Professional Documents

Culture Documents

Inflation Vaishu

Inflation Vaishu

Uploaded by

vaishnavi tipirneniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inflation Vaishu

Inflation Vaishu

Uploaded by

vaishnavi tipirneniCopyright:

Available Formats

Inflation

Inflation is a rise in prices, which can be translated as the decline of purchasing

power over time. The rate at which purchasing power drops can be reflected

in the average price increase of a basket of selected goods and services over

some period of time. The rise in prices, which is often expressed as a

percentage, means that a unit of currency effectively buys less than it did in

prior periods. Inflation can be contrasted with deflation, which occurs when

prices decline and purchasing power increases.

Favourable Impacts of Inflation

1. Higher Profits

Inflation, usually, benefits the producers of products. They experience

better profits since they can sell their products at higher prices.

2. Better Investment Returns

During inflation, investors and entrepreneurs receive added incentives for

investing in productive activities. Therefore, they receive better returns.

3. Increase in Production

Once the producers receive the right investment, they create more goods

and services. Hence, inflation leads to an increase in production of

products/services.

4. More Employment and Better Income

Since production increases, there is an increased demand for the various

factors of production, including manpower. Therefore, employment and

income increases during inflation.

5. Shareholders can earn a good income

If a company earns higher profits, which is possible during inflation, it can

declare dividends to its shareholders. Thus, the shareholders can

experience a rise in their dividend income during inflationary periods

Unfavourable Impacts of Inflation

The unfavourable impacts of inflation are as follows:

1. Fixed-Income Groups experience a fall in income

The true income of an individual is the purchasing power of his money

income. For people belonging to the fixed-income group like salaried

individuals, pensioners, etc. this means that they will experience a fall in

real income. In other words, their purchasing power will reduce.

2. Inequality in Income Distribution Increases

During inflation, businessmen and entrepreneurs experience an increase

in profits. On the other hand, people belonging to the fixed-income groups

experience a decline in their real income. Hence, the inequality in income

distribution becomes acute during this period.

3. Upsets the Planning Process

During inflation, the prices of goods, raw materials, and factor services

increase. Therefore, the Government has to spend more money to

complete any investment project taken up during the planning period. If

the Government fails to raise more financial resources through savings or

taxation, then it upsets the entire planning process.

4. Speculative Investment Increases

Let’s say that the price levels are rising at a very fast rate. People are

unsure about how much the prices will rise in the next few weeks or

months. In such cases, many people start speculative investments. For

example, they might start purchasing shares, gems, land, etc. just for

speculative purposes. This is done with the objective of earning quick

profits. Such investments do not help in creating productive capital in the

economy.

5. Harmful Effects on Capital Accumulation

Let’s say that rising prices become chronic in an economy. During such

periods, people start preferring goods to money since the real value of

money will fall in the future. Also, people start preferring immediate

consumption to consumption in the future. Therefore, the general desire

to save starts reducing. As the willingness and ability to save reduces, the

amount of funds available for further investment reduces too. Therefore,

the overall impact on the capital accumulation of the economy is negative

since capital accumulation in an economy depends on the growth of

investment.

6. Lenders face Losses

Under favourable impacts of inflation, we mentioned that borrowers

benefit from inflation. Therefore, lenders stand a chance of losing during

such periods. This is because they receive an amount having lower

purchasing power than the amount loaned.

7. Negative Impact on Export Income

Since the prices of raw materials and factors of production increase, the

prices of export items also increase during inflation. Hence, their demand

in the foreign markets might fall which leads to a fall in the export income

of the country.

Types of Inflation

There are several types of inflation, each characterised by its underlying causes

and effects. Here are some common types of inflation:

1. Demand-Pull Inflation: This occurs when aggregate demand in an

economy outpaces the supply of goods and services. It is typically fueled

by factors such as increased consumer spending, expansionary fiscal

policies, or excessive money supply. Demand-pull inflation leads to rising

prices as businesses struggle to meet the high demand.

2. Cost-Push Inflation: Cost-push inflation arises from increases in

production costs, such as wages, raw materials, or taxes. When

businesses face higher input costs, they pass on the additional expenses

to consumers through higher prices. Cost-push inflation can be triggered

by factors like rising energy prices, changes in government regulations,

or supply chain disruptions.

3. Built-In Inflation: Built-in inflation is a self-perpetuating cycle of price

increases driven by inflation expectations. It occurs when workers and

businesses anticipate future inflation and negotiate higher wages and

prices to protect their purchasing power. This leads to an upward spiral

of wages, production costs, and prices.

4. Hyperinflation: Hyperinflation is an extreme and rapid form of inflation

where prices skyrocket uncontrollably. It typically occurs due to a severe

collapse in confidence in the currency, often caused by excessive money

printing, political instability, or economic crises. Hyperinflation erodes

the value of money and can have devastating effects on an economy.

5. Stagflation: Stagflation refers to a combination of stagnant economic

growth, high unemployment, and inflationary pressures. It presents a

challenging situation for policymakers because traditional measures to

stimulate economic growth, such as lowering interest rates or increasing

government spending, can exacerbate inflation.

6. Disinflation: It refers to a decrease in the rate of inflation. It means that

while prices are still rising, they are doing so at a slower rate compared

to the past. Disinflation is often seen as a positive development as it

brings relief from rapid price increases, but it is different from deflation,

where overall prices decline.

You might also like

- Gold Account: Your Account Arranged Overdraft Limit 250.00Document6 pagesGold Account: Your Account Arranged Overdraft Limit 250.00Shaziia Ali100% (2)

- Development Studies-Notes & Revision Questions Module 1-4Document164 pagesDevelopment Studies-Notes & Revision Questions Module 1-4laone sephiri100% (2)

- OpenDocument61 pagesOpenChristopher Banton67% (3)

- Engineering Management Case 6-7Document1 pageEngineering Management Case 6-7maryNo ratings yet

- INFLATIONDocument3 pagesINFLATIONRohan JhaNo ratings yet

- A Persistent Increase in The Level of Consumer Prices or A Persistent Decline in The Purchasing Power of Money... "Document6 pagesA Persistent Increase in The Level of Consumer Prices or A Persistent Decline in The Purchasing Power of Money... "marketfreekNo ratings yet

- Rakib, InflationDocument3 pagesRakib, Inflationrakibul.hasandhaka45No ratings yet

- SS3 First Term Lesson NT NewestDocument86 pagesSS3 First Term Lesson NT NewestTuntise AkintundeNo ratings yet

- Inflation GceDocument16 pagesInflation GceRakesh RawtNo ratings yet

- Inflation Note Form 5Document4 pagesInflation Note Form 5Sandya PriyadarshaniNo ratings yet

- InflationDocument16 pagesInflationAlec Angel Alianza HaguisanNo ratings yet

- Introduction To Money and BankingDocument11 pagesIntroduction To Money and BankingAyomikunNo ratings yet

- InflationDocument2 pagesInflationAnuja NijhawanNo ratings yet

- Inflation (10 .27 .41 .25)Document5 pagesInflation (10 .27 .41 .25)Ahsan IslamNo ratings yet

- Macro Economics: Inflation and UnemploymentDocument11 pagesMacro Economics: Inflation and UnemploymentHashim RiazNo ratings yet

- INFLATIONDocument17 pagesINFLATIONlillygujjarNo ratings yet

- InflationDocument2 pagesInflationSyed Abdullah NabilNo ratings yet

- Local Media3234683759531526224Document24 pagesLocal Media3234683759531526224Jeoven Dave T. MejosNo ratings yet

- Tugas 2 Bahasa Inggris NiagaDocument2 pagesTugas 2 Bahasa Inggris NiagaXyaNo ratings yet

- Economic 4th SemDocument9 pagesEconomic 4th SemSomnath PahariNo ratings yet

- What Is InflationDocument222 pagesWhat Is InflationAhim Raj JoshiNo ratings yet

- Inflation: By: Prescious Ann Joy Eleuterio Lauren Julleza Nicole Aira BilbaoDocument36 pagesInflation: By: Prescious Ann Joy Eleuterio Lauren Julleza Nicole Aira BilbaoLauren Saavedra JullezaNo ratings yet

- Seminar in Economic Policies: Assignment # 1Document5 pagesSeminar in Economic Policies: Assignment # 1Muhammad Tariq Ali KhanNo ratings yet

- Monetary Theory (UNIT 02) ...Document8 pagesMonetary Theory (UNIT 02) ...AbhishekNo ratings yet

- Unit 2 - Inflation & Related Concepts - 220921 - 125916Document13 pagesUnit 2 - Inflation & Related Concepts - 220921 - 125916theworkingangel2No ratings yet

- Inflation V/S Interest Rates: Grou P6Document26 pagesInflation V/S Interest Rates: Grou P6Karan RegeNo ratings yet

- Effects of InflationDocument21 pagesEffects of InflationRanjeet Ramaswamy Iyer50% (6)

- Module 7 - Inflation & UnemploymentDocument51 pagesModule 7 - Inflation & UnemploymentPrashasti100% (1)

- Currency: Inflation Is A Key Concept in Macroeconomics, and A Major Concern For Government PolicymakersDocument3 pagesCurrency: Inflation Is A Key Concept in Macroeconomics, and A Major Concern For Government PolicymakersElvie Abulencia-BagsicNo ratings yet

- InflationDocument6 pagesInflationDr. Swati GuptaNo ratings yet

- InflationDocument5 pagesInflationSyeda SamiaNo ratings yet

- tiền tệDocument35 pagestiền tệNga BuiNo ratings yet

- Trade Cycle or Business Cycle: By: Mariam & KhooshiDocument14 pagesTrade Cycle or Business Cycle: By: Mariam & KhooshiMariam MohamedNo ratings yet

- Assignment of InflationDocument5 pagesAssignment of InflationAY ChNo ratings yet

- Inflation: BY KiranDocument18 pagesInflation: BY KiranKiran Kumar PatnaikNo ratings yet

- InflationDocument33 pagesInflationHari prakarsh NimiNo ratings yet

- Macro Economics NotesDocument6 pagesMacro Economics NotesPrastuti SachanNo ratings yet

- Inflation Hand-OutDocument4 pagesInflation Hand-OutTashaneNo ratings yet

- InflationDocument10 pagesInflationRavi PatelNo ratings yet

- Consequences of InflationDocument2 pagesConsequences of InflationKailash RoheeNo ratings yet

- Managerial Eco.Document10 pagesManagerial Eco.kavitabNo ratings yet

- Manar DerbelDocument8 pagesManar DerbelManar DerbelNo ratings yet

- Causes OF InflationDocument5 pagesCauses OF InflationAnkush SharmaNo ratings yet

- DeflationDocument1 pageDeflationmlaz2406No ratings yet

- Inflation Economics Study Material Amp NotesDocument5 pagesInflation Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Measures of Inflation in IndiaDocument5 pagesMeasures of Inflation in IndiavishwastiwariNo ratings yet

- Inflation, Types and Pakistan's Inflation: Mam Fadia NazDocument16 pagesInflation, Types and Pakistan's Inflation: Mam Fadia NazGhulamMuhammad ChNo ratings yet

- The Meaning of Inflation, Disinflation and DeflationDocument6 pagesThe Meaning of Inflation, Disinflation and DeflationVanessa KuaNo ratings yet

- What Is InflationDocument28 pagesWhat Is Inflationsahil jainNo ratings yet

- Inflation Unemployment and Interest - 12&13&14 PDFDocument14 pagesInflation Unemployment and Interest - 12&13&14 PDFDebabrattaNo ratings yet

- 12 Unit III Money InflationDocument14 pages12 Unit III Money InflationShubham SarkarNo ratings yet

- InflationDocument2 pagesInflationAmandeep SinghNo ratings yet

- Demand-Pull Inflation & Cost-Push InflationDocument4 pagesDemand-Pull Inflation & Cost-Push InflationAlec Hope BuenaventuraNo ratings yet

- Concept of Inflation and MoneyDocument9 pagesConcept of Inflation and Moneysafiashakeel188No ratings yet

- CH 4 AS - Inflation and DeflationDocument20 pagesCH 4 AS - Inflation and DeflationRabee BasitNo ratings yet

- Inflation: How Inflation Is Measured?Document14 pagesInflation: How Inflation Is Measured?slimhippolyte100% (23)

- The Theory of InflationDocument16 pagesThe Theory of InflationJoseph OkpaNo ratings yet

- Inflation - WPS OfficeDocument5 pagesInflation - WPS OfficeWillyn AbanNo ratings yet

- Effects of Inflation:: Inflation and Interest RateDocument10 pagesEffects of Inflation:: Inflation and Interest RatesangramlifeNo ratings yet

- Introduction To Economics of Inflation and DeflationDocument16 pagesIntroduction To Economics of Inflation and DeflationVen ClariseNo ratings yet

- Inflation and It's Impact On BusinessDocument3 pagesInflation and It's Impact On BusinessAngie FloresNo ratings yet

- InflationDocument40 pagesInflationRosebell MelgarNo ratings yet

- Inflation: What Is Inflation? 1) Inflation Refers To A Continuous Rise in General Price Level Which Reduces The Value ofDocument7 pagesInflation: What Is Inflation? 1) Inflation Refers To A Continuous Rise in General Price Level Which Reduces The Value ofconc oxygenNo ratings yet

- Post Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditDocument5 pagesPost Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditPaolo IcangNo ratings yet

- Budget PreparationDocument2 pagesBudget PreparationAAAAANo ratings yet

- HCIA Student Resume BooDocument48 pagesHCIA Student Resume Boogecopi100% (1)

- Dealer Credit Sale ModuleDocument15 pagesDealer Credit Sale ModuleNakul DixitNo ratings yet

- Job InterviewDocument4 pagesJob InterviewLi'anaNo ratings yet

- My Mikes Bikes Page ReportDocument2 pagesMy Mikes Bikes Page Reportapi-489930791No ratings yet

- Final Complete CIDocument32 pagesFinal Complete CIBhaskar ReddyNo ratings yet

- Document 4Document4 pagesDocument 4Ana Sofía Cruz AcostaNo ratings yet

- ProQuestDocuments 2022 09 07Document17 pagesProQuestDocuments 2022 09 07Fathi HaidarNo ratings yet

- ICICI Prudential SignatureDocument6 pagesICICI Prudential Signaturemanojkp33No ratings yet

- Quiz in Basic Accounting SHSDocument3 pagesQuiz in Basic Accounting SHSTRISHA MAE ABOCNo ratings yet

- Consumer Behavior: Building Marketing Strategy, 9th: Hawkins, Del I. Best, Roger J. Coney, Kenneth ADocument4 pagesConsumer Behavior: Building Marketing Strategy, 9th: Hawkins, Del I. Best, Roger J. Coney, Kenneth ABantheng Rusu RaiNo ratings yet

- United Airlines V CIRDocument1 pageUnited Airlines V CIRiciamadarangNo ratings yet

- Sustainable Development in Bangladesh - Bridging The SDGs and Climate Action 1.2Document18 pagesSustainable Development in Bangladesh - Bridging The SDGs and Climate Action 1.2Feisal RahmanNo ratings yet

- Quiz Advance AccountingDocument5 pagesQuiz Advance AccountingGeryNo ratings yet

- Inventory Pick List Bin LookupDocument3 pagesInventory Pick List Bin LookupAbdelmadjid BouamamaNo ratings yet

- Gujarat Technological University Mba Programme - Semester Iv Batch 12-14Document6 pagesGujarat Technological University Mba Programme - Semester Iv Batch 12-14sarfaraj123No ratings yet

- Alternative Network Letter Vol 5 No.3-Sep 1989-EQUATIONSDocument12 pagesAlternative Network Letter Vol 5 No.3-Sep 1989-EQUATIONSEquitable Tourism Options (EQUATIONS)No ratings yet

- Analyzing Financial Performance ReportDocument3 pagesAnalyzing Financial Performance ReportTiaradipa Amanda100% (1)

- Aggregate Planning + MPS +capacity PlanningDocument21 pagesAggregate Planning + MPS +capacity PlanningAnoo PsNo ratings yet

- Siddanagouda ReportDocument60 pagesSiddanagouda ReportBharath KNNo ratings yet

- Case 6 LeadershipDocument2 pagesCase 6 LeadershipBerjame Tan MayNo ratings yet

- 05 Banco Filipino Savings & Mortgage Bank v. NavarroDocument3 pages05 Banco Filipino Savings & Mortgage Bank v. NavarroGraceSantosNo ratings yet

- OneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporeDocument11 pagesOneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporejaitleyarushiNo ratings yet

- Lecture 6 - Pricing DecisionDocument30 pagesLecture 6 - Pricing DecisionRaeka AriyandiNo ratings yet

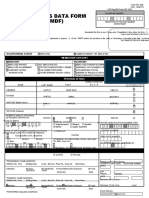

- Member'S Data Form (MDF) : InstructionsDocument3 pagesMember'S Data Form (MDF) : InstructionsVan Errl Nicolai SantosNo ratings yet