Professional Documents

Culture Documents

Dnda Putri Nurhaliza - Tugas Chapter 3

Dnda Putri Nurhaliza - Tugas Chapter 3

Uploaded by

dindawatanabe54Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dnda Putri Nurhaliza - Tugas Chapter 3

Dnda Putri Nurhaliza - Tugas Chapter 3

Uploaded by

dindawatanabe54Copyright:

Available Formats

Tugas Chapter 3

Nama: Dinda Putri Nurhaliza

Kelas : 2023 B

NIM : 23080694413

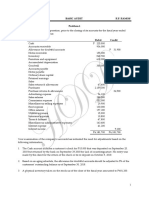

2.EX 3-10

a.

Accounts Receivable 8,450

Fees Earned 8,450

b.if the cash basis rather than the accrual basis had been used, would an adjusting entry

have been necessary?explain

Basis tunai(cash basis) yakni sebbuah metode pencatatan di dalam akuntansi.yang hanya

mencatat transaksi.jika ada penerimaan atau pengeluaran kas.Jadi, meski ada transaksi

yang terjadi.misalnya hutang atau piutang.Tetapi karena tidak adanya kas yang masuk

atau keluar, maka transaksi itu tidak dicatat jika menggunakan metode basis

tunai.Contohnya, jika anda menerima pendapatan dari perusahaan lainnya, tetapi uangnya

anda terima nanti maka transaksi tersebut tidak akan dicatat.Karena itu tidak ada kas yang

masuk dan itu tidak dianggap sebagai pendapatan

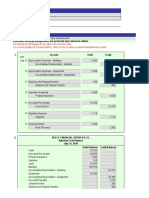

3.PR 3-5A

Adjusting Entries

Dicken Company

Adjusting Entries

October 31, 2014

No Account Name Ref Debet Kredit

a Insurance expense 1,800

Prepaid insurance 1,800

b Supplies expense 1,605

Supplies 1,605

c Depreciation Expense Building 6,000

Accumulated Depreciation Building 6,000

d Depreciation Expense-Equipment 3,000

Accumulated Depreciation

Equipment 3,000

e Unearned Rent 5,400

Rent revenue 5,400

f Salaries expense 2,900

Wages payable 2,900

g Accounts receivable 18,600

Fees earned 18,600

39,305 39,305

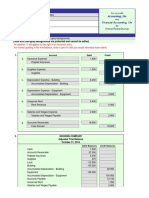

Adjusted Trial Balance

Dickens Company

Account Name Debet kredit

Cash 7500

Account Receivable 57,000

Prepaid Insurance 5,400

Supplies 375

Land 112,500

Building 150,250

Accumulated Depreciation Building 93,550

Equipment 135,300

Accumulated Depreciation Equipment 100,950

Accounts Payable 12,150

Unearned Rent 1,350

Monica Baker, Capital 221,000

Monika Baker,Drawing 15,000

Fees Earned 343,200

Salaries and wages expense 196,270

Utilities expense 42.375

Advertisting Expense 22.800

Repair Expense 17.250

Miscellaneous Expense 6,075

Insurance Expense 1,800

Supplies Expense 1,605

Depreciation Expense-building 6,000

Depreciation Expense-equipment 3,000

Rent Revenue 5,400

Balance 780,500 780,500

You might also like

- CH 3 HomeworkDocument6 pagesCH 3 HomeworkAxel OngNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Problem 3-5B: InstructionsDocument4 pagesProblem 3-5B: InstructionsAlba LunaNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Comprehensive ProblemDocument17 pagesComprehensive Problemapi-27308818360% (5)

- HWChap003 ANSDocument68 pagesHWChap003 ANShelloocean100% (1)

- Dwidhitia Arnensy MustikaDocument3 pagesDwidhitia Arnensy MustikadNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Class Question (Accounting Cycle)Document2 pagesClass Question (Accounting Cycle)Iqra AliNo ratings yet

- Accounting Worksheet: Business Name: Accounting PeriodDocument5 pagesAccounting Worksheet: Business Name: Accounting Periodhgiang2308No ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- E34Document9 pagesE34Nguyen Nguyen KhoiNo ratings yet

- Trial BalanceDocument5 pagesTrial BalanceHanna Ysabelle AldeaNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Problem 3-5B: InstructionsDocument3 pagesProblem 3-5B: Instructionsselse060No ratings yet

- Practice Qs - Closing EntriesDocument1 pagePractice Qs - Closing EntriesAhmed P. FatehNo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Mcws Jaya Wijayanti - Tugas 5 - Bfa 51Document6 pagesMcws Jaya Wijayanti - Tugas 5 - Bfa 51lajujaya.adm01No ratings yet

- Name: Muhammad Usman Zafar I.D: 17278. SEAT NO. 721 Program: Mba (W) Course: Accounting For ManagerDocument6 pagesName: Muhammad Usman Zafar I.D: 17278. SEAT NO. 721 Program: Mba (W) Course: Accounting For ManagerUsman KhanNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Chapter 4, Accounting CycleDocument23 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Accounting Cycle Requirement 1: Journal Entries T-AccountsDocument5 pagesAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloNo ratings yet

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocument4 pagesQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Income Statement: 1 Account Debit Credit RevenueDocument4 pagesIncome Statement: 1 Account Debit Credit RevenueNguyen Ha Vi (K16HL)No ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Akuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Document2 pagesAkuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Muhamad Rizal DinyatNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- ACC101 Chapter 2 Problem SolvedDocument7 pagesACC101 Chapter 2 Problem SolvedNhi NguyễnNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Problem 3-5A: InstructionsDocument2 pagesProblem 3-5A: InstructionsJEERAPA KHANPHETNo ratings yet

- Solution Assignment. Adjusting EntriespdfDocument3 pagesSolution Assignment. Adjusting EntriespdfKim Patrick VictoriaNo ratings yet

- Worksheet: Lazlo Service Co. Trial Balance December 31, 2006 Debit CreditDocument2 pagesWorksheet: Lazlo Service Co. Trial Balance December 31, 2006 Debit CreditRoby RamdhanNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Augustus Institute Unadjusted Trial Balance 31-Dec-09 Accounts Unadjusted Trial Balance Adjustment AdjustedDocument6 pagesAugustus Institute Unadjusted Trial Balance 31-Dec-09 Accounts Unadjusted Trial Balance Adjustment Adjustedhuongchi011205No ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Accounting Compeleting The CycleDocument14 pagesAccounting Compeleting The CyclecamilleNo ratings yet

- Final Exams AccountingDocument6 pagesFinal Exams AccountingCzarina Joy PeñaNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Mis 26 - 03 - 2024 Isl 197 Closing EntriesDocument1 pageMis 26 - 03 - 2024 Isl 197 Closing Entriessahiny883No ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Problem 8, 9, 14Document5 pagesProblem 8, 9, 14Margarette Novem T. PaulinNo ratings yet

- Course 3 Completing The Accounting Cycle22222Document1 pageCourse 3 Completing The Accounting Cycle22222scrbdthowaway271023No ratings yet

- NO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Document6 pagesNO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Rizki Fajar RhamadanNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument4 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The Questionfennie ilinah molinaNo ratings yet

- Pleting The Accounting CycleDocument65 pagesPleting The Accounting Cycleyow jing peiNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Mercedes-Benz India Private Limited: Detailed ReportDocument14 pagesMercedes-Benz India Private Limited: Detailed Reportb0gm3n0tNo ratings yet

- Far 02 - Discontinued Operations and Non-Current Assets Held For SaleDocument2 pagesFar 02 - Discontinued Operations and Non-Current Assets Held For SaleMarie GonzalesNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMary Grace Errabo FloridoNo ratings yet

- Basic Accounting IDocument24 pagesBasic Accounting IAlpha HoNo ratings yet

- Financial Accounting 1 ValixDocument70 pagesFinancial Accounting 1 ValixChraze GBNo ratings yet

- Chapter 1 NotesDocument7 pagesChapter 1 NotesSurelis AcostaNo ratings yet

- Week 6 Tutorial SolutionsDocument13 pagesWeek 6 Tutorial SolutionsFarah PatelNo ratings yet

- 2GO: H1 ResultsDocument99 pages2GO: H1 ResultsBusinessWorld100% (1)

- Lec1 ProblemsDocument16 pagesLec1 Problems김가영 / 학생 / 경제학부No ratings yet

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSDocument6 pagesFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanNo ratings yet

- Ho Branch Quiz 3 2016Document9 pagesHo Branch Quiz 3 2016shampaloc100% (2)

- D. YFC UPSALE Sample FInancial Statement FormatDocument9 pagesD. YFC UPSALE Sample FInancial Statement FormatEmmanuel Mary Angelo ChuaNo ratings yet

- IFRS SummaryDocument66 pagesIFRS SummaryRaji Stephen67% (3)

- Accounts Project 2Document17 pagesAccounts Project 2navya almalNo ratings yet

- Accounting Process Quizzer PDFDocument6 pagesAccounting Process Quizzer PDFDaniel Laurence Salazar Itable100% (1)

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- RULE68-2005 (Audited Financial Statements)Document17 pagesRULE68-2005 (Audited Financial Statements)Michael AlinaoNo ratings yet

- Solution Chapter 16Document99 pagesSolution Chapter 16Sy Him76% (17)

- Definitions of Common Accounting TermsDocument6 pagesDefinitions of Common Accounting TermsAliya SaeedNo ratings yet

- Chapter 3 Adjusting The Accounts-8EDocument28 pagesChapter 3 Adjusting The Accounts-8Emyechoes_1233% (3)

- BRGAAP Vs IFRS - The Basics 2010Document20 pagesBRGAAP Vs IFRS - The Basics 2010Marcelo Da Costa MarquesNo ratings yet

- Chapter 7 Revenue Recognition: Learning ObjectivesDocument16 pagesChapter 7 Revenue Recognition: Learning Objectivessamuel_dwumfourNo ratings yet

- Chapter 6 Win Ballada 2019Document7 pagesChapter 6 Win Ballada 2019Rea Mariz JordanNo ratings yet