Professional Documents

Culture Documents

Page 1 of 2

Page 1 of 2

Uploaded by

GODSON NKUNUOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page 1 of 2

Page 1 of 2

Uploaded by

GODSON NKUNUCopyright:

Available Formats

Page 1 of 2

UNIVERSITY OF CAPE COAST

COLLEGE OF HUMANITIES AND LEGAL STUDIES

SCHOOL OF BUSINESS

DEPARTMENT OF ACCOUNTING

ACC 402 ADVANCED FINANCIAL REPORTING II – GROUP ASSIGNMENT 2

Question 1

AFR, a public limited company, owns 75% of the equity share capital of FR3, a public limited company which

is situated in a foreign country. AFR acquired FR3 on 1 October 2017 for 240 million Krows (KR) when the

retained earnings of FR3 were 160 million Krows. FR3 has not revalued its assets or issued any equity capital

since its acquisition by AFR. The following financial statements relate to AFR and FR3:

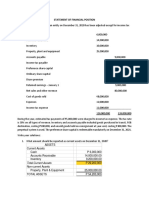

Statements of Financial Position as at 30 September 2018

AFR FR3

Assets GH¢'000 KR'000

Property plant and equipment 594,000 292,000

Investment in FR3 96,000

Loan to FR3 10,000

Current Assets 710,000 204,000

Total Assets 1,410,000 496,000

Equity and Liabilities

Share capital (GH¢1/KR1) 120,000 64,000

Share premium 100,000 40,000

Retained earnings 720,000 190,000

Non-current liabilities 60,000 82,000

Current liabilities 410,000 120,000

Total Equity and Liabilities 1,410,000 496,000

Statements of Profit or Loss for the year ended 30 September 2018

AFR FR3

Assets GH¢'000 KR'000

Revenue 400,000 284,000

Cost of sales (240,000) (192,000)

Gross profit 160,000 92,000

Operating expenses (60,000) (40,000)

Operating profit 100,000 52,000

Investment income 8,000 -

Finance cost (4,000)

Profit before tax 108,000 48,000

Tax (40,000) (18,000)

Profit for the year 68,000 30,000

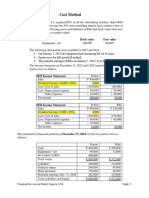

The following information is relevant to the preparation of the consolidated financial statements of AFR:

• AFR had made an interest free loan to FR3 of GH¢10 million on 1 October 2017. The loan was repaid

on 31 October 2018. FR3 had included the loan in non-current liabilities and had recorded it at the

exchange rate at 1 October 2017.

Page 2 of 2

• The fair value of the net assets of FR3 at the date of acquisition is to be assumed to be the same as

the carrying value. AFR uses the full goodwill method when accounting for acquisition of a subsidiary.

Goodwill was impairment tested at the reporting date and had reduced in value by ten per cent. At

the date of acquisition, the fair value of the non-controlling interest was KR76 million.

• FR3 operates with a significant degree of autonomy in its business operations.

• The following exchange rates are relevant to the financial statements:

Krows to GH¢1

1 October 2017 2.5

30 September 2018 2.1

Average rate for year to 30 September 2018 2

• AFR has paid a dividend of GH¢8 million during the financial year.

Required: Prepare a consolidated statement of profit or loss and other comprehensive income for the

year ended 30 September 2018 and a consolidated statement of financial position at that date.

You might also like

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisValtteri Itäranta0% (2)

- 17 Proven Currency Trading Strategies-Pages-250-255Document6 pages17 Proven Currency Trading Strategies-Pages-250-255quan lyhongNo ratings yet

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- Problem 2: To Record Stock-Related Issuance CostsDocument6 pagesProblem 2: To Record Stock-Related Issuance CostsRuel Lenard Calusin83% (6)

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Homework CH 3Document12 pagesHomework CH 3LNo ratings yet

- Inside Job PDFDocument87 pagesInside Job PDFAriel MarascalcoNo ratings yet

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Document16 pagesAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiNo ratings yet

- Exhibit 4-5 Chan Audio Company: Current RatioDocument35 pagesExhibit 4-5 Chan Audio Company: Current Ratiofokica840% (1)

- R27 CFA Level 3Document10 pagesR27 CFA Level 3Ashna0188No ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Assignment Subsequent To Date of AcquisitionDocument5 pagesAssignment Subsequent To Date of AcquisitionTrelle DiazNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- ACC401-2023 Business Valuation TutorialsDocument3 pagesACC401-2023 Business Valuation TutorialsOhene Asare PogastyNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Bca 304 Financial Statement AnalysisDocument5 pagesBca 304 Financial Statement Analysiskennymugo39No ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- FR 2018 Paper PrelimDocument12 pagesFR 2018 Paper PrelimshashalalaxiangNo ratings yet

- Business Combi PrelimDocument4 pagesBusiness Combi PrelimmcespressoblendNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Tutorial QuestionsDocument3 pagesTutorial QuestionsAkwasi Addai BoatengNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Change in Structure-Notes and QuestionsDocument5 pagesChange in Structure-Notes and QuestionsBilliee ButccherNo ratings yet

- IAS 21-2022 Conso QuestionsDocument4 pagesIAS 21-2022 Conso QuestionseoafriyieNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- FINANCIAL REPORTING PAPER 2.1nov 2023Document27 pagesFINANCIAL REPORTING PAPER 2.1nov 2023xodic49847No ratings yet

- Lesson 1 Partnership FormationDocument21 pagesLesson 1 Partnership FormationDan Gabrielle SalacNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Questions 1 A) .: Page 1 of 15Document15 pagesQuestions 1 A) .: Page 1 of 15Richie BoomaNo ratings yet

- Chapter 2 Hyperinflation LectureDocument4 pagesChapter 2 Hyperinflation LectureChristine SondonNo ratings yet

- P1 (Statement of Change in Equity)Document1 pageP1 (Statement of Change in Equity)Shiela Mae Pon AnNo ratings yet

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Financial ReportingDocument26 pagesFinancial Reportingxodic49847No ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Ifrs 2 TutorialsDocument3 pagesIfrs 2 TutorialsGODSON NKUNUNo ratings yet

- BBBBBDocument3 pagesBBBBBGODSON NKUNUNo ratings yet

- PUBLIC SECTOR ACCOUNTING FINANCE PAPER 2.5 Nov 2017Document19 pagesPUBLIC SECTOR ACCOUNTING FINANCE PAPER 2.5 Nov 2017GODSON NKUNUNo ratings yet

- Change in Group Structure TutorialsDocument5 pagesChange in Group Structure TutorialsGODSON NKUNUNo ratings yet

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic ExposureJoão Côrte-Real Rodrigues50% (2)

- RAJESH Accounts STUDY MATERIAL-2Document111 pagesRAJESH Accounts STUDY MATERIAL-2rajesh indukuriNo ratings yet

- Caucasus School of BusinessDocument6 pagesCaucasus School of BusinessDavid ChikhladzeNo ratings yet

- Bataan Peninsula State University: Reaction Paper in Advanced Accounting IiiDocument1 pageBataan Peninsula State University: Reaction Paper in Advanced Accounting IiiRodette Adajar PajanonotNo ratings yet

- Interim Letter To Investors Year 4Document6 pagesInterim Letter To Investors Year 4Victor FebriantNo ratings yet

- Analyze Company's Performance Using Ratios - Guided Project WorkbookDocument19 pagesAnalyze Company's Performance Using Ratios - Guided Project WorkbookAditya SeethaNo ratings yet

- ch10 p001-044 FinalDocument44 pagesch10 p001-044 FinalĐào Huyền Trang 4KT-20ACNNo ratings yet

- Chapter 10 Corporations - Retained Earnings Exercises T3AY2021Document6 pagesChapter 10 Corporations - Retained Earnings Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Assignment 1: Submitted byDocument9 pagesAssignment 1: Submitted byzarin tasnimNo ratings yet

- Formula SheetDocument35 pagesFormula SheetGorvita GuhaNo ratings yet

- Stocks, Bonds and Mutual BondsDocument4 pagesStocks, Bonds and Mutual BondsChrisNo ratings yet

- AA2 Chapter 11 SolDocument16 pagesAA2 Chapter 11 SolJoan RomeroNo ratings yet

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Document12 pagesExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNo ratings yet

- Stockholders' Equity Accounts With Normal BalancesDocument3 pagesStockholders' Equity Accounts With Normal BalancesMary67% (3)

- 04 NGASReconciliation OkDocument36 pages04 NGASReconciliation OkAttyGalva22No ratings yet

- CAMEL Rating With Analysis and DiscussionDocument10 pagesCAMEL Rating With Analysis and DiscussionFaysal KhanNo ratings yet

- Types of Taxes Applicable On Sale of Mutual Fund UnitsDocument3 pagesTypes of Taxes Applicable On Sale of Mutual Fund UnitsdineshNo ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- PFRS 10, Consolidated Financial StatementsDocument32 pagesPFRS 10, Consolidated Financial Statementsjulia4razoNo ratings yet

- Digital Resilience: How Work-From-Home Feasibility Affects Firm PerformanceDocument40 pagesDigital Resilience: How Work-From-Home Feasibility Affects Firm PerformanceluanasimonNo ratings yet

- Chapter 22: Futures Markets: Problem SetsDocument8 pagesChapter 22: Futures Markets: Problem SetsMehrab Jami Aumit 1812818630No ratings yet

- Finance NotesDocument6 pagesFinance NotesFahad BhayoNo ratings yet

- Nestle Pakistan Limited Financial Ratio AnalysisDocument5 pagesNestle Pakistan Limited Financial Ratio AnalysisMaarij KhanNo ratings yet

- Full Download Fundamentals of Corporate Finance 9th Edition Brealey Solutions ManualDocument35 pagesFull Download Fundamentals of Corporate Finance 9th Edition Brealey Solutions Manualempiercefibberucql19100% (38)