Professional Documents

Culture Documents

HSBC Fee Tariff

HSBC Fee Tariff

Uploaded by

saisrinivasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSBC Fee Tariff

HSBC Fee Tariff

Uploaded by

saisrinivasCopyright:

Available Formats

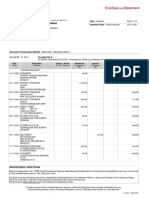

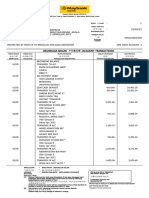

HSBC Tariff of mortgage charges

HSBC is closely involved in the mortgage industry’s initiative with UK Finance and Which? to make our fees and charges easy for

you to understand.

Our tariff of charges fully reflects the initiative’s good practice principles. A similar document is being used across the industry

to help customers compare mortgages.

When looking at the fees that other firms charge, you may notice some that don’t appear in our tariff (below). This means we

don’t charge you these fees.

When you will pay this charge

Before your first monthly payment

These are the fees and charges you may have to pay before we transfer your mortgage funds

Name of charge What this charge is for How much is the charge?

Product fee This is charged on some mortgages as part of the deal. £0 - £1,999

It can be paid up-front or added to the total mortgage

amount. If you add it to your mortgage, you’ll pay interest

on it at the same rate as the rest of your borrowing. It might

be a flat fee, or a percentage of the loan amount.

At HSBC, we call this a Booking fee.

Funds transfer fee Electronically transferring the mortgage funds to you or £17

your solicitor.

At HSBC we call this a Completion fee.

Legal fee You will normally instruct a solicitor to act on your behalf in These fees are payable directly to your

connection with your home purchase transaction. You may solicitor or licenced conveyancer.

be required to pay their legal fees and costs as part of their

work on your behalf. These fees/costs are normally charged If a separate solicitor is required to act on

by the solicitor, directly to you, unless we tell you that we will behalf of HSBC there will be a charge of

contribute to the legal costs as part of your product deal. £295 payable to HSBC.

HSBC will also require a solicitor or licenced conveyancer

to act on behalf of the bank. If your appointed solicitor or

licensed conveyancer meets our criteria then we will appoint

them to act on behalf of the bank. If not, HSBC will instruct

another solicitor.

In certain scenarios additional legal fees may be payable.

For further information please contact us on

0800 169 6333*.

Valuation fee We will undertake a Standard Valuation of your property to £0 for Standard Valuations for residential

confirm the property value for the bank’s purpose. There will or buy to let mortgages.

not be a charge for this. This is separate from any valuation

or survey of the property you might want to commission.

If you change your mortgage

NB If you change to a new mortgage product, the ‘before your first monthly payment’ fees may also apply at this stage.

Early repayment You may have to pay this if: The fee will be a percentage of the loan

charge (Changing ®® You overpay more than your mortgage terms allow; amount overpaid or repaid early multiplied

your mortgage) by the number of years remaining on the

®® You switch mortgage product or lender during a special

fixed rate period, reducing daily. Please

rate period (e.g. while you’re on a fixed interest rate)

refer to your Mortgage Illustration or Offer

At HSBC this is only payable on certain products, and Document for full details.

where overpayments have been made above the permitted

overpayment allowance. This may also be payable if you

close your mortgage or move to another mortgage product.

For further information, please contact us on

0800 169 6333* or refer to your original mortgage offer.

Ending your mortgage term

Early repayment You may be charged this if you repay your mortgage in full The fee will be a percentage of the loan

charge (Ending your before the mortgage term ends. amount overpaid or repaid early multiplied

mortgage) At HSBC this is only payable on certain products, and by the number of years remaining on the

where overpayments have been made above the permitted fixed rate period, reducing daily.

overpayment allowance.

For further information, please contact us on

0800 169 6333* or refer to your original mortgage offer.

*Lines open Monday to Friday 8am - 9pm, Saturday 8am - 8pm, Sunday 9am - 6pm. Opening hours within the mortgage departments may vary.

Calls may be monitored and recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Accessibility

To find out more about our accessible services please visit www.hsbc.co.uk/accessibility or ask at any of our branches.

If you’d like this in another format such as large print, Braille or audio, please contact us.

A textphone service is also available for customers with hearing and/or speech impairments.

If you use your own textphone you can call us on 03457 125 563 (+44 207 088 2077 from overseas).

hsbc.co.uk

Issued by HSBC UK Bank plc

HSBC UK Bank plc, Customer Information, PO Box 6201, Coventry CV3 9HW.

RFB1331 MCP53731 ©HSBC Group 2019. All Rights Reserved.

You might also like

- Account Summary April 30, 2020. Account Number, 00001213456789Document1 pageAccount Summary April 30, 2020. Account Number, 00001213456789Arm CandyNo ratings yet

- Broker Fee AgreementDocument1 pageBroker Fee AgreementmaediannaNo ratings yet

- InstructionsDocument5 pagesInstructionsCege Wa Njoroge0% (1)

- Personal Loan AgreementDocument3 pagesPersonal Loan AgreementMj AndesNo ratings yet

- KW LifeDocument289 pagesKW LifeCSE BOTNo ratings yet

- FHA Loan GuideDocument5 pagesFHA Loan GuideFHAMortgageCenter100% (2)

- Moneysprite Mortgage GuideDocument8 pagesMoneysprite Mortgage GuideMoneyspriteNo ratings yet

- Good Faith EstimateDocument3 pagesGood Faith EstimateafncorpNo ratings yet

- Premier Discover BrochureDocument8 pagesPremier Discover BrochuredfNo ratings yet

- Equity ReleaseDocument17 pagesEquity ReleaseEquity Release WiseNo ratings yet

- A Guide To Portable Mortgages - v2Document5 pagesA Guide To Portable Mortgages - v2singhdeep258779No ratings yet

- Tridel Condos and TownhousesDocument12 pagesTridel Condos and TownhouseskrishkissoonNo ratings yet

- Loan AskedDocument4 pagesLoan AskedAhmed MohammedNo ratings yet

- CBA Fixed Rate Fact SheetDocument8 pagesCBA Fixed Rate Fact SheetPrincess DomingoNo ratings yet

- Early Termination Fee Fact Sheet - July 2021Document3 pagesEarly Termination Fee Fact Sheet - July 2021ts2jkkys8rNo ratings yet

- Essential InformationDocument14 pagesEssential InformationdavemuncNo ratings yet

- Dictionary of Home Loan FinancingDocument16 pagesDictionary of Home Loan FinancingnetworkcapitalNo ratings yet

- University Ave Updated GFE 1-8-10Document3 pagesUniversity Ave Updated GFE 1-8-10Amit KumarNo ratings yet

- A Helping Hand With Owning Your HomeDocument24 pagesA Helping Hand With Owning Your HomeDarren ShepherdNo ratings yet

- 101 Mortgage Broker Secrets To Get The Best MortgageDocument22 pages101 Mortgage Broker Secrets To Get The Best Mortgageweb3752100% (1)

- FTC Facts: High-Rate, High-Fee LoansDocument4 pagesFTC Facts: High-Rate, High-Fee Loanstb34No ratings yet

- HSBC Expat Tariff of ChargesDocument9 pagesHSBC Expat Tariff of ChargesDougNo ratings yet

- Sample GFEDocument3 pagesSample GFEcmoscoolNo ratings yet

- A Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMDocument3 pagesA Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMAncuţa AlupoaeiNo ratings yet

- Capital MarketDocument19 pagesCapital MarketUrbano, Lourene Fe S. BSBA FM 2CNo ratings yet

- Mini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775Document10 pagesMini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775sampv90No ratings yet

- Credit Card Terms 04 19Document11 pagesCredit Card Terms 04 19THNo ratings yet

- UNIT 3 Consumer CreditDocument5 pagesUNIT 3 Consumer CreditDanoNo ratings yet

- Financial Terminology Jargon Buster A - EDocument5 pagesFinancial Terminology Jargon Buster A - Embarty2010No ratings yet

- Good Faith Estimate As of 2010-01-01Document3 pagesGood Faith Estimate As of 2010-01-01Darrell1573No ratings yet

- UNIT 3 to 5Document10 pagesUNIT 3 to 5DanoNo ratings yet

- MORTGAGEDocument9 pagesMORTGAGEbibin100% (1)

- Your Home Buying GuideDocument13 pagesYour Home Buying Guideapi-182635653No ratings yet

- Consumer Guide To Rate LocksDocument5 pagesConsumer Guide To Rate LocksJarred AlexandrovNo ratings yet

- Essential InformationDocument14 pagesEssential InformationALEXANDRANo ratings yet

- ME Home Loan and Mortgage Terms and ConditionsDocument50 pagesME Home Loan and Mortgage Terms and Conditionsbrendon.lai89No ratings yet

- Larkbridge Coronavirus Info SheetDocument2 pagesLarkbridge Coronavirus Info SheetDave HughanNo ratings yet

- Majorprjctppt 1Document3 pagesMajorprjctppt 1raghavilathaNo ratings yet

- Agreement in PrincipleDocument10 pagesAgreement in PrincipleAnonymous Y7iconnNo ratings yet

- Finance by Invoice Discounting: Product GuideDocument3 pagesFinance by Invoice Discounting: Product GuideAndrew LeeNo ratings yet

- Tambadana Short Term Loan PDSDocument1 pageTambadana Short Term Loan PDSSanthy SubraNo ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- A Guide To Business Current Account Fees ULST1556NIDocument8 pagesA Guide To Business Current Account Fees ULST1556NIi.adriansi23No ratings yet

- What Is A Nonperforming Loan NPLDocument6 pagesWhat Is A Nonperforming Loan NPLJacksonNo ratings yet

- Loan Document For Test UserDocument11 pagesLoan Document For Test UserBenedict BabuNo ratings yet

- AmortizationDocument22 pagesAmortizationROXANE FLORESNo ratings yet

- Reverse Mortgage Guide (October 2023 Version)Document8 pagesReverse Mortgage Guide (October 2023 Version)gsdelacruzNo ratings yet

- Buying A HouseDocument35 pagesBuying A HouseDiwakar SHARMA100% (1)

- Walk Into Your Dream Home: #OnestepcloserDocument13 pagesWalk Into Your Dream Home: #OnestepcloserMark Adam TevesNo ratings yet

- CertificateDocument3 pagesCertificategenevieveolkersNo ratings yet

- Guide To Staircasing Amended Jan 20 V 1Document12 pagesGuide To Staircasing Amended Jan 20 V 1Ollie GreenNo ratings yet

- KS ER Tob - Mp.int - Res.11.0 2Document12 pagesKS ER Tob - Mp.int - Res.11.0 2CristinaNo ratings yet

- Kfs Secured Personal LoansDocument6 pagesKfs Secured Personal Loansrealtestemail1No ratings yet

- Convergence of Bank To Housing FinanceDocument6 pagesConvergence of Bank To Housing FinancePritesh MaparaNo ratings yet

- Guide To RemortgagingDocument6 pagesGuide To RemortgagingdmntssNo ratings yet

- Home Plan: PurchaseDocument16 pagesHome Plan: PurchaseYasin1231 AhmedNo ratings yet

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCNo ratings yet

- 154Th Place, Orland Park, IL 60462 - Resident Approval - SignedDocument19 pages154Th Place, Orland Park, IL 60462 - Resident Approval - SignedJaelon TriceNo ratings yet

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- Guide EN 1Document9 pagesGuide EN 1HP ServiceNo ratings yet

- Presentation of Money and Banking FinalDocument25 pagesPresentation of Money and Banking FinalGHANI BUTTNo ratings yet

- Working Capital Short Term LoanDocument5 pagesWorking Capital Short Term LoanYap HSNo ratings yet

- MO 06 Devloping and Undestanding Debit and Consumer Credit ModuleDocument52 pagesMO 06 Devloping and Undestanding Debit and Consumer Credit Modulekukushajossi100% (1)

- Ohana Hale ASB FlierDocument1 pageOhana Hale ASB FlierJonathan PangNo ratings yet

- Statement Nov 23 XXXXXXXX1574Document14 pagesStatement Nov 23 XXXXXXXX1574Arun SinghNo ratings yet

- Manpower Salary Slip Images - Google SearchDocument6 pagesManpower Salary Slip Images - Google SearchAbdus Subhan100% (1)

- Statement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)Document2 pagesStatement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)PRAMOD KUMARNo ratings yet

- CimbDocument3 pagesCimbMOHD KHAIRUL AMIN BIN MOHAMMAD MoeNo ratings yet

- Lalu Muhamad Akbar JanDocument3 pagesLalu Muhamad Akbar JanMobilkamu JakartaNo ratings yet

- NGT Ubl Bank Statement Fmo May 2023Document5 pagesNGT Ubl Bank Statement Fmo May 2023Arshad SadeequeNo ratings yet

- StatementDocument4 pagesStatementfinape6897No ratings yet

- PDF Cibil ReportDocument8 pagesPDF Cibil ReportDeepak AcsNo ratings yet

- 3108 13 06 FinancialResponsibility GN SEDocument9 pages3108 13 06 FinancialResponsibility GN SENEEVE SHETHNo ratings yet

- PYBOM00347440000064737 NewDocument4 pagesPYBOM00347440000064737 New4608 VANSHIKA SHARMANo ratings yet

- IBIZ_013901003399300_20240501_20240531_1717503041675998057.Document1 pageIBIZ_013901003399300_20240501_20240531_1717503041675998057.kgp.valiandraNo ratings yet

- E StatementDocument3 pagesE StatementChegg tutorsNo ratings yet

- Form - H: State Bank of IndiaDocument1 pageForm - H: State Bank of Indiaabhijit majarkhedeNo ratings yet

- e-StatementBRImo 107901054754504 Dec2023 20240118 133151Document11 pagese-StatementBRImo 107901054754504 Dec2023 20240118 133151Deci SusantiNo ratings yet

- M Finance 3rd Edition Cornett Test Bank 1Document202 pagesM Finance 3rd Edition Cornett Test Bank 1andrew100% (53)

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet

- PBOR Pension BenifitDocument9 pagesPBOR Pension Benifitशिवा यादव सोनूNo ratings yet

- Mhban01262860000070815 2023Document2 pagesMhban01262860000070815 2023Umarraza SayyedNo ratings yet

- Comerica E Statement 1 PDFDocument5 pagesComerica E Statement 1 PDFJonathan Seagull LivingstonNo ratings yet

- Momo Statement ReportDocument2 pagesMomo Statement ReportHolybabyNo ratings yet

- Ibs Kuala Pilah 1 31/05/23Document9 pagesIbs Kuala Pilah 1 31/05/23NATASHANo ratings yet

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Document50 pagesForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure Fraud100% (1)

- Statement 726xxxx7124 15112023 235234Document5 pagesStatement 726xxxx7124 15112023 235234mahendrayadav7355406461No ratings yet