Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsNotification 98 2023

Notification 98 2023

Uploaded by

tax.contactThis notification provides income tax exemption to the Press Council of India for assessment years 2019-2023 under section 10 of the Income Tax Act of 1961. It exempts the Council's income from levies on newspapers and interest earned on bank accounts. This exemption is subject to conditions that the Council not engage in commercial activities, its activities and income sources remain unchanged, and it files tax returns as required. The notification applies retrospectively to the listed assessment years corresponding to financial years 2018-2023.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Notification 97 2023Document1 pageNotification 97 2023tax.contactNo ratings yet

- Notification 93 2023Document1 pageNotification 93 2023tax.contactNo ratings yet

- Ministry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Document1 pageMinistry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Vishal KanadeNo ratings yet

- Notification 3Document1 pageNotification 3Parmeet NainNo ratings yet

- Ministry of Finance (Department of Revenue) : ART ECDocument1 pageMinistry of Finance (Department of Revenue) : ART ECVishal KanadeNo ratings yet

- Notification 1Document1 pageNotification 1Parmeet NainNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- 02 2024 CT EngDocument1 page02 2024 CT EngSSSARMANo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- Amendment Recruitment Rules 24082023Document3 pagesAmendment Recruitment Rules 24082023Dilip BannerjiNo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- SRO774 2023-Amendment SRO 645 2018-24-05-2018Document1 pageSRO774 2023-Amendment SRO 645 2018-24-05-2018owaisharifNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- 11 2024 CT EngDocument1 page11 2024 CT EngaekurnoolNo ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryDocument2 pagesNotification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryIshanNo ratings yet

- CBDT Circular No. 9 2023Document1 pageCBDT Circular No. 9 2023ABUBAKARNo ratings yet

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- The March, 2017: Amend (Inspector) Recruitment RulesDocument1 pageThe March, 2017: Amend (Inspector) Recruitment RulesRanjitNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- CST 17 2024Document1 pageCST 17 2024ndshiva22No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- (Falling Under Section 28 (9) (B) of The)Document1 page(Falling Under Section 28 (9) (B) of The)Anonymous Gg6z0u9IBzNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- Import Gatt DeclarationDocument2 pagesImport Gatt Declarationishan guptaNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument10 pagesSupplement Executive Programme: For June, 2021 ExaminationSP CONTRACTORNo ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- 20 Lakh After 29 March 2018Document1 page20 Lakh After 29 March 2018MCB ACCOUNT BRANCHNo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- June 2020 SP 2Document27 pagesJune 2020 SP 2Avinash ShettyNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- Circular 9 2021Document3 pagesCircular 9 2021Camp Asst. to ADGP AdministrationNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- John Ruginski and Ines E. Franco Zapata v. Immigration and Naturalization Service, 942 F.2d 13, 1st Cir. (1991)Document8 pagesJohn Ruginski and Ines E. Franco Zapata v. Immigration and Naturalization Service, 942 F.2d 13, 1st Cir. (1991)Scribd Government DocsNo ratings yet

- 265955-2020-Misamis - Oriental - Rural - Electric - Service - Case of Reassignment of Officers Without Reissuance of LOADocument4 pages265955-2020-Misamis - Oriental - Rural - Electric - Service - Case of Reassignment of Officers Without Reissuance of LOAJohn Patrick GuillenNo ratings yet

- Commercial Agency Private AgreementDocument6 pagesCommercial Agency Private AgreementMenna ElabdeenyNo ratings yet

- ABBOTT LABORATORIES, PHILIPPINES, CECILLE A. TERRIBLE, EDWIN D. FEIST, MARIA OLIVIA T. YABUT-MISA, TERESITA C. BERNARDO, AND ALLAN G. ALMAZAR, PetitionersDocument7 pagesABBOTT LABORATORIES, PHILIPPINES, CECILLE A. TERRIBLE, EDWIN D. FEIST, MARIA OLIVIA T. YABUT-MISA, TERESITA C. BERNARDO, AND ALLAN G. ALMAZAR, PetitionerselmerNo ratings yet

- Tacay V RTC Tagum, Davao Del NorteDocument3 pagesTacay V RTC Tagum, Davao Del Nortemaginoo69No ratings yet

- Corey Cagle Mason OH Debt Collector DenialDocument7 pagesCorey Cagle Mason OH Debt Collector DenialghostgripNo ratings yet

- Supreme Court Judgment On Scope of Appeal Against Arbitral AwardDocument90 pagesSupreme Court Judgment On Scope of Appeal Against Arbitral AwardLatest Laws TeamNo ratings yet

- Yuk Ling Ong v. CoDocument7 pagesYuk Ling Ong v. CoElla CanuelNo ratings yet

- How To Brief A CaseDocument4 pagesHow To Brief A CaseIljuha9No ratings yet

- Corrections TerminologiesDocument3 pagesCorrections TerminologiesFrancha AndradeNo ratings yet

- 01 - Ang Kek Chen vs. Javalera-SulitDocument8 pages01 - Ang Kek Chen vs. Javalera-SulitanajuanitoNo ratings yet

- 1 Cebu - State - College - of - Science - and - Technology PDFDocument11 pages1 Cebu - State - College - of - Science - and - Technology PDFVia Rhidda ImperialNo ratings yet

- 3.conrado Lindo Vs Comelec (CD)Document1 page3.conrado Lindo Vs Comelec (CD)Deanne Mitzi SomolloNo ratings yet

- CIT v. Vegetable Products Ltd.Document4 pagesCIT v. Vegetable Products Ltd.Karsin ManochaNo ratings yet

- Sibulo Vs IlaganDocument7 pagesSibulo Vs IlaganAnonymous p8aVCBx7No ratings yet

- Lorie Marie Tomas Callo vs. Commissioner Jaime H. Morente, Bureau of Immigration, OIC Associates Commissioners, Bureau of Immigration, and Brian Alas, Bureau of ImmigrationDocument9 pagesLorie Marie Tomas Callo vs. Commissioner Jaime H. Morente, Bureau of Immigration, OIC Associates Commissioners, Bureau of Immigration, and Brian Alas, Bureau of ImmigrationBonito Bulan100% (1)

- Logrosa Vs Sps AzaresDocument2 pagesLogrosa Vs Sps Azaresmerren bloomNo ratings yet

- ArsonDocument53 pagesArsonIrish Martinez100% (5)

- Tort Law Exam Questions and AnswersDocument7 pagesTort Law Exam Questions and AnswersAhmed IbrahimNo ratings yet

- John Textor's Restraining Order Against Alki DavidDocument6 pagesJohn Textor's Restraining Order Against Alki DavidDefiantly.netNo ratings yet

- IPC Part-II PDFDocument38 pagesIPC Part-II PDFHarsh Vardhan Singh HvsNo ratings yet

- LLB6Sem - RTI Exam QuestionsDocument6 pagesLLB6Sem - RTI Exam QuestionsYassar KhanNo ratings yet

- Isip Vs PeopleDocument2 pagesIsip Vs PeopleAnonymous QlsnjX1No ratings yet

- McLemore v. Powell, 25 U.S. 554 (1827)Document4 pagesMcLemore v. Powell, 25 U.S. 554 (1827)Scribd Government DocsNo ratings yet

- Booking 03 11Document2 pagesBooking 03 11Bryan FitzgeraldNo ratings yet

- Joint Affidavit of Two Disinterested Persons: Re: One and The Same PersonDocument1 pageJoint Affidavit of Two Disinterested Persons: Re: One and The Same PersonAnthony ElmaNo ratings yet

- Flowchart PDFDocument2 pagesFlowchart PDFvina tNo ratings yet

- Cep Pre-Board CorDocument8 pagesCep Pre-Board CorRODOLFO JR. CASTILLONo ratings yet

- Padua vs. PeopleDocument2 pagesPadua vs. PeopleRobNo ratings yet

- Jesus v. Commission On AuditDocument3 pagesJesus v. Commission On AuditKDNo ratings yet

Notification 98 2023

Notification 98 2023

Uploaded by

tax.contact0 ratings0% found this document useful (0 votes)

3 views1 pageThis notification provides income tax exemption to the Press Council of India for assessment years 2019-2023 under section 10 of the Income Tax Act of 1961. It exempts the Council's income from levies on newspapers and interest earned on bank accounts. This exemption is subject to conditions that the Council not engage in commercial activities, its activities and income sources remain unchanged, and it files tax returns as required. The notification applies retrospectively to the listed assessment years corresponding to financial years 2018-2023.

Original Description:

Notification 98 2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis notification provides income tax exemption to the Press Council of India for assessment years 2019-2023 under section 10 of the Income Tax Act of 1961. It exempts the Council's income from levies on newspapers and interest earned on bank accounts. This exemption is subject to conditions that the Council not engage in commercial activities, its activities and income sources remain unchanged, and it files tax returns as required. The notification applies retrospectively to the listed assessment years corresponding to financial years 2018-2023.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageNotification 98 2023

Notification 98 2023

Uploaded by

tax.contactThis notification provides income tax exemption to the Press Council of India for assessment years 2019-2023 under section 10 of the Income Tax Act of 1961. It exempts the Council's income from levies on newspapers and interest earned on bank accounts. This exemption is subject to conditions that the Council not engage in commercial activities, its activities and income sources remain unchanged, and it files tax returns as required. The notification applies retrospectively to the listed assessment years corresponding to financial years 2018-2023.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

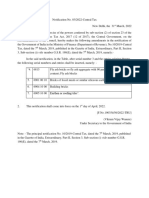

2 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC.

3(ii)]

(ग) आयकर अजधजनयम 1961, की धारा 139 की उप-धारा (4ग) के खंड (छ) के प्रािधान के अनुसार आयकर

जििरणी फाइल करे गी।

3. यह अजधसूचना जनधाडरण िषों 2019-2020, 2020-2021, 2021-2022, 2022-2023 एिं 2023-2024 के

जलए लागू की गई मानी िाएगी तथा क्रमिः जित्तीय िषों 2018-2019, 2019-2020, 2020-2021, 2021-2022 एिं

2022-2023 के जलए संगत होगी।

[अजधसूचना सं. 98 /2023 फा.सं. 300196/8/2018-आईटीए-I]

जिकास ससंह, जनिेिक (आईटीए)-I

व्याख्यात्मक ज्ञापन

यह प्रमाजणत दकया िाता है दक इस अजधसूचना को भूतलक्षी प्रभाि िेने से दकसी व्यजि पर प्रजतकू ल प्रभाि नहीं पड़ रहा

है।

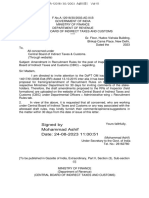

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 6th November, 2023

S.O. 4828(E).—In exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961

(43 of 1961), the Central Government hereby notifies for the purposes of the said clause, ‘Press Council of India’

(PAN AAABP0351P), a body established under Para 1 of Chapter II of the Press Council of India Act, 1978 (Central

Act), in respect of the following specified income arising to that body, namely:-

(a) Levy of fees on publishers and news papers; and

(b) Interest earned on FDRs and Savings bank accounts of Press Council of India.

2. This notification shall be effective subject to the conditions that Press Council of India,-

(a) shall not engage in any commercial activity;

(b) activities and the nature of the specified income shall remain unchanged throughout the financial

years; and

(c) shall file return of income in accordance with the provision of clause (g) of sub-section (4C) of

section 139 of the Income-tax Act, 1961.

3. This notification shall be deemed to have been applied for the assessment year 2019-2020, 2020-2021, 2021-

2022, 2022-2023 and 2023-2024 relevant to financial years 2018-2019, 2019-2020, 2020-2021, 2021-2022 and 2022-

2023 respectively.

[Notification No. 98/2023 F. No. 300196/8/2018-ITA-I]

VIKAS SINGH, Director (ITA)-I

Explanatory Memorandum

It is certified that no person is being adversely affected by giving retrospective effect to this notification.

Uploaded by Dte. of Printing at Government of India Press, Ring Road, Mayapuri, New Delhi-110064

and Published by the Controller of Publications, Delhi-110054.

You might also like

- Notification 97 2023Document1 pageNotification 97 2023tax.contactNo ratings yet

- Notification 93 2023Document1 pageNotification 93 2023tax.contactNo ratings yet

- Ministry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Document1 pageMinistry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Vishal KanadeNo ratings yet

- Notification 3Document1 pageNotification 3Parmeet NainNo ratings yet

- Ministry of Finance (Department of Revenue) : ART ECDocument1 pageMinistry of Finance (Department of Revenue) : ART ECVishal KanadeNo ratings yet

- Notification 1Document1 pageNotification 1Parmeet NainNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- 02 2024 CT EngDocument1 page02 2024 CT EngSSSARMANo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- Amendment Recruitment Rules 24082023Document3 pagesAmendment Recruitment Rules 24082023Dilip BannerjiNo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- SRO774 2023-Amendment SRO 645 2018-24-05-2018Document1 pageSRO774 2023-Amendment SRO 645 2018-24-05-2018owaisharifNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- 11 2024 CT EngDocument1 page11 2024 CT EngaekurnoolNo ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryDocument2 pagesNotification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryIshanNo ratings yet

- CBDT Circular No. 9 2023Document1 pageCBDT Circular No. 9 2023ABUBAKARNo ratings yet

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- The March, 2017: Amend (Inspector) Recruitment RulesDocument1 pageThe March, 2017: Amend (Inspector) Recruitment RulesRanjitNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- CST 17 2024Document1 pageCST 17 2024ndshiva22No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- (Falling Under Section 28 (9) (B) of The)Document1 page(Falling Under Section 28 (9) (B) of The)Anonymous Gg6z0u9IBzNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- Import Gatt DeclarationDocument2 pagesImport Gatt Declarationishan guptaNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument10 pagesSupplement Executive Programme: For June, 2021 ExaminationSP CONTRACTORNo ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- 20 Lakh After 29 March 2018Document1 page20 Lakh After 29 March 2018MCB ACCOUNT BRANCHNo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- June 2020 SP 2Document27 pagesJune 2020 SP 2Avinash ShettyNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- Circular 9 2021Document3 pagesCircular 9 2021Camp Asst. to ADGP AdministrationNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- John Ruginski and Ines E. Franco Zapata v. Immigration and Naturalization Service, 942 F.2d 13, 1st Cir. (1991)Document8 pagesJohn Ruginski and Ines E. Franco Zapata v. Immigration and Naturalization Service, 942 F.2d 13, 1st Cir. (1991)Scribd Government DocsNo ratings yet

- 265955-2020-Misamis - Oriental - Rural - Electric - Service - Case of Reassignment of Officers Without Reissuance of LOADocument4 pages265955-2020-Misamis - Oriental - Rural - Electric - Service - Case of Reassignment of Officers Without Reissuance of LOAJohn Patrick GuillenNo ratings yet

- Commercial Agency Private AgreementDocument6 pagesCommercial Agency Private AgreementMenna ElabdeenyNo ratings yet

- ABBOTT LABORATORIES, PHILIPPINES, CECILLE A. TERRIBLE, EDWIN D. FEIST, MARIA OLIVIA T. YABUT-MISA, TERESITA C. BERNARDO, AND ALLAN G. ALMAZAR, PetitionersDocument7 pagesABBOTT LABORATORIES, PHILIPPINES, CECILLE A. TERRIBLE, EDWIN D. FEIST, MARIA OLIVIA T. YABUT-MISA, TERESITA C. BERNARDO, AND ALLAN G. ALMAZAR, PetitionerselmerNo ratings yet

- Tacay V RTC Tagum, Davao Del NorteDocument3 pagesTacay V RTC Tagum, Davao Del Nortemaginoo69No ratings yet

- Corey Cagle Mason OH Debt Collector DenialDocument7 pagesCorey Cagle Mason OH Debt Collector DenialghostgripNo ratings yet

- Supreme Court Judgment On Scope of Appeal Against Arbitral AwardDocument90 pagesSupreme Court Judgment On Scope of Appeal Against Arbitral AwardLatest Laws TeamNo ratings yet

- Yuk Ling Ong v. CoDocument7 pagesYuk Ling Ong v. CoElla CanuelNo ratings yet

- How To Brief A CaseDocument4 pagesHow To Brief A CaseIljuha9No ratings yet

- Corrections TerminologiesDocument3 pagesCorrections TerminologiesFrancha AndradeNo ratings yet

- 01 - Ang Kek Chen vs. Javalera-SulitDocument8 pages01 - Ang Kek Chen vs. Javalera-SulitanajuanitoNo ratings yet

- 1 Cebu - State - College - of - Science - and - Technology PDFDocument11 pages1 Cebu - State - College - of - Science - and - Technology PDFVia Rhidda ImperialNo ratings yet

- 3.conrado Lindo Vs Comelec (CD)Document1 page3.conrado Lindo Vs Comelec (CD)Deanne Mitzi SomolloNo ratings yet

- CIT v. Vegetable Products Ltd.Document4 pagesCIT v. Vegetable Products Ltd.Karsin ManochaNo ratings yet

- Sibulo Vs IlaganDocument7 pagesSibulo Vs IlaganAnonymous p8aVCBx7No ratings yet

- Lorie Marie Tomas Callo vs. Commissioner Jaime H. Morente, Bureau of Immigration, OIC Associates Commissioners, Bureau of Immigration, and Brian Alas, Bureau of ImmigrationDocument9 pagesLorie Marie Tomas Callo vs. Commissioner Jaime H. Morente, Bureau of Immigration, OIC Associates Commissioners, Bureau of Immigration, and Brian Alas, Bureau of ImmigrationBonito Bulan100% (1)

- Logrosa Vs Sps AzaresDocument2 pagesLogrosa Vs Sps Azaresmerren bloomNo ratings yet

- ArsonDocument53 pagesArsonIrish Martinez100% (5)

- Tort Law Exam Questions and AnswersDocument7 pagesTort Law Exam Questions and AnswersAhmed IbrahimNo ratings yet

- John Textor's Restraining Order Against Alki DavidDocument6 pagesJohn Textor's Restraining Order Against Alki DavidDefiantly.netNo ratings yet

- IPC Part-II PDFDocument38 pagesIPC Part-II PDFHarsh Vardhan Singh HvsNo ratings yet

- LLB6Sem - RTI Exam QuestionsDocument6 pagesLLB6Sem - RTI Exam QuestionsYassar KhanNo ratings yet

- Isip Vs PeopleDocument2 pagesIsip Vs PeopleAnonymous QlsnjX1No ratings yet

- McLemore v. Powell, 25 U.S. 554 (1827)Document4 pagesMcLemore v. Powell, 25 U.S. 554 (1827)Scribd Government DocsNo ratings yet

- Booking 03 11Document2 pagesBooking 03 11Bryan FitzgeraldNo ratings yet

- Joint Affidavit of Two Disinterested Persons: Re: One and The Same PersonDocument1 pageJoint Affidavit of Two Disinterested Persons: Re: One and The Same PersonAnthony ElmaNo ratings yet

- Flowchart PDFDocument2 pagesFlowchart PDFvina tNo ratings yet

- Cep Pre-Board CorDocument8 pagesCep Pre-Board CorRODOLFO JR. CASTILLONo ratings yet

- Padua vs. PeopleDocument2 pagesPadua vs. PeopleRobNo ratings yet

- Jesus v. Commission On AuditDocument3 pagesJesus v. Commission On AuditKDNo ratings yet