Professional Documents

Culture Documents

Accounting For Income Tax

Accounting For Income Tax

Uploaded by

gummydummy5678Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Income Tax

Accounting For Income Tax

Uploaded by

gummydummy5678Copyright:

Available Formats

ACCOUNTING FOR INCOME TAX

① C AMT > TAX BASE

FIN INC > TAX INC TTD * TAX % = DTL

C AMT < TAX BASE

FIN INC < TAX INC DTD * TAX % = DTA

②

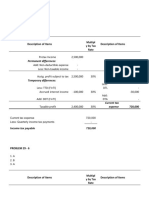

Pretax Income xx

Non-deductible Exp xx

Non-taxable Inc (xx)

AcctgProfSubj2Tax xx * % = IncTaxExp / TotTaxExp

Temp Diff:

TAX ACCTG T-A % DTL / DTA

ASSET + + (xx)

TTD*% (xx) = DTL IF DTL > DTA = DefTxExp

(LIAB) - - (xx)

REV + + xx

DTD*% xx = DTA IF DTL < DTA = DefTxBenefit

(EXP) - - xx

TAXABLE INCOME xx % CURRENT TAX EXP

Ex:

PRE TAX INC 7,000,000

NON-DED EXP 0

NON-TXBL INC 0

ACCTG PROF SUBJ2TX 7,000,000 30% 2,100,000

TAX ACCTG T-A % DTL DTA

ASSET 0 1,000,000 (1,000,000) 30% (300,000)

LIAB 0 (200,000) 200,000 30% 60,000

TAXABLE INCOME 6,200,000 30% 1,860,000

DEF TAX LIAB 300,000

DEF TAX ASSET 60,000

DEF TAX EXP 240,000

③ NOLCO ⇾ DTA

You might also like

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- Solution:: Description of Items Description of ItemsDocument1 pageSolution:: Description of Items Description of ItemsQueen ValleNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Ac5a Week 4 Session 2Document13 pagesAc5a Week 4 Session 2RayaNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Income Taxation - Chapter 2 - Individual TaxpayersDocument5 pagesIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNo ratings yet

- Chương 5e Tích Phân 5Document60 pagesChương 5e Tích Phân 5chuong01No ratings yet

- CMM 2016 12 20Document5 pagesCMM 2016 12 20enrico.michelatoNo ratings yet

- Tension Calculation DSDocument1 pageTension Calculation DStotok.madriantolubisNo ratings yet

- DESARROLLOPRACTICADocument6 pagesDESARROLLOPRACTICAJhonnyVegaCarrionNo ratings yet

- John Paul - Ia2 She QuizDocument2 pagesJohn Paul - Ia2 She QuizTomas JMNo ratings yet

- Yohanes Sihdanardi 201712037 Tugas Analisis LeverageDocument10 pagesYohanes Sihdanardi 201712037 Tugas Analisis LeverageFebri Jkw 1No ratings yet

- Application Notes LGDP4535 Ver2.0Document6 pagesApplication Notes LGDP4535 Ver2.0Jaime BarraganNo ratings yet

- Caso JD Williams MetodosDocument34 pagesCaso JD Williams Metodosjhonatan.andradeloliNo ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Intacc2 Assignment 6.1 AnswersDocument6 pagesIntacc2 Assignment 6.1 AnswersMingNo ratings yet

- Protocol McuDocument8 pagesProtocol McuGilbert San JoseNo ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- Assignment 1Document10 pagesAssignment 1Mudit KumarNo ratings yet

- RST Jun 2012Document14 pagesRST Jun 2012Ariel SpallettiNo ratings yet

- Grafik Antara DT/DT Dengan X: D T DX D T DXDocument1 pageGrafik Antara DT/DT Dengan X: D T DX D T DXAsharinaJuliyaniNo ratings yet

- Lecture 05 Keyenesian Multipliers in An Open EconomyDocument4 pagesLecture 05 Keyenesian Multipliers in An Open EconomyAn AnesNo ratings yet

- Assignment 3Document2 pagesAssignment 3Greco S50No ratings yet

- 2019 Hattendorf Theorem-2Document2 pages2019 Hattendorf Theorem-2hanNo ratings yet

- Aditi Singh - 11-B - 25419: Computer Science ProjectDocument4 pagesAditi Singh - 11-B - 25419: Computer Science ProjectAditi SinghNo ratings yet

- COR Jun 2012Document14 pagesCOR Jun 2012Ariel SpallettiNo ratings yet

- Implementation of A MIPS Processor Architecture Design ReportDocument5 pagesImplementation of A MIPS Processor Architecture Design ReportapookuNo ratings yet

- Recap I Tulati IDocument1 pageRecap I Tulati IPaul Gabriel BălteanuNo ratings yet

- UntitledDocument95 pagesUntitledRolwin Paul BenedictNo ratings yet

- UntitledDocument3 pagesUntitledSARASVATHYDEVI SUBRAMANIAMNo ratings yet

- TaxationDocument8 pagesTaxationPeligrino MacNo ratings yet

- 7Document2 pages7juwa12588No ratings yet

- Even Group: Problem No 1Document2 pagesEven Group: Problem No 1Emon IkramNo ratings yet

- RiccatiDocument3 pagesRiccatiTushar SanwareyNo ratings yet

- Safety Stat FormulaeDocument6 pagesSafety Stat FormulaePankaj PandeyNo ratings yet

- Sale of Shares Versus AssetsDocument6 pagesSale of Shares Versus Assetstara.tzaferisNo ratings yet

- Tax, Sum of Digit, Heap Permutation MergeDocument4 pagesTax, Sum of Digit, Heap Permutation MergePoongodi SNo ratings yet

- Indefinite Integration NotesDocument21 pagesIndefinite Integration NotesRahulNo ratings yet

- Tutorial 12 (Answer)Document6 pagesTutorial 12 (Answer)Vidya IntaniNo ratings yet

- Lecture 24 Working SheetDocument2 pagesLecture 24 Working Sheetsobian356No ratings yet

- Chapter#7 Cost Theory and Analysis SolutionDocument8 pagesChapter#7 Cost Theory and Analysis SolutionSadaf Faruqui80% (10)

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- GW9 SolutionsDocument3 pagesGW9 Solutionswangshiui2002No ratings yet

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612No ratings yet

- Generate Machine Code-SsDocument4 pagesGenerate Machine Code-Ss1DT19CS032 Chethana T SNo ratings yet

- Electrical and Computer Engineering Computer Organization and Architecture CSE 332 Credits - 3 Prerequisites: CSE 231 Digital Logic DesignDocument39 pagesElectrical and Computer Engineering Computer Organization and Architecture CSE 332 Credits - 3 Prerequisites: CSE 231 Digital Logic DesignSyed Latiful Akhter AnkonNo ratings yet

- SM CHDocument75 pagesSM CHJonathanNo ratings yet

- EXIS INC - Financial Report 2022Document25 pagesEXIS INC - Financial Report 2022JohnfreNo ratings yet

- ITO Jun 2012Document14 pagesITO Jun 2012Ariel SpallettiNo ratings yet

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- MEB Modelling TrainingDocument83 pagesMEB Modelling TrainingA AbiyyuNo ratings yet

- Fnynn: ÉaamsDocument6 pagesFnynn: Éaamsphanucanngkh461No ratings yet