Professional Documents

Culture Documents

Bank Reconciliations Memo

Bank Reconciliations Memo

Uploaded by

lindort00Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliations Memo

Bank Reconciliations Memo

Uploaded by

lindort00Copyright:

Available Formats

1

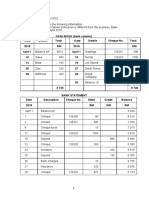

Bank Reconciliations 2021 DBE

QUESTION 1

1.1 CASH RECEIPT JOURNAL - MARCH 2020 CRJ 3

Doc Day Details Bank Amount Details

30 Total 118 960

B/S P.Piet 8 500 8 500 Rent income

B/S Mona Bank 96 96 Interest income

127 556 7

CASH PAYMENT JOURNAL - MARCH 2020 CPJ 3

Doc Day Details Bank Amount Details

30 Total 40 400

B/S Fast Insurers 4 400 4 400 Insurance

B/S Parys Water and electricity

Municipaliy 4 150 4 150

B/S Mona Bank 430 430 Bank charges

49 380 10

1.2 GENERAL LEDGER OF DADDY STORES

Bank

2020 2020

Mar 1 Balance b/d 12 340 Mar 31 Sundry Accounts 49 380

2020

Mar 31 Sundry Accounts 127 556 Balance 90 516

139 896 139 896

Balance 90 516 7

1.3 Prepare a Bank Reconciliation Statement for March 2020.

Debit Credit

Balance according to bank

statement 81 916

Cr. Outstanding deposit 21 000

Dr. Outstanding EFT No 6 12 400

Dr. Balance according to the 90 516

bank account See 1.2.

102 916 102 916

both figures must be the same

Copyright reserved Please turn over

2

Bank Reconciliations 2021 DBE

QUESTION 2

2.1 CASH RECEIPT JOURNAL - MARCH 2020 CRJ 3

Doc Day Details Bank Amount Details

30 Total 116 000 50 000

B/S M. Mashiane 7 500 7 500 Rent income

B/S D. Dlamini 1 250 1 250 Debtors Control

B/S Disa Bank 75 75 Interest income 10

124 825 58 825

CASH PAYMENT JOURNAL - MARCH 2020 CPJ 3

Doc Day Details Bank Amount Details

30 Total 54 700 5 700

B/S Quick Insurers 3 900 3 900 Insurance

B/S Town Council 3 600 3 600 Water and electricity

B/S Disa Bank 725 725 Bank charges

62 925 13 925 (388 + 212 + 125)

10

2.2 GENERAL LEDGER OF DADDY STORES

Bank

2020 2020

Mar 1 Balance 21 300 Mar 31 Sundry Accounts 62 925

Mar 31 Sundry Accounts 124 825 Balance 83 200

146 125

146 125

Balance 83 200

6

2.3 Prepare a Bank Reconciliation Statement for March 2020.

Debit Credit

Balance as per bank statement 85 800

Cr. Outstanding deposit 18 000

Dr. Outstanding EFT No 9 2 000

Dr amount wrongly credited 18 600

Dr. Balance according to the 83 200

bank account See 1.2.

103 800 103 800

both figures must be the same

Copyright reserved Please turn over

3

Bank Reconciliations 2021 DBE

QUESTION 3

3.1 CASH RECEIPTS JOURNAL - JANUARY 2021 CRJ 4

Doc Day Details Bank Amount Details

31 Total 31 580 13 650

B/S T. Rogers 4 500 4 500 Rent Income

B/S BB 21 000 20 000 Fixed Deposit:

Investments BB Investments

1 000 Interest on fixed deposit

B/S C. Charlie 2 500 2 500 Debtors’ Control

B/S Big Bank 340 340 Interest

59 920 12

CASH PAYMENTS JOURNAL - JANUARY 2021 CPJ 4

Doc Day Details Bank Amount Details

31 Total 23 349 10 399

B/S Big Bank 525 525 Bank charges

B/S ST Insurance 2 340 2 340 Insurance

B/S Nala 4 660 3 000 Water and electricity

1 660 Drawings

30 874

10

3.2 GENERAL LEDGER - CD STORES

Bank

2021 2021 Sundry

Jan 1 Balance 25 210 Jan 31 accounts 30 874

Sundry 59 920

Jan 31 Balance 54 256

accounts

85 130

85 130

Balance 54 256

6

Copyright reserved Please turn over

4

Bank Reconciliations 2021 DBE

3.3 Bank Reconciliation Statement for CD Stores on 31 January 2021.

Debit Credit

Balance according to bank

balancing

statement 56 266 figure

Credit outstanding deposit 4 600

Debit outstanding EFT Nr 18 3 550

Debit amount wrongly credited 3 700

Credit interest wrongly debited 640

Debit balance according to bank 54 256

account See 1.2.

61 506 61 506

both figures must be the same 8

Copyright reserved Please turn over

5

Bank Reconciliations 2021 DBE

QUESTION 4

4.1 CASH RECEIPT JOURNAL - MARCH 2020 CRJ 3

Doc Day Details Bank Amount Details

30 Total 66 000 66 000

B/S D. Dawie 9 600 9 600 Rent income

B/S K. Nokanda 6 700 6 700 Debtors Control

B/S HL Bank 85 85 Interest income 10

82 385 82 385

CASH PAYMENT JOURNAL - MARCH 2020 CPJ 3

Doc Day Details Bank Amount Details

30 Total 58 500 58 500

B/S Town Council 4 890 4 890 Water and electricity

B/S Best Insurers 5 300 5 300 Insurance

B/S ABBA Bank 4 500 4 500 Loan

B/S HL Bank 711 711 Bank charges

73 901 73 901 13

4.2 GENERAL LEDGER OF JENNY STORES

Bank

2020 2020

Mar 1 Balance 11 300 Mar 31 Sundry Accounts 73 901

Mar 31 Sundry Accounts 82 385 Balance 19 784

93 685 93 685

Balance 19 784

6

4.3 Prepare a Bank Reconciliation Statement for March 2020.

Debit Credit

Balance according to bank

statement balancing figure 2 645

Cr. Outstanding deposit 21 700

Dr. Outstanding EFT – 222 7 220

– 223 2 896

Cr amount wrongly debited 5 555

Dr. Balance according to the 19 784

See 4.2

bank account

29 900 29 900

both figures must be the same

8

Copyright reserved Please turn over

6

Bank Reconciliations 2021 DBE

QUESTION 5

5.1 CASH RECEIPT JOURNAL - MARCH 2021 CRJ 3

Doc Day Details Bank Amount Details

31 Total 46 200 46 200

BS 31 AG Investments 10 200 9 000 Investment: AG

Investments

1 200 Interest on

investment

BS 31 P.Jacobs 4 500 4 500 Debtors control

60 900 82 385 9

CASH PAYMENT JOURNAL - MARCH 2021 CPJ 3

Doc Day Details Bank Amount Details

31 Total 74 300 74 300

BS 31 Nala Municipality 1 500 1 500 Water and electricity

BS 31 Virseker 6 000 4 500 Insurance

1 500 Drawings

EFT 31 Naude Enterprises 9 600 9 600 Rent expenses

BS 31 BR Bank 610 490 Bank charges

120 Interest on overdraft

92 010 92 010 15

5.2 GENERAL LEDGER OF JENNY STORES

Bank

2021 2021

Mar 31 Total receipts 60 900 Mar 1 Balance 15 200

2021

Balance 46 310 Mar 31 Total payments 92 010

107 210 107 210

2021

Apr 1 Balance 46 310 6

5.3 Bank Reconciliation Statement on 31 March 2021.

Debit Credit

Balance according to bank

statement balancing figure 47 700

Cr. Outstanding deposit 23 400

Dr. Outstanding EFT – 120 9 220

– 125 4 790

Dr. amount wrongly credited 8 000

Cr. Balance according to the 46 310

See 5.2

bank account

69 710 69 710

both figures must be the same

Copyright reserved Please turn over

7

Bank Reconciliations 2021 DBE

QUESTION 6

6.1 CONCEPTS

6.1.1 True

6.1.2 False

6.1.3 True

3

6.2.1 CASH RECEIPT JOURNAL - MARCH 2020 CRJ 3

Doc Day Details Bank Amount Details

30 Total 49 000 49 000

B/S W. Western 8 300 8 300 Rent income

B/S B. Bennie 2 750 2 750 Debtors Control

B/S WW Bank 232 232 Interest income 10

60 282 60 282

CASH PAYMENT JOURNAL - MARCH 2020 CPJ 3

Doc Day Details Bank Amount Details

30 Total 48 000 48 000

Sales 5 000 5 000 Sales

B/S BB Traders 5 900 5 900 Creditors Control

B/S Town Council 3 200 3 200 Water and electricity

B/S WW Bank 1 112 1 112 Bank charges

B/S Boabab 5 100 Insurance

Insurers 6 600 1 500 Drawings 19

69 812 69 812

6.2.2 GENERAL LEDGER OF MARIAAN STORES

Bank

2020 2020

Mar 1 Balance 11 400 Mar 31 Sundry Accounts 69 812

Mar 31 Sundry Accounts 60 282 Balance 1 870

71 682 71 682

Balance 1 870

6

Copyright reserved Please turn over

8

Bank Reconciliations 2021 DBE

6.2.3 Prepare a Bank Reconciliation Statement for March 2020.

Debit Credit

Balance according to bank

statement balancing figure 10 070

Cr. Outstanding deposit 17 400

Dr. Outstanding EFT 6 600

Dr amount wrongly credited 19 000

Dr. Balance according to the 1 870

bank account See 6.2.2

27 470 27 470

both figures must be the same 7

QUESTION 7

7.1 CONCEPTS

7.1.1 False

7.1.2 False

7.1.3 True

3

7.2.1 CASH RECEIPT JOURNAL - February 2021 CRJ 2

Doc Day Details Bank Amount Details

28 Total 52 000 52 000

B/S L. Lopez 7 100 7 100 Rent income

B/S L. Canizares 2 750 2 750 Debtors Control

B/S MW Bank 230 230 Interest income

62 080 62 080 10

CASH PAYMENT JOURNAL - February 2021 CPJ 2

Doc Day Details Bank Amount Details

28 Total 51 000 51 000

Commission 6 000 6 000 Commission

income

B/S Benzema 6 200 6 200 Creditors Control

Traders

B/S Municipality 2 800 2 800 Rates and Taxes

B/S MW Bank 1 280 1 280 Bank charges

B/S Hazard 5 700 Insurance

Insurers 8 000 2 300 Drawings

75 280 75 280 19

Copyright reserved Please turn over

9

Bank Reconciliations 2021 DBE

7.2.2 GENERAL LEDGER OF Real Madrid STORES

Bank

2021 2021

Feb 1 Balance 13 600 Feb 28 Sundry Accounts 75 280

Feb 28 Sundry Accounts 62 080 Balance 400

75 680 75 680

2021 Balance 400

March 1 6

7.2.3 Prepare a Bank Reconciliation Statement for February 2021.

Debit Credit

Balance according to bank

statement balancing figure 10 700

Cr. Outstanding deposit 18 500

Dr. Outstanding EFT 111 10 000

Dr amount wrongly credited 18 800

Dr. Balance according to the 400

bank account See 7.2.2

29 200 29 200

both figures must be the same 7

Copyright reserved Please turn over

10

Bank Reconciliations 2021 DBE

QUESTION 8

8.1 CASH RECEIPT JOURNAL - APRIL 2020 CRJ 3

Doc Day Details Bank Amount Details

30 Total 53 000 53 000

B/S K. Marais 4 900 4 900 Debtors Control

D. Dawie 9 600 9 600 Rent income

7

67 500 67 500

CASH PAYMENT JOURNAL - APRIL 2020 CPJ 3

Doc Day Details Bank Amount Details

30 Total 64 000 64 000

Sales 15 000 15 000 Sales

B/S Town Council 4 890 4 890 Water and electricity

B/S Easy Insurers 7 000 5 300 Insurance

1 700 Drawings

B/S ABBA Bank 3 500 3 500 Loan

B/S WW Bank 672 549 Bank charges

123 Interest on overdraft

21

95 062 95 062

8.2 GENERAL LEDGER OF KETSI STORES

Bank

2020 2020

Apr 30 Sundry Accounts 67 500 Apr 1 Balance 2 345

Balance 29 907 Apr 30 Sundry Accounts 95 062

97 407 97 407

Balance 29 907

6

8.3 Bank Reconciliation Statement on 30 April 2020.

Debit Credit

Dr. Balance according to bank

statement balancing figure 27 585

Cr. Outstanding deposit 12 600

Dr amount wrongly credited 13 600

Cr EFT Wrongly debited 3 333

Dr. Outstanding EFT – 564 4 655

Cr. Balance according to the 29 907

see 8.2

bank account

45 840 45 840

both figures must be the same

9

Copyright reserved Please turn over

11

Bank Reconciliations 2021 DBE

QUESTION 9

9.1 CASH RECEIPT JOURNAL - JUNE 2020 CRJ 6

Doc Day Details Bank Amount Details

30 Total 56 200 56 200

B/S P. Nel 11 600 11 600 Rent income

Rand Bank 4 800 4 800 Telephone

N. Botha 3 400 3 400 Debtors Control 10

76 000 76 000

CASH PAYMENT JOURNAL - JUNE 2020 CPJ 6

Doc Day Details Bank Amount Details

30 Total 67 400 67 400

Service fees 1 500 1 500 Fee income

B/S Pro Insurers 5 890 5 890 Insurance

B/S Matjhabeng 6 000 4 500 Rates and taxes

1 500 Drawings

B/S YEN Bank 5 300 5 300 Loan

B/S Rand Bank 910 593 Bank charges

317 Interest on overdraft

87 000 87 000 21

9.2 GENERAL LEDGER OF HILTON TRADERS

Bank

2020 2020

Jun 30 Sundry Accounts 76 000 Jun 1 Balance 3 456

Balance 14 456 Jun 30 Sundry Accounts 87 000

90 456 90 456

Balance 14 456

6

9.3 Bank Reconciliation Statement on 30 June 2020.

Debit Credit

Dr. Balance according to bank balancing figure

statement 12 645

Cr. Outstanding deposit 17 800

Dr amount wrongly credited 16 300

Cr Debit orders wrongly debited 2 244

Dr. Outstanding EFT – 654 5 555

Cr. Balance according to the bank 14 456

See 9.2

account

34 500 34 500

both figures must be the same

9

Copyright reserved Please turn over

12

Bank Reconciliations 2021 DBE

9.4 Provide TWO suggestions that the business can use to prevent a

situation like the one experience on 26 May 2020 in the future.

Any exceptable answers

All bank notes received must first be scanned under an UV light to

detect counterfeit money, to ensure it is not excepted.

`

Encourage customers to make card / electronic payments.

4

9.5 Identify the problem that is revealed by the previous reconciliation,

and list TWO internal control measures to solve this problem.

PROBLEM:

Late deposits / not depositing money on time / keeping cash for a long

period is risky.

TWO CONTROL MEASURES

Division of duties – ensure that the person receiving cash is not the

one depositing cash

Supervise deposits – authorised person to check and sign deposit

slips

Arrange with bank for notifications for all transactions (sms)

5

9.6 Refer to the debit order for R2 244. Explain a possible reason how

this may have occured, and provide advise on how this can be

rectified.

POSSIBLE EXPLANATION:

Fraudulent entry; someone hacked the business security code; business

entered the wrong account number for a service provider.

POINT OF ADVICE

Cancel the debit order with the incorrect business / person receiving the

funds

If that cannot be done, it may be necessary to change the business

banking details Or change the security code

Closely monitor the statement / statement or transaction records can be

easily accessed at regular intervals; to detect unusual entries.

4

Copyright reserved Please turn over

13

Bank Reconciliations 2021 DBE

QUESTION 10

10.1 CASH RECEIPTS JOURNAL - FEBRUARY 2020 CRJ 1

Doc Day Details Bank Amount Details

29 Total 64 811 64 811

B/S SPY Bank 54 000 52 000 Fixed deposit: SPY

Bank

2 000 Interest on fixed

deposit

B/S S Bester 18 200 18 200 Rent income

B/S PA Bank 108 108 Interest on current

account

137 119 137 119 12

CASH PAYMENTS JOURNAL - FEBRUARY 2020 CPJ 1

Doc Day Details Bank Amount Details

29 Total 53 991 53 991

Sales 62 420 62 420 Sales

B/S PA Bank 890 890 Bank charges

B/S ML Insurers 8 400 6 200 Insurance

2 200 Drawings

B/S CM Bank 4 300 4 300 Loan: CM Bank

B/S City council 56 230 56 230 Water and electricity

186 231 186 231 19

10.2 GENERAL LEDGER OF VDM TRADERS

Bank

2020 2020

Feb 1 Balance 474 188 Feb 29 Sundry accounts 186 231

2020 Sundry

Feb 29

accounts 137 119 Balance 425 076

611 307 611 307

2020 Balance 425 076 6

Mar 1

Copyright reserved Please turn over

14

Bank Reconciliations 2021 DBE

10.3 Bank Reconciliation Statement op 29 February 2020.

Debit Credit

Cr. Balance as per Bank

Statement 392 650

Cr. Outstanding deposit 25/02 13 820

28/02 22 336

Cr EFT wrongly debited 2 631

Dr. Outstanding EFT – No. 323 6 361

Dr. Balance according to bank 425 076

account See 10.2

431 437 431 437

Both figures must be the same

8

Copyright reserved Please turn over

15

Bank Reconciliations 2021 DBE

QUESTION 11

11.1 Calculate the correct Bank Account balance on 31 March 2020.

Receipts: 55 400 + 900 + 2 850 + 9 300 + 120 = 68 570

Payments: 36 900 + 6 000 + 1 450 + 5 350 + 980 = 50 680

7 500 + 68 570 – 50 680 = 25 270 16

11.2 Bank Reconciliation Statement on 31 March 2020.

Debit Credit

Balance according to Bank Statement

Balancing figure 15 380

Cr Outstanding deposit 22 700

Dr Outstanding EFT – 333 6 500

Dr amount wrongly credited 6 400

Bank charges overstated 210

Dr Balance on the bank account 25 390

See 11.1

38 290 38 290

both figures must be the same

9

11.3 (a) Identify the GAAP principle which will be applied in this

case.

GAAP Principle:

Principle of prudence

1

(b) Provide TWO internal control measures that Jane can use

to prevent such a loss in future.

Any TWO valid point

Division of duties/Rotation of duties/Divide duties amongst

employees so that the one can act as a check on the other / The

person issuing receipts should not be the same person doing the

deposits.

Responsible staff members to check/make the deposits.

Regular and timely supervision / monitor cash deposits

Cash must be deposited daily (check deposit slip against receipts).

Outstanding deposits must be investigated promptly.

Encourage EFT payments by customers / debtors.

4

Request bank to send confirmation of all transactions (e.g. sms).

Copyright reserved Please turn over

You might also like

- Statement Sutton BankDocument2 pagesStatement Sutton Bankdarling boy100% (2)

- US Bank Business Statement - Mbcvirtual 4Document4 pagesUS Bank Business Statement - Mbcvirtual 4Aleesha Aleesha100% (2)

- 2023 Grade 11 Written Report MGDocument5 pages2023 Grade 11 Written Report MGfiercestallionofficial0% (2)

- Your RBC Personal Banking Account StatementDocument4 pagesYour RBC Personal Banking Account StatementHICTOR100% (2)

- Your RBC Personal Banking Account StatementDocument2 pagesYour RBC Personal Banking Account Statementkarely jackson lopez100% (1)

- Gold Business Account 82Document1 pageGold Business Account 82nicole.philippsNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

- PDF DocumentDocument6 pagesPDF DocumentGregory RodriguezNo ratings yet

- 01730XXX3885 2019may14 2019jun14Document2 pages01730XXX3885 2019may14 2019jun14saad0% (1)

- Chapter 10 AnswersDocument3 pagesChapter 10 AnswersThe Nightwatchmen100% (1)

- Ally-Bank-Statement - Helen ZhaoDocument4 pagesAlly-Bank-Statement - Helen ZhaoJonathan Seagull Livingston100% (1)

- Statement Message : Penyata AkaunDocument2 pagesStatement Message : Penyata AkaunAbdul Aziz JefriNo ratings yet

- Ibd 50Document16 pagesIbd 50Dal MakhaniNo ratings yet

- BK Form Iii Package 2023Document9 pagesBK Form Iii Package 2023jasmina.mushy22No ratings yet

- Grade 11 March 2023 Control Test MemoDocument7 pagesGrade 11 March 2023 Control Test MemofiercestallionofficialNo ratings yet

- Bank ReconciliationsDocument17 pagesBank ReconciliationsseateecharonNo ratings yet

- FS Accounting REVISION 2022 Grade 12 Paper 2Document273 pagesFS Accounting REVISION 2022 Grade 12 Paper 2Nonhlanhla NhlapoNo ratings yet

- 2024 Acc Grade 11 Written Report MGDocument4 pages2024 Acc Grade 11 Written Report MGtewos76345No ratings yet

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- TOPIC 8 - Bank ReconciliationDocument4 pagesTOPIC 8 - Bank ReconciliationMOHD FITRI SAIMINo ratings yet

- 1 - QPDocument7 pages1 - QPburtontris23No ratings yet

- Controlled Test GR11 MG 13 April 2021Document6 pagesControlled Test GR11 MG 13 April 2021fatimah WajoodeenNo ratings yet

- Topic 5 Bank ReconciliationDocument13 pagesTopic 5 Bank Reconciliationqbf28kbgc4No ratings yet

- Homework 2Document1 pageHomework 2britsomaxmillianNo ratings yet

- 1 Paper 2 Topics QPDocument100 pages1 Paper 2 Topics QPkgahlisomosala24No ratings yet

- 2022 - 10 - 22 2 - 32 PM Office LensDocument5 pages2022 - 10 - 22 2 - 32 PM Office LensRizalito SisonNo ratings yet

- Accounting P2 May-June 2023 EngDocument14 pagesAccounting P2 May-June 2023 EngZNo ratings yet

- Fixed Options Home Loan: Your Account Summary Your Account Status As at 26 Mar 2021Document3 pagesFixed Options Home Loan: Your Account Summary Your Account Status As at 26 Mar 2021ผม หล่อNo ratings yet

- Test Reconciliation Grade 11Document6 pagesTest Reconciliation Grade 11Stars2323100% (2)

- Accounting-A1 ST10028294 NsitholeDocument7 pagesAccounting-A1 ST10028294 NsitholeBuhlebendalo MsizaNo ratings yet

- Bank Reconciliation AssignmentDocument2 pagesBank Reconciliation AssignmentOckouri BarnesNo ratings yet

- Bank Rec HKALEDocument10 pagesBank Rec HKALEKwan Yin HoNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementMichael BwireNo ratings yet

- Further Information: Schedule of Accounts Receivable MayDocument6 pagesFurther Information: Schedule of Accounts Receivable MaySaifullah WaqarNo ratings yet

- Cred Control QuestionsDocument22 pagesCred Control Questionslesleymohlala70% (1)

- KMSDocument17 pagesKMS黄颀桓No ratings yet

- CashbookDocument6 pagesCashbookNeeraj GadviNo ratings yet

- GR 10 Engels MemosDocument110 pagesGR 10 Engels Memosonaleronamodisane048No ratings yet

- Grade 11 ACC P2 (English) June 2023 Possible AnswersDocument11 pagesGrade 11 ACC P2 (English) June 2023 Possible AnswerszembenomazwiNo ratings yet

- Books of Prime Entry: The Cash BookDocument11 pagesBooks of Prime Entry: The Cash Bookأحمد عبد الحميدNo ratings yet

- Bank StatementDocument5 pagesBank StatementjadeisangryNo ratings yet

- Accounting p2 QP Gr12 Sept 2023 - EnglishDocument11 pagesAccounting p2 QP Gr12 Sept 2023 - Englishbrandon.tabaneNo ratings yet

- Jojoe Agyeman RBC Mar 2022Document2 pagesJojoe Agyeman RBC Mar 2022Ali HassanNo ratings yet

- Bank Reconciliation StatementsDocument25 pagesBank Reconciliation StatementsVernan ZivanaiNo ratings yet

- Grade 11 Accn June 2023 P2 MGDocument9 pagesGrade 11 Accn June 2023 P2 MGKwakhanya StemelaNo ratings yet

- Acc117 Test 2 July 2022 - Tapah BRS SSDocument3 pagesAcc117 Test 2 July 2022 - Tapah BRS SSNajmuddin AzuddinNo ratings yet

- Cover Test 17.04.2015Document4 pagesCover Test 17.04.2015lloydbwalya588No ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- 2018 GR 10 Test 1 MemoDocument3 pages2018 GR 10 Test 1 MemoSuraj SukhuNo ratings yet

- Ems Grade 9 Paper 1 Year End Test 2022 MemorandumDocument5 pagesEms Grade 9 Paper 1 Year End Test 2022 MemorandumMidyondzi ngobeniNo ratings yet

- Myungsoo YooDocument3 pagesMyungsoo YooITNo ratings yet

- Cash BookDocument14 pagesCash BookSi Brian TohNo ratings yet

- Practice Questions DM112 No 22Document13 pagesPractice Questions DM112 No 22Bianca BenNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationAman kumarNo ratings yet

- AFA241Document5 pagesAFA241sarah josephNo ratings yet

- ACCT 110 Foundations of Accounting I - Kabarak UniversityDocument8 pagesACCT 110 Foundations of Accounting I - Kabarak UniversityewayuaNo ratings yet

- Gr10 Acc (English) June 2019 Possible AnswersDocument13 pagesGr10 Acc (English) June 2019 Possible AnswersLethabo Mmankale TabaneNo ratings yet

- 05 Mar 2020 - (Free) ..BwQJUkEKBQU - YX4AYAdheA4DBQN0bHxxdmgAd2wGDgAGDwFzB2wIBQcHAXQDAwgFBwcHdgQDCAwFDgl3AgDocument1 page05 Mar 2020 - (Free) ..BwQJUkEKBQU - YX4AYAdheA4DBQN0bHxxdmgAd2wGDgAGDwFzB2wIBQcHAXQDAwgFBwcHdgQDCAwFDgl3AgDon MadzivaNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- G10 Algebra Checkpoint Test 2 MEMODocument2 pagesG10 Algebra Checkpoint Test 2 MEMOlindort00No ratings yet

- LIFE SCIENCES P1 GR11 QP NOV2019 - Eng DDocument16 pagesLIFE SCIENCES P1 GR11 QP NOV2019 - Eng Dlindort00No ratings yet

- Mathematics 2020 P1 MemoDocument17 pagesMathematics 2020 P1 Memolindort00No ratings yet

- Life Sciences P2 Nov 2021 EngDocument17 pagesLife Sciences P2 Nov 2021 Englindort00No ratings yet

- ACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - Englishlindort00No ratings yet

- Accounting P2 GR 11 Exemplar Nov 2019 Memo EngDocument10 pagesAccounting P2 GR 11 Exemplar Nov 2019 Memo Englindort00No ratings yet

- Acc Nov QpmemoDocument52 pagesAcc Nov Qpmemolindort00No ratings yet

- Accn P2 QP Ansbk Memo GR11 Nov2020 Eng DDocument32 pagesAccn P2 QP Ansbk Memo GR11 Nov2020 Eng Dlindort00No ratings yet

- Accounting May-June 2019 EngDocument18 pagesAccounting May-June 2019 Englindort00No ratings yet

- Mathematics 2019 P2 MemoDocument13 pagesMathematics 2019 P2 Memolindort00No ratings yet

- ACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJDocument9 pagesACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJlindort00No ratings yet

- NJ LasDocument2 pagesNJ LasPA SCALPERNo ratings yet

- Osceola County Real Property Records Forensic ExaminationDocument759 pagesOsceola County Real Property Records Forensic ExaminationStephen Dibert100% (2)

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoNo ratings yet

- Cases in Insurance 2022Document3 pagesCases in Insurance 2022Orlando III De GuzmanNo ratings yet

- Initial Public Offerings, Investment Banking, & Financial Restructuring 1Document19 pagesInitial Public Offerings, Investment Banking, & Financial Restructuring 1faezaNo ratings yet

- Mrs Sonya Elisanee Proforma InvoiceDocument2 pagesMrs Sonya Elisanee Proforma InvoiceJavier E. Hernández F.100% (1)

- Financial Ana Fundament Assessment Review - Corporate Finance InstituteDocument22 pagesFinancial Ana Fundament Assessment Review - Corporate Finance Instituteolaomotito hossanaNo ratings yet

- Answers With ExplanationDocument10 pagesAnswers With Explanationdebate ddNo ratings yet

- LGE - 23 1Q - Consolidated - F - SignedDocument85 pagesLGE - 23 1Q - Consolidated - F - Signedramannamj4No ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- Transcript of Warren Buffett Interview With FCICDocument23 pagesTranscript of Warren Buffett Interview With FCICSantangel's ReviewNo ratings yet

- Accounting and Finance CertificationsDocument2 pagesAccounting and Finance CertificationswesamNo ratings yet

- Financial Management Principles and Applications 13Th Edition Titman Test Bank Full Chapter PDFDocument68 pagesFinancial Management Principles and Applications 13Th Edition Titman Test Bank Full Chapter PDFMichelleJenkinsmtqi100% (15)

- A Primer On Money, Banking, and Gold Peter BernsteinDocument8 pagesA Primer On Money, Banking, and Gold Peter Bernsteinad9292No ratings yet

- IFRICDocument2 pagesIFRICStephanie Joy NogollosNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument55 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownRagini SharmaNo ratings yet

- WRD FinMan 14e - SM 05Document82 pagesWRD FinMan 14e - SM 05CyyyNo ratings yet

- PDFDocument1 pagePDFKsenija Cica JovanovicNo ratings yet

- Additional Financial Reporting Issues: Chapter OutlineDocument26 pagesAdditional Financial Reporting Issues: Chapter OutlineFernando III PerezNo ratings yet

- QUALIFYING EXAM TOS - 2nd Year - 2021Document8 pagesQUALIFYING EXAM TOS - 2nd Year - 2021christ maryNo ratings yet

- Banking 18-4-2022Document17 pagesBanking 18-4-2022KAMLESH DEWANGANNo ratings yet

- Aafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiDocument35 pagesAafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiMuhammad Sohaib AzharNo ratings yet

- Chapter 3 - MCQ SolDocument3 pagesChapter 3 - MCQ SolinasNo ratings yet

- E-Circular On Super Top UpDocument3 pagesE-Circular On Super Top UpsankarshanadasNo ratings yet

- Financial SystemDocument7 pagesFinancial SystemsaadsaaidNo ratings yet

- Accounting Principles Costs & Conventions: Ravikant AgarwalDocument21 pagesAccounting Principles Costs & Conventions: Ravikant AgarwalSakshi koulNo ratings yet

- International Trade Course 2Document45 pagesInternational Trade Course 2Sudershan ThaibaNo ratings yet

- GA Bu I 1 - CLCDocument15 pagesGA Bu I 1 - CLChsifjpobNo ratings yet