Professional Documents

Culture Documents

QP Corporate Finance and Asset Management

QP Corporate Finance and Asset Management

Uploaded by

Harpreet KaurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QP Corporate Finance and Asset Management

QP Corporate Finance and Asset Management

Uploaded by

Harpreet KaurCopyright:

Available Formats

MST 1 (2022)

Corporate Finance and Asset management

Total Time: 40 mins Total Marks: 20 Marks

● Each section is compulsory, try to attempt all.

● The question paper has 3 sections. All sections are compulsory.

Section 1

● This section consists of Multiple Choices questions

● Answer all the questions (1 X 10= 10 Marks)

1. Capital structure is the study _______?

a) Only debt b)Only equity

c) debt and equity d) None of the above

2. Business finance is needed to _______

A) Expand a business b) grow a business c) run a business d) All of the above

3. Which one is related to planning, organizing, directing, controlling of financial activities?

a) Financial management b)financial decisions c)Investment decisions d)Capital structure

4. ____ is the decision related to composition of capital structure & also depends upon ability of the business to

generate cash.

a) Market Condition

b) Flexibility

c) Cash flow ability

d) Control

5. _____ refers to the structure of total capital funds raised by the company.

(a) Fixed capital

(b) Capital structure

(c) Capital requirements

(d) Under capitalization

6. Optimal size of firms is a factor of which of the following principles

A) Investment b) financing c)Dividend d)capital structure

7. Under the assets management decisions greater emphasis is put on the management of

a) Current assets

b) Fixed assets

c) Tangible assets

d) Intangible assets

8. Why does discount rate calculation exist?

a) As a substitute of b.y.e b)Late yield conversions c) Short hand calculations d)Several discount rates

9. Which is the best measure to calculate yield on T-bills?

a) Bond yield equivalent b) yield equivalent c) Discounted yield equivalent d)None of the above

10. Annuity is a stream of __________

a) Both inflows and outflows b) Cash withdrawn

C) Equal cash flows d) unequal cash flows

Section 2

Short Answer Type Questions

This section carries short answer questions, answer any 2 out of 3 (2 X 2=4 Marks)

1. Pen down the principles of Corporate finance.

2. A project costs $600,000, its scrap is $40,000 after five years, and profits after depreciation and taxes over

five years are $50,000, $70,000, $60,000 and $30,000. Calculate the average rate of return on investment.

3. Write about the factors that affect capital structure decisions of a company.

Section 3

This section carries Case Study/ Numerical questions (1X 6 = 6 Marks)

1. Calculate the net present value for Proposals A and B when the discount rate is 10%. The cash flows shown

below are before depreciation and after taxes and recommend which proposal company should undertake.

Year A B

$ $

1 5,000 20,000

2 10,000 10,000

3 10,000 5,000

4 3,000 3,000

5 2,000 20,000

A B

Investment ($) 20,000 30,000

Life of Investment (years) 5 5

Scrap Value ($) 1,000 2,000

2. Calculate the Future value of ordinary annuity and annuity due given that CF- $5000, Rate of return- 8%,

and time is 5 years. (4+2 marks)

You might also like

- Budgeting CS - Budget or BustDocument9 pagesBudgeting CS - Budget or BustHLeigh Nietes-Gabutan20% (5)

- CMA Part2 MT 1-10 Q&ADocument893 pagesCMA Part2 MT 1-10 Q&ASandeep SawanNo ratings yet

- Mock Exam QuestionsDocument43 pagesMock Exam QuestionsFerran Mola ReverteNo ratings yet

- Financial Management:: Professional Level Suggested Answers Nov-Dec 2020Document13 pagesFinancial Management:: Professional Level Suggested Answers Nov-Dec 2020Md Aliul AlimNo ratings yet

- Sample Question Paper Level 5 Effective Financial ManagementDocument4 pagesSample Question Paper Level 5 Effective Financial ManagementTheocryte SergeotNo ratings yet

- F9 Financial Management Progress Test 2 PDFDocument3 pagesF9 Financial Management Progress Test 2 PDFCoc GamingNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- 2016 GMA 711s Test 1Document4 pages2016 GMA 711s Test 1Nolan TitusNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- 16 Financial Management September October 2021Document2 pages16 Financial Management September October 2021sathyachandana7No ratings yet

- FM Assignment 6Document2 pagesFM Assignment 6Vundi RohitNo ratings yet

- Sem 2 April 2023Document20 pagesSem 2 April 2023mr.shewalkarNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- 32 Financial Management 44 Sep Oct 2022Document3 pages32 Financial Management 44 Sep Oct 2022sathyachandana7No ratings yet

- Financial Analysis Spreadsheet Templates: Main Menu - Chapter 9Document12 pagesFinancial Analysis Spreadsheet Templates: Main Menu - Chapter 9Aaniya AliNo ratings yet

- Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamDocument1 pageDepartment of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamTHIND TAXLAWNo ratings yet

- 2016 GMA 711s Test 1Document4 pages2016 GMA 711s Test 1PaulusNo ratings yet

- Foundations in Financial ManagementDocument16 pagesFoundations in Financial ManagementQuỳnhNo ratings yet

- CW HWDocument8 pagesCW HWRupok AnandaNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Binder 1Document105 pagesBinder 1prineetu143No ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Ejercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Document3 pagesEjercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Alison Joyce Herrera Maldonado0% (1)

- Hong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Document17 pagesHong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Sin TungNo ratings yet

- Financial ManagementDocument3 pagesFinancial ManagementKala DhashnamoorthyNo ratings yet

- Unit 3 - Essay QuestionsDocument4 pagesUnit 3 - Essay QuestionsJaijuNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingMateen PathanNo ratings yet

- MQP - MBA - Sem2 - Financial Management (DMBA202) PDFDocument4 pagesMQP - MBA - Sem2 - Financial Management (DMBA202) PDFsanjeev misraNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Investment Appraisal: Mas Educational CentreDocument7 pagesInvestment Appraisal: Mas Educational CentreSaad Khan YTNo ratings yet

- AMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDocument3 pagesAMIS 525 Pop Quiz - Chapter 21: A) The Net Present Value of Project C Will Be The HighestDan Andrei Bongo100% (1)

- FM Question BankDocument6 pagesFM Question Bankthoolakshay193No ratings yet

- Financial Management Model Question PaperDocument2 pagesFinancial Management Model Question PaperdvraoNo ratings yet

- FM Assignment 5Document2 pagesFM Assignment 5Vundi RohitNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- SampleFinal1 PDFDocument7 pagesSampleFinal1 PDFC A.No ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoDocument3 pagesTime: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoHimanshuNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- 71 Elective 1 Advance Financial Management Repeaters 2014 15 Onwards - 2Document4 pages71 Elective 1 Advance Financial Management Repeaters 2014 15 Onwards - 2premium info2222No ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- MANAGERIAL ECONOMICS AND FINANCIAL ANALYSIS Nov-Dec-2016Document2 pagesMANAGERIAL ECONOMICS AND FINANCIAL ANALYSIS Nov-Dec-2016Hemanth HemanthNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- 4243 Financial Management Aug Sep 2023Document3 pages4243 Financial Management Aug Sep 2023sathyachandana7No ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- The Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 ExaminationDocument8 pagesThe Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 Examination李敏浩No ratings yet

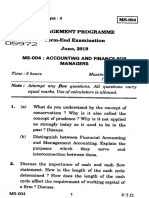

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersDocument4 pagesManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- Paper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document8 pagesPaper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Jeremy LuNo ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- FNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFDocument3 pagesFNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFC A.No ratings yet

- Lecture 24 - Manage Stress To Improve Work-Life BalanceDocument14 pagesLecture 24 - Manage Stress To Improve Work-Life BalanceHarpreet KaurNo ratings yet

- Factors Affecting Consumer Awareness and The Purchase of Eco-Friendly Vehicles: Textual Analysis of Korean MarketDocument17 pagesFactors Affecting Consumer Awareness and The Purchase of Eco-Friendly Vehicles: Textual Analysis of Korean MarketHarpreet KaurNo ratings yet

- LAWS IN HRM by Harpreet KaurDocument25 pagesLAWS IN HRM by Harpreet KaurHarpreet KaurNo ratings yet

- Finanical ProductsDocument19 pagesFinanical ProductsHarpreet KaurNo ratings yet

- Assessment 3 OmDocument5 pagesAssessment 3 OmHarpreet KaurNo ratings yet

- Fab HotelsDocument12 pagesFab HotelsHarpreet KaurNo ratings yet

- Welcome To Our Presentation: Dining EtiquetteDocument9 pagesWelcome To Our Presentation: Dining EtiquetteHarpreet KaurNo ratings yet

- Presentation On Mbo & Organisational StructureDocument8 pagesPresentation On Mbo & Organisational StructureHarpreet KaurNo ratings yet

- Gov Canada Scavenger HuntDocument8 pagesGov Canada Scavenger HuntEmikah TaylorNo ratings yet

- How To Approach BanksDocument9 pagesHow To Approach BankssohailNo ratings yet

- Gitman - Test Bank CH - 14Document41 pagesGitman - Test Bank CH - 14Hazem TharwatNo ratings yet

- IDFCFIRSTBankstatement 10104880969 110438261Document6 pagesIDFCFIRSTBankstatement 10104880969 110438261ralesh694No ratings yet

- Chapter 6 SPACE MATRIXDocument14 pagesChapter 6 SPACE MATRIXgulfam ashrafNo ratings yet

- Investment BankingDocument85 pagesInvestment BankingJoshuva DanielNo ratings yet

- Bayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYDocument5 pagesBayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYEriko Timothy GintingNo ratings yet

- Common Account Opening Form For Resident Individual (Common Aof Other Than Ckyc)Document9 pagesCommon Account Opening Form For Resident Individual (Common Aof Other Than Ckyc)iamyandmoorifanNo ratings yet

- Soal Quiz AdvanceDocument18 pagesSoal Quiz AdvanceAditya Agung SatrioNo ratings yet

- (Term Paper) The Rationale of Shari'ah Supporting Contracts - A Case of MPODocument22 pages(Term Paper) The Rationale of Shari'ah Supporting Contracts - A Case of MPOHaziyah HalimNo ratings yet

- Check List For Yearly ClosingDocument4 pagesCheck List For Yearly Closingvaishaliak2008No ratings yet

- Dumaguete Cathedral Credit Cooperative vs. CIRDocument3 pagesDumaguete Cathedral Credit Cooperative vs. CIRrejine mondragonNo ratings yet

- FP 03 Questions On Cost Volume Profit AnanlysisDocument4 pagesFP 03 Questions On Cost Volume Profit AnanlysisMana PlanetNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- 1st Term s1 Financial AccountDocument21 pages1st Term s1 Financial AccountAsabia OmoniyiNo ratings yet

- Determinants of The Variability in Corporate Effective Tax Rate PDFDocument35 pagesDeterminants of The Variability in Corporate Effective Tax Rate PDFKristy Dela CernaNo ratings yet

- Business Studies Project On Credit CardsDocument10 pagesBusiness Studies Project On Credit CardsPiyush Setia0% (1)

- Chapter 9 - Financial AnalysisDocument13 pagesChapter 9 - Financial AnalysisNicole Feliz InfanteNo ratings yet

- Risk Appetite and Internal AuditDocument15 pagesRisk Appetite and Internal Auditmuratandac33570% (1)

- Security Argeement New OneDocument14 pagesSecurity Argeement New OneLamario Stillwell75% (4)

- Determination of Annual Value (Section 23)Document15 pagesDetermination of Annual Value (Section 23)AlezNo ratings yet

- Dean Robert Blair GibsonDocument2 pagesDean Robert Blair GibsonKabanNo ratings yet

- Financial Performance of Sonali Bank LimitedDocument55 pagesFinancial Performance of Sonali Bank LimitedSharifMahmud67% (3)

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- Company Analysis of Axis BankDocument66 pagesCompany Analysis of Axis BankKirti Bhite100% (1)

- RRL Na Laging NawawalaDocument26 pagesRRL Na Laging NawawalaLovely GonzalesNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneySouvik NandiNo ratings yet

- NMDFC PresentationDocument12 pagesNMDFC PresentationbhawakshiNo ratings yet