Professional Documents

Culture Documents

Paslc 84681 2023 Trim

Paslc 84681 2023 Trim

Uploaded by

phantomhabzicOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paslc 84681 2023 Trim

Paslc 84681 2023 Trim

Uploaded by

phantomhabzicCopyright:

Available Formats

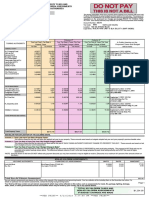

DO NOT PAY

PROPOSED OR ADOPTED NON-AD VALOREM ASSESSMENTS

Parcel ID 3420-650-1459-000-5

THIS IS NOT A BILL

The taxing authorities which levy property taxes against your property will soon hold

PUBLIC HEARINGS to adopt budgets and tax rates for the next year. The purpose of

the PUBLIC HEARINGS is to receive opinions from the general public and to answer

questions on the proposed tax change and budget PRIOR TO TAKING FINAL

ACTION. Each taxing authority may AMEND OR ALTER its proposals at the hearing.

Account Number: 84681

Tax Code: 0011 Port Saint Lucie

Paul Kin Kwan Siu / Sabrina Y M Siu

Location: 2117 SW TAMPICO ST

3 Boyce Rd C5 Butler Tower Legal Desc: PORT ST LUCIE-SECTION 31- BLK 1739 LOT 2 (MAP 43/11N)

Jardines Lookou

(OR 790-1279)

HONG KONG

Column 1* Column 2* Column 3*

Your Last Year's Tax Rate & Your Tax Rate & Taxes This Year Your Tax Rate & Taxes This Year A Public Hearing on the

TAXING AUTHORITY

Property Taxes If No Budget Change is Made If Budget Change is Made Proposed Taxes and Budget

Tax Rate Tax Amount Tax Rate Tax Amount Tax Rate Tax Amount will be held:

GENERAL COUNTY

SLC General Fund 4.2077 244.05 3.7567 239.68 4.2840 273.32 September 7, 2023 6:00 PM

Jail,Law Enf 2.7294 158.31 2.4261 154.79 2.7294 174.14 2300 Virginia Ave 3rd Floor, Fort Pierce

Erosion Dist E 0.1763 10.23 0.1559 9.95 0.1000 6.38 (772) 462-1670

Mosquito Control 0.1352 7.84 0.1189 7.59 0.1352 8.63

County Parks 0.1813 10.52 0.1603 10.23 0.0000 0.00

County Transit 0.1269 7.36 0.1122 7.16 0.2500 15.95

PUBLIC SCHOOLS

By State Law 3.2310 481.10 2.8402 422.91 3.1640 471.12 September 12, 2023 5:01 PM

By Local Board 3.2480 483.63 2.8552 425.14 3.2480 483.63 9461 Brandywine Ln, PSL

(772) 429-3970

MUNICIPALITY

Port Saint Lucie 4.7307 274.38 4.1488 264.69 4.7057 300.22 September 11, 2023 6:00 PM

121 SW Port St Lucie Blvd, PSL

(772) 871-7390

WATER MANAGEMENT

S FL Wtr Mgmt Dist 0.0948 5.50 0.0850 5.42 0.0948 6.05 September 14, 2023 5:15 PM

SFWMD-Okee Basin 0.1026 5.95 0.0920 5.87 0.1026 6.55 3301 Gun Club Rd Bldg B-1, WPB

Everglades Project 0.0327 1.90 0.0293 1.87 0.0327 2.09 (561) 686-8800

INDEPENDENT DISTRICTS

SLC Fire Dist 3.0000 174.00 2.6555 169.42 3.0000 191.40 September 6, 2023 5:01 PM

5160 NW Milner Dr, PSL

(772) 621-3400

FL Inland Nav Dist 0.0320 1.86 0.0288 1.84 0.0288 1.84 September 7, 2023 5:05 PM

1707 NE Indian River Dr, Jensen Beach

(561) 627-3386

Children`s Services 0.4025 23.35 0.3563 22.73 0.3790 24.18 September 5, 2023 5:01 PM

546 NW University Blvd, PSL

(772) 408-1100

VOTER APPROVED DEBT SERVICE

PSL Voted Debt 0.5693 33.02 0.5693 36.32 0.4943 31.54 September 11, 2023 6:00 PM

121 SW Port St Lucie Blvd, PSL

(772) 871-7390

Total Property Taxes $1,923.00 $1,785.61 $1,997.04

SEE BELOW FOR EXPLANATION OF THE COLUMNS ABOVE.

*Column 1 - "Your Last Year's Tax Rate & Property Taxes"

This column shows the tax rate and taxes that applied last year to your property. These amounts were based on budgets adopted last year and your property's previous taxable value.

*Column 2 - "Your Tax Rate & Taxes This Year If No Budget Change is Made"

This column shows what the tax rate and your taxes will be this year IF EACH TAXING AUTHORITY DOES NOT CHANGE ITS PROPERTY TAX LEVY. These amounts are based on last

year's budgets and your current assessment.

*Column 3 - "Your Tax Rate & Taxes This Year If Budget Change is Made"

This column shows what the tax rate and your taxes will be this year under the BUDGET ACTUALLY PROPOSED by each local taxing authority. The proposal is NOT final and may be

amended at the public hearings shown above. The difference between columns 2 and 3 is the tax change proposed by each local taxing authority and is NOT the result of higher

assessments.

*NOTE: Amounts shown on this form DO NOT reflect early payment discounts you may have received or may be eligible to receive. (Discounts are a maximum of 4 percent of the amounts shown on

this form.)

NON-AD VALOREM ASSESSMENTS

LEVYING AUTHORITY PURPOSE OF ASSESSMENT UNITS RATE AMOUNT

PSL Stormwater Stormwater Mgmt - PROPOSED RATE (772) 871-1775 (1PSL) 0.75000 178.000 133.50

Total Non-Ad Valorem Assessment $133.50

Non-ad valorem assessments are placed on this notice at the request of the respective local governing boards. Your tax collector will be including them on the November tax notice. For

details on particular non-ad valorem assessments, contact the levying local governing board.

Page 1

Your final tax bill may contain non-ad valorem assessments which may not be reflected on this notice, such as assessments for roads, fire, garbage, lighting, drainage,

water, sewer, or other governmental services and facilities which may be levied by your county, city or any special district.

TOTAL AD VALOREM TAXES AND TOTAL AD VALOREM TAXES AND

NON-AD VALOREM ASSESSMENTS $9,403.08 NON-AD VALOREM ASSESSMENTS $2,130.54

FROM LAST YEAR IF BUDGET CHANGES ARE MADE

**WEB PRINT** 11/6/2023 6:04:30 PM **WEB PRINT**

DO NOT PAY - THIS IS NOT A BILL

Michelle Franklin

Certified Florida Appraiser

Parcel ID 3420-650-1459-000-5

Tax Code: 0011 Port Saint Lucie Account Number: 84681

Location: 2117 SW TAMPICO ST Legal Desc: PORT ST LUCIE-SECTION 31- BLK 1739 LOT 2 (MAP 43/11N) (OR

790-1279)

Property Valuation

Last Year This Year

Market Value

148,900 148,900

Assessed Value Exemptions Taxable Value

Taxing Authority Last Year This Year Last Year This Year Last Year This Year

County 58,000 63,800 0 0 58,000 63,800

Public Schools 148,900 148,900 0 0 148,900 148,900

Municipality 58,000 63,800 0 0 58,000 63,800

Water Management 58,000 63,800 0 0 58,000 63,800

Independent Districts 58,000 63,800 0 0 58,000 63,800

Voter Approved Debt Service 58,000 63,800 0 0 58,000 63,800

Assessment Reductions / Portability Applies to Value

Non-Homestead Cap Non-School Funds 85,100

Exemptions* Applies to Last Year This Year

*Where more than one value exists, county value of exemption will be indicated

If you feel that the market value of your property is inaccurate or does not If the property appraiser's office is unable to resolve the matter as to market

reflect fair market value, or if you are entitled to an exemption or value, classification, or an exemption, you may file a petition for adjustment

classification that is not reflected on this form, contact the with the Value Adjustment Board. Petition forms are available from the

Saint Lucie County Property Appraiser at: County Property Appraiser and must be filed

2300 Virginia Ave Rm 121, Fort Pierce, FL 34982 ON OR BEFORE:

or (772) 462-1021 September 12, 2023

Market Value: Market (also called "just") value is the most probable sale price for your property in a competitive, open market. It is based on a willing buyer

and a willing seller.

Assessed Value: Assessed value is the market value of your property minus any assessment reductions. The assessed value may be different for levies

made by different taxing authorities.

Assessment Reductions / Portability:

Properties can receive an assessment reduction for a number of reasons. Some of the common reasons are below.

•There are limits on how much the assessment of your property can increase each year. The Save Our Homes program and the limitation for

non-homestead property are examples.

•Certain types of property, such as agricultural land and land used for conservation, are valued on their current use rather than their market value.

•Some reductions lower the assessed value only for levies of certain taxing authorities.

If your assessed value is lower than your market value because limits on increases apply to your property or because your property is valued based on its

current use, the amount of the difference and reason for the difference are listed in the box titled "Assessment Reductions".

Exemptions: Exemptions that apply to your property are listed in this section along with its corresponding exemption value. Specific dollar or percentage

reductions in assessed value may be applicable to a property based upon certain qualifications of the property or property owner. In some cases, an

exemption's value may vary depending on the taxing authority. The tax impact of an exemption may also vary for the same taxing authority, depending on

the levy (e.g., operating millage vs. debt service millage).

Taxable Value: Taxable value is the value used to calculate the tax due on your property. Taxable value is the assessed value minus the value of your

exemptions and discounts.

Our Promise to You... www.paslc.gov

Superior Service, Trusted Results (772) 462-1021

Page 2

**WEB PRINT** 11/6/2023 6:04:30 PM **WEB PRINT**

You might also like

- TD Bank StatementDocument1 pageTD Bank StatementBaba d100% (2)

- 53RD Personal Bank StatementDocument3 pages53RD Personal Bank StatementKelvin Dominic50% (2)

- Complete FreedomDocument24 pagesComplete Freedomelatucker1No ratings yet

- BUCODocument2 pagesBUCOAlex De Vries100% (1)

- BS FormatDocument12 pagesBS Formatsudershan90% (1)

- TD Business Premier Checking: Account SummaryDocument3 pagesTD Business Premier Checking: Account SummaryJohn Bean75% (4)

- William Richardson TD-Bank-StatementDocument5 pagesWilliam Richardson TD-Bank-StatementJonathan Seagull Livingston100% (1)

- Case Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationDocument3 pagesCase Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationArnav MittalNo ratings yet

- Corporate Tax Chapter 2 HomeworkDocument3 pagesCorporate Tax Chapter 2 HomeworkAndrew Steven0% (1)

- Paslc 43079 2022 AtrmDocument2 pagesPaslc 43079 2022 AtrmMr AndersonNo ratings yet

- 2022 Ococ0594962002Document1 page2022 Ococ0594962002john yorkNo ratings yet

- Broward County Real Estate 504209 18 0434 2022 Installment Bill 1Document1 pageBroward County Real Estate 504209 18 0434 2022 Installment Bill 1skycastleoaksNo ratings yet

- Bills List For 10-12-10Document4 pagesBills List For 10-12-10Ewing Township, NJNo ratings yet

- TD Bank Statement - Scott W Springer#2Document2 pagesTD Bank Statement - Scott W Springer#2fehijan689No ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572hanhNo ratings yet

- Exempt CorporationsDocument12 pagesExempt CorporationsCARLO JOSE BACTOLNo ratings yet

- Net Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningsDocument8 pagesNet Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningslplclcircNo ratings yet

- POSB Payroll AccountDocument2 pagesPOSB Payroll Accountcu64432No ratings yet

- United Bank of India HO: 11, Hemanta Basu Sarani, Kolkata 700001 Internet BankingDocument3 pagesUnited Bank of India HO: 11, Hemanta Basu Sarani, Kolkata 700001 Internet Bankingrajeshroy1No ratings yet

- 22bca20044 Exp1Document2 pages22bca20044 Exp1Yash SiwachNo ratings yet

- Dallas County Briefing and Court Order PDFDocument3 pagesDallas County Briefing and Court Order PDFThe TexanNo ratings yet

- 2021 - 05 - 04 2 - 05 Am Office LensDocument1 page2021 - 05 - 04 2 - 05 Am Office Lensshani ChahalNo ratings yet

- Ordinance Budget FY2024 CompleteDocument10 pagesOrdinance Budget FY2024 CompleteKayode CrownNo ratings yet

- Oasis Distribution (Usd)Document1 pageOasis Distribution (Usd)Lynn AbelgasNo ratings yet

- Liska Paystub PDFDocument2 pagesLiska Paystub PDFMik JrNo ratings yet

- SOA Acct 1853481 22023Document2 pagesSOA Acct 1853481 220234zqz75b2znNo ratings yet

- BP002758 PermitDocument1 pageBP002758 PermitExcelNo ratings yet

- DownloadDocument2 pagesDownloadChelsea KayeNo ratings yet

- Statement All Transactions 20231001 20231006Document1 pageStatement All Transactions 20231001 20231006ThomsonNo ratings yet

- Account Statement 15-10-2023T12 57 07Document3 pagesAccount Statement 15-10-2023T12 57 07tq.waseemhashmi13No ratings yet

- 07.2022 - PPS Pampanga - SSS PRNDocument2 pages07.2022 - PPS Pampanga - SSS PRNSharmaine Jane SanoriasNo ratings yet

- 2022 11 01 - 2023 10 31 - TransactionDocument40 pages2022 11 01 - 2023 10 31 - TransactionChidinma NnoliNo ratings yet

- December, 2023Document4 pagesDecember, 2023lesly malebrancheNo ratings yet

- Oluwale AdebayoDocument1 pageOluwale Adebayowhitneydemetria007No ratings yet

- 01 19 2022 - MainStreetRenewalInvoice 21 SnowDocument15 pages01 19 2022 - MainStreetRenewalInvoice 21 SnowAlexander BonillaNo ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572Abdelali ArabNo ratings yet

- (Page No: 1 - 21N - LIC0415621N - 17002417158701) Batch: 1st of 11/2023Document2 pages(Page No: 1 - 21N - LIC0415621N - 17002417158701) Batch: 1st of 11/2023nia.interiors26No ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List Summaryallgorrez.studentNo ratings yet

- Patricia Fairclough-Staggers' Conflicting TRIM NoticesDocument1 pagePatricia Fairclough-Staggers' Conflicting TRIM NoticesBen KellerNo ratings yet

- Earnings Statement: Other Benefits andDocument1 pageEarnings Statement: Other Benefits andAngerlette PerryNo ratings yet

- MR Emmanuel K Tshimanga Kanyinda 2 Waterhout ST Blue Downs 7100Document3 pagesMR Emmanuel K Tshimanga Kanyinda 2 Waterhout ST Blue Downs 7100emmatshims36No ratings yet

- Inventory Report JUNE 2020Document32 pagesInventory Report JUNE 2020alexisNo ratings yet

- BCCmeeting 083010Document5 pagesBCCmeeting 083010Michael PitmanNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryTylyn Travel and ToursNo ratings yet

- TempDocument4 pagesTempShiv PatelNo ratings yet

- Summary of Accounts: Accounts Account Number Balance Ytd DivDocument4 pagesSummary of Accounts: Accounts Account Number Balance Ytd DivalexNo ratings yet

- Summary of Accounts: Accounts Account Number Balance Ytd DivDocument4 pagesSummary of Accounts: Accounts Account Number Balance Ytd DivalexNo ratings yet

- Statement 3Document8 pagesStatement 3GeminiCrescentNo ratings yet

- County 072309Document5 pagesCounty 072309jsweigartNo ratings yet

- TD BankDocument1 pageTD BankShaggy Shag0% (1)

- Statement of Account MayDocument7 pagesStatement of Account Maytylermichael912No ratings yet

- 222 S Gale - BS2104151 - ElecDocument2 pages222 S Gale - BS2104151 - Elecmaria ysareli jaimes rodriguezNo ratings yet

- STATEMENTS, October2023 3287Document7 pagesSTATEMENTS, October2023 3287aduadjoechristophereduNo ratings yet

- Autosweep Sept 1-Oct 16Document44 pagesAutosweep Sept 1-Oct 16Genevieve-LhangLatorenoNo ratings yet

- NRSC - Gross ComplaintDocument10 pagesNRSC - Gross ComplaintJacob OglesNo ratings yet

- Sched of Ropa & Ncahs As of February 2014Document62 pagesSched of Ropa & Ncahs As of February 2014Mich FelloneNo ratings yet

- Statement 2Document6 pagesStatement 2liletagalvez1987No ratings yet

- Tariff Petition of LESCO For FY 2013-14Document85 pagesTariff Petition of LESCO For FY 2013-14Ab CNo ratings yet

- How to Exercise Statutory Powers Properly: Cayman Islands Administrative LawFrom EverandHow to Exercise Statutory Powers Properly: Cayman Islands Administrative LawNo ratings yet

- Avanti: Feeds LimitedDocument27 pagesAvanti: Feeds LimitedSudhir Kumar SinghNo ratings yet

- Veena Texchem IndustriesDocument3 pagesVeena Texchem IndustriesBala_9990No ratings yet

- Idea Cellular Limited: Input Form For Full & Final Settlement & Clearance - FinanceDocument2 pagesIdea Cellular Limited: Input Form For Full & Final Settlement & Clearance - FinanceSAI ASSOCIATENo ratings yet

- Letter Endorsement To BLGFDocument1 pageLetter Endorsement To BLGFJeffre AbarracosoNo ratings yet

- MTC-100 Treasury FormDocument1 pageMTC-100 Treasury FormvijiNo ratings yet

- What Is Leave Travel Allowance or LTADocument3 pagesWhat Is Leave Travel Allowance or LTAMukesh UpadhyeNo ratings yet

- Computation FY 21-22Document2 pagesComputation FY 21-22gondaliyaconsultancy0909No ratings yet

- Taxation Syl2Document13 pagesTaxation Syl2attywithnocaseyetNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- Thoma Cash FlowDocument2 pagesThoma Cash FlowflorentinaNo ratings yet

- Project Report For Bank Loan - Format, Details - AKT AssociatesDocument13 pagesProject Report For Bank Loan - Format, Details - AKT AssociatesCatch a starNo ratings yet

- Peza-Esd Reportorial RequirementsDocument2 pagesPeza-Esd Reportorial RequirementsBelle MadrigalNo ratings yet

- 08 Actvity 1Document3 pages08 Actvity 1Angelo MorenoNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Lesson 14 - Maintenance of Registers and RecordsDocument4 pagesLesson 14 - Maintenance of Registers and RecordshemaNo ratings yet

- B-BTAX313 Module 4 (Expenditure Cycle) - Part 1Document15 pagesB-BTAX313 Module 4 (Expenditure Cycle) - Part 1will passNo ratings yet

- Petronet TDS Circular For Website (01082022)Document24 pagesPetronet TDS Circular For Website (01082022)ajeshtnNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Kanya KarungalDocument13 pagesKanya KarungalramNo ratings yet

- Noa-Iit Ob2120200629085533331Document1 pageNoa-Iit Ob2120200629085533331Jay Maung MaungNo ratings yet

- Question - Chapter 6. Basis of AssessmentDocument5 pagesQuestion - Chapter 6. Basis of AssessmentTâm TốngNo ratings yet

- Kakinada Municipal Corporation: ReceiptDocument1 pageKakinada Municipal Corporation: ReceiptYagna PrakashraoNo ratings yet

- File 01052023152738148Document3 pagesFile 01052023152738148Arun RajangamNo ratings yet

- RMO No. 34-2020Document1 pageRMO No. 34-2020Joel SyNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- The Double Entry System For Expenses and RevenuesDocument2 pagesThe Double Entry System For Expenses and RevenuesAung Zaw HtweNo ratings yet

- Revision Q&ADocument5 pagesRevision Q&ADylan Rabin PereiraNo ratings yet