Professional Documents

Culture Documents

Turkcell Summary Data Document Q123 ENG Vfinal

Turkcell Summary Data Document Q123 ENG Vfinal

Uploaded by

mahmoud.te.strategyCopyright:

Available Formats

You might also like

- Orient Electric Report - Aazeb A. ParbataniDocument7 pagesOrient Electric Report - Aazeb A. ParbataniPreet JainNo ratings yet

- TLKM 1q21 Info MemoDocument20 pagesTLKM 1q21 Info MemopcpeceNo ratings yet

- Tsel2020 AR Webversion FINALDocument164 pagesTsel2020 AR Webversion FINALazka zulfa KhairinaNo ratings yet

- ABNL A SnapshotDocument2 pagesABNL A SnapshotajaysushNo ratings yet

- TLKM 9M23 Info MemoDocument19 pagesTLKM 9M23 Info Memorudyjabbar23No ratings yet

- Pdffile 1700758477537Document19 pagesPdffile 17007584775379tkpvc46rgNo ratings yet

- Ar 2021Document184 pagesAr 2021mailimailiNo ratings yet

- Reliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39Document31 pagesReliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39sachinborade11997No ratings yet

- Q2 FY24 Investor Presentation FINALDocument45 pagesQ2 FY24 Investor Presentation FINALDMT IPONo ratings yet

- ADRO ADMR May 2023 - 230811 - 000428Document48 pagesADRO ADMR May 2023 - 230811 - 000428Aditya Dani NugrahaNo ratings yet

- Telecommunication Sector 200903Document6 pagesTelecommunication Sector 200903Brian StanleyNo ratings yet

- Telefónica - Presentation Jan-Sep 23Document19 pagesTelefónica - Presentation Jan-Sep 23meditationinstitute.netNo ratings yet

- CGG Announces q1 2022 ResultsDocument15 pagesCGG Announces q1 2022 ResultsCa WilNo ratings yet

- LIT FactsheetDocument2 pagesLIT FactsheetAlex MilarNo ratings yet

- TelecomDocument8 pagesTelecomVaibhav JainNo ratings yet

- ATT Sustainability ReportDocument54 pagesATT Sustainability ReportcattleyajenNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- Siemens Business Fact SheetsDocument9 pagesSiemens Business Fact Sheetszain shafiqNo ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Ganesha Ecosphere 3QFY24 PresentationDocument31 pagesGanesha Ecosphere 3QFY24 PresentationAnand SrinivasanNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- Annual Report Telkomsel 2003Document44 pagesAnnual Report Telkomsel 2003jakabareNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedDocument5 pagesTata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedAnkita ChauhanNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor Presentationashokdb2kNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor PresentationKaveri PandeyNo ratings yet

- Tata-Motors-Group-Investor-Presentation-Q3 FY23Document51 pagesTata-Motors-Group-Investor-Presentation-Q3 FY23Sai Biplab BeheraNo ratings yet

- Resource Sharing For An Intelligent Future: Annual Report 2020Document176 pagesResource Sharing For An Intelligent Future: Annual Report 2020mailimailiNo ratings yet

- CMS Info SystemsDocument29 pagesCMS Info Systemskrishna_buntyNo ratings yet

- Spotify - Shareholder Deck Q2 2023 FINALDocument36 pagesSpotify - Shareholder Deck Q2 2023 FINALLeandro DemariNo ratings yet

- 2015 Aker Solutions Annual ReportDocument70 pages2015 Aker Solutions Annual ReportDebbie CollettNo ratings yet

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocument8 pages1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJNo ratings yet

- GCC Telecom Sector Results FY2009Document4 pagesGCC Telecom Sector Results FY2009Omar RanaNo ratings yet

- Q223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesDocument9 pagesQ223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesAndrei CucuNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- GTL Analyst Presentation: Safe HarborDocument17 pagesGTL Analyst Presentation: Safe Harborvsekar_1No ratings yet

- Mediaset (MS - MI) : 3Q03 Results On TuesdayDocument8 pagesMediaset (MS - MI) : 3Q03 Results On Tuesdaypoutsos1984No ratings yet

- L&T Technology Services LTDDocument40 pagesL&T Technology Services LTDCatAsticNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Tata Elxsi - Initiating Coverage - HSIE-202103161136119562073Document26 pagesTata Elxsi - Initiating Coverage - HSIE-202103161136119562073Deepak JayaramNo ratings yet

- Astrocast Bryan Garnier Report Buy-Tpnok85Document50 pagesAstrocast Bryan Garnier Report Buy-Tpnok85Cesar LizarazoNo ratings yet

- Half Yearly Financial Report 2019Document61 pagesHalf Yearly Financial Report 2019MAYERLIN TORRES PAEZNo ratings yet

- The Communication Powerhouse!: Sri Lanka TelecomDocument7 pagesThe Communication Powerhouse!: Sri Lanka TelecomniggerondopeNo ratings yet

- Affle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451Document23 pagesAffle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451stockengageNo ratings yet

- Aurubis 2016Document211 pagesAurubis 2016Fredrick TimotiusNo ratings yet

- Bharti Airtel: Performance, Upwardly Mobile: Stock DataDocument5 pagesBharti Airtel: Performance, Upwardly Mobile: Stock Datachirag_kamdarNo ratings yet

- Q3 2023 Presentation - 240227 - 140404Document13 pagesQ3 2023 Presentation - 240227 - 140404jbilyasseNo ratings yet

- Teleperformance Slideshow h1 2021 Va Def RsDocument60 pagesTeleperformance Slideshow h1 2021 Va Def RsJanella Marie BautistaNo ratings yet

- HCL Tech Q1 FY23 Investor ReleaseDocument25 pagesHCL Tech Q1 FY23 Investor ReleasedeepeshNo ratings yet

- 3-Auto Di MicrografDocument28 pages3-Auto Di Micrografsuthir_msNo ratings yet

- Citigroup Q1 Earnings Financial SupplementDocument33 pagesCitigroup Q1 Earnings Financial SupplementWall Street FollyNo ratings yet

- Wipro Annual Report 2004 2005Document308 pagesWipro Annual Report 2004 2005raghu myNo ratings yet

- Further Resource SharingDocument172 pagesFurther Resource SharingmailimailiNo ratings yet

- Electronic Financial Services: Technology and ManagementFrom EverandElectronic Financial Services: Technology and ManagementRating: 5 out of 5 stars5/5 (1)

- Alsavi Babra 3333 Sem 4 Minor Project - Docx 33-1-1-4-1Document4 pagesAlsavi Babra 3333 Sem 4 Minor Project - Docx 33-1-1-4-1rishabhverma934540No ratings yet

- Loctite Case SolutionDocument10 pagesLoctite Case SolutionLavina DNo ratings yet

- General Journal BestDocument12 pagesGeneral Journal BestNhatty WeroNo ratings yet

- (VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsDocument15 pages(VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsJoanne SunielNo ratings yet

- Freeport-Mcmoran Inc.: Higher Cost and Capex Guidance Dampens OutlookDocument18 pagesFreeport-Mcmoran Inc.: Higher Cost and Capex Guidance Dampens OutlookForexliveNo ratings yet

- MGT101 Midterm Past PaperDocument117 pagesMGT101 Midterm Past PaperKinza LaiqatNo ratings yet

- Proposal For Ecommerce WebsiteDocument3 pagesProposal For Ecommerce WebsitejayNo ratings yet

- Financial Planning and Forecasting NewDocument27 pagesFinancial Planning and Forecasting NewKinza gulNo ratings yet

- Guidelines For Upfront Tariff Setting For PPP Projects at Major Port Trusts, 2008Document20 pagesGuidelines For Upfront Tariff Setting For PPP Projects at Major Port Trusts, 2008vishalaquarianNo ratings yet

- HydrogenPro Integrated Report 2022Document162 pagesHydrogenPro Integrated Report 2022Aya ElbouhaliNo ratings yet

- Diversity Inclusion StrategyDocument11 pagesDiversity Inclusion StrategyCarolina AndaliaNo ratings yet

- 100 Essential Business VerbsDocument4 pages100 Essential Business VerbsMerly ColmenaresNo ratings yet

- 10. Performance Measurement and responsibility accountingDocument57 pages10. Performance Measurement and responsibility accountingmaramessiNo ratings yet

- Stakeholder Interview TemplateDocument2 pagesStakeholder Interview Templatewenli suNo ratings yet

- Operating CostingDocument33 pagesOperating Costingenpreet kaur aroraNo ratings yet

- Business Functions and Organization StructureDocument4 pagesBusiness Functions and Organization StructureJoseph GithaigaNo ratings yet

- Penner PDFDocument2 pagesPenner PDFpalak0% (1)

- Internship Report On SHAMA Ghee HGGM by Asim MalikDocument66 pagesInternship Report On SHAMA Ghee HGGM by Asim MalikAsim Malik89% (9)

- Manufacturing Industries: One Mark QuestionsDocument7 pagesManufacturing Industries: One Mark QuestionsaryanNo ratings yet

- Breakeven Analysis Cost AccountingDocument6 pagesBreakeven Analysis Cost AccountingLaibaNo ratings yet

- My - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Document2 pagesMy - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Bibhor KumarNo ratings yet

- Main Street Unionville Market Application - 2021aDocument5 pagesMain Street Unionville Market Application - 2021aHeidi TongNo ratings yet

- Unit II 1st G Bus EthicsDocument48 pagesUnit II 1st G Bus EthicsAnna fe AlviorNo ratings yet

- Quality Managementpracticein EthiopiaDocument12 pagesQuality Managementpracticein Ethiopiaandu asfaw100% (1)

- Color Vector 3D Business PowerPoint TemplatesDocument23 pagesColor Vector 3D Business PowerPoint TemplatesCielo Amor RabangNo ratings yet

- BAKERYDocument18 pagesBAKERYBavatharaniNo ratings yet

- A Study of Financial Performance of Samsung Electronics Pvt. Ltd.Document11 pagesA Study of Financial Performance of Samsung Electronics Pvt. Ltd.dipawali randiveNo ratings yet

- Chapter 8Document61 pagesChapter 8Anik BhowmickNo ratings yet

- Essentials of Business Communication 10th Edition Guffey Test Bank Full Chapter PDFDocument57 pagesEssentials of Business Communication 10th Edition Guffey Test Bank Full Chapter PDFquandiendjv100% (16)

- INV01604226 3962674 08272023+-+tokboxDocument2 pagesINV01604226 3962674 08272023+-+tokboxAnkit VermaNo ratings yet

Turkcell Summary Data Document Q123 ENG Vfinal

Turkcell Summary Data Document Q123 ENG Vfinal

Uploaded by

mahmoud.te.strategyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Turkcell Summary Data Document Q123 ENG Vfinal

Turkcell Summary Data Document Q123 ENG Vfinal

Uploaded by

mahmoud.te.strategyCopyright:

Available Formats

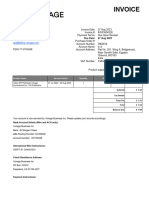

Turkcell Summary Data Document Q123

Ownership Structure Financial Performance

Turkey Revenue

IMTIS TRY million

Wealth Holdings

Fund 26% 62%

20% 17,276

10,695

54%

Publicly

Traded Q122 Q123

About Turkcell EBITDA

TRY million

Turkcell is a digital operator headquartered 57%

in Turkey, serving its customers with its 6,759

unique portfolio of digital services along 4,302

with voice, messaging, data and IPTV

services on its mobile and fixed networks.

Turkcell Group companies operate in 4

Q122 Q123

countries: Turkey, Ukraine, Belarus, and

Northern Cyprus.

Net Income

Turkcell Group reported TRY17.3 billion TRY million

revenue in 1st quarter of 2023 with total

assets of TRY109.8 billion as of March 31, 251%

2023. It has been listed on the NYSE and 2,817

the BIST since July 2000, and is the only

NYSE-listed company in Turkey. 803

Stock Information Q122 Q123

Ticker: TCELL / TKC Operational CAPEX/Sales

Market Cap (May 8): US$3.7 billion

19.9%

Foreign Ownership (May 8): 77% 17.3%

Dividend Yield (2021): 3.2%

2023 Guidance Q122 Q123

Leverage & FX Position

Revenue 1.2x 1.2x 1.0x 0.9x 0.9x

55-57% 300

Growth

200 0.5

100 -0.5

0

EBITDA ~TRY34 Bn -100

-1.5

(19) (25) (31) -2.5

-200

(149)

-300 (204) -3.5

Op. CAPEX*/

~22% Q122 Q222 Q322 Q422 Q123

Sales

FX Position (USDmn) Net Leverage*

* Excluding license fees

* Net Debt / EBITDA

Telecom Services - Highlights Strategic Focus Areas

4%

Subscribers (million) Revenue Digital Services & Solutions

25.9 Share

Revenue (TRY million)

11.6

3.0 1.3 65%

700

Postpaid Prepaid Fixed IPTV

broadband 424

520

QoQ

342K↑ 367K↓ 44K↑ 28K↑ 302

Net Add

122 180

ARPU (TRY) Q122 Q123

31.4% Digital Telco Services Digital OTT Services

67.9% • 5.2 Mn standalone paid user

118.1

100.4 89.9 • 1.3 Mn IPTV paid user; 1.0 Mn OTT TV

Q122 paid user

59.8

• 1.9 Mn lifebox paid user

Q123

9%

Mobile Blended Residential Fiber

(excl.M2M)

Revenue Digital Business Services

Share

Revenue (TRY million)

Churn (Monthly Avg.) 104%

1.6% 1.7% 1.5% 1,613

1.4% Fixed

1.2% 791

1.0% Fiber

Q122 Q123 Q122 Q123 Q122 Q123

Mobile Fixed Broadband

• 1,160+ new contracts in Q123

• TRY2.5 Bn backlog from system

Mobile Data KPIs (Avg. GB/User) integration projects

Non 4.5G Users 4.5G Users Total Users

4%

Revenue Techfin Services

Share

17.4 16.2 Revenue (TRY million)

14.7 13.4

72%

5.5 6.3 606*

Q122 Q123 353* 294

164

Smartphone 88% 317

Penetration ↑1.5pp YoY 193

Q122 Q123

Fiber Homepass & Subscribers (million) Financell** Paycell

2.0 2.1 2.1 2.2 Paycell

1.9

2.1 • 79% YoY revenue growth in Q123

5.4 5.5

5.6 5.0 5.2 1.6 • 7.7 Mn 3-month active users, up 12% YoY

4.7 • TRY18.2 Bn transaction volume, 2.7x YoY

4.6 1.1

Financell

3.6 0.6

• 65% YoY revenue growth in Q123

Q122 Q222 Q322 Q422 Q123

• 13 Mn customers with ready credit limit

Fiber Homepass Fiber Subscriber • 13% market share*** for loans below TRY10K

* Includes the revenues of Turkcell Aracılık Hizmetleri AS (Insurance Agency) and intercompany eliminations. ** Following the change in the organizational structure, the revenues of Turkcell Sigorta Aracılık Hizmetleri A.Ş. (Insurance Agency), which was

previously managed under the Financell, has been classified from Financell to "Other" in the Techfin segment as of the first quarter of 2023. Within this scope, all past data have been revised for comparability purposes. *** As of February 2023.

You might also like

- Orient Electric Report - Aazeb A. ParbataniDocument7 pagesOrient Electric Report - Aazeb A. ParbataniPreet JainNo ratings yet

- TLKM 1q21 Info MemoDocument20 pagesTLKM 1q21 Info MemopcpeceNo ratings yet

- Tsel2020 AR Webversion FINALDocument164 pagesTsel2020 AR Webversion FINALazka zulfa KhairinaNo ratings yet

- ABNL A SnapshotDocument2 pagesABNL A SnapshotajaysushNo ratings yet

- TLKM 9M23 Info MemoDocument19 pagesTLKM 9M23 Info Memorudyjabbar23No ratings yet

- Pdffile 1700758477537Document19 pagesPdffile 17007584775379tkpvc46rgNo ratings yet

- Ar 2021Document184 pagesAr 2021mailimailiNo ratings yet

- Reliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39Document31 pagesReliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39sachinborade11997No ratings yet

- Q2 FY24 Investor Presentation FINALDocument45 pagesQ2 FY24 Investor Presentation FINALDMT IPONo ratings yet

- ADRO ADMR May 2023 - 230811 - 000428Document48 pagesADRO ADMR May 2023 - 230811 - 000428Aditya Dani NugrahaNo ratings yet

- Telecommunication Sector 200903Document6 pagesTelecommunication Sector 200903Brian StanleyNo ratings yet

- Telefónica - Presentation Jan-Sep 23Document19 pagesTelefónica - Presentation Jan-Sep 23meditationinstitute.netNo ratings yet

- CGG Announces q1 2022 ResultsDocument15 pagesCGG Announces q1 2022 ResultsCa WilNo ratings yet

- LIT FactsheetDocument2 pagesLIT FactsheetAlex MilarNo ratings yet

- TelecomDocument8 pagesTelecomVaibhav JainNo ratings yet

- ATT Sustainability ReportDocument54 pagesATT Sustainability ReportcattleyajenNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- Siemens Business Fact SheetsDocument9 pagesSiemens Business Fact Sheetszain shafiqNo ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Ganesha Ecosphere 3QFY24 PresentationDocument31 pagesGanesha Ecosphere 3QFY24 PresentationAnand SrinivasanNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- Annual Report Telkomsel 2003Document44 pagesAnnual Report Telkomsel 2003jakabareNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Tata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedDocument5 pagesTata Communications LTD Short Term Debt Issue PR1+: Credit Analysis & Research LimitedAnkita ChauhanNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor Presentationashokdb2kNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor PresentationKaveri PandeyNo ratings yet

- Tata-Motors-Group-Investor-Presentation-Q3 FY23Document51 pagesTata-Motors-Group-Investor-Presentation-Q3 FY23Sai Biplab BeheraNo ratings yet

- Resource Sharing For An Intelligent Future: Annual Report 2020Document176 pagesResource Sharing For An Intelligent Future: Annual Report 2020mailimailiNo ratings yet

- CMS Info SystemsDocument29 pagesCMS Info Systemskrishna_buntyNo ratings yet

- Spotify - Shareholder Deck Q2 2023 FINALDocument36 pagesSpotify - Shareholder Deck Q2 2023 FINALLeandro DemariNo ratings yet

- 2015 Aker Solutions Annual ReportDocument70 pages2015 Aker Solutions Annual ReportDebbie CollettNo ratings yet

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocument8 pages1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJNo ratings yet

- GCC Telecom Sector Results FY2009Document4 pagesGCC Telecom Sector Results FY2009Omar RanaNo ratings yet

- Q223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesDocument9 pagesQ223 - Form8K - Exhibit99-1 - Earnings - Release - Tables - XLSX - Q223 - Form8K - Exhibit99-1 - Earnings - Release - TablesAndrei CucuNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- GTL Analyst Presentation: Safe HarborDocument17 pagesGTL Analyst Presentation: Safe Harborvsekar_1No ratings yet

- Mediaset (MS - MI) : 3Q03 Results On TuesdayDocument8 pagesMediaset (MS - MI) : 3Q03 Results On Tuesdaypoutsos1984No ratings yet

- L&T Technology Services LTDDocument40 pagesL&T Technology Services LTDCatAsticNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Tata Elxsi - Initiating Coverage - HSIE-202103161136119562073Document26 pagesTata Elxsi - Initiating Coverage - HSIE-202103161136119562073Deepak JayaramNo ratings yet

- Astrocast Bryan Garnier Report Buy-Tpnok85Document50 pagesAstrocast Bryan Garnier Report Buy-Tpnok85Cesar LizarazoNo ratings yet

- Half Yearly Financial Report 2019Document61 pagesHalf Yearly Financial Report 2019MAYERLIN TORRES PAEZNo ratings yet

- The Communication Powerhouse!: Sri Lanka TelecomDocument7 pagesThe Communication Powerhouse!: Sri Lanka TelecomniggerondopeNo ratings yet

- Affle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451Document23 pagesAffle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451stockengageNo ratings yet

- Aurubis 2016Document211 pagesAurubis 2016Fredrick TimotiusNo ratings yet

- Bharti Airtel: Performance, Upwardly Mobile: Stock DataDocument5 pagesBharti Airtel: Performance, Upwardly Mobile: Stock Datachirag_kamdarNo ratings yet

- Q3 2023 Presentation - 240227 - 140404Document13 pagesQ3 2023 Presentation - 240227 - 140404jbilyasseNo ratings yet

- Teleperformance Slideshow h1 2021 Va Def RsDocument60 pagesTeleperformance Slideshow h1 2021 Va Def RsJanella Marie BautistaNo ratings yet

- HCL Tech Q1 FY23 Investor ReleaseDocument25 pagesHCL Tech Q1 FY23 Investor ReleasedeepeshNo ratings yet

- 3-Auto Di MicrografDocument28 pages3-Auto Di Micrografsuthir_msNo ratings yet

- Citigroup Q1 Earnings Financial SupplementDocument33 pagesCitigroup Q1 Earnings Financial SupplementWall Street FollyNo ratings yet

- Wipro Annual Report 2004 2005Document308 pagesWipro Annual Report 2004 2005raghu myNo ratings yet

- Further Resource SharingDocument172 pagesFurther Resource SharingmailimailiNo ratings yet

- Electronic Financial Services: Technology and ManagementFrom EverandElectronic Financial Services: Technology and ManagementRating: 5 out of 5 stars5/5 (1)

- Alsavi Babra 3333 Sem 4 Minor Project - Docx 33-1-1-4-1Document4 pagesAlsavi Babra 3333 Sem 4 Minor Project - Docx 33-1-1-4-1rishabhverma934540No ratings yet

- Loctite Case SolutionDocument10 pagesLoctite Case SolutionLavina DNo ratings yet

- General Journal BestDocument12 pagesGeneral Journal BestNhatty WeroNo ratings yet

- (VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsDocument15 pages(VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsJoanne SunielNo ratings yet

- Freeport-Mcmoran Inc.: Higher Cost and Capex Guidance Dampens OutlookDocument18 pagesFreeport-Mcmoran Inc.: Higher Cost and Capex Guidance Dampens OutlookForexliveNo ratings yet

- MGT101 Midterm Past PaperDocument117 pagesMGT101 Midterm Past PaperKinza LaiqatNo ratings yet

- Proposal For Ecommerce WebsiteDocument3 pagesProposal For Ecommerce WebsitejayNo ratings yet

- Financial Planning and Forecasting NewDocument27 pagesFinancial Planning and Forecasting NewKinza gulNo ratings yet

- Guidelines For Upfront Tariff Setting For PPP Projects at Major Port Trusts, 2008Document20 pagesGuidelines For Upfront Tariff Setting For PPP Projects at Major Port Trusts, 2008vishalaquarianNo ratings yet

- HydrogenPro Integrated Report 2022Document162 pagesHydrogenPro Integrated Report 2022Aya ElbouhaliNo ratings yet

- Diversity Inclusion StrategyDocument11 pagesDiversity Inclusion StrategyCarolina AndaliaNo ratings yet

- 100 Essential Business VerbsDocument4 pages100 Essential Business VerbsMerly ColmenaresNo ratings yet

- 10. Performance Measurement and responsibility accountingDocument57 pages10. Performance Measurement and responsibility accountingmaramessiNo ratings yet

- Stakeholder Interview TemplateDocument2 pagesStakeholder Interview Templatewenli suNo ratings yet

- Operating CostingDocument33 pagesOperating Costingenpreet kaur aroraNo ratings yet

- Business Functions and Organization StructureDocument4 pagesBusiness Functions and Organization StructureJoseph GithaigaNo ratings yet

- Penner PDFDocument2 pagesPenner PDFpalak0% (1)

- Internship Report On SHAMA Ghee HGGM by Asim MalikDocument66 pagesInternship Report On SHAMA Ghee HGGM by Asim MalikAsim Malik89% (9)

- Manufacturing Industries: One Mark QuestionsDocument7 pagesManufacturing Industries: One Mark QuestionsaryanNo ratings yet

- Breakeven Analysis Cost AccountingDocument6 pagesBreakeven Analysis Cost AccountingLaibaNo ratings yet

- My - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Document2 pagesMy - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Bibhor KumarNo ratings yet

- Main Street Unionville Market Application - 2021aDocument5 pagesMain Street Unionville Market Application - 2021aHeidi TongNo ratings yet

- Unit II 1st G Bus EthicsDocument48 pagesUnit II 1st G Bus EthicsAnna fe AlviorNo ratings yet

- Quality Managementpracticein EthiopiaDocument12 pagesQuality Managementpracticein Ethiopiaandu asfaw100% (1)

- Color Vector 3D Business PowerPoint TemplatesDocument23 pagesColor Vector 3D Business PowerPoint TemplatesCielo Amor RabangNo ratings yet

- BAKERYDocument18 pagesBAKERYBavatharaniNo ratings yet

- A Study of Financial Performance of Samsung Electronics Pvt. Ltd.Document11 pagesA Study of Financial Performance of Samsung Electronics Pvt. Ltd.dipawali randiveNo ratings yet

- Chapter 8Document61 pagesChapter 8Anik BhowmickNo ratings yet

- Essentials of Business Communication 10th Edition Guffey Test Bank Full Chapter PDFDocument57 pagesEssentials of Business Communication 10th Edition Guffey Test Bank Full Chapter PDFquandiendjv100% (16)

- INV01604226 3962674 08272023+-+tokboxDocument2 pagesINV01604226 3962674 08272023+-+tokboxAnkit VermaNo ratings yet