Professional Documents

Culture Documents

Study Notes

Study Notes

Uploaded by

Isaac GisoreCopyright:

Available Formats

You might also like

- Siemens Mechatronic Systems Certification Program: Test QuestionsDocument22 pagesSiemens Mechatronic Systems Certification Program: Test QuestionsIsaac Gisore100% (1)

- BB Dashboard Template SolutionDocument4 pagesBB Dashboard Template SolutionMavin JeraldNo ratings yet

- HSEF Credit Card Statement Mar 2019Document6 pagesHSEF Credit Card Statement Mar 2019Mike Schmoronoff67% (3)

- Tariff GuideDocument1 pageTariff GuideMETANOIANo ratings yet

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniNo ratings yet

- Equity Bank Tarrif and ChargesDocument1 pageEquity Bank Tarrif and Chargesedward mpangile0% (1)

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Young Savers AccountDocument2 pagesYoung Savers Accountasmazaryab042No ratings yet

- WHT Chart Subj Wise TY - 2022Document8 pagesWHT Chart Subj Wise TY - 2022Anam IqbalNo ratings yet

- Rate Schedule - American Airlines Credit UnionDocument2 pagesRate Schedule - American Airlines Credit UnionJonathan Seagull LivingstonNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- Current Deposit Plus AccountDocument2 pagesCurrent Deposit Plus AccountLakshmi NarasaiahNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Website Notice Revision in Tariff - April 2023Document5 pagesWebsite Notice Revision in Tariff - April 2023MDNo ratings yet

- Prepaid Brokerage Plan - ICICIDirectDocument1 pagePrepaid Brokerage Plan - ICICIDirect7v4cj5nrq9No ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Statement 122925Document3 pagesStatement 122925Itsmevenki SmileNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- Featured Calculators & Articles: Home Loan Personal Loan Car LoanDocument2 pagesFeatured Calculators & Articles: Home Loan Personal Loan Car LoanSk RajNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Leverage and Excess Risk Acivity Based Costing: BusinessDocument1 pageLeverage and Excess Risk Acivity Based Costing: Businessjavier apodacaNo ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- Upload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)Document5 pagesUpload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)RAJESH MISHRANo ratings yet

- Alhabib Woman Islamic Asaan Savings AccountDocument2 pagesAlhabib Woman Islamic Asaan Savings Accountprofessional.ca728No ratings yet

- Yes Aim CA MIDDocument2 pagesYes Aim CA MIDgdrivelink07No ratings yet

- Bank NII and NIM Scenarios Case StudyDocument8 pagesBank NII and NIM Scenarios Case Studynedhul50No ratings yet

- K2 SCA, MEA 6 December 2023 English BDocument3 pagesK2 SCA, MEA 6 December 2023 English Baltaf.usmanNo ratings yet

- SPE-ESCO Financial Model Tool v3.3Document21 pagesSPE-ESCO Financial Model Tool v3.3santhiNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Schedule of Charges Effective From Jan-Jun 2022: Funds OutflowDocument20 pagesSchedule of Charges Effective From Jan-Jun 2022: Funds OutflowDesign HubNo ratings yet

- Emerchant Current Account RCSMS SOFDocument5 pagesEmerchant Current Account RCSMS SOFmajhi.deepashreeNo ratings yet

- Investment Valuation Model TemplateDocument37 pagesInvestment Valuation Model TemplateousmaneNo ratings yet

- B) Quote For Pvt. Ltd. AMCDocument1 pageB) Quote For Pvt. Ltd. AMCManish ReddyNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaCA JANAMDEEP SINGHNo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsMyco StreptoNo ratings yet

- HDFCDocument2 pagesHDFCrocowi4677No ratings yet

- SOC Jul Dec 2022 CONVENTIONAL BANKINGDocument20 pagesSOC Jul Dec 2022 CONVENTIONAL BANKINGAssad Ullah KhanNo ratings yet

- Allied Bank Schedule of Charges JAN JUN 2017Document25 pagesAllied Bank Schedule of Charges JAN JUN 2017A Ali KhanNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- AXS - Home - Financial ReportingDocument2 pagesAXS - Home - Financial ReportingjoseyNo ratings yet

- Investment ValuationDocument16 pagesInvestment ValuationJaco CrouseNo ratings yet

- Portfolio Management and Capital Asset Risk and Return SLIDE 2Document16 pagesPortfolio Management and Capital Asset Risk and Return SLIDE 2Matodzi ArehoneNo ratings yet

- DownloadDocument2 pagesDownloadishubhamthakerNo ratings yet

- HDFC Savings AC Fees and ChargesDocument2 pagesHDFC Savings AC Fees and ChargesSampada SawantNo ratings yet

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooNo ratings yet

- SOC Islamic Banking Jan Jun 2019Document24 pagesSOC Islamic Banking Jan Jun 2019Syed MantashaNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- You Exec - Viral Strategies FreeDocument14 pagesYou Exec - Viral Strategies FreePradeep ChandranNo ratings yet

- Business Solutions For Start-Ups: Citibusiness LeapDocument10 pagesBusiness Solutions For Start-Ups: Citibusiness LeapAnand BiNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- 401k Cost Comparison WorksheetsDocument3 pages401k Cost Comparison Worksheetserichaaz0% (1)

- DIrect TaxDocument17 pagesDIrect Taxsureshkappe98No ratings yet

- Business Operating Conditions September 2020Document1 pageBusiness Operating Conditions September 2020Alpha ManomanoNo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsKamlesh SonareNo ratings yet

- GR 10 ACC (English) June 2023 Possible AnswersDocument9 pagesGR 10 ACC (English) June 2023 Possible AnswerswhyyouliketvmaneNo ratings yet

- Effective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlyDocument2 pagesEffective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlySavitha ENo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsAniket DubeyNo ratings yet

- External Advert - Coxswain - 2023Document2 pagesExternal Advert - Coxswain - 2023Isaac GisoreNo ratings yet

- City of GodDocument838 pagesCity of GodIsaac GisoreNo ratings yet

- Courses 2023Document1 pageCourses 2023Isaac GisoreNo ratings yet

- Advert - 31.10.23-1Document19 pagesAdvert - 31.10.23-1Isaac GisoreNo ratings yet

- Studies FormDocument4 pagesStudies FormIsaac GisoreNo ratings yet

- Gis NotesDocument4 pagesGis NotesIsaac GisoreNo ratings yet

- Development of Pneumatic Systems: Section 1Document39 pagesDevelopment of Pneumatic Systems: Section 1Isaac GisoreNo ratings yet

- SMSCP Level 1 System Analysis: Analyzing A Mechatronic SystemDocument25 pagesSMSCP Level 1 System Analysis: Analyzing A Mechatronic SystemIsaac GisoreNo ratings yet

- Structure and Signal Flow of Pneumatic Systems: Chapter 1 (Continued)Document32 pagesStructure and Signal Flow of Pneumatic Systems: Chapter 1 (Continued)Isaac GisoreNo ratings yet

- Course Philosophy: Dr. Saleh Ahamd Pneumatic and Hydraulic SystemsDocument17 pagesCourse Philosophy: Dr. Saleh Ahamd Pneumatic and Hydraulic SystemsIsaac GisoreNo ratings yet

- Forms KvatDocument63 pagesForms KvatShashi KanthNo ratings yet

- GSTDocument3 pagesGSTdevil_3565No ratings yet

- ABC Analysis GROUP-I CA INTERMEDIATEDocument4 pagesABC Analysis GROUP-I CA INTERMEDIATESanu SanuNo ratings yet

- HKB FORM Remittance ApplicationDocument2 pagesHKB FORM Remittance ApplicationangkalabawNo ratings yet

- Payment InstructionsDocument2 pagesPayment InstructionsJe FeNo ratings yet

- 2017 BAR Tax Law Review SyllabusDocument23 pages2017 BAR Tax Law Review SyllabusErby Jennifer Sotelo-GesellNo ratings yet

- REST Professional Consulting Order Form: Rockend Client IDDocument1 pageREST Professional Consulting Order Form: Rockend Client IDScriberNo ratings yet

- Receipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDocument3 pagesReceipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDani PermanaNo ratings yet

- CIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825Document2 pagesCIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825bestie bushNo ratings yet

- What Is A Tax ExemptionDocument5 pagesWhat Is A Tax ExemptionVirgilio VolosoNo ratings yet

- How To Apply For HyperPay CardDocument12 pagesHow To Apply For HyperPay CardAchyut AcharyaNo ratings yet

- DocumentDocument5 pagesDocumentMadan ChaturvediNo ratings yet

- Sindh Bank Ltd. Sindh Bank LTDDocument1 pageSindh Bank Ltd. Sindh Bank LTDSyed AzizNo ratings yet

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNo ratings yet

- AIA Life Planner PortalDocument1 pageAIA Life Planner PortalmuhammadrusdysuyodNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Payroll Records January 2013: Employee Hours Overtime HoursDocument2 pagesPayroll Records January 2013: Employee Hours Overtime HoursMary Rose DiazNo ratings yet

- JR MGOAEXM0 Z5 Ys XWDocument5 pagesJR MGOAEXM0 Z5 Ys XWTathagata DasNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Tax Sample AssignmentDocument7 pagesTax Sample AssignmentAli SiddiqueNo ratings yet

- Concept Nature Characteristics of TaxationDocument5 pagesConcept Nature Characteristics of TaxationJhaymaeca BajilloNo ratings yet

- Transactions List ITFOX TECHNOLOGIES LLP 024005003462Document4 pagesTransactions List ITFOX TECHNOLOGIES LLP 024005003462Arushi SinghNo ratings yet

- AllrecDocument81 pagesAllrecShubham JhaNo ratings yet

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Document18 pagesSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- Invoice PDFDocument1 pageInvoice PDFAbhishek AgrawalNo ratings yet

- Direct Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerDocument2 pagesDirect Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerKelvin WiegersNo ratings yet

- 231018143119USS0TCOWPLVEWDocument1 page231018143119USS0TCOWPLVEWMohammad Imran NewazNo ratings yet

- InvoicexyDocument1 pageInvoicexySiddharth PatelNo ratings yet

- PDFDocument8 pagesPDFLeah MoscareNo ratings yet

Study Notes

Study Notes

Uploaded by

Isaac GisoreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study Notes

Study Notes

Uploaded by

Isaac GisoreCopyright:

Available Formats

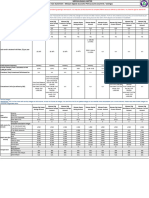

EQUITY BANK (KENYA) LIMITED PRODUCTS & SERVICES TARIFF GUIDE

EQUITY PERSONAL JUNIOR TEEN ACHIEVERS SCHOOL CREDIT TARIFFS TRADE FINANCE

REMITTANCE

PERSONAL ACCOUNTS ORDINARY CURRENT MEMBER MEMBER STUDENTS FEES

ACCOUNT Applicable Charge in Kshs. (Exclusive of Excise Duty)

ACCOUNT ACCOUNT ACCOUNT ACCOUNT ACCOUNT ACCOUNT Sector Service/Product

Interest Import Letters Of Credit

Retail KSHS KSHS KSHS KSHS KSHS KSHS KSHS

The pricing will be based on the Bank’s Reference Rate (EBRR) currently 1% per quarter or part thereof

at 12.5% plus a margin of between 0.5% to 8.0% per annum. The pricing is Opening Commission

Account Opening Balance 400 5,000 200 Nil 200 Nil 100 minimum 2,000

inclusive of Loan Application and Credit Evaluation (LACE) of upto 5%

Amendment 2,000 plus swift charges

Minimum Operating Balance Nil Nil 200 Nil 200 Nil 100

• SME Working Capital & Overdrafts 1% per quarter or part thereof

• Project Financing Extension of the LC validity

Inter-branch Cash Withdrawal 150 150 150 150 150 150 150 minimum 2,000

Business • Mortgages (Commercial) 1% per quarter or part thereof

17% - 19.5% Increase in amount of credit

Account Closing Fees 350 1,000 300 350 300 300 300 Banking - SME • Mortgages (Residential) minimum 2,000

• Asset & Equipment Financing

2 Free in a year, 2 Free in a year, 4 Free in a year, 0.25% minimum 2,000 max

Counter Cash Withdrawal 100 100 100 100 • Equity Release Retirement commission

additional 100 additional 100 additional 100 10,000

Corporates • Working Capital • Overdraft 1% per quarter or part thereof

Corporate KSHS KSHS KSHS KSHS KSHS KSHS KSHS Acceptance commission

& Large • CapEx Financing • Equity Release 15% - 17.5% minimum 2,000

Account Opening Balance 5,000 10,000 200 5,000 200 Nil 100 Enterprises • Project Financing 0.5% per quarter or part there-

Post import Finance Commission

Digital / Mobile • Eazzy Loans • Merchant Loans of plus applicable interest

Minimum Operating Balance Nil Nil 200 Nil 200 Nil 100 13% - 15%

Loans • Eazzy Stock Agent Loans Extension of maturity of Bill - LC 1% per quarter or part thereof

Inter-branch Cash Withdrawal 150 150 150 150 150 150 150

• Farm input • CapEx

Account Closing Fees 350 1,000 300 350 300 300 300 Food & Postage for LCs Actual courier charges plus 50

• Kilimo Working Capital Overdrafts

Agriculture 17% - 19%

2 Free in a year, 2 Free in a year, 4 Free in a year, • Commercial Agriculture Finance Document Handling 500

Counter Cash Withdrawal 100 100 100 100 Loans

additional 100 additional 100 additional 100 • Farm Asset & Equipment Financing LC discharged unutilised 2,000

Counter Cash Withdrawal - Non • Biashara & Pamoja Banking 1,500 for short message and

300 300 300 300 300 300 300 Retail Swift Charges

Corporate Customers • Micro Enterprises Working Capital 3,000 for long message

Business 18% - 20%

• Micro Enterprises • CapEx Export Letters Of Credit

BUSINESS BUSINESS CURRENT INSTITUTION COLLECTION Banking

BUSINESS ACCOUNTS • Group-Based Lending

ACCOUNT ACCOUNT ACCOUNT ACCOUNT Advising Commission 2,000

Retail KSHS KSHS KSHS KSHS • Salary Advance

Retail 0.5% per quarter or part

• Check offs Loans Confirmation commission

Account opening balance 1,000 10,000 Nil 10,000 Personal 13% - 20.5% thereof minimum 2,000

• Pensioner Loans

Banking Amendment 2,000

Minimum operating balance Nil N/A Nil Nil • Secured Salary Loans

• Parastatal • Public Schools 0.5% per quarter or part

Inter-branch cash withdrawal 150 150 Free 150 Extension Commission - Confirmed LC

• Hospitals • SACCOs thereof minimum 2,000

Account closing fees 500 1000 300 1000 Public Sector 15% - 19.5% Extension Commission

• Micro Finance Institutions 2,000

Counter cash withdrawal 100 100 Nil 100 • Secured Salary Loans - Unconfirmed LC

10% on the 0.5% per quarter or part

Corporate KSHS KSHS KSHS KSHS Increase of Amount - Confirmed LC

Temporary Overdraft Fee (TOD) amount thereof minimum 2,000

Account opening balance 5,000 10,000 Nil 10,000 granted Actual courier charges

Courier charges

min.4,000

Minimum operating balance Nil Nil Nil Nil 300/= or 3%

0.5% per quarter or part

Uncleared Effects whichever is Acceptance commission - Confirmed LC

Inter-branch cash withdrawal 150 150 Nil 150 thereof minimum 2,000

higher

Acceptance commission 0.25% per quarter or part

Account closing fees 500 1,000 300 1,000 Other Charges Group Member Passbook Kshs. 100 - Unconfirmed LC thereof minimum 2,000

Counter cash withdrawal 100 100 Nil 100 Group member registration fee 0.25% minimum 2,000 max

Kshs. 500 Retirement commission

(Annual) 10,000

Counter cash withdrawal - Non Corporate Customers 300 300 Nil 300 1% per quarter or part thereof

Loan Application & Credit Evaluation

Discounting of Bills minimum 2,000 plus applicable

BUSINESS / BUSINESS Fee (LACE) for Digital Loans and Upto 5%

EQUITY PERSONAL INSTITUTION INSTITUTION JUNIOR interest

SUPREME BRANCHES ORDINARY CURRENT MEMBER facilities with tenors below 12months

ACCOUNT ACCOUNT / COLLECTION / COLLECTION ACCOUNT Import documentary Collections

SAVINGS ACCOUNT CURRENT ACCOUNT Loan Restructuring Fees Upto 5%

Document Handling 500

KSHS KSHS KSHS KSHS KSHS Forex *Forex denominated facilities are priced at Reference

Denominated Rate* plus a Margin subject to a floor Ammendment 2,000

Account opening balance 50,000 50,000 200,000 200,000 200 Loans USD - S.O.F.R, GBP - S.O.N.I.A , EURO - E.S.T.R 0.25% minimum 2,000 max

Minimum operating balance 50,000 50,000 200,000 200,000 N/A Retirement commission

10,000

Below minimum balance charge (pm) 2,000 2,000 2,000 2,000 N/A DEBIT CARDS 1% per quarter or part thereof

Avalising of Bills

Scheme Debit Cards minimum 2,000

Account closing fees 2,000 2,000 2,000 2,000 300 Swift Charges 1,500

Card Application 600

Inter-branch charges (non supreme customers) 3,000 3,000 3,000 3,000 3,000

Export Documentary Collection

Card Annual Fee 200

Document Processing 2,000

Card replacement 600

ACCOUNT FEES & COMMISSIONS FIXED AND JIJENGE ACCOUNT KSHS Actual courier charges min.

Card re-issue due to PIN forgotten 600 Courier charges

Account Services Charges in KShs 4,000

Fixed Account min bal 50,000 Proprietary Debit 0.25% minimum 2,000 max

Ad hoc Statement Fees (per page) 150 Retirement commission

Card Application fee 400 10,000

Bank Opinion / Introduction / Credit Fixed Account min bal - Corporate 50,000 1% per quarter or part thereof

2,000 Card Annual Fee 100

Reference Discounting Commission minimum 2,000 plus applicable

USD 5,000 Card Replacement 400

Dormant Account reactivation Fees 200 Fixed Deposit - Foreign currency interest

(equivalent for Other currencies)

Prepaid Cards Swift Charges 1,500

Interest Certificate (Free for Churches) 500

Jijenge account min bal - all Branches 300 Card Application Fee 500

Ledger Fees Nil Guarantees

Application Fee (Students) 350

Photocopy per page 20 Jijenge minimum monthly

300 Card Replacement Fee 300 Bank guarantees 3% per annum min 5,000

Postage/Registered Mail As per courier charges contribution

Debit & Prepaid Cards Transaction Charges. Bid bonds 1% per annum min 5,000

Retrieval of Documents 5% of the savings (minimum Kes

500 Jijenge premature withdrawal Perfomance bonds 3% per annum min 5,000

(more than 1 month old) 200 maximum Kes 5,000) ATM Withdrawal at Equity 30

Search Fees 500 Fixed deposit withdrawal Nil Cash withdrawal (Other Banks' ATM) 200 Extension (bid bond) beyond one year 1% per annum min 5,000

SMS Alert fee Agent Withdrawal Agent tariff applies Extension (other guarantees) beyond

2 Jijenge Account withdrawal Nil 3% per annum min 5,000

(Per transaction, where applicable) POS Purchase Free one year

Cash Services ATM Mini-statement - Display Free Amendment (all Guarantees) Kshs.1,000

Fixed deposit premature withdrawal call rate applies

Bulk coins over Kshs 10,000 0 ATM Balance Enquiry- Display Free Custom Bonds 3% per annum min 5,000

Bulk notes over Kshs 500,000 0 FOREIGN CURRENCY ACCOUNT Cancellation guarantee if not returned Free

Declined Cash Transaction (Other Banks' ATMs) 30

Collection account charges per transaction 50

Account opening balance 100 USD/ equivalent Card Balance Enquiry (Other Banks' ATMs) 30 Cancellation of returned guarantees Free

Bank Funds Transfer

Cash Back withdrawal 25 1,500 for short message and

SWIFT Remittance (MT103) - Incoming 600 or Equivalent in Forex Minimum operating balance 100 USD/ equivalent Swift Charges

3,000 for long message

SWIFT Remittance (MT103) - Outgoing 1,500 or Equivalent in Forex Bills Payment 30

CHANNELS & ONLINE BANKING Structured Finance

EAPS Remittance (MT103) - Incoming Free VISA USD Debit Card

EazzyBiz Deal Structuring Fees 0.5% of deal amount

EAPS Remittance (MT103) - Outgoing 500 Card application fee USD 8

RTGS Remittance (MT103) - Incoming Free Annual Subscription Charges Free Collateral Management fees As per Collateral Management

Card annual Fee USD 3

RTGS Remittance (MT103) - Outgoing 500 View account balances Free

Card replacement USD 8 AGENCY BANKING

Standing instructions placement Free View transactions summary and Agent Annual Renewal fees 1,000

Free ATM Withdrawal fee (Both Equity and Non Equity) USD 3

download statements

Cheque Services CREDIT CARDS Agent Approval Fee 1,000

Bankers Cheques - Customers 100 Service request Charges e.g Cheque

30 VISA Credit Card Agent Network Approval (Access Fee) 15,000

Book. Cost of requested item applies

Issuance of Foreign Currency Drafts Joining fee - Classic (Main card) 2,500 Agent Withdrawal & Deposit Agency Tariff applies

600 Report access & downloads Free

(Drawn outside Kenya)

Annual subscription fee - Classic (Main card) 2,500

Cheque Book Per leaf Host 2 Host Service Installation Free PESALINK

17.5 Annual subscription fee - Classic (Supplementary) 1,500

(Incl. KShs. 2.5 stamp duty) Within Bank Transfers 50 Cash Withdrawal (incl. of 20% excise duty)

Counter Cheque (Retail) 300 Credit card replacement fee (Classic) 1,000

Salary Remittance 100 KShs. 0 - 1,000 0

Counter Cheque (Supreme) 500 Insurance fee (Classic) 303

EFT Outward 200 KShs. 1,000 - 99,999 60

Dividend Cheque Clearing Charges Nil Joining fee- Gold (Main card) 7,500

Transfer to Other Banks (RTGS) 500 KShs. 100,000 - 999,999 120

Inhouse Unpaid Cheque Annual subscription fee- Gold (Main card) 4,500

2,500 International Transfers (SWIFT) 1,500

(Refer to Drawer)-Issuer AGENT TARIFF

Annual subscription fee- Gold (Supplementary) 3,500

Inhouse Unpaid Cheque Bill & Statutory Payments 30

2,000 Credit card replacement fee (Gold) 1,500 Transaction Cash Withdrawal

(Refer to Drawer)-Payee Token access First 2 tokens are Free Cash Deposit

Amount (incl. of 20% excise duty)

Inhouse Unpaid Cheque (Technical) 2,000 Insurance fee (Gold) 963

Additional token 3,500 2,500 and Below 30 0

Inward Clearing Charge 50 Payments to Equitel Free AMEX Credit Cards

2,501-5,000 54 0

Inward Unpaid Cheque (Refer to Drawer) 2,500 Payments to Mobile wallets As Per Mobile Wallet Tariff Joining Fee (Green & Gold) Free

5,001-10,000 90 0

Inward Unpaid Cheque (Technical) 2,000 Insurance fee (Green & Gold) 0.2% of limit

Retail Web 10,001-20,000 174 0

Outward Clearing Charge Nil Annual subscription fee - Green (Main Card) 3,500

Airtime Purchase Free 20,001-35,000 204 0

Outward Unpaid Cheque (Refer to Drawer) 2,000 Annual subscription fee - Green (Supplementary) 2,000

Bill Payments 30 35,001-50,000 234 0

Outward Unpaid Cheque (Technical) 2,000

Buy Goods Credit Card Replacement fee - Green 500 50,001-100,000 270 0

Payment Voucher Stop Payment Free

1,500 (One Equity Till Number/ Pay with Equity)

Instructions Annual Subscription fee - Gold (Main Card) 7,000

PAYPAL TARIFF (Commission %)

Stop Cheque Instructions 1,000 Buy / Sell Stocks Free

Annual subscription fee - Gold (Supplementary) 4,000 Link your PayPal Account Free

Transaction Processing EFT 200 Credit Card Replacement fee - Gold 1,000 Withdrawal Amounts in USD

Bills Payable Printing for Per Cheque 100 Send Money to Mobile wallet As Per Mobile Wallet Tariff Corporate Credit Cards 500 and below 1.500%

Direct Debit failure charge 300 Joining Fee 5,000 501 – 1,000 1.375%

Send Money via (Pesalink) As per Pesalink Tariff

Funds Transfer/EFTs - Internal 100 1,001-2,000 1.250%

Send Money via (RTGS) 500 Annual Subscription Fee - Per Card 4,000 2,001-5,000 1.125%

Local Money Transfer EFT

300

to Non-Customers Statement download Free Credit Card Replacement Fee 1,000 Above 5,000 1.000%

PAYE Remittances 300 SWIFT 1,500 All Credit Cards MOBILE MONEY WALLET (Telco charges apply)

Remittances - Tea, Salaries, Coffee, Milk 100 Transfer within Equity 50 Cash Advance Fee On Us 6% RECEIVE MONEY FROM

Standing Orders - Internal Free

Mobile Banking Cash Advance Fee Not On Us 10% Airtel Money

Standing Orders/EFTs - External 300 Free

Send Money within Equity 0 (any amount)

Standing Orders/EFTs - Failed 500 Late Payment Fee (Except Corporate Cards) 6% M-Pesa (any amount) Free

Send Money via (RTGS) 500

Certification of Balances for Audit Purposes 1,000 Interest Rate 3.5%p.m. SEND MONEY CHARGES (KSHS)

KPLC Payments Commission 25 Send Money via (Pesalink) As per Pesalink Tariff

Overlimit fee 4%

Send Money Cross Boarder (Swift) 1,500 TO MPESA TO AIRTEL MONEY

Intercountry Cash Services (Uganda, Rwanda, Tanzania & South Sudan) Virtual Prepaid Cards

0.25% 1 - 100 0 0

Send Money to Mobile wallet As Per Mobile Wallet Tariff Card Application Fee 300

Deposit Subject to a minimum $2 101 - 500 10 9

& a maximum of $25 Bill Payments 30 Loading Fee 2% 501 - 1,000 12 11

Transfer $6 View Statement Free E-Commerce Transactions Free 1,001 - 1,500 14 13

Withdrawal $0 - $1,000 $3 Buy Airtime Free 1,501 - 2,500 23 21

2,501 - 3,500 33 31

Withdrawal $1,001 - $5,000 $4

3,501 - 5,000 43 41

Withdrawal $5,001 - $10,000 $5 5,001 - 7,500 55 53

Withdrawal > $10,000 $10 7,501 - 20,000 65 63

Utility payments commission 100 *All charges are exclusive of taxes | Revised in March 2023 20,001 - 150,000 67 64

Tel: +254 763 000 000 @KeEquityBank KeEquityBank

Equity Bank (Kenya) Limited is regulated by the Central Bank of Kenya

You might also like

- Siemens Mechatronic Systems Certification Program: Test QuestionsDocument22 pagesSiemens Mechatronic Systems Certification Program: Test QuestionsIsaac Gisore100% (1)

- BB Dashboard Template SolutionDocument4 pagesBB Dashboard Template SolutionMavin JeraldNo ratings yet

- HSEF Credit Card Statement Mar 2019Document6 pagesHSEF Credit Card Statement Mar 2019Mike Schmoronoff67% (3)

- Tariff GuideDocument1 pageTariff GuideMETANOIANo ratings yet

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniNo ratings yet

- Equity Bank Tarrif and ChargesDocument1 pageEquity Bank Tarrif and Chargesedward mpangile0% (1)

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Young Savers AccountDocument2 pagesYoung Savers Accountasmazaryab042No ratings yet

- WHT Chart Subj Wise TY - 2022Document8 pagesWHT Chart Subj Wise TY - 2022Anam IqbalNo ratings yet

- Rate Schedule - American Airlines Credit UnionDocument2 pagesRate Schedule - American Airlines Credit UnionJonathan Seagull LivingstonNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- Current Deposit Plus AccountDocument2 pagesCurrent Deposit Plus AccountLakshmi NarasaiahNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Website Notice Revision in Tariff - April 2023Document5 pagesWebsite Notice Revision in Tariff - April 2023MDNo ratings yet

- Prepaid Brokerage Plan - ICICIDirectDocument1 pagePrepaid Brokerage Plan - ICICIDirect7v4cj5nrq9No ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Statement 122925Document3 pagesStatement 122925Itsmevenki SmileNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- Featured Calculators & Articles: Home Loan Personal Loan Car LoanDocument2 pagesFeatured Calculators & Articles: Home Loan Personal Loan Car LoanSk RajNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Leverage and Excess Risk Acivity Based Costing: BusinessDocument1 pageLeverage and Excess Risk Acivity Based Costing: Businessjavier apodacaNo ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- Upload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)Document5 pagesUpload D e V I A Ti o N Remarks View PRI NT Save & Proceed: Credit Appraisal Memo (CAM)RAJESH MISHRANo ratings yet

- Alhabib Woman Islamic Asaan Savings AccountDocument2 pagesAlhabib Woman Islamic Asaan Savings Accountprofessional.ca728No ratings yet

- Yes Aim CA MIDDocument2 pagesYes Aim CA MIDgdrivelink07No ratings yet

- Bank NII and NIM Scenarios Case StudyDocument8 pagesBank NII and NIM Scenarios Case Studynedhul50No ratings yet

- K2 SCA, MEA 6 December 2023 English BDocument3 pagesK2 SCA, MEA 6 December 2023 English Baltaf.usmanNo ratings yet

- SPE-ESCO Financial Model Tool v3.3Document21 pagesSPE-ESCO Financial Model Tool v3.3santhiNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Schedule of Charges Effective From Jan-Jun 2022: Funds OutflowDocument20 pagesSchedule of Charges Effective From Jan-Jun 2022: Funds OutflowDesign HubNo ratings yet

- Emerchant Current Account RCSMS SOFDocument5 pagesEmerchant Current Account RCSMS SOFmajhi.deepashreeNo ratings yet

- Investment Valuation Model TemplateDocument37 pagesInvestment Valuation Model TemplateousmaneNo ratings yet

- B) Quote For Pvt. Ltd. AMCDocument1 pageB) Quote For Pvt. Ltd. AMCManish ReddyNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaCA JANAMDEEP SINGHNo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsMyco StreptoNo ratings yet

- HDFCDocument2 pagesHDFCrocowi4677No ratings yet

- SOC Jul Dec 2022 CONVENTIONAL BANKINGDocument20 pagesSOC Jul Dec 2022 CONVENTIONAL BANKINGAssad Ullah KhanNo ratings yet

- Allied Bank Schedule of Charges JAN JUN 2017Document25 pagesAllied Bank Schedule of Charges JAN JUN 2017A Ali KhanNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- AXS - Home - Financial ReportingDocument2 pagesAXS - Home - Financial ReportingjoseyNo ratings yet

- Investment ValuationDocument16 pagesInvestment ValuationJaco CrouseNo ratings yet

- Portfolio Management and Capital Asset Risk and Return SLIDE 2Document16 pagesPortfolio Management and Capital Asset Risk and Return SLIDE 2Matodzi ArehoneNo ratings yet

- DownloadDocument2 pagesDownloadishubhamthakerNo ratings yet

- HDFC Savings AC Fees and ChargesDocument2 pagesHDFC Savings AC Fees and ChargesSampada SawantNo ratings yet

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooNo ratings yet

- SOC Islamic Banking Jan Jun 2019Document24 pagesSOC Islamic Banking Jan Jun 2019Syed MantashaNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- You Exec - Viral Strategies FreeDocument14 pagesYou Exec - Viral Strategies FreePradeep ChandranNo ratings yet

- Business Solutions For Start-Ups: Citibusiness LeapDocument10 pagesBusiness Solutions For Start-Ups: Citibusiness LeapAnand BiNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- 401k Cost Comparison WorksheetsDocument3 pages401k Cost Comparison Worksheetserichaaz0% (1)

- DIrect TaxDocument17 pagesDIrect Taxsureshkappe98No ratings yet

- Business Operating Conditions September 2020Document1 pageBusiness Operating Conditions September 2020Alpha ManomanoNo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsKamlesh SonareNo ratings yet

- GR 10 ACC (English) June 2023 Possible AnswersDocument9 pagesGR 10 ACC (English) June 2023 Possible AnswerswhyyouliketvmaneNo ratings yet

- Effective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlyDocument2 pagesEffective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlySavitha ENo ratings yet

- Schedule of Charges - Indus Online Savings Account VariantsDocument6 pagesSchedule of Charges - Indus Online Savings Account VariantsAniket DubeyNo ratings yet

- External Advert - Coxswain - 2023Document2 pagesExternal Advert - Coxswain - 2023Isaac GisoreNo ratings yet

- City of GodDocument838 pagesCity of GodIsaac GisoreNo ratings yet

- Courses 2023Document1 pageCourses 2023Isaac GisoreNo ratings yet

- Advert - 31.10.23-1Document19 pagesAdvert - 31.10.23-1Isaac GisoreNo ratings yet

- Studies FormDocument4 pagesStudies FormIsaac GisoreNo ratings yet

- Gis NotesDocument4 pagesGis NotesIsaac GisoreNo ratings yet

- Development of Pneumatic Systems: Section 1Document39 pagesDevelopment of Pneumatic Systems: Section 1Isaac GisoreNo ratings yet

- SMSCP Level 1 System Analysis: Analyzing A Mechatronic SystemDocument25 pagesSMSCP Level 1 System Analysis: Analyzing A Mechatronic SystemIsaac GisoreNo ratings yet

- Structure and Signal Flow of Pneumatic Systems: Chapter 1 (Continued)Document32 pagesStructure and Signal Flow of Pneumatic Systems: Chapter 1 (Continued)Isaac GisoreNo ratings yet

- Course Philosophy: Dr. Saleh Ahamd Pneumatic and Hydraulic SystemsDocument17 pagesCourse Philosophy: Dr. Saleh Ahamd Pneumatic and Hydraulic SystemsIsaac GisoreNo ratings yet

- Forms KvatDocument63 pagesForms KvatShashi KanthNo ratings yet

- GSTDocument3 pagesGSTdevil_3565No ratings yet

- ABC Analysis GROUP-I CA INTERMEDIATEDocument4 pagesABC Analysis GROUP-I CA INTERMEDIATESanu SanuNo ratings yet

- HKB FORM Remittance ApplicationDocument2 pagesHKB FORM Remittance ApplicationangkalabawNo ratings yet

- Payment InstructionsDocument2 pagesPayment InstructionsJe FeNo ratings yet

- 2017 BAR Tax Law Review SyllabusDocument23 pages2017 BAR Tax Law Review SyllabusErby Jennifer Sotelo-GesellNo ratings yet

- REST Professional Consulting Order Form: Rockend Client IDDocument1 pageREST Professional Consulting Order Form: Rockend Client IDScriberNo ratings yet

- Receipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDocument3 pagesReceipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDani PermanaNo ratings yet

- CIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825Document2 pagesCIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825bestie bushNo ratings yet

- What Is A Tax ExemptionDocument5 pagesWhat Is A Tax ExemptionVirgilio VolosoNo ratings yet

- How To Apply For HyperPay CardDocument12 pagesHow To Apply For HyperPay CardAchyut AcharyaNo ratings yet

- DocumentDocument5 pagesDocumentMadan ChaturvediNo ratings yet

- Sindh Bank Ltd. Sindh Bank LTDDocument1 pageSindh Bank Ltd. Sindh Bank LTDSyed AzizNo ratings yet

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNo ratings yet

- AIA Life Planner PortalDocument1 pageAIA Life Planner PortalmuhammadrusdysuyodNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Payroll Records January 2013: Employee Hours Overtime HoursDocument2 pagesPayroll Records January 2013: Employee Hours Overtime HoursMary Rose DiazNo ratings yet

- JR MGOAEXM0 Z5 Ys XWDocument5 pagesJR MGOAEXM0 Z5 Ys XWTathagata DasNo ratings yet

- Tax Lecture VAT Answer KeyDocument2 pagesTax Lecture VAT Answer KeyKathreen Aya ExcondeNo ratings yet

- Tax Sample AssignmentDocument7 pagesTax Sample AssignmentAli SiddiqueNo ratings yet

- Concept Nature Characteristics of TaxationDocument5 pagesConcept Nature Characteristics of TaxationJhaymaeca BajilloNo ratings yet

- Transactions List ITFOX TECHNOLOGIES LLP 024005003462Document4 pagesTransactions List ITFOX TECHNOLOGIES LLP 024005003462Arushi SinghNo ratings yet

- AllrecDocument81 pagesAllrecShubham JhaNo ratings yet

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Document18 pagesSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- Invoice PDFDocument1 pageInvoice PDFAbhishek AgrawalNo ratings yet

- Direct Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerDocument2 pagesDirect Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerKelvin WiegersNo ratings yet

- 231018143119USS0TCOWPLVEWDocument1 page231018143119USS0TCOWPLVEWMohammad Imran NewazNo ratings yet

- InvoicexyDocument1 pageInvoicexySiddharth PatelNo ratings yet

- PDFDocument8 pagesPDFLeah MoscareNo ratings yet