Professional Documents

Culture Documents

SSRN Id3640517

SSRN Id3640517

Uploaded by

Abul Kalam FarukCopyright:

Available Formats

You might also like

- Building The Bloomberg Interest Rate Curve - Definitions and MethodologyDocument26 pagesBuilding The Bloomberg Interest Rate Curve - Definitions and MethodologyLucas Mestres0% (1)

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsFrom EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsRating: 4 out of 5 stars4/5 (21)

- (Bank of America) Pricing Mortgage-Back SecuritiesDocument22 pages(Bank of America) Pricing Mortgage-Back Securitiesbhartia2512100% (4)

- Bloomberg InterpolationDocument19 pagesBloomberg InterpolationAndreea Naste (CL)100% (3)

- Report Sample To Board of DirectorsDocument5 pagesReport Sample To Board of Directorskerepekpisang100% (4)

- Case 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDocument3 pagesCase 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDoreen0% (1)

- Singapore Airline Dividend CaseDocument2 pagesSingapore Airline Dividend CaseAamir KhanNo ratings yet

- Simultaneous Equations Modelling in PythonDocument24 pagesSimultaneous Equations Modelling in PythonFernando Perez SavadorNo ratings yet

- Bootstrapping The Libor CurveDocument3 pagesBootstrapping The Libor Curveto_vin100% (1)

- Technical Yield Curve BuildingDocument44 pagesTechnical Yield Curve BuildingsowmikchakravertyNo ratings yet

- Thomson Reuters Eikon Adfin Term Structure Calculation GuideDocument44 pagesThomson Reuters Eikon Adfin Term Structure Calculation GuideHải Dương100% (1)

- Report - Project8 - FRA - Surabhi - ReportDocument15 pagesReport - Project8 - FRA - Surabhi - ReportSurabhi Sood0% (1)

- Automated Propeller Generation in GrasshopperDocument39 pagesAutomated Propeller Generation in GrasshopperAbul Kalam Faruk100% (1)

- Essbase Calc ScriptDocument8 pagesEssbase Calc ScriptAmit Sharma50% (2)

- Bootstrap AlgorithmDocument3 pagesBootstrap AlgorithmlaxadNo ratings yet

- Bloomberg ModelDocument12 pagesBloomberg ModelDavid C PostiglioneNo ratings yet

- BTRM WP15 - SOFR OIS Curve Construction - Dec 2020Document23 pagesBTRM WP15 - SOFR OIS Curve Construction - Dec 2020MypatNo ratings yet

- Fincad Curve BuildingDocument11 pagesFincad Curve BuildingprmoonNo ratings yet

- Interest Rate Modelling A Matlab ImplementationDocument41 pagesInterest Rate Modelling A Matlab ImplementationBen Salah MounaNo ratings yet

- Calibration and Monte Carlo Pricing of The SABR-Hull-White Model For Long-Maturity Equity DerivativesDocument24 pagesCalibration and Monte Carlo Pricing of The SABR-Hull-White Model For Long-Maturity Equity DerivativesndebstNo ratings yet

- Floating Point To FixedDocument15 pagesFloating Point To Fixedcnt2sskNo ratings yet

- In Arrears Swap - VijayRaghavanDocument10 pagesIn Arrears Swap - VijayRaghavanSubrat VermaNo ratings yet

- Job Monitoring Setup With SAP Solution Manager 7.1 SP 10Document5 pagesJob Monitoring Setup With SAP Solution Manager 7.1 SP 10Wikendro DjuminNo ratings yet

- SIngle Index MethodDocument17 pagesSIngle Index Methodamericus_smile7474No ratings yet

- Swaptions Pricing Under The Single Factor Hull-White Model Through The Analytical Formula and Finite Difference MethodsDocument65 pagesSwaptions Pricing Under The Single Factor Hull-White Model Through The Analytical Formula and Finite Difference MethodsXNo ratings yet

- A Pairs Trading Strategy For GOOG:GOOGL Using Machine LearningDocument5 pagesA Pairs Trading Strategy For GOOG:GOOGL Using Machine Learningalexa_sherpyNo ratings yet

- The Exponencial Yield Curve ModelDocument6 pagesThe Exponencial Yield Curve Modelleao414No ratings yet

- Antilogarithmic ConverterDocument13 pagesAntilogarithmic ConverterJohn LeonsNo ratings yet

- Typical Reports To Aid The Progress Review: Cost ControlDocument35 pagesTypical Reports To Aid The Progress Review: Cost ControlAshish KumarNo ratings yet

- Notes 1Document5 pagesNotes 1dhavdavNo ratings yet

- Statistical Arbitrage For Mid-Frequency TradingDocument17 pagesStatistical Arbitrage For Mid-Frequency Tradingc0ldlimit8345No ratings yet

- Price Prediction Evolution: From Economic Model To Machine LearningDocument7 pagesPrice Prediction Evolution: From Economic Model To Machine LearningmohitbguptaNo ratings yet

- Extension and Implementation of The BDT ModelDocument70 pagesExtension and Implementation of The BDT ModelPeter StimesNo ratings yet

- Jackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005Document12 pagesJackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005levine_simonNo ratings yet

- Lepetit-Strobel-JIFMIN mc3Document22 pagesLepetit-Strobel-JIFMIN mc3Enrique jaime Tito ccopaNo ratings yet

- Seminar Questions RBC Partii PDFDocument3 pagesSeminar Questions RBC Partii PDFKarishma ShahNo ratings yet

- Eurodollar Convexity Adjustment in Stochastic Vol ModelsDocument19 pagesEurodollar Convexity Adjustment in Stochastic Vol ModelsJamesMc1144No ratings yet

- Linear Regression - Jupyter NotebookDocument56 pagesLinear Regression - Jupyter NotebookUjwal Vajranabhaiah100% (3)

- (Applied Mathematical Finance, Hagan) Interpolation Methods For Curve ConstructionDocument41 pages(Applied Mathematical Finance, Hagan) Interpolation Methods For Curve Constructioncamw_007No ratings yet

- Part IIDocument281 pagesPart IILeng SovannarithNo ratings yet

- Matlab Bond Pricing Examples PDFDocument5 pagesMatlab Bond Pricing Examples PDFromanticos2014No ratings yet

- DDLab ManualsDocument36 pagesDDLab Manualskelsiu1No ratings yet

- CNC-Calc Post Processor - Basic ConfigurationDocument4 pagesCNC-Calc Post Processor - Basic ConfigurationThiênMệnhNo ratings yet

- Algorithmic Adjoint Differentiation (AAD) For Swap Pricing and DV01 RiskDocument21 pagesAlgorithmic Adjoint Differentiation (AAD) For Swap Pricing and DV01 Riskdoc_oz3298No ratings yet

- Unit I TS&FDocument55 pagesUnit I TS&FEugene Berna INo ratings yet

- Lecture12 TS Index PDFDocument20 pagesLecture12 TS Index PDFsnoozermanNo ratings yet

- CQG and Matlab WhitepaperDocument3 pagesCQG and Matlab WhitepaperAbhishek ShuklaNo ratings yet

- Algorithms AnalysisDocument5 pagesAlgorithms Analysismunir ahmedNo ratings yet

- IT 112 Problem SetDocument4 pagesIT 112 Problem Setevanlugo96No ratings yet

- QF 5206 Topics On Quantitative Finance Group Project ReportDocument25 pagesQF 5206 Topics On Quantitative Finance Group Project ReportMiguel Angel Vilariño Monreal100% (1)

- Interpolation Methods For Curve Construction: Applied Mathematical Finance February 2006Document42 pagesInterpolation Methods For Curve Construction: Applied Mathematical Finance February 2006pyrole1No ratings yet

- Report - Project8 - FRA - Surabhi - ReportDocument15 pagesReport - Project8 - FRA - Surabhi - ReportSurabhi Sood100% (1)

- Ch15 LMM1 SampleDocument63 pagesCh15 LMM1 SampleqwweasdasdfdfgfgfdgsNo ratings yet

- Jorge L. Silva, Joelmir J. Lopes Valentin O. Roda, Kelton P. CostaDocument4 pagesJorge L. Silva, Joelmir J. Lopes Valentin O. Roda, Kelton P. CostaSimranjeet SinghNo ratings yet

- Kooderive: Multi-Core Graphics Cards, The Libor Market Model, Least-Squares Monte Carlo and The Pricing of Cancellable SwapsDocument18 pagesKooderive: Multi-Core Graphics Cards, The Libor Market Model, Least-Squares Monte Carlo and The Pricing of Cancellable SwapsRishi SinghNo ratings yet

- Homework-4 Cap416: Simulation and Modeling: Time Series Data AnalysisDocument42 pagesHomework-4 Cap416: Simulation and Modeling: Time Series Data AnalysisvarunmainiNo ratings yet

- Budget Plan Customer Name: Directions For Using TemplateDocument10 pagesBudget Plan Customer Name: Directions For Using TemplatesemiariNo ratings yet

- On The Design and Implementation of A Generic Number Type For Real Algebraic Number Computations Based On Expression DagsDocument27 pagesOn The Design and Implementation of A Generic Number Type For Real Algebraic Number Computations Based On Expression DagsIvo RösslingNo ratings yet

- AP EtoregobetDocument34 pagesAP EtoregobetdeepNo ratings yet

- Proc ReportDocument7 pagesProc ReportrajeshdatastageNo ratings yet

- New Tools For Project Managers: Evolution of S-Curve and Earned Value FormalismDocument10 pagesNew Tools For Project Managers: Evolution of S-Curve and Earned Value FormalismFadhel GhribiNo ratings yet

- Lead-Lag Relationships in Multivariate Time Series DataDocument6 pagesLead-Lag Relationships in Multivariate Time Series DataKexinYuNo ratings yet

- Arellano Bond GMM EstimatorsDocument10 pagesArellano Bond GMM Estimatorsamnoman17100% (1)

- Bundle Adjustment: Optimizing Visual Data for Precise ReconstructionFrom EverandBundle Adjustment: Optimizing Visual Data for Precise ReconstructionNo ratings yet

- SSRN Id4355794Document11 pagesSSRN Id4355794Abul Kalam FarukNo ratings yet

- Savings and Loan CrisisDocument2 pagesSavings and Loan CrisisAbul Kalam FarukNo ratings yet

- Solutions Titard All ChaptersDocument92 pagesSolutions Titard All ChaptersAbul Kalam Faruk0% (2)

- Problems in Thermodynamics, BUET ME169Document12 pagesProblems in Thermodynamics, BUET ME169Abul Kalam FarukNo ratings yet

- How Do Regular Treasury Bonds WorkDocument3 pagesHow Do Regular Treasury Bonds WorkiluvparixitNo ratings yet

- Dax 1Document27 pagesDax 1GOMTINo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Long-Term Financing: An IntroductionDocument20 pagesLong-Term Financing: An IntroductionThuyDuongNo ratings yet

- Interest Rates: Options, Futures, and Other Derivatives 6Document30 pagesInterest Rates: Options, Futures, and Other Derivatives 6Hay JirenyaaNo ratings yet

- Capital Market Assumptions For Major Asset Classes: Executive SummaryDocument20 pagesCapital Market Assumptions For Major Asset Classes: Executive SummaryjitenparekhNo ratings yet

- Coupon RateDocument2 pagesCoupon RateNiño Rey LopezNo ratings yet

- FIN515 MidtermDocument9 pagesFIN515 MidtermNatasha DeclanNo ratings yet

- Solution Assignment 7 2Document15 pagesSolution Assignment 7 2irinasarjveladze19No ratings yet

- Solution Chap 3 Qs Calculation InvestmentDocument7 pagesSolution Chap 3 Qs Calculation InvestmentYuki XuanNo ratings yet

- Yields at A Glance: Please Note: Availability Is Based On Account Type and May Depend On Other Eligibility CriteriaDocument3 pagesYields at A Glance: Please Note: Availability Is Based On Account Type and May Depend On Other Eligibility Criteriapedro perezNo ratings yet

- Notes Cfa Fixed Income R39Document35 pagesNotes Cfa Fixed Income R39Ayah AkNo ratings yet

- Lessons Learnt From Security Analysis-100Document8 pagesLessons Learnt From Security Analysis-100ravi_405No ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- BMO Research Highlights Mar 24Document34 pagesBMO Research Highlights Mar 24smutgremlinNo ratings yet

- Financial Ratios and Their InterpretationDocument10 pagesFinancial Ratios and Their InterpretationPriyanka_Bhans_7838100% (3)

- Bond DocumentDocument37 pagesBond DocumentNayamotNo ratings yet

- Self Study Practice Questions Topic 3 Part 2 AnswersDocument6 pagesSelf Study Practice Questions Topic 3 Part 2 AnswersTriet NguyenNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- LNT Arbitrage Opportunities FundDocument51 pagesLNT Arbitrage Opportunities FundcompletebhejafryNo ratings yet

- Environgrad Corporation: A Case StudyDocument25 pagesEnvirongrad Corporation: A Case StudyAbhi Krishna ShresthaNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Ratio Analysis 1. Profitability Ratios: NB: Capital Employed Total Assets - Current LiabilitiesDocument8 pagesRatio Analysis 1. Profitability Ratios: NB: Capital Employed Total Assets - Current LiabilitiesTawanda Tatenda HerbertNo ratings yet

- How To Value Straight Vanilla Bonds (Solutions)Document9 pagesHow To Value Straight Vanilla Bonds (Solutions)hadosib264No ratings yet

- V1 - 20140410 FRM-2 - Questions PDFDocument30 pagesV1 - 20140410 FRM-2 - Questions PDFIon VasileNo ratings yet

SSRN Id3640517

SSRN Id3640517

Uploaded by

Abul Kalam FarukOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id3640517

SSRN Id3640517

Uploaded by

Abul Kalam FarukCopyright:

Available Formats

MATCHING THE BLOOMBERG CURVE S45 WITH QUANTLIB

PETER CASPERS AND ANDREA PALERMO

Abstract. In this short note we summarise one of the results achieved in

a project conducted by SoftSolutions! with the goal of aligning some of the

bond analytics result in their system nexRates with those that are produced

in Bloomberg. By adding a global bootstrapper to the QuantLib library [1, 2]

we are able to apply a certain smoothing algorithm to the Euribor 6M curve

bootstrapping. Thereby we achieve a very close match of the corresponding

Bloomberg S45 curve, which is the basis for the computation of the Z-Spread

for bonds.

1. Overview and Motivation

SoftSolutions! is an Italian fintech company providing, among other products,

an e-trading system named nexRates for fixed income instruments. nexRates covers

a wide part of the whole process involved in the market making activities: pricing

analytics, prices contribution to market platforms, trading actions (most notably

RFQ management), risk aggregation, STP. Pricing analytics are based on C++

QuantLib libraries, see [1]. Being nexRates developed in Java, C++ QuantLib

libraries are embedded using JNI (Java Native Interface), specifically leveraging

the SWIG project [3] that simplifies the creation of wrapper interfaces.

A key financial analytic provided by nexRates is the yield-to-price conversion,

that is the base for the bonds pricing structure. But an important role is also

played by the Zero-volatility spread (a.k.a. Z-spread): Z-Spread is the flat spread

that, added to the yield at each tenor of the curve chosen for Z-Spread calculation

related to bonds cash flows, makes the price of the bond equal to the present value

of all its cash flows.

This analytic has two main practical applications for a fixed-income desk: as

a risk comparison metric among bonds of same currency and as a driver for the

pricing generation. In the first case, along with yield and Asset Swap Spread, the

Z-Spread allows to evaluate how two bonds are relatively perceived as risky by the

market. Instead, when used as a driver, the price of the bond is directly linked

to the live movements of the Z-Spread curve related to the currency of the bond.

Usually Z-Spread is chosen as the pricing driver for short-maturing fixed-coupon

bonds; moreover for some currencies, like Norwegian Crown (NOK), the market

practice is to use Z-Spread for the entire maturity spectrum of fixed-coupon bonds.

The algorithm for calculating the Z-Spread of a bond given its price (or yield) is

based on a number of conventions that makes it a non unique figure among diverse

calculation providers. Said that, given its predominance in the market among

both the sell-side and buy-side traders, Bloomberg is the reference for analytic

calculations: when the user of a trading platform communicates the Z-Spread of

Date: 28 June 2020.

1

Electronic copy available at: https://ssrn.com/abstract=3640517

2 PETER CASPERS AND ANDREA PALERMO

a bond to a counterpart and the counterpart uses Bloomberg Terminal as his/her

main financial tool, the relation between Z-Spread and price must be coherent, with

possible misalignments not leading to difference in the settlement values derived by

the price figure. This condition can be translated into a maximum acceptable

difference in the Z-Spread to price conversion of 0.0009.

One core component to reach the desired accuracy w.r.t. Bloomberg reference re-

sults is to match the daily zero rates of the rate curves constructed in Bloomberg un-

derlying the Z-Spread calculation. While some of the curves are relatively straight-

forward to reproduce in QuantLib (like NOK 313, the reference curve for computing

Z-Spread for NOK bonds), others requires smoothing techniques that were not sup-

ported in QuantLib so far. One such curve is the EUR S45 (Euribor 6M) curve,

which serves as the benchmark for the Z-Spread computation of EUR bonds.

This paper is organised as follows. In section 2 we describe the methodology

we employed to match the Bloomberg EUR S45 curve. Section 3 describes the

extensions that were added to QuantLib to implement the methodology. The usage

of the extensions in Python are described in 4. We give numerical results based on

real market data in 5.

2. Matching Bloomberg Calculations

In this section we give a detailed description of the methodology we devised to

match the Bloomberg S45 (Euribor 6M) curve. We tested the methodology for

the S45 curve, but we believe it will work for any other curve that is built from a

similar instrument set. A special feature of the S45 curve is posed by the fact that

it contains serial FRA instruments. To achieve a good matching with Bloomberg

results, we decided to apply a smoothing algorithm, which we describe in detail

in section 2.2.8.1 and which requires a global bootstrapping approach rather than

an iterative, by-instrument approach.

2.1. Settings in the SWDF Screen. There are some settings in Bloomberg

which control the curve building. These settings can be found in the so called

“SWDF” screen. In what follows, we assume the following settings in this screen,

which we found to be the default settings:

• Curve Defaults: Pay=Mid / Receive =Mid

• Interpolation Method: Piecewise linear (Simple-comp)

• Enable OIS Discount/Dual Curve Stripping: not enabled

The settings “Cross Currency Basis Defaults” and “Brazilian Curve Interpolation

Method” are not relevant for the curves discussed here.

2.2. Bootstrap Methodology.

2.2.1. Date to time conversion. To be able to interpolate the zero rates of a rate

curve for all calendar dates (or even in continuous time), one needs to define a

function that converts calendar dates to non-negative real numbers. For this, let

d0 denote the current date. For a date d ≥ d0 the time τ (d0 , d) between d0 and d is

computed using a day count convention with the property that it assigns an equal

weight to each calendar day, i.e., it is of the form

1notice that the smoothing is not applied for IMM FRA instruments, where it is not needed

to match the Bloomberg results

Electronic copy available at: https://ssrn.com/abstract=3640517

MATCHING THE BLOOMBERG CURVE S45 WITH QUANTLIB 3

d − d0

τ (d0 , d) =

N

where d − d0 should be read as the number of calendar days between d0 and d

and N is a fixed number. Typical examples for such day counters are ACT/365F

or ACT/360 for which N = 365 or N = 360, respectively. In our concrete imple-

mentations we use ACT/365F as the curve day-count convention. However notice

that the actual choice of N does not impact the results of the interpolation.

2.2.2. Settlement dates. The discount factors and zero rates displayed in Bloomberg

associated to each quoted market instrument against which we compare our results

are—we believe—forward discount factors and forward zero rates using the settle-

ment delay of the respective instrument. We denote the settlement date for each

instrument by ds . Although ds in general depends on the instrument, for the S45

curve we have ds = d0 + 2bd w.r.t. the TARGET calendar for all instruments.

Notice that by construction, the discount factor on the settlement date is 1.

2.2.3. Simply compounded zero rate. The simply compounded zero rate z(d0 , d2 )

for a period d0 to d2 is defined by the relation

1

D(d0 , d2 ) =

1 + z(d) · τ (d0 , d2 )

where D(d0 , d2 ) is the discount factor for the period d0 to d2 . A similar definition

can be given for the settlement date by replacing d0 by ds .

2.2.4. Curve instruments, pillars and Interpolation. The curve is built from a set

of liquid market instruments. Each instrument defines a “pillar date” as outlined in

sections 2.2.5 to 2.2.7. The set of pillar dates d1 , . . . , dn is translated to curve times

t1 , . . . , tn as described in 2.2.1. Adding t0 = 0 to this set we get an interpolation

grid

(t0 , y0 ), (t1 , y1 ), . . . , (tn , yn )

To match the Bloomberg interpolation method (“Piecewise linear (Simple-comp)”),

the yi are simply compounded zero rates (see 2.2.3) and we compute an arbitrary

point (t, y) as follows:

• if t < t1 we apply a “constant forward extrapolation”:

y = (e−ht − 1)/t

with

ln(1 + y1 · t1 )

h=

t

i.e., the instantaneous forward rate h is extrapolated flat from t1 to the left

• if t1 < t < tn we apply a linear interpolation: y is interpolated linearly

between the adjacent interpolation grid points (ti , yi )

• if t > tn (“constant non-annualized zero extrapolation”):

y = yn tn /t

i.e., the product yt is kept constant right from tn

This set of rules fully defines the interpolation of the curve in continuous time

in terms of simply compounded zero rates.

Electronic copy available at: https://ssrn.com/abstract=3640517

4 PETER CASPERS AND ANDREA PALERMO

2.2.5. Cash Point (Euribor Fixing). The first point in the S45 curve is given by the

current Euribor 6M fixing, i.e., we have a cash deposit with

• fixing date = d0

• start date = d0 plus start delay (2 bd for Euribor)

• maturity date = start date plus tenor (6 months for Euribor 6M, modfol

adjusted).

The pillar date for curve interpolation is equal to the maturity date.

2.2.6. Serial FRA Points. After the cash point, serial FRAs 1M-7M, 2M-8M, . . . ,

12M-18M with an Euribor 6M underlying are used to bootstrap the curve. The

characteristic dates of a FRA are given by:

• spot date = d0 plus settlement delay (2 bd for Euribor 6M FRAs)

• start date = spot date plus the period to start (i.e. 1M, 2M, 3M etc.,

modfol adjusted for Euribor 6M)

• maturity date = spot date plus the period to the FRA end (i.e. 7M, 8M,

9M, etc., modfol adjusted for Euribor 6M)

The pillar date for curve interpolation is equal to the maturity date. We notice

that the forward rate for the FRA is estimated between the start date and the

maturity date, which is often identical to the actual index estimation end date

computed as the start date plus index period (adjusted), but not always. For

example for d0 = 16-Sep-2019, the Euribor 6M FRA 7x13 has

• spot date = 18-Sep-2019

• start date = 20-Apr-2020 (spot date plus 7M, adjusted)

• maturity date = 19-Oct-2020 (spot date plus 13M, adjusted)

• index estimation end date = 20-Oct-2020 (start date plus 6M, adjusted)

In this case the forward rate is estimated between the start and maturity date,

which is a slight approximation to the “correct” estimation between the start and

index estimation end date.

2.2.7. Swap Points. After the FRA section fixed vs. Euribor 6M interest rate swaps

follow. The characteristic dates for a swap are given by:

• spot date = d0 plus settlement delay (2 bd for Euribor 6M Swaps)

• maturity date = last payment date of the swap

Similarly to serial FRAs the maturity date is sometimes not identical to the index

estimation end date of the last floating rate period of the swap. Nevertheless the

pillar date is again chosen as the maturity date and the forward rate (intermediate

+ final periods) are estimated using the accrual periods of the swap, which again

can introduce a slight approximation due to a mismatch of the true index estimation

period end dates and accrual end dates for some of the periods.

2.2.8. Smoothing for curves with serial FRAs. For a curve which contains serial

FRAs we found that the application of a smoothing algorithm is necessary in order

to match the Bloomberg zero rates. Specifically for the S45 curve, we consider

additional 5 serial FRA instruments

• FRA13x19, FRA14x20, FRA15x21, FRA16x22, FRA17x23

which are not quoted in the market. We require the implied quotes of these

FRAs during the curve bootstrap to be linearly interpolated between the (quoted)

Electronic copy available at: https://ssrn.com/abstract=3640517

MATCHING THE BLOOMBERG CURVE S45 WITH QUANTLIB 5

FRA12x18 and (not quoted) FRA18x24 implied FRA quotes. We assume that for

the interpolation in the x-y-plane the x-grid is simply given by

0, 1, 2, 3, 4, 5, 6

i.e., we do not use exact dates of any kind for the interpolation of the implied

FRA rates, but simply assume that the FRAs used for the interpolation have equal

distance. To meet the addition 5 constraints we introduce 5 additional degrees of

freedom to the interpolation grid of the curve by adding the start dates of the

• FRA 1M-7M, 2M-8M, 3M-9M, 4M-10M, 5M-11M

instruments as additional curve pillars. The bootstrap is implemented as a global

optimisation in this case.

3. Implementation in QuantLib

In this section we describe the concrete implementation of the methodology

described in 2 in QuantLib. To a great extend the existing code could be used

without any modifications or extensions. We do not describe these parts here in

detail, see [5], chapter 3, for a discussion.

3.1. Rate Helpers. The rate helpers we used are the standard helpers, for the

S45 curve these are:

• DepositRateHelper to represent the current Euribor 6M fixing

• FraRateHelper to cover the FRA quotes section

• SwapRateHelper to cover the Swap quotes section

3.2. The Use Indexed Coupon setting. We observe that one should leave the

QL_USE_INDEXED_COUPON setting deactivated to achieve an exact match of the pillar

dates.

3.3. PiecewiseYieldCurve, Global Bootstrap. To build the curve, the (stan-

dard) PiecewiseYieldCurve can be used. The interpolation variable trait should

be set to SimpleZeroYield which was previously not available to QuantLib. The in-

terpolation method should be Linear. To apply the smoothing algorithm described

above, a new Bootstrap class GlobalBootstrap was added to the QuantLib library.

The complete constructor call is given in listing 1.

typedef PiecewiseYieldCurve<SimpleZeroYield, Linear, GlobalBootstrap> Curve;

ext::shared_ptr<Curve> curve = ext::make_shared<Curve>(

2, TARGET(), helpers, Actual365Fixed(), std::vector<Handle<Quote> >(), std::vector<Date>(),

Linear(),

Curve::bootstrap_type(additionalHelpers, additionalDates(),

additionalErrors(additionalHelpers), 1.0e-12));

Listing 1: PiecewiseYieldCurve constructor call

Here, we construct the curve with 2 settlement days w.r.t. the T ARGET cal-

endar. We pass in the rate helpers as a vector helpers as usual. We set the day

counter (rather arbitrarily, see above) to Act/365 (fixed). The last parameter is

the new global boostrap instance taking 4 parameters:

Electronic copy available at: https://ssrn.com/abstract=3640517

6 PETER CASPERS AND ANDREA PALERMO

• additionalHelpers: This is a vector of rate helpers that will be available in

the definition of the additional error terms additionalErrors (see below).

In the case of the S45 curve these are FRA helpers for 12–18, 13–19, . . . ,

18–24 FRAs.

• additionalDates: This is a functor returning a vector of dates that are

used as additional curve pillars to compensate for the additional error terms.

In the case of the S45 curve these pillars are given as today plus 1M, 2M,

. . . , 5M. The code defining this functor is given in listing 2 for reference.

• additionalErrors: This is a function returning a an array of additional

error terms used during the bootstrap. In the case of the S45 curve this is

the deviation of the 13–19, 14–20, . . . , 17–23 fair FRA quotes (defined as

additionalHelpers above) from linearly interpolated quotes between the

12–18 and 18–24 fair FRA quotes. The code defining this functor is given

in listing 3 for reference.

struct additionalErrors {

explicit additionalErrors(

const std::vector<ext::shared_ptr<BootstrapHelper<YieldTermStructure> > >&

additionalHelpers)

: additionalHelpers(additionalHelpers) {}

std::vector<ext::shared_ptr<BootstrapHelper<YieldTermStructure> > > additionalHelpers;

Array operator()() {

Array errors(5);

Real a = additionalHelpers[0]->impliedQuote();

Real b = additionalHelpers[6]->impliedQuote();

for (Size k = 0; k < 5; ++k) {

errors[k] = (5.0 - k) / 6.0 * a + (1.0 + k) / 6.0 * b -

additionalHelpers[1 + k]->impliedQuote();

}

return errors;

}

};

Listing 2: Functor definition for additional dates

struct additionalDates {

std::vector<Date> operator()() {

Date settl = TARGET().advance(Settings::instance().evaluationDate(), 2 * Days);

std::vector<Date> dates;

for (Size i = 0; i < 5; ++i)

dates.push_back(TARGET().advance(settl, (1 + i) * Months));

return dates;

}

};

Listing 3: Functor definition for additional errors

4. Python interfaces

There is a binder example available at [4] demonstrating the global bootstrap.

Electronic copy available at: https://ssrn.com/abstract=3640517

MATCHING THE BLOOMBERG CURVE S45 WITH QUANTLIB 7

5. Numerical Results

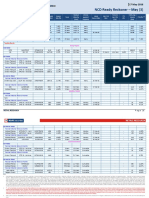

In table 1 we provide a comparison between BBG zero rate and QuantLib zero

rates for the S45 (Euribor 6M) curve using market data as of 26-Sep-2019. We dis-

play differences between QuantLib and Bloomberg zero rates with and without the

application of the smoothing. All numbers are in percent. Without the smoothing

the error in the zero rate reaches almost 1 basis point in the FRA segment, while

with the treatment the error stays below 0.01 basis points.

The table is divided into the 3 segments made up from

• the cash point,

• the FRA instruments (1M-7M, . . . , 12M-18M), and

• the swap instruments (2Y, 3Y, . . . , 10Y, 11Y, 12Y, 15Y, 20Y, 25Y, 30Y,

35Y, 40Y, 45Y, 50Y)

Notice that the zero rates are expressed using 2 TARGET settlement days and

the following conventions:

• for the cash point (1st segment) and the FRA points (2nd segment): Act/360

simply compounded annual rate

• the the swap points (3rd segment): 30/360 simple then compounded annual

rate

Figure 1 shows a graph the zero curve with and without smoothing. In the graph

the additional calibration points for the serial FRA treatment and the regular cali-

bration points are marked by blue and yellow arrows, respectively. Furthermore the

implied FRA rates for the 12M-18M, . . . , 18M-24M FRA instruments are plotted

as stars (with smoothing) and boxes (without smoothing).

-0.3

Zero Rates (Special FRA Treatment)

Zero Rates (Standard)

Implied FRA Quotes (Special FRA Treatment)

Implied FRA Quotes (Standard)

-0.35

zero rate / implied FRA quote

-0.4

-0.45

-0.5

0 0.5 1 1.5 2

time

Figure 1. Zero rates up to 2Y with and without smoothing, the

blue arrows mark additional calibration points, the yellow arrows

mark the regular calibration points

References

[1] QuantLib: a free/open-source library for quantitative finance, http://www.quantlib.org,

http://doi.org/10.5281/zenodo.3724021 (version 1.18).

Electronic copy available at: https://ssrn.com/abstract=3640517

8 PETER CASPERS AND ANDREA PALERMO

Curve Pillar Date Diff QL/BBG With Smoothing Diff QL/BBG Without Smoothing

2020-03-31 0.00000 -0.00000

2020-04-30 -0.00000 0.00513

2020-05-29 0.00000 0.00744

2020-06-30 0.00000 0.00910

2020-07-31 0.00000 0.00028

2020-08-31 0.00010 -0.00268

2020-09-30 0.00000 0.00000

2020-10-30 -0.00000 0.00275

2020-11-30 -0.00000 0.00420

2020-12-31 -0.00000 0.00542

2021-01-29 0.00001 0.00018

2021-02-26 0.00006 -0.00175

2021-03-31 -0.00000 -0.00000

2021-09-30 -0.00000 -0.00000

2022-09-30 0.00002 0.00002

2023-09-29 0.00000 0.00000

2024-09-30 -0.00000 -0.00000

2025-09-30 0.00006 0.00006

2026-09-30 -0.00000 -0.00000

2027-09-30 0.00001 0.00001

2028-09-29 0.00006 0.00006

2029-09-28 0.00000 0.00000

2030-09-30 0.00002 0.00002

2031-09-30 0.00003 0.00003

2034-09-29 0.00000 0.00000

2039-09-30 0.00000 0.00000

2044-09-30 0.00000 0.00000

2049-09-30 0.00000 0.00000

2054-09-30 -0.00000 -0.00000

2059-09-30 0.00000 0.00000

2064-09-30 -0.00000 -0.00000

2069-09-30 -0.00000 -0.00000

Table 1. Comparison between BBG and QuantLib Zero Rates as

of 26-Sep-2019 for the Euribor 6M curve S45 with and without

smoothing, all numbers are in percent

[2] QuantLib-SWIG: QuantLib wrappers to other languages, http://doi.org/10.5281/zenodo.

3724022 (version 1.18).

[3] SWIG project http://www.swig.org/

[4] Binder example global bootstrap in QuantLib, https://mybinder.org/v2/gh/lballabio/

QuantLib-SWIG/binder?filepath=Python%2Fexamples (global-bootstrap.py)

[5] Luigi Ballabio: Implementing QuantLib, available at https://leanpub.com/

implementingquantlib

(Peter Caspers) Quaternion Risk Management

E-mail address: peter.caspers@quaternion.com

(Andrea Palermo) SoftSolutions!

E-mail address: andrea.palermo@softsolutions.it

Electronic copy available at: https://ssrn.com/abstract=3640517

You might also like

- Building The Bloomberg Interest Rate Curve - Definitions and MethodologyDocument26 pagesBuilding The Bloomberg Interest Rate Curve - Definitions and MethodologyLucas Mestres0% (1)

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsFrom EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsRating: 4 out of 5 stars4/5 (21)

- (Bank of America) Pricing Mortgage-Back SecuritiesDocument22 pages(Bank of America) Pricing Mortgage-Back Securitiesbhartia2512100% (4)

- Bloomberg InterpolationDocument19 pagesBloomberg InterpolationAndreea Naste (CL)100% (3)

- Report Sample To Board of DirectorsDocument5 pagesReport Sample To Board of Directorskerepekpisang100% (4)

- Case 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDocument3 pagesCase 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDoreen0% (1)

- Singapore Airline Dividend CaseDocument2 pagesSingapore Airline Dividend CaseAamir KhanNo ratings yet

- Simultaneous Equations Modelling in PythonDocument24 pagesSimultaneous Equations Modelling in PythonFernando Perez SavadorNo ratings yet

- Bootstrapping The Libor CurveDocument3 pagesBootstrapping The Libor Curveto_vin100% (1)

- Technical Yield Curve BuildingDocument44 pagesTechnical Yield Curve BuildingsowmikchakravertyNo ratings yet

- Thomson Reuters Eikon Adfin Term Structure Calculation GuideDocument44 pagesThomson Reuters Eikon Adfin Term Structure Calculation GuideHải Dương100% (1)

- Report - Project8 - FRA - Surabhi - ReportDocument15 pagesReport - Project8 - FRA - Surabhi - ReportSurabhi Sood0% (1)

- Automated Propeller Generation in GrasshopperDocument39 pagesAutomated Propeller Generation in GrasshopperAbul Kalam Faruk100% (1)

- Essbase Calc ScriptDocument8 pagesEssbase Calc ScriptAmit Sharma50% (2)

- Bootstrap AlgorithmDocument3 pagesBootstrap AlgorithmlaxadNo ratings yet

- Bloomberg ModelDocument12 pagesBloomberg ModelDavid C PostiglioneNo ratings yet

- BTRM WP15 - SOFR OIS Curve Construction - Dec 2020Document23 pagesBTRM WP15 - SOFR OIS Curve Construction - Dec 2020MypatNo ratings yet

- Fincad Curve BuildingDocument11 pagesFincad Curve BuildingprmoonNo ratings yet

- Interest Rate Modelling A Matlab ImplementationDocument41 pagesInterest Rate Modelling A Matlab ImplementationBen Salah MounaNo ratings yet

- Calibration and Monte Carlo Pricing of The SABR-Hull-White Model For Long-Maturity Equity DerivativesDocument24 pagesCalibration and Monte Carlo Pricing of The SABR-Hull-White Model For Long-Maturity Equity DerivativesndebstNo ratings yet

- Floating Point To FixedDocument15 pagesFloating Point To Fixedcnt2sskNo ratings yet

- In Arrears Swap - VijayRaghavanDocument10 pagesIn Arrears Swap - VijayRaghavanSubrat VermaNo ratings yet

- Job Monitoring Setup With SAP Solution Manager 7.1 SP 10Document5 pagesJob Monitoring Setup With SAP Solution Manager 7.1 SP 10Wikendro DjuminNo ratings yet

- SIngle Index MethodDocument17 pagesSIngle Index Methodamericus_smile7474No ratings yet

- Swaptions Pricing Under The Single Factor Hull-White Model Through The Analytical Formula and Finite Difference MethodsDocument65 pagesSwaptions Pricing Under The Single Factor Hull-White Model Through The Analytical Formula and Finite Difference MethodsXNo ratings yet

- A Pairs Trading Strategy For GOOG:GOOGL Using Machine LearningDocument5 pagesA Pairs Trading Strategy For GOOG:GOOGL Using Machine Learningalexa_sherpyNo ratings yet

- The Exponencial Yield Curve ModelDocument6 pagesThe Exponencial Yield Curve Modelleao414No ratings yet

- Antilogarithmic ConverterDocument13 pagesAntilogarithmic ConverterJohn LeonsNo ratings yet

- Typical Reports To Aid The Progress Review: Cost ControlDocument35 pagesTypical Reports To Aid The Progress Review: Cost ControlAshish KumarNo ratings yet

- Notes 1Document5 pagesNotes 1dhavdavNo ratings yet

- Statistical Arbitrage For Mid-Frequency TradingDocument17 pagesStatistical Arbitrage For Mid-Frequency Tradingc0ldlimit8345No ratings yet

- Price Prediction Evolution: From Economic Model To Machine LearningDocument7 pagesPrice Prediction Evolution: From Economic Model To Machine LearningmohitbguptaNo ratings yet

- Extension and Implementation of The BDT ModelDocument70 pagesExtension and Implementation of The BDT ModelPeter StimesNo ratings yet

- Jackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005Document12 pagesJackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005levine_simonNo ratings yet

- Lepetit-Strobel-JIFMIN mc3Document22 pagesLepetit-Strobel-JIFMIN mc3Enrique jaime Tito ccopaNo ratings yet

- Seminar Questions RBC Partii PDFDocument3 pagesSeminar Questions RBC Partii PDFKarishma ShahNo ratings yet

- Eurodollar Convexity Adjustment in Stochastic Vol ModelsDocument19 pagesEurodollar Convexity Adjustment in Stochastic Vol ModelsJamesMc1144No ratings yet

- Linear Regression - Jupyter NotebookDocument56 pagesLinear Regression - Jupyter NotebookUjwal Vajranabhaiah100% (3)

- (Applied Mathematical Finance, Hagan) Interpolation Methods For Curve ConstructionDocument41 pages(Applied Mathematical Finance, Hagan) Interpolation Methods For Curve Constructioncamw_007No ratings yet

- Part IIDocument281 pagesPart IILeng SovannarithNo ratings yet

- Matlab Bond Pricing Examples PDFDocument5 pagesMatlab Bond Pricing Examples PDFromanticos2014No ratings yet

- DDLab ManualsDocument36 pagesDDLab Manualskelsiu1No ratings yet

- CNC-Calc Post Processor - Basic ConfigurationDocument4 pagesCNC-Calc Post Processor - Basic ConfigurationThiênMệnhNo ratings yet

- Algorithmic Adjoint Differentiation (AAD) For Swap Pricing and DV01 RiskDocument21 pagesAlgorithmic Adjoint Differentiation (AAD) For Swap Pricing and DV01 Riskdoc_oz3298No ratings yet

- Unit I TS&FDocument55 pagesUnit I TS&FEugene Berna INo ratings yet

- Lecture12 TS Index PDFDocument20 pagesLecture12 TS Index PDFsnoozermanNo ratings yet

- CQG and Matlab WhitepaperDocument3 pagesCQG and Matlab WhitepaperAbhishek ShuklaNo ratings yet

- Algorithms AnalysisDocument5 pagesAlgorithms Analysismunir ahmedNo ratings yet

- IT 112 Problem SetDocument4 pagesIT 112 Problem Setevanlugo96No ratings yet

- QF 5206 Topics On Quantitative Finance Group Project ReportDocument25 pagesQF 5206 Topics On Quantitative Finance Group Project ReportMiguel Angel Vilariño Monreal100% (1)

- Interpolation Methods For Curve Construction: Applied Mathematical Finance February 2006Document42 pagesInterpolation Methods For Curve Construction: Applied Mathematical Finance February 2006pyrole1No ratings yet

- Report - Project8 - FRA - Surabhi - ReportDocument15 pagesReport - Project8 - FRA - Surabhi - ReportSurabhi Sood100% (1)

- Ch15 LMM1 SampleDocument63 pagesCh15 LMM1 SampleqwweasdasdfdfgfgfdgsNo ratings yet

- Jorge L. Silva, Joelmir J. Lopes Valentin O. Roda, Kelton P. CostaDocument4 pagesJorge L. Silva, Joelmir J. Lopes Valentin O. Roda, Kelton P. CostaSimranjeet SinghNo ratings yet

- Kooderive: Multi-Core Graphics Cards, The Libor Market Model, Least-Squares Monte Carlo and The Pricing of Cancellable SwapsDocument18 pagesKooderive: Multi-Core Graphics Cards, The Libor Market Model, Least-Squares Monte Carlo and The Pricing of Cancellable SwapsRishi SinghNo ratings yet

- Homework-4 Cap416: Simulation and Modeling: Time Series Data AnalysisDocument42 pagesHomework-4 Cap416: Simulation and Modeling: Time Series Data AnalysisvarunmainiNo ratings yet

- Budget Plan Customer Name: Directions For Using TemplateDocument10 pagesBudget Plan Customer Name: Directions For Using TemplatesemiariNo ratings yet

- On The Design and Implementation of A Generic Number Type For Real Algebraic Number Computations Based On Expression DagsDocument27 pagesOn The Design and Implementation of A Generic Number Type For Real Algebraic Number Computations Based On Expression DagsIvo RösslingNo ratings yet

- AP EtoregobetDocument34 pagesAP EtoregobetdeepNo ratings yet

- Proc ReportDocument7 pagesProc ReportrajeshdatastageNo ratings yet

- New Tools For Project Managers: Evolution of S-Curve and Earned Value FormalismDocument10 pagesNew Tools For Project Managers: Evolution of S-Curve and Earned Value FormalismFadhel GhribiNo ratings yet

- Lead-Lag Relationships in Multivariate Time Series DataDocument6 pagesLead-Lag Relationships in Multivariate Time Series DataKexinYuNo ratings yet

- Arellano Bond GMM EstimatorsDocument10 pagesArellano Bond GMM Estimatorsamnoman17100% (1)

- Bundle Adjustment: Optimizing Visual Data for Precise ReconstructionFrom EverandBundle Adjustment: Optimizing Visual Data for Precise ReconstructionNo ratings yet

- SSRN Id4355794Document11 pagesSSRN Id4355794Abul Kalam FarukNo ratings yet

- Savings and Loan CrisisDocument2 pagesSavings and Loan CrisisAbul Kalam FarukNo ratings yet

- Solutions Titard All ChaptersDocument92 pagesSolutions Titard All ChaptersAbul Kalam Faruk0% (2)

- Problems in Thermodynamics, BUET ME169Document12 pagesProblems in Thermodynamics, BUET ME169Abul Kalam FarukNo ratings yet

- How Do Regular Treasury Bonds WorkDocument3 pagesHow Do Regular Treasury Bonds WorkiluvparixitNo ratings yet

- Dax 1Document27 pagesDax 1GOMTINo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Long-Term Financing: An IntroductionDocument20 pagesLong-Term Financing: An IntroductionThuyDuongNo ratings yet

- Interest Rates: Options, Futures, and Other Derivatives 6Document30 pagesInterest Rates: Options, Futures, and Other Derivatives 6Hay JirenyaaNo ratings yet

- Capital Market Assumptions For Major Asset Classes: Executive SummaryDocument20 pagesCapital Market Assumptions For Major Asset Classes: Executive SummaryjitenparekhNo ratings yet

- Coupon RateDocument2 pagesCoupon RateNiño Rey LopezNo ratings yet

- FIN515 MidtermDocument9 pagesFIN515 MidtermNatasha DeclanNo ratings yet

- Solution Assignment 7 2Document15 pagesSolution Assignment 7 2irinasarjveladze19No ratings yet

- Solution Chap 3 Qs Calculation InvestmentDocument7 pagesSolution Chap 3 Qs Calculation InvestmentYuki XuanNo ratings yet

- Yields at A Glance: Please Note: Availability Is Based On Account Type and May Depend On Other Eligibility CriteriaDocument3 pagesYields at A Glance: Please Note: Availability Is Based On Account Type and May Depend On Other Eligibility Criteriapedro perezNo ratings yet

- Notes Cfa Fixed Income R39Document35 pagesNotes Cfa Fixed Income R39Ayah AkNo ratings yet

- Lessons Learnt From Security Analysis-100Document8 pagesLessons Learnt From Security Analysis-100ravi_405No ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- BMO Research Highlights Mar 24Document34 pagesBMO Research Highlights Mar 24smutgremlinNo ratings yet

- Financial Ratios and Their InterpretationDocument10 pagesFinancial Ratios and Their InterpretationPriyanka_Bhans_7838100% (3)

- Bond DocumentDocument37 pagesBond DocumentNayamotNo ratings yet

- Self Study Practice Questions Topic 3 Part 2 AnswersDocument6 pagesSelf Study Practice Questions Topic 3 Part 2 AnswersTriet NguyenNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- LNT Arbitrage Opportunities FundDocument51 pagesLNT Arbitrage Opportunities FundcompletebhejafryNo ratings yet

- Environgrad Corporation: A Case StudyDocument25 pagesEnvirongrad Corporation: A Case StudyAbhi Krishna ShresthaNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Ratio Analysis 1. Profitability Ratios: NB: Capital Employed Total Assets - Current LiabilitiesDocument8 pagesRatio Analysis 1. Profitability Ratios: NB: Capital Employed Total Assets - Current LiabilitiesTawanda Tatenda HerbertNo ratings yet

- How To Value Straight Vanilla Bonds (Solutions)Document9 pagesHow To Value Straight Vanilla Bonds (Solutions)hadosib264No ratings yet

- V1 - 20140410 FRM-2 - Questions PDFDocument30 pagesV1 - 20140410 FRM-2 - Questions PDFIon VasileNo ratings yet