Professional Documents

Culture Documents

Tax Deduction/Collection Account Number: Meaning of TAN

Tax Deduction/Collection Account Number: Meaning of TAN

Uploaded by

Onkar BandichhodeCopyright:

Available Formats

You might also like

- 9 Smart Money Concepts That Every Trader Must KnowDocument19 pages9 Smart Money Concepts That Every Trader Must Knowclrgwa80% (5)

- En Custom Form 22Document1 pageEn Custom Form 22Tamil Arasu100% (1)

- MetabankDocument3 pagesMetabanktempmailNo ratings yet

- Tax Deduction/Collection Account Number: Meaning of TANDocument8 pagesTax Deduction/Collection Account Number: Meaning of TANakashNo ratings yet

- Y KPYh 21 Sy 3 y 2 W 0 HHX PQo 0 R 94 HX 68 GOn 12 Ps Yo BSPDocument8 pagesY KPYh 21 Sy 3 y 2 W 0 HHX PQo 0 R 94 HX 68 GOn 12 Ps Yo BSPKumar DiwakarNo ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- Application For PAN Through Online Services: Tax Information NetworkDocument6 pagesApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaNo ratings yet

- Detailed Steps and Explanation of Procedure To Start Business in IndiaDocument10 pagesDetailed Steps and Explanation of Procedure To Start Business in IndiaWhats BuzzNo ratings yet

- What Is Pan?: Frequently Asked Questions and Answers (Faqs)Document7 pagesWhat Is Pan?: Frequently Asked Questions and Answers (Faqs)deepak_itsmeNo ratings yet

- Session - 1Document14 pagesSession - 1AARCHI JAINNo ratings yet

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- Tds On Foreign Remittances: Surprises Continued.Document9 pagesTds On Foreign Remittances: Surprises Continued.AdityaNo ratings yet

- What Is PAN CardDocument14 pagesWhat Is PAN CardkamleshmistriNo ratings yet

- Tds TutorialsDocument25 pagesTds TutorialsdagliamitNo ratings yet

- Overview of TDS: Who Shall Deduct Tax at Source?Document37 pagesOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7No ratings yet

- Employee Communication On PF WithdrawalDocument1 pageEmployee Communication On PF WithdrawalchaitanyaNo ratings yet

- Sarala TDS Final 16a CircularDocument3 pagesSarala TDS Final 16a CircularYashwiniGowdaNo ratings yet

- Unit 5Document43 pagesUnit 5sujal mundhraNo ratings yet

- Pan CardDocument39 pagesPan Cardfasttrack0420No ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Pan Card Application - Pan Card Status Information of Pan Card ApplicationDocument5 pagesPan Card Application - Pan Card Status Information of Pan Card ApplicationShankar JhaNo ratings yet

- Guidelines For Filling PAN New ApplicationDocument2 pagesGuidelines For Filling PAN New ApplicationSuniil RavikumarNo ratings yet

- NDNC - How To RegisterDocument5 pagesNDNC - How To Registershanky688No ratings yet

- Tax. 23Document18 pagesTax. 23RahulNo ratings yet

- Guidelines UAN BasedDocument2 pagesGuidelines UAN BasedDhamu DharanNo ratings yet

- Ref.: SC/1017155/GGN/CRMIO/2019 Date: 08-Feb-2019: This Is A System Generated Letter and Does Not Require Any SignaturesDocument2 pagesRef.: SC/1017155/GGN/CRMIO/2019 Date: 08-Feb-2019: This Is A System Generated Letter and Does Not Require Any Signaturesgajala jamirNo ratings yet

- Expression of InterestDocument10 pagesExpression of InterestRahul JainNo ratings yet

- Form-16 Part-A From TDSCPC Website PDFDocument3 pagesForm-16 Part-A From TDSCPC Website PDFgaurav singhNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- All About Form 15CA Form 15CBDocument6 pagesAll About Form 15CA Form 15CBKirti SanghaviNo ratings yet

- 1.permanent Account Number (Pan)Document10 pages1.permanent Account Number (Pan)akashNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Leaflet For Deductors PDFDocument2 pagesLeaflet For Deductors PDFCA Hiralal ArsiddhaNo ratings yet

- Administrative Provisions SEC. 236. Registration Requirements.Document6 pagesAdministrative Provisions SEC. 236. Registration Requirements.Blanca Louise Vali ValledorNo ratings yet

- Compliance Procedures 15 CA & CBDocument4 pagesCompliance Procedures 15 CA & CBMangesh AherkarNo ratings yet

- Permanent Account Number (Pan)Document11 pagesPermanent Account Number (Pan)KrishanuNayakNo ratings yet

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNo ratings yet

- L13LLB183031Document29 pagesL13LLB183031Debasis MisraNo ratings yet

- Instruction ITR1 Sahaj 2018Document8 pagesInstruction ITR1 Sahaj 2018MadNo ratings yet

- Circulars 2009 Onreturnforms Final 10062009Document6 pagesCirculars 2009 Onreturnforms Final 10062009api-20002381No ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- How To File TDS On The Sale of PropertyDocument12 pagesHow To File TDS On The Sale of PropertyManjukesanNo ratings yet

- Guidelines For Filling Pan New ApplicationDocument2 pagesGuidelines For Filling Pan New Applicationapi-250913495No ratings yet

- Maharashtra Profession Tax FaqsDocument5 pagesMaharashtra Profession Tax FaqsPrashant BedaseNo ratings yet

- b0d9c Reply To 16 4 NoticeDocument7 pagesb0d9c Reply To 16 4 NoticeahemadriandcoNo ratings yet

- Instructions For Application Form For Claiming Tax Refund of Indonesia Tax Withholding (FORM-DGT 3)Document2 pagesInstructions For Application Form For Claiming Tax Refund of Indonesia Tax Withholding (FORM-DGT 3)Ilma YunidaNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Steps To Claim Dividend Shares IepfDocument4 pagesSteps To Claim Dividend Shares IepfBiswambhar GhoshNo ratings yet

- Mantri Garib Kalyan Deposit Scheme, 2016.: TH STDocument8 pagesMantri Garib Kalyan Deposit Scheme, 2016.: TH STrakeshambasanaNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

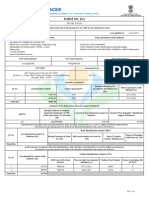

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Commercial Tax Regulations EnglishDocument25 pagesCommercial Tax Regulations EnglishYeyint099No ratings yet

- Um CitizenDocument28 pagesUm CitizenNasir AhmedNo ratings yet

- SPL Terms N Conditions For Phase III 270716Document12 pagesSPL Terms N Conditions For Phase III 270716Mahesh KumarNo ratings yet

- Appendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Document3 pagesAppendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Samarjit KararNo ratings yet

- Instructions For Filling ITR-4 SUGAM A.Y. 2020-21 General InstructionsDocument53 pagesInstructions For Filling ITR-4 SUGAM A.Y. 2020-21 General InstructionsRavindra PoojaryNo ratings yet

- Profession Tax Registration ProcedureDocument9 pagesProfession Tax Registration ProcedureParas ShahNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Financial Management-Capital BudgetingDocument24 pagesFinancial Management-Capital Budgetingakash yadavNo ratings yet

- PDIC Law Additional NotesDocument6 pagesPDIC Law Additional NotesBay Ariel Sto TomasNo ratings yet

- Sesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Document15 pagesSesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Nur Ulfawati HadiNo ratings yet

- Assignment 1 Precis Writing For Rbi Grade B/Nabard Grade A/B & Sebi Grade ADocument2 pagesAssignment 1 Precis Writing For Rbi Grade B/Nabard Grade A/B & Sebi Grade AKIRAN MEENANo ratings yet

- Tugas Makroekonomi 3Document15 pagesTugas Makroekonomi 3AzaleaNo ratings yet

- Practice Question 1-Portfolio ManagementDocument8 pagesPractice Question 1-Portfolio Managementzoyaatique72No ratings yet

- LoanDocument2 pagesLoanpratheeshNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Mergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test BankDocument32 pagesMergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test Bankwolfgangmagnusyya100% (27)

- Chapter 2Document35 pagesChapter 2Demise WakeNo ratings yet

- Compound Interest VyapamDocument8 pagesCompound Interest VyapamPrafulla JoshiNo ratings yet

- Cfas Notes (Pas and PFRS)Document3 pagesCfas Notes (Pas and PFRS)Gio BurburanNo ratings yet

- Small Business Loans ICICI BankDocument4 pagesSmall Business Loans ICICI BankAyush BishtNo ratings yet

- Equity Investment I - Nov 2022Document98 pagesEquity Investment I - Nov 2022Pranjal ShendeNo ratings yet

- COUNTRY - CAPTIAL - WPS OfficeDocument4 pagesCOUNTRY - CAPTIAL - WPS OfficeHimasankarNo ratings yet

- ACC2200 Milestone 1Document7 pagesACC2200 Milestone 1Kayla IgwuokuNo ratings yet

- 10 1108 - Imefm 07 2021 0290Document13 pages10 1108 - Imefm 07 2021 0290hazwani tarmiziNo ratings yet

- Cryptocurrency: Prepared By: 1-Mohamed Raheem 2 - Bassant Hegazi 3 - Mohamed Nour 4 - Mariam 5 - DinaDocument29 pagesCryptocurrency: Prepared By: 1-Mohamed Raheem 2 - Bassant Hegazi 3 - Mohamed Nour 4 - Mariam 5 - DinaMohamed RaheemNo ratings yet

- Economics VocabularyDocument5 pagesEconomics VocabularyMedrouaNo ratings yet

- Corp LiquiDocument15 pagesCorp Liquijikee11No ratings yet

- Income StatementDocument7 pagesIncome StatementZahidRiazHaansNo ratings yet

- Balance Sheet of ICICI Bank2Document1 pageBalance Sheet of ICICI Bank2john_muellorNo ratings yet

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaNo ratings yet

- 62c39f2609022 Ferrell 12e PPT ch14Document51 pages62c39f2609022 Ferrell 12e PPT ch14fayyasin99No ratings yet

- In Financial Trouble QuestionsDocument6 pagesIn Financial Trouble QuestionsJosh LeBlancNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- PGP Macroeconomics (Session 16)Document34 pagesPGP Macroeconomics (Session 16)Swarnilee PatraNo ratings yet

Tax Deduction/Collection Account Number: Meaning of TAN

Tax Deduction/Collection Account Number: Meaning of TAN

Uploaded by

Onkar BandichhodeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Deduction/Collection Account Number: Meaning of TAN

Tax Deduction/Collection Account Number: Meaning of TAN

Uploaded by

Onkar BandichhodeCopyright:

Available Formats

TAX DEDUCTION/COLLECTION ACCOUNT NUMBER

Meaning of TAN

Tax Deduction Account Number or Tax Collection Account Number is a 10-digit alpha-

numeric number issued by the Income-tax Department (we will refer to it as TAN). TAN

is to be obtained by all persons who are responsible for deducting tax at source (TDS) or

who are required to collect tax at source (TCS).

Structure of TAN

First 4 digits of TAN are alphabets, the next 5 digits of TAN are numeric and last digit is

an alphabet.

First 3 alphabets of TAN represent the jurisdiction code, 4th alphabet is the initial of the

name of the TAN holder who can be a company, firm, individual, etc. For example, TAN

allotted to Mr. Mahesh of Delhi may appear as under:

DEL M 12345 L

Jurisdiction Code Name of deductee

Persons liable to apply for TAN

As discussed above, every person liable to deduct tax at source or collect tax at source is

required to obtain TAN. However, a person required to deduct tax under section 194-IA

can use PAN in place of TAN as such person is not required to obtain TAN.

Further, a person required to deduct tax under section 194-IB or section 194M shall not

be required to obtain tax deduction account number (TAN).

As per section 194-IB any individual or HUF [whose books of account are not required to

be audited under section 44AB] is liable to deduct tax at the rate of 5% while making

payment of rent of any land or building or both to a resident person if amount of rent

exceeds Rs. 50,000 for a month or part of a month.

Section 194M provides for deduction of tax, at the rate of 5%, from the sum paid or

credited to a resident, in a year on account of contractual work, commission (not being

insurance commission as referred to in Section 194D), brokerage or professional fees, by

an individual or a HUF [whose books of account are not required to be audited under

Section 44AB], if aggregate of such sum exceeds Rs. 50 lakhs in a year.

Relevance of TAN

As per section 203A of the Income-tax Act, 1961, every person who deducts or collects

tax at source has to apply for the allotment of TAN. Section 203A also makes it

mandatory to quote TAN in following documents:

(a) TDS statements i.e. return

(b) TCS statements i.e. return

[As amended by Finance Act, 2023]

(c) Statement of financial transactions or reportable accounts

(d) Challans for payment of TDS/TCS

(e) TDS/TCS certificates

(f) Other documents as may be prescribed

Consequences of not quoting TAN

Section 272BB(1) provides for penalty for failure to obtain TAN and section 272BB(1A)

provides for penalty for quoting incorrect TAN. Penalty imposable under section 272BB

is Rs. 10,000.

Procedure to obtain TAN

There are two modes for applying for TAN: (1) Online mode and (ii) Offline mode. They

are as follows:

OFFLINE—An application for allotment of TAN is to be filed in Form 49B in duplicate

and submitted to any TIN-FC. Addresses of TIN-FCs are available at protean-tinpan

website (https://www.protean-tinpan.com).

In case of an applicant, being a company which has not been registered under the

Companies Act, 2013, the application for allotment of Tax Deduction Account Number

may be made in Form No. INC-32 (SPICe) specified under sub-section (1) of section 7 of

the said Act for incorporation of the company.

ONLINE—Online application for TAN can be made from the Protean-tinpan website.

Places from where to obtain Form 49B

(1) Form 49B is freely downloadable from the website of Income-tax Department

(http://www.incometaxindia.gov.in)

(2) It is also available at TIN-FCs.

(3) Legible photocopies of Form 49B or forms legibly printed exactly as per the format

prescribed by Income-tax Department are also allowed to be used.

Authority empowered to allot TAN

TAN is allotted by the Income-tax Department on the basis of the application submitted

online at Protean-tinpan website or offline to TIN-FC managed by Protean-tinpan .

Protean-tinpan will intimate TAN to the applicant at the address specified in the

application.

Documents to be submitted along with TAN application

No documents are required to be submitted along with application for allotment of TAN.

However, for online application, the signed acknowledgment which is generated after

filling up the form is to be forwarded to Protean-tinpan .

[As amended by Finance Act, 2023]

Procedure for online TAN application

The deductor can apply for TAN online at Protean-tinpan website (https://www.protean-

tinpan.com/)

(1) On confirmation of correct uploading of online application, an acknowledgement will

be displayed on screen. The acknowledgement consists of:

Unique 14-digit acknowledgement number

Status of the applicant

Name of the applicant

Contact details

Payment details

Space for signature

(2) Applicant has to save the acknowledgment and should obtain a print of the same.

(3) The applicant should sign the acknowledgment. Signature should only be within the

box provided in the acknowledgement.

(4) In case of applicants other than individual, the authorised signatory shall sign the

acknowledgement and affix the appropriate seal or stamp.

(5) Thumb impression, if used, should be attested by Magistrate/Notary Public/Gazetted

Officer under his official seal and stamp.

Payment:

(1) The applicant has to make the payment of processing fee which is Rs 55 + GST (as

applicable)

(2) Payment can be made by

Demand draft

Cheque

E-payment (for mode and other procedure applicable in case of e-payment visit

https://tin.tin.nsdl.com/tan/form49B.html

(3) Demand draft/Cheque shall be in favour of Protean-tinpan .

(4) Name of applicant and acknowledgement number should be mentioned on reverse of

DD/Cheque.

(5) DD shall be payable at Mumbai.

(6) Applicant making payment by cheque shall deposit a local cheque (drawn on any

bank) with any HDFC Bank across the country (except Dahej) . The applicant shall

mention TANNSDL on deposit slip.

On successful payment by e-payment mode an acknowledgement will be displayed.

Applicant shall save and print the acknowledgement and send it to NSDL as mentioned in

“submission of document”.

[As amended by Finance Act, 2023]

Submission of documents:

(a) The duly signed acknowledgement along with DD, if any, shall be sent to NSDL at

NSDL – e – Governance Infrastructure Limited,

5th floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model colony, Near Deep Bungalow chowk,

Pune – 411016.

(b) Superscribe the envelope with .APPLICATION FOR TAN – Acknowledgement

number..

(c) It should reach NSDL within 15 days from the date of online application

(d) Application will be processed only on receipt of duly signed acknowledgement and

realisation of payment.

No separate TAN is required to obtain for the purpose of TCS

TAN allotted for TDS can be used for the purpose of TCS also. In other words, no

separate TAN is required to obtain for the purpose of TCS, if the person already holds

TAN for the purpose of TDS.

How to find the address of nearest TIN-FC?

Addresses of all TIN-FC are available on Protean-tinpan website ( https://www.protean-

tinpan.com/.

Single TAN is to be used in case of deductor who has to deduct tax from different

types of payment such as salary, interest payment, etc.

TAN once allotted can be used for all types of deduction and collection. In other words, it

is not necessary to apply for different TAN if the deductor has to deduct tax from

different types of payment such as salary, interest payment, etc.

Enquire about the status of TAN application

After making the application for allotment of TAN, the deductor can enquire about the

status of his application by accessing Protean-tinpan website at status track option and by

quoting the unique 14-digit acknowledgement number after three days of his application.

This facility can be accessed from the website of Income-tax Department too

(www.incometaxindia.gov.in).

Government deductors are also liable to obtain TAN

Like Non-Government deductors, the Government deductors are also required to apply

for TAN.

PAN cannot be quoted in place of TAN

PAN should never be quoted in the field where TAN is required to be quoted. In other

words, the deductor/collector cannot quote his PAN in place of TAN. If he does not

[As amended by Finance Act, 2023]

possess TAN, then he has to apply for the same. However, a person required to deduct

tax under section 194-IA can use PAN in place of TAN as such person is not required to

obtain TAN.

Taxpayer cannot hold more than one TAN

It is illegal to possess or use more than one TAN. Different branches/ divisions of an

entity may, however, have separate TAN.

In case more than one TAN have been allotted, then the TAN which is being used

regularly should be continued and the other TAN(s) should immediately be surrendered

for cancellation using “Form for changes or correction in TAN” which can be

downloaded from Protean-tinpan website or may be procured from TIN-FC.

Changes in the basic data communicated at the time of making the application for

allotment of TAN

Any change or correction in the data associated with TAN should be communicated to

the Income-tax Department by filing up “Form for changes or correction in TAN data for

TAN allotted” along with necessary fees at any of the TIN-FCs or Protean-tinpan

website.

[As amended by Finance Act, 2023]

MCQ ON TAX DEDUCTION/COLLECTION ACCOUNT NUMBER

Q1.Tax Deduction Account Number or Tax Collection Account Number (TAN) is

a alpha-numeric number issued by the Income-tax Department.

(a) 5 digit (b) 10 digit

(c) 15 digit (d) 20 digit

Correct answer : (b)

Justification of correct answer :

Tax Deduction Account Number or Tax Collection Account Number (TAN) is a 10-digit

alpha-numeric number issued by the Income-tax Department.

Thus, option (b) is the correct option.

Q2.As per section of the Income-tax Act, 1961, every person who deducts or

collects tax at source has to apply for the allotment of TAN.

(a)203A (b) 139A

(c) 203AA (d) 210

Correct answer : (a)

Justification of correct answer :

As per section 203A of the Income-tax Act, 1961, every person who deducts or collects

tax at source has to apply for the allotment of TAN. However, the provisions relating to

obtaining of TAN will not apply to a person deducting tax under section 194-IA (i.e.

from sale consideration of land/building) and to such person, as may be notified by the

Central Government in this behalf.

Further, a person required to deduct tax under section 194-IB shall not be required to

obtain tax deduction account number (TAN).

As per section 194-IB (as inserted by Finance Act, 2017), any individual or HUF [whose

books of account are not required to be audited under section 44AB] is liable to deduct

tax at the rate of 5% while making payment of rent of any land or building or both to a

resident person if amount of rent exceeds Rs. 50,000 for a month or part of a month.

Section 194M [inserted by Finance (No. 2) Act, 2019] provides for deduction of tax, at

the rate of 5%, from the sum paid or credited to a resident, in a year on account of

contractual work, commission (not being insurance commission as referred to in Section

194D), brokerage or professional fees, by an individual or a HUF [whose books of

account are not required to be audited under Section 44AB], if aggregate of such sum

exceeds Rs. 50 lakhs in a year.

Thus, option (a) is the correct option.

Q3.First 3 alphabets of TAN represent the _.

(a) Name of the TAN holder

(b) Surname of the TAN holder

(c) Jurisdiction code

[As amended by Finance Act, 2023]

(d) Residential status of the TAN holder

Correct answer : (c)

Justification of correct answer :

First 3 alphabets of TAN represent the jurisdiction code.

Thus, option (c) is the correct option.

Q4.4th alphabet of TAN represents the initial of the name of the TAN holder who can be

a company, firm, individual, etc.

(a) True (b) False

Correct answer : (a)

Justification of correct answer :

4th alphabet of TAN represents the initial of the name of the TAN holder who can be a

company, firm, individual, etc.

Thus, option (a) is the correct option.

Q5.Section provides for penalty for failure to obtain Tax Deduction Account

Number or Tax Collection Account Number (as the case may be).

(a) 272BB(1A) (b)272BB(1)

(c) 271H (d) 271C

Correct answer : (b)

Justification of correct answer :

Section 272BB(1) provides for penalty for failure to obtain Tax Deduction Account

Number or Tax Collection Account Number (as the case may be).

Thus, option (b) is the correct option.

Q6.No penalty has been prescribed under the Income-tax Law for quoting incorrect Tax

Deduction Account Number or Tax Collection Account Number (as the case may be).

(a) True (b) False

Correct answer : (b)

Justification of correct answer :

Section 272BB(1A) provides for penalty for quoting incorrect Tax Deduction Account

Number or Tax Collection Account Number (as the case may be).

Thus, option (b) is the correct option.

Q7.Penalty imposable under section 272BB is _

(a) Rs. 50,000 (b) Rs. 25,000

(c) Rs. 10,000 (d) Rs. 5,000

Correct answer : (c)

Justification of correct answer :

Section 272BB(1) provides for penalty for failure to obtain Tax Deduction Account

Number or Tax Collection Account Number (as the case may be) and section

272BB(1A) provides for penalty for quoting incorrect Tax Deduction Account Number

[As amended by Finance Act, 2023]

or Tax Collection Account Number (as the case may be). Penalty imposable under

section 272BB is Rs. 10,000.

Thus, option (c) is the correct option.

Q8.Which form is required to be filed in for applying for TAN?

(a) Form 49B (b) Form 49C

Correct answer : (a)

Justification of correct answer :

Form 49B is required to be filed for applying for TAN. In case of an applicant, being a

company which has not been registered under the Companies Act, 2013, the application

for allotment of Tax Deduction Account Number may be made in Form No. INC-32

(SPICe) specified under sub-section (1) of section 7 of the said Act for incorporation of

the company.

Thus, option (a) is the correct option.

Q9.A person required to deduct tax under section can use PAN in place of

TAN as such person is not required to obtain TAN.

(a) 192 (b) 193

(c) 194A (d) 194-IA

Correct answer : (d)

Justification of correct answer :

A person required to deduct tax under section 194-IA can use PAN in place of TAN as

such person is not required to obtain TAN.

Thus, option (d) is the correct option.

Q10.Any change or correction in the data associated with TAN should be communicated

to the Income-tax Department by filing up “Form for changes or correction in TAN data

for TAN allotted”.

(a) True (b) False

Correct answer : (a)

Justification of correct answer :

Any change or correction in the data associated with TAN should be communicated to

the Income-tax Department by filing up “Form for changes or correction in TAN data for

TAN allotted” along with necessary fees at any of the TIN-FCs or Protean-tinpan

website.

Thus, option (a) is the correct option.

[As amended by Finance Act, 2023]

You might also like

- 9 Smart Money Concepts That Every Trader Must KnowDocument19 pages9 Smart Money Concepts That Every Trader Must Knowclrgwa80% (5)

- En Custom Form 22Document1 pageEn Custom Form 22Tamil Arasu100% (1)

- MetabankDocument3 pagesMetabanktempmailNo ratings yet

- Tax Deduction/Collection Account Number: Meaning of TANDocument8 pagesTax Deduction/Collection Account Number: Meaning of TANakashNo ratings yet

- Y KPYh 21 Sy 3 y 2 W 0 HHX PQo 0 R 94 HX 68 GOn 12 Ps Yo BSPDocument8 pagesY KPYh 21 Sy 3 y 2 W 0 HHX PQo 0 R 94 HX 68 GOn 12 Ps Yo BSPKumar DiwakarNo ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- Application For PAN Through Online Services: Tax Information NetworkDocument6 pagesApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaNo ratings yet

- Detailed Steps and Explanation of Procedure To Start Business in IndiaDocument10 pagesDetailed Steps and Explanation of Procedure To Start Business in IndiaWhats BuzzNo ratings yet

- What Is Pan?: Frequently Asked Questions and Answers (Faqs)Document7 pagesWhat Is Pan?: Frequently Asked Questions and Answers (Faqs)deepak_itsmeNo ratings yet

- Session - 1Document14 pagesSession - 1AARCHI JAINNo ratings yet

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- Tds On Foreign Remittances: Surprises Continued.Document9 pagesTds On Foreign Remittances: Surprises Continued.AdityaNo ratings yet

- What Is PAN CardDocument14 pagesWhat Is PAN CardkamleshmistriNo ratings yet

- Tds TutorialsDocument25 pagesTds TutorialsdagliamitNo ratings yet

- Overview of TDS: Who Shall Deduct Tax at Source?Document37 pagesOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7No ratings yet

- Employee Communication On PF WithdrawalDocument1 pageEmployee Communication On PF WithdrawalchaitanyaNo ratings yet

- Sarala TDS Final 16a CircularDocument3 pagesSarala TDS Final 16a CircularYashwiniGowdaNo ratings yet

- Unit 5Document43 pagesUnit 5sujal mundhraNo ratings yet

- Pan CardDocument39 pagesPan Cardfasttrack0420No ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Pan Card Application - Pan Card Status Information of Pan Card ApplicationDocument5 pagesPan Card Application - Pan Card Status Information of Pan Card ApplicationShankar JhaNo ratings yet

- Guidelines For Filling PAN New ApplicationDocument2 pagesGuidelines For Filling PAN New ApplicationSuniil RavikumarNo ratings yet

- NDNC - How To RegisterDocument5 pagesNDNC - How To Registershanky688No ratings yet

- Tax. 23Document18 pagesTax. 23RahulNo ratings yet

- Guidelines UAN BasedDocument2 pagesGuidelines UAN BasedDhamu DharanNo ratings yet

- Ref.: SC/1017155/GGN/CRMIO/2019 Date: 08-Feb-2019: This Is A System Generated Letter and Does Not Require Any SignaturesDocument2 pagesRef.: SC/1017155/GGN/CRMIO/2019 Date: 08-Feb-2019: This Is A System Generated Letter and Does Not Require Any Signaturesgajala jamirNo ratings yet

- Expression of InterestDocument10 pagesExpression of InterestRahul JainNo ratings yet

- Form-16 Part-A From TDSCPC Website PDFDocument3 pagesForm-16 Part-A From TDSCPC Website PDFgaurav singhNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- All About Form 15CA Form 15CBDocument6 pagesAll About Form 15CA Form 15CBKirti SanghaviNo ratings yet

- 1.permanent Account Number (Pan)Document10 pages1.permanent Account Number (Pan)akashNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Leaflet For Deductors PDFDocument2 pagesLeaflet For Deductors PDFCA Hiralal ArsiddhaNo ratings yet

- Administrative Provisions SEC. 236. Registration Requirements.Document6 pagesAdministrative Provisions SEC. 236. Registration Requirements.Blanca Louise Vali ValledorNo ratings yet

- Compliance Procedures 15 CA & CBDocument4 pagesCompliance Procedures 15 CA & CBMangesh AherkarNo ratings yet

- Permanent Account Number (Pan)Document11 pagesPermanent Account Number (Pan)KrishanuNayakNo ratings yet

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNo ratings yet

- L13LLB183031Document29 pagesL13LLB183031Debasis MisraNo ratings yet

- Instruction ITR1 Sahaj 2018Document8 pagesInstruction ITR1 Sahaj 2018MadNo ratings yet

- Circulars 2009 Onreturnforms Final 10062009Document6 pagesCirculars 2009 Onreturnforms Final 10062009api-20002381No ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- How To File TDS On The Sale of PropertyDocument12 pagesHow To File TDS On The Sale of PropertyManjukesanNo ratings yet

- Guidelines For Filling Pan New ApplicationDocument2 pagesGuidelines For Filling Pan New Applicationapi-250913495No ratings yet

- Maharashtra Profession Tax FaqsDocument5 pagesMaharashtra Profession Tax FaqsPrashant BedaseNo ratings yet

- b0d9c Reply To 16 4 NoticeDocument7 pagesb0d9c Reply To 16 4 NoticeahemadriandcoNo ratings yet

- Instructions For Application Form For Claiming Tax Refund of Indonesia Tax Withholding (FORM-DGT 3)Document2 pagesInstructions For Application Form For Claiming Tax Refund of Indonesia Tax Withholding (FORM-DGT 3)Ilma YunidaNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Steps To Claim Dividend Shares IepfDocument4 pagesSteps To Claim Dividend Shares IepfBiswambhar GhoshNo ratings yet

- Mantri Garib Kalyan Deposit Scheme, 2016.: TH STDocument8 pagesMantri Garib Kalyan Deposit Scheme, 2016.: TH STrakeshambasanaNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Commercial Tax Regulations EnglishDocument25 pagesCommercial Tax Regulations EnglishYeyint099No ratings yet

- Um CitizenDocument28 pagesUm CitizenNasir AhmedNo ratings yet

- SPL Terms N Conditions For Phase III 270716Document12 pagesSPL Terms N Conditions For Phase III 270716Mahesh KumarNo ratings yet

- Appendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Document3 pagesAppendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Samarjit KararNo ratings yet

- Instructions For Filling ITR-4 SUGAM A.Y. 2020-21 General InstructionsDocument53 pagesInstructions For Filling ITR-4 SUGAM A.Y. 2020-21 General InstructionsRavindra PoojaryNo ratings yet

- Profession Tax Registration ProcedureDocument9 pagesProfession Tax Registration ProcedureParas ShahNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Financial Management-Capital BudgetingDocument24 pagesFinancial Management-Capital Budgetingakash yadavNo ratings yet

- PDIC Law Additional NotesDocument6 pagesPDIC Law Additional NotesBay Ariel Sto TomasNo ratings yet

- Sesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Document15 pagesSesi 2-1 Indivara - Risk in Financing Multifinance Company v1.4Nur Ulfawati HadiNo ratings yet

- Assignment 1 Precis Writing For Rbi Grade B/Nabard Grade A/B & Sebi Grade ADocument2 pagesAssignment 1 Precis Writing For Rbi Grade B/Nabard Grade A/B & Sebi Grade AKIRAN MEENANo ratings yet

- Tugas Makroekonomi 3Document15 pagesTugas Makroekonomi 3AzaleaNo ratings yet

- Practice Question 1-Portfolio ManagementDocument8 pagesPractice Question 1-Portfolio Managementzoyaatique72No ratings yet

- LoanDocument2 pagesLoanpratheeshNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Mergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test BankDocument32 pagesMergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test Bankwolfgangmagnusyya100% (27)

- Chapter 2Document35 pagesChapter 2Demise WakeNo ratings yet

- Compound Interest VyapamDocument8 pagesCompound Interest VyapamPrafulla JoshiNo ratings yet

- Cfas Notes (Pas and PFRS)Document3 pagesCfas Notes (Pas and PFRS)Gio BurburanNo ratings yet

- Small Business Loans ICICI BankDocument4 pagesSmall Business Loans ICICI BankAyush BishtNo ratings yet

- Equity Investment I - Nov 2022Document98 pagesEquity Investment I - Nov 2022Pranjal ShendeNo ratings yet

- COUNTRY - CAPTIAL - WPS OfficeDocument4 pagesCOUNTRY - CAPTIAL - WPS OfficeHimasankarNo ratings yet

- ACC2200 Milestone 1Document7 pagesACC2200 Milestone 1Kayla IgwuokuNo ratings yet

- 10 1108 - Imefm 07 2021 0290Document13 pages10 1108 - Imefm 07 2021 0290hazwani tarmiziNo ratings yet

- Cryptocurrency: Prepared By: 1-Mohamed Raheem 2 - Bassant Hegazi 3 - Mohamed Nour 4 - Mariam 5 - DinaDocument29 pagesCryptocurrency: Prepared By: 1-Mohamed Raheem 2 - Bassant Hegazi 3 - Mohamed Nour 4 - Mariam 5 - DinaMohamed RaheemNo ratings yet

- Economics VocabularyDocument5 pagesEconomics VocabularyMedrouaNo ratings yet

- Corp LiquiDocument15 pagesCorp Liquijikee11No ratings yet

- Income StatementDocument7 pagesIncome StatementZahidRiazHaansNo ratings yet

- Balance Sheet of ICICI Bank2Document1 pageBalance Sheet of ICICI Bank2john_muellorNo ratings yet

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaNo ratings yet

- 62c39f2609022 Ferrell 12e PPT ch14Document51 pages62c39f2609022 Ferrell 12e PPT ch14fayyasin99No ratings yet

- In Financial Trouble QuestionsDocument6 pagesIn Financial Trouble QuestionsJosh LeBlancNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- PGP Macroeconomics (Session 16)Document34 pagesPGP Macroeconomics (Session 16)Swarnilee PatraNo ratings yet