Professional Documents

Culture Documents

Newzoo Global Games Market Report May 2023 Update

Newzoo Global Games Market Report May 2023 Update

Uploaded by

Sao224Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Newzoo Global Games Market Report May 2023 Update

Newzoo Global Games Market Report May 2023 Update

Uploaded by

Sao224Copyright:

Available Formats

Update May | 2023

Global Games Market Report

Data Updates | State of the VR Market | Third-Party Research | Top 25

Public Game Companies | Financial Headlines | Cloud Gaming Update

2023

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Introduction

Table of Contents

01. Introduction & Key Takeaways 03

02. Data Updates 05

03. State of the VR Market 14

04. Third-Party Research 20

05. Top 25 Public Game Companies 24

06. Financial Headlines 27

07. Cloud Gaming Update 29

08. About Newzoo 33

©2023 Newzoo Global Games Market Report | May 2023 Update 2

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 01. Introduction & Key Takeaways

Introduction

We are pleased to present the games market update for May 2023, which is part of your

subscription to Newzoo’s Games Market Reports & Forecasts service.

In this update, we share our final revenue estimate for the games market in 2023 and

updated forecast from 2023 to 2025. These revisions result from an analysis of over 150

publicly-listed game companies.

The result is a minor change to the forecast published in November 2022. We now estimate

revenues for all three segments declined year on year in 2022, leading to an overall -5.1% decline

for the games market to $182.9 billion. The background behind the revision is part of the Data

Updates section. Furthermore, we updated GDP and HHC metrics based on new information

provided by the World Bank and switched app store data provider for our genre revenue

model. The results of these model changes are also described in the Data Updates section.

Chapter 3 is dedicated to the VR game market. The chapter outlines the current state of the

market and shares our latest estimates and forecasts for both the VR headset install base

and VR game revenues.

As usual, this Update includes comparisons to relevant third-party research published

between January to April 2023, an overview of the top 25 publicly-listed game companies (for

2022), and selected financial headlines for the top 10.

Finally, we end the Update with a chapter on the state of the cloud gaming market,

contextualizing our take on CMA’s decision to block Microsoft’s proposed acquisition of

Activision-Blizzard. This chapter also shares the highlights from our March 2023 Cloud

Gaming Update, which is now part of your subscription as this product was merged into

Newzoo’s Games Market Reports & Forecasts subscription.

All data in this update is available on the Newzoo Platform.

Authors Contributors

Tom Wijman Michiel Buijsman, Senior Market Analyst

Lead Analyst - Games Michael Wagner, Senior Market Analyst

tom@newzoo.com Tomofumi Kuzuhara, VR Market Analyst

Tiago Reis, Cloud Gaming Analyst

Rhys Elliott, Market Analyst & Writer

Please note that this report is for internal use only and publication or disclosure to third parties, in any manner

whatsoever, of any data contained herein is not allowed without the prior written consent of Newzoo.

©2023 Newzoo Global Games Market Report | May 2023 Update 3

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 01. Introduction & Key Takeaways

Key Takeaways

May 2023 Games Market Report Update

1 We now estimate that the games market generated $182.9 billion in 2022, declining

-5.1% year on year. This is lower than the $184.4 billion we forecast in November 2022.

a. The one change compared to our November forecast is our estimate for

global PC revenues. PC game revenues in H2 2022 strongly declined com-

pared to the previous year. As a result, we now estimate PC revenues were

$38.9 billion in 2022, a year-on-year decline of -3.4%

b. We now estimate global mobile game revenues in 2022 were $91.9 billion,

down -6.7% year on year.

c. We now estimate global console game revenues in 2022 were $52.2 billion,

down -3.4% year on year. This is slightly above our November 2022 forecast.

2 We now forecast the games market to grow to $206.4 billion at a +2.9% CAGR from

2020 to 2025.

In preparation for this update, we found that using the constant currency method

3 to convert reported revenues misrepresented spending in the market. To better rep-

resent consumer spending per market, we used the US$ exchange rate at the end of

each quarter.

4 The global active VR hardware install base reached 26.6 million in 2022, a growth

of +30.7%. Standalone VR headsets remained the fastest-growing ecosystem with a

year-on-year growth of +63.7% to reach an install base of 18.7 million in 2022.

5 We now estimate that VR games generated $1.5 billion in 2022, with 14.3% annual growth.

6 The top 25 public companies by game revenues earned a combined $152 billion in

2022, a year-on-year decrease of -4.0%. Despite a strong first quarter (+8.5%), reve-

nues slowed throughout the year.

©2023 Newzoo Global Games Market Report | May 2023 Update 4

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

Data Updates

In preparation for this May Update, we updated a selection of models. This chapter pro-

vides the background for each model. In order of relevance, these models were updated.

1. Games Market Revenues, 2022 – 2025

a. Impact of foreign exchange rates

b. 2022 Revenue Estimate

c. 2023 – 2025 Revenue Forecast

2. GDP Update

3. Genre Revenue 2022

Additionally, we updated our estimates and forecasts for VR install base and VR game

revenues. These results are presented in the next chapter.

Games Market Revenues, 2022 – 2025

The revenue revision presented in this update is the result of our extensive analysis of

the financial results of more than 150 publicly listed game companies (for the full year

of 2022), app store intelligence data provided through our data partner, and our propri-

etary title-level revenue data for PC and console games. Performing this analysis twice

yearly gives us key insights into the revenues and growth rates of the gaming segments

and regions within the world’s games market.

In preparation for the 2023 – 2025 revenue forecast, we rely on forward-looking state-

ments presented by publicly listed game companies and our understanding of trends

shaping engagement with games. The broader conceptual framework supporting our

forecasts consists of the expected growth of the online population plus the expected

development of the Key Market Indicators per region. Overall, our forecasts are always

the outcome of an iterative process, reviewing the implications of our assumptions on a

very granular level.

©2023 Newzoo Global Games Market Report | May 2023 Update 5

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

Impact of foreign exchange rates

Newzoo reports on games market revenues in US$. To do so, we convert revenues

reported in local currency. In the past, we used the year-end US$ exchange rate. The

method removes most impact of changes in foreign exchange rates, allowing us to focus

on changes in consumer spending – the goal of our games market revenue metrics.

However, the value of foreign currencies to the US$ were extremely volatile during 2022.

In preparation for this update, we found that using the constant currency method to

convert reported revenues misrepresented spending in the market. It would inflate locally

reported revenue earned in the U.S. and undervalue locally earned revenues in non-U.S.

markets.

2022 US$ exchange rate 2022 US$ exchange

Currency Difference %

(constant currency) rate (average of 2022)

EUR 1.1369 1.0520 8.1%

GBP (UK) 1.3528 1.2136 11.5%

KRW (KR) 0.0008412 0.000771 9.1%

JPY (JP) 0.0087 0.0075 15.3%

RMB (CN) 0.1574 0.1481 6.3%

For example, using a constant currency approach, every 100 JPY earned by Sony in the

U.S. would convert into $0.87. However, using the 2022 average currency exchange rate, this

same 100 JPY converts into $0.75, more than a 15% difference. The value of the Japanese Yen

is the most extreme example, but there is a significant difference between the methods for

every major foreign currency (see table 1).

To better represent consumer spending per market, we used the US$ exchange rate at

the end of each quarter.

The advantage of this approach is that we do not overvalue revenues earned by compa-

nies in the U.S. that report in non-US$ currency – such as Sony and Nintendo. However, it

does mean that the US$ value of companies that earn the lion’s share of their revenues in

non-U.S. markets is lower than it would have been using the constant currency approach,

as is the revenue recognized by U.S.-based companies for revenues earned in regions

outside the U.S. We will note when this change impacts our revenue estimates whenever

relevant in the coming section.

©2023 Newzoo Global Games Market Report | May 2023 Update 6

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

2022 Revenue Estimate

2022 Global Games Market

Per Segment

Browser PC Games

$2.3Bn Dowloaded/Boxed

PC Games

-14.8% YoY $36.5Bn

-2.6% YoY

1%

Console Games

20%

29%

$52.2Bn

2022 Total

-3.4% YoY

$182.9Bn

-5.1%

YoY

Mobile Games

50% $91.8Bn

-6.7% YoY

2022 Global Games Market

Per Region

Middle East & Africa

Europe

$6.8Bn

$33.3Bn +5.8% YoY

-2.4% YoY 4%

18%

Latin America

$8.4Bn Asia-Pacific

5%

+3.3% YoY

2022 Total

$84.8Bn

$182.9Bn

-5.1% 46% -8.9% YoY

YoY

27%

North America

$49.7Bn

-2.5% YoY

©2023 Newzoo Global Games Market Report | May 2023 Update 7

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

We now estimate that the games market generated $182.9 billion in 2022, declining -5.1%

year on year. This is lower than the $184.4 billion we forecast in November 2022.

North America performed better than previously forecast, as the US$ was strong com-

pared to foreign currencies. The opposite effect happened in China, Japan, and South

Korea. Local companies tend to be very successful in these markets, but revenues gener-

ated locally convert into a lower US$ value due to the impact of foreign exchange rates,

leading to a lower games market estimate.

PC Games

North America performed better than previously forecast, as the US$ was strong com-

pared to foreign currencies. The opposite effect happened in China, Japan, and South

Korea. Local companies tend to be very successful in these markets, but revenues generated

locally convert into a lower US$ value due to the impact of foreign exchange rates, leading

to a lower games market estimate.

The one change compared to our November forecast is our estimate for global PC reve-

nues. We anticipated PC revenues to be flat year on year based on company results in H1

2022; however, H2 2022 was significantly worse than the previous year. As a result, we now

estimate PC revenues were $38.9 billion in 2022, a year-on-year decline of -3.4%. Even with

constant currency, PC revenues would have declined compared to 2021.

The decline in PC revenues does not seem to result from a single game or company per-

forming worse than expected. Engagement data from Newzoo’s Game Performance Monitor

shows that the sum of PC MAUs of the top 250 PC games across 37 markets declined, mostly

due to lower engagement in H2 2022. The same trend is visible in the company revenues

we collect and Newzoo’s PC revenue data for the U.S. and the United Kingdom. MAU grew

in some markets – Japan, notably – but the impact of foreign exchange rates negated the

positive impact of that.

Our estimate for China's PC market is the largest difference in the PC games segment.

We now estimate it declined -8.3% year on year to $13.0 billion, significantly lower than the

$14.2 billion we forecast in November 2022. While exchange rates are a factor here, the steep

decline is more than that. Tencent’s China PC revenue declined -13.8% year on year – note

that we estimate Tencent’s China PC revenues in 2022 were over $5 billion, almost 40% of

the local PC market.

©2023 Newzoo Global Games Market Report | May 2023 Update 8

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

Mobile Games

We now estimate global mobile game revenues in 2022 were $91.9 billion, down -6.7% year

on year. This is slightly below our November 2022 forecast. The change is the result of

foreign exchange rates. As China, South Korea, and Japan are three of the largest mobile

games markets, the value of local currencies compared to the US$ negatively impacted our

estimate.

Console Games

We now estimate global console game revenues in 2022 were $52.2 billion, down -3.4% year

on year. This is slightly above our November 2022 forecast. Like the mobile game segment,

the change results from the impact of foreign exchange rates. The United States is the

world’s largest console market, and two of the world’s largest revenue generators (Sony

and Nintendo) are headquartered in Japan.

2023 – 2025 Revenue Forecast

Global Game Revenues per Segment

2020-2025

$250.0Bn

$206.4Bn

$192.7Bn $197.2Bn

$200.0Bn $182.9Bn $189.0Bn

$179.1Bn

31% 32%

28% 30%

$150.0Bn 30% 29%

$100.0Bn

51% 50% 50% 49% 48%

49%

$50.0Bn

21% 21% 21% 21% 20% 19%

$0.0Bn

2020 2021 2022 2023 2024 2025

PC Mobile Console

©2023 Newzoo Global Games Market Report | May 2023 Update 9

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

We now forecast the games market to grow to $206.4 billion at a +2.9% CAGR from 2020

to 2025. This is below our previous forecast. Our mid- to long-term outlook on the games

market remains positive; we forecast growth in every year but 2022.

These are the key reasons for the lower forecast:

• Our lower 2022 PC estimate results in a lower CAGR between 2020 – 2025 for the PC

game segment: growing from $37.1 billion in 2020 to $40.0 billion by 2025 at a +1.5%

CAGR. Our outlook for the coming years remains unchanged: we forecast small growth

in each of the coming three years.

• We have lowered our growth forecast for the mobile game segment in 2023 and 2024.

We expect the impact of stricter privacy regulation and the post-COVID effect on

spending to have a prolonged negative effect on mobile gaming revenues.

• Note that we still forecast minor mobile game revenue growth each year from 2023 to

2025. The growth is mostly driven by revenue growth in emerging markets.

• As it was in November, we still forecast console gaming to grow rapidly in the coming

years, as the next two years are bringing loads of new content for a rapidly growing

user base of PS5 and Xbox Series. Furthermore, we expect a new Nintendo device

around 2024-2025, as the Nintendo Switch will launch eight years ago.

• By region, our take on China is the largest difference compared to our previous forecast.

• We remain pessimistic about the future of PC gaming in China, as we believe that

the lockdowns of past years and the restrictions on minors’ playtime have led to a

fundamental shift in playing habits (from PC to mobile).

• The discontinuation of NetEase’s partnership with Activision-Blizzard for the local

publication of Blizzard’s PC games will affect PC game revenues in China. Even if

Blizzard finds a new partner, the games probably won’t go live early in 2023—but

might return in late 2023 or even in 2024. This is big enough to affect PC gaming

revenue in the coming years, and we have adjusted our forecast.

• The number of games with approved licenses has accelerated since the last quarter

of 2022 and in 2023 to date. Approvals in 2023 already surpassed the total in 2022

and 2021 and are on the verge of surpassing the number of games approved in 2020.

Simply put, more games will generally lead to more revenues, so we have upgraded

our mobile gaming forecast in line with it.

©2023 Newzoo Global Games Market Report | May 2023 Update 10

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

Global Games Market Forecast by Segment

2020-2025 | May 2023 vs. November 2022 Forecasts

Mobile Games - May 2023 Console Games - May 2023 PC Games - May 2023

Mobile Games - November 2022 Console Games - November 2022 PC Games - November 2022

$120Bn

$100Bn

$80Bn

$60Bn

$40Bn

$20Bn

$0Bn

2020 2021 2022 2023 2024 2025

GDP Update

In March 2023, a new data set with GDP per capita and household consumption data was

released by World Bank. We incorporated it into our global games market model, using the

metrics to split regional revenues by country and estimate revenues for countries outside

our proprietary research scope.

The data update results in revised revenue estimates and forecasts for nearly every

country. As the World Bank revisits estimates of past years in every update, historic games

market estimates have already been adjusted.

New country-level estimates are available in the Newzoo Platform and are part of the

downloadable data set.

Genre Revenue 2022

We estimate genre revenues for the year using a combination of reported company reve-

nues, title-level engagement and revenue data from Newzoo’s Game Performance Monitor,

our proprietary consumer research, and per-app downloads and revenues from our app

store intelligence partner.

©2023 Newzoo Global Games Market Report | May 2023 Update 11

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

In the past months, we have switched our app store intelligence data provider (to Appto-

pia). Due to the methodology used by app store intelligence providers, switching providers

leads to significant swings in revenue estimations on a category level. This is true for both

genres defined by the performance of a select few top games and those where the estimate

is a sum of many different games. After all, the difference between rank #1 to #2 within a

certain category might be much larger than the difference between #101 and #102 – com-

plicating accuracy for genres with only a few games driving most of the performance.

Conversely, estimates for genres with many successful games can differ strongly between

providers depending on which partners they have to validate accuracy.

Table 2 summarizes the differences between our new mobile game per genre estimates

(using Apptopia) and the November 2022 data.

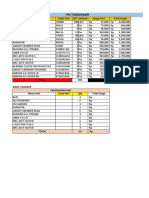

Genre Global mobile revenue estimate Difference to November 2022

Adventure $7,758.7M +6%

Arcade $327.7M -92%

Battle Arena $4,879.0M +2%

Battle Royale $5,184.7M -33%

Card Battle $3,731.5M -33%

Fighting $2,560.8M +14%

Casino $4,927.7M +31%

Music $767.5M -32%

Platformer $709.5M +21%

Puzzle $10,384.5M -8%

Racing $507.2M -62%

Role Playing $21,609.0M +79%

Shooter $3,912.0M -15%

Simulation $2,596.1M -34%

Sports $2,501.3M +8%

Strategy $8,552.3M -23%

Tabletop $748.8M -25%

Educational $407.9M +25%

Hyper Casual $883.6M +48%

Idle $7,217.9M +51%

Sandbox $1,653.6M -7%

Table 2: mobile game revenue estimate per genre and % difference compared to November 2022

©2023 Newzoo Global Games Market Report | May 2023 Update 12

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 02. Data Updates

In the past months, we have switched our app store intelligence data provider (to Appto-

pia). Due to the methodology used by app We also ingested three extra months of title-level

engagement data for our per-genre PC and console revenue estimates, leading to minor

changes.

We also added 2020 and 2021 genre revenue estimates to the downloadable data set and

will work on adding these natively to the Newzoo Platform in the coming months.

New genre revenue estimates for 2022 are available on the Newzoo Platform and are part

of the downloadable data set.

©2023 Newzoo Global Games Market Report | May 2023 Update 13

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

State of the VR Market

Model Update

Like all other forms of gaming, VR gaming’s popularity benefited from the lockdown

periods. Arguably even more so, as immersive experiences in VR filled a social need in a

time of isolation. The return to semi regular life has led to lower time spent playing and

purchasing new content in the segment. This effect is compounded by several challenges

– old and new – that the VR segment faces.

In this section, we summarize the result of the update to Newzoo’s VR install base and

game revenue model. You can also find the revised numbers on the Newzoo platform and

the accompanying Excel data set.

Scope of VR Market Sizing

The scope of Newzoo’s VR research covers consumer VR headsets capable of Six Degrees

of Freedom (DoF) positional tracking and VR game revenues generated through these

headsets. We exclude enterprise headsets that can also be used to play VR games. Degrees

of Freedom refers to the number of directions of users' positional tracking in VR, which

relies on built-in or external sensors to capture movement.

We categorize consumer VR headsets into the following three ecosystems: PlaySta-

tion VR, PC VR, and standalone VR. PC VR includes consumer VR headsets that require a

VR-ready PC to run the requisite software, such as Valve Index and HTC Vive Pro. Stand-

alone VR includes, for example, Meta Quest 2 and Pico 4, which do not necessarily require

a PC to play games.

Lastly, our forecasts only include potential successors of existing headsets and works

confirmed (or hinted at) by suppliers or new brands. The new entry of game-changing

headsets (brands) and introductions of killer specs with aggressive prices could easily

affect the market situation. Newzoo will continue monitoring the market closely and

include the latest developments in our forecasts.

©2023 Newzoo Global Games Market Report | May 2023 Update 14

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

Active VR Hardware Install Base Growth

Global | 2019-2025

Standalone VR CAGR: +36.1%

Total 2019-2025

PC VR

PlayStationVR

50.8M

41.4M

33.1M

26.6M 42.0M

33.0M

20.3M

25.0M

18.7M

12.7M 11.5M

8.0M 3.8M

1.0M 3.7M 3.8M 2.7M 2.3M

2.6M 3.5M 3.1M

5.2M 5.0M 5.0M 5.7M 6.4M

4.4M 4.3M

2019 2020 2021 2022 2023 2024 2025

The global active VR hardware install base reached 26.6 million in 2022, representing a

steady year-on-year growth of +30.7%. Above all, standalone VR headsets—those that do

not require extra hardware—remained the fastest-growing ecosystem with a year-on-year

growth of +63.7% to reach an install base of 18.7 million in 2022.

Meta’s Quest 2, despite a $100 price increase in its third year, helped the ecosystem main-

tain its dominant position. Pico, a Chinese VR brand owned by ByteDance, also launched

the new standalone headset Pico 4 in Europe and select Asian markets last October. The

new headset has pancake lenses, making it more compact than Quest 2, and Pico is enrich-

ing its VR content library by supporting VR developers in porting their content to the

Pico Store. With the new headset, Pico aims to strengthen its position in China and gain a

stronger presence in the West to compete with Meta.

©2023 Newzoo Global Games Market Report | May 2023 Update 15

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

Looking ahead, Meta is launching its next-gen consumer headset (Quest 3) later in 2023,

as the Quest 2 approaches its fourth year in the market. One of the Quest 3’s selling points

will be color passthrough for mixed reality as seen in the Quest Pro (featured in our free

VR Games Market Report). The headset will reportedly be twice as thin, twice as powerful,

and slightly more expensive than Quest 2. As new headsets will see technological advance-

ment, it is likely that some of the new games as well as live-service games developed for the

new headsets drop support for the previous-gen headsets. In fact, Resident Evil 4 launched

as a Quest 2 exclusive in 2021, and several popular games, such as Population: One and

Zenith, dropped or will end support for Quest 1. These developments might prompt some

owners to replace their headsets with new ones.

We expect other tech giants to enter the market in the coming years. Driven by Meta's

ongoing investment in hardware and an influx of standalone headsets from other tech

giants, standalone VR's active install base will reach 25.0 million by the end of 2023, repre-

senting +33.4% year-on-year growth.

We estimate that PC VR's active install base dropped slightly to 3.5 million in 2022 (-8.8%

year-on-year). The mass-consumer VR market continued to shift away from (PC-)teth-

ered to more accessible standalone experiences to reach a wider audience. Meta's low-cost

Quest 2 strategy also made it challenging for other headset manufacturers to compete in

the mass-consumer VR space. Many of Meta's competitors in the space shifted their focus

to enterprise VR or high-end consumer VR like HTC's Vive Pro 2 and Vive XR Elite. There

have been fewer PC VR headset releases, and those that do launch have been high-end

devices. These factors did and will lead to fewer PC VR sales. As a result, we forecast that

the PC VR’s active install base will decrease to 3.1 million by the end of 2023.

Lastly, PlayStation (PS) VR's active install base decreased to 4.3 million in 2022 (-14.2%

year-on-year). Sony's first-gen headset is at the end of its lifecycle owing to its outdated

resolution, tracking, and controllers. Following that, Sony launched the PS VR2 (with over

40 launch window titles) in February 2023. The PS VR2 is one of the first mass-consum-

er-targeting headsets to feature eye-tracking and foveated rendering. This combination of

innovative technologies enables higher-resolution graphics with a faster performance by

concentrating graphics processing on areas of the screen the user is looking at.

©2023 Newzoo Global Games Market Report | May 2023 Update 16

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

Adopting such cutting-edge technologies contributes to its high price point of $550,

which is even higher than the price of the PS5 itself. Requiring an approximate $1,000

initial investment on the headset and the console limits PS VR2's mass adoption com-

pared to the wider total addressable markets of standalone headsets such as Meta’s Quest

headset family.

PS VR2's launch will, nevertheless, naturally push up PS VR's overall active install base

again. We forecast it will reach 5.0 million by the end of 2023, growing by +15.7% year-

on-year. Sony has already built more VR knowledge and connections from its first VR

experiment, having acquired studios with experience in VR, including Insomniac in 2019

and Firesprite in 2021. Sony can also leverage its strong first-party franchises for future VR

content, like Horizon Call of the Mountain and Gran Turismo 7, to attract users. We expect

slightly higher shares of PS5 owners to buy PS VR2 headsets than those of PS4 owners

who first bought PS VR1 headsets.

Are you interested in the key developments in VR hardware?

Read our Free VR Games Market Report to learn more.

©2023 Newzoo Global Games Market Report | May 2023 Update 17

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

VR Games Revenues Growth

Global | 2019-2025 CAGR: +32.7%

2019-2025

$2.8Bn

$2.2Bn

$1.7Bn

$1.5Bn

$1.3Bn

$0.8Bn

$0.5Bn

2019 2020 2021 2022 2023 2024 2025

New insights from our improved data sources and an increasing number of VR games

tracked allowed us to validate our assumptions and fine-tune the model. As a result, we

have revised our VR game revenue estimates to reach $1.3 billion in 2021.

We now estimate that VR games generated $1.5 billion in 2022, with 14.3% annual growth.

This is $0.3 billion less than our previous forecast. The primary reason for the downward

revision is that the 2021 yearly revenues, which we revised this time, and the calculated

spend per install base were the starting points for drawing up a forecast for 2022. However,

our internal data sources also suggest that spending on VR games has slowed down in Q4

2022 despite including the holiday season, more substantially than the drop we had orig-

inally anticipated due to post-pandemic effects, content release schedules, and the price

hike of the Quest 2 headset.

A significant contributing factor here is that many people engaged with VR to social-

ize, fill time, and escape reality during the pandemic’s lockdown periods. Just like in the

general games market, some of these consumers churned from VR and returned to their

regular lives now that other experiential spending and leisure activities are possible once

more. New game releases in the VR market are fewer and further between than in the

general games market—especially on the AAA front, so VR has faced even more challenges

in retaining its users.

©2023 Newzoo Global Games Market Report | May 2023 Update 18

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 03. State of the VR Market

Looking ahead, we now forecast that yearly revenues from VR games will exceed $1.7

billion (+16.2% year-on-year) by the end of 2023. The active VR hardware will drive this

growth (+24.6% year-on-year), while we incorporate average spend per install base to show

another decrease in 2023 following 2022’s sharp decline.

All in all, creating and maintaining compelling VR content will remain one of the key

challenges and drivers for further adoption of VR headsets, user retention, and growth of

spending on VR games. To that end, our VR game revenue forecasts assume that, with the

PS VR2 and Pico 4 recently launched and Quest 3 on the way, these platform holders will

ramp up their efforts to enrich their content catalogs via first and third parties. Invest-

ment into VR content is essential for attracting and retaining users and will help these

platform holders justify and recoup (a part of) their hardware investment.

Meta has acquired eight VR studios over the past few years, including Camouflaj (makers

of former PlayStation-exclusive Iron Man VR) and Armature Studio (the developer of

Resident Evil 4‘s VR port on Meta devices). However, none of these first-party studios has

officially announced any new games. It is likely that some of these studios are developing

content for Quest 3. Meta also recently claimed that 150 titles are currently in active devel-

opment with Oculus Publishing (its third-party publishing program). These efforts will

gradually appear in the market as developing VR games, especially bigger ones, takes time.

As always, we will keep an eye on the market’s developments and will adjust our esti-

mates and forecasts accordingly.

©2023 Newzoo Global Games Market Report | May 2023 Update 19

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 04. Third-Party Research

Third-Party Research

This section compares our latest market sizing and forecasts to those published by third

parties in the past three months. Please refer to earlier updates for comparisons to research

firms not mentioned here or reach out to your Newzoo contact in case you have questions.

We also compare our market sizing and forecasting methodology to third parties on our

Platform FAQ.

Data.ai

Mobile Game Revenue, Global & Selected Countries

2022 | Data.ai vs. Newzoo comparison

$120 Bn

$109.5Bn

$100 Bn

$91.8Bn

$80 Bn

$60 Bn

$42.4Bn

$40 Bn

$30.0Bn

$24.2Bn

$20 Bn $16.8Bn

$12.4Bn $13.1Bn

$4.3Bn $5.3Bn

$1.6Bn $2.5Bn

$0 Bn

Global United States China Germany Japan South Korea

Newzoo Data.ai

Data.ai’s State of Mobile 2023 report repeated the mobile market forecast first published

in December 2022. In the report, data.ai also shares country-level mobile game revenue

estimates. In addition to a global comparison, we have compared our 2022 estimates to

data.ai’s for five of the world’s largest mobile gaming markets.

Overall, Newzoo’s estimate per country is below data.ai’s, a trend consistent with the

difference in the global estimate for 2022. From past articles by data.ai, we know Newzoo’s

market estimate is consistently below data.ai’s since 2014.

©2023 Newzoo Global Games Market Report | May 2023 Update 20

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 04. Third-Party Research

Having country-level data to compare helps us understand where this difference comes

from. Based on this comparison, the most difference comes from a different revenue esti-

mate in Western markets (U.S. and Germany) and China.

The revenue for Japan is closest – Newzoo’s estimate is at 95% of data.ai’s. Many of

Japan’s most successful mobile companies are publicly listed and generate most of their

revenues in their local market. Japan is typically the market where our collection of public

revenues covers the highest share of the total market estimate. Therefore, it makes sense

that estimates for all research companies are similar: the information is largely public.

The lack of public data also explains why estimates for other regions are less compa-

rable: these are revenues generated by listed companies operating on a multinational or

global stage or privately-held companies. Either way, the estimates are comparatively

reliant on the methodology and interpretation of us (versus that of data.ai).

A detailed comparison of methodology is available on our platform FAQ. In short,

however, Newzoo relies on publicly reported financials for revenue estimates and uses a

top-down approach to estimate revenues per country. Data.ai and other app store intel-

ligence providers rely on frequent polls of public app store rankings, which are enriched

with actual download and revenue data from their many publishing partners to calculate

revenues per game. These are then aggregated for country-specific estimates.

Another key difference is the moment of revenue recognition: either when the player

purchases virtual currency (data.ai) or when the players spend that virtual currency

in-game (Newzoo). It is not uncommon for players to hold on to virtual currency (or never

spend it), but it is practically impossible to “return” the currency. Data.ai’s method will

always lead to higher estimates than Newzoo’s.

As for interpretation, from past articles on the subject, we know data.ai does not attri-

bute 2022’s mobile revenue decline to changes in privacy regulation and subsequent UA

challenges. We also know Newzoo’s growth estimate for the COVID period was higher, so

the actual estimates differ from the period before 2019.

©2023 Newzoo Global Games Market Report | May 2023 Update 21

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 04. Third-Party Research

Sensor Tower

Mobile Game Revenue, Global & Selected Countries

2022 | Sensor Tower vs. Newzoo comparison

Newzoo Sensor Tower

$100 Bn $91.8Bn

$78.7Bn

$80 Bn

$60 Bn

$40 Bn

$30.0Bn

$22.5Bn

$20 Bn $16.8Bn $14.5Bn $12.4Bn $14.5Bn

$4.3Bn $5.3Bn

$1.6Bn $2.2Bn

$0 Bn

Global United States China* Germany Japan South Korea

Note: Sensor Tower's China estimate does not include third-party Android stores

Sensor Tower’s mobile market estimate and forecast are not exactly comparable to New-

zoo’s, as Sensor Tower only reports on Apple App Store & Google Play; it doesn’t include

third-party app stores in its market sizing data.

The country-level estimates in Sensor Tower’s report titled ‘The State of Mobile Gaming

2023’ highlight that difference. Newzoo’s estimate for China’s mobile games market is more

than twice that of Sensor Tower’s, as the Android game market consists entirely of third-

party app stores. However, Newzoo’s estimate is consistently lower than Sensor Tower’s

in other countries. Many of the arguments used in the previous piece on data.ai’s mobile

games market estimate apply here, too. Like data.ai, Sensor Tower’s methodology relies

on frequent polls of public app store rankings, and with that difference in methodology, a

difference in market estimates is logically expected.

Likewise, Newzoo and Sensor Tower’s estimates are most comparable in Japan and

South Korea – both markets where local mobile game companies are more often than not

publicly listed and generate a high share of revenue domestically. Sensor Tower’s report

does not provide much insight into the reasons behind its estimates.

©2023 Newzoo Global Games Market Report | May 2023 Update 22

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 04. Third-Party Research

GPC

China Games Market Revenue

2022 | GPC vs. Newzoo comparison

$50.0Bn

$44.0Bn

$45.0Bn

$40.7Bn $1.0Bn

$40.0Bn $1.0Bn

$35.0Bn

$30.0Bn

$30.0Bn

$25.0Bn $29.6Bn

$20.0Bn

$15.0Bn

$10.0Bn

$13.0Bn

$5.0Bn $10.2Bn

$0.0Bn

GPC Newzoo

PC Mobile Console

The 2022 China Gaming Industry Report by GPC estimates that China’s games market

declined -10.3% year on year. Converted into US$ using the same exchange rate applied by

Newzoo, this equates to $40.7 billion in revenue.

This is slightly less than Newzoo’s estimate of $44.0 billion. Analyzing differences per

segment shows that a different estimate for the PC game segment causes GPC’s lower esti-

mate: GPC’s $10.2 billion estimate is just short of 79% of Newzoo’s $13.0 billion estimate.

Unlike Newzoo, GPC does not include non-official sales—including via global Steam—

as part of its PC and console market calculations. We consider all consumer behavior a

necessary part of the market, especially in light of China's aforementioned license freeze,

which led to many Chinese players using VPNs and accelerators to play unapproved games

available in other territories.

This is a non-factor for mobile games; thereby, our and GPC’s estimates are comparable

for the segment. There is a so-called grey market for the console game segment, which is

mostly imported consoles and console games resold to local consumers. Neither GPC nor

Newzoo captures this revenue stream as part of China’s games market: these revenues are

recognized in the country of the original purchase. Furthermore, this pattern is much less

prevalent after China lifted the ban on game consoles during the last decade.

©2023 Newzoo Global Games Market Report | May 2023 Update 23

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 05. Top 25 Public Game Companies

Top 25 Public Game Companies

The top 25 public game companies in 2022 by revenue

By Game Revenues | CY 2022

Rank Company 2022 FY 2021 FY YoY

1 Tencent $30,710 $32,539 -5.6%

2 Sony $15,987 $16,876 -5.3%

3 Apple $14,540 $15,325 -5.1%

4 Microsoft $12,308 $12,929 -4.8%

5 NetEase $10,214 $9,740 4.9%

6 Google $9,925 $11,046 -10.1%

7 Electronic Arts $7,377 $6,512 13.3%

8 Activision Blizzard $6,923 $8,144 -15.0%

9 Nintendo $6,821 $7,415 -8.0%

10 Take-Two Interactive $4,399 $3,414 28.8%

11 Sea Group $3,877 $4,320 -10.3%

12 Bandai Namco Entertainment $3,256 $2,889 12.7%

13 Nexon $2,662 $2,455 8.4%

14 Playtika $2,545 $2,526 0.8%

15 Ubisoft $2,352 $2,226 5.6%

16 37 Interactive $2,334 $2,514 -7.2%

17 Roblox $2,225 $1,919 15.9%

18 Netmarble $2,059 $2,160 -4.7%

19 Square Enix $1,907 $2,424 -21.3%

20 NCSoft $1,872 $1,841 1.7%

21 Konami $1,646 $1,905 -13.6%

22 Embracer Group $1,623 $1,308 24.1%

23 CyberAgent $1,600 $2,603 -38.5%

24 Warner Bros. Entertainment $1,525 $1,770 -13.9%

25 Century Huatong Group $1,411 $1,669 -15.4%

Total $152,099 $158,467 -4.0%

©2023 Newzoo Global Games Market Report | May 2023 Update 24

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 05. Top 25 Public Game Companies

The top 25 public companies by game revenues earned a combined $152 billion in 2022, a

year-on-year decrease of -4.0%. Despite a strong first quarter (+8.5%), revenues slowed

throughout the year. Many companies cited a challenging macro environment creating

headwinds to revenue growth. With ever-increasing market saturation, demand reduc-

tion, and ongoing global inflation challenges, 2022 was more a correction from the highs of

the pandemic than a downturn for much of the industry.

However, while currency conversion has typically not played a significant role in past

annual comparisons, 2022 is unique. Due to the rising strength of Western currencies, espe-

cially the US dollar, companies that have lower exposure to the Western markets, such as

CyberAgent (#23), may have seen higher revenues in their own currencies. Japanese com-

panies were uniquely affected due to the weak Yen. Both Sony (#2) and Bandai Namco (#12)

expressed greater revenue due to high revenue exposure to Western currencies.

Meanwhile, Roblox (#17) continues to see top-line growth of 16% in 2022 and a 23% increase

in daily active users with a 19% increase in engagement time. However, profits continue

to trend further red (-$1 billion in 2022 vs -$504 million in 2021). Additionally, while both

pure engagement and MAUs continue to grow, engagement has fallen -3.5% from 2021. The

company says it will start in-game advertising in 2023 to users over the age of 13, a demo-

graphic that is estimated to make up 43% of its total users per Statista.

Although 2022 saw gaming revenues drop overall, inorganic growth contributed to

several games experiencing solid revenue growth. Take-Two’s (#10) acquisition of Zynga for

$12.7 billion, which closed in May, saw Q1 net quarterly revenues of $930 million increase

to $1,394 million for Q3. In the same vein, Embracer Group continues to increase revenues

through acquisition. The company’s purchase of Asmodee and Perfect World in December

2021 took full effect in 2022. It also added Square Enix and Lord of the Rings IPs along with

14 other studios between Q1 and Q3 2022.

Bandai Namco (#12) only released 8 games in 2021, which made 2022 comparatively

stronger thanks to a busier release schedule. The company launched 15 games last year,

including the wildly successful Elden Ring. EA (#7) benefitted from live-service games like

Apex Legends and their perennial titles, where FIFA saw the most successful launch of the

franchise as the company departed from its partnership with FIFA to rebrand as EA Sports

FC in 2023.

©2023 Newzoo Global Games Market Report | May 2023 Update 25

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 05. Top 25 Public Game Companies

Due to the Yen weakening, Japanese companies experienced outsized revenue losses in

2021. Sony (#2), Konami (#21), and CyberAgent (#23) illustrated this trend, with each company

reporting significant revenue drops in USD. However, when looking at financials in local

JPY, Sony (+11.7%) and Konami (+1.9%) posted revenue increases, while CyberAgent (-27.5%)

and Square Enix (-7.2%) posted smaller losses compared to their activity in USD. Bandai

Namco, on the flipside, remains the biggest winner with +32.3% revenue growth YoY.

USD (in $ million) JPY (in million)

2021 2022 % Change 2021 2022 % Change

Nintendo $7,415 $6,821 -8.0% ¥834,626 ¥902,140 8.1%

Square Enix $2,424 $1,907 -21.3% ¥272,035 ¥252,397 -7.2%

Sony $16,876 $15,987 -5.3% ¥1,893,855 ¥2,115,097 11.7%

Cyber Agent $2,603 $1,600 -38.5% ¥291,126 ¥210,974 -27.5%

Bandai Namco $2,889 $3,256 12.7% ¥323,920 ¥428,547 32.3%

Konami $1,905 $1,646 -13.6% ¥213,511 ¥217,475 1.9%

Mobile developers who once relied on precise targeting for user acquisition must now

shore up their budgets to overcome the increased scrutiny on user privacy. The changes to

user tracking limit the effectiveness of this precise targeting to drive revenue growth effi-

ciently. Apple (#3) and Google (#6) face pressure from endemic and non-endemic parties

regarding app store policies and data protection. Both firms stayed silent about their game

revenues in their 2022 annual reports, which may indicate a lack of growth for the segment.

Looking at markets, the Americas (+1.8%), EMEA (+0.4%), and APAC (+6.2%) all saw

growth in 2022, while China (-10.2%), Japan (-19.4%), and South Korea (-20.6%) saw signifi-

cant revenue reduction. We must again point out that the currency conversion to a strong

USD greatly exaggerates the revenue decline in the three big Asian markets. By platform,

mobile (-5.6%) and PC (-5.8%) saw sizable revenue reductions in 2022, while console (-2.9%)

took a smaller loss.

©2023 Newzoo Global Games Market Report | May 2023 Update 26

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 06. Financial Headlines

Financial Headlines

Tencent's 2022 game revenues decreased -5.6% to $30,710 million. International game revenue

increased +5%, led by the continued success of VALORANT and League of Legends, along

with the new releases of GODDESS OF VICTORY: NIKKE and Warhammer 40,000: Darktide.

Domestic game revenue decreased -6% YoY, with Tencent citing China’s continued efforts to

reduce minors' playing time as a contributing factor. Revenue from Honor of Kings contin-

ues to grow after record-high sales during Chinese New Year.

Sony's 2022 game revenues decreased by -5.3% to $15,987 million when compared to YoY in

USD. However, due to the current weakness of the Japanese Yen, especially to USD, favorable

foreign exchange conditions drove a sizeable revenue increase (+13.9%) for Sony’s financial

statements. Additionally, both first-party titles and hardware sales increased YoY.

Apple's game app revenues declined by an estimated -5.1% YoY to $14,540 million in 2022.

Apple did not outright comment on game revenue from its App Store or its Apple Arcade

services. However, Apple’s Q3 report emphasized that the European Union’s Digital Markets

Act and Epic Games’ ongoing lawsuit could materially affect their company going forward.

Microsoft's 2022 game revenues declined by an estimated -4.8% to $12,308 million, with Q3

and Q4 seeing revenue decreases of -3% and -12%, respectively. Growth in Game Pass sub-

scriptions was offset by a decline in content that Microsoft cites as lower engagement hours

and monetization in both first- and third-party games. No further information was provided

about the ongoing acquisition of Activision Blizzard.

NetEase's 2022 game revenues grew an estimated +4.9% to $10,214 million. Growth was driven

by Fantasy Westward Journey and Westward Journey Online, while Eggy Party’s launch

helped the company break its highest daily active user record. Online games accounted for

92.5% of NetEase’s revenue in 2022. Share mobile game revenue dropped from 70.4% to 67.0%.

Blizzard and NetEase officially ended their decade-long partnership in January 2023.

Google's generated estimated game app revenues of $9,925 million in 2022, declining -10.1%

YoY versus an 8% decline within Google’s “other revenues” category. Google mimicked Apple’s

statements by citing antitrust litigation and European data protection efforts as potential

headwinds for Google Play.

©2023 Newzoo Global Games Market Report | May 2023 Update 27

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 06. Financial Headlines

Electronic Arts (EA)'s 2022 game revenues grew +13.3% to $7,377 million. EA launched nine

new titles in 2022, including FIFA 22, which was the most successful launch in the franchise.

Live service and other revenue increased +24%, generating just under $5 million accounting

for 71% of net revenue. Apex Legends’ MAU increased 35% YoY and EA Play now supports

580 million unique active accounts (+16% YoY). Revenues generated from mobile jumped to

$1,059 million from $718 million in 2020. Direct sales from Sony and Microsoft represented

33% and 16% of net revenue, respectively.

Activision Blizzard's 2022 game revenues declined -15.0% to $6,821 million, led primarily by

Activision’s $200 million revenue reduction. Call of Duty (Vanguard, Black Ops Cold War,

and Mobile), World of Warcraft, and Diablo II: Resurrected revenues fell by $2 billion in 2022,

while Call of Duty (Modern Warfare II and Vanguard), Diablo Immortal, and Candy Crush

increased by $871 million. MAUs increased 5% led by an 87.5% increase for Blizzard (primar-

ily from the launch of Overwatch 2). Activision Blizzard’s top three franchises (Call of Duty,

Warcraft, and Candy Crush) accounted for 79% of net revenues for the company.

Nintendo's 2022 game revenues declined -8.0% to $6,821 million. Despite Nintendo featuring

27 first- and third-party titles with over 1 million copies in 2022, software was down 4%, while

hardware saw a 21.3% decline YoY. The company cited the previous summer’s component

shortage as a major contributing factor. Digital sales (incl. digital copies of packaged games

and Nintendo Switch Online subscriptions) increased 21.5% YoY. Finally, mobile and IP-re-

lated revenues declined -2.3% YoY.

Take-Two entered the top 10 game companies by revenue after seeing a +28.8% increase in

revenues to $4,399 million in 2022. H2 2022’s revenues were $2.88 billion, driven by sales and

booking within NBA 2K23 and Grand Theft Auto Online/Grand Theft Auto V. With the Zynga

acquisition, Take-Two is expecting to reach $160 billion in gross bookings over the next four

years. Q4 was lower than expected as Take-Two cites the macroeconomic environment and a

shift in consumer spending to “established blockbuster franchises and titles.”

©2023 Newzoo Global Games Market Report | May 2023 Update 28

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 07. Cloud Gaming Update

Cloud Gaming Update

This section shares an update from our March 2023 Cloud Gaming Update. Moving forward,

we will share highlights from other markets previously covered in standalone reports. This

is included in your subscription to Newzoo’s Games Market Reports & Forecasts. Future

reports will also include cloud gaming, esports, or live streaming highlights.

Cloud gaming took center stage last month when the U.K.’s Competition and Markets

Authority (CMA) blocked Microsoft’s planned acquisition of Activision Blizzard, a decision

that took much of the games market off guard.

The antitrust regulator cited neither console exclusivity nor mobile as the reasoning behind

its decision. The nascent cloud gaming market was the focus, with the CMA claiming that

content like Call of Duty and Blizzard’s library might stifle competition in cloud gaming.

Cloud gaming is a high-potential and growing market, but the market makes up but a

fraction of the games market. It is also part of the games ecosystem, not its own separate

market. In the long term, we at Newzoo expect cloud gaming to be a pivotal part of game

delivery and development. Some of the biggest tech companies and publishers are pouring

resources into the market, and cloud gaming usage and revenues are growing. But as the

technology and business model is still young, it is difficult to predict cloud gaming’s trajec-

tory in 20 years, 10 years, or even 5 years from now.

As per documentation from the U.K.’s government, the CMA based decision on numbers

forecasting the cloud gaming to generate up to £11 billion globally in 2026 (and £1 billion in the

U.K.). The cloud gaming numbers used by the CMA exceed our own Newzoo cloud gaming

forecasts, for which we present three different scenarios as the cloud gaming is so young

and therefore highly subject to change based on different market factors:

• In our most likely scenario, we forecast that paying users of cloud gaming services will

spend $3.3 billion on cloud gaming services, growing to $7.0 billion by 2025.

• Our optimistic scenario sees spending will reach $9.0 billion by 2025.

• However, our pessimistic scenario expects $5.5 billion by 2025.

While our methodology and the methods used by the CMA and its advisors are different,

it seems likely that their figures for 2025 are in line with or even above our most optimistic

outlook of the market.

©2023 Newzoo Global Games Market Report | May 2023 Update 29

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 07. Cloud Gaming Update

Cloud gaming remains poised for solid growth, especially as demand for cloud gaming

services outweighs supply. Yet, that does not mean that the earliest cloud gaming success

stories should be seen as anti-competitive. Xbox’s commitment to cloud gaming may even

empower the market and bring more consumers—U.K.-based and otherwise—into it, giving

consumers more choices in the short term.

Xbox has found success by making cloud gaming additive to its core game library; cloud

gaming is a value-adding feature in the Xbox Game Pass subscription. Therefore, cloud

gaming is a different delivery method for Xbox’s content subscription — not a market

in and of itself. The reality is that if Xbox does find success with its take on cloud gaming,

other game companies will follow suit. In fact, they already are, as PlayStation offers similar

functionality with the higher tiers of its PlayStation Plus subscription.

While Xbox offers titles outside of Game Pass via cloud gaming (Fortnite, for example),

this value proposition is not unique to Xbox; NVIDIA and Amazon Luna also offer it. Simply

put, the CMA’s argument distils cloud gaming to an individual market, ignoring its place

in the wider games ecosystem. The digital and boxed games ecosystems are not separate;

neither are cloud-delivered games via a subscription and natively delivered games via a

subscription.

©2023 Newzoo Global Games Market Report | May 2023 Update 30

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 07. Cloud Gaming Update

Highlights from the March 2023 Cloud Gaming Update

Cloud Gaming Paying User Forecast per Region

Base Scenario | 2021-2025

North America 80.4M

Latin America

Europe

Middle East & Africa 16.6%

China

Asia-Pacific (Excl. China) 61.0M 9.2%

17.7%

8.5% 28.3%

43.1M

18.7%

29.7%

30.0M 7.7% 6.9%

20.8%

21.5M 30.6% 5.9% 15.8%

6.8%

26.0% 4.9% 16.2%

31.6%

5.8%

3.3% 17.1%

32.2%

17.1% 23.2%

1.8% 22.0%

16.4% 20.9%

17.7% 20.4%

2021 2022 2023 2024 2025

• Cloud gaming is poised for solid growth, especially as demand for cloud gaming ser-

vices outweighs supply. At the same time, while cloud gaming is not a new technology,

it is a new market. And that novelty comes with challenges.

• Some of the cloud gaming’s latest developments led us to revisit our outlook on the market

and make downward adjustments. Nevertheless, it is important to stress that even the

newly lowered forecast still displays strong growth toward 2025 across all metrics.

• Cloud gaming’s SOM in 2022 was 221.2 million people. This number will grow +28.7% on

average each year to reach 471.4 million in 2025, thanks to improved service availability,

internet connections, and higher interest levels in cloud gaming globally.

• In our most likely scenario, we forecast 43.1 million paying users of cloud gaming services

by the end of 2023, spending a total of $3.3 billion on cloud gaming services. This will

grow to 80.4 million paying users spending $7.0 billion by 2025. We also now forecast the

ARPPU to grow from $76.1 in 2023 (down -$4.16 from our previous forecast) to $87.0 in 2025

(down -$7.08 from previously).

©2023 Newzoo Global Games Market Report | May 2023 Update 31

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents 07. Cloud Gaming Update

Global Cloud Gaming Paying User Forecasts

Optimistic, Base, and Pessimistic Scenarios | 2021-2025

Optimistic Base Pessimistic

120M

100M

80M

60M

40M

20M

0M

2021 2022 2023 2024 2025

• In our most recent optimistic scenario, spending will reach $9.0 billion by 2025.

• In our pessimistic scenario, we expect revenues to grow significantly slower, reaching

$5.5 billion by 2025.

• Cloud gaming companies are expanding their business models to reach non-gaming

markets, to help ensure their servers are being used as much as possible while limiting

impact to player experience.

• Cloud continues bringing gaming to new products and destinations, including fitness

equipment, the hospitality industry, and even cars.

• Edge computing may ease cloud gaming challenges and facilitate VR and the metaverse,

as it could help offset some of the technical challenges developers face for these growth

segments.

• Chinese cloud gaming companies have adopted a modest, game-by-game approach to

cloud gaming and are now eyeing international expansion opportunities.

• Cloud gaming remains a viable technology even after Stadia’s closure, but the closure has

lessons for the broader industry that should not be ignored.

©2023 Newzoo Global Games Market Report | May 2023 Update 32

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

Table of Contents About Newzoo

Helping you thrive

in the games market

Game Performance Global Gamer Game Health

Monitor Study Tracker

Unlock title-level engagement Explore the global gamer audi- Track brand health and purchase

and revenue data for thousands ences across all dimensions with funnel data over time for

of PC and console games. the largest gamer research study. hundreds of games.

Custom Gamer Games Market Consulting &

Research Reports & Forecasts Analyst Services

Specialized research designed Discover games market sizing, Consult our experts and access

for you by our leading games forecasts, and trends on a the most relevant data and

market experts. global and local level. insights for your gaming project.

Questions?

Tom Wijman

Lead Analyst - Games

tom@newzoo.com

©2023 Newzoo Global Games Market Report | May 2023 Update 33

Downloaded by: matthew.heritage@outrightgames.com - Outright Games

You might also like

- Gaming Industry Final DissertationDocument50 pagesGaming Industry Final DissertationJayadtiya Singh jasolNo ratings yet

- MA0 - Marvel Super Heroes Advanced SetDocument189 pagesMA0 - Marvel Super Heroes Advanced SetAndres Rodriguez83% (6)

- Game Design Patterns For Mobile GamesDocument57 pagesGame Design Patterns For Mobile GamesSanath BhatNo ratings yet

- TR11 Sets In-Depth Version 0.4Document6 pagesTR11 Sets In-Depth Version 0.4saulius mickusNo ratings yet

- Nike CaseDocument21 pagesNike CaseAnksNo ratings yet

- Block Blast (Game) : Department of Computer Science COMSATS University Islamabad, Lahore CampusDocument72 pagesBlock Blast (Game) : Department of Computer Science COMSATS University Islamabad, Lahore CampusSubhan Ahmad100% (1)

- OMORI Discord ProgressDocument87 pagesOMORI Discord ProgressstreamingNo ratings yet

- Nazara - EquirisDocument52 pagesNazara - EquirisBBNo ratings yet

- Cshreve Idle Game Design DocumentDocument4 pagesCshreve Idle Game Design Documentapi-273624154No ratings yet

- Fashion Coin Whitepaper (EN) PDFDocument24 pagesFashion Coin Whitepaper (EN) PDFAdhytLimberzLimbanadiNo ratings yet

- Nintendo Wii Brand Analysis FinalDocument38 pagesNintendo Wii Brand Analysis FinalAsep Kurniawan0% (1)

- Longboard InstructionsDocument10 pagesLongboard InstructionstononoinkNo ratings yet

- Six Circles - An Experience Design FrameworkDocument50 pagesSix Circles - An Experience Design FrameworkJames Kelway100% (4)

- ESA Essential Facts 2005Document16 pagesESA Essential Facts 2005Alejandro Rossette100% (1)

- Game Design Document TemplateDocument14 pagesGame Design Document TemplateOAPM78No ratings yet

- Star Ocean Second EvolutionDocument99 pagesStar Ocean Second EvolutionLester WintersNo ratings yet

- Integrated Marketing Communications Plan For XboxDocument22 pagesIntegrated Marketing Communications Plan For Xboxapi-534799667No ratings yet

- Tien Len RulesDocument5 pagesTien Len RulesdvoyevodNo ratings yet

- My Real Book Vol 5Document86 pagesMy Real Book Vol 5Phurinut Khumyoung100% (1)

- Games Marketing Insights For 2022Document33 pagesGames Marketing Insights For 2022Trà My NguyễnNo ratings yet

- My+Neighbor+Alice+Whitepaper+ +version+1.0.1+ (Final)Document28 pagesMy+Neighbor+Alice+Whitepaper+ +version+1.0.1+ (Final)Suci atunNo ratings yet

- June Live MagazineDocument142 pagesJune Live MagazineRob JenkinsNo ratings yet

- Dragon Force DesignDocument66 pagesDragon Force Designjon_jonesNo ratings yet

- One UpDocument297 pagesOne Upderyadinc48No ratings yet

- Riot Games: 1. Introduction On The CompanyDocument4 pagesRiot Games: 1. Introduction On The CompanyHoàng PhúcNo ratings yet

- Nintendo Brand AuditDocument34 pagesNintendo Brand Auditapi-301794183No ratings yet

- ReportDocument6 pagesReportMmNo ratings yet

- Game DevDocument7 pagesGame DevAditya Yoga WidyaswaraNo ratings yet

- 585 GamedesigndocumentDocument3 pages585 Gamedesigndocumentapi-476484101No ratings yet

- Game Design DocumentationDocument9 pagesGame Design DocumentationVincent WuNo ratings yet

- Bantam Menace: Chop Socky ChooksDocument16 pagesBantam Menace: Chop Socky Chooksntv2000100% (1)

- GDD - Crazy RoadDocument14 pagesGDD - Crazy RoadpopoNo ratings yet

- Coup RG 54 RolesDocument1 pageCoup RG 54 RolesHanNo ratings yet

- Links To The Past User Research Rage 2: Ea HangeDocument68 pagesLinks To The Past User Research Rage 2: Ea HangeJUJANo ratings yet

- Wireframe 017 2019-07Document68 pagesWireframe 017 2019-07Tony LeMesmerNo ratings yet

- Game Design Doc ExampleDocument9 pagesGame Design Doc ExampleAnonymous pSZTQLQNo ratings yet

- 101 Ways To Use Third-Party Data Ebook FINAL 10 - 05Document109 pages101 Ways To Use Third-Party Data Ebook FINAL 10 - 05MAURICIOMVNo ratings yet

- Assassin S CreedDocument3 pagesAssassin S CreedcristiantrapaniNo ratings yet

- DC Comics Strategic AuditDocument14 pagesDC Comics Strategic AuditAfsheen Danish NaqviNo ratings yet

- Gamasutra - The Anatomy of A Design Document, Part 2Document5 pagesGamasutra - The Anatomy of A Design Document, Part 2MyNameNo ratings yet

- Wireframe 028 2019-12Document68 pagesWireframe 028 2019-12Tony LeMesmerNo ratings yet

- Game MonetizationDocument19 pagesGame MonetizationAristotle GoNo ratings yet

- Video Game PiracyDocument31 pagesVideo Game Piracyvicky100% (1)

- Dwi14202a Cs94 VideogameDocument171 pagesDwi14202a Cs94 VideogameDaniel Chan Ka LokNo ratings yet

- Gamasutra - Into The Woods - A Practical Guide To The Hero's JourneyDocument6 pagesGamasutra - Into The Woods - A Practical Guide To The Hero's JourneyGustavo ErazoNo ratings yet

- Emperor Rise of The Middle Kingdom - Campaign Creator Users Guide PDFDocument43 pagesEmperor Rise of The Middle Kingdom - Campaign Creator Users Guide PDFluisperezcheleNo ratings yet

- Article GTA 5 DownloadDocument2 pagesArticle GTA 5 Downloadyvonne6booth2No ratings yet

- Newzoo Global Games Market Report 2017 LightDocument21 pagesNewzoo Global Games Market Report 2017 LightRodrigo BrandãoNo ratings yet

- Lis 671 Video Game PreservationDocument12 pagesLis 671 Video Game Preservationapi-664863413No ratings yet

- Analysys Mason Rcs Business Messaging Nov2021 Rdmv0 Rdmy0Document21 pagesAnalysys Mason Rcs Business Messaging Nov2021 Rdmv0 Rdmy0Ta Xuan HuyNo ratings yet

- Alpha Corebook 0.4Document21 pagesAlpha Corebook 0.4regectNo ratings yet

- TDDDocument34 pagesTDDKaylen WheelerNo ratings yet

- Wireframe 023 2019-09Document68 pagesWireframe 023 2019-09Tony LeMesmerNo ratings yet

- Amuka Esports & Gaming Deck - (Presentation Mode)Document22 pagesAmuka Esports & Gaming Deck - (Presentation Mode)Andris AanNo ratings yet

- Gaming in IndiaDocument5 pagesGaming in IndiadcbroNo ratings yet

- Intersections of Video Game Design and Psychology: The FantasyDocument20 pagesIntersections of Video Game Design and Psychology: The FantasyCecilia ScavuzzoNo ratings yet

- The Last of Us (TV Series)Document42 pagesThe Last of Us (TV Series)NopeDeNope100% (1)

- Agency and Narrative in Video GamesDocument197 pagesAgency and Narrative in Video GamesRafael ConterNo ratings yet

- World of Tanks Game ManualDocument72 pagesWorld of Tanks Game ManualXHolyNoobXNo ratings yet

- Indian Gaming Market Review 06112015 SecuredDocument28 pagesIndian Gaming Market Review 06112015 SecuredswapNo ratings yet

- Media Kit Final - UpdatedDocument12 pagesMedia Kit Final - Updatedapi-4904187010% (1)

- Innovations in The Video Game IndustryDocument22 pagesInnovations in The Video Game IndustryIsmael FelixNo ratings yet

- GDD AnnotatedDocument46 pagesGDD AnnotatedArturo MBNo ratings yet

- Advertising Within: Video GamesDocument5 pagesAdvertising Within: Video GamesKarl GookeyNo ratings yet

- Tension Narrative and GameplayDocument8 pagesTension Narrative and GameplayCharlottevanLeeuwenNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market ReportGotchu BroNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market ReportdatsabbathNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market Reportbrunobueno.lmNo ratings yet

- PD Tamansari: Nama Part Kode Part QTY Satuan Harga Part Total HargaDocument12 pagesPD Tamansari: Nama Part Kode Part QTY Satuan Harga Part Total HargaAdi GrohlNo ratings yet

- Ranger Beast Master RedesignDocument8 pagesRanger Beast Master RedesignThiago SouzaNo ratings yet

- Family Fitness NightDocument1 pageFamily Fitness Nightapi-530144731No ratings yet

- Snake Game in Python - Using Pygame Module - FinalDocument17 pagesSnake Game in Python - Using Pygame Module - FinalBirjesh RathourNo ratings yet

- Oath of The ChaliceDocument1 pageOath of The ChaliceI love you Evans PeterNo ratings yet

- NFHS Softball 2015 Rules Changes Major Editorial Changes Points of EmphasisDocument74 pagesNFHS Softball 2015 Rules Changes Major Editorial Changes Points of EmphasisFree Music - No CopyrightNo ratings yet

- Public (EU) - 2 Whisper You: Public (EU) - 2 Whisper You: Public (EU) - 2 Whisper You: Public (EU) - 2 Whisper YouDocument46 pagesPublic (EU) - 2 Whisper You: Public (EU) - 2 Whisper You: Public (EU) - 2 Whisper You: Public (EU) - 2 Whisper Youholypoopie_humanityNo ratings yet

- KeysDocument19 pagesKeysRocky tsaiNo ratings yet

- Histogram Examples.Document6 pagesHistogram Examples.Rajkumar VijNo ratings yet

- Combat Advantage #07 - SidekicksDocument7 pagesCombat Advantage #07 - SidekicksVault VNo ratings yet

- Blue Doodle Project PresentationDocument9 pagesBlue Doodle Project PresentationSahil SheteNo ratings yet

- 05.20.21 Mariners Minor League ReportDocument12 pages05.20.21 Mariners Minor League ReportMarinersPRNo ratings yet

- Hero Kids Monsters Compendum - Big BadsDocument10 pagesHero Kids Monsters Compendum - Big BadsMichael BatzakisNo ratings yet

- Spirit - World - Gallery-The Key To Lenormand Divination PDFDocument28 pagesSpirit - World - Gallery-The Key To Lenormand Divination PDFCarla Cabrita100% (4)

- ET0136032Document19 pagesET0136032Anderson LuizNo ratings yet

- Fast Past Paper 1 Iq SolvedDocument20 pagesFast Past Paper 1 Iq SolvedHussnain SaleemNo ratings yet

- Ascendant Character Design Sheet GuideDocument25 pagesAscendant Character Design Sheet GuideConnor GreenNo ratings yet

- Geogebra Voved 3 MKDocument69 pagesGeogebra Voved 3 MKKristina Roko EvcevskaNo ratings yet

- CV - Francisc Traian ApostuDocument4 pagesCV - Francisc Traian ApostuAliceNo ratings yet

- EC487 SyllabusDocument2 pagesEC487 Syllabuskashmira100% (1)

- 3418324-Wild Beyond The Witchlight Story Tracker PrintFriendlyDocument1 page3418324-Wild Beyond The Witchlight Story Tracker PrintFriendlyHBENo ratings yet

- The Tower in The Mist (v1.2) PDFDocument29 pagesThe Tower in The Mist (v1.2) PDFMatias RobsonNo ratings yet