Professional Documents

Culture Documents

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Uploaded by

Nitin BCopyright:

Available Formats

You might also like

- Getnet Dry COFFEE PROJECT Final - OrgDocument41 pagesGetnet Dry COFFEE PROJECT Final - OrgAlelign Tilahun100% (4)

- 101 FDI-SinDocument49 pages101 FDI-SinLê Hoàng Việt HảiNo ratings yet

- Comprehensive Agrarian Reform Law ReviewerDocument13 pagesComprehensive Agrarian Reform Law ReviewerAngela Marie Acielo Almalbis100% (2)

- current-account-dlDocument2 pagescurrent-account-dlr6334943No ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- service-charges-and-fees-of-current-account-for-new-economy-group-20102020Document2 pagesservice-charges-and-fees-of-current-account-for-new-economy-group-20102020VICHAR VIMARSHNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- HSBC Saving Current TariffDocument2 pagesHSBC Saving Current TariffpremiummaharazNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Schedule - A: Schedule of Charges For Depository Services (W.E.F. 01-03-2017)Document1 pageSchedule - A: Schedule of Charges For Depository Services (W.E.F. 01-03-2017)Ajay KumarNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Niyo Global DCB SOCDocument4 pagesNiyo Global DCB SOCbxhhdNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- Table I - Service Charges For Current Accounts and Other Running AccountsDocument8 pagesTable I - Service Charges For Current Accounts and Other Running AccountsAthish KumarNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Schedule of Charges - Apr 19 V - ConciseDocument3 pagesSchedule of Charges - Apr 19 V - ConciseUpendra SahuNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

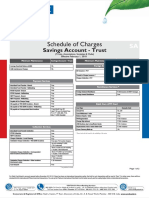

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Schedule of Charges For Demat Account (Resident Indian)Document1 pageSchedule of Charges For Demat Account (Resident Indian)Wing of fireNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- CA Start Up GSFC Wef 01st September 2023Document5 pagesCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaNo ratings yet

- PK 4Document15 pagesPK 4Instagram OfficeNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

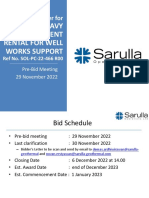

- PT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022Document1 pagePT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022337Corp -HardCORENo ratings yet

- Test Bank For Macroeconomics 3rd Canadian Edition Paul Krugman Robin Wells Iris Au Jack ParkinsonDocument71 pagesTest Bank For Macroeconomics 3rd Canadian Edition Paul Krugman Robin Wells Iris Au Jack ParkinsonDianeBoyerqmjs100% (45)

- PFLPRD 60bf0399b360bDocument2,016 pagesPFLPRD 60bf0399b360bDianne Christine Bacalla - CocaNo ratings yet

- Pride Hospitality Power PointDocument47 pagesPride Hospitality Power PointKaren BerthelsonNo ratings yet

- Sri City 2017 A Look BackDocument12 pagesSri City 2017 A Look Backindraseenayya chilakalaNo ratings yet

- Chinese Coke Plants To Cut Production by 30% To Raise Prices PDFDocument2 pagesChinese Coke Plants To Cut Production by 30% To Raise Prices PDFRajeev MishraNo ratings yet

- Asianpaints Company ProfileDocument7 pagesAsianpaints Company ProfileRakib IslamNo ratings yet

- DeaeratorDocument2 pagesDeaeratorzinha_alNo ratings yet

- Pre-Bid Meeting Presentation - Heavy EquipmentDocument12 pagesPre-Bid Meeting Presentation - Heavy EquipmentNanangNo ratings yet

- MMSY As On 20 04 2022Document16 pagesMMSY As On 20 04 2022Akshay KumarNo ratings yet

- 0-Maintenance PerformanceDocument29 pages0-Maintenance PerformanceMohamed Al-Odat100% (1)

- Shriram Housing Finance List-Of-Collection-AgenciesDocument3 pagesShriram Housing Finance List-Of-Collection-AgenciesSonal GuptaNo ratings yet

- Notice List of Approved DEMIs and PSPs FINAL 1Document5 pagesNotice List of Approved DEMIs and PSPs FINAL 1Fuaad DodooNo ratings yet

- Ch02 World Trade An OverviewDocument32 pagesCh02 World Trade An OverviewEda UstaogluNo ratings yet

- Sigon Beauty Show & K-Beauty Expo Vietnam 2023Document4 pagesSigon Beauty Show & K-Beauty Expo Vietnam 2023Mỹ Nữ DươngNo ratings yet

- Literature Review On Automobile Industry in IndiaDocument4 pagesLiterature Review On Automobile Industry in Indiaea59j0hqNo ratings yet

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- Cajournal Jan2023 9Document3 pagesCajournal Jan2023 9ajitNo ratings yet

- Cambridge International AS & A Level: Business 9609/22Document4 pagesCambridge International AS & A Level: Business 9609/22Ibrahim AbidNo ratings yet

- Sabbour Interview - Business Today PDFDocument3 pagesSabbour Interview - Business Today PDFMohamed ZainNo ratings yet

- Copeland r22 DatasheetDocument3 pagesCopeland r22 DatasheetHector MenesesNo ratings yet

- Life Expectancy of Schneider Electrical Distribution ProductsDocument2 pagesLife Expectancy of Schneider Electrical Distribution ProductsChetan VarmaNo ratings yet

- Draft-For PartnershipDocument104 pagesDraft-For Partnershipjen camNo ratings yet

- Exp KDL April-14 (Excel)Document48 pagesExp KDL April-14 (Excel)vivek_domadiaNo ratings yet

- Automobile Industry Report-2019Document18 pagesAutomobile Industry Report-2019Abhishek MukherjeeNo ratings yet

- Impact of GATT and WTO On Indian ForeignDocument30 pagesImpact of GATT and WTO On Indian Foreignshipra29No ratings yet

- 3.PE Company ListDocument4 pages3.PE Company ListHarunSaripNo ratings yet

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Uploaded by

Nitin BOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Service Charges and Fees For Current Account Club 50 Effective July 01 2022

Uploaded by

Nitin BCopyright:

Available Formats

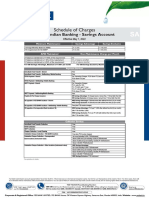

WHOLESALE BANKING PRODUCTS

Schedule of charges - Current Account Club50 CAC50 (w.e.f. July 01, 2022)

Monthly Average Balance (MAB) OR

AQB

Average Quarterly Balance (AQB)

Metro & Urban Branches (in `) 50,00,000

Semi-Urban & Rural Branches (in `) 25,00,000

Charges for Non-Maintenance (in `) 15000 if AQB> = 50% & 25000 if AQB<50%

Complimentary Benefits and Services

• DD/ PO Issuance • Chequebook Issuance • SMS alerts • Standing instructions setup • Certificate of Balance

Cash Deposit - Home &

Monthly limits & charges

Non-Home Branch (Combined)

Free Limit per month (in `)* 2,00,00,000

Charges (Min 50 per txn, in `) 2/1000

Note:

- For CAC50 applicable cash deposit charges will be deducted quarterly

- In case atleast 75% of required scheme MAB/AQB is not maintained, cash deposit free limits for the particular month will become zero

Monthly Service Charge Monthly limits & charges

Charges (Fixed monthly in `) Nil

NEFT/RTGS/IMPS transactions (Outward) Monthly limits & charges

NEFT- from branch (in `) Free

NEFT - other digital channels Free

RTGS- from branch (in `) Free

RTGS - other digital channels Free

IMPS fund transfer (in `) Upto 1,000 - 2.50/- per txn

1,000 to 1 lakh - 5/- per txn

1 lakh to 5 lakh - 10/- per txn

NEFT/RTGS/IMPS inwards transactions are free

Debit Card Charges Business Platinum Business Supreme

ATM Charges - Cash Withdrawal (Non-Axis Bank only) (in `) 20* 20**

ATM Charges - Balance Equiry (Non-Axis Bank only) (in `) 8.5* 8.5**

ATM Charges - Cash Withdrawal & Balance Enquiry Nil Nil

(Axis Bank ATMs) (in `)

Purchase Transaction (POS) Charges (in `) Nil Nil

Issuance Fees (in `) 500*** 1000

Annual Fees (in `) 500*** 1000

*Domestic Cash Withdrawal and balance enquiry on Non-Axis Bank's ATM waived upto first 5 transactions on CAC50

**Free- First 5 transactions (including financial and non-financial) subject to monthly 1 purchase activity

*** NIL for CAC50

Penal Charges - Returns

Cheque Returns (Inward) - Issued by Customer `500 per instrument

Cheque Returns (Outward) - Deposited by Customer 1st return for the month – `50

2nd return onwards for the month – `100

Cheque Returns - Deposited by Customer for 50% of OSC commission;

Outstation Collection Minimum `50 / Cheque + Other bank charges if any

ECS (Debit) Returns `500 per instance

Standing Instruction Reject Fee SI reject due to Credit Card/Loans/

Auto Debit- `250 per reject

SI reject due to RD/MF/SIP- NIL

Other Charges

BNA Convenience charges (Applicable on cash deposit in `50 per transaction

Cash Deposit Machines (CDM) post office hours on working Exceeding `15,000 per month

days and entire day on bank holidays & state holidays) in either single or multiple transaction

Cash handling charges on cash deposited in 2% on the value of cash deposited in

Low Denomination Notes (LDN) Low Denomination Notes, Exceeding `10,000 per month

either single or multiple transaction

Demand Drafts (payable at Correspondent Bank locations `1/1,000; Min. `25 per DD

under Desk Drawing arrangement)

Demand Drafts purchased from other Banks Actual + `0.50/1,000; Min. `50 per DD

DD drawn on Axis Bank branches - Cancellation, `100/- per instance

Reissuance or Revalidation

DD drawn on Correspondent Bank branches - Cancellation, `100/- per instance + other bank's charges at actuals if any

Reissuance or Revalidation

Cheques Deposited at any Axis Bank branch for `100 per instrument

outstation collection

Stop Payment Charges Per Instrument: `50, Per Series: `100

Signature Verification Certificate `50 per verification

Account Statement - Duplicate statement from branch `100 per statement

Account Closure Charges Less than 14 days: Nil

Older than 14 days: `500

NOTE:

• All the terms are subject to change without any prior notice

• All the service charges will attract GST as applicable

• Charges are applicable as per the transactions done during charge cycle period. The charge cycle period shall be first of every month to the last day

of the same month for all scheme codes except Club 50. For Club 50 charge cycle period shall be financial quarters defined as Q1-1st April to 30th June,

Q2-1st July to 30th September, Q3- 1st October to 31st December, Q4-1st January to 31st March

• For Club 50, non-maintenance charges are not applicable for the first financial quarter in which account is opened or converted to Club 50

• Cheque Transactions are subject to 48 hour notice and Bank's confirmations for transaction exceeding Rs 1 Crore a day where the destination branch

is a Non-RBI centre. (RBI centres are: Mumbai, Chennai, Kolkata, New Delhi, Ahmedabad, Hyderabad, Jaipur, Kanpur, Nagpur,Trivandrum, Bhubaneswar,

Chandigarh, Bangalore, Guwahati, Bhopal & Patna)

• All cash transaction of Rs 10 Lacs and above on a single day will require prior intimation and approval of the Branch at least one working day in advance

• Maximum Non-Home Branch Cash Deposit / withdrawal per day shall be Rs 1 Lac. Maximum third party deposit / withdrawal up to 50,000 per day.

Beyond this the cash transactions may be carried out at the discretion of branch head where the cash is being deposited / withdrawn

• Maximum Non-Home Branch Cash Withdrawal is at the discretion of the Branch head where cash is being withdrawn

• For BNA convenience charges post office hours on working days to be considered as 5.00 PM to 9.30 AM and holidays to include all 2nd & 4th Saturdays,

Sundays and National & State Holidays

• Monthly charges applicable in a current account will be based on the scheme code of that account in the current month

• The customer hereby agrees and acknowledges that Bank shall have the right to recover any charges as may be payable by the customer to the Bank,

by debiting or making repeated attempts to recover the same, from any operative account held under same customer id, where funds are available.

• Monthly Average Balance (MAB) or Average Quarterly Balance (AQB) is the average of day end balance maintained by the customer for the duration

• BNA convenience charges are applicable in addition to scheme wise cash deposit charges

• Physical statements will not be sent for the current account where there are no transactions consecutively for 6 months

I / We have chosen to open a CAC50 Current Account with Axis Bank and have understood the facilities and charges applicable

to the said product.

Customer Signature Signature of Branch Staff

Employee ID of Branch Staff

Charges effective from July 01, 2022

For cases processed through BYOD (Paperless Journey), wet signatures are not required on the SOC

You might also like

- Getnet Dry COFFEE PROJECT Final - OrgDocument41 pagesGetnet Dry COFFEE PROJECT Final - OrgAlelign Tilahun100% (4)

- 101 FDI-SinDocument49 pages101 FDI-SinLê Hoàng Việt HảiNo ratings yet

- Comprehensive Agrarian Reform Law ReviewerDocument13 pagesComprehensive Agrarian Reform Law ReviewerAngela Marie Acielo Almalbis100% (2)

- current-account-dlDocument2 pagescurrent-account-dlr6334943No ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- service-charges-and-fees-of-current-account-for-new-economy-group-20102020Document2 pagesservice-charges-and-fees-of-current-account-for-new-economy-group-20102020VICHAR VIMARSHNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- HSBC Saving Current TariffDocument2 pagesHSBC Saving Current TariffpremiummaharazNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Schedule - A: Schedule of Charges For Depository Services (W.E.F. 01-03-2017)Document1 pageSchedule - A: Schedule of Charges For Depository Services (W.E.F. 01-03-2017)Ajay KumarNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Niyo Global DCB SOCDocument4 pagesNiyo Global DCB SOCbxhhdNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- Table I - Service Charges For Current Accounts and Other Running AccountsDocument8 pagesTable I - Service Charges For Current Accounts and Other Running AccountsAthish KumarNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Schedule of Charges - Apr 19 V - ConciseDocument3 pagesSchedule of Charges - Apr 19 V - ConciseUpendra SahuNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Schedule of Charges For Demat Account (Resident Indian)Document1 pageSchedule of Charges For Demat Account (Resident Indian)Wing of fireNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- CA Start Up GSFC Wef 01st September 2023Document5 pagesCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaNo ratings yet

- PK 4Document15 pagesPK 4Instagram OfficeNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- PT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022Document1 pagePT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022337Corp -HardCORENo ratings yet

- Test Bank For Macroeconomics 3rd Canadian Edition Paul Krugman Robin Wells Iris Au Jack ParkinsonDocument71 pagesTest Bank For Macroeconomics 3rd Canadian Edition Paul Krugman Robin Wells Iris Au Jack ParkinsonDianeBoyerqmjs100% (45)

- PFLPRD 60bf0399b360bDocument2,016 pagesPFLPRD 60bf0399b360bDianne Christine Bacalla - CocaNo ratings yet

- Pride Hospitality Power PointDocument47 pagesPride Hospitality Power PointKaren BerthelsonNo ratings yet

- Sri City 2017 A Look BackDocument12 pagesSri City 2017 A Look Backindraseenayya chilakalaNo ratings yet

- Chinese Coke Plants To Cut Production by 30% To Raise Prices PDFDocument2 pagesChinese Coke Plants To Cut Production by 30% To Raise Prices PDFRajeev MishraNo ratings yet

- Asianpaints Company ProfileDocument7 pagesAsianpaints Company ProfileRakib IslamNo ratings yet

- DeaeratorDocument2 pagesDeaeratorzinha_alNo ratings yet

- Pre-Bid Meeting Presentation - Heavy EquipmentDocument12 pagesPre-Bid Meeting Presentation - Heavy EquipmentNanangNo ratings yet

- MMSY As On 20 04 2022Document16 pagesMMSY As On 20 04 2022Akshay KumarNo ratings yet

- 0-Maintenance PerformanceDocument29 pages0-Maintenance PerformanceMohamed Al-Odat100% (1)

- Shriram Housing Finance List-Of-Collection-AgenciesDocument3 pagesShriram Housing Finance List-Of-Collection-AgenciesSonal GuptaNo ratings yet

- Notice List of Approved DEMIs and PSPs FINAL 1Document5 pagesNotice List of Approved DEMIs and PSPs FINAL 1Fuaad DodooNo ratings yet

- Ch02 World Trade An OverviewDocument32 pagesCh02 World Trade An OverviewEda UstaogluNo ratings yet

- Sigon Beauty Show & K-Beauty Expo Vietnam 2023Document4 pagesSigon Beauty Show & K-Beauty Expo Vietnam 2023Mỹ Nữ DươngNo ratings yet

- Literature Review On Automobile Industry in IndiaDocument4 pagesLiterature Review On Automobile Industry in Indiaea59j0hqNo ratings yet

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- Cajournal Jan2023 9Document3 pagesCajournal Jan2023 9ajitNo ratings yet

- Cambridge International AS & A Level: Business 9609/22Document4 pagesCambridge International AS & A Level: Business 9609/22Ibrahim AbidNo ratings yet

- Sabbour Interview - Business Today PDFDocument3 pagesSabbour Interview - Business Today PDFMohamed ZainNo ratings yet

- Copeland r22 DatasheetDocument3 pagesCopeland r22 DatasheetHector MenesesNo ratings yet

- Life Expectancy of Schneider Electrical Distribution ProductsDocument2 pagesLife Expectancy of Schneider Electrical Distribution ProductsChetan VarmaNo ratings yet

- Draft-For PartnershipDocument104 pagesDraft-For Partnershipjen camNo ratings yet

- Exp KDL April-14 (Excel)Document48 pagesExp KDL April-14 (Excel)vivek_domadiaNo ratings yet

- Automobile Industry Report-2019Document18 pagesAutomobile Industry Report-2019Abhishek MukherjeeNo ratings yet

- Impact of GATT and WTO On Indian ForeignDocument30 pagesImpact of GATT and WTO On Indian Foreignshipra29No ratings yet

- 3.PE Company ListDocument4 pages3.PE Company ListHarunSaripNo ratings yet