodwill and Shares 1Document31 pagesValuation of Goodwill and Shares 1p66610072No ratings yet

- Test of Productivity and Profitability Objectives:: Ratios Formulas SignificanceDocument5 pagesTest of Productivity and Profitability Objectives:: Ratios Formulas SignificanceGenkakuNo ratings yet

- Lesson 3: Statement of Comprehensive IncomeDocument14 pagesLesson 3: Statement of Comprehensive IncomeReymark TalaveraNo ratings yet

- Chapter 2 Separate and Consolidated FS - Date of AcquisitionDocument21 pagesChapter 2 Separate and Consolidated FS - Date of AcquisitioneiaNo ratings yet

- Liv PDFDocument24 pagesLiv PDFravi sharmaNo ratings yet

- Material 1.1 Additional NotesDocument2 pagesMaterial 1.1 Additional NotesCristine Joy BenitezNo ratings yet

- Seminar FFSDocument27 pagesSeminar FFSanurulxxNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Understanding Basics of Financial StatementsDocument32 pagesUnderstanding Basics of Financial StatementsAparna PavaniNo ratings yet

- Mock BPP P2 (3 8)Document32 pagesMock BPP P2 (3 8)naveedawan3210% (1)

- Preparation of Gross - Net Value Added Statement For CompaniesDocument6 pagesPreparation of Gross - Net Value Added Statement For CompaniesKamal JoshiNo ratings yet

- Chapter 6Document14 pagesChapter 6Louie Ann CasabarNo ratings yet

- Financial Statement Part 1Document51 pagesFinancial Statement Part 1aashishkumar4123No ratings yet

- DCF Presentation Ahemdabad 20 01 2018Document33 pagesDCF Presentation Ahemdabad 20 01 2018pre.meh21No ratings yet

- Lecture 3Document44 pagesLecture 3felipeNo ratings yet

- SMA AnswerDocument4 pagesSMA AnswerNawoda SamarasingheNo ratings yet

- Basic Accounting ReviewerDocument5 pagesBasic Accounting ReviewerJoshua BaquiranNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Correction of Error Etc.Document9 pagesCorrection of Error Etc.lemisahirineNo ratings yet

- Ap Audit of IntangiblesDocument1 pageAp Audit of IntangibleslemisahirineNo ratings yet

- AFAR CONSO FS Subsequent To Date of AcquisitionDocument6 pagesAFAR CONSO FS Subsequent To Date of AcquisitionlemisahirineNo ratings yet

- Afar NotesDocument20 pagesAfar NoteslemisahirineNo ratings yet

- InventoryDocument8 pagesInventoryDianna DayawonNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Final Exam - Fall 2023Document5 pagesFinal Exam - Fall 2023hani.sharma324No ratings yet

- ACCT 201 Pre-Quiz Number 6 F09Document7 pagesACCT 201 Pre-Quiz Number 6 F09bob_lahblawNo ratings yet

- Chapter 12 LiabilitiesDocument5 pagesChapter 12 LiabilitiesAngelica Joy ManaoisNo ratings yet

- A Study On The Performance Analysis of Parle India Limited With Special Reference To Profitability and Risk Using DuPont AnalysisDocument11 pagesA Study On The Performance Analysis of Parle India Limited With Special Reference To Profitability and Risk Using DuPont Analysisarcherselevators100% (1)

- DEPRECIATIONDocument3 pagesDEPRECIATIONUsirika Sai KumarNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Cost and Managment Accounting PDFDocument142 pagesCost and Managment Accounting PDFNaveen NaviNo ratings yet

- T24 Accounting Set-Up - For Consolidation - R16Document95 pagesT24 Accounting Set-Up - For Consolidation - R16adyani_0997100% (2)

- Assignment 1 - SolutionDocument10 pagesAssignment 1 - SolutionKhem Raj GyawaliNo ratings yet

- FMVA BrochureDocument2 pagesFMVA BrochureDumeus WidenskyNo ratings yet

- International School of Asia and The Pacific Management Advisory Services Institutional ReviewDocument27 pagesInternational School of Asia and The Pacific Management Advisory Services Institutional ReviewCharles BarcelaNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- Exercises 4 Financial Planning BudgetingDocument2 pagesExercises 4 Financial Planning BudgetingKyle PereiraNo ratings yet

- Solved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course HeroDocument5 pagesSolved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course Herojau chiNo ratings yet

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyNo ratings yet

- Review Topics For Cpa ReviewfgDocument5 pagesReview Topics For Cpa ReviewfgYaj CruzadaNo ratings yet

- Market X Ls FunctionsDocument73 pagesMarket X Ls FunctionsNaresh KumarNo ratings yet

- Tut 04 QDocument2 pagesTut 04 Q微柚柚No ratings yet

- CH-6 Working Capital ManagementDocument66 pagesCH-6 Working Capital ManagementRahul KukrejaNo ratings yet

- Model Grace CorporationDocument9 pagesModel Grace CorporationEhtisham AkhtarNo ratings yet

- AC15 Quiz 1 Solution ManualDocument8 pagesAC15 Quiz 1 Solution ManualKristine Esplana ToraldeNo ratings yet

- MNGRL AccDocument21 pagesMNGRL AcceiNo ratings yet

- ch03 SM Leo 10eDocument72 pagesch03 SM Leo 10ePyae PhyoNo ratings yet

- Capital Budgeting and Cost AnalysisDocument54 pagesCapital Budgeting and Cost AnalysisemmyindraNo ratings yet

- TRẮC NGHIỆM TỔ CHỨC KẾ TOÁN 1Document28 pagesTRẮC NGHIỆM TỔ CHỨC KẾ TOÁN 1Ngân GiangNo ratings yet