Professional Documents

Culture Documents

Cost Sheet 19.08.2020

Cost Sheet 19.08.2020

Uploaded by

VISHAGAN MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Sheet 19.08.2020

Cost Sheet 19.08.2020

Uploaded by

VISHAGAN MCopyright:

Available Formats

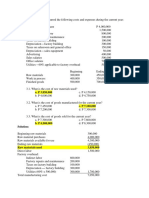

From the following particulars calculate (1) Prime Cost (2) Factory Cost (3) Cost of

Production and (4) Cost of Sales

Rs. Rs.

33,000 1000

Direct Raw Materials Depreciation of office building

35,000

Direct Wages Depreciation of delivery Van 200

Direct Expenses 3,000 Bad debts 100

Factory Rent and rates 7,500 Advertising 300

Indirect Wages (Factory) 10,500 Salaries of salesmen 1,500

factory Lighting 2,050 Up keeping of delivery Van 700

Factory Heating 1,500 Bank charges loo

Power (Factory) 4,400 Commission on sales

1,500

Office Stationery 900 Rent and rates (Office) 500

Director’s Remuneration (Factory) 2.000 Loose tools written off

600

Director’s Remuneration (Office) 4.000 Output (tonnes)

1000 5,000

Factory Cleaning (sales O Rs.40 per unit)

Sundry Office Expenses 200

Factory Stationery 750

Water supply (Factory) 1,300

Factory Insurance l,l00

Oft2ce Insurance 500

Legal Expenses (Office)

400

Rent of Warehouse 300

33,000

Direct materials

35,000

Direct wages

3,000

Direct expenses

71,OOO

Prime Cost (1)

Add : Factory overheads

7,500

Factory rent and rates

10,500

Indirect wages

2,050

Factory lighting

1,500

Factory heating

4,4IXI

Power (Factory)

2,000

Director’s remuneration (Factory)

1,000

Factory cleaning

750

factory stationery

1,300

Water supply (Factory)

1,100

Factory Insurance

2,000

Depreciation of Plant & Machinery

600

Loose Tools written ofT 34,700

Works Cost (or) Factory Cost (2)

1,05,7tXi

Add : Office and Administrative Overhead:

900

Office stationery

4,000

Director’s remuneration (Office)

200

Sundry office expenses

500

Office insurance

400

Legal expenses (Office)

Depreciation of office building loo

Bank charges

500

Rent and rates (Omce) 7,600

Cost of production (3) 1,13,300

Add : Selling and Distribution Overhead:

Cost of production (3) 1,13,300

Add : Selling and Distribution

Overhead:

300

Rent of warehouse

200

Depreciation of delivery van

100

Bad debts

300

Advertising

1,500

Salesmen salaries

700

Up keep of delivery van

1,500

4,600

Commission on sales

1,17,900

Total Cost of Sales (4)

Profit

82,100

2,00,000

Sales 5000 tones la Rs. 40 per unit

From the following information prepare a cost sheet to

show :

(a)Prime cost; (b) Works cost; (c) Cost of production ; (d)

Cost of sales; and (e) Profit.

` Raw materials purchased 32,250

Carriage on purchases 850

Direct wages 18,450

Factory overhead 2,750

Selling overhead 2,450

Office overhead 1,850

Sales 75,000

Opening stock of finished goods 9,750

Closing stock of finished goods 11,100

SALE OF Scrab 250

Solution: Cost Sheet for the period

PARTICULARS RS RS

...................... ` ` Raw materials 35,250

Add: Carriage on purchases 850 36,100

18,450

Direct wages 54,550

Prime Cost

2,750

Factory overhead 57,300

250

Less : Sale of factory scrap 57,050

(b) Works Cost

Office overhead 1,850

58,900

(c) Cost of Production

9,750

Add : Opening stock of finished goods 68,650

Less : Closing stock of finished goods 11,100

Cost of Goods Sold 57,550

Selling overhead 2,450

(d) Cost of Sales 60,000

(e) Profit 15,000

Sales 75,000

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The Online Poker Starting Guide (Frank Miller) PDFDocument39 pagesThe Online Poker Starting Guide (Frank Miller) PDFDe_VinciNo ratings yet

- Cafe RomaDocument6 pagesCafe Romahmdme100% (2)

- Cost and Management Accounting CIA 1.1Document5 pagesCost and Management Accounting CIA 1.1Kanika BothraNo ratings yet

- Yakyuken ReadmeDocument3 pagesYakyuken Readmediabolik1234No ratings yet

- Cost Sheet 1Document1 pageCost Sheet 1ARUNSANKAR NNo ratings yet

- Entrada Gericho TP-Costing-1Document3 pagesEntrada Gericho TP-Costing-1jessalyn carranzaNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Cost Sheet ProblemsDocument1 pageCost Sheet ProblemsK DIVYANo ratings yet

- Module 2 - Problems On Cost SheetDocument8 pagesModule 2 - Problems On Cost SheetSupreetha100% (1)

- Cost-V Sem BBMDocument10 pagesCost-V Sem BBMAR Ananth Rohith BhatNo ratings yet

- Module 2 - Problems On Cost Sheet New 2019 PDFDocument7 pagesModule 2 - Problems On Cost Sheet New 2019 PDFJibin JoseNo ratings yet

- Cost Sheet Practical Solevd QuestionsDocument6 pagesCost Sheet Practical Solevd QuestionsMansi VermaNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Cost Sheet Problems: Prepare Cost Sheet On The Basis of Following InfoDocument6 pagesCost Sheet Problems: Prepare Cost Sheet On The Basis of Following InfoBrad johnsonNo ratings yet

- Illustration Questions 7Document3 pagesIllustration Questions 7mohammedahalys100% (1)

- Cost Sheet and Single and Output CostingDocument21 pagesCost Sheet and Single and Output CostingHard WorkoutNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- Day 2 - COST - TEMPLATEDocument27 pagesDay 2 - COST - TEMPLATEum23328No ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Costing Aug2015Document2 pagesCosting Aug2015A BPNo ratings yet

- Cost HeetDocument4 pagesCost HeetYuvnesh KumarNo ratings yet

- Raw MaterialsDocument1 pageRaw Materialstan jamesNo ratings yet

- Eos Elements of Cost Accounting Acc203Document3 pagesEos Elements of Cost Accounting Acc203Emilia JacobNo ratings yet

- Cost Sheet QuestionsDocument4 pagesCost Sheet QuestionsAbhishekNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Introduction To Cost AccountingDocument5 pagesIntroduction To Cost AccountingDaniel Jackson100% (1)

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- Computing CosgDocument6 pagesComputing CosgAngelica BayaNo ratings yet

- Revision Note - Section 10Document9 pagesRevision Note - Section 10Sohid BacusNo ratings yet

- Cost SheetDocument20 pagesCost SheetVannoj AbhinavNo ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Cost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000Document10 pagesCost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000amolNo ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- Adm Excel EtDocument168 pagesAdm Excel EtShashank PullelaNo ratings yet

- Parcor Quiz Manufacturing Operations ProblemDocument1 pageParcor Quiz Manufacturing Operations ProblemArman Dizon100% (1)

- Particulars Rs. in (000) Particulars Rs. inDocument2 pagesParticulars Rs. in (000) Particulars Rs. inLikitha Kiran PeramNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Manufacturing Excercise 3Document2 pagesManufacturing Excercise 3Meg sharkNo ratings yet

- CA Work Sheet Unit 2Document23 pagesCA Work Sheet Unit 2Shalini SavioNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Sir Syed University of Engineering & Technology: Answer ScriptDocument7 pagesSir Syed University of Engineering & Technology: Answer ScriptWasif FarooqNo ratings yet

- Factory Over Head: Particular UNIT-1000 AmountDocument2 pagesFactory Over Head: Particular UNIT-1000 AmountPintu MaharanaNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetPintu MaharanaNo ratings yet

- Cost Sheet Questions - AssignmentDocument5 pagesCost Sheet Questions - AssignmentDiptee ShettyNo ratings yet

- Activity Based Costing-ExerciseDocument4 pagesActivity Based Costing-ExerciseKevin James Sedurifa OledanNo ratings yet

- Cost Sheet SumsDocument6 pagesCost Sheet SumsHanan MathewNo ratings yet

- Adjusting Journal EntriesDocument3 pagesAdjusting Journal EntriesAmirahNo ratings yet

- Cost Sheet 1Document6 pagesCost Sheet 1Tamilselvi ANo ratings yet

- ACMA Unit 7 Problems - Cost Sheet PDFDocument3 pagesACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNo ratings yet

- PRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023Document6 pagesPRACTICE-EXERCISES-SOLUTIONS-I_MI1_10.2023honguyenkimkhanh55No ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Chapter2A - Cost SheetDocument15 pagesChapter2A - Cost SheetDhwni A NanavatiNo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- Completed (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkDocument4 pagesCompleted (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkYolo LeetNo ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- 5 6145526858256483500ijknhDocument36 pages5 6145526858256483500ijknhVISHAGAN MNo ratings yet

- Application No. 2021123728: Application Form For B.Tech. Admissions - 2021Document2 pagesApplication No. 2021123728: Application Form For B.Tech. Admissions - 2021VISHAGAN MNo ratings yet

- 4956 17UCM16 17UAF14 17UCB15 17UCC13 BCom BCom CA BCom AF BCom BI 21 06 2021 FNDocument20 pages4956 17UCM16 17UAF14 17UCB15 17UCC13 BCom BCom CA BCom AF BCom BI 21 06 2021 FNVISHAGAN MNo ratings yet

- Cost Accounting MCQ 4.10.22Document6 pagesCost Accounting MCQ 4.10.22VISHAGAN MNo ratings yet

- Management Accounting Unit-2Document72 pagesManagement Accounting Unit-2VISHAGAN MNo ratings yet

- I M.com Cost May 21Document3 pagesI M.com Cost May 21VISHAGAN MNo ratings yet

- Chemistry ProjectDocument7 pagesChemistry ProjectVISHAGAN MNo ratings yet

- 20ucm2c03 20 05 2021Document3 pages20ucm2c03 20 05 2021VISHAGAN MNo ratings yet

- Commerce External DetailsDocument2 pagesCommerce External DetailsVISHAGAN MNo ratings yet

- MGT Ac - QB - Unit I & II - CGDocument12 pagesMGT Ac - QB - Unit I & II - CGVISHAGAN MNo ratings yet

- MGT Ac - Tentative - CGDocument1 pageMGT Ac - Tentative - CGVISHAGAN MNo ratings yet

- Commerce Examiner DetailsDocument3 pagesCommerce Examiner DetailsVISHAGAN MNo ratings yet

- Management Accounting Unit-1Document28 pagesManagement Accounting Unit-1VISHAGAN MNo ratings yet

- 20uba2a02 22 05 2021Document2 pages20uba2a02 22 05 2021VISHAGAN MNo ratings yet

- MGT AC Notes - Unit I, II - CGDocument17 pagesMGT AC Notes - Unit I, II - CGVISHAGAN MNo ratings yet

- 20ues201 24 05 2021Document2 pages20ues201 24 05 2021VISHAGAN MNo ratings yet

- I M.com Accounting For Managerial DecisionDocument10 pagesI M.com Accounting For Managerial DecisionVISHAGAN MNo ratings yet

- 20ucm2c04 21 05 2021Document2 pages20ucm2c04 21 05 2021VISHAGAN MNo ratings yet

- Chapter 3 2D Simulations 1Document23 pagesChapter 3 2D Simulations 1Tran Van TienNo ratings yet

- International CompensationDocument39 pagesInternational CompensationyogaknNo ratings yet

- Artigo Fator de PotênciaDocument4 pagesArtigo Fator de PotênciaDiego FaenelloNo ratings yet

- Oracle: 1Z0-819 ExamDocument9 pagesOracle: 1Z0-819 ExamdspNo ratings yet

- FLIX Ticket 1069511041 PDFDocument2 pagesFLIX Ticket 1069511041 PDFAngela RedeiNo ratings yet

- UT Dallas Syllabus For Soc4396.501.11s Taught by Malinda Hicks (Meh033000)Document11 pagesUT Dallas Syllabus For Soc4396.501.11s Taught by Malinda Hicks (Meh033000)UT Dallas Provost's Technology GroupNo ratings yet

- NYSDOT-Safety Information Management System: Average Accident Costs/Severity Distribution State Highways 2018Document4 pagesNYSDOT-Safety Information Management System: Average Accident Costs/Severity Distribution State Highways 2018jamcoso3240No ratings yet

- Aviation News - December 2015Document84 pagesAviation News - December 2015serge.pungweNo ratings yet

- Version 6.0Document14 pagesVersion 6.0socialboy002No ratings yet

- Nanomaterials HomeworkDocument5 pagesNanomaterials Homeworkafefiebfr100% (1)

- Comprehensive Plan For Lee CountyDocument9 pagesComprehensive Plan For Lee County3798chuckNo ratings yet

- TK19 - Final Report PDFDocument137 pagesTK19 - Final Report PDFekiNo ratings yet

- 2 Replacement AnalysisDocument10 pages2 Replacement AnalysisKrishna BirlaNo ratings yet

- PMC Composites:,, Are Generally SmallDocument13 pagesPMC Composites:,, Are Generally SmallharnoorNo ratings yet

- Assignment 1Document6 pagesAssignment 1Meron SolomonNo ratings yet

- 2021 10 YR SWM PLAN With Guideliness Drop OffDocument160 pages2021 10 YR SWM PLAN With Guideliness Drop OffALMA BELLA M. PRADONo ratings yet

- Ethics in Engineering Profession - IES General StudiesDocument16 pagesEthics in Engineering Profession - IES General StudiesSandeep PrajapatiNo ratings yet

- Masterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerDocument2 pagesMasterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerAbidNo ratings yet

- Prepositions and ConjunctionsDocument10 pagesPrepositions and ConjunctionsPhạm Đức ThịnhNo ratings yet

- Challenges Faced in Indian Construction SectorDocument20 pagesChallenges Faced in Indian Construction SectorEditor IJTSRDNo ratings yet

- 11 Task Performance 1Document2 pages11 Task Performance 1ChiLL MooDNo ratings yet

- CH.18 The Marketing Mix - Product and PriceDocument12 pagesCH.18 The Marketing Mix - Product and PriceRosina KaneNo ratings yet

- S3b QSG WEB EU 19022019 2.4 PDocument100 pagesS3b QSG WEB EU 19022019 2.4 PSERVICE TESTNo ratings yet

- Guwahati Smart GirlDocument5 pagesGuwahati Smart GirlManKapNo ratings yet

- APPLICATION FORM - A&W (Malaysia) SDN BHDDocument5 pagesAPPLICATION FORM - A&W (Malaysia) SDN BHDzackergamersNo ratings yet

- Chapter 7 - Strategy Implementation - NarrativeDocument14 pagesChapter 7 - Strategy Implementation - NarrativeShelly Mae SiguaNo ratings yet

- NRC Policy PDFDocument6 pagesNRC Policy PDFTarak AhujaNo ratings yet