Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsBIR - Ruling DA-263-00 (20 June 2000)

BIR - Ruling DA-263-00 (20 June 2000)

Uploaded by

josephine.t.ycongMs. Marilyn Angeles had a contract to purchase a condominium unit, paying in installments. She wanted to assign her rights in the contract to Spouses Ricardo and Estela Bernabe in exchange for repayment of her payments. The developer said this would require paying capital gains tax and documentary stamp tax. However, the BIR ruled that an assignment of rights is not a sale or disposition, so the capital gains tax does not apply. It also does not require documentary stamp tax, though the notarial acknowledgment is subject to a P15 documentary stamp fee. The gain derived by Ms. Angeles would be subject to income tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Gre AwaDocument286 pagesGre Awaprudhvi chNo ratings yet

- I 843Document6 pagesI 843ayi imaduddinNo ratings yet

- BIR - Ruling DA-026-00 (11 January 2000)Document2 pagesBIR - Ruling DA-026-00 (11 January 2000)josephine.t.ycongNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- Bir Ruling (Da - (C-179) 464-09)Document4 pagesBir Ruling (Da - (C-179) 464-09)E ENo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- 5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wDocument2 pages5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wCarlo AlfonsoNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- CIR V Filinvest PDFDocument24 pagesCIR V Filinvest PDFJoyce KevienNo ratings yet

- BIR Ruling No. 522-2017Document7 pagesBIR Ruling No. 522-2017liz kawiNo ratings yet

- BIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Document6 pagesBIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Hailin QuintosNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- 2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pDocument3 pages2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pVence EugalcaNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- 2000 ITAD RulingsDocument409 pages2000 ITAD RulingsJerwin DaveNo ratings yet

- 12.01.13 MOCK - Real Estate Taxation SolutionsDocument4 pages12.01.13 MOCK - Real Estate Taxation SolutionsMiggy Zurita100% (5)

- Bir Ruling (Da - (C-104) 328-08)Document3 pagesBir Ruling (Da - (C-104) 328-08)E ENo ratings yet

- Bir Vat (Case)Document16 pagesBir Vat (Case)Jay Ryan Sy BaylonNo ratings yet

- TAX - Documentary Stamp Tax CasesDocument9 pagesTAX - Documentary Stamp Tax CasesMarife Tubilag ManejaNo ratings yet

- Petitioner Vs Vs Respondents: First DivisionDocument37 pagesPetitioner Vs Vs Respondents: First DivisionmarkcatabijanNo ratings yet

- Bir Ruling (Da-042-04)Document3 pagesBir Ruling (Da-042-04)E ENo ratings yet

- Placer DomeDocument18 pagesPlacer DomeMaisie ZabalaNo ratings yet

- BIR Ruling No. 389-16 - Department of Public Works and HighwaysDocument3 pagesBIR Ruling No. 389-16 - Department of Public Works and HighwaysOmie AmpangNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- 116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFDocument12 pages116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFVener Angelo MargalloNo ratings yet

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- CIR Vs Filinvest Development Corporation - Tax CaseDocument17 pagesCIR Vs Filinvest Development Corporation - Tax CaseKyle AlmeroNo ratings yet

- Cta 00 CV 03475 D 1987may20 Ass PDFDocument12 pagesCta 00 CV 03475 D 1987may20 Ass PDFjjbbrrNo ratings yet

- Ate Riah 2014 Tax Bar Q and ADocument19 pagesAte Riah 2014 Tax Bar Q and Adnel13No ratings yet

- BIR Ruling No. 340-11 - E-BooksDocument5 pagesBIR Ruling No. 340-11 - E-BooksCkey ArNo ratings yet

- BIR RULING NO. 498-93: Pastelero Law OfficeDocument2 pagesBIR RULING NO. 498-93: Pastelero Law OfficeLee Anne YabutNo ratings yet

- Silicon Phil. Vs CIRDocument8 pagesSilicon Phil. Vs CIRGladys BantilanNo ratings yet

- Cir Vs FilinvestDocument17 pagesCir Vs FilinvestJeff GomezNo ratings yet

- Annex A - CIR V Filinvest (July 19, 2011)Document40 pagesAnnex A - CIR V Filinvest (July 19, 2011)Jean RNo ratings yet

- BIR Ruling No. 015-12Document5 pagesBIR Ruling No. 015-12nikkaremullaNo ratings yet

- Mar 0 S: Republic of The Philippines Court of Tax Appeals Quezon CityDocument10 pagesMar 0 S: Republic of The Philippines Court of Tax Appeals Quezon Citycatherine martinNo ratings yet

- 1.8 CIR V FilInvestDocument11 pages1.8 CIR V FilInvestJayNo ratings yet

- 1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yDocument2 pages1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yJM CBNo ratings yet

- Denden 1028Document779 pagesDenden 1028Dence Cris RondonNo ratings yet

- GR No. 166786 M Lhuillier V CIR (Good Faith)Document10 pagesGR No. 166786 M Lhuillier V CIR (Good Faith)Jerwin DaveNo ratings yet

- CIR Vs Filinvest Development CorpoDocument18 pagesCIR Vs Filinvest Development CorpoGabby ElardoNo ratings yet

- La TondenaDocument15 pagesLa TondenaJae LeeNo ratings yet

- Rules of Civil Procedure Are The Decisions Rendered by The Court of Appeals (CA) in TheDocument25 pagesRules of Civil Procedure Are The Decisions Rendered by The Court of Appeals (CA) in TheYhelene Marie Avenido-AbiasNo ratings yet

- CIR v. Placer DomeDocument9 pagesCIR v. Placer DomeKristineSherikaChyNo ratings yet

- Dizon Vs CIRDocument3 pagesDizon Vs CIRRay John Uy-Maldecer AgregadoNo ratings yet

- Cathay Land Inc. and Masa Homes Wholesale Partnership Term SheetDocument2 pagesCathay Land Inc. and Masa Homes Wholesale Partnership Term SheetMitz CerialesNo ratings yet

- Cir Vs FilinvestDocument10 pagesCir Vs FilinvestShiena Lou B. Amodia-RabacalNo ratings yet

- Da 404 05Document4 pagesDa 404 05fatmaaleahNo ratings yet

- SILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Document7 pagesSILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Francise Mae Montilla MordenoNo ratings yet

- Republic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Document18 pagesRepublic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Jopan SJNo ratings yet

- Limcoma Rural Bank, Inc. June 25, 2010Document4 pagesLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNo ratings yet

- COCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)Document5 pagesCOCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)ELIXABETH LEENo ratings yet

- BIR Ruling Dated 21dec1972 (STT, Nominee-SB)Document2 pagesBIR Ruling Dated 21dec1972 (STT, Nominee-SB)Hailin QuintosNo ratings yet

- BIR RULING NO. 278-13: Noritake Porcelana MFG., IncDocument3 pagesBIR RULING NO. 278-13: Noritake Porcelana MFG., IncJoyceMendozaNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresRating: 4.5 out of 5 stars4.5/5 (9)

- Tender Document Sanitary PadDocument94 pagesTender Document Sanitary PadImdadHussainOPositiveNo ratings yet

- Tax Treaties Between Philippines and USADocument32 pagesTax Treaties Between Philippines and USACzarina Danielle EsequeNo ratings yet

- Certificate in Science and Technology Assignment 2 - Question BookletDocument8 pagesCertificate in Science and Technology Assignment 2 - Question BookletpNo ratings yet

- Vodacom TZ 2023 Annual ReportDocument164 pagesVodacom TZ 2023 Annual ReportGabriel MwangendeNo ratings yet

- Circular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Document3 pagesCircular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Vivek AgarwalNo ratings yet

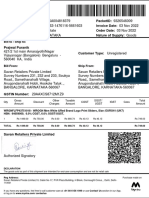

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPrajwal PuranikNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaJuhi AwasthiNo ratings yet

- Strategic Sustainable DevelopmentDocument18 pagesStrategic Sustainable DevelopmentLuis F. González DíazNo ratings yet

- Consti G1 G12Document523 pagesConsti G1 G12River Mia RomeroNo ratings yet

- Shivam MobileDocument1 pageShivam MobileShivam GuptaNo ratings yet

- VAT Tax CreditsDocument3 pagesVAT Tax Creditsdarlene floresNo ratings yet

- Soriano vs. Secretary of FinanceDocument3 pagesSoriano vs. Secretary of FinanceDenn Geocip SalimbangonNo ratings yet

- CT20220906003383-1-Resaaa01 - TikTok X CreatoDocument73 pagesCT20220906003383-1-Resaaa01 - TikTok X CreatoResa SuryaniNo ratings yet

- An Important Update: Benefit Information IRS Form: What You Need To DoDocument8 pagesAn Important Update: Benefit Information IRS Form: What You Need To DoYordis RamirezNo ratings yet

- Practical SAP US Payroll GuideDocument469 pagesPractical SAP US Payroll GuidekavitasreeNo ratings yet

- Technical Offer From Thermax On 13.05.10Document32 pagesTechnical Offer From Thermax On 13.05.10venka07100% (1)

- PT Oorja Indo KGSDocument27 pagesPT Oorja Indo KGSibadoyeokNo ratings yet

- Module 6Document14 pagesModule 6Tin ZamudioNo ratings yet

- 74101747-Strategic Analysis of Marriot and Starwood MergerDocument15 pages74101747-Strategic Analysis of Marriot and Starwood MergerRaghdaa Raafat100% (2)

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- SAP PartnerEdge VAR Delivered Support Specific Terms and ConditionsDocument16 pagesSAP PartnerEdge VAR Delivered Support Specific Terms and ConditionsTatyNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- Financial Literacy ReflectionDocument1 pageFinancial Literacy Reflectionapi-607918645No ratings yet

- Benefits of Wage EarnersDocument16 pagesBenefits of Wage EarnersJulianaNo ratings yet

- Financial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFDocument65 pagesFinancial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFvanbernie75nn6100% (10)

- Rhom Apollo vs. CIRDocument1 pageRhom Apollo vs. CIRKia BiNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Re Linguist Opportunity at VoxCroftDocument13 pagesRe Linguist Opportunity at VoxCroftderejesfufaNo ratings yet

BIR - Ruling DA-263-00 (20 June 2000)

BIR - Ruling DA-263-00 (20 June 2000)

Uploaded by

josephine.t.ycong0 ratings0% found this document useful (0 votes)

8 views2 pagesMs. Marilyn Angeles had a contract to purchase a condominium unit, paying in installments. She wanted to assign her rights in the contract to Spouses Ricardo and Estela Bernabe in exchange for repayment of her payments. The developer said this would require paying capital gains tax and documentary stamp tax. However, the BIR ruled that an assignment of rights is not a sale or disposition, so the capital gains tax does not apply. It also does not require documentary stamp tax, though the notarial acknowledgment is subject to a P15 documentary stamp fee. The gain derived by Ms. Angeles would be subject to income tax.

Original Description:

Original Title

BIR_Ruling DA-263-00 (20 June 2000)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMs. Marilyn Angeles had a contract to purchase a condominium unit, paying in installments. She wanted to assign her rights in the contract to Spouses Ricardo and Estela Bernabe in exchange for repayment of her payments. The developer said this would require paying capital gains tax and documentary stamp tax. However, the BIR ruled that an assignment of rights is not a sale or disposition, so the capital gains tax does not apply. It also does not require documentary stamp tax, though the notarial acknowledgment is subject to a P15 documentary stamp fee. The gain derived by Ms. Angeles would be subject to income tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesBIR - Ruling DA-263-00 (20 June 2000)

BIR - Ruling DA-263-00 (20 June 2000)

Uploaded by

josephine.t.ycongMs. Marilyn Angeles had a contract to purchase a condominium unit, paying in installments. She wanted to assign her rights in the contract to Spouses Ricardo and Estela Bernabe in exchange for repayment of her payments. The developer said this would require paying capital gains tax and documentary stamp tax. However, the BIR ruled that an assignment of rights is not a sale or disposition, so the capital gains tax does not apply. It also does not require documentary stamp tax, though the notarial acknowledgment is subject to a P15 documentary stamp fee. The gain derived by Ms. Angeles would be subject to income tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

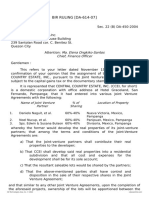

June 20, 2000

BIR RULING [DA-263-00]

24 (D) (1); DA-466-99

Ms. Marilyn B. Angeles

21 Apollo St., Acropolis

Quezon City

Madam:

This refers to your letter dated April 12, 2000 stating that you are

presently paying a four-year installment plan under a Contract to Sell for a

condominium unit of 31.22 sq.m. (Unit 912) of the Cityland Shaw Tower, a

building project of Cityland, Inc. located at Shaw Blvd. cor. St. Francis St.,

Mandaluyong City; that the contract price of the aforesaid condominium unit

is One Million Two Hundred Thirty One Thousand One Hundred Eighty Three

Pesos and Seventy Five Centavos (P1,231,183.75) (excluding interest) of

which you have already paid Seven Hundred Sixty Four Thousand Nine

Hundred Ninety One Pesos and Seventy Five Centavos (P764,991.75)

[P246,236.75 as downpayment plus P518,755.00 equivalent to twenty (20)

months amortization]; that at present you are assigning your rights under

this contract to Spouses Ricardo and Estela Bernabe because of financial

reasons; that in consideration of the transfer of rights, spouses Ricardo and

Estela Bernabe will pay you back the payments you have made for the said

condominium unit; and that in this regard, the developer, Cityland, Inc.,

requires the payment of capital gains tax of six percent (6%) and

documentary stamp tax of one and one-half percent (1.5%).

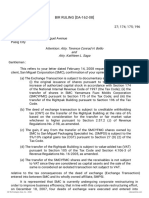

Based on the foregoing representation and documents submitted, you

are now requesting for a ruling that you are exempted from the payment of

capital gains tax and documentary stamp tax on your Assignment of Rights

with Assumption of Obligations in the Contract to Sell in favor of Spouses

Ricardo and Estela Bernabe.

In reply, please be informed that under Section 24(D)(1) of the Tax

Code of 1997, a final tax of six percent (6%) based on the gross selling price

or current fair market value as determined in accordance with Section 6(E)

of the Tax Code of 1997, whichever is higher, is imposed upon capital gains

presumed to have been realized from the sale, exchange, or other

disposition of real property located in the Philippines classified as capital

asset including pacto de retro sales and other forms of conditional sales, by

individuals, including estates and trust. cdlex

In the instant case, however, the transfer of your property in favor of

Spouses Ricardo and Estela Bernabe was not a sale, exchange or disposition

of real property classified as capital asset located in the Philippine but rather

an assignment of right pertaining to such property, hence, not included

within the provision of Section 24(D)(1) of the Tax Code of 1997. This is so,

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

considering that in assignment of right, the assignee merely steps into the

shoes of the assignor without acquiring a better right that what the assignor

had in the property to which the assigned right pertains.

Moreover, a Deed of Assignment of Rights is not a Deed of Sale

because what is conveyed by the assignor is not the property itself but the

rights pertaining to such property. It is, however, understood that the gain

derived by the assignor from and as a consequence thereof, is subject to

income tax. Cdpr

Accordingly, the assignment of your rights over the said property in

favor of Spouses Ricardo and Estela Bernabe is not subject to the capital

gains tax imposed under Section 24(D)(1) of the Tax Code of 1997, nor to

the documentary stamp tax prescribed under Section 196 of the same Code.

The notarial acknowledgment of the deed however, is subject to P15.00

documentary stamp pursuant to Sec. 188 of the Tax Code of 1997. (DA-466-

99 dated August 13, 1999)

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the

facts are different, then this ruling shall be considered null and void.

Very truly yours,

Commissioner of Internal Revenue

By:

(SGD.) LILIAN B. HEFTI

OIC, Deputy Commissioner

(Legal and Inspection Group)

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Gre AwaDocument286 pagesGre Awaprudhvi chNo ratings yet

- I 843Document6 pagesI 843ayi imaduddinNo ratings yet

- BIR - Ruling DA-026-00 (11 January 2000)Document2 pagesBIR - Ruling DA-026-00 (11 January 2000)josephine.t.ycongNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- Bir Ruling (Da - (C-179) 464-09)Document4 pagesBir Ruling (Da - (C-179) 464-09)E ENo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- 5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wDocument2 pages5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8wCarlo AlfonsoNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- CIR V Filinvest PDFDocument24 pagesCIR V Filinvest PDFJoyce KevienNo ratings yet

- BIR Ruling No. 522-2017Document7 pagesBIR Ruling No. 522-2017liz kawiNo ratings yet

- BIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Document6 pagesBIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Hailin QuintosNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- 2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pDocument3 pages2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pVence EugalcaNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- 2000 ITAD RulingsDocument409 pages2000 ITAD RulingsJerwin DaveNo ratings yet

- 12.01.13 MOCK - Real Estate Taxation SolutionsDocument4 pages12.01.13 MOCK - Real Estate Taxation SolutionsMiggy Zurita100% (5)

- Bir Ruling (Da - (C-104) 328-08)Document3 pagesBir Ruling (Da - (C-104) 328-08)E ENo ratings yet

- Bir Vat (Case)Document16 pagesBir Vat (Case)Jay Ryan Sy BaylonNo ratings yet

- TAX - Documentary Stamp Tax CasesDocument9 pagesTAX - Documentary Stamp Tax CasesMarife Tubilag ManejaNo ratings yet

- Petitioner Vs Vs Respondents: First DivisionDocument37 pagesPetitioner Vs Vs Respondents: First DivisionmarkcatabijanNo ratings yet

- Bir Ruling (Da-042-04)Document3 pagesBir Ruling (Da-042-04)E ENo ratings yet

- Placer DomeDocument18 pagesPlacer DomeMaisie ZabalaNo ratings yet

- BIR Ruling No. 389-16 - Department of Public Works and HighwaysDocument3 pagesBIR Ruling No. 389-16 - Department of Public Works and HighwaysOmie AmpangNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- 116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFDocument12 pages116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFVener Angelo MargalloNo ratings yet

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- CIR Vs Filinvest Development Corporation - Tax CaseDocument17 pagesCIR Vs Filinvest Development Corporation - Tax CaseKyle AlmeroNo ratings yet

- Cta 00 CV 03475 D 1987may20 Ass PDFDocument12 pagesCta 00 CV 03475 D 1987may20 Ass PDFjjbbrrNo ratings yet

- Ate Riah 2014 Tax Bar Q and ADocument19 pagesAte Riah 2014 Tax Bar Q and Adnel13No ratings yet

- BIR Ruling No. 340-11 - E-BooksDocument5 pagesBIR Ruling No. 340-11 - E-BooksCkey ArNo ratings yet

- BIR RULING NO. 498-93: Pastelero Law OfficeDocument2 pagesBIR RULING NO. 498-93: Pastelero Law OfficeLee Anne YabutNo ratings yet

- Silicon Phil. Vs CIRDocument8 pagesSilicon Phil. Vs CIRGladys BantilanNo ratings yet

- Cir Vs FilinvestDocument17 pagesCir Vs FilinvestJeff GomezNo ratings yet

- Annex A - CIR V Filinvest (July 19, 2011)Document40 pagesAnnex A - CIR V Filinvest (July 19, 2011)Jean RNo ratings yet

- BIR Ruling No. 015-12Document5 pagesBIR Ruling No. 015-12nikkaremullaNo ratings yet

- Mar 0 S: Republic of The Philippines Court of Tax Appeals Quezon CityDocument10 pagesMar 0 S: Republic of The Philippines Court of Tax Appeals Quezon Citycatherine martinNo ratings yet

- 1.8 CIR V FilInvestDocument11 pages1.8 CIR V FilInvestJayNo ratings yet

- 1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yDocument2 pages1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yJM CBNo ratings yet

- Denden 1028Document779 pagesDenden 1028Dence Cris RondonNo ratings yet

- GR No. 166786 M Lhuillier V CIR (Good Faith)Document10 pagesGR No. 166786 M Lhuillier V CIR (Good Faith)Jerwin DaveNo ratings yet

- CIR Vs Filinvest Development CorpoDocument18 pagesCIR Vs Filinvest Development CorpoGabby ElardoNo ratings yet

- La TondenaDocument15 pagesLa TondenaJae LeeNo ratings yet

- Rules of Civil Procedure Are The Decisions Rendered by The Court of Appeals (CA) in TheDocument25 pagesRules of Civil Procedure Are The Decisions Rendered by The Court of Appeals (CA) in TheYhelene Marie Avenido-AbiasNo ratings yet

- CIR v. Placer DomeDocument9 pagesCIR v. Placer DomeKristineSherikaChyNo ratings yet

- Dizon Vs CIRDocument3 pagesDizon Vs CIRRay John Uy-Maldecer AgregadoNo ratings yet

- Cathay Land Inc. and Masa Homes Wholesale Partnership Term SheetDocument2 pagesCathay Land Inc. and Masa Homes Wholesale Partnership Term SheetMitz CerialesNo ratings yet

- Cir Vs FilinvestDocument10 pagesCir Vs FilinvestShiena Lou B. Amodia-RabacalNo ratings yet

- Da 404 05Document4 pagesDa 404 05fatmaaleahNo ratings yet

- SILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Document7 pagesSILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Francise Mae Montilla MordenoNo ratings yet

- Republic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Document18 pagesRepublic of The Philippines Manila: CIR v. Filinvest Dev't. Corp. G.R. No. 163653Jopan SJNo ratings yet

- Limcoma Rural Bank, Inc. June 25, 2010Document4 pagesLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNo ratings yet

- COCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)Document5 pagesCOCOSDE Legal Basis of Condominiums and Condominium Plan by LEE, Elixabeth S. (Leeleebeth)ELIXABETH LEENo ratings yet

- BIR Ruling Dated 21dec1972 (STT, Nominee-SB)Document2 pagesBIR Ruling Dated 21dec1972 (STT, Nominee-SB)Hailin QuintosNo ratings yet

- BIR RULING NO. 278-13: Noritake Porcelana MFG., IncDocument3 pagesBIR RULING NO. 278-13: Noritake Porcelana MFG., IncJoyceMendozaNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresRating: 4.5 out of 5 stars4.5/5 (9)

- Tender Document Sanitary PadDocument94 pagesTender Document Sanitary PadImdadHussainOPositiveNo ratings yet

- Tax Treaties Between Philippines and USADocument32 pagesTax Treaties Between Philippines and USACzarina Danielle EsequeNo ratings yet

- Certificate in Science and Technology Assignment 2 - Question BookletDocument8 pagesCertificate in Science and Technology Assignment 2 - Question BookletpNo ratings yet

- Vodacom TZ 2023 Annual ReportDocument164 pagesVodacom TZ 2023 Annual ReportGabriel MwangendeNo ratings yet

- Circular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Document3 pagesCircular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Vivek AgarwalNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPrajwal PuranikNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaDocument19 pagesDr. Ram Manohar Lohiya National Law University Economics: Parallel Economy in IndiaJuhi AwasthiNo ratings yet

- Strategic Sustainable DevelopmentDocument18 pagesStrategic Sustainable DevelopmentLuis F. González DíazNo ratings yet

- Consti G1 G12Document523 pagesConsti G1 G12River Mia RomeroNo ratings yet

- Shivam MobileDocument1 pageShivam MobileShivam GuptaNo ratings yet

- VAT Tax CreditsDocument3 pagesVAT Tax Creditsdarlene floresNo ratings yet

- Soriano vs. Secretary of FinanceDocument3 pagesSoriano vs. Secretary of FinanceDenn Geocip SalimbangonNo ratings yet

- CT20220906003383-1-Resaaa01 - TikTok X CreatoDocument73 pagesCT20220906003383-1-Resaaa01 - TikTok X CreatoResa SuryaniNo ratings yet

- An Important Update: Benefit Information IRS Form: What You Need To DoDocument8 pagesAn Important Update: Benefit Information IRS Form: What You Need To DoYordis RamirezNo ratings yet

- Practical SAP US Payroll GuideDocument469 pagesPractical SAP US Payroll GuidekavitasreeNo ratings yet

- Technical Offer From Thermax On 13.05.10Document32 pagesTechnical Offer From Thermax On 13.05.10venka07100% (1)

- PT Oorja Indo KGSDocument27 pagesPT Oorja Indo KGSibadoyeokNo ratings yet

- Module 6Document14 pagesModule 6Tin ZamudioNo ratings yet

- 74101747-Strategic Analysis of Marriot and Starwood MergerDocument15 pages74101747-Strategic Analysis of Marriot and Starwood MergerRaghdaa Raafat100% (2)

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- SAP PartnerEdge VAR Delivered Support Specific Terms and ConditionsDocument16 pagesSAP PartnerEdge VAR Delivered Support Specific Terms and ConditionsTatyNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- Financial Literacy ReflectionDocument1 pageFinancial Literacy Reflectionapi-607918645No ratings yet

- Benefits of Wage EarnersDocument16 pagesBenefits of Wage EarnersJulianaNo ratings yet

- Financial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFDocument65 pagesFinancial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFvanbernie75nn6100% (10)

- Rhom Apollo vs. CIRDocument1 pageRhom Apollo vs. CIRKia BiNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Re Linguist Opportunity at VoxCroftDocument13 pagesRe Linguist Opportunity at VoxCroftderejesfufaNo ratings yet