Professional Documents

Culture Documents

Syllabus Ca Final

Syllabus Ca Final

Uploaded by

hssushmitha4040 ratings0% found this document useful (0 votes)

10 views5 pagesThe document outlines the syllabus for the CA FINAL exam under the new syllabus. It provides details on the chapters covered in each of the 8 papers, including the title of each chapter and whether it is covered at 50%. The key papers cover topics such as financial reporting, strategic financial management, auditing, corporate laws, cost management, and direct and indirect tax laws.

Original Description:

Original Title

syllabus_ca_final

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the syllabus for the CA FINAL exam under the new syllabus. It provides details on the chapters covered in each of the 8 papers, including the title of each chapter and whether it is covered at 50%. The key papers cover topics such as financial reporting, strategic financial management, auditing, corporate laws, cost management, and direct and indirect tax laws.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views5 pagesSyllabus Ca Final

Syllabus Ca Final

Uploaded by

hssushmitha404The document outlines the syllabus for the CA FINAL exam under the new syllabus. It provides details on the chapters covered in each of the 8 papers, including the title of each chapter and whether it is covered at 50%. The key papers cover topics such as financial reporting, strategic financial management, auditing, corporate laws, cost management, and direct and indirect tax laws.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

Exam Syllabus for CA FINAL (New Syllabus)

CA FINAL Mock Test (New Syllabus)

Syllabus for 100A & 100B Test Series is Full Syllabus as per ICAI

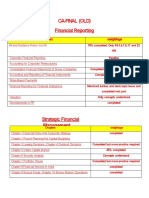

PAPER 1 : FINANCIAL REPORTING

Chapter Title 50%

Chapter 1 Application of Accounting Standards Yes

Chapter 2 Application of Guidance Notes Yes

Chapter 3 Framework for Preparation and Presentation of Financial Statements Yes

Chapter 4 Ind AS on Presentation of Items in the Financial Statements Yes

Chapter 6 Ind AS on Measurement based on Accounting Policies Yes

Chapter 7 Ind AS 20 “Accounting for Government Grants and Disclosure of Government Assistance” Yes

Chapter 8 Ind AS 101 "First-time Adoption of Indian Accounting Standards" Yes

Chapter 9 Ind AS on Assets of the Financial Statements Yes

Chapter 10 Ind AS 41 “Agriculture” Yes

Chapter 11 Ind AS on Libilities of the Financial Statements Yes

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

Chapter Title 50%

Chapter 6 Portfolio Management Yes

Chapter 7 Securitization Yes

Chapter 8 Mutual Funds Yes

Chapter 9 Derivatives Analysis and Valuation Yes

Chapter 10 Foreign Exchange Exposure and Risk Management Yes

Chapter 14 Mergers, Acquisitions and Corporate Restructuring Yes

Chapter 17 Small and Medium Enterprises Yes

PAPER 3 : ADVANCED AUDITING AND PROFESSIONAL ETHICS

Chapter Title 50%

Chapter 1 Auditing Standards, Statements and Guidance Notes- An Overview Yes

Chapter 2 Audit Planning, Strategy and Execution Yes

Chapter 4 Special Aspects of Auditing in an Automated Environment Yes

Chapter 5 Audit of Limited Companies Yes

Chapter 10 Audit of Banks Yes

Chapter 14 Special Audit Assignments Yes

Unit 4: Audit of Stock and Debtors/ Unit Inspection (Audit of Borrower Accounts)

Chapter 18 Due Diligence, Investigation and Forensic Audit Yes

Chapter 20 Professional Ethics Yes

PAPER 4 : CORPORATE LAWS

Chapter Title 50%

Section A: Corporate Laws :

Chapter1 Appointment and Quali cations of Directors Yes

Chapter2 Appointment and Remuneration of Managerial Personnel Yes

Chapter3 Meetings of Board and its Powers Yes

Chapter4 Inspection, Inquiry and Investigation Yes

Section-B: Securities Laws

Chapter1 The Securities Contract (Regulation) Act, 1956 and the Securities Contract (Regulation) Rules, 1957 Yes

Part-II: Economic Laws

Chapter1 The Foreign Exchange Management Act, 1999 Yes

The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest

Chapter2 Yes

Act, 2002

Chapter6 The Insolvency and Bankruptcy Code, 2016 Yes

Paper-5: Strategic Cost Management and Performance Evaluation

Chapter Title 50%

Sub Part-I: Strategic Cost Management

Chapter 3 Lean System and Innovation Yes

Chapter 5 Cost Management for Speci c Sector Yes

Sub Part 2 Strategic Decision Making

Chapter 6 Decision Making Yes

Chapter 7 Pricing Decision Yes

Part-B: Performance Evaluation and Control

Sub Part-I: Performance Evaluation and Reporting

Chapter 9 Divisional Transfer Pricing Yes

Sub Part-II: Managerial Control

Chapter 11 Budgetary Control Yes

Part C Case Study

Chapter 13 Case Study Yes

Paper-6B: Financial Services and Capital Markets

Chapter Title 50%

Chapter 3 Capital Market - Primary Yes

Chapter 4 Capital Market - Secondary Yes

Chapter 9 Mutual Funds Yes

Chapter 10 Private Equity Yes

Chapter 11 Investment Banking Yes

Chapter 16 SEBI Guidelines Yes

Paper-6C: International Taxation

Chapter Title 50%

Part I Taxation of International Transactions and Non-resident Taxation in India

Chapter 1 Transfer Pricing Yes

Chapter 2 Non-resident Taxation Yes

Part II Other aspects of International Taxation

Chapter 7 Tax Treaties: Overview, Features, Application and Interpretation Yes

Chapter 8 Anti Avoidance Measures Yes

Chapter 9 Taxation of E-Commerce Transactions Yes

Paper-7: Direct Tax Laws and International Taxation

Chapter Title 50%

Part I Direct Tax Laws

Chapter 6 Pro ts And Gains Of Business Or Profession Yes

Chapter 7 Capital Gains Yes

Chapter 8 Income From Other Sources Yes

Chapter 11 Deductions From Gross Total Income Yes

Chapter 12 Assessment of Various Entities Yes

Chapter 17 Assessment Procedure Yes

Chapter 22 Liability in Special Cases Yes

Chapter 23 Miscellaneous Provisions Yes

Part II: International Taxation

Chapter 1 Non-resident Taxation Yes

Chapter 2 Double Taxation Relief Yes

Chapter 4 Advance Rulings Yes

Chapter 5 Equalisation Levy Yes

Paper 8 : Indirect Tax Laws

Chapter Title 50%

Goods and Services Tax

Chapter 1 GST in India - An Introduction Yes

Chapter 2 Taxable Event - Supply Yes

Chapter 3 Charge of GST Yes

Chapter 4 Exemptions from GST Yes

Chapter 5 Place of Supply Yes

Chapter 6 Time of Supply Yes

Chapter 7 Value of Supply Yes

Chapter 8 Input Tax Credit Yes

Chapter 9 Registration Yes

Chapter 10 Tax Invoice, Credit and Debit Notes Yes

Part-II Customs & FTP

Chapter 3 Classi cation of Imported and Export Goods Yes

Chapter 9 Refund Yes

Chapter 15 Foreign Trade Policy Yes

You might also like

- Original PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFDocument42 pagesOriginal PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFmathew.robertson818100% (39)

- Forex Trading Using Volume Price Analysis - Anna CoullingDocument282 pagesForex Trading Using Volume Price Analysis - Anna CoullingMundofut Club91% (11)

- INSETA Learning Material RE 1 Key Individual PDFDocument301 pagesINSETA Learning Material RE 1 Key Individual PDFLesego Nthite67% (3)

- Financial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFDocument41 pagesFinancial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFdon.anderson433100% (42)

- Jerry Lee Selling Put Options My WayDocument123 pagesJerry Lee Selling Put Options My WayzzyzxzzNo ratings yet

- Ambrish Gupta - Financial Accounting For Management - An Analytical Perspective (2016, Pearson Education) PDFDocument759 pagesAmbrish Gupta - Financial Accounting For Management - An Analytical Perspective (2016, Pearson Education) PDFManirul100% (9)

- CF-A#1 - Waris - 01-322221-024Document8 pagesCF-A#1 - Waris - 01-322221-024Waris 3478-FBAS/BSCS/F16No ratings yet

- The 10 Key Points of Management ControlDocument20 pagesThe 10 Key Points of Management ControlJoseph Mamy100% (1)

- Exam Syllabus CA Final May 2023 UDocument4 pagesExam Syllabus CA Final May 2023 Uasthapande24No ratings yet

- Exam Syllabus CA Intermediate May 2023 V1602.2023Document4 pagesExam Syllabus CA Intermediate May 2023 V1602.2023devkharbanda.10No ratings yet

- Exam Syllabus For CA IPCC (Old Syllabus)Document5 pagesExam Syllabus For CA IPCC (Old Syllabus)Keerthi Reddy DNo ratings yet

- CA-Final Detailed Test ScheduleDocument9 pagesCA-Final Detailed Test ScheduleCA Mohit SharmaNo ratings yet

- Exam Syllabus CA Intermediate May 2023Document8 pagesExam Syllabus CA Intermediate May 2023Pratim BahetiNo ratings yet

- 50% Syllabus - Inter 2024Document2 pages50% Syllabus - Inter 2024pandyji8453No ratings yet

- Final Detailed Test and NotedDocument8 pagesFinal Detailed Test and NotedYash GargNo ratings yet

- Foreword: Financial Auditing 1 - 9 Edition - 1Document37 pagesForeword: Financial Auditing 1 - 9 Edition - 1meyyNo ratings yet

- CA INTER TimetableDocument8 pagesCA INTER TimetableRohini SurijaNo ratings yet

- Module Audit 1 Genap 2021 - 2022Document48 pagesModule Audit 1 Genap 2021 - 2022Catarine TarunaNo ratings yet

- Exam Syllabus CA Foundation NewDocument2 pagesExam Syllabus CA Foundation Newvishwasiddharthan04No ratings yet

- Ca-Final (Old) Financial Reporting: Chapters WeightageDocument6 pagesCa-Final (Old) Financial Reporting: Chapters WeightageabcNo ratings yet

- Course Breakup - FsaDocument4 pagesCourse Breakup - FsaUNIVERSITY uniNo ratings yet

- Titman Ch1 3 PDFDocument87 pagesTitman Ch1 3 PDFMae Astoveza67% (3)

- Course Outline Financial Management NTUDocument6 pagesCourse Outline Financial Management NTUHassaanNo ratings yet

- 1 EconomicsDocument300 pages1 EconomicsAman PawarNo ratings yet

- CA Final New Syllabus ChangesDocument6 pagesCA Final New Syllabus ChangesRajiv ChoudharyNo ratings yet

- CAF SyllabusDocument89 pagesCAF Syllabusmanadish nawazNo ratings yet

- Paper 1Document248 pagesPaper 1Thangavelu SaravananNo ratings yet

- CA Foundation Study PlanDocument7 pagesCA Foundation Study PlanVs Sivaraman100% (1)

- CAF SyllabusDocument89 pagesCAF SyllabusFaheem MajeedNo ratings yet

- Instant Download Ebook PDF Essentials of Corporate Finance 3rd Australian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Essentials of Corporate Finance 3rd Australian Edition PDF Scribdsamuel.nicely296100% (42)

- Accounting 621: Year 2 Semester 1Document173 pagesAccounting 621: Year 2 Semester 1Sarah Precious Nkoana100% (1)

- P01 Fundamentals of Economics and ManagementDocument300 pagesP01 Fundamentals of Economics and ManagementVu Duc HuuNo ratings yet

- Corporate Finance Course OutlineDocument4 pagesCorporate Finance Course OutlineMD Rifat Zahir0% (1)

- Principles of AccountingDocument5 pagesPrinciples of AccountingDawoodkhan safiNo ratings yet

- Business FinanceDocument7 pagesBusiness Financejaspermallari1995No ratings yet

- Vsi Jaipur CA Foundation Nov - 2021 Accounting ABC AnalysisDocument3 pagesVsi Jaipur CA Foundation Nov - 2021 Accounting ABC AnalysisFREEFIRE IDNo ratings yet

- BUS 510 Course OutlineDocument2 pagesBUS 510 Course OutlineNoor NabiNo ratings yet

- Selected Topics: International Organization For Standardization (ISO)Document27 pagesSelected Topics: International Organization For Standardization (ISO)Jocelyn SantamaríaNo ratings yet

- SFM - New Scheme - Changes in SM May 2022Document2 pagesSFM - New Scheme - Changes in SM May 2022sairad1999No ratings yet

- 1687245247individual Chapterwise Nov 23 - CA FinalDocument5 pages1687245247individual Chapterwise Nov 23 - CA FinalSriramsai EswarNo ratings yet

- Scott Besley and Eugene F. Brigham. Essentials of Managerial Finance. 14 Edition. USA: Thomson, South-WesternDocument2 pagesScott Besley and Eugene F. Brigham. Essentials of Managerial Finance. 14 Edition. USA: Thomson, South-WesternominNo ratings yet

- Conceptual Framework Dalam Pelaporan KeuanganDocument63 pagesConceptual Framework Dalam Pelaporan KeuangansyafiraNo ratings yet

- Concepts Underlying Financial AccountingDocument31 pagesConcepts Underlying Financial AccountingsueernNo ratings yet

- Research Methodology Principles of Accounting International Cooperation Corporate FinanceDocument2 pagesResearch Methodology Principles of Accounting International Cooperation Corporate FinanceClintonKrugerNo ratings yet

- Handout Topic 1Document34 pagesHandout Topic 1mNo ratings yet

- Class 1 CF BBA Course OutlineDocument4 pagesClass 1 CF BBA Course OutlineArif BokhtiarNo ratings yet

- Finan Service IndustryDocument140 pagesFinan Service IndustryankdeepNo ratings yet

- Relevance of Questions From Past Level III Essay Exams: Year Relevant Topic CommentDocument6 pagesRelevance of Questions From Past Level III Essay Exams: Year Relevant Topic CommentahmedbilalmansoorNo ratings yet

- ETHICS MAY 2016 Revised01 - BEFORE SCH 1Document63 pagesETHICS MAY 2016 Revised01 - BEFORE SCH 1Hardik PatelNo ratings yet

- TeachingGuide - FINANCIAL MATHEMATICSDocument12 pagesTeachingGuide - FINANCIAL MATHEMATICSsaturmendozaNo ratings yet

- Conceptual Framework of Financial ReportingDocument14 pagesConceptual Framework of Financial ReportinghudaNo ratings yet

- Intermediate Financial Accounting 1 1657742265Document803 pagesIntermediate Financial Accounting 1 1657742265Ian UyNo ratings yet

- Depar't of Accounting & Finance: Recognition, Measurement, and Disclosure ConceptsDocument3 pagesDepar't of Accounting & Finance: Recognition, Measurement, and Disclosure ConceptsHistory and EventNo ratings yet

- Jamila Mufazzal - Syllabus Principles of Business Finance (BF)Document4 pagesJamila Mufazzal - Syllabus Principles of Business Finance (BF)jamila mufazzalNo ratings yet

- Financial Reporting Analysis Using Financial Accounting Information 13th PDFDocument41 pagesFinancial Reporting Analysis Using Financial Accounting Information 13th PDFdon.anderson43398% (40)

- Business Finance 2Document6 pagesBusiness Finance 2jaspermallari1995No ratings yet

- Consolidated Listing and Disclosure Rules As of May 2023Document162 pagesConsolidated Listing and Disclosure Rules As of May 2023Kyra Kae DiolaNo ratings yet

- AP Course OutlineDocument4 pagesAP Course Outlined.pagkatoytoyNo ratings yet

- The Audit Process Overview of Audit and AssuranceDocument34 pagesThe Audit Process Overview of Audit and AssuranceJonathan Villazon RosalesNo ratings yet

- Selected Topics: International Organization For Standardization (ISO)Document25 pagesSelected Topics: International Organization For Standardization (ISO)Jocelyn SantamaríaNo ratings yet

- Brief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMDocument13 pagesBrief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMĐức NghĩaNo ratings yet

- Conceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Document43 pagesConceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Ching Yin HoNo ratings yet

- East Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthFrom EverandEast Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthNo ratings yet

- IGCSE Business Studies Essential Book Answers For Unit 3Document6 pagesIGCSE Business Studies Essential Book Answers For Unit 3emonimtiazNo ratings yet

- ACFI3203 Week 3 PostDocument39 pagesACFI3203 Week 3 Post詹博智No ratings yet

- 3-Forward ExchangeDocument6 pages3-Forward Exchangeyaseenjaved466No ratings yet

- Strategic Management Concepts and Cases Competitiveness and Globalization 12Th Edition Hitt Solutions Manual Full Chapter PDFDocument52 pagesStrategic Management Concepts and Cases Competitiveness and Globalization 12Th Edition Hitt Solutions Manual Full Chapter PDFAdrianSmitheqim100% (11)

- Reflection Paper On Valuation Concepts and MethodsDocument1 pageReflection Paper On Valuation Concepts and Methodskhaye3tecsonNo ratings yet

- Deadline 03 Jan 2023Document3 pagesDeadline 03 Jan 2023zainabsalimissaNo ratings yet

- Csec CXC Pob Past Papers June 2002 Paper 02 PDFDocument5 pagesCsec CXC Pob Past Papers June 2002 Paper 02 PDFnishtaramdial19No ratings yet

- Glossary of TermsDocument5 pagesGlossary of TermsEslam NaguibNo ratings yet

- Group Activity - FRIA S1Document4 pagesGroup Activity - FRIA S1Ralph Ryan TooNo ratings yet

- FLDGDocument6 pagesFLDGSaurabh MalooNo ratings yet

- HW 082623Document30 pagesHW 082623Cath OquialdaNo ratings yet

- ACI PolicyBrief CreatingFertileGroundsforPrivateInvestmentinAirportsDocument48 pagesACI PolicyBrief CreatingFertileGroundsforPrivateInvestmentinAirportsIndranovsky IskandarNo ratings yet

- 01 Arif Khan - Bangladesh Rising Tiger-Invement in Cap Market-Dubai-Feb 9, 2021Document29 pages01 Arif Khan - Bangladesh Rising Tiger-Invement in Cap Market-Dubai-Feb 9, 2021Nafis ShahriarNo ratings yet

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- Ankita's Resume Feb 2023Document2 pagesAnkita's Resume Feb 2023ankita sardaNo ratings yet

- Maf253 Q Dec 2019Document12 pagesMaf253 Q Dec 2019alisatasnimNo ratings yet

- Verizon Investment ThesisDocument7 pagesVerizon Investment Thesisafksooisybobce100% (2)

- Questions and Answers On Items Included and ExcludedDocument7 pagesQuestions and Answers On Items Included and ExcludedSHRISHNA SNo ratings yet

- Dissertation On RbiDocument6 pagesDissertation On RbiBuyingPapersOnlineUK100% (1)

- Strategic Cost Management Prelim SummaryDocument5 pagesStrategic Cost Management Prelim Summaryamorashella5No ratings yet

- Ccasbbar04 PDFDocument59 pagesCcasbbar04 PDFMani KumarNo ratings yet

- Co Operative BankDocument7 pagesCo Operative Bankவிதை SOUNDAR CholaNo ratings yet

- Overview of RBI Act 1934 - Taxguru - inDocument2 pagesOverview of RBI Act 1934 - Taxguru - inritikaagr292No ratings yet

- CofpDocument5 pagesCofpAdil HassanNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- Divyesh Dagli - Analytics UpdateDocument4 pagesDivyesh Dagli - Analytics UpdateDivyesh DagliNo ratings yet

- Chap 15Document22 pagesChap 15Sakshi GuptaNo ratings yet