Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

78 viewsIGCSE-OL - Bus - CH - 20 - Answers To CB Activities

IGCSE-OL - Bus - CH - 20 - Answers To CB Activities

Uploaded by

Oscar WilliamsThe document provides answers and explanations to activities and questions about cash flow forecasting and working capital from a Cambridge IGCSE and O Level Business Studies textbook. It includes sample cash flow forecasts, explanations of key terms like cash flow and working capital, and suggestions for improving cash flow and working capital for businesses facing shortages.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Uber Full AssignmentDocument13 pagesUber Full Assignmenttea50% (2)

- 3.7 ExercisesDocument6 pages3.7 ExercisesGeorgios MilitsisNo ratings yet

- Questions 1 PDFDocument10 pagesQuestions 1 PDFdkishore28100% (1)

- Libby Financial Accounting Chapter6Document6 pagesLibby Financial Accounting Chapter6Jie Bo TiNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- A Report On Silver River Manufacturing CompanyDocument59 pagesA Report On Silver River Manufacturing CompanyManish JaiswalNo ratings yet

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- Volkswagen Strategic ManagementDocument15 pagesVolkswagen Strategic ManagementSaloni Maheshwari100% (1)

- T10 Managing Finance Notes by SeahDocument43 pagesT10 Managing Finance Notes by SeahSeah Chooi KhengNo ratings yet

- Model Answers Subject - Working Capital Management Paper code-AS-2377Document8 pagesModel Answers Subject - Working Capital Management Paper code-AS-2377avni shrmaNo ratings yet

- The Role of Working CapitalDocument9 pagesThe Role of Working CapitalAbuBakarSiddiqueNo ratings yet

- Revision Sheet For Quiz1 1025343525Document6 pagesRevision Sheet For Quiz1 1025343525ayten.ayman.elerakyNo ratings yet

- Financial Accounting 9th Edition Libby Solutions ManualDocument42 pagesFinancial Accounting 9th Edition Libby Solutions Manualmeganmooreobwypjenim100% (33)

- Module III AFM (Part-I)Document32 pagesModule III AFM (Part-I)shuklayuvaan22No ratings yet

- Financial Accounting 9Th Edition Libby Solutions Manual Full Chapter PDFDocument63 pagesFinancial Accounting 9Th Edition Libby Solutions Manual Full Chapter PDFDawnZimmermanxwcq100% (13)

- Chapter 6 - Solution Manual PDFDocument41 pagesChapter 6 - Solution Manual PDFNatalie ChoiNo ratings yet

- LLH9e Ch06 SolutionsManual FINALDocument41 pagesLLH9e Ch06 SolutionsManual FINALIgnjatNo ratings yet

- Problems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document3 pagesProblems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Aaleen AamirNo ratings yet

- Unit 5 Topic 4Document5 pagesUnit 5 Topic 4Ibrahim AbidNo ratings yet

- Topic 3 7 Cash FlowDocument16 pagesTopic 3 7 Cash FlowEren BarlasNo ratings yet

- Working Capital Management SscEDocument38 pagesWorking Capital Management SscEKinNo ratings yet

- FM SD21 AsDocument6 pagesFM SD21 AsRamcharan KeshavNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Working Capital Management SscEDocument38 pagesWorking Capital Management SscEJastinNo ratings yet

- Working Capital BBA Kshitij MahamuniDocument32 pagesWorking Capital BBA Kshitij MahamuniVishwajit PatilNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Assignment # 4 26 CH 22Document6 pagesAssignment # 4 26 CH 22Ibrahim AbdallahNo ratings yet

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- Financial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFDocument48 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFthomasowens1asz100% (11)

- Financial Accounting Canadian Canadian 5th Edition Libby Solutions Manual 1Document70 pagesFinancial Accounting Canadian Canadian 5th Edition Libby Solutions Manual 1sharon100% (45)

- IB Bm2tr 3 Resources Answers7Document7 pagesIB Bm2tr 3 Resources Answers7Gabriel FungNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Entrep Week 5Document25 pagesEntrep Week 5edward.mkl12345No ratings yet

- Quiz 1 - Period 3 Working Capital Mansgement Wioth AnswersDocument4 pagesQuiz 1 - Period 3 Working Capital Mansgement Wioth AnswersLieza Jane AngelitudNo ratings yet

- Cash Receipts and PaymentsDocument14 pagesCash Receipts and Paymentsmh bachooNo ratings yet

- Cash and Liquidity ManagementDocument23 pagesCash and Liquidity Managementrkarora1209No ratings yet

- Chapter SixDocument47 pagesChapter SixAlmaz Getachew0% (1)

- Chapter SixDocument47 pagesChapter SixAshenafi ZelekeNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- Test Bank 3 - Ia 1Document25 pagesTest Bank 3 - Ia 1JEFFERSON CUTE100% (1)

- 2022 ND - FM Suggested AnswerDocument10 pages2022 ND - FM Suggested Answermiradvance studyNo ratings yet

- BBA 2011 Corporate Financial ManagementDocument20 pagesBBA 2011 Corporate Financial ManagementVentusNo ratings yet

- CH2 CashDocument3 pagesCH2 CashSamir SubediNo ratings yet

- Cash FlowDocument20 pagesCash FlowJuan CarlosNo ratings yet

- Soluciones Flujo de EfectivoDocument7 pagesSoluciones Flujo de EfectivoJimmy RoblesNo ratings yet

- Select One: A.: B. Deducted From The Book BalanceDocument6 pagesSelect One: A.: B. Deducted From The Book BalanceHiếu Minh NguyễnNo ratings yet

- Tutorial 7 Solutions FinalDocument5 pagesTutorial 7 Solutions FinalLuz Helena Molina PintoNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- Cash and Liquidity ManagementDocument14 pagesCash and Liquidity ManagementAldrin ZolinaNo ratings yet

- Lecture 7-8 Cash Budget - Cash Operating CycleDocument18 pagesLecture 7-8 Cash Budget - Cash Operating CyclesajedulNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocument26 pagesSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (90)

- Xi Account QPDocument7 pagesXi Account QPPooja KukrejaNo ratings yet

- Hock CMA P1 2019 (Sections A, B & C) AnswersDocument17 pagesHock CMA P1 2019 (Sections A, B & C) AnswersNathan DrakeNo ratings yet

- Cash & Liquidity MGTDocument19 pagesCash & Liquidity MGTsabijagdishNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- 3 Working Capital ManagementDocument46 pages3 Working Capital Managementpagaduanbianca412No ratings yet

- Paper 1 ExplainedDocument54 pagesPaper 1 ExplainedOscar WilliamsNo ratings yet

- Exam Questions For Life of Pi Examples and Past Papers 2024Document2 pagesExam Questions For Life of Pi Examples and Past Papers 2024Oscar WilliamsNo ratings yet

- Telegraph WiresDocument8 pagesTelegraph WiresOscar WilliamsNo ratings yet

- Thought FoxDocument12 pagesThought FoxOscar WilliamsNo ratings yet

- 2024 2026 SyllabusDocument34 pages2024 2026 SyllabusOscar WilliamsNo ratings yet

- IGCSE Spanish Revision Workbook Vocabulary GrammarDocument42 pagesIGCSE Spanish Revision Workbook Vocabulary GrammarOscar WilliamsNo ratings yet

- Bumper Structure List With Translation PracticeDocument8 pagesBumper Structure List With Translation PracticeOscar WilliamsNo ratings yet

- 3G Ardzyka Raka R 1910631030065 Assignment 8Document3 pages3G Ardzyka Raka R 1910631030065 Assignment 8Raka RamadhanNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (12)

- Project Management Notes-1Document43 pagesProject Management Notes-1MrugendraNo ratings yet

- PDF Social MarketingDocument2 pagesPDF Social Marketingentr200No ratings yet

- Purchasing and Supply Chain Management 3Rd Edition Benton Test Bank PDFDocument26 pagesPurchasing and Supply Chain Management 3Rd Edition Benton Test Bank PDFviola.moore764100% (19)

- Concrete Construction Article PDF Strategic Planning For ContractorsDocument4 pagesConcrete Construction Article PDF Strategic Planning For ContractorsMohammed NizamNo ratings yet

- Volvo It Running It As A Bus 235742Document17 pagesVolvo It Running It As A Bus 235742Juan PerezNo ratings yet

- Unit 1: Quiz On Introduction To Internal Auditing: Virgilkitaugustin - Abanilla@spsps - Edu.phDocument2 pagesUnit 1: Quiz On Introduction To Internal Auditing: Virgilkitaugustin - Abanilla@spsps - Edu.phTATYANA PAULA GOLONGNo ratings yet

- FE Manual - Chapter 12Document39 pagesFE Manual - Chapter 12Saad ShamsNo ratings yet

- Jun18l1eth-E03 QaDocument2 pagesJun18l1eth-E03 Qarafav10No ratings yet

- KARTHICK B.P (NOV '21-Time Sheet)Document3 pagesKARTHICK B.P (NOV '21-Time Sheet)SureshNo ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- James A. Davies ResumeDocument1 pageJames A. Davies ResumeJimmy DaviesNo ratings yet

- Digital TransformationDocument16 pagesDigital Transformationmmarikar270% (1)

- Mutual Fund (User Manual)Document24 pagesMutual Fund (User Manual)satyagodfatherNo ratings yet

- Iso 9001 2008 HindiDocument32 pagesIso 9001 2008 HindiNilesh D PatilNo ratings yet

- Befa Mid-Ii B.tech Iii YearDocument5 pagesBefa Mid-Ii B.tech Iii YearNaresh GuduruNo ratings yet

- CounterfeitDocument5 pagesCounterfeitVivek GoudNo ratings yet

- Chapter 15 MonopolyDocument40 pagesChapter 15 MonopolyThanh Nguyen100% (2)

- Full Download PDF of (Original PDF) Management by Christopher P. Neck All ChapterDocument43 pagesFull Download PDF of (Original PDF) Management by Christopher P. Neck All Chapterprillaaguil100% (6)

- MARKETING MIX - Maruthi SuzukiDocument4 pagesMARKETING MIX - Maruthi SuzukiSRINIVASHNo ratings yet

- Exercise 1: How Much? Do The Calculations. Write The Answers in Two WaysDocument3 pagesExercise 1: How Much? Do The Calculations. Write The Answers in Two WaysKamilatti ChoudjayNo ratings yet

- Company Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceDocument5 pagesCompany Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceNavi FisNo ratings yet

- MI TV 43 InchDocument2 pagesMI TV 43 Inchharry tharunNo ratings yet

- Managemnt 12a ReferencesDocument5 pagesManagemnt 12a Referenceszanderhero30No ratings yet

- Mercantile Law I llb2 Course OutlineDocument11 pagesMercantile Law I llb2 Course Outlinerobert TibaruhaNo ratings yet

IGCSE-OL - Bus - CH - 20 - Answers To CB Activities

IGCSE-OL - Bus - CH - 20 - Answers To CB Activities

Uploaded by

Oscar Williams0 ratings0% found this document useful (0 votes)

78 views3 pagesThe document provides answers and explanations to activities and questions about cash flow forecasting and working capital from a Cambridge IGCSE and O Level Business Studies textbook. It includes sample cash flow forecasts, explanations of key terms like cash flow and working capital, and suggestions for improving cash flow and working capital for businesses facing shortages.

Original Description:

Original Title

IGCSE-OL_Bus_Ch_20_Answers to CB activities

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides answers and explanations to activities and questions about cash flow forecasting and working capital from a Cambridge IGCSE and O Level Business Studies textbook. It includes sample cash flow forecasts, explanations of key terms like cash flow and working capital, and suggestions for improving cash flow and working capital for businesses facing shortages.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

78 views3 pagesIGCSE-OL - Bus - CH - 20 - Answers To CB Activities

IGCSE-OL - Bus - CH - 20 - Answers To CB Activities

Uploaded by

Oscar WilliamsThe document provides answers and explanations to activities and questions about cash flow forecasting and working capital from a Cambridge IGCSE and O Level Business Studies textbook. It includes sample cash flow forecasts, explanations of key terms like cash flow and working capital, and suggestions for improving cash flow and working capital for businesses facing shortages.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Cambridge IGCSE and O Level Business Studies

20 Cash-flow forecasting and

working capital

Answers to Coursebook activities

Activity 20.1 (page 260)

1 February

2 Payments are greater than receipts, or outflows are greater than inflows.

Activity 20.2 (page 261)

1 May: 2; June: 7.

2 Positive cash balance in January and February becomes negative in March and April before returning

to positive in May and June. Temporary cash shortage in March and April may need overdraft facility

if it happens.

3 Knowing that there is a temporary cash shortage in both March and April, the finance manager could

look at ways of increasing cash inflows or decreasing cash outflows to improve the position. If not

possible then make sure the bank agrees to finance the shortage with an overdraft.

Activity 20.3 (page 262)

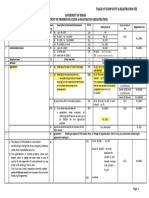

1 Month 1 Month 2 Month 3 Month 4

$000 $000 $000 $000

Cash inflow

Receipts 36 43 38 49

Total inflow 36 43 38 49

Cash outflows

Payments 33 46 45 37

Total outflow 33 46 45 37

Net cash flow 3 (3) (7) 12

Opening balance 11 14 11 4

Closing balance 14 11 4 16

2 Monthly closing balances are all now positive – better than having a negative cash balance for month 3.

3 Yes, because it improved closing balances and removed the need for an overdraft. No, because they do

not own the vehicle and in the long run it will cost more to have the vehicle. The one month negative

cash balance when buying the vehicle would have meant using an overdraft, but only for one month.

Would have been better off buying the vehicle rather than leasing it as they would own the vehicle and

cost would have been less.

Test yourself (page 262)

1 Needed to finance day-to-day expenses. Without cash, a business cannot pay its debts and will not be

able to survive.

2 To avoid negative cash balances that would require use of an overdraft or other form of borrowing,

both of which increase a business’s costs.

3 Using an overdraft or a short-term bank loan.

© Cambridge University Press 2018 Chapter 20 Answers to Coursebook activities 1

Cambridge IGCSE and O Level Business Studies

Case study (page 263)

a Flow of cash into and out of a business over time.

b Metrorail could not pay Sinqobile the money it was due on time. This will have reduced Sinqobile’s cash

inflows and made it more difficult to meet its cash outgoings.

c Sinqobile is a small company and will have lower cash inflows than a large business such as Metrorail.

If Sinqobile has a shortage of cash, banks might not be prepared to grant an overdraft facility or other

short-term borrowing, which could threaten the survival of Sinqobile.

d Make sure that Metrorail and other businesses it supplies services to pay on time. Could try to reduce

costs or delay payments to own trade payables.

Test yourself (page 264)

1 Capital needed to finance day-to-day running expenses and pay short-term debts of the business.

2 Working capital = current assets − current liabilities

3 Measures the ability of a business to pay short-term debts. Business that does not have enough working

capital may have to borrow the finance required. Will have to pay interest on the amount borrowed –

increases the business’s costs. If the business is unable to borrow the finance required, it may fail.

Case study (page 265)

a She took risks and had a business idea.

b To purchase raw materials for buggies and pay the wages of two employees.

c Measures Shonaquip’s ability to pay short-term debts. If Shonaquip does not have enough working

capital then she may have to borrow the finance required. Would have to pay interest on any amount

borrowed – increases the business’s costs. If the business is unable to finance short-term debts, it

may fail.

d Depends on the time it takes from buying raw materials, making these into buggies for sale, finding

buyers for these and then receiving payment from customers.

Exam-style practice questions (pages 266–267)

1 a Capital needed to finance day-to-day running expenses and pay short-term debts of the business (1).

Current assets − current liabilities (1) [Total: 2]

b A: 1060 − 640 = 420 (1); B: (−180) + 390 = 210 (1) [Total: 2]

c Closing balances in January and February are negative (1), do not have enough cash to pay business

expenses and debts (1), might need to use overdraft facility (1), overdraft is an expensive source of

finance, which increases Cards4U’s costs (1). [Total: 4]

d Increase cash inflows (1), manage trade receivables more effectively (1), offer discount to credit sales

customers to pay for goods sooner (1), increase cash sales (1). Reduce cash outflows (1), buy fewer

inventories (1), negotiate longer credit terms with suppliers (1). [Total: 6]

e No, because without cash Cards4U will not be able to pay its debts and will have no cash to pay for

supplies (1), without supplies nothing to sell, if cannot pay rent then will have to close down (1),

might waste cash buying goods does not need (1), credit customers take longer to pay if not properly

managed (1), if have a cash shortage have to use an overdraft or other short-term finance, which

increases costs (1). Statement agreeing or disagreeing supported by points discussed (1). [Total: 6]

2 a To pay day-today expenses, to avoid the need for an overdraft which increases the business’s costs. [2]

b Difference between cash inflows and cash outflows for a particular time period. [2]

© Cambridge University Press 2018 Chapter 20 Answers to Coursebook activities 2

Cambridge IGCSE and O Level Business Studies

c Jan Feb Mar Apr

$000 $000 $000 $000

Cash inflows

Credit sales 230 250 200 180

Total cash inflows 230 250 200 180

Cash outflows

Payments 160 350 230 160

Net cash flow 70 (100) (30) 20

Opening balance 20 90 (10) (40)

Closing balance 90 (10) (40) (20) [Total: 4]

d Cash inflows may improve (1), recovering money owed from trade receivables on time (1), more cash

coming in to the business to finance cash outflows (1). Cash outflows kept to a minimum (1), avoid

paying trade payables early (1), ensure cash outflows not greater than cash inflows – improves cash

balances (1). [Total: 6]

e ABC has cash shortages from February to March (1), needs to increase cash inflows in these months or

reduce cash outflows (1). Offer discounts to trade receivables to encourage early payment (1), improve

credit control to make sure trade receivables pay on time (1), reduce inventories (1). Delay purchases if

possible (1), ask trade payables for longer credit period (1). [Total: 6]

© Cambridge University Press 2018 Chapter 20 Answers to Coursebook activities 3

You might also like

- Uber Full AssignmentDocument13 pagesUber Full Assignmenttea50% (2)

- 3.7 ExercisesDocument6 pages3.7 ExercisesGeorgios MilitsisNo ratings yet

- Questions 1 PDFDocument10 pagesQuestions 1 PDFdkishore28100% (1)

- Libby Financial Accounting Chapter6Document6 pagesLibby Financial Accounting Chapter6Jie Bo TiNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- A Report On Silver River Manufacturing CompanyDocument59 pagesA Report On Silver River Manufacturing CompanyManish JaiswalNo ratings yet

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- Volkswagen Strategic ManagementDocument15 pagesVolkswagen Strategic ManagementSaloni Maheshwari100% (1)

- T10 Managing Finance Notes by SeahDocument43 pagesT10 Managing Finance Notes by SeahSeah Chooi KhengNo ratings yet

- Model Answers Subject - Working Capital Management Paper code-AS-2377Document8 pagesModel Answers Subject - Working Capital Management Paper code-AS-2377avni shrmaNo ratings yet

- The Role of Working CapitalDocument9 pagesThe Role of Working CapitalAbuBakarSiddiqueNo ratings yet

- Revision Sheet For Quiz1 1025343525Document6 pagesRevision Sheet For Quiz1 1025343525ayten.ayman.elerakyNo ratings yet

- Financial Accounting 9th Edition Libby Solutions ManualDocument42 pagesFinancial Accounting 9th Edition Libby Solutions Manualmeganmooreobwypjenim100% (33)

- Module III AFM (Part-I)Document32 pagesModule III AFM (Part-I)shuklayuvaan22No ratings yet

- Financial Accounting 9Th Edition Libby Solutions Manual Full Chapter PDFDocument63 pagesFinancial Accounting 9Th Edition Libby Solutions Manual Full Chapter PDFDawnZimmermanxwcq100% (13)

- Chapter 6 - Solution Manual PDFDocument41 pagesChapter 6 - Solution Manual PDFNatalie ChoiNo ratings yet

- LLH9e Ch06 SolutionsManual FINALDocument41 pagesLLH9e Ch06 SolutionsManual FINALIgnjatNo ratings yet

- Problems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document3 pagesProblems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Aaleen AamirNo ratings yet

- Unit 5 Topic 4Document5 pagesUnit 5 Topic 4Ibrahim AbidNo ratings yet

- Topic 3 7 Cash FlowDocument16 pagesTopic 3 7 Cash FlowEren BarlasNo ratings yet

- Working Capital Management SscEDocument38 pagesWorking Capital Management SscEKinNo ratings yet

- FM SD21 AsDocument6 pagesFM SD21 AsRamcharan KeshavNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Working Capital Management SscEDocument38 pagesWorking Capital Management SscEJastinNo ratings yet

- Working Capital BBA Kshitij MahamuniDocument32 pagesWorking Capital BBA Kshitij MahamuniVishwajit PatilNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Assignment # 4 26 CH 22Document6 pagesAssignment # 4 26 CH 22Ibrahim AbdallahNo ratings yet

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- Financial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFDocument48 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFthomasowens1asz100% (11)

- Financial Accounting Canadian Canadian 5th Edition Libby Solutions Manual 1Document70 pagesFinancial Accounting Canadian Canadian 5th Edition Libby Solutions Manual 1sharon100% (45)

- IB Bm2tr 3 Resources Answers7Document7 pagesIB Bm2tr 3 Resources Answers7Gabriel FungNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Entrep Week 5Document25 pagesEntrep Week 5edward.mkl12345No ratings yet

- Quiz 1 - Period 3 Working Capital Mansgement Wioth AnswersDocument4 pagesQuiz 1 - Period 3 Working Capital Mansgement Wioth AnswersLieza Jane AngelitudNo ratings yet

- Cash Receipts and PaymentsDocument14 pagesCash Receipts and Paymentsmh bachooNo ratings yet

- Cash and Liquidity ManagementDocument23 pagesCash and Liquidity Managementrkarora1209No ratings yet

- Chapter SixDocument47 pagesChapter SixAlmaz Getachew0% (1)

- Chapter SixDocument47 pagesChapter SixAshenafi ZelekeNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- Test Bank 3 - Ia 1Document25 pagesTest Bank 3 - Ia 1JEFFERSON CUTE100% (1)

- 2022 ND - FM Suggested AnswerDocument10 pages2022 ND - FM Suggested Answermiradvance studyNo ratings yet

- BBA 2011 Corporate Financial ManagementDocument20 pagesBBA 2011 Corporate Financial ManagementVentusNo ratings yet

- CH2 CashDocument3 pagesCH2 CashSamir SubediNo ratings yet

- Cash FlowDocument20 pagesCash FlowJuan CarlosNo ratings yet

- Soluciones Flujo de EfectivoDocument7 pagesSoluciones Flujo de EfectivoJimmy RoblesNo ratings yet

- Select One: A.: B. Deducted From The Book BalanceDocument6 pagesSelect One: A.: B. Deducted From The Book BalanceHiếu Minh NguyễnNo ratings yet

- Tutorial 7 Solutions FinalDocument5 pagesTutorial 7 Solutions FinalLuz Helena Molina PintoNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- Cash and Liquidity ManagementDocument14 pagesCash and Liquidity ManagementAldrin ZolinaNo ratings yet

- Lecture 7-8 Cash Budget - Cash Operating CycleDocument18 pagesLecture 7-8 Cash Budget - Cash Operating CyclesajedulNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocument26 pagesSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (90)

- Xi Account QPDocument7 pagesXi Account QPPooja KukrejaNo ratings yet

- Hock CMA P1 2019 (Sections A, B & C) AnswersDocument17 pagesHock CMA P1 2019 (Sections A, B & C) AnswersNathan DrakeNo ratings yet

- Cash & Liquidity MGTDocument19 pagesCash & Liquidity MGTsabijagdishNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- 3 Working Capital ManagementDocument46 pages3 Working Capital Managementpagaduanbianca412No ratings yet

- Paper 1 ExplainedDocument54 pagesPaper 1 ExplainedOscar WilliamsNo ratings yet

- Exam Questions For Life of Pi Examples and Past Papers 2024Document2 pagesExam Questions For Life of Pi Examples and Past Papers 2024Oscar WilliamsNo ratings yet

- Telegraph WiresDocument8 pagesTelegraph WiresOscar WilliamsNo ratings yet

- Thought FoxDocument12 pagesThought FoxOscar WilliamsNo ratings yet

- 2024 2026 SyllabusDocument34 pages2024 2026 SyllabusOscar WilliamsNo ratings yet

- IGCSE Spanish Revision Workbook Vocabulary GrammarDocument42 pagesIGCSE Spanish Revision Workbook Vocabulary GrammarOscar WilliamsNo ratings yet

- Bumper Structure List With Translation PracticeDocument8 pagesBumper Structure List With Translation PracticeOscar WilliamsNo ratings yet

- 3G Ardzyka Raka R 1910631030065 Assignment 8Document3 pages3G Ardzyka Raka R 1910631030065 Assignment 8Raka RamadhanNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (12)

- Project Management Notes-1Document43 pagesProject Management Notes-1MrugendraNo ratings yet

- PDF Social MarketingDocument2 pagesPDF Social Marketingentr200No ratings yet

- Purchasing and Supply Chain Management 3Rd Edition Benton Test Bank PDFDocument26 pagesPurchasing and Supply Chain Management 3Rd Edition Benton Test Bank PDFviola.moore764100% (19)

- Concrete Construction Article PDF Strategic Planning For ContractorsDocument4 pagesConcrete Construction Article PDF Strategic Planning For ContractorsMohammed NizamNo ratings yet

- Volvo It Running It As A Bus 235742Document17 pagesVolvo It Running It As A Bus 235742Juan PerezNo ratings yet

- Unit 1: Quiz On Introduction To Internal Auditing: Virgilkitaugustin - Abanilla@spsps - Edu.phDocument2 pagesUnit 1: Quiz On Introduction To Internal Auditing: Virgilkitaugustin - Abanilla@spsps - Edu.phTATYANA PAULA GOLONGNo ratings yet

- FE Manual - Chapter 12Document39 pagesFE Manual - Chapter 12Saad ShamsNo ratings yet

- Jun18l1eth-E03 QaDocument2 pagesJun18l1eth-E03 Qarafav10No ratings yet

- KARTHICK B.P (NOV '21-Time Sheet)Document3 pagesKARTHICK B.P (NOV '21-Time Sheet)SureshNo ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- James A. Davies ResumeDocument1 pageJames A. Davies ResumeJimmy DaviesNo ratings yet

- Digital TransformationDocument16 pagesDigital Transformationmmarikar270% (1)

- Mutual Fund (User Manual)Document24 pagesMutual Fund (User Manual)satyagodfatherNo ratings yet

- Iso 9001 2008 HindiDocument32 pagesIso 9001 2008 HindiNilesh D PatilNo ratings yet

- Befa Mid-Ii B.tech Iii YearDocument5 pagesBefa Mid-Ii B.tech Iii YearNaresh GuduruNo ratings yet

- CounterfeitDocument5 pagesCounterfeitVivek GoudNo ratings yet

- Chapter 15 MonopolyDocument40 pagesChapter 15 MonopolyThanh Nguyen100% (2)

- Full Download PDF of (Original PDF) Management by Christopher P. Neck All ChapterDocument43 pagesFull Download PDF of (Original PDF) Management by Christopher P. Neck All Chapterprillaaguil100% (6)

- MARKETING MIX - Maruthi SuzukiDocument4 pagesMARKETING MIX - Maruthi SuzukiSRINIVASHNo ratings yet

- Exercise 1: How Much? Do The Calculations. Write The Answers in Two WaysDocument3 pagesExercise 1: How Much? Do The Calculations. Write The Answers in Two WaysKamilatti ChoudjayNo ratings yet

- Company Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceDocument5 pagesCompany Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceNavi FisNo ratings yet

- MI TV 43 InchDocument2 pagesMI TV 43 Inchharry tharunNo ratings yet

- Managemnt 12a ReferencesDocument5 pagesManagemnt 12a Referenceszanderhero30No ratings yet

- Mercantile Law I llb2 Course OutlineDocument11 pagesMercantile Law I llb2 Course Outlinerobert TibaruhaNo ratings yet