Professional Documents

Culture Documents

ABANDO Answer Sheet (Ratio Analysis)

ABANDO Answer Sheet (Ratio Analysis)

Uploaded by

ALEXANDRINE NICOLE ABANDO0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document provides the answer sheet for the midterm exam in FIN 210. It contains computations of 5 financial ratios for Year 2 - current ratio, acid-test ratio, times interest earned ratio, debt-to-equity ratio, and inventory turnover ratio. It also provides an overall interpretation of the company's creditworthiness based on the ratios.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the answer sheet for the midterm exam in FIN 210. It contains computations of 5 financial ratios for Year 2 - current ratio, acid-test ratio, times interest earned ratio, debt-to-equity ratio, and inventory turnover ratio. It also provides an overall interpretation of the company's creditworthiness based on the ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesABANDO Answer Sheet (Ratio Analysis)

ABANDO Answer Sheet (Ratio Analysis)

Uploaded by

ALEXANDRINE NICOLE ABANDOThe document provides the answer sheet for the midterm exam in FIN 210. It contains computations of 5 financial ratios for Year 2 - current ratio, acid-test ratio, times interest earned ratio, debt-to-equity ratio, and inventory turnover ratio. It also provides an overall interpretation of the company's creditworthiness based on the ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

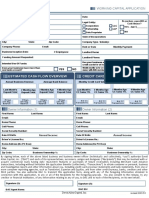

FIN 210 MIDTERM EXAM

ANSWER SHEET: RATIO ANALYSIS

NAME: Alexandrine Nicole P. Abando

Requirement 1 Requirement 2

Year 2 Ratios Computation Overall Interpretation

(round off to 2 (Year 2 Ratios)

decimal places) Rate the overall credit worthiness of TRI

15 points; 3 points each Rating scale: 1 to 4 (4 being the highest rating for credit

15 points; 3 points worthiness)

each Explain your credit rating for TRI based on the financial ratios

(i.e. trend from Year 0 to Year 2 and industry average)

20 points

Hint: Use Year 2 figures only in the Balance Sheet

(Total of Current Assets / Total Current Liabilities) Type/write your answer here.

Current ratio 1.57

9 900 The current ratio measures the firm's ability to pay off

= 1.57 short-term debt by evaluating overall short-term liquidity.

6 300 The quick ratio is also a measure of short-term liquidity. It

is, however, a more immediate liquidity metric than the

4 100 current ratio and is an indicative of a company's ability to

Acid-test ratio

0.65 = 0.65 pay off all of its short-term debts using cash or near-cash

6 300 assets. The quick ratio, when compared to the current

ratio, reflects the amount of inventory in the company's

current assets. Inventory turnover is the number of times a

firm sells its average inventory level in a given year. A low

Times interest 7 960 inventory turnover rate may indicate an inventory

earned 8.84 = 8.84 imbalance or expired products. A profitability ratio is return

900

on equity. It assesses the company's performance in

creating money for the benefit of its stockholders by

measuring the return on stockholder investment

Debt to

0.95 8 300

equity ratio = 0.95

8 700

Hint: Use Year 2 Cost of Goods Sold (COGS); Use Year 1 and

Year 2 Inventory balance to solve the average inventory)

Inventory 17 000

turnover 3.14 = 3.14

(5 400 + 5 800) ÷ 2

You might also like

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- 21day Studyplan For LLQP ExamDocument9 pages21day Studyplan For LLQP ExamMatthew ChambersNo ratings yet

- Bank of BarodaDocument2 pagesBank of BarodaSudhir SatyanarayanNo ratings yet

- Financial Management Their AnalysisDocument22 pagesFinancial Management Their AnalysisAngellie LaborteNo ratings yet

- ONGC Analysis - 2019 To 2020Document46 pagesONGC Analysis - 2019 To 2020MaxNo ratings yet

- Financial AnalysisDocument37 pagesFinancial AnalysisAlliah Kaye De ChavezNo ratings yet

- Ratio AnalysisDocument19 pagesRatio AnalysisBhaskar MohanNo ratings yet

- Financial Statements AnalysisDocument54 pagesFinancial Statements AnalysisSudarshan ChitlangiaNo ratings yet

- Raunak Maheshwari - 2023 BBE 1003Document9 pagesRaunak Maheshwari - 2023 BBE 1003Raunak MaheshwariNo ratings yet

- For 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision PracticeDocument67 pagesFor 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision Practice6D10 NG YAN HUNG 吳欣鴻No ratings yet

- Prepared By: Mark Vincent B. Bantog, LPTDocument40 pagesPrepared By: Mark Vincent B. Bantog, LPTLilyfhel VenturaNo ratings yet

- Example:: Basis Assets LiabilitiesDocument23 pagesExample:: Basis Assets LiabilitiesAmbika Prasad ChandaNo ratings yet

- Financial Statements AnalysisDocument6 pagesFinancial Statements Analysisangelika dijamcoNo ratings yet

- 4 Data Analysis and Interpretetion PDFDocument33 pages4 Data Analysis and Interpretetion PDFpoovarasnNo ratings yet

- FS Ratio AnalysisDocument6 pagesFS Ratio AnalysisAngelica Valdez BautoNo ratings yet

- I. Analysis of Liquidity or Short Term SolvencyDocument6 pagesI. Analysis of Liquidity or Short Term SolvencyAngelica Valdez BautoNo ratings yet

- Sno. Ratios Formula Result Analysis Liquidity RatioDocument6 pagesSno. Ratios Formula Result Analysis Liquidity RatioIndrani PanNo ratings yet

- Accounting TermsDocument2 pagesAccounting TermsWatashi Wa HitodesuNo ratings yet

- Ratio Analysis On Hero HondaDocument20 pagesRatio Analysis On Hero Hondapraxy86No ratings yet

- Methods of AnalysisDocument7 pagesMethods of AnalysisjenniferNo ratings yet

- FS Analysis PDFDocument20 pagesFS Analysis PDF수지No ratings yet

- 04 MNGT Reporting 1Document4 pages04 MNGT Reporting 1Macy SantosNo ratings yet

- Strategic Cost Management 2 Financial Analysis: Percentage Composition StatementsDocument13 pagesStrategic Cost Management 2 Financial Analysis: Percentage Composition StatementsAlexandra Nicole IsaacNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisLeilanie M. GabrielNo ratings yet

- MAS 08 - FS Analysis PDFDocument20 pagesMAS 08 - FS Analysis PDFAaron tamboongNo ratings yet

- 1 Financial Statements AnalysisDocument6 pages1 Financial Statements AnalysisJamaica DavidNo ratings yet

- Financial Statment Analysis PGDocument56 pagesFinancial Statment Analysis PGMelakuNo ratings yet

- Financial Statement Analysis: LECTURE 16 & 17Document23 pagesFinancial Statement Analysis: LECTURE 16 & 17Tasim IshraqueNo ratings yet

- Financial Analysis of Crown CementDocument20 pagesFinancial Analysis of Crown CementTareq RahmanNo ratings yet

- Accounts Specific Project 1Document28 pagesAccounts Specific Project 1sakshi pandey100% (1)

- Ratio Report Excel Template Copy El - Copy 2Document21 pagesRatio Report Excel Template Copy El - Copy 2api-736389893No ratings yet

- Ms & Oracle Project Ex DDocument53 pagesMs & Oracle Project Ex DA.D. Home TutorsNo ratings yet

- Pawandeep Singh FSACADocument11 pagesPawandeep Singh FSACARaj MishraNo ratings yet

- Chapter 3 Fs AnalysisDocument8 pagesChapter 3 Fs AnalysisYlver John YepesNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMark Lawrence YusiNo ratings yet

- QTR Three ReviewerDocument5 pagesQTR Three ReviewerHannah Michaela GemidaNo ratings yet

- Smarts - Fs AnalysisDocument11 pagesSmarts - Fs AnalysisKarlo D. ReclaNo ratings yet

- Analysis and Interpretation - Ballada-Part 2Document4 pagesAnalysis and Interpretation - Ballada-Part 2Claire Evann Villena EboraNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisLeora CameroNo ratings yet

- Ratio Analysis 2022Document34 pagesRatio Analysis 2022Asanka8522No ratings yet

- Analysis and Interpretation of Financial StatementsDocument29 pagesAnalysis and Interpretation of Financial StatementsJessiEsquivelNo ratings yet

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- Financial Ratios and Analysis of Tata Motors: Research PaperDocument15 pagesFinancial Ratios and Analysis of Tata Motors: Research PaperMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- CH 4 Part 1 Ratio AnalysisDocument28 pagesCH 4 Part 1 Ratio AnalysisMuhammad iqbal HakiimNo ratings yet

- Ratio AnalysisDocument38 pagesRatio AnalysisrachitNo ratings yet

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- Module 1 - Financial Statement Analysis - P1Document5 pagesModule 1 - Financial Statement Analysis - P1Jose Eduardo GumafelixNo ratings yet

- Financial Statements AnalysisDocument30 pagesFinancial Statements AnalysisSabia Gul BalochNo ratings yet

- ABC Association: Financial Statement, Financial Statement Analysis, and Audit Findings and RecommendationsDocument9 pagesABC Association: Financial Statement, Financial Statement Analysis, and Audit Findings and RecommendationsReianne EspesorNo ratings yet

- FA FInalDocument14 pagesFA FInalJesintha SureshNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMariel BalanditanNo ratings yet

- Unit Three Financial AnalysisDocument56 pagesUnit Three Financial AnalysisHibretNo ratings yet

- Acc205 Ca2Document14 pagesAcc205 Ca2AakankshaNo ratings yet

- ACCOUNTING RATIOS-notesDocument5 pagesACCOUNTING RATIOS-notesMohamed MuizNo ratings yet

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraNo ratings yet

- Topic 13 - Analysis 2022Document20 pagesTopic 13 - Analysis 2022Danyael millevoNo ratings yet

- Ratio Analysis Cheat SheetDocument2 pagesRatio Analysis Cheat SheetcinkayunramNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosMAURICIO CONTRERAS CABALLERONo ratings yet

- United International University: Assignment On Ratio Analysis & Dupont AnalysisDocument8 pagesUnited International University: Assignment On Ratio Analysis & Dupont AnalysisMostofa Reza PigeonNo ratings yet

- What Is Decentralized Finance (DeFi)Document8 pagesWhat Is Decentralized Finance (DeFi)GodPacoNo ratings yet

- 10715... Fee ChalanDocument2 pages10715... Fee ChalanMesmerizing PoetryNo ratings yet

- HISTORYDocument3 pagesHISTORYpenusila6941No ratings yet

- PDIC and AMENDED PDICDocument27 pagesPDIC and AMENDED PDICEnnavy YongkolNo ratings yet

- Auditing ProblemsDocument37 pagesAuditing ProblemsDonna Mae HernandezNo ratings yet

- Assignment of PMJY, PMMY and PMBSYDocument47 pagesAssignment of PMJY, PMMY and PMBSYPrakash Kumar HindujaNo ratings yet

- Arens17 PPT 17Document27 pagesArens17 PPT 17ssslll2No ratings yet

- Procedure Bpu MethodDocument1 pageProcedure Bpu MethodKiki SajaNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- Report of The Board of Directors On Corporate GovernanceDocument6 pagesReport of The Board of Directors On Corporate GovernanceglorydharmarajNo ratings yet

- MC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedDocument16 pagesMC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedKeshav JhaNo ratings yet

- Indian Financial SystemDocument5 pagesIndian Financial SystemHimaja GharaiNo ratings yet

- Case Digest: FAR EAST BANK v. Gold Palace Jewellery CoDocument3 pagesCase Digest: FAR EAST BANK v. Gold Palace Jewellery Comarkhan18No ratings yet

- Statement of Account: Product: SB Nonchq-Gen-Pub-Su/Rural-Inr Currency: INRDocument1 pageStatement of Account: Product: SB Nonchq-Gen-Pub-Su/Rural-Inr Currency: INRGullipalli Simhachalam NaiduNo ratings yet

- SUBJECT MATTER 6 - QuizDocument4 pagesSUBJECT MATTER 6 - QuizKingChryshAnneNo ratings yet

- NBM PLC ANNUAL REPORT 2022Document101 pagesNBM PLC ANNUAL REPORT 2022Takondwa MsosaNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Analytical Review ProceduresDocument5 pagesAnalytical Review ProceduresnderitulinetNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument20 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancecs.saisampathNo ratings yet

- Terra Updated ResumeDocument1 pageTerra Updated Resumeapi-726918881No ratings yet

- FY-7.6 Student Activity Packet - Google DocsDocument2 pagesFY-7.6 Student Activity Packet - Google Docstarikhero755No ratings yet

- Chime Checking Statement December 2023Document6 pagesChime Checking Statement December 2023nasblack112No ratings yet

- Ali Qamar Shaikh-CVDocument3 pagesAli Qamar Shaikh-CValiqamarshaikhNo ratings yet

- Economics of Money Banking and Financial Markets Global 10th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets Global 10th Edition Mishkin Test BankPeterHolmesfdns100% (59)

- DAC Loan ApplicationDocument1 pageDAC Loan ApplicationDunhamNo ratings yet

- PESONet ParticipantsDocument2 pagesPESONet ParticipantsHoly Wayne 'Trinity' ChuaNo ratings yet

- Credit Recovery ManagementDocument75 pagesCredit Recovery ManagementSudeep Chinnabathini75% (4)