Professional Documents

Culture Documents

Chapter 7 Solutions-2

Chapter 7 Solutions-2

Uploaded by

mackkshellOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7 Solutions-2

Chapter 7 Solutions-2

Uploaded by

mackkshellCopyright:

Available Formats

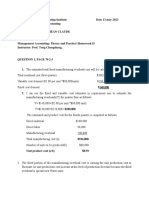

Exercise 7-13 (30 minutes)

1. Activity rates are computed as follows:

(a)

Estimated (b) (a) ÷ (b)

Overhead Expected Activity

Activity Cost Pool Cost Activity Rate

Machine setups ...... $72,000 400 setups $180 per setup

Special processing .. $200,000 5,000 MHs $40 per MH

There is no activity rate for the General Factory activity because it is an organization-sustaining

activity. Organization-sustaining costs should not be allocated to products.

2. Overhead is assigned to the two products as follows:

Hubs:

(a) (b) (a) × (b)

Activity Cost Pool Activity Rate Activity ABC Cost

Machine setups ..................... $180 per setup 100 setups $ 18,000

Special processing ................. $40 per MH 5,000 MHs 200,000

Total..................................... $218,000

Sprockets:

(a) (b) (a) × (b)

Activity Cost Pool Activity Rate Activity ABC Cost

Machine setups ..................... $180 per setup 300 setups $54,000

Special processing ................. $40 per MH 0 MHs 0

Total..................................... $54,000

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 1

Exercise 7-13 (continued)

Hubs Sprockets

Direct materials ................................... $32.00 $18.00

Direct labor:

$15 per DLH × 0.80 DLHs per unit..... 12.00

$15 per DLH × 0.40 DLHs per unit..... 6.00

Overhead:

$218,000 ÷ 10,000 units ................... 21.80

$54,000 ÷ 40,000 units .................... 1.35

Unit cost ............................................. $65.80 $25.35

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 2

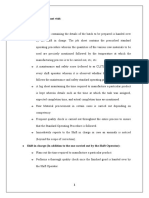

Exercise 7-15 (30 minutes)

1. First-stage allocations of overhead costs to the activity cost pools:

Distribution of Resource Consumption

Across Activity Cost Pools

Supporting Order Customer

Direct Labor Processing Support Other Totals

Wages and salaries.......... 40% 30% 20% 10% 100%

Other overhead costs ...... 30% 10% 20% 40% 100%

Direct Labor Order Customer

Support Processing Support Other Totals

Wages and salaries.......... $120,000 $ 90,000 $ 60,000 $ 30,000 $300,000

Other overhead costs ...... 30,000 10,000 20,000 40,000 100,000

Total cost........................ $150,000 $100,000 $ 80,000 $ 70,000 $400,000

Example: 40% of $300,000 is $120,000.

2. Computation of activity rates:

(a) (b) (a) ÷ (b)

Activity Cost Pools Total Cost Total Activity Activity Rate

Supporting direct

labor ..................... $150,000 20,000 DLHs $7.50 per DLH

Order processing ...... $100,000 400 orders $250 per order

Customer support ..... $80,000 200 customers $400 per customer

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter7 3

Exercise 7-15 (continued)

3. Computation of the overhead costs for the Shenzhen Enterprises order:

(a) (b) (a) × (b)

Activity Cost Pool Activity Rate Activity ABC Cost

Supporting direct

labor .................. $7.50 per DLH 20 DLHs* $150

Order processing ... $250 per order 1 order 250

Customer support .. $400 per customer 1 customer 400

Total..................... $800

*2 DLHs per unit × 10 units = 20 DLHs.

4. The customer margin for Shenzhen Enterprises is computed as follows:

Customer Margin—ABC Analysis

Sales (10 units × $300 per unit)..................... $3,000

Costs:

Direct materials ($180 per unit × 10 units) ... $1,800

Direct labor ($50 per unit × 10 units) ........... 500

Support direct labor overhead (see part 3

above) ..................................................... 150

Order processing overhead (see part 3

above) ..................................................... 250

Customer support overhead (see part 3

above) ..................................................... 400 3,100

Customer margin ........................................... $ (100)

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 4

Problem 7-16 (45 minutes)

1. Under the traditional direct labor-dollar based costing system,

manufacturing overhead is applied to products using the predetermined

overhead rate computed as follows:

Predetermined = Estimated total manufacturing overhead cost

overhead rate Estimated total direct labor dollars

$608,000

= = $2.00 per DL$

$304,000

The product margins using the traditional approach would be computed

as follows:

B300 T500 Total

Sales ................................... $1,400,000 $700,000 $2,100,000

Direct materials .................... 436,300 251,700 688,000

Direct labor .......................... 200,000 104,000 304,000

Manufacturing overhead

applied @ $2.00 per direct

labor-dollar........................ 400,000 208,000 608,000

Total manufacturing cost ...... 1,036,300 563,700 1,600,000

Product margin .................... $ 363,700 $136,300 $ 500,000

Note that all of the manufacturing overhead cost is applied to the

products under the company’s traditional costing system.

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 5

Problem 7-16 (continued)

2. The first step is to determine the activity rates:

(a)

Total (b) (a) ÷ (b)

Activity Cost Pools Cost Total Activity Activity Rate

Machining .............. $213,500 152,500 MH $1.40 per MH

Setups ................... $157,500 375 setup hrs $420 per setup hr

Product sustaining .. $120,000 2 products $60,000 per product

*The Other activity cost pool is not shown above because it includes

organization-sustaining and idle capacity costs that should not be

assigned to products.

Under the activity-based costing system, the product margins would be

computed as follows:

B300 T500 Total

Sales .................................. $1,400,000 $700,000 $2,100,000

Direct materials ................... 436,300 251,700 688,000

Direct labor ......................... 200,000 104,000 304,000

Advertising expense ............. 50,000 100,000 150,000

Machining ........................... 126,000 87,500 213,500

Setups ................................ 31,500 126,000 157,500

Product sustaining ............... 60,000 60,000 120,000

Total cost ............................ 903,800 729,200 1,633,000

Product margin.................... $ 496,200 $(29,200) $ 467,000

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 6

Problem 7-16 (continued)

3. The quantitative comparison is as follows:

B300 T500 Total

Traditional Cost System (a) (a) ÷ (c) (b) (b) ÷ (c) (c)

Amount % Amount % Amount

Direct materials ......................... $436,300 63.4% $251,700 36.6% $ 688,000

Direct labor ............................... 200,000 65.8% 104,000 34.2% 304,000

Manufacturing overhead ............ 400,000 65.8% 208,000 34.2% 608,000

Total cost assigned to products .. $1,036,300 $563,700 $1,600,000

Selling and administrative .......... 550,000

Total cost .................................. $2,150,000

Activity-Based Costing System

Direct costs:

Direct materials ......................... $436,300 63.4% $251,700 36.6% $ 688,000

Direct labor ............................... 200,000 65.8% 104,000 34.2% 304,000

Advertising expense ................... 50,000 33.3% 100,000 66.7% 150,000

Indirect costs:

Machining ................................. 126,000 59.0% 87,500 41.0% 213,500

Setups ...................................... 31,500 20.0% 126,000 80.0% 157,500

Product sustaining ..................... 60,000 50.0% 60,000 50.0% 120,000

Total cost assigned to products .. $903,800 $729,200 1,633,000

Costs not assigned to products:

Selling and administrative .......... 400,000

Other .................................... 117,000

Total cost .................................. $2,150,000

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 7

Problem 7-16 (continued)

The traditional and activity-based cost assignments differ for three

reasons. First, the traditional system assigns all $608,000 of

manufacturing overhead to products. The ABC system assigns only

$491,000 (= $213,500 + $157,500 + $120,000) of manufacturing

overhead to products. The ABC system does not assign the

$117,000 of Other activity costs to products because they

represent organization-sustaining costs. Second, the traditional

system uses one unit-level activity measure, direct labor dollars, to

assign 65.8% of all overhead to the B300 product line and 34.2%

of all overhead to the T500 product line. The ABC system assigns

59.0% of Machining costs to the B300 product line and 41.0% to

the T500 product line. The ABC system assigns 20.0% of Setup

costs (a batch-level activity) to the B300 product line and 80.0%

to the T500 product line. The ABC system assigns 50% of Product

sustaining costs (a product-level activity) to each product line.

Third, the traditional system does not trace any advertising

expenses to the two products. The ABC system traces $50,000 of

advertising to the B300 and $100,000 of advertising to the T500

product line.

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 8

© The McGraw-Hill Companies, Inc., 2018. All rights reserved.

Solutions Manual, Chapter 7 9

You might also like

- Hi-Survey Road User Manual-EN-20200330Document276 pagesHi-Survey Road User Manual-EN-20200330Mauricio RuizNo ratings yet

- Ab Costing - ProblemsDocument8 pagesAb Costing - ProblemsMarcial VillegasNo ratings yet

- 38t GEI41047 PDocument28 pages38t GEI41047 PJorge DiazNo ratings yet

- Chapter 8 Solutions ExercisesDocument25 pagesChapter 8 Solutions Exerciseswajeeda awadNo ratings yet

- Chapter 6 HomeworkDocument10 pagesChapter 6 HomeworkAshy Lee0% (1)

- HW Session 5Document3 pagesHW Session 5Tiffany KimNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- Chapter 2 Cost Concepts and ClassificationDocument10 pagesChapter 2 Cost Concepts and ClassificationSteffany RoqueNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Studi Kasus SCMDocument8 pagesStudi Kasus SCMMuflihul Khair0% (5)

- Solutions Ch. 7 ABCDocument11 pagesSolutions Ch. 7 ABCThanawat PHURISIRUNGROJNo ratings yet

- Ab Costing CathDocument5 pagesAb Costing CathRoy Mitz Aggabao Bautista VNo ratings yet

- Solutions 1Document4 pagesSolutions 1Markus H.No ratings yet

- ABC MethodDocument6 pagesABC MethodPrincess RapisuraNo ratings yet

- Key Chapter 2 & 3Document9 pagesKey Chapter 2 & 3bxp9b56xv4No ratings yet

- Chapter 8-SolutiondocxDocument17 pagesChapter 8-Solutiondocxevani1998No ratings yet

- Session 16 PGPDocument10 pagesSession 16 PGPtanvi gargNo ratings yet

- CH 12Document15 pagesCH 12Firas HamadNo ratings yet

- Cornerstone Exercises Cornerstone Exercise 17.1Document30 pagesCornerstone Exercises Cornerstone Exercise 17.1Nirwana PuriNo ratings yet

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- ManaktugasDocument7 pagesManaktugasNimas KartikaNo ratings yet

- ADMS 2510 Week 13 SolutionsDocument20 pagesADMS 2510 Week 13 Solutionsadms examzNo ratings yet

- ANSWERS TO PRACTICE MIDTERM (Multiple Choice) : RequiredDocument5 pagesANSWERS TO PRACTICE MIDTERM (Multiple Choice) : RequiredGwendolyn Chloe PurnamaNo ratings yet

- AF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Document12 pagesAF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Shadow IpNo ratings yet

- Kerjakan 4-12 Dan 4 - 17: 1. "Plantwide"Document4 pagesKerjakan 4-12 Dan 4 - 17: 1. "Plantwide"natan. lieNo ratings yet

- A Chp6 TUTDocument11 pagesA Chp6 TUTYong Jing YinNo ratings yet

- 201B Exam 3 PracticeDocument16 pages201B Exam 3 PracticeChanel NguyenNo ratings yet

- Answer To Assignment #2 - Variable Costing PDFDocument14 pagesAnswer To Assignment #2 - Variable Costing PDFVivienne Rozenn LaytoNo ratings yet

- Solution P5 - 4656Document5 pagesSolution P5 - 4656HO JING YI MBS221190No ratings yet

- Prof. VG CMA Practice Problems With SolutionsDocument6 pagesProf. VG CMA Practice Problems With SolutionssudiptakrNo ratings yet

- Solution To Questions On Decision MakingDocument27 pagesSolution To Questions On Decision Makingdanishbashir786No ratings yet

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- ASG 3 Soloist PDFDocument4 pagesASG 3 Soloist PDFJohnsen PratamaNo ratings yet

- Akuntansi BiayaDocument4 pagesAkuntansi BiayaIntan Bella YuspramanaNo ratings yet

- Review Problem: Differential Analysis: RequiredDocument17 pagesReview Problem: Differential Analysis: RequiredBảo Anh Phạm100% (1)

- Problem 1.: Beginnin G EndingDocument3 pagesProblem 1.: Beginnin G EndingMarsha Zhafira ANo ratings yet

- Chapter 2Document16 pagesChapter 2Manish SadhuNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- MA Mids Muneeb Ahmed 10180Document11 pagesMA Mids Muneeb Ahmed 10180zainNo ratings yet

- ACC 213 Exercise 6Document3 pagesACC 213 Exercise 6rechell obusaNo ratings yet

- Problem 2Document3 pagesProblem 2Mohammed Al ArmaliNo ratings yet

- Sol ch15Document4 pagesSol ch15Julian PoerwanjanaNo ratings yet

- Latihan Soal Week 8Document6 pagesLatihan Soal Week 8Natasya Prashta WidyadhariNo ratings yet

- Abc RemedialDocument6 pagesAbc RemedialMinie KimNo ratings yet

- Exercise MADocument7 pagesExercise MAthanhntt21No ratings yet

- Solutions To Self-Study QuestionsDocument47 pagesSolutions To Self-Study QuestionsChristina ZhangNo ratings yet

- Answer - Case 1Document10 pagesAnswer - Case 1EVI MARIA SIBUEANo ratings yet

- MGT Acc SolutionsDocument34 pagesMGT Acc Solutionsshamsirarefin275285No ratings yet

- Relevant Cost Exercise SolutionDocument14 pagesRelevant Cost Exercise SolutionHimadri DeyNo ratings yet

- Example-2 With SolutionDocument4 pagesExample-2 With SolutionDeepNo ratings yet

- Ch7 Variable Absoorption Extra ExcersisesDocument7 pagesCh7 Variable Absoorption Extra ExcersisesSarah Al MuallaNo ratings yet

- COSMAN ASSIGNMENT 21 32 Answers CheggDocument8 pagesCOSMAN ASSIGNMENT 21 32 Answers CheggwalsondevNo ratings yet

- Chapter 1 2 SolutionsDocument10 pagesChapter 1 2 SolutionsShiv AchariNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- Service Department Cost Allocation: Solutions To Exercises and ProblemsDocument27 pagesService Department Cost Allocation: Solutions To Exercises and ProblemsMafi De LeonNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- CASE Limiting FactorsDocument2 pagesCASE Limiting FactorsEhrom SaidovNo ratings yet

- Practice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalDocument2 pagesPractice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalKaren Joyce SinsayNo ratings yet

- Problem10 18 and 10 20Document10 pagesProblem10 18 and 10 20roseNo ratings yet

- Ch05 SolutionsDocument12 pagesCh05 SolutionsHạnh Đỗ Thị ThanhNo ratings yet

- m80221012-Kanyabwira Jean Claude - 基因 - Ass2Document10 pagesm80221012-Kanyabwira Jean Claude - 基因 - Ass2UKURI TV7No ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Elphos Erald: Police Chief Clarifies Child's ID Kit UsageDocument10 pagesElphos Erald: Police Chief Clarifies Child's ID Kit UsageThe Delphos HeraldNo ratings yet

- Observations From The Plant VisitDocument2 pagesObservations From The Plant VisitAniket ShrivastavaNo ratings yet

- Valorisation of Spent Coffee Grounds Production of Biodiesel Via Enzimatic Catalisis With Ethanol and Co-SolventDocument14 pagesValorisation of Spent Coffee Grounds Production of Biodiesel Via Enzimatic Catalisis With Ethanol and Co-SolventAline GonçalvesNo ratings yet

- Fil-Chin Engineering: To: Limketkai Attn: Mr. Eduard Oh Re: Heat ExchangerDocument6 pagesFil-Chin Engineering: To: Limketkai Attn: Mr. Eduard Oh Re: Heat ExchangerKeith Henrich M. ChuaNo ratings yet

- Daftar Harga 2021 (Abjad)Document9 pagesDaftar Harga 2021 (Abjad)Arahmaniansyah HenkzNo ratings yet

- Circuito Integrado BA05STDocument10 pagesCircuito Integrado BA05STEstefano EspinozaNo ratings yet

- Open Web Floor Trusses - MiTek IncDocument7 pagesOpen Web Floor Trusses - MiTek IncinfoNo ratings yet

- EN ISO 13503-2 (2006) (E) CodifiedDocument8 pagesEN ISO 13503-2 (2006) (E) CodifiedEzgi PelitNo ratings yet

- Apple Serial Number Info - Decode Your Mac's Serial Number!Document1 pageApple Serial Number Info - Decode Your Mac's Serial Number!edp8 malsbyNo ratings yet

- Individual Development WorkoutDocument3 pagesIndividual Development WorkoutmichelleNo ratings yet

- Parts Catalog ARDFDocument30 pagesParts Catalog ARDFUlmanu ValentinNo ratings yet

- Cryolite JM File 2011Document5 pagesCryolite JM File 2011mutemuNo ratings yet

- Min Pin Sweater Paradise - Autumn Stripes Crochet Min Pin SweaterDocument6 pagesMin Pin Sweater Paradise - Autumn Stripes Crochet Min Pin SweaterNathalyaNo ratings yet

- Pressure Relief Valve, Pilot-OperatedDocument52 pagesPressure Relief Valve, Pilot-OperatedAlvaro YépezNo ratings yet

- Fourth Quarter Exam in TLE Grade SevenDocument5 pagesFourth Quarter Exam in TLE Grade SevenShabby Gay Trogani83% (12)

- Essay Types Character Analysis EssayDocument7 pagesEssay Types Character Analysis EssayFatihNo ratings yet

- Agile ManufacturingDocument17 pagesAgile Manufacturingkaushalsingh20No ratings yet

- Direction TestDocument3 pagesDirection TestprascribdNo ratings yet

- IGNITE CIB 24 February 2024Document4 pagesIGNITE CIB 24 February 2024jigarNo ratings yet

- Guia 5Document2 pagesGuia 5Luz Analía Valdez CandiaNo ratings yet

- Lesson Plan Format (Acad)Document4 pagesLesson Plan Format (Acad)Aienna Lacaya MatabalanNo ratings yet

- P2 Chp2 Section 2.1ADocument3 pagesP2 Chp2 Section 2.1APaing Khant KyawNo ratings yet

- Product Data: Order Tracking Analyzer - Type 2145Document8 pagesProduct Data: Order Tracking Analyzer - Type 2145jhon vargasNo ratings yet

- Ingersoll Rand Ingersoll Rand Compressor 39880984 Interstage Pressure SwitchDocument1 pageIngersoll Rand Ingersoll Rand Compressor 39880984 Interstage Pressure Switchbara putranta fahdliNo ratings yet

- Assignment2 NamocDocument5 pagesAssignment2 NamocHenry Darius NamocNo ratings yet

- PPP-Eclipse-E05 Module 05 IDUsDocument11 pagesPPP-Eclipse-E05 Module 05 IDUsJervy SegarraNo ratings yet