Professional Documents

Culture Documents

Study Note 2

Study Note 2

Uploaded by

Keerthana Raghu RamanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study Note 2

Study Note 2

Uploaded by

Keerthana Raghu RamanCopyright:

Available Formats

1

Study Note 2: Accounting Principles

This study note focuses on various accounting concepts that should be understood before

learning the accounting mechanism.

Business entity concept

The legal entity of a corporate business is distinct from the entity of its owners and managers,

and the people understand it well. Less understood, however, is that the accounting entity of a

business is distinct from its owners. For example, for many business purposes legal entity of

a sole-proprietary business may not be very distinct from the entity of the proprietor himself.

However, the business entity concept requires that this should not come in the way of treating

the business as a distinct accounting entity for the purpose of treating transactions relating to

the operations of the business. It is in accordance with this concept that when and on a brings

capital into the business, the business intern is DM to O the capital to the owner. Again,

coming to the business between the sole-proprietary concern and its sole proprietor, usually,

the proprietor may not be himself a salary even when he works for his business. However, in

accordance with the business as a separate entity, his position as an owner may not come in

the way the office charges a salary to the business for the services rendered by him. This is

because, as far as the business is concerned, the services rendered cannot be regarded as cost-

free. The reward of ownership is manifested only in profit, which must be arrived at after

charging all the costs.

Going Concern

A business entity is assumed to carry on its operations forever. Even if all the members of the

management die, the concern will continue to exist. Going Concern concept implies that the

resources of the concern should be used for the purpose of business which they are meant to

be used. The concept of employees that land, building, machinery, etc. Which are required

for carrying out the production and selling of certain products, should continue to be a

concern for a long time.

Cost concept

The cost concept implies that in accounting, all transactions are generally recorded at cost

and not at market value. For example, if a piece of land is acquired for 2lac, it would continue

to be shown in the balance sheet at Rs.200000 even when the market value of the land rises

to, say, Rs. 5lacs. The cost concept is closely related to Going Concern Concept. Suppose the

land is acquired for operations of the business and would continue to be used for its

operations and would not be sold shortly. In that case, it is mainly in material what the land’s

market value is since it will not be sold anyway. Thus, it is consistent with the going concern

concept to keep recording the land at a cost of 2 lacs on an ongoing basis.

Money Measurement Concept

All transactions are recorded through a common denominator, namely the monetary unit.

Thus, if a certain event cannot be measured in monetary terms, no matter how significant it is

Curated by: Poonam Namjoshi TRI1:FRA

2

for the help of or even the existence of the business, it cannot be recorded in the books of

accounts. For example, the purchase of an inconsequential asset such as tables and chairs,

which is easily method in rupee terms, is accounted for in the business; however, the

retirement or death of a chairman of a company has far-reaching consequences for the health

of the business. It is not accounted for since no monetary measurement for the event is

feasible.

Duality or double entry concept

This concept states that for every transaction, there will be two aspects. For example, when

capital is introduced into business, there is cash inflow, capital forms a liability, and the cash

inflow is an asset. Similarly, when equipment is purchased for cash, the new asset comes in

(use of funds), and cash will decrease (source of funds). Or, when the equipment is purchased

for credit, the new asset comes in, and a liability will occur. For every transaction, there are

two aspects. In effect, all transaction affects the basic accounting equation given under

Assets = Liabilities + Owners' equity

Accounting period concept

To be able to prepare income statements for business, the period for which it is to be prepared

must be specified. An Accounting Period may be a calendar year or a financial year. In some

businesses, such as trading, the operating period may be relatively short, say a month or even

less in other cases it may stretch well beyond the year. Under the Companies Act, a company

usually is not permitted to have the accounting period extending beyond 15 months.

Matching concept

In order to determine the profits or losses accrued in an accounting period, the expenses must

relate to the goods and services sold during the period. The expenses incurred in producing

goods and services should be matched to the revenue realised from selling goods and

services.

Conservatism concept

The idea behind this concept is that revenue recognition requires better evidence than

recognition of expenses. The concept emphasises that revenues are recognised only when

they are reasonably, certain, and expenses are to be recognised as soon as possible. For

example, a sales manager might have finalised the deal with the client to sell 100 units of a

product. But unless this item is produced and delivered to the client, there is no reasonable

certainty about receiving the payment for those hundred units. It is only thereafter that he can

record the sales amount on those hundred units as due from the client. On the other hand, if

you come to know that the customer has lost all his Assets and it is likely to default payment,

then we should immediately either make probation for sex losses or write them off.

Consistency concept

Curated by: Poonam Namjoshi TRI1:FRA

3

The consistency concept requires that once an entity has decided on one method, it will treat

all subsequent events of the same character in the same fashion unless it has sound reason to

change the treatment method of that event. For example, if a concern is charging depreciation

by one method, it is expected to follow the same method in subsequent years also.

Materiality concept

All financial transactions need to be recorded in books of accounts; however, there may be

transactions that may be insignificant and are not shown separately. They are usefully club

with others. There is no agreement as to the exact line separating the material events from the

material events. The decision depends on judgements and common sense.

Realisation concept

According to this concept, revenues are recognised only when goods and services have been

delivered, and there is certain that revenue will be realised. If, from past experience, it is

realised that revenue is realised for 95% of the sales, a provision of 5% can be treated as a

doubtful account. For example, orders may be obtained at time 1, which may be accepted at

time 2, the work towards the production of an order may commence at time 3, the production

process is completed at time 4, the goods are dispatched at time 5, and the cash is received at

time 6, and so on. At which time can one say that revenue is realised, or a sale is made?

Normally, revenue is said to be realised when efforts are rendered or rewarded either in cash

or kind or in the form of a promise of reward sometime in future. Now, in the above context,

a reward or a promise of reward sometime in future may normally forthcoming only after

goods are dispatched. Thus, revenue is normally recognised only when goods or services are

transferred, and a reward or a promise of reward is forthcoming. If there is no transfer of

goods or services normally, no reward may be expected either now or in the future, and no

revenue will be realised. Similarly, there is no reward or a promise of reward in return for

goods or services nearly B and act of philanthropy or squandering and cannot be construed as

a "Sale". Thus, usually, revenue is recognised at the time of transfer of goods or services

respective whether payment is made immediately or in future. However, there are exceptions

to the rule of revenue recognition.

Curated by: Poonam Namjoshi TRI1:FRA

You might also like

- Cambridge IGCSE Physics Coursebook AnswersDocument41 pagesCambridge IGCSE Physics Coursebook AnswersVictor Stone81% (172)

- Bridgewater Associates Presentation (Updated)Document17 pagesBridgewater Associates Presentation (Updated)GHaj100% (3)

- Accounting ConceptsDocument4 pagesAccounting ConceptsSk KhatibNo ratings yet

- 64340e0ee4b0987fa0cd09e0 OriginalDocument7 pages64340e0ee4b0987fa0cd09e0 OriginalSiddharth OjhaNo ratings yet

- Accounting Concepts: 1. The Entity ConceptDocument3 pagesAccounting Concepts: 1. The Entity ConceptNormanRockfellerNo ratings yet

- Lesson 6 Accounting Concepts and PrinciplesDocument3 pagesLesson 6 Accounting Concepts and PrinciplesACCOUNTING STRESSNo ratings yet

- Study of Challenges Faced by Small Companies in Adopting Social Media MarketingDocument7 pagesStudy of Challenges Faced by Small Companies in Adopting Social Media MarketingAshish ChandraNo ratings yet

- Accounting Concepts and Principles-Module 3Document4 pagesAccounting Concepts and Principles-Module 3gerlie gabrielNo ratings yet

- Q) Any 5 Types of Accounting Concepts: 1. Business Separate Entity ConceptDocument49 pagesQ) Any 5 Types of Accounting Concepts: 1. Business Separate Entity ConceptrashNo ratings yet

- Accounting Concepts 1. Introduction:Defination: (I) One Set of Final Accounts For All PurposesDocument8 pagesAccounting Concepts 1. Introduction:Defination: (I) One Set of Final Accounts For All PurposesSamuel NgatheNo ratings yet

- Ov Ov Ov OvDocument8 pagesOv Ov Ov Ovdeepak_rathod_5No ratings yet

- Accounting ConceptsDocument8 pagesAccounting ConceptsBajra VinayaNo ratings yet

- Accounting Concepts and Conventions Qualitative FeaturesDocument8 pagesAccounting Concepts and Conventions Qualitative FeaturesKhadejai LairdNo ratings yet

- 3.5 ConceptsDocument7 pages3.5 Conceptsattaelahi804No ratings yet

- Concepts, Principles and Convensions - AnoverviewDocument6 pagesConcepts, Principles and Convensions - AnoverviewA KA SH TickuNo ratings yet

- Advance FA Term Paper1Document4 pagesAdvance FA Term Paper1Anonymous in4fhbdwkNo ratings yet

- Fundamental of AccountingDocument10 pagesFundamental of AccountingRISHABH MEHTANo ratings yet

- Accounting Concepts: 1-Business Entity ConceptDocument20 pagesAccounting Concepts: 1-Business Entity ConceptAkash GuptaNo ratings yet

- Group 2 11-Amber - PPT Lesson 3Document16 pagesGroup 2 11-Amber - PPT Lesson 3kazumaNo ratings yet

- Accounting For Decision Making: Unit-Iii Accounting Principles & ConventionsDocument24 pagesAccounting For Decision Making: Unit-Iii Accounting Principles & ConventionsVishal ChandakNo ratings yet

- FINANCIAL ACCOUNTING - Alternative Material 16.06.2020Document35 pagesFINANCIAL ACCOUNTING - Alternative Material 16.06.2020AllandexNo ratings yet

- Accounting Is The Language of BusinessDocument5 pagesAccounting Is The Language of BusinessFunny Sexy VideosNo ratings yet

- Role of Accounting in SocietyDocument9 pagesRole of Accounting in SocietyAbdul GafoorNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsAjmal KhanNo ratings yet

- Accounting Concepts and Principles PDFDocument9 pagesAccounting Concepts and Principles PDFDennis LacsonNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionsPrincess RubyNo ratings yet

- Tally NotesDocument9 pagesTally Notesdummysold7No ratings yet

- Group D - Accounting PrinciplesDocument27 pagesGroup D - Accounting PrinciplesRisha RoyNo ratings yet

- Accounting Concepts and ConventionsDocument7 pagesAccounting Concepts and ConventionsPraveenKumarPraviNo ratings yet

- Accounting Framework and ConceptsDocument30 pagesAccounting Framework and Conceptsyow jing peiNo ratings yet

- Accounting PrinciplesDocument24 pagesAccounting Principlestegegn mogessieNo ratings yet

- Accounting AssignmentDocument6 pagesAccounting AssignmentOmer NasirNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionssrinugudaNo ratings yet

- Lesson-2 Generally Accepted Accounting Principles and Accounting StandardsDocument10 pagesLesson-2 Generally Accepted Accounting Principles and Accounting StandardsKarthigeyan Balasubramaniam100% (1)

- Lecture One Role of Accounting in SocietyDocument10 pagesLecture One Role of Accounting in SocietyJagadeep Reddy BhumireddyNo ratings yet

- Study and Briefly Explain On: Accounting Concepts AssumptionsDocument4 pagesStudy and Briefly Explain On: Accounting Concepts AssumptionsAziz AhmadNo ratings yet

- MODULE 3-Financial Accounting and ReportingDocument7 pagesMODULE 3-Financial Accounting and ReportingAira AbigailNo ratings yet

- Chapter: 3 Theory Base of AccountingDocument2 pagesChapter: 3 Theory Base of AccountingJedhbf DndnrnNo ratings yet

- Management AccountingDocument13 pagesManagement Accountingniharika bishtNo ratings yet

- AccountDocument17 pagesAccountbindiNo ratings yet

- Chapter 4 - Accounting Concepts and PrinciplesDocument27 pagesChapter 4 - Accounting Concepts and Principlesmarkalvinlagunero1991No ratings yet

- Accounting Concepts6Document7 pagesAccounting Concepts6TAI LONGNo ratings yet

- Accounting ConceptsDocument12 pagesAccounting ConceptsshafnafNo ratings yet

- Accounting RulesDocument15 pagesAccounting RulesRimmy's BrainNo ratings yet

- Business Entity ConceptDocument3 pagesBusiness Entity ConceptM. Waasih IqbalNo ratings yet

- Accounting Concepts and AssumptionsDocument3 pagesAccounting Concepts and AssumptionsMiriam RapaNo ratings yet

- Assumptions and PrinciplesDocument9 pagesAssumptions and Principlessakshum SoodNo ratings yet

- Accounting ConceptsDocument3 pagesAccounting ConceptsArpit GuptaNo ratings yet

- (L) Chapter 5 Accounting Concepts - ConventionsDocument6 pages(L) Chapter 5 Accounting Concepts - ConventionsCHZE CHZI CHUAHNo ratings yet

- Accounting Principles: Separate Entity Concept: It Is A Very Important Concepts. Business Is ADocument7 pagesAccounting Principles: Separate Entity Concept: It Is A Very Important Concepts. Business Is ASreeranjPrakashNo ratings yet

- Fundamental of Financial AccountingDocument14 pagesFundamental of Financial AccountingMohd SayyedNo ratings yet

- 4 Accounting PrinciplesDocument3 pages4 Accounting Principlesapi-299265916No ratings yet

- Accounts PracticalDocument22 pagesAccounts PracticalDivija MalhotraNo ratings yet

- Essentials of Accounting: To Appreciate The Importance of Different Accounting Concepts and ConventonsDocument5 pagesEssentials of Accounting: To Appreciate The Importance of Different Accounting Concepts and ConventonsMathew KanichayNo ratings yet

- Accounts Notes 1Document7 pagesAccounts Notes 1Dynmc ThugzNo ratings yet

- Accounting ConceptsDocument13 pagesAccounting ConceptsdeepshrmNo ratings yet

- General Accepted Accounting PrinciplesDocument4 pagesGeneral Accepted Accounting Principlesnadeem.rana0257No ratings yet

- Befa Accounting Concepts and ConventionsDocument24 pagesBefa Accounting Concepts and ConventionsJaipal Nayak BanavathNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionsSaumitra TripathiNo ratings yet

- Fin Accounting Preparation For MidtermDocument89 pagesFin Accounting Preparation For MidtermSrabon BaruaNo ratings yet

- Accounting ConceptsDocument2 pagesAccounting Conceptssoumyasundar720No ratings yet

- Quickbooks: Guide to Master Bookkeeping and Accounting for Small Businesses and Simple Concept TechniquesFrom EverandQuickbooks: Guide to Master Bookkeeping and Accounting for Small Businesses and Simple Concept TechniquesNo ratings yet

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet

- LS 231g3 Advanced Multifunctional Servo DriveDocument60 pagesLS 231g3 Advanced Multifunctional Servo DriveIlhami DemirNo ratings yet

- English 10-18-2022Document54 pagesEnglish 10-18-2022Wilma PeñaNo ratings yet

- CF D Module Users GuideDocument572 pagesCF D Module Users Guidematin100% (1)

- A Perspective of Braided Hairstyles PDFDocument9 pagesA Perspective of Braided Hairstyles PDFhumble happyNo ratings yet

- Designing Esp32 Base Shield Board For Iot Application: Maier, Sharp & VagapovDocument8 pagesDesigning Esp32 Base Shield Board For Iot Application: Maier, Sharp & VagapovRamesh NagarNo ratings yet

- For Those With Internet Access: What To Do?Document6 pagesFor Those With Internet Access: What To Do?Jian Krissy Chavez BarroNo ratings yet

- Transverse, Vertical TpaDocument8 pagesTransverse, Vertical Tpasyaza azmanNo ratings yet

- Rudder - Steering Gear Speed RulesDNVGL-RU-SHIP-Pt4Ch10 19Document1 pageRudder - Steering Gear Speed RulesDNVGL-RU-SHIP-Pt4Ch10 19Tolias EgwNo ratings yet

- Spun PileDocument7 pagesSpun Pileمحمد فيذول100% (3)

- Quarter 1 Lesson 1Document3 pagesQuarter 1 Lesson 1Lester EstoquiaNo ratings yet

- Fyp Report - Shin Yin TanDocument131 pagesFyp Report - Shin Yin TanZunayed IslamNo ratings yet

- LP PaintingDocument8 pagesLP PaintingJoselito JualoNo ratings yet

- Ellis, Sheen, Murakami, Takashima, The Case For Feedback PDFDocument19 pagesEllis, Sheen, Murakami, Takashima, The Case For Feedback PDFpjvpetri100% (1)

- UntitledDocument124 pagesUntitledSunil SharmaNo ratings yet

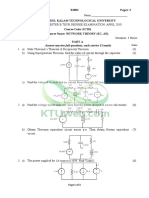

- Answer Answer Any Two Full Questions, Each Carries 15 Marks MarksDocument3 pagesAnswer Answer Any Two Full Questions, Each Carries 15 Marks MarksanuNo ratings yet

- Review Sheet For Math Midterm Exam Revised 1Document34 pagesReview Sheet For Math Midterm Exam Revised 1api-294158678No ratings yet

- Quartiere Italia To Faroe Islands - 6 Ways To TraDocument1 pageQuartiere Italia To Faroe Islands - 6 Ways To Trayxrnkv6gnwNo ratings yet

- Ahmedabad Smart City - Solar RooftopDocument1 pageAhmedabad Smart City - Solar RooftopShintia AhediaNo ratings yet

- Classical MechanicsDocument14 pagesClassical MechanicsandhracollegesNo ratings yet

- Elmo Rietschle V Series Oil Lubricated Rotary Vane BrochureDocument8 pagesElmo Rietschle V Series Oil Lubricated Rotary Vane Brochuregeorge andreiNo ratings yet

- Sabal Bharat Sansthan ProgramDocument54 pagesSabal Bharat Sansthan ProgramapurvarayNo ratings yet

- SingaporeDocument29 pagesSingaporeTường Anh PhanNo ratings yet

- Work On Your VocabularyDocument128 pagesWork On Your VocabularygokagokaNo ratings yet

- Stanford The Lord Is My ShepherdDocument16 pagesStanford The Lord Is My ShepherdEmanuela MussoNo ratings yet

- Targeted SlimmingDocument8 pagesTargeted SlimmingHarsh Goyal67% (3)

- Ignite SampleDocument88 pagesIgnite Samplexbsd0% (1)

- Amp Net Connect Catalog FullDocument304 pagesAmp Net Connect Catalog Fullelvis1281No ratings yet