Professional Documents

Culture Documents

Bacc5 Midterm Reviewer

Bacc5 Midterm Reviewer

Uploaded by

Kyla CorbantesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bacc5 Midterm Reviewer

Bacc5 Midterm Reviewer

Uploaded by

Kyla CorbantesCopyright:

Available Formats

KEIRETSU SECURITY AND EXCHANGE COMMISSION

~ Keiretsu is a Japanese term referring to a business ~ The Securities and Exchange Commission oversees

network made up of different companies, including securities exchanges, securities brokers and dealers,

manufacturers, supply chain partners, distributors, and investment advisors, and mutual funds in an effort to

occasionally financiers. promote fair dealing, the disclosure of important market

information, and to prevent fraud.

~ A keiretsu is a set of companies with interlocking

business relationships and shareholdings that have ~ SEC is the registrar and overseer of the Philippine

dominated the Japanese economy since the second half corporate sector; it supervises more than 500,000 active

of the 20th century. corporations and evaluates the financial statements (FS)

filed by all corporations registered with it.

~ Japanese term refers to industrial network linked by

trading relationships as well as cross-share holdings of Models of Corporate Governance and their Key Players

debt and equity.

1. The Anglo-US Model

Areas of CSR

- characterized by share ownership of individual, and

- State increasingly institutional, investors not affiliated with

the corporation (known as outside shareholders or

- Business

“outsiders”)

- Civic Society

Key Players

Elements of CSR

Management

1. Economic Responsibility Directors Corporate Governance Triangle

Shareholders

- first and most apparent

- Composition of Board of Directors

- focuses on the different practices that would lead to

long-term growth of the business. A. Insiders – a person who is either employed by the

corporation or somebody who has significant personal

2. Legal Responsibility relationships with corporate management.

- to obey all laws set forth by society all the time. B. Outsiders – a person or institution which has no

- to follow all written and codified laws that concern its direct relationship with the corporation or corporate

existence. management.

- the government act as the regulators of the business. 2. The Japanese Model

3. Ethical Responsibility - characterized by a high level of stock ownership by

affiliated banks and companies; a banking system

- directly connected to the legal responsibility characterized by strong, long-term links between bank

- to do what is right even when business is not obligated and corporation.

to do so by the law. Key Players

4. Environmental Responsibility main bank (a major inside shareholder)

- refers to the organization’s commitment to affiliated company or keiretsu (a major inside

sustainability and environmental-friendly. shareholder)

management

5. Philanthropic Responsibility government

- also known as discretionary responsibility.

- refers to the corporations’ aims, goals and objectives

for actively bettering society as a whole.

3. The German Model Investment Bankers

- governs German and Austrian corporations. Some - is an individual or entity which acts as an agent for

elements of the model also apply in the Netherlands corporation issuing securities. Some investment bankers

and Scandinavia. Furthermore, some corporations in also maintain a brokerage or a dealership operation and

France and Belgium have recently introduced some offer advisory services to its client.

elements of the German model.

ROLE OF INVESTMENT BANKER

Key Players

1. Origination - It covers the secondary operations of

German banks discovery, investigation, and negotiation. The primary

corporate shareholders function of the Investment banking is the cautious study

of the soundness and reliability of the corporation with

the view of bringing its securities to the investment

CORE VALUES OF CSR

market.

1.Excellence – good output, striving high standards

2. Underwriting - is an arrangement with an investment

2.Innovation – adopt solutions, develop, strategize banker whereby the investment banker agrees to buys

the entire issue at a set price. Investment banker also

3.Participation – contributions, initiatives refers to the guarantee by the IB that the issuer

4.Ownership – don’t expect in return, trust company will receive a minimum amount of cash for

their new issued securities for sale.

5.Leadership – dedicated, setting example

3. Distribution - announcement of bidding

- means the investment banker will sell

Stock Exchanges the securities on behalf of the company because it will

- is a centralized location that brings corporations and be expensive to sell the securities. The investment

governments so that investors can buy and sell equities. banker will have a channel to sell the securities.

- refers to the entity which offers trading services and

facilities for stock brokers and traders, to buy and sell

share of stock ang securities.

ROLES OF STOCK EXCHANGE

1. Raise capital/funds

2. Issuing equity shares

3. Facilitates the stock

4. Mobilize saving

5. Improves corporate governance

6. Indicator for economy

7. Distributes profit

8. Creates opportunities for small investors

9. Facilitates growth

10. Facilitating raising capital for government

You might also like

- Dole Standard ContractDocument3 pagesDole Standard ContractJanice Domogan78% (36)

- McFly - McFly Collection PDFDocument266 pagesMcFly - McFly Collection PDFJavi Echarri100% (2)

- Verification of InsuranceDocument1 pageVerification of InsuranceMorenita ParelesNo ratings yet

- Chapter 1 - An Overview of Financial Managemen: ReviewerDocument3 pagesChapter 1 - An Overview of Financial Managemen: ReviewerChristian Mozo Oliva67% (3)

- Accounting 1Document3 pagesAccounting 1Carmina Dongcayan100% (1)

- A&R Articles of Incorporation - Hunters Ridge Phase 5 & 6 - 20170825Document5 pagesA&R Articles of Incorporation - Hunters Ridge Phase 5 & 6 - 20170825James WallsNo ratings yet

- Investm Ent Bank Comme Rcial Bank: Principles of FinanceDocument4 pagesInvestm Ent Bank Comme Rcial Bank: Principles of FinanceJustine PascualNo ratings yet

- Lesson 8Document7 pagesLesson 8Jeliemay VergaraNo ratings yet

- Financial Management ReviewerDocument63 pagesFinancial Management ReviewerJoyce MacatangayNo ratings yet

- Finance PointersDocument8 pagesFinance PointersMgrace arendaknNo ratings yet

- FINMAR - Introduction To Financial Management and Financial MarketsDocument8 pagesFINMAR - Introduction To Financial Management and Financial MarketsLagcao Claire Ann M.No ratings yet

- Fin Man ReviewerDocument5 pagesFin Man ReviewerJea BalagtasNo ratings yet

- Xfinmar - PrelimsDocument22 pagesXfinmar - PrelimsAndrea CuiNo ratings yet

- Business-Finance ReviewerDocument7 pagesBusiness-Finance ReviewerRed TigerNo ratings yet

- Good Gov ReviewerrrDocument12 pagesGood Gov ReviewerrrAlyssa GalivoNo ratings yet

- Xfinmar Module 1Document7 pagesXfinmar Module 1abrylle opinianoNo ratings yet

- Introduction To Business FinanceDocument28 pagesIntroduction To Business Financeloucyjay04No ratings yet

- FinancialDocument12 pagesFinancialPhuong ThanhNo ratings yet

- Module 2 Bpa 3a, Pa 108Document5 pagesModule 2 Bpa 3a, Pa 108Charibelle AvilaNo ratings yet

- Chapter 1-2 .Good GovernanceDocument8 pagesChapter 1-2 .Good Governanceshielamaemae0No ratings yet

- Business FinanceDocument6 pagesBusiness FinanceshaneemacasiNo ratings yet

- Mbfs With 16 MarkDocument16 pagesMbfs With 16 MarkPadmavathiNo ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument28 pagesChapter 1 - Introduction To Financial ManagementArminda Villamin100% (1)

- Introduction To Financial Management (History, Nature and Significance of Finance)Document41 pagesIntroduction To Financial Management (History, Nature and Significance of Finance)Ronan PermejoNo ratings yet

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- SBL Chapter 5 Governance and ApproachDocument37 pagesSBL Chapter 5 Governance and ApproachGirma DagneNo ratings yet

- Chapter 123Document12 pagesChapter 123Nak HusderNo ratings yet

- Value of StocksDocument3 pagesValue of StocksYummyNo ratings yet

- Finance, Focuses On Decisions Relating To How Much andDocument3 pagesFinance, Focuses On Decisions Relating To How Much andMeng DanNo ratings yet

- Financial Management 2 - Chapter 1 and 2 SummaryDocument2 pagesFinancial Management 2 - Chapter 1 and 2 Summary19100265-studentNo ratings yet

- Attachment Tutor 2Document6 pagesAttachment Tutor 2Florielyn Asto ManingasNo ratings yet

- Lesson+1 +Introduction+to+Financial+Management - FinalDocument33 pagesLesson+1 +Introduction+to+Financial+Management - Finalweird childNo ratings yet

- Notes For BFDocument14 pagesNotes For BFReymart SaladasNo ratings yet

- BUSINESS FINANCE Chapter 1Document16 pagesBUSINESS FINANCE Chapter 1Melvin J. ReyesNo ratings yet

- Business EthicsDocument2 pagesBusiness EthicsFrancine CasidaNo ratings yet

- Chapter 20 - IPO, Investment Bank, Financial RestructionDocument20 pagesChapter 20 - IPO, Investment Bank, Financial RestructionFariza SiswantiNo ratings yet

- Finmar Prelims Reviewer 2ND Yr BsaDocument7 pagesFinmar Prelims Reviewer 2ND Yr BsaCristine Joy JemillaNo ratings yet

- SHS Business Finance Chapter 1Document19 pagesSHS Business Finance Chapter 1Ji Baltazar100% (1)

- 1st Semester (Digital Notebook - Business Finance)Document9 pages1st Semester (Digital Notebook - Business Finance)Raven RubiNo ratings yet

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- 3rd QTR ReviewerDocument7 pages3rd QTR ReviewerRaeven Lei ParaleNo ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- Chapter 8 Institutional Invetsors Governance Organizations and Legal InitiativesDocument66 pagesChapter 8 Institutional Invetsors Governance Organizations and Legal Initiativesgladys moralesNo ratings yet

- Intoduction To Good Governance and Social ResponisibilityDocument8 pagesIntoduction To Good Governance and Social ResponisibilityJoram David BeltranNo ratings yet

- Roxanne Babe B. Castro ABM-1: Let's Dig inDocument4 pagesRoxanne Babe B. Castro ABM-1: Let's Dig inRoxie CastroNo ratings yet

- 1st Prelim Reviewer in EthicsDocument2 pages1st Prelim Reviewer in EthicsmarieNo ratings yet

- Financial MarketsDocument10 pagesFinancial MarketsCathleen TenaNo ratings yet

- Institutional Investors, Governance Organizations and Legal InitiativesDocument54 pagesInstitutional Investors, Governance Organizations and Legal InitiativesThetel Loren Cruiz0% (2)

- Finance Chapter 1Document11 pagesFinance Chapter 1MayNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- Finals Fnm103Document40 pagesFinals Fnm103Novelyn DuyoganNo ratings yet

- Business Finance ModuleDocument41 pagesBusiness Finance ModulerhyzeNo ratings yet

- FM Additional NotesDocument62 pagesFM Additional NotesCbNo ratings yet

- 2 UCSP Module Chapter 10Document6 pages2 UCSP Module Chapter 10jannprems01No ratings yet

- ABM NotesDocument9 pagesABM Notesdanie.hermosaNo ratings yet

- Unit 12 Investors' Protection and Corporate Governance: ObjectivesDocument20 pagesUnit 12 Investors' Protection and Corporate Governance: Objectivespranav kNo ratings yet

- The Role and Environment of Corporate Finance: Dr. Doaa AymanDocument30 pagesThe Role and Environment of Corporate Finance: Dr. Doaa AymanMohamed HosnyNo ratings yet

- M1 4 CM 1Document9 pagesM1 4 CM 1guillermoilustre29No ratings yet

- Roles of Invesment Bankers in IndiaDocument17 pagesRoles of Invesment Bankers in Indianikita_8No ratings yet

- Introduction To Financial Management NotesDocument4 pagesIntroduction To Financial Management NotesDana Gabrielle Sta Maria OconNo ratings yet

- d076 Study GuideDocument15 pagesd076 Study GuideMonique CruzNo ratings yet

- FINANCE SYSTEM ReviewerDocument2 pagesFINANCE SYSTEM ReviewerChen-chen NecesarioNo ratings yet

- CSR PPT CH.2Document24 pagesCSR PPT CH.2Asegid gezehagnNo ratings yet

- Commercial MBDocument6 pagesCommercial MBarvinbtcbtcNo ratings yet

- Tata Aia Endowment Op With 15071984-1Document35 pagesTata Aia Endowment Op With 15071984-1atul0070No ratings yet

- Quiz 3Document2 pagesQuiz 3ivejdNo ratings yet

- Title 12 Civil StatusDocument4 pagesTitle 12 Civil StatusAlfred AmindalanNo ratings yet

- FAR.2933 - Share-Based Payment.Document9 pagesFAR.2933 - Share-Based Payment.Edmark LuspeNo ratings yet

- Mauritius Hire Purchase and Credit Sale ActDocument21 pagesMauritius Hire Purchase and Credit Sale ActrockxanderNo ratings yet

- No Co Maker Application Form TSL v.052623Document2 pagesNo Co Maker Application Form TSL v.052623Rio A. EbueNo ratings yet

- CIBIL Score 699: Nikith Karunakar PujariDocument4 pagesCIBIL Score 699: Nikith Karunakar PujariNik NikNo ratings yet

- Third Party Liability Insurance PDFDocument15 pagesThird Party Liability Insurance PDFAnonymous fk1QdO0% (1)

- Rental Agreement Sample and All You Need To Know Google DocsDocument5 pagesRental Agreement Sample and All You Need To Know Google DocsArvind KumarNo ratings yet

- Deed of Trust & Memorandum of Agreement Made and Entered Into by and BetweenDocument9 pagesDeed of Trust & Memorandum of Agreement Made and Entered Into by and Betweenislam2059No ratings yet

- 2013 Bar Examinations: Group 1: Succession BAR QUESTIONS 2013 & 2015 Members: Abuzo, Agot, Arcenal, Bayan, BernardinoDocument9 pages2013 Bar Examinations: Group 1: Succession BAR QUESTIONS 2013 & 2015 Members: Abuzo, Agot, Arcenal, Bayan, BernardinoCrystal KateNo ratings yet

- Application Loan 1Document4 pagesApplication Loan 1pratibhamote8No ratings yet

- University of Lucknow Faculty of Law: Subject-Jurisprudence IIDocument10 pagesUniversity of Lucknow Faculty of Law: Subject-Jurisprudence IIkuldeep Roy SinghNo ratings yet

- Examples of Donald Sterling Harassing Doctors, LawyersDocument61 pagesExamples of Donald Sterling Harassing Doctors, LawyersLos Angeles Daily NewsNo ratings yet

- 2Document11 pages2Christopher Gutierrez Calamiong100% (1)

- Possessor+ +Sample+Letter+Owner+of+RecordDocument10 pagesPossessor+ +Sample+Letter+Owner+of+Recordvoyager13321100% (1)

- Fm-I Chap-V EditedDocument30 pagesFm-I Chap-V Editedtibebu5420No ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- GR 95703Document1 pageGR 95703Joseph James BacayoNo ratings yet

- Senga Sales SyllabusDocument2 pagesSenga Sales SyllabusPochoy Mallari0% (1)

- Chapter 3 Civil Courts JurisdictionDocument7 pagesChapter 3 Civil Courts JurisdictionSanthosh RudrappaNo ratings yet

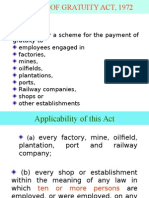

- Payment of Gratuity Act-1972Document35 pagesPayment of Gratuity Act-1972Ramesh KannaNo ratings yet

- Midterm Civil Law AnswerDocument9 pagesMidterm Civil Law AnswerFrancis Louie Allera HumawidNo ratings yet

- Service Policy Text EnglischDocument11 pagesService Policy Text EnglischFranz JW MontezaNo ratings yet

- TL 1Document26 pagesTL 1Ishan Bramhbhatt100% (2)