Professional Documents

Culture Documents

Vamsi Krishna Loan Sanction Letter 456

Vamsi Krishna Loan Sanction Letter 456

Uploaded by

Venkatesh DoodamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vamsi Krishna Loan Sanction Letter 456

Vamsi Krishna Loan Sanction Letter 456

Uploaded by

Venkatesh DoodamCopyright:

Available Formats

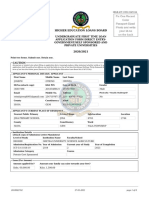

LOAN SANCTION LETTER

Date: 17-June-2023

To,

Mr BHEEMARAJU

VENKATA MARUTHI VAMSI

KRISHNA Scan this QR Code with a

Smartphone or a Barcode Reader to

Mr BHEEMARAJU LAKSHMI

KANTHA RAO

instantly validate the information with

D NO: PLOT NO-514,FLAT NO-02, our Avanse Loan Verification Portal

SUSHEELA BHAVAN,

BACKSIDE MONTESSORI SCHOOL,

BACHUPALLY,

BACHPALLE,

MEDCHAL-MALKAJGIRI

TELANGANA

PIN CODE:500090

Dear Sir/Madam,

Ref : Loan A/C No.: VIJEE00821129

With reference to your Loan Application dated 05-JUNE-2023. We are pleased to inform you that an Education

Loan of Rs 4100000/- (Rupees Forty ONE Lakh Only) is sanctioned to you for pursuing the Higher Studies of

BHEEMARAJU VENKATA MARUTHI VAMSI KRISHNA in CONCORDIA UNIVERSITY for doing masters Course in

Computer and information sciences in UNITED STATES OF AMERICA, on the followingterms and conditions

mentioned below and additional conditions printed overleaf.

Loan Sanction Details:

Rs 4100000/- (Rupees Forty One Lakh Only)

Loan Amount Sanctioned in Rs * Equivalent to US Dollar (USD) 49463 as per prevailing

Rate on 17-june-2 (Source:XE.COM)

*Benchmark rate + Spread = 14.0% p.a., ROI on

Rate of Interest (ROI) floating basis

*Present Benchmark rate is 13.65% p.a.

Total Tenure of the Loan in Months 120

Interest Period in Months 36

PMII (Pre-Monthly Instalment Interest)Start Date 10th of the subsequent month after disbursal date.

PMII Amount in Rs ** 50282/-

Signature Borrower Co-Borrower/s Guarantor

Date:

PMII Amount Serviced during moratorium period in Rs

5000.0/-

**

Principal Outstanding post unpaid interest in Rs ** 6458256/-

MI Period in Months 84

MI (Monthly Instalment) Start Months 37th month onwards

MI Amount in Rs *** 121028/-

Loan Processing Fees inclusive of Applicable Taxes 62304.0/- to be paid before availing the loan.

Signature Borrower Co-Borrower/s Guarantor

Date:

Loan Repayment Mode PSI

Security:

*Including Tuition Fee, living expenses and insurance, if any, basis Borrower's request. Lender is entitled to

directly disburse the premium amount to the Insurer.

*Living expenses of Rs. 1600000.0 /- may be credited to the Borrowers account/prepaid card (as applicable).

**Interest servicing i.e. Pre-Monthly Instalment Interest (PMII) will start immediately after the disbursement of

First Instalment/Tranche Subject to change based on disbursement taken and ROI.

***MI (Principal and Interest repayment), Subject to change based on disbursement taken and ROI.

Loan Disbursement Conditions (If any):

4 PDC of Mr BHEEMARAJU LAKSHMI KANTHA RAO , ANDHRA BANK A/c NO.00810100079025 with 3 NACH

mandates to be submitted and 1 SPDC covering full amount required from BHEEMARAJU LAKSHMI KANTHA

RAO .

1. Processing Fees to be payable prior to hand over of the sanction letter.

2. Student's unconditional Admit letter & I20 to be documented.

3. Visa Copy to be documented.

4. Disbursement to happen in HSBC account (if any deviation require National Head approval)

5. Property owner to be required as co applicant and ownership proof to be documented

Disbursement of the loan will be only upon successfully fulfilling all the conditions for disbursements. The

Borrowers wish to provide following details to the servicer/issuer: [DCB Bank through Slonkit for availing credit

of living expenses that Lender may agree to disburse at its discretion. The borrower hereby gives his consent

for servicer / issuer to contact it regarding the issuance of the prepaid card / instrument.

The MI, Pre-MI interests are to be paid on or before 10th day of every month.

The Loan amount will be released directly in the name of the Educational Institute / authorized dealer /

Borrower, as per their demand letter from the Institute / College / University where the student has secured

admission. Avanse Financial Services Ltd (the Lender) shall have the discretion to credit living expenses in the

customer's account or reimburse basis the documents provided.

This sanction availability is valid for a period of 6 months from the date of issue of this letter. If the offer is

acceptable to you, please sign on the duplicate copy of the letter duly accepting the terms & conditions of the

sanction letter and return the same within 30 days from the date of receipt of this letter.

Important: All charges will attract applicable statutory levies and GST. Please visit our website

www.avanse.com for details of other charges applicable to this loan.

We also request to complete the Loan disbursement formalities as it is an integral process to disburse the Loan.

For AVANSE Financial Services Limited

Authorized Signatory

I/We hereby confirm that I/We have read, understood and accept the terms & conditions of the Loan sanction

letter

Additional Terms and Conditions:

Signature Borrower Co-Borrower/s Guarantor

Date:

1. The terms of this letter shall be binding on the Borrower(s) and shall form an integral part of the Transaction

Documents including the Loan Agreement (along with the Schedule thereto). In the event of inconsistency, the

Lender's interpretation and view shall be final and binding. In absence of Lender's inability to interpret and

conclude on any conflicting terms between the Loan Agreement and this Sanction Letter, the Loan Agreement

shall prevail. Inter-alia disbursements will be subject to the said terms and shall be utilized only/solely for the

purpose communicated to the Lender.

2. The Borrower undertakes to execute the Loan Agreement/ other Transaction Documents for the purpose of

availing Loans in terms thereof and pay/repay the Loan/s in a timely manner. This sanction is subject to

realization of cheque / demand draft/ pay order towards the processing fees and charges for loan sanctioning

which will be non-refundable.

3. The Lender is entitled to cancel/revoke the unutilized sanctioned limit at its sole discretion. Where such

decision to cancel/revoke the sanctioned limits is taken for reasons attributable to the Borrower or its credit

assessment, then the Borrower (without prejudice to other rights of the Lender) will not be entitled to any part

and proportionate refund of processing fees & charges.

4. The Loan shall be disbursed in lump sum/in suitable Installments, to be decided by the Lender at its sole

discretion. If the Lender disburses any amount into prepaid card applied/to be applied by the Borrower then the

Borrower acknowledges that such services will be facilitated at Borrower's costs and expenses. In this regard,

the Borrower/s expressly authorizes the Lender to disclose Borrower's information / KYC details to such issuer

/servicer. Also the Borrower permits Lender to receive information from the servicer/issuer and use /process

information regarding its card's usage from time to time for promoting financial products or services (by itself

and/or within its group).

5. For the purpose of secured facility, unless otherwise agreed, the Loan shall be secured by first and exclusive

charge on the immovable and movable property and/or such other security, to the satisfaction of the Lender. For

the purpose of disbursements ,such documents/reports/evidence as may be required by the Lender shall be

produced to ascertain that the property to be mortgaged has a clear, marketable and unencumbered title. The

Borrower/Co-Borrower/s shall produce such original/copy of title deeds, documents, reports as may be required

by the Lender. In case of additional limits, the existing mortgage shall stand extended to cover the proposed

additional limit and/ or as per the sanctioned conditions.

6. The Borrower acknowledges that Lender's interest rate depends on many factors including cost of its

borrowed funds. The Lender may vary the interest rate prospectively as it may deem fit and/or in accordance

with guidelines laid down by RBI, from time to time and will be published on its website. Moreover, upon change

in the base lending rate (BLR)/ Benchmark Rate, the Borrower will pay the Loans linked to BLR in accordance

with the revised rate announced by the Lender.

7. The Lender is hereby entitled to make proportionate changes in the repayment schedule, consequent to

revision of interest rate. If any extension of the tenure of the Loan as is likely to exceed maximum tenure

assessed by the Lender for the Loan, then Lender may also give required effect in any number and amount of

Instalment as it may deem fit and appropriate.

8. Unless otherwise notified by the Lender in writing, this Sanction Letter shall stand revoked and cancelled if:

a. Any material changes occur in the proposal for which this Loan is, in principle sanctioned.

b. Any material fact concerning income or ability to repay or any other relevant aspect of the proposal or

application for loan is withheld, suppressed, concealed or not made known to the Lender.

c. Any statement made in the loan application is found to be incorrect or untrue.

d. Unconditional and absolute acceptance of the Sanction Letter has not been received by the Lender within

thirty (30) days from the date of issuance of this Sanction Letter;

e. the Lender at its sole discretion revoke / cancel / recall this Sanction Letter.

Signature Borrower Co-Borrower/s Guarantor

Date:

9. Pre-MI interest at the rate, at which the MI has been calculated, shall be charged from the respective date(s)

of disbursements to the date of commencement of MI in respect of the Loan. The MI comprises of principal and

interest calculated on the basis of monthly rest at the rate applicable, which is rounded off to the next higher

rupee. Subject to the Loan Agreement, eligible Borrowers', who have provided specific written request for

Lender to consider flexible operation such as switching, deferring or preponing MI/PMII (as the case maybe)

during the loan tenor, will abide by the repayment schedule provided by the Lender accordingly, pursuant to

such request. The Borrower inter-alia acknowledges such request shall not exceed for more than two (2)

instances and shall be effective only if expressly agreed by the Lender in writing.

10. The Lender shall be informed in writing about any changes, in correspondence address, change in

employment, loss of job, business, profession, as the case may be immediately after such changes/ loss, notify

the causes of delay, loss/damage to the property, notify the additions /alterations to the property.

11. Stamp Duty, registration charges, or other taxes/levies as applicable from time to time, on the Loan and

security documents or any document/s executed by the Borrower/Co-Borrower/s including but not limited to the

applicable service tax on the processing fee, in respect of the Loan and/or in respect of the documents

evidencing/concerning the Loan and/or any penalty(ies) that may be imposed, shall be borne and paid by the

Borrower/Co-Borrower/s without claiming any set-off, counter claim, damages etc. In addition to the above

charges, the Borrower/Co-Borrower/s are also required to pay the charges to be paid (if any) to CERSAI for

creation/modification of charge /satisfaction of charge, as applicable from time to time.

12. The Borrower shall register under the Central Goods and Services Tax Act, 2017 (CGST Act), the State

Goods and Services Tax(SGST) Act, 2017, Integrated Goods and Services Tax (IGST) Act, 2017, Union

Territory Goods and Service Tax (UTGST) Act,2017 (hereinafter individually/collectively called as "GST Law") as

applicable to him and disclose the registration number to the Lender, failing which it will be considered as if the

Applicant is not registered under the GST law and the provisions as may be applicable to unregistered Borrower

would be applicable.

13. In case of violation of any provisions of taxation law including GST laws by Borrower then the Borrower

undertakes to indemnify the Lender for any loss or claim or demand or penalty, if any, which may be incurred or

suffered by the Lender.

14. The Borrower will pay other applicable charges as per the Lender's schedule of charges as updated/ may be

updated on its website from time to time.

15. Notwithstanding the issuance of this Sanction Letter and the acceptance thereof, The Lender in its sole

discretion may decide to not disburse the Loan, repudiate and rescind this Sanction Letter unilaterally without

being required to give the Borrower any prior notice and without assigning any reasons.

16. The post-dated cheques (PDCs) if any, issued towards repayment of loan to be replenished as and when

they are exhausted towards payment of balance monthly / periodic Installments, till such time the entire loan is

paid off.

17. The Lender is entitled to add to, delete or modify all or any of the terms and conditions of the Loan applicable

to the Loan by providing a written notice to the Borrower.

18. The Borrower acknowledges that, by giving the loan facility, Lender have not and do not intend to give any

professional advice or make any statement regarding taxation and related benefits. The Borrower/s will

independently consult/have consulted its tax advisors/ other professionals for their financial planning and tax

assessment/s.

Signature Borrower Co-Borrower/s Guarantor

Date:

19. The Borrower/s expressly undertake that.

a. Payment of installments shall be under the NACH/ECS mandate for appropriate administration of loan

account;

b. Lender will be entitled to present NACH on the due date, despite prior or additional payments if any;

c. Any additional payment in the loan account will be adjusted against the amounts payable/ in terms of the

loan agreement;

d. Lender will not be obliged to suspend NACH presentation for any reason whatsoever.

20. Additional Interest/Default Charges (including on non - compliance of loan terms): 24% p.a.

21. The customer is required to submit the remittance proof within a maximum timeline of 30 days. If the

customer fails to submit the forex remittance proof within defined timeline of 30 days then the Rate of Interest on

the loan will get increased by 1% without any further notice. The increased rate will be applicable until the

pending PDD is cured or the loan is recalled. For Pre-Visa cases, timeline will only be applicable after removal

of the lien.

Note : This is a computer generated Letter hence no signature is required.

Signature Borrower Co-Borrower/s Guarantor

Date:

You might also like

- Sanction Letter-A2210353706Document1 pageSanction Letter-A2210353706Venkatesh Doodam100% (1)

- Sanction Letter-A2210353706Document1 pageSanction Letter-A2210353706Venkatesh Doodam100% (1)

- Early Salary Noc - LetterDocument1 pageEarly Salary Noc - LettersidvikventuresNo ratings yet

- Axis Card Payment ReceiptDocument1 pageAxis Card Payment Receiptunicornfinance7869No ratings yet

- Sanction Letter A2301300139 1Document1 pageSanction Letter A2301300139 1Mohammed Masood50% (2)

- Raya Venkata ReddyDocument1 pageRaya Venkata Reddyraja reddy ThotapalliNo ratings yet

- (AUS) UG Admission Letter 1.2.6Document3 pages(AUS) UG Admission Letter 1.2.6cheerlife0723No ratings yet

- Kotak Sanction LetterDocument1 pageKotak Sanction LetterKeshav MahatoNo ratings yet

- Specimen of Education Loan Sanction LetterDocument1 pageSpecimen of Education Loan Sanction LetterNisheeth Jaiswal100% (1)

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- CHISOM GWF067513935 BRP Decision 2022-10-28Document3 pagesCHISOM GWF067513935 BRP Decision 2022-10-28sophie abdullahiNo ratings yet

- GO2Bank Template 2Document5 pagesGO2Bank Template 2Tony CasseroNo ratings yet

- Loan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)Document19 pagesLoan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)niranjan krishnaNo ratings yet

- Sample Bank Loan Sanction Letter: Subject: Education Loan: Limit Rs. 20 LakhsDocument2 pagesSample Bank Loan Sanction Letter: Subject: Education Loan: Limit Rs. 20 LakhsAbhishekNarangNo ratings yet

- True Credits Private Limited: Loan Sanction LetterDocument17 pagesTrue Credits Private Limited: Loan Sanction LetterSrinivasu Chintala100% (1)

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Education LoansDocument4 pagesEducation LoansManzer ImamNo ratings yet

- Solvency Certificate PDFDocument1 pageSolvency Certificate PDFBRIJENDRANo ratings yet

- HDFC Loan EMI Bill Payments - Billdesk122019 PDFDocument1 pageHDFC Loan EMI Bill Payments - Billdesk122019 PDFPrasadNo ratings yet

- MRL3702-Text Book SummaryDocument24 pagesMRL3702-Text Book SummarynigelNo ratings yet

- Sanction LetterDocument17 pagesSanction LetterAbhishek gautamNo ratings yet

- Sanction Letter 1Document13 pagesSanction Letter 1RohithNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Loan LetterDocument4 pagesLoan Lettermohd.hadi36No ratings yet

- Education Loan Sanction Letter TemplateDocument1 pageEducation Loan Sanction Letter TemplateParam BataviaNo ratings yet

- Ofltr 4311063 181103114418718 1 3Document3 pagesOfltr 4311063 181103114418718 1 3폴로 쥰 차No ratings yet

- Education Loan: NF-546 NF-416 NF-440Document11 pagesEducation Loan: NF-546 NF-416 NF-440Santosh Kumar50% (2)

- HL Sanction LetterDocument4 pagesHL Sanction LetterAarib ZaidiNo ratings yet

- Solvency CertificateDocument1 pageSolvency CertificateOnkar KharadkarNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)No ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Insta Overdraft Facility (Insta Od) Application FormDocument8 pagesInsta Overdraft Facility (Insta Od) Application Formsanjay sharmaNo ratings yet

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarNo ratings yet

- Welcome LetterDocument3 pagesWelcome LetterDeepak DevasiNo ratings yet

- SBI - Fixed Deposit Account DeviDocument1 pageSBI - Fixed Deposit Account DevialvinrichartNo ratings yet

- MockLoanLetter PDFDocument1 pageMockLoanLetter PDFDeepak Reddy RakasiNo ratings yet

- Fixed DepositDocument1 pageFixed Depositjavedmonis07No ratings yet

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- FD Certificate PDFDocument1 pageFD Certificate PDFDilip DineshNo ratings yet

- Declaration 80EEDocument1 pageDeclaration 80EERanga.SathyaNo ratings yet

- Visa Letter and Certificate of InsuranceDocument7 pagesVisa Letter and Certificate of InsuranceThuy TaNo ratings yet

- Solvency CertificateDocument1 pageSolvency CertificateTwisha PandeyNo ratings yet

- WelcomeKit - T02972221022093313 - 2 Feb 2023Document3 pagesWelcomeKit - T02972221022093313 - 2 Feb 2023rajkumar sainiNo ratings yet

- IBS Mumbai PDFDocument1 pageIBS Mumbai PDFRajesh Kumar PatnaikNo ratings yet

- Date: 11.06.2019: FD Balance As On 31.03.2020Document14 pagesDate: 11.06.2019: FD Balance As On 31.03.2020DILIP VELHALNo ratings yet

- Solvency Certificate FormatDocument1 pageSolvency Certificate FormatAbhishek DhekaneNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceShivam SinghNo ratings yet

- Noc LetterDocument1 pageNoc LetterSingh SahabNo ratings yet

- Examination Form Online Payment Receipt: SignatureDocument2 pagesExamination Form Online Payment Receipt: SignaturePranabesh RoyNo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGONo ratings yet

- JoginderDocument2 pagesJoginderVikash Kumar100% (1)

- Madhu Balance Certificate PDFDocument1 pageMadhu Balance Certificate PDFpavan kumar teppalaNo ratings yet

- FeesPaymentReceipt 1358Document1 pageFeesPaymentReceipt 1358Subrata DasNo ratings yet

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiNo ratings yet

- Lic Policy For Jeevan BeemaDocument14 pagesLic Policy For Jeevan BeemaPatel ZeelNo ratings yet

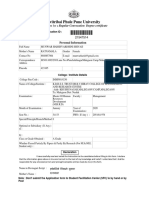

- Savitribai Phule Pune University: Application For A Regular Convocation Degree CertificateDocument2 pagesSavitribai Phule Pune University: Application For A Regular Convocation Degree CertificateharshNo ratings yet

- SBI InsuranceDocument5 pagesSBI InsuranceankurNo ratings yet

- GoAir - BoardingPass - PNR B3FSXI - 16 Nov 2019Document1 pageGoAir - BoardingPass - PNR B3FSXI - 16 Nov 2019sainibuntyNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentRohit chavanNo ratings yet

- Nagoor SANCTION - LETTER - PSI - AVFSDocument16 pagesNagoor SANCTION - LETTER - PSI - AVFSgudavalli0088No ratings yet

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Durgarao 1Document3 pagesDurgarao 1Venkatesh DoodamNo ratings yet

- Offer LetterDocument19 pagesOffer LetterVenkatesh DoodamNo ratings yet

- Order ID 4850435343Document1 pageOrder ID 4850435343Venkatesh DoodamNo ratings yet

- Germany Process DetailsDocument4 pagesGermany Process DetailsVenkatesh DoodamNo ratings yet

- Narrative Report SampleDocument3 pagesNarrative Report SampleChristineLacsamana100% (7)

- SITXHRM009 Student Assessment Tasks.v1.0Document36 pagesSITXHRM009 Student Assessment Tasks.v1.0Jeewan Lamichhane DhanushNo ratings yet

- Public PolicyDocument11 pagesPublic PolicyssebandekejacksonNo ratings yet

- EMP TM: Fisher:Shad:SprtDocument93 pagesEMP TM: Fisher:Shad:SprtplayyceoNo ratings yet

- Tally Assignment1Document9 pagesTally Assignment1Pixel PlanetNo ratings yet

- 3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlyDocument5 pages3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlySabeoNo ratings yet

- Using Project CostingDocument134 pagesUsing Project CostingmanitenkasiNo ratings yet

- Income Taxation Unit 2 - PreludeDocument8 pagesIncome Taxation Unit 2 - PreludeEllieNo ratings yet

- FINANCIAL MANAGEMENT Learning Assessment Ch1 & Ch3Document3 pagesFINANCIAL MANAGEMENT Learning Assessment Ch1 & Ch3JoongNo ratings yet

- BSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliDocument3 pagesBSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliFiroz ShaikhNo ratings yet

- Anibal Garcia Venezuela: Sheet # Content Sheet # ContentDocument33 pagesAnibal Garcia Venezuela: Sheet # Content Sheet # ContentDayronToro0% (1)

- GNV Tax News December 2021Document6 pagesGNV Tax News December 2021BenjaminNo ratings yet

- John Insurance Middle EastDocument52 pagesJohn Insurance Middle Eastjohn.brunoNo ratings yet

- Contracts Project With FootnotesDocument34 pagesContracts Project With FootnotesNalini chandrakarNo ratings yet

- (PDF) Strategy and Organisation at Singapore Airlines - Achieving Sustainable Advantage Through Dual StrategyDocument6 pages(PDF) Strategy and Organisation at Singapore Airlines - Achieving Sustainable Advantage Through Dual Strategyishkol39No ratings yet

- Sekarningsih, Dkk. (2020)Document7 pagesSekarningsih, Dkk. (2020)iwang saudjiNo ratings yet

- Bank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)Document30 pagesBank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)jyottsnaNo ratings yet

- Unit 9 Recent Trends in Human Resource ManagementDocument33 pagesUnit 9 Recent Trends in Human Resource ManagementSujina BadalNo ratings yet

- The Seeding Company CEDE TRUST Owned by DTCDocument14 pagesThe Seeding Company CEDE TRUST Owned by DTCRoosevelt Kyle100% (2)

- Market Intelligence Report Mid TermDocument15 pagesMarket Intelligence Report Mid TermUmer ZindaniNo ratings yet

- Internship Report SampleDocument13 pagesInternship Report SamplekomalNo ratings yet

- AI Implementation in Org & ConclusionDocument3 pagesAI Implementation in Org & ConclusionAnish DalmiaNo ratings yet

- Employers Requirements - ASV Zone 1 Zone 7 Building Asset ContractorDocument107 pagesEmployers Requirements - ASV Zone 1 Zone 7 Building Asset ContractorRaees AhmedNo ratings yet

- Semua Online Assesment Mira Sem 4Document6 pagesSemua Online Assesment Mira Sem 4Hamierul MohamadNo ratings yet

- CreditCard PDS ENGDocument8 pagesCreditCard PDS ENGzainulariffhusaini2No ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentDebabrata PaulNo ratings yet

- Chapter 4 - Foundations of PlanningDocument6 pagesChapter 4 - Foundations of PlanningMy KiềuNo ratings yet

- Aggregate Demand II: Applying The - Model: IS LMDocument14 pagesAggregate Demand II: Applying The - Model: IS LMhujjajNo ratings yet