Professional Documents

Culture Documents

Assignment 1 Worksheet

Assignment 1 Worksheet

Uploaded by

golemwitch010 ratings0% found this document useful (0 votes)

74 views1 pageThe trial balance and financial information is provided for Imperial Consulting Service for the year ended December 31, 2022. Additional data is given regarding adjusting entries needed to prepare the company's financial statements, including prepaid expenses, accrued expenses, unearned revenue, and depreciation. The required tasks are to prepare an adjusted trial balance in a worksheet and then the income statement, statement of owner's equity, and statement of financial position.

Original Description:

worksheet

Original Title

ASSIGNMENT-1-WORKSHEET

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe trial balance and financial information is provided for Imperial Consulting Service for the year ended December 31, 2022. Additional data is given regarding adjusting entries needed to prepare the company's financial statements, including prepaid expenses, accrued expenses, unearned revenue, and depreciation. The required tasks are to prepare an adjusted trial balance in a worksheet and then the income statement, statement of owner's equity, and statement of financial position.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

74 views1 pageAssignment 1 Worksheet

Assignment 1 Worksheet

Uploaded by

golemwitch01The trial balance and financial information is provided for Imperial Consulting Service for the year ended December 31, 2022. Additional data is given regarding adjusting entries needed to prepare the company's financial statements, including prepaid expenses, accrued expenses, unearned revenue, and depreciation. The required tasks are to prepare an adjusted trial balance in a worksheet and then the income statement, statement of owner's equity, and statement of financial position.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Assignment:

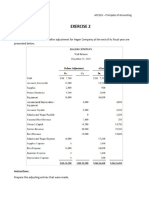

The trial balance of Imperial Consulting Service at December 31, 2022, the end of its accounting year, is

presented below:

Imperial Consulting Service

Trial Balance

December 31, 2022

Account title Debit Credit

Cash P98,200

Consulting fees receivable 46,800

Prepaid office rent 12,600

Prepaid dues and subscriptions 600

Unused supplies 1,200

Equipment 72,000

Accumulated depreciation-equipment P 20,400

Notes payable 30,000

Unearned consulting fees 11,900

James Cabrera,Capital 9,400

Consulting fees earned 514,360

Salaries expense 277,640

Telephone expense 5,100

Rent expense 44,000

Dues and subscriptions expense 3,120

Supplies expense 3,200

Depreciation expense-equipment 13,200

Miscellaneous expense 8,400

TOTAL P586,060 P 586,060

Data needed for the adjusting entries include:

a. On December 1, the company signed a new rental agreement and paid three month’s rent in

advance at a rate of P4,200 per month. This advance payment was debited to the Prepaid

Office Rent account.

b. Dues and subscriptions expired during December amounted to 100.

c. An estimate of supplies on hand was made at December 31, the estimated cost of the unused

supplies was 900.

d. The useful life of the equipment has been estimated at five years (60 months)from date of

acquisition. No depreciation for equipment has been recorded for December.

e. The notes payable is for 60 days at 8% due to BPI dated December 1,2022.

f. Consulting services valued at P 5,700 were rendered during December to clients who had

made payment in advance

g. It is the custom of the firm to bill clients only when consulting work is completed or, in the

case of prolonged engagements, at monthly intervals. At December 31, engineering services

valued at 22,000 have been rendered to clients but not yet billed. No advance payments

have been received from these clients.

h. Salaries earned by employees but not paid as of December 31 amounted to 3,400.

Required:

1. Prepare the accounting work sheet of Imperial Consulting Service for the year ended

December 31, 2022. Key each adjusting entry by the letter corresponding to the data given.

2. Prepare the company’s Income Statement, Statement of Owner’s Equity and Statement of

Financial Position.

You might also like

- TMDTDocument3 pagesTMDTDiệu QuỳnhNo ratings yet

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- San Beda College Alabang: INSTRUCTION: Worksheet PreparationDocument1 pageSan Beda College Alabang: INSTRUCTION: Worksheet PreparationMarriel Fate CullanoNo ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Arima Kousei QuizDocument2 pagesArima Kousei QuizKen Alob100% (1)

- European ProductsDocument72 pagesEuropean Productsthermosol5416No ratings yet

- Asynch Activities 2 CTA SEDocument1 pageAsynch Activities 2 CTA SElingat airenceNo ratings yet

- Topic 5 ONLINE CLASS EXERCISEDocument1 pageTopic 5 ONLINE CLASS EXERCISEStevenNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Final Exams AccountingDocument6 pagesFinal Exams AccountingCzarina Joy PeñaNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Complete Cycle Servicing Graded ActivityDocument2 pagesComplete Cycle Servicing Graded ActivityErfel Al KitmaNo ratings yet

- Adjusting EntryDocument8 pagesAdjusting EntryRaeha Tul Jannat BuzdarNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- Activity in FABM 2Document2 pagesActivity in FABM 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Practice Question (Accounting Cycle) With Solution v2Document17 pagesPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorNo ratings yet

- Exercise 2ADocument3 pagesExercise 2A31231020764No ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- HP Service Company TransactionsDocument18 pagesHP Service Company TransactionsAndrew Sy ScottNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Tutorial On AdjustmentsDocument8 pagesTutorial On AdjustmentsPushpa ValliNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- Easy Round: Suggested Answer: ADocument35 pagesEasy Round: Suggested Answer: ALovely Dela Cruz GanoanNo ratings yet

- Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS PreparationDocument1 pageAnswer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparationkakao100% (1)

- University of Luzo4Document1 pageUniversity of Luzo4Mariphie OsianNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- Answers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintDocument5 pagesAnswers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintT.F. EvansNo ratings yet

- Chapter 3 ExercisesDocument8 pagesChapter 3 ExercisesNguyen Khanh Ly K17 HLNo ratings yet

- Preparation of A Work Sheet, Financial Statements, and Adjusting, Closing, and Reversing EntriesDocument2 pagesPreparation of A Work Sheet, Financial Statements, and Adjusting, Closing, and Reversing EntriesSumair ShahidNo ratings yet

- DAA5014 Tutorial Topic 3 QuestionsDocument4 pagesDAA5014 Tutorial Topic 3 QuestionstyrenshunhengNo ratings yet

- Igcse - Final AccountsDocument4 pagesIgcse - Final AccountsMUSTHARI KHANNo ratings yet

- Activity 13Document1 pageActivity 13Jenievive RevillaNo ratings yet

- Audit of LiabilitiesDocument54 pagesAudit of LiabilitiesWerpa PetmaluNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Exercises - Adjusted Trial BalanceDocument1 pageExercises - Adjusted Trial BalanceJason RadamNo ratings yet

- Last Term RevisionDocument2 pagesLast Term RevisionNgoc Huỳnh HyNo ratings yet

- Completion of Accounting CycleDocument12 pagesCompletion of Accounting Cycleeater PeopleNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Determination of Forward and Futures PricesDocument25 pagesDetermination of Forward and Futures PricesSagheer MuhammadNo ratings yet

- Cpio FaaDocument23 pagesCpio FaaVishal GavliNo ratings yet

- Unit FourDocument28 pagesUnit FourTesfaye Megiso BegajoNo ratings yet

- Leslie Ha Contract Quote PDFDocument1 pageLeslie Ha Contract Quote PDFfllamas1973No ratings yet

- AJE Practice Problems - 2127759290Document2 pagesAJE Practice Problems - 2127759290Nichole Joy XielSera TanNo ratings yet

- General BankingDocument8 pagesGeneral BankingSharifMahmudNo ratings yet

- Traders Royal Bank Vs CA - G.R. No. 93397. March 3, 1997Document11 pagesTraders Royal Bank Vs CA - G.R. No. 93397. March 3, 1997Ebbe DyNo ratings yet

- BK 1 CH 6 Question BankDocument27 pagesBK 1 CH 6 Question BanktrumpNo ratings yet

- 230-Executive Board Meeting of NHADocument36 pages230-Executive Board Meeting of NHAHamid Naveed100% (1)

- Process Flow of 'PM KISSAN SAMMAN NIDHIDocument20 pagesProcess Flow of 'PM KISSAN SAMMAN NIDHIsubhalaxmi computerNo ratings yet

- BPI v. LeeDocument3 pagesBPI v. LeeHanna QuiambaoNo ratings yet

- Dao Heng Bank Inc. Etc vs. Spouse Laigo DigestDocument1 pageDao Heng Bank Inc. Etc vs. Spouse Laigo DigestLuz Celine CabadingNo ratings yet

- General Journal CholoDocument9 pagesGeneral Journal CholokrylNo ratings yet

- CH 18Document129 pagesCH 18PopoChandran100% (1)

- Corn ProductionDocument158 pagesCorn ProductionarnoldalejadoNo ratings yet

- (L) Chapter 5 Accounting Concepts - ConventionsDocument6 pages(L) Chapter 5 Accounting Concepts - ConventionsCHZE CHZI CHUAHNo ratings yet

- Protfolio ManagementDocument88 pagesProtfolio ManagementSatish ChakravarthyNo ratings yet

- Standards On Auditing and Its Usage in AuditingDocument5 pagesStandards On Auditing and Its Usage in Auditingbhagaban_fm8098No ratings yet

- Application For Loan Scheme of JSMFDCDocument5 pagesApplication For Loan Scheme of JSMFDCDhanesh KumarNo ratings yet

- InstallmentDocument5 pagesInstallmentKESHAB BHOINo ratings yet

- Essentials of Managerial Finance, 13th Edition: Besley and Brigham Errata SheetDocument1 pageEssentials of Managerial Finance, 13th Edition: Besley and Brigham Errata SheetHas RabNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- Business Accounting Quiz 2 (Answers) Updated.Document7 pagesBusiness Accounting Quiz 2 (Answers) Updated.Hareen JuniorNo ratings yet

- Excel Function ListDocument130 pagesExcel Function ListdesaikeyurNo ratings yet

- 50T Drop Table SEC RailwayDocument28 pages50T Drop Table SEC RailwaymailbkraoNo ratings yet

- DownloadDocument92 pagesDownloadJitendra PanwarNo ratings yet

- Boyce Hydro Bankruptcy Filing - U.S. Bankruptcy Court - EASTERN DISTRICT OF MICHIGANDocument51 pagesBoyce Hydro Bankruptcy Filing - U.S. Bankruptcy Court - EASTERN DISTRICT OF MICHIGANCaleb HollowayNo ratings yet

- Commercial PaperDocument4 pagesCommercial PaperGaurav JainNo ratings yet