Professional Documents

Culture Documents

BEC 3357 Monetary Theory Practice

BEC 3357 Monetary Theory Practice

Uploaded by

kassimmakoy05Copyright:

Available Formats

You might also like

- BEC 3303 Economics of MoneyDocument2 pagesBEC 3303 Economics of MoneyKelvin MagiriNo ratings yet

- BEC 3303 Economics of Money BankingDocument2 pagesBEC 3303 Economics of Money BankingKelvin MagiriNo ratings yet

- Bec 3100 Introduction To EconomicsDocument2 pagesBec 3100 Introduction To EconomicsKelvin MagiriNo ratings yet

- BEC 3250 Intermediate MacroEconomicsDocument3 pagesBEC 3250 Intermediate MacroEconomicsKelvin MagiriNo ratings yet

- Bed3104 Intermediate Macroeconomics Reg SuppDocument2 pagesBed3104 Intermediate Macroeconomics Reg SuppCaroline NyamburaNo ratings yet

- Bce 200-Economics of Money and BankingDocument2 pagesBce 200-Economics of Money and Bankingtonikanyange07No ratings yet

- BFC 3328 Financial Institution and MarketsDocument3 pagesBFC 3328 Financial Institution and MarketsAbel BejaNo ratings yet

- BBC 2301 Money and Banking Year III Supplementary & SpecialDocument2 pagesBBC 2301 Money and Banking Year III Supplementary & SpecialitulejamesNo ratings yet

- Fundamentals of Commercial BanksDocument3 pagesFundamentals of Commercial BanksWesleyNo ratings yet

- Fmbo QPDocument4 pagesFmbo QPjpkassociates2019No ratings yet

- BEC 3100 Introduction The EconomicsDocument2 pagesBEC 3100 Introduction The EconomicsKelvin MagiriNo ratings yet

- BBB 2406 Money and Banking Year Iv Semester IIDocument1 pageBBB 2406 Money and Banking Year Iv Semester IIprittycarol8No ratings yet

- Microsoft Word Sta 2190 Introduction To Actuarial ScienceDocument3 pagesMicrosoft Word Sta 2190 Introduction To Actuarial ScienceAnuoluwapo PalmerNo ratings yet

- BCM 3115Document3 pagesBCM 3115korirenock764No ratings yet

- KASNEB - Aug 2009 To Nov 2010Document13 pagesKASNEB - Aug 2009 To Nov 2010Josephe Mwinizi50% (2)

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1Document2 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1AshNo ratings yet

- SEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426Document2 pagesSEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426PranjalNo ratings yet

- 6812 Question Paper Winter 2023Document3 pages6812 Question Paper Winter 2023karanNo ratings yet

- Csec Econ Section 5 Past Paper QuestionsDocument3 pagesCsec Econ Section 5 Past Paper QuestionskimmilianggNo ratings yet

- (Cored) HRD 2103 General EconomicsDocument2 pages(Cored) HRD 2103 General EconomicsJoe NjoreNo ratings yet

- 0102 Managerial Economics and Financial AnalysisDocument7 pages0102 Managerial Economics and Financial AnalysisFozia PanhwerNo ratings yet

- CAPE Economics 2006 U2 P1Document6 pagesCAPE Economics 2006 U2 P1GhNo ratings yet

- CSEC Principles of Business P2 2011Document4 pagesCSEC Principles of Business P2 2011Jada BrownNo ratings yet

- Economics Question BankDocument39 pagesEconomics Question BankAnish KumarNo ratings yet

- Engineering Economics and Accountancy 18MBC01 - 23-6-21Document2 pagesEngineering Economics and Accountancy 18MBC01 - 23-6-21AjayNo ratings yet

- (Karen) HRD 2103 General EconomicsDocument3 pages(Karen) HRD 2103 General EconomicsJoe NjoreNo ratings yet

- HRD 2103 General EconomicsDocument3 pagesHRD 2103 General EconomicsJohn MbugiNo ratings yet

- Bec 3101 Principles of MicroeconomicsDocument4 pagesBec 3101 Principles of MicroeconomicsKelvin MagiriNo ratings yet

- BEC 3101 BEC 3102 Principles of MicroEconomicsDocument2 pagesBEC 3101 BEC 3102 Principles of MicroEconomicsKelvin MagiriNo ratings yet

- (A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75Document1 page(A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75sameer_kini0% (1)

- Uganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesDocument2 pagesUganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesJohn DoeNo ratings yet

- Fundamentals of Finance and Banking Section A - Compulsory: TH THDocument3 pagesFundamentals of Finance and Banking Section A - Compulsory: TH THShivamNo ratings yet

- 856 Economics Sem II SpecimenDocument4 pages856 Economics Sem II SpecimenCharushree ChundawatNo ratings yet

- Bright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80Document4 pagesBright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80ADITYA SINGHNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Econ 10.5 PDFDocument3 pagesEcon 10.5 PDFpeter wongNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Economics Exclusive Sample PapersDocument8 pagesEconomics Exclusive Sample Paperslightinghappiness575No ratings yet

- International Trade Finance - May 2009Document6 pagesInternational Trade Finance - May 2009Basilio MaliwangaNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Central Banking CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Central Banking Cbcgsankityadav13heroNo ratings yet

- Macroeconomics 2 ExamDocument3 pagesMacroeconomics 2 ExamMWEBI OMBUI ERICK D193/15656/2018No ratings yet

- Rr310106 Managerial Economics and Financial AnalysisDocument9 pagesRr310106 Managerial Economics and Financial AnalysisSRINIVASA RAO GANTANo ratings yet

- (A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75Document2 pages(A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75sameer_kiniNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Financial Institution & MarketsDocument1 pageFinancial Institution & MarketsPILLO PATELNo ratings yet

- Buss 104 - Introduction To Macro-EconomicsDocument1 pageBuss 104 - Introduction To Macro-EconomicsEnock TareNo ratings yet

- Economics Exam-2Document2 pagesEconomics Exam-2MachelMDotAlexanderNo ratings yet

- 20sema69 m2 AssignmentDocument10 pages20sema69 m2 AssignmentprateekNo ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- 2023 Economics II HEG HEL MEG LEG MCEDocument4 pages2023 Economics II HEG HEL MEG LEG MCEishimwef501No ratings yet

- s.4 Ent Pp2 Revision & Past PapersDocument3 pagess.4 Ent Pp2 Revision & Past PapersKalule AlexNo ratings yet

- Great Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceDocument2 pagesGreat Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceARCHIBALDNo ratings yet

- Money and Banking J Worksheet 1 (2) (AutoRecovered)Document4 pagesMoney and Banking J Worksheet 1 (2) (AutoRecovered)Kritika MauryaNo ratings yet

- PM - I CIADocument5 pagesPM - I CIAgkvimal nathanNo ratings yet

- International Trade Finance - May 2013Document4 pagesInternational Trade Finance - May 2013Basilio MaliwangaNo ratings yet

- Econ 1Document1 pageEcon 1Ochola CharlesNo ratings yet

- DBA7103 - Economics Ananlysis For BusinessDocument20 pagesDBA7103 - Economics Ananlysis For BusinessThanigaivel KNo ratings yet

- Monetary EconomicsDocument3 pagesMonetary EconomicsStriky10No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- CÂU HỎI TRẮC NGHIỆM IRP 1Document4 pagesCÂU HỎI TRẮC NGHIỆM IRP 1Nhi PhanNo ratings yet

- Capital Gains CalculatorDocument2 pagesCapital Gains CalculatorA.YOGAGURUNo ratings yet

- Classical and Keynesian MacroeconomicsDocument8 pagesClassical and Keynesian MacroeconomicsarigatonituNo ratings yet

- Economics For Engineer Ca2Document6 pagesEconomics For Engineer Ca2Monglafru MogNo ratings yet

- JB SayDocument36 pagesJB Saysteven jobsNo ratings yet

- HEC 311 COURSE Outline 2024Document2 pagesHEC 311 COURSE Outline 2024jiwaraymondNo ratings yet

- MSTM 5030 C - Group Assignment - Anjali and SumeetDocument11 pagesMSTM 5030 C - Group Assignment - Anjali and SumeetANJALI ARORANo ratings yet

- FRBM Act - Objectives, Features, Full Form, FRBM ActDocument3 pagesFRBM Act - Objectives, Features, Full Form, FRBM ActK SinghNo ratings yet

- Negative Interest Rates The Bank of Japan ExperienceDocument17 pagesNegative Interest Rates The Bank of Japan ExperienceGabriela AbalosNo ratings yet

- Key Terms Assignment CH 2Document4 pagesKey Terms Assignment CH 2mkaderNo ratings yet

- Assessment 4Document3 pagesAssessment 4selNo ratings yet

- Maurice Dobb - WikipediaDocument1 pageMaurice Dobb - WikipediaBruno Miller TheodosioNo ratings yet

- Rent Receipt FormatDocument3 pagesRent Receipt FormatSiv RamNo ratings yet

- Macroeconomic Theories of InflationDocument5 pagesMacroeconomic Theories of InflationCarlos Beltrá MerinoNo ratings yet

- Ghosh and Ghosh, MacroeconomicsDocument436 pagesGhosh and Ghosh, MacroeconomicsArkaadeb Kapat80% (5)

- Mundell Fleming Open Economy ModelDocument19 pagesMundell Fleming Open Economy ModelPANDHARE SIDDHESHNo ratings yet

- Chapter SixDocument23 pagesChapter SixHaile GirmaNo ratings yet

- Multiple Choice - POB EXAM 2021Document5 pagesMultiple Choice - POB EXAM 2021Jumiah DanielNo ratings yet

- Comparing Economic Systems - Quiz Answer KeyDocument5 pagesComparing Economic Systems - Quiz Answer KeyAndrew WardNo ratings yet

- Monetary Policy Its Role For Financial StabilizationDocument6 pagesMonetary Policy Its Role For Financial StabilizationZahid HassanNo ratings yet

- Macro CH 10Document31 pagesMacro CH 10Tanisha Tibrewal0% (1)

- CapitalismDocument15 pagesCapitalismFernando Dominic Cunanan AlfonsoNo ratings yet

- IBF301 Ch006Document38 pagesIBF301 Ch006Đặng Quỳnh TrangNo ratings yet

- Course Outline - Anwar Shaikh - Foundation of Political Economy IDocument7 pagesCourse Outline - Anwar Shaikh - Foundation of Political Economy IAsim JaanNo ratings yet

- The Classical Economists: Name YEA R National ITY Adam Smith 172 3-179 0 BritishDocument5 pagesThe Classical Economists: Name YEA R National ITY Adam Smith 172 3-179 0 British'Iris S. MacaratNo ratings yet

- Pioneer of Communism - Karl MarxDocument5 pagesPioneer of Communism - Karl MarxFrank NyapanzeNo ratings yet

- Literature Review On Inflation and Economic GrowthDocument8 pagesLiterature Review On Inflation and Economic Growthea4c954qNo ratings yet

- NeoliberalismDocument50 pagesNeoliberalismJoviecca Lawas67% (3)

- ECO 102 - Assignment IIDocument2 pagesECO 102 - Assignment IISayeeda JahanNo ratings yet

- 1 Basic Economic ConceptsDocument101 pages1 Basic Economic ConceptsPaco MtnezNo ratings yet

BEC 3357 Monetary Theory Practice

BEC 3357 Monetary Theory Practice

Uploaded by

kassimmakoy05Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BEC 3357 Monetary Theory Practice

BEC 3357 Monetary Theory Practice

Uploaded by

kassimmakoy05Copyright:

Available Formats

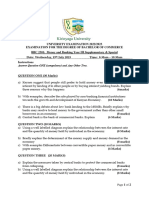

MERU UNIVERSITY OF SCIENCE AND TECHNOLOGY

P.O. Box 972-60200 – Meru-Kenya.

Tel: +254 (0)799529958, +254 (0)799529959, +254 (0)712524293

Website: www.must.ac.ke Email: info@must.ac.ke

University Examinations 2019/2020

THIRD YEAR, SECOND SEMESTER EXAMINATION FOR THE DEGREE OF

BACHELOR OF ECONOMICS AND BACHELOR OF COOPERATIVE MANAGEMENT

BEC 3357 – MONETARY THEORY & PRACTICE

DATE: OCTOBER 2020 TIME: 2 HOURS

INSTRUCTIONS: Answer question oe and any other two questions.

QUESTION ONE (30 MARKS)

a) Briefly explain the following monetary theories:

(i) Classical theory (2 Marks)

(ii) Rational expectations theory (2 Marks)

b) (i) Clearly explain what economists mean by “money” (2 Marks)

(ii) State and comment on the functions that money performs in an economy.(6 Marks)

(iii) Explain what money consists of in most countries today. (4 Marks)

c) (i) Explain how banks create money. (6 Marks)

(ii) Outline the four economic functions of banks and explain every function (8 Marks)

QUESTION TWO (20 MARKS)

a) Explain the banking system in Kenya , highlighting the groups of institutions involved in

its performance. (10 Marks)

b) State the four types of assets a bank usually owns and provide a summary of each.

(10 Marks)

QUESTION THREE (20 MARKS)

a) (i) Explain monetary policy. (2 Marks)

Meru University of Science & Technology is ISO 9001:2015 Certified

Foundation of Innovations Page 1

(ii) State the principal aim of monetary policy and the role of the Central Bank of Kenya

in maintaining economic stability. (6 Marks)

b) (i) Explain the factors that influence the quantity of money that people choose to

hold. (8 Marks)

(ii) Explain the following monetary policy transmission mechanisms;

• The Keynesian Version (2 Marks)

• The monetarist version (2 Marks)

QUESTION FOUR (20 MARKS)

a) Explain the role of the Central Bank of Kenya as monetary authority. (6 Marks)

b) (i) Using a suitable graphic illustration, explain the demand for money curve(5 Marks)

(ii) State the factors that limit the quantity of deposits that banks can create.(9 Marks)

QUESTION FIVE (20 MARKS)

a) State the main measures of money and specify the elements of each. (10 Marks)

b) (i) Explain what a bank does in order to achieve security for its depositors.(2 Marks)

(ii) Explain each of the safeguard measures the bank employs in (i) above.(8 Marks)

Meru University of Science & Technology is ISO 9001:2015 Certified

Foundation of Innovations Page 2

You might also like

- BEC 3303 Economics of MoneyDocument2 pagesBEC 3303 Economics of MoneyKelvin MagiriNo ratings yet

- BEC 3303 Economics of Money BankingDocument2 pagesBEC 3303 Economics of Money BankingKelvin MagiriNo ratings yet

- Bec 3100 Introduction To EconomicsDocument2 pagesBec 3100 Introduction To EconomicsKelvin MagiriNo ratings yet

- BEC 3250 Intermediate MacroEconomicsDocument3 pagesBEC 3250 Intermediate MacroEconomicsKelvin MagiriNo ratings yet

- Bed3104 Intermediate Macroeconomics Reg SuppDocument2 pagesBed3104 Intermediate Macroeconomics Reg SuppCaroline NyamburaNo ratings yet

- Bce 200-Economics of Money and BankingDocument2 pagesBce 200-Economics of Money and Bankingtonikanyange07No ratings yet

- BFC 3328 Financial Institution and MarketsDocument3 pagesBFC 3328 Financial Institution and MarketsAbel BejaNo ratings yet

- BBC 2301 Money and Banking Year III Supplementary & SpecialDocument2 pagesBBC 2301 Money and Banking Year III Supplementary & SpecialitulejamesNo ratings yet

- Fundamentals of Commercial BanksDocument3 pagesFundamentals of Commercial BanksWesleyNo ratings yet

- Fmbo QPDocument4 pagesFmbo QPjpkassociates2019No ratings yet

- BEC 3100 Introduction The EconomicsDocument2 pagesBEC 3100 Introduction The EconomicsKelvin MagiriNo ratings yet

- BBB 2406 Money and Banking Year Iv Semester IIDocument1 pageBBB 2406 Money and Banking Year Iv Semester IIprittycarol8No ratings yet

- Microsoft Word Sta 2190 Introduction To Actuarial ScienceDocument3 pagesMicrosoft Word Sta 2190 Introduction To Actuarial ScienceAnuoluwapo PalmerNo ratings yet

- BCM 3115Document3 pagesBCM 3115korirenock764No ratings yet

- KASNEB - Aug 2009 To Nov 2010Document13 pagesKASNEB - Aug 2009 To Nov 2010Josephe Mwinizi50% (2)

- CU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1Document2 pagesCU-2021 B.A. B.Sc. (Honours) Economics Semester-VI Paper-DSE-A-2-1AshNo ratings yet

- SEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426Document2 pagesSEM 6 - 10 - BA BSC - HONS - ECONOMICS - DSE A2 - MONEY AND FINANCIAL MARKETS 10426PranjalNo ratings yet

- 6812 Question Paper Winter 2023Document3 pages6812 Question Paper Winter 2023karanNo ratings yet

- Csec Econ Section 5 Past Paper QuestionsDocument3 pagesCsec Econ Section 5 Past Paper QuestionskimmilianggNo ratings yet

- (Cored) HRD 2103 General EconomicsDocument2 pages(Cored) HRD 2103 General EconomicsJoe NjoreNo ratings yet

- 0102 Managerial Economics and Financial AnalysisDocument7 pages0102 Managerial Economics and Financial AnalysisFozia PanhwerNo ratings yet

- CAPE Economics 2006 U2 P1Document6 pagesCAPE Economics 2006 U2 P1GhNo ratings yet

- CSEC Principles of Business P2 2011Document4 pagesCSEC Principles of Business P2 2011Jada BrownNo ratings yet

- Economics Question BankDocument39 pagesEconomics Question BankAnish KumarNo ratings yet

- Engineering Economics and Accountancy 18MBC01 - 23-6-21Document2 pagesEngineering Economics and Accountancy 18MBC01 - 23-6-21AjayNo ratings yet

- (Karen) HRD 2103 General EconomicsDocument3 pages(Karen) HRD 2103 General EconomicsJoe NjoreNo ratings yet

- HRD 2103 General EconomicsDocument3 pagesHRD 2103 General EconomicsJohn MbugiNo ratings yet

- Bec 3101 Principles of MicroeconomicsDocument4 pagesBec 3101 Principles of MicroeconomicsKelvin MagiriNo ratings yet

- BEC 3101 BEC 3102 Principles of MicroEconomicsDocument2 pagesBEC 3101 BEC 3102 Principles of MicroEconomicsKelvin MagiriNo ratings yet

- (A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75Document1 page(A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75sameer_kini0% (1)

- Uganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesDocument2 pagesUganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesJohn DoeNo ratings yet

- Fundamentals of Finance and Banking Section A - Compulsory: TH THDocument3 pagesFundamentals of Finance and Banking Section A - Compulsory: TH THShivamNo ratings yet

- 856 Economics Sem II SpecimenDocument4 pages856 Economics Sem II SpecimenCharushree ChundawatNo ratings yet

- Bright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80Document4 pagesBright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80ADITYA SINGHNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Econ 10.5 PDFDocument3 pagesEcon 10.5 PDFpeter wongNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Economics Exclusive Sample PapersDocument8 pagesEconomics Exclusive Sample Paperslightinghappiness575No ratings yet

- International Trade Finance - May 2009Document6 pagesInternational Trade Finance - May 2009Basilio MaliwangaNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Central Banking CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Central Banking Cbcgsankityadav13heroNo ratings yet

- Macroeconomics 2 ExamDocument3 pagesMacroeconomics 2 ExamMWEBI OMBUI ERICK D193/15656/2018No ratings yet

- Rr310106 Managerial Economics and Financial AnalysisDocument9 pagesRr310106 Managerial Economics and Financial AnalysisSRINIVASA RAO GANTANo ratings yet

- (A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75Document2 pages(A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75sameer_kiniNo ratings yet

- Eet 201 Macroeconomics Theory IiDocument2 pagesEet 201 Macroeconomics Theory Iidragon labNo ratings yet

- Financial Institution & MarketsDocument1 pageFinancial Institution & MarketsPILLO PATELNo ratings yet

- Buss 104 - Introduction To Macro-EconomicsDocument1 pageBuss 104 - Introduction To Macro-EconomicsEnock TareNo ratings yet

- Economics Exam-2Document2 pagesEconomics Exam-2MachelMDotAlexanderNo ratings yet

- 20sema69 m2 AssignmentDocument10 pages20sema69 m2 AssignmentprateekNo ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- 2023 Economics II HEG HEL MEG LEG MCEDocument4 pages2023 Economics II HEG HEL MEG LEG MCEishimwef501No ratings yet

- s.4 Ent Pp2 Revision & Past PapersDocument3 pagess.4 Ent Pp2 Revision & Past PapersKalule AlexNo ratings yet

- Great Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceDocument2 pagesGreat Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceARCHIBALDNo ratings yet

- Money and Banking J Worksheet 1 (2) (AutoRecovered)Document4 pagesMoney and Banking J Worksheet 1 (2) (AutoRecovered)Kritika MauryaNo ratings yet

- PM - I CIADocument5 pagesPM - I CIAgkvimal nathanNo ratings yet

- International Trade Finance - May 2013Document4 pagesInternational Trade Finance - May 2013Basilio MaliwangaNo ratings yet

- Econ 1Document1 pageEcon 1Ochola CharlesNo ratings yet

- DBA7103 - Economics Ananlysis For BusinessDocument20 pagesDBA7103 - Economics Ananlysis For BusinessThanigaivel KNo ratings yet

- Monetary EconomicsDocument3 pagesMonetary EconomicsStriky10No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- CÂU HỎI TRẮC NGHIỆM IRP 1Document4 pagesCÂU HỎI TRẮC NGHIỆM IRP 1Nhi PhanNo ratings yet

- Capital Gains CalculatorDocument2 pagesCapital Gains CalculatorA.YOGAGURUNo ratings yet

- Classical and Keynesian MacroeconomicsDocument8 pagesClassical and Keynesian MacroeconomicsarigatonituNo ratings yet

- Economics For Engineer Ca2Document6 pagesEconomics For Engineer Ca2Monglafru MogNo ratings yet

- JB SayDocument36 pagesJB Saysteven jobsNo ratings yet

- HEC 311 COURSE Outline 2024Document2 pagesHEC 311 COURSE Outline 2024jiwaraymondNo ratings yet

- MSTM 5030 C - Group Assignment - Anjali and SumeetDocument11 pagesMSTM 5030 C - Group Assignment - Anjali and SumeetANJALI ARORANo ratings yet

- FRBM Act - Objectives, Features, Full Form, FRBM ActDocument3 pagesFRBM Act - Objectives, Features, Full Form, FRBM ActK SinghNo ratings yet

- Negative Interest Rates The Bank of Japan ExperienceDocument17 pagesNegative Interest Rates The Bank of Japan ExperienceGabriela AbalosNo ratings yet

- Key Terms Assignment CH 2Document4 pagesKey Terms Assignment CH 2mkaderNo ratings yet

- Assessment 4Document3 pagesAssessment 4selNo ratings yet

- Maurice Dobb - WikipediaDocument1 pageMaurice Dobb - WikipediaBruno Miller TheodosioNo ratings yet

- Rent Receipt FormatDocument3 pagesRent Receipt FormatSiv RamNo ratings yet

- Macroeconomic Theories of InflationDocument5 pagesMacroeconomic Theories of InflationCarlos Beltrá MerinoNo ratings yet

- Ghosh and Ghosh, MacroeconomicsDocument436 pagesGhosh and Ghosh, MacroeconomicsArkaadeb Kapat80% (5)

- Mundell Fleming Open Economy ModelDocument19 pagesMundell Fleming Open Economy ModelPANDHARE SIDDHESHNo ratings yet

- Chapter SixDocument23 pagesChapter SixHaile GirmaNo ratings yet

- Multiple Choice - POB EXAM 2021Document5 pagesMultiple Choice - POB EXAM 2021Jumiah DanielNo ratings yet

- Comparing Economic Systems - Quiz Answer KeyDocument5 pagesComparing Economic Systems - Quiz Answer KeyAndrew WardNo ratings yet

- Monetary Policy Its Role For Financial StabilizationDocument6 pagesMonetary Policy Its Role For Financial StabilizationZahid HassanNo ratings yet

- Macro CH 10Document31 pagesMacro CH 10Tanisha Tibrewal0% (1)

- CapitalismDocument15 pagesCapitalismFernando Dominic Cunanan AlfonsoNo ratings yet

- IBF301 Ch006Document38 pagesIBF301 Ch006Đặng Quỳnh TrangNo ratings yet

- Course Outline - Anwar Shaikh - Foundation of Political Economy IDocument7 pagesCourse Outline - Anwar Shaikh - Foundation of Political Economy IAsim JaanNo ratings yet

- The Classical Economists: Name YEA R National ITY Adam Smith 172 3-179 0 BritishDocument5 pagesThe Classical Economists: Name YEA R National ITY Adam Smith 172 3-179 0 British'Iris S. MacaratNo ratings yet

- Pioneer of Communism - Karl MarxDocument5 pagesPioneer of Communism - Karl MarxFrank NyapanzeNo ratings yet

- Literature Review On Inflation and Economic GrowthDocument8 pagesLiterature Review On Inflation and Economic Growthea4c954qNo ratings yet

- NeoliberalismDocument50 pagesNeoliberalismJoviecca Lawas67% (3)

- ECO 102 - Assignment IIDocument2 pagesECO 102 - Assignment IISayeeda JahanNo ratings yet

- 1 Basic Economic ConceptsDocument101 pages1 Basic Economic ConceptsPaco MtnezNo ratings yet