Professional Documents

Culture Documents

Ia T21 Ans

Ia T21 Ans

Uploaded by

ckwai0603Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ia T21 Ans

Ia T21 Ans

Uploaded by

ckwai0603Copyright:

Available Formats

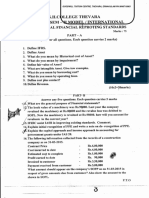

E21.

2

lease payable for Burke (lessee)

(a) rental payment (starting from dec31) 8668

PV annuity due (i=5%;n=5) 4.54595

PV of rental payments 39404.29

(b) 12/31/2021

right of use assets 39404.29

lease liabilities 39404.29

lease liabilities(100%P ) 8668

cash 8668

12/31/2022

lease liability 7131.19

interest expense 1536.81

cash 8668

depreciation expense 7880.86

right of use assets 7880.86

E21.4 lease payable for stora enso (lessee)

rental payment (starting from 31 dec) 71830

PV annuity due (i=8%; n=10) 7.24689

PV of annual rental payment 520544.11

additional lease payment (guaranteed residual value > expexted residual value)

guaranteed residual value 10000

expected residual value 7000

additional lease payment 3000

PV $1(i=8%; n=10) 0.46319

PV of single amount of residual value 1389.57

lease liabilities

PV of annual rental payment 520544.11

PV of single amount of residual value 1389.57

521933.68

(a) 12/31/2021

right of use assets 521933.68

lease liabilities 521933.68

lease liabilities 71830

cash 71830

12/31/2022

interest expense 36008.29

lease liabilities 35821.71

cash 71830

depreciation expense 52193.37

right of use assets 52193.37

12/31/2023

interest expense 33142.56

lease liabilities 38687.44

cash 71830

depreciation expense 52193.37

right of use assets 52193.37

(d) lease liabilities 3000

gain on lease 3000

E21.13 Y/N

transfer of ownership N lease term test = 5

purchases option test N 6

lease term test (75%) Y 0.83333333

PV test (90%) N

alternative use test N

lease: non-cancellable Y PV test =

>> finance lease

You might also like

- Waltham Oil Lube Centre Inc - FinalDocument10 pagesWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Car Terms - V2Document2 pagesCar Terms - V2sgv thinkpad202150% (2)

- Rent Agreement LeadsChiefDocument3 pagesRent Agreement LeadsChiefRakesh kumarNo ratings yet

- Leases Part 1 (Accounting by Lessees)Document22 pagesLeases Part 1 (Accounting by Lessees)Queen ValleNo ratings yet

- The Nature of The Farm - Contracts, Risk, and Organization in AgricultureDocument267 pagesThe Nature of The Farm - Contracts, Risk, and Organization in Agriculture016200No ratings yet

- E21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnDocument3 pagesE21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnWarmthx0% (1)

- Leases (Part 1) : Problem 1: True or FalseDocument26 pagesLeases (Part 1) : Problem 1: True or FalseKim HanbinNo ratings yet

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- Tutorial Solution Lease LessessDocument13 pagesTutorial Solution Lease LessessOm PrakashNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- Restaurant Technical Analysis in IndiaDocument24 pagesRestaurant Technical Analysis in IndiaMilansinh JetavatNo ratings yet

- StudentBook ShapesOfAlgebraDocument93 pagesStudentBook ShapesOfAlgebrakirkframke100% (1)

- Living in AustraliaDocument129 pagesLiving in AustraliaSusie HopeNo ratings yet

- Acyfar4 K31 HWDocument442 pagesAcyfar4 K31 HWarmiejimenezzNo ratings yet

- Chapter 21 Latihan SoalDocument10 pagesChapter 21 Latihan SoalJulyaniNo ratings yet

- Homework Chapter 21 - Group 8Document5 pagesHomework Chapter 21 - Group 8Thư LuyệnNo ratings yet

- Sol. Man. - Chapter 7 Leases Part 1Document12 pagesSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- T10 Tutorial SolutionsDocument4 pagesT10 Tutorial SolutionsAnathi AnathiNo ratings yet

- Solution - Quiz On Lessee AccountingDocument10 pagesSolution - Quiz On Lessee AccountingMeeka CalimagNo ratings yet

- Assignment No. 1 - Leases - Cunanan & ManlangitDocument7 pagesAssignment No. 1 - Leases - Cunanan & ManlangitCunanan, Malakhai JeuNo ratings yet

- Ias 38, 10, 37 Ifrs 15Document83 pagesIas 38, 10, 37 Ifrs 15Mehedi Hasan MunnaNo ratings yet

- Week 05 2022 Topic 5 Lecture Leases Part CDocument11 pagesWeek 05 2022 Topic 5 Lecture Leases Part CErnest LeongNo ratings yet

- Chapter 3-Lease ContractDocument5 pagesChapter 3-Lease ContractmarsupilamiNo ratings yet

- Tugas AKM III - Week 2Document10 pagesTugas AKM III - Week 2Rifda Amalia100% (1)

- CHAPTER 12 Operating Lease - Lessor Operating LeaseDocument5 pagesCHAPTER 12 Operating Lease - Lessor Operating LeaseLady PilaNo ratings yet

- Akm P21-1, P21-2Document5 pagesAkm P21-1, P21-2nandya rizkyNo ratings yet

- Lease TutorDocument17 pagesLease Tutorelainelxy2508100% (1)

- Chapter 7 - Leases Part 1Document4 pagesChapter 7 - Leases Part 1JEFFERSON CUTE100% (1)

- Chapter 13 Direct Finance LeaseDocument6 pagesChapter 13 Direct Finance LeaseLady Pila0% (1)

- Reassessment of Lease LiabilityDocument6 pagesReassessment of Lease LiabilityJULIA CHRIS ROMERONo ratings yet

- Week 05 2022 Topic 5 Lecture Leases Part BDocument19 pagesWeek 05 2022 Topic 5 Lecture Leases Part BErnest LeongNo ratings yet

- FINANCE LEASE-lecture and ExercisesDocument10 pagesFINANCE LEASE-lecture and ExercisesJamie CantubaNo ratings yet

- Leases Robles Empleo Solution Manual - CompressDocument18 pagesLeases Robles Empleo Solution Manual - Compresschnxxi iiNo ratings yet

- Lease Tute WorkDocument6 pagesLease Tute WorkDylan AdrianNo ratings yet

- Chapter 7 Leases Part 1Document10 pagesChapter 7 Leases Part 1Thalia Rhine AberteNo ratings yet

- Right-of-Use Assets Lease LiabilityDocument10 pagesRight-of-Use Assets Lease LiabilityMoe ChurappiNo ratings yet

- Lease Acctg ExerciseDocument12 pagesLease Acctg ExerciseIts meh SushiNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- Seatwork 11.1 TaliteDocument10 pagesSeatwork 11.1 Taliteandrea taliteNo ratings yet

- Lecture CHAPTER 10 LESSEE ACCOUNTINGDocument7 pagesLecture CHAPTER 10 LESSEE ACCOUNTINGLady Pila0% (1)

- (ANSWER) Week 10 Problem 2Document3 pages(ANSWER) Week 10 Problem 2Vidya IntaniNo ratings yet

- Beams9esm ch05Document5 pagesBeams9esm ch05David IroayNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen Valle100% (2)

- Akm 2Document10 pagesAkm 2Putu DenyNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- Pelaporan Korporat Tugas 6Document3 pagesPelaporan Korporat Tugas 6SyahputraNo ratings yet

- Lap keu-MNC INVESTAMA 31 December 2020-6-8Document3 pagesLap keu-MNC INVESTAMA 31 December 2020-6-8Amel GpNo ratings yet

- Solutions Tutorial 5 Accounting For LeasesDocument5 pagesSolutions Tutorial 5 Accounting For LeasesZakir HossainNo ratings yet

- Assignment 3 - SolutionsDocument4 pagesAssignment 3 - SolutionsEsther LiuNo ratings yet

- IFRS NotesDocument2 pagesIFRS NotesArchana M.DNo ratings yet

- Chapter 13-Leases: Leases - An Agreement Whereby The Lessor Conveys To The Lessee, in Return For A Payment or Series ofDocument5 pagesChapter 13-Leases: Leases - An Agreement Whereby The Lessor Conveys To The Lessee, in Return For A Payment or Series ofShantalNo ratings yet

- Leases Problems Solution GuideDocument11 pagesLeases Problems Solution Guidedane f.100% (1)

- Problem 7-1 Requirement 1: Date Payment Interest PrincipalDocument9 pagesProblem 7-1 Requirement 1: Date Payment Interest PrincipalMarya GonzalesNo ratings yet

- Lecture Workings - 29.03.2023Document3 pagesLecture Workings - 29.03.2023kasun SenadheeraNo ratings yet

- 1 C Ifrs 16 Example Finance Lease by Lessor 01 Revisi 020921Document6 pages1 C Ifrs 16 Example Finance Lease by Lessor 01 Revisi 020921Jashinta Mahadewi MjmNo ratings yet

- Old Exam Problem 1 With SolutionDocument3 pagesOld Exam Problem 1 With SolutionPaul GeorgeNo ratings yet

- Seminar Outline 4Document16 pagesSeminar Outline 4cccqNo ratings yet

- Jawaban CH 21 Leasing (Fix)Document7 pagesJawaban CH 21 Leasing (Fix)abd storeNo ratings yet

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Document6 pagesAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNo ratings yet

- Lessee SolutionsDocument16 pagesLessee SolutionsNhel AlvaroNo ratings yet

- IntAcc 2 - CHAPTER 11 NotesDocument5 pagesIntAcc 2 - CHAPTER 11 NotesikiNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- Test Far510 Sept 2019 SSDocument4 pagesTest Far510 Sept 2019 SS2022478048No ratings yet

- Cae05-Chapter 8 Leases Problem DiscussionDocument22 pagesCae05-Chapter 8 Leases Problem Discussioncris tellaNo ratings yet

- Chap 21 - Leasing (PSAK 73) - E12-12Document27 pagesChap 21 - Leasing (PSAK 73) - E12-12Happy MichaelNo ratings yet

- Leases Part 1 Accounting by LesseesDocument18 pagesLeases Part 1 Accounting by Lesseesnathaliefayeb.tajaNo ratings yet

- Civil Law Bar Exam Answers: Torts and Damages Collapse of Structures Last Clear Chance (1990)Document16 pagesCivil Law Bar Exam Answers: Torts and Damages Collapse of Structures Last Clear Chance (1990)SGT100% (1)

- Perez vs. Gutierrez, 53 SCRA 149, September 28, 1973Document4 pagesPerez vs. Gutierrez, 53 SCRA 149, September 28, 1973lifeware04No ratings yet

- An Office Market in Transition? The Urban vs. Suburban DebateDocument3 pagesAn Office Market in Transition? The Urban vs. Suburban DebateKevin ParkerNo ratings yet

- 03 LeasingDocument16 pages03 Leasingnotes.mcpuNo ratings yet

- 02-STRAMAN (What and Why of Strategy)Document19 pages02-STRAMAN (What and Why of Strategy)marjsbarsNo ratings yet

- Tenancy Agreement VKS CAR WASHDocument4 pagesTenancy Agreement VKS CAR WASHsivachandran subramaniamNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- Assignment 02 Leases-SolutionDocument10 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- 3 LandDocument4 pages3 LandHazwan AzreenNo ratings yet

- Real Estate in IndiaDocument9 pagesReal Estate in IndiaVandan SapariaNo ratings yet

- MahaRERA pptv7Document34 pagesMahaRERA pptv7shivakesarlaNo ratings yet

- 02 Activity 1Document1 page02 Activity 1ab galeNo ratings yet

- Henson vs. IAC PDFDocument10 pagesHenson vs. IAC PDFEvan NervezaNo ratings yet

- National Municipal Accounting Manual PDFDocument722 pagesNational Municipal Accounting Manual PDFpravin100% (1)

- 20,000 Prepaid Rent 100,000 Rent ExpenseDocument3 pages20,000 Prepaid Rent 100,000 Rent ExpensedfsdfdsfNo ratings yet

- Aditi Ameet Ankit Bharat Jinen Mohini Pooja Rohit Vikram: Pradhan Kankariya Godre Rao Shah Kedari Bhanushali Pawar KoradeDocument22 pagesAditi Ameet Ankit Bharat Jinen Mohini Pooja Rohit Vikram: Pradhan Kankariya Godre Rao Shah Kedari Bhanushali Pawar KoradeAnisha VargheseNo ratings yet

- ESM201Document15 pagesESM201Olawumi Timothy OluwatosinNo ratings yet

- Gr11R - 2024 ENGLISHlearnerGUIDETERM2Document10 pagesGr11R - 2024 ENGLISHlearnerGUIDETERM2masidkota028No ratings yet

- Legal Notice To Vacate Property Under Section 106 Format - Advocate Chenoy Ceil PDFDocument1 pageLegal Notice To Vacate Property Under Section 106 Format - Advocate Chenoy Ceil PDFkishore26480% (1)

- (Digest) Marimperia V CADocument2 pages(Digest) Marimperia V CACarlos PobladorNo ratings yet

- 3456782345Document17 pages3456782345Jade MarkNo ratings yet

- Valencia Vs CADocument2 pagesValencia Vs CAAnonymous oaAcMOuZHRNo ratings yet

- Agrarian Law Barte BasedDocument2 pagesAgrarian Law Barte BasedAyme SoNo ratings yet