Professional Documents

Culture Documents

WW 2023.08.07-Min

WW 2023.08.07-Min

Uploaded by

Alyssa TomanengOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WW 2023.08.07-Min

WW 2023.08.07-Min

Uploaded by

Alyssa TomanengCopyright:

Available Formats

Weekly Wrap

07 August 2023

Week in Review

Global: Fitch Ratings cut its US credit rating to AA+ (from AAA previously), citing expected fiscal deterioration over the next three

years, erosion of governance amid repeated debt limit standoffs and last-minute resolutions that threatened the government’s

ability to pay its bills. Meanwhile, nonfarm payrolls were lower-than-expected at 187,000 in July (vs 200,000 estimate), but solid

wage gains (+4.4% y-y) and a decline in unemployment rate (to 3.5% from 3.6% in June) pointed to continued tightness in US

Macro

labor market conditions.

Local: PH inflation cooled further for the sixth straight month to 4.7% in July (from 5.4% in June), better than the 4.9% consensus

estimate, due to slower price increases of food and non-alcoholic beverages, housing, electricity, gas and other fuels. Core inflation,

which excludes select food and energy items, likewise decelerated to 6.7% in July (from 7.4% in June). The average inflation rate

from January to July 2023 stood at 6.8%, still above the BSP target range of 2-4%.

Global: UST bond yields (see Fig. 1) were mostly up last week following reports of the credit downgrade by Fitch and government

plans to raise borrowings in the coming months (amounting to around USD1tn in 3Q23). Meanwhile, the Federal Reserve may

Bonds

keep its tight monetary policy stance as the labor market continues to look resilient.

Local: Domestic yields also rose on hawkish remarks from BSP Governor Remolona that the “Philippines is not out of the woods

yet when it comes to inflation, and the central bank is ready to raise the policy rate as soon as this month’s policy meeting if

needed.” The BSP chief also cited recent typhoon disruptions and escalating global rice prices as risks to the inflation outlook.

Global: Global stock markets fell (see Fig. 5) as rising bond yields continue to put pressure on equities in the wake of the US credit

downgrade. Global growth worries also weighed on sentiment following reports of slowing manufacturing activity in the eurozone

and China. Meanwhile, oil prices continued to climb (Dubai crude +2.5% w-w and 11.3% YTD to USD86.87/bbl) on reports of

Equities

extended supply cuts from top producers Saudi Arabia and Russia through September.

Local: The PCOMP also closed lower to 6,450.84 last Friday (-1.9% d-d and -2.6% w-w) tracking the decline of global markets,

despite improving manufacturing activity (manufacturing PMI up to 51.9 from 50.9 in June) and slowing inflation trends in the

country. The PHP also depreciated 1.5% w-w to 55.74 vs the USD, along with regional peers following the release of robust US

labor data as well as lingering concerns on the global economy after the US credit downgrade by Fitch. Foreigners remained net

buyers at PHP13.1bn (from PHP303mn the week prior).

The PCOMP erased its 1.9% gain in July as it fell 2.1% so far in August (-1.8% YTD), and continues to trade at attractive valuations

Market Insights

(13.0x forward P/E vs 17.0x historical average). We expect investors to continue watching for cues on the health of economies

and businesses with the release of 2Q23 PH GDP, several regional trade data, and earnings reports this week. We continue to

recommend sectors and names that can sustain earnings growth in: 1) banks (BPI, MBT) on the back of healthy loan growth and

improving lending margins; 2) conglomerates with consumer-centric portfolios (SM, GTCAP, and AGI) that benefit from the

country’s economic resilience; and 3) power (AP, ACEN) with still tight power supply conditions likely to keep spot prices elevated.

Eight of our covered names reported 2Q23 earnings last week, with 4 in-line (ACEN, ALI, TEL, FB), 2 beats (MBT, MER), and 2

Corporate Updates

misses (URC, NIKL), bringing our running earnings tally to 7 in-line, 4 beats, and 3 misses. Beats came from higher lending (MBT)

and power generation (MER) margins on favorable pricing, while the misses were due to still elevated prices of some input costs

(URC) and lower selling prices of mined commodities (NIKL).

AEV and Coca-Cola Europacific Partners (CCEP) have signed a non-binding term sheet to acquire Coca-Cola Beverages

Philippines, Inc. (CCBPI) with enterprise value placed at USD1.8bn (~PHP99.3bn) and ownership structure at 60:40. AEV said the

transaction: 1) will expand its consumer portfolio and provide synergies with its other units; 2) will be funded through a combination

of cash and debt (parent net D/E at 0.2x as of 2Q23); and 3) will be completed by end-2023 subject to meeting necessary closing

conditions and regulatory approvals.

New Issue Monitor

Government Securities PH Corporate Bonds PH Equities

Date Security Tenor Amount Date Security Amount Tenor & Pricing Date Security Amount Tenor & Pricing

07 Aug T-bills 3M PHP5bn Series C: 5Y BVAL + Series A: 5Y BVAL +

T-bills 6M PHP5bn PHP10bn [25 to 60 bps] ACEN Perp. PHP12.5bn [75 to 115 bps]

07 Aug

21 Sep AEV Bonds + 01 Sep +

07 Aug T-bills 12M PHP5bn PHP7.45bn

Series D: 10Y BVAL + Prefs PHP12.5bn Series B: Dividend rate

08 Aug T-bonds 6Y 2M PHP30bn [40 to 85 bps] guidance within 8.00%

The Week Ahead

Date Event Period Estimate Prior

09 Aug PH Unemployment Rate Jun - 4.3%

10 Aug PH GDP y-y 2Q 6.0% 6.4%

10 Aug US CPI y-y Jul 3.3% 3.0%

11 Aug US PPI m-m Jul 0.7% 0.1%

11 Aug US Consumer Sentiment Aug 71.0 71.6

Disclaimer: The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or

implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall

BDO or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within

this report.

PLEASE CONSIDER THE ENVIRONMENT BEFORE YOU PRINT

Weekly Wrap | 07 August 2023

Fig. 1: US Treasury (UST) yield curve Fig. 2: PH government securities (GS) yield curve

12/31/2022 7/28/2023 8/4/2023 12/31/2022 7/28/2023 8/4/2023

8.0% 8.0%

6.20%

6.0% 5.33% 6.0%

6.35% 6.56%

4.15% 4.05%

4.0% 4.0%

2.0% 2.0%

0.0% 0.0%

3M 6M 1Y 2Y 3Y 5Y 7Y 10Y 20Y 3M 6M 1Y 2Y 3Y 5Y 7Y 10Y 20Y

Source: Bloomberg Source: Bloomberg

Fig. 3: PCOMP & net foreign buying (selling) trends Fig. 4: PCOMP top gainers and losers w-w

ALI 3.3%

Net foreign buying/selling - PHPmn (RHS)

7,500 2,000 ACEN 3.2%

Top 5

JFC 3.2%

7,000 1,000

BPI 1.7%

6,500 -

EMI 1.0%

6,000 (1,000) MONDE -9.6%

AEV -10.0%

Bottom 5

5,500 (2,000)

CNVRG -10.7%

5,000 (3,000)

SMC -11.0%

JGS -12.1%

Source: Bloomberg Source: Bloomberg

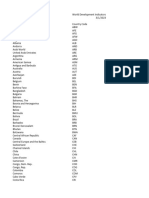

Fig. 5: Equity indices movements Fig. 6: Currency and commodity trends

Last price w -w MTD YTD Currencies Last price w -w MTD YTD

Philippines PCOMP Index 6,450.84 -2.6% -2.1% -1.8% USD/PHP 55.74 -1.5% -1.6% 0.03%

US (S&P 500) SPX Index 4,478.03 -2.3% -2.4% 16.3% EUR/USD 1.10 0.1% -0.1% -3.2%

US (Nasdaq) NDX Index 15,274.92 -3.0% -3.1% 39.5% USD/JPY 141.76 -0.4% 0.4% -6.6%

China (CSI 300) SHSZ300 Index 4,020.58 0.7% 0.1% 4.2% Commodities Last price w -w MTD YTD

China (Hang Seng) HSI Index 19,539.46 -1.9% -2.7% -1.0% Dubai crude USD/ bbl 86.87 2.5% 1.5% 11.3%

Japan NKY Index 32,192.75 -1.7% -3.0% 23.4% Natural gas USD/ MMBt u 2.58 -2.3% -2.2% -43.5%

Europe SX5E Index 4,332.91 -3.0% -3.1% 12.5% Coal USD/ mt 137.00 1.9% -0.2% -66.1%

UK UKX Index 7,564.37 -1.7% -1.8% 0.7% Gold USD/ t oz 1,942.91 -0.8% -1.1% 7.1%

MSCI World MXWO Index 2,986.54 -2.3% -2.5% 14.3% Copper USD/ mt 8,523.25 -1.2% -3.1% 1.4%

MSCI EM MXEF Index 1,018.02 -2.4% -2.8% 6.3% Nickel USD/ mt 21,082.00 -4.5% -4.5% -29.9%

Source: Bloomberg Source: Bloomberg

Disclaimer: The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or

implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall

BDO or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within

this report.

PLEASE CONSIDER THE ENVIRONMENT BEFORE YOU PRINT

Stock Coverage

Mkt Cap Last Price Target Upside/ EPS Growth P/E (x) EV/EBITDA P/B (x) ROE Div Yield

Company Ticker Rating (USD mn) 4-Aug-2023 Price Downside FY23F FY24F FY23F FY24F FY23F FY24F FY23F FY23F FY23F

Banking

BDO Unibank BDO Not Rated 13,429 141.00

Bank of the Philippine Islands BPI Buy 10,462 117.00 138.00 17.9% 16.0% 14.6% 11.5 10.0 NA NA 1.6 14.8% 2.4%

Metropolitan Bank & Trust Company MBT Buy 4,473 55.00 81.00 47.3% 27.7% 12.1% 5.9 5.3 NA NA 0.7 12.6% 5.5%

Security Bank Corporation SECB Buy 1,123 82.45 118.00 43.1% 4.4% 12.0% 5.6 5.0 NA NA 0.5 8.5% 3.6%

Conglomerates

Aboitiz Equity Ventures AEV Neutral 5,065 49.75 55.00 10.6% 11.2% 14.8% 11.8 10.3 9.7 7.9 0.7 11.5% 3.0%

Alliance Global Group, Inc. AGI Buy 2,013 12.30 18.60 51.2% 20.3% 24.2% 5.8 4.7 4.2 3.7 0.3 7.7% 1.0%

Ayala Corporation AC Buy 6,803 607.00 950.00 56.5% 35.0% 21.6% 10.8 8.9 10.8 10.7 0.6 8.5% 1.1%

DMC Holdings DMC Buy 2,190 9.12 10.90 19.5% -27.0% -23.1% 5.3 6.9 3.1 3.6 0.9 26.1% 15.4%

GT Capital Holdings, Inc. GTCAP Buy 2,032 522.00 773.00 48.1% 39.3% 13.7% 4.5 4.0 9.0 6.3 0.5 14.2% 1.1%

JG Summit Holdings, Inc. JGS Neutral 5,304 39.00 54.00 38.5% 70.4% 119.1% 30.0 13.7 9.9 7.7 0.7 5.2% 1.0%

LT Group, Inc. LTG Buy 1,839 9.40 11.90 26.6% 3.2% 6.4% 4.1 3.8 - - 0.3 11.0% 13.6%

Metro Pacific Investments MPI Buy 2,517 4.85 5.60 15.5% 25.0% 6.0% 8.6 8.1 10.6 9.9 0.6 8.8% 2.3%

San Miguel Corporation SMC Neutral 4,172 97.00 109.00 12.4% NM 24.0% 14.1 11.4 6.4 5.8 0.4 7.9% 1.4%

SM Investments Corporation SM Buy 20,075 908.50 1,110.00 22.2% 15.2% 14.0% 15.4 13.5 15.7 13.4 1.4 13.4% 0.8%

Consumer

Century Pacific Food CNPF Buy 1,681 26.25 30.50 16.2% 9.7% 25.6% 17.0 13.5 11.3 9.3 2.8 16.7% 1.5%

D&L Industries DNL Buy 909 7.04 9.50 34.9% -3.2% 24.7% 15.7 12.6 10.3 8.6 2.3 14.5% 3.4%

Emperador Inc. EMI Neutral 6,047 21.25 22.00 3.5% 11.5% 14.7% 29.7 25.9 22.0 19.2 3.8 12.8% 1.5%

Jollibee Foods Corp JFC Buy 5,262 260.00 280.00 7.7% 57.7% 25.1% 43.5 34.7 10.6 9.2 3.5 8.1% 1.0%

Monde Nissin Corporation MONDE Buy 2,437 7.50 10.60 41.3% 9.9% 14.4% 18.6 16.2 10.3 9.1 2.3 12.3% -

Puregold Price Club PGOLD Buy 1,432 27.50 51.00 85.5% 7.8% 13.5% 7.9 7.0 2.4 2.1 0.9 11.1% 3.5%

Robinsons Retail Holdings, Inc. RRHI Buy 1,443 54.30 85.00 56.5% 7.9% 13.1% 14.1 12.4 5.5 4.7 1.1 8.3% 4.3%

San Miguel Food and Beverage Inc. FB Buy 5,396 50.50 70.00 38.6% 13.7% 11.2% 12.2 11.0 4.8 4.4 2.5 20.2% 3.2%

Shakey's Pizza Asia Ventures PIZZA Buy 286 9.40 10.60 12.8% 19.0% 14.9% 15.2 13.2 8.5 7.6 2.0 13.8% 0.3%

Universal Robina Corporation URC Buy 4,758 120.80 164.00 35.8% 16.3% 20.9% 20.0 16.5 10.7 9.2 2.2 10.9% 2.9%

Wilcon Depot, Inc. WLCON Buy 1,631 22.00 30.30 37.7% 1.6% 17.7% 23.2 19.7 10.6 9.2 3.9 18.1% 1.7%

Property

Ayala Land ALI Buy 7,681 28.40 35.00 23.2% 25.9% 26.2% 17.9 14.2 11.1 9.8 1.5 9.1% 1.3%

Filinvest Land Inc. FLI Neutral 298 0.68 0.90 32.4% 30.0% 15.3% 4.6 4.0 9.5 8.6 0.2 4.7% 5.1%

Megaworld MEG Buy 1,150 2.04 3.50 71.6% 13.8% 11.0% 4.2 3.7 4.6 4.4 0.2 7.0% 3.0%

Robinsons Land RLC Buy 1,358 15.40 26.00 68.8% 6.4% 15.5% 7.5 6.5 5.7 4.8 0.5 8.3% 3.2%

SM Prime Holdings SMPH Buy 17,754 34.00 42.00 23.5% 37.7% 10.8% 23.7 21.4 16.9 15.5 2.5 11.2% 0.8%

Vista Land & Lifescapes VLL Buy 365 1.59 3.00 88.7% 13.0% 14.4% 2.3 2.0 9.0 8.4 0.2 8.3% 2.3%

REITs

AREIT, Inc. AREIT Buy 1,089 34.20 41.00 19.9% 7.0% 7.4% 14.2 13.2 15.5 13.9 1.0 6.8% 6.9%

Citicore Energy REIT Corp. CREIT Buy 299 2.53 3.00 18.6% 5.5% 7.9% 13.7 12.7 13.0 12.1 3.8 29.2% 7.7%

MREIT, Inc. MREIT Buy 703 13.90 18.00 29.5% 11.3% 3.2% 12.7 12.3 13.7 13.0 0.7 5.2% 7.7%

RL Commercial REIT, Inc. RCR Buy 1,026 5.29 6.70 26.7% -2.1% 5.1% 12.3 11.7 12.6 12.0 0.9 6.7% 7.7%

Power & Industrials

Aboitiz Power Corporation AP Buy 4,657 35.00 47.00 34.3% 31.7% 13.5% 7.4 6.5 8.0 7.1 1.3 20.1% 5.3%

AC Energy Corporation ACEN Buy 3,946 5.50 7.00 27.3% 42.8% 16.8% 30.0 25.7 16.6 15.0 1.6 5.7% 0.8%

First Gen Corporation FGEN Buy 1,314 20.20 26.00 28.7% 31.0% 16.0% 4.1 3.5 2.1 1.6 0.4 15.2% 1.6%

Manila Electric Company MER Buy 6,624 325.00 438.00 34.8% 32.9% -2.9% 10.2 10.5 7.9 8.5 2.7 27.8% 6.8%

Manila Water Company, Inc. MWC Rating Suspended 955 18.32

Megawide Construction Corp. MWIDE Neutral 118 3.25 3.50 7.7% NM NM NM 24.7 12.9 6.9 0.4 1.5% 30.8%

Intl Container Terminal Services ICT Buy 7,422 202.00 258.00 27.7% 16.6% 18.5% 11.8 10.0 6.3 5.6 3.5 37.6% 5.2%

Mining

Nickel Asia Corporation NIKL Buy 1,481 5.90 8.30 40.7% 23.5% 1.8% 9.2 9.0 5.2 5.2 1.3 33.6% 7.3%

Semirara Mining and Power Corporation SCC Buy 2,244 29.20 37.00 26.7% -25.8% -18.3% 4.2 5.1 2.9 3.3 1.6 41.5% 12.0%

Telecom

Converge ICT Solutions, Inc. CNVRG Buy 1,183 9.00 17.40 93.3% 14.6% 13.5% 7.7 6.8 4.2 3.8 1.5 21.1% -

Globe Telecom GLO Buy 4,723 1,811.00 2,265.00 25.1% 2.0% 3.1% 13.3 13.0 5.7 5.3 1.5 23.4% 5.4%

PLDT Inc. TEL Buy 4,981 1,275.00 1,655.00 29.8% 1.4% 1.4% 8.2 8.1 4.9 4.8 2.2 29.2% 8.3%

Tourism

Bloomberry Resorts Corporation BLOOM Buy 2,261 11.50 14.50 26.1% 93.7% 37.7% 12.8 9.3 9.3 7.2 3.0 26.1% 1.1%

Cebu Air CEB Buy 403 35.90 54.00 50.4% NM 92.3% 5.3 2.8 1.5 1.1 NM NM -

MacroAsia Corporation MAC Buy 141 4.13 6.30 52.5% 133.4% 18.1% 9.9 8.4 13.5 11.7 1.3 16.0% 1.3%

Sources: BDO Securities estimates, Bloomberg

Disclaimer: The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or

implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall

BDO or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within

this report.

For concerns, you may contact us thru the BDO Securities Hotline (02) 8840-7878 between 8:30AM to 5:30PM, Monday to Friday or email us at bdosec-

customercare@bdo.com.ph. BDO Securities is a PSE and PDex Trading Participant, an SCCP and SIPF Member, and is regulated by the CMIC with Telephone

No. (02) 8876-4580 and email address at info@cmic.com.ph, and SEC with Telephone No. 0916-383-8633 and (02) 8818-0921 and email address at

msrd_covid19@sec.gov.ph.

PLEASE CONSIDER THE ENVIRONMENT BEFORE YOU PRINT

You might also like

- 40078780-MB-July 2021 Red WaveDocument23 pages40078780-MB-July 2021 Red Wavetaxglobal009No ratings yet

- Customer Service Career Success Through Customer Loyalty 6th Edition Timm Test BankDocument5 pagesCustomer Service Career Success Through Customer Loyalty 6th Edition Timm Test Bankamandaretepc100% (32)

- Asset Quality: That Sinking Feeling!Document33 pagesAsset Quality: That Sinking Feeling!Ronitsinghthakur SinghNo ratings yet

- JUL 29 DBS Daily Breakfast SpreadDocument8 pagesJUL 29 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Bandhan Debt-Market-Monthly-Outlook-Nov-2023Document3 pagesBandhan Debt-Market-Monthly-Outlook-Nov-2023Shivani NirmalNo ratings yet

- Asian Development Bank - Weekly HighlightsDocument13 pagesAsian Development Bank - Weekly Highlightsrryan123123No ratings yet

- JUL 27 DBS Daily Breakfast SpreadDocument7 pagesJUL 27 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- The World Economy ... - 11/03/2010Document2 pagesThe World Economy ... - 11/03/2010Rhb InvestNo ratings yet

- Weekly Credit Update: Week Ending 12 June, 2020Document3 pagesWeekly Credit Update: Week Ending 12 June, 2020muhjaerNo ratings yet

- US Fed Between A Stock and A Bond Place 100810Document4 pagesUS Fed Between A Stock and A Bond Place 100810tuyetnt20016337No ratings yet

- Tracking The World Economy... - 09/08/2010Document3 pagesTracking The World Economy... - 09/08/2010Rhb InvestNo ratings yet

- 0927 UsfiwDocument42 pages0927 Usfiwbbj1039No ratings yet

- PHP HRty 8 RDocument5 pagesPHP HRty 8 Rfred607No ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- JP Morgan - Global ReportDocument88 pagesJP Morgan - Global Reporttrinidad01No ratings yet

- Municipal Bond Market CommentaryDocument8 pagesMunicipal Bond Market CommentaryAnonymous Ht0MIJNo ratings yet

- JUL 30 DBS Daily Breakfast SpreadDocument7 pagesJUL 30 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Phatra Wealth Daily Note: Global Markets: Draghi QE, Japan RecessionDocument17 pagesPhatra Wealth Daily Note: Global Markets: Draghi QE, Japan RecessionbodaiNo ratings yet

- Weekly Economicand Markets Review 20211010Document2 pagesWeekly Economicand Markets Review 20211010Václav NěmecNo ratings yet

- Weekly Trends Nov 5Document4 pagesWeekly Trends Nov 5dpbasicNo ratings yet

- FM Report July 2010Document11 pagesFM Report July 2010smashinguzairNo ratings yet

- ScotiaBank AUG 04 Daily PointsDocument2 pagesScotiaBank AUG 04 Daily PointsMiir ViirNo ratings yet

- Tracking The World Economy... - 09/09/2010Document2 pagesTracking The World Economy... - 09/09/2010Rhb InvestNo ratings yet

- The World Economy - 08/03/2010Document3 pagesThe World Economy - 08/03/2010Rhb InvestNo ratings yet

- Economics Group: Weekly Economic & Financial CommentaryDocument9 pagesEconomics Group: Weekly Economic & Financial Commentaryamberyin92No ratings yet

- The World Economy... - 09/06/2010Document2 pagesThe World Economy... - 09/06/2010Rhb InvestNo ratings yet

- Bond Market Weekly: China Merchants Securities Debt Capital MarketDocument4 pagesBond Market Weekly: China Merchants Securities Debt Capital MarketougyajNo ratings yet

- MSFL - Inflation Aug'11Document4 pagesMSFL - Inflation Aug'11Himanshu KuriyalNo ratings yet

- Monitor Markets 20230908Document2 pagesMonitor Markets 20230908Kicki AnderssonNo ratings yet

- AUG 02 DBS Daily Breakfast SpreadDocument9 pagesAUG 02 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Inflation Environment and OutlookDocument8 pagesInflation Environment and OutlookStephen LinNo ratings yet

- Eadlines: Saturday, September 24, 2011Document16 pagesEadlines: Saturday, September 24, 2011Seema GusainNo ratings yet

- AUG 04 DBS Daily Breakfast SpreadDocument6 pagesAUG 04 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Weekly Economic and Markets Review: International & MENADocument2 pagesWeekly Economic and Markets Review: International & MENAVáclav NěmecNo ratings yet

- ICICIdirect MonthlyMFReportDocument27 pagesICICIdirect MonthlyMFReportGanesh RajNo ratings yet

- The Wire-Economics 29 JulyDocument6 pagesThe Wire-Economics 29 JulyThomasNo ratings yet

- Tracking The World Economy.... - 01/10/2010Document3 pagesTracking The World Economy.... - 01/10/2010Rhb InvestNo ratings yet

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read MoreDocument12 pagesKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read Morerryan123123No ratings yet

- HSBC 12072010 Vietnam MonitorDocument16 pagesHSBC 12072010 Vietnam MonitorNguyen Xuan QuangNo ratings yet

- MI WP YearAhead2023 PDFDocument13 pagesMI WP YearAhead2023 PDFJNo ratings yet

- Dow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Document6 pagesDow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Andre_Setiawan_1986No ratings yet

- RBI Policy Review Oct 2011 Highlights and RecommendationDocument7 pagesRBI Policy Review Oct 2011 Highlights and RecommendationKirthan Ψ PurechaNo ratings yet

- Fed Watch: FOMC Statement: October 29 - 30Document2 pagesFed Watch: FOMC Statement: October 29 - 30Varphi16No ratings yet

- Daily FX STR Europe 27 July 2011Document8 pagesDaily FX STR Europe 27 July 2011timurrsNo ratings yet

- Jul 16 Erste Group Macro Markets UsaDocument6 pagesJul 16 Erste Group Macro Markets UsaMiir ViirNo ratings yet

- Bullions Rally On Inflation Hedge and Safe Haven BuyingDocument5 pagesBullions Rally On Inflation Hedge and Safe Haven BuyingJameel KhanNo ratings yet

- Global Views: The View Ahead: Double-Dip DecisionsDocument4 pagesGlobal Views: The View Ahead: Double-Dip DecisionseconomicburnNo ratings yet

- Reliance Single PremiumDocument80 pagesReliance Single Premiumsumitkumarnawadia22No ratings yet

- AUG 06 DBS Daily Breakfast SpreadDocument7 pagesAUG 06 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Tracking The World Economy... - 24/09/2010Document3 pagesTracking The World Economy... - 24/09/2010Rhb InvestNo ratings yet

- The World Overall 04:12 - Week in ReviewDocument6 pagesThe World Overall 04:12 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Barclays UPDATE Global Rates Weekly Withdrawal SymptomsDocument74 pagesBarclays UPDATE Global Rates Weekly Withdrawal SymptomsVitaly Shatkovsky100% (1)

- The Pensford Letter - 2.11.13Document4 pagesThe Pensford Letter - 2.11.13Pensford FinancialNo ratings yet

- Motilal REc ResearchDocument10 pagesMotilal REc ResearchhdanandNo ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Fixed Income Weekly 03082007Document3 pagesFixed Income Weekly 03082007FarahZBNo ratings yet

- UBS Weekly Guide: Help WantedDocument13 pagesUBS Weekly Guide: Help Wantedshayanjalali44No ratings yet

- SLAMC Weekly (Oct 24, 2011)Document3 pagesSLAMC Weekly (Oct 24, 2011)Engkiong GoNo ratings yet

- Market Analysis Aug 2023Document17 pagesMarket Analysis Aug 2023nktradzNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesFrom EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesNo ratings yet

- Working Capital Practical QuestionsDocument8 pagesWorking Capital Practical Questionsfatimabiriq799No ratings yet

- Year 12 Business Studies Marketing Topic 3 - Study Notes-3Document85 pagesYear 12 Business Studies Marketing Topic 3 - Study Notes-3Oliver Al-MasriNo ratings yet

- UTS Ak Man Lanjutan PPAk 2022 - I Gusti Agus Eka WidianaDocument9 pagesUTS Ak Man Lanjutan PPAk 2022 - I Gusti Agus Eka WidianaIGusti WidianaNo ratings yet

- 9707 Business Studies: MARK SCHEME For The October/November 2013 SeriesDocument9 pages9707 Business Studies: MARK SCHEME For The October/November 2013 Series8jnmvbvqvwNo ratings yet

- Purchasing Power Prity and Internatinal FIsher EffectDocument37 pagesPurchasing Power Prity and Internatinal FIsher EffectshreyaaamisraNo ratings yet

- Amit Bafna SIP ReportDocument34 pagesAmit Bafna SIP ReportAnupNo ratings yet

- Liquidity, Asset Utilization, Debt Ratio and Firm Performance: Evidence From EgyptDocument32 pagesLiquidity, Asset Utilization, Debt Ratio and Firm Performance: Evidence From EgyptMsa-Management Sciences JournalNo ratings yet

- Fin546 Article ReviewDocument4 pagesFin546 Article ReviewZAINOOR IKMAL MAISARAH MOHAMAD NOORNo ratings yet

- Fundamentals of Corporate Finance 12th Edition Ross Solutions ManualDocument15 pagesFundamentals of Corporate Finance 12th Edition Ross Solutions Manuallovellmil51wg1100% (36)

- All in 1 Past Papers - CFR AFACR S-IDocument83 pagesAll in 1 Past Papers - CFR AFACR S-Im.rafimahmoodNo ratings yet

- Brand Chapter 6Document34 pagesBrand Chapter 6Sadia PromiNo ratings yet

- Recent Trends in Management Set 1Document6 pagesRecent Trends in Management Set 1Balaram BeheraNo ratings yet

- Branding in The Digital EraDocument25 pagesBranding in The Digital EraEriicpratamaNo ratings yet

- Sanchoy PatraDocument2 pagesSanchoy PatraSushen GainNo ratings yet

- Problem 6 7Document1 pageProblem 6 7tushar1007singhNo ratings yet

- API LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Document47 pagesAPI LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Thúy HàNo ratings yet

- DERIVATIVESDocument30 pagesDERIVATIVESDeepak ParidaNo ratings yet

- Distribution-Module 3Document22 pagesDistribution-Module 3Charmie EmotinNo ratings yet

- Financial Statements Formate 3.2Document21 pagesFinancial Statements Formate 3.2vkvivekkm163No ratings yet

- STD 8 Maths Q Book T 3Document44 pagesSTD 8 Maths Q Book T 3kingkamwazaNo ratings yet

- 219 488 1 PBDocument9 pages219 488 1 PBSurya AdhigamikaNo ratings yet

- Capital Float (India) New Pitch DeckDocument21 pagesCapital Float (India) New Pitch Deckpushkar royNo ratings yet

- A Comparative Study On Financial Performance of Private and PublicDocument17 pagesA Comparative Study On Financial Performance of Private and PublicaskmeeNo ratings yet

- Chapter 2Document22 pagesChapter 2Okorie Chinedu PNo ratings yet

- Buy Back IntroductionDocument5 pagesBuy Back Introduction7013 Arpit DubeyNo ratings yet

- CONSIGNMENT ACCOUNT - Docx2Document8 pagesCONSIGNMENT ACCOUNT - Docx2Gamer nestNo ratings yet

- Driving & Towards Growth: Businesses EntrepreneursDocument116 pagesDriving & Towards Growth: Businesses EntrepreneursTwimukye MarkNo ratings yet

- QChartist Highly Profitable Trading SystemsDocument23 pagesQChartist Highly Profitable Trading SystemsJulien MoogNo ratings yet