Professional Documents

Culture Documents

Invst Letter Part6

Invst Letter Part6

Uploaded by

H. M. Dulal HossainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invst Letter Part6

Invst Letter Part6

Uploaded by

H. M. Dulal HossainCopyright:

Available Formats

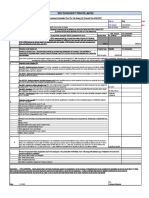

Date: May 08, 2023

Mr. Md. Dulal Hossain

Shift in - Charge - welding, OCL Plant

Omera Cylinders Limited

Mobil House, CWS (C): 9, Gulshan -1, Dhaka 1212

Subject : Investment in approved securities for the purpose of income tax rebate for the

income year: 2022-2023 (assessment year: 2023-2024)

Dear Mr. Md. Dulal Hossain,

You are aware that every employee is required to invest in approved securities/ instruments each year for income tax

rebate. As per your present salary and benefits, you are required to invest at least an amount of Tk. 76,083.00

(estimated) during the income year 2022-2023, but not later than 30th June 2023 to get maximum tax rebate.

Please, note that your estimated tax burden has been calculated considering maximum tax rebate assuming that you

will invest the required amount in approved securities/ instruments during the income year 2022-2023. If you do not

or partially invest, you will get no rebate or partial rebate, as the case may be, and accordingly your tax burden/

deduction will be increased.

Please, confirm to us the actual investment made by you during the income year 2022-2023 before processing the

June 2023 payroll.

Thanking you.

Yours truly,

Payroll Accountant Financial Controller HR Manager

You might also like

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- Education Loan PDFDocument1 pageEducation Loan PDFBikram Mudi80% (5)

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- Education LoanDocument1 pageEducation LoanAjinkya Bagade100% (1)

- Undertaking For Notice Period Buyout Reimb - pdf.1 PDFDocument1 pageUndertaking For Notice Period Buyout Reimb - pdf.1 PDFYogesh kuarNo ratings yet

- Investment Declaration For Income Tax Calculation For The Financial Year 2023-24Document2 pagesInvestment Declaration For Income Tax Calculation For The Financial Year 2023-24Bheemineni ChandrikaNo ratings yet

- Certificate For Income Tax - July 2022 To June 2023: To Whom It May ConcernDocument1 pageCertificate For Income Tax - July 2022 To June 2023: To Whom It May Concernমোঃ জহুরুল ইসলামNo ratings yet

- Gillela Raghavender 6029273 2022 SALARY REVISION LETTER1Document3 pagesGillela Raghavender 6029273 2022 SALARY REVISION LETTER1Careersjobs IndiaNo ratings yet

- Declaration - For - Due Date After Cut Off DateDocument1 pageDeclaration - For - Due Date After Cut Off DateJitender MadanNo ratings yet

- End of Service Custom ReportDocument1 pageEnd of Service Custom ReportMuhammad NaveedNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Releaving LetterDocument2 pagesReleaving Lettersimakdarwesh04No ratings yet

- 199 013823Document2 pages199 013823aradhyaprateekNo ratings yet

- Section 6D Income TaxDocument1 pageSection 6D Income Taxahchee88No ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Income Tax Declaration FormDocument1 pageIncome Tax Declaration Formdiwakar1978No ratings yet

- Your Personalised Gratuity Report: Employment Duration BreakdownDocument1 pageYour Personalised Gratuity Report: Employment Duration BreakdownEXPERTISE STORENo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Releaving Letter RAJA BOOPATHY SDocument2 pagesReleaving Letter RAJA BOOPATHY Ssimakdarwesh04No ratings yet

- Education LoanDocument1 pageEducation Loanabhishek.abbeyNo ratings yet

- Job Appointment Letter Format: Subject: ( (Subject) )Document4 pagesJob Appointment Letter Format: Subject: ( (Subject) )Swaroopa AbbineniNo ratings yet

- Deeksha Education LoanDocument1 pageDeeksha Education Loanabhishek.abbeyNo ratings yet

- Disb AdviceDocument2 pagesDisb AdviceRaj Kumar GundlaNo ratings yet

- Investment Proof For Income Tax Computation (FY 2023-24)Document1 pageInvestment Proof For Income Tax Computation (FY 2023-24)Nandu kumarNo ratings yet

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- 5.1.4. Career CounselingDocument57 pages5.1.4. Career CounselingankitNo ratings yet

- Position To Seek Employment, Having Been Released by Your Current EmployerDocument1 pagePosition To Seek Employment, Having Been Released by Your Current EmployerMohammad KamruzzamanNo ratings yet

- Batch 2 Draft Question-1Document5 pagesBatch 2 Draft Question-1Somnath BhattaraiNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022Document21 pagesOffer: Computer Consultancy Ref: TCSL/DT20222317867/Hyderabad Date: 30/07/2022jd2saiNo ratings yet

- Guidelines TaxRelatedDeclarations2023 24Document22 pagesGuidelines TaxRelatedDeclarations2023 24karthik sNo ratings yet

- Byjus - Offer Letter - TNL71885888 - 21 Jan 2022 - EncryptedDocument1 pageByjus - Offer Letter - TNL71885888 - 21 Jan 2022 - EncryptedpraveenNo ratings yet

- IT Declaration Form April 2023 To March 2024.Document3 pagesIT Declaration Form April 2023 To March 2024.partha.uneesolutionsNo ratings yet

- Assignment Taxation 2Document13 pagesAssignment Taxation 2afiq hisyamNo ratings yet

- Ilovepdf - Merged (1) - MergedDocument6 pagesIlovepdf - Merged (1) - Mergedshivani malhotraNo ratings yet

- Abhilash Mattummal,: Dr. Rashid Ali Al Balushi Dr. Raveendranath P.K. Chief Executive Officer Managing DirectorDocument1 pageAbhilash Mattummal,: Dr. Rashid Ali Al Balushi Dr. Raveendranath P.K. Chief Executive Officer Managing DirectorPradeep SukumaranNo ratings yet

- Job Appointment Letter FormatDocument4 pagesJob Appointment Letter Formatsatvik workNo ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20206377163/Kolkata Date: 12/10/2021Document20 pagesOffer: Computer Consultancy Ref: TCSL/DT20206377163/Kolkata Date: 12/10/2021Ahana BhattacharjeeNo ratings yet

- Staff Pensioners Investment Declaration For Fy 2023 24Document2 pagesStaff Pensioners Investment Declaration For Fy 2023 24Shaik RaziullaNo ratings yet

- 2024.02.12 GRSP Bonus Contribution LetterDocument1 page2024.02.12 GRSP Bonus Contribution Letteresmaeil62No ratings yet

- DownloadfileDocument20 pagesDownloadfileNaga RajuNo ratings yet

- 27 16x31a04c2 Shriya Reddy PonnalaDocument19 pages27 16x31a04c2 Shriya Reddy Ponnalaranjit sivakumarNo ratings yet

- Mindtree - Bommineni Saiteja 19-20Document19 pagesMindtree - Bommineni Saiteja 19-20jaganbecs0% (1)

- Self Declaration For Future Proof2Document2 pagesSelf Declaration For Future Proof2Mohan kishoreNo ratings yet

- A405Document1 pageA405Awadh GroupNo ratings yet

- TCS Offer LetterDocument20 pagesTCS Offer LetterSurya rohitNo ratings yet

- MMMMDocument1 pageMMMMParthiban ManiNo ratings yet

- 244-264 Vijay S - CseDocument21 pages244-264 Vijay S - Cse6055 - Ragul TNo ratings yet

- Offer Letter 70Document19 pagesOffer Letter 70Aashish PMNo ratings yet

- Ahmed Faisal 43222080 2023 RewardDocument2 pagesAhmed Faisal 43222080 2023 RewardGeorge KelvinNo ratings yet

- TCS - 1Document19 pagesTCS - 1viruridsNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2024 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2024 - QuestionmizanacmaNo ratings yet

- Gaurav 3 192669 Offer LetterDocument4 pagesGaurav 3 192669 Offer LetterNaveen KumarNo ratings yet

- End of Service Custom ReportDocument1 pageEnd of Service Custom ReportDonald VelosoNo ratings yet

- Abhijit RowlDocument22 pagesAbhijit Rowljawedaman123No ratings yet

- 265-285 Anupriya K - EceDocument21 pages265-285 Anupriya K - Ece6055 - Ragul TNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet