Professional Documents

Culture Documents

RB Fee Information Document

RB Fee Information Document

Uploaded by

Hunain ZehriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RB Fee Information Document

RB Fee Information Document

Uploaded by

Hunain ZehriCopyright:

Available Formats

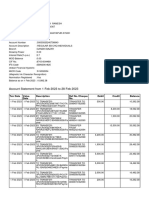

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: SELECT

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

Maintaining the account No fee

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

P0556282.indd 1 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of

foreign currency transaction

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 39.49% EAR

• Unarranged Overdraft Interest 39.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period).

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

P0556282.indd 2 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: REVOLVE

Date: The information in this Fee Information Document is correct as of 9th January 2022

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

Maintaining the account No fee

Payments (excluding cards)

Direct Debit No Fee

Standing Order No Fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

P0556282.indd 3 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of

foreign currency transaction

Overdrafts and related services

• Arranged Overdraft Interest Service not

Arranged overdraft

available

Unarranged overdraft • Unarranged Overdraft Interest 0%

Refusing a payment due to lack • Unpaid Transaction Fee No fee

of funds

Allowing a payment despite lack No fee

of funds

Other services

Service not

Cancelling a cheque

available

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

P0556282.indd 4 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: STUDENT

Date: The information in this Fee Information Document is correct as of 3 September 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

• Monthly account fee: £10 for International Students

who opened their account

between 5 August 2018 and

20 June 2021

Maintaining the account

• Total annual fee: £120 for International Students

who opened their account

between 5 August 2018 and

20 June 2021

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

P0556282.indd 5 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

• Payments under £100 Euro – no fee

Receiving money from outside Non-Euro – £1

the UK • Payments over £100 Euro – no fee

Non-Euro – £7

Cards and cash

Cash withdrawal in pounds in No fee

the UK

Cash withdrawals in foreign • Non-Sterling Transaction Fee 2.75% of withdrawal

currency outside the UK

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of transaction

foreign currency

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 0%

Unarranged overdraft • Unarranged Overdraft Interest 0%

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £2.15 in a monthly charging period for an unarranged overdraft or

any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

P0556282.indd 6 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: Graduate

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

Maintaining the account No fee

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

P0556282.indd 7 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of

foreign currency transaction

Overdrafts and related services

• Arranged Overdraft Interest 39.49% EAR

Arranged Overdraft Interest will

Arranged overdraft only be charged if you use your

arranged overdraft by more than

your interest free buffer (Year 1

£2000, Year 2 £1000).

Unarranged overdraft • Unarranged Overdraft Interest 0% EAR

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £2.15 in a monthly charging period for an unarranged overdraft or

any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

P0556282.indd 8 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: FOUNDATION

Date: The information in this Fee Information Document is correct as of 27 March 2020

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

Maintaining the account No fee

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Receiving money from outside Non-Euro – £1

the UK • Payments over £100 Euro – no fee

Non-Euro – £7

P0556282.indd 9 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign • Non-Sterling Transaction Fee 2.75% of

currency outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of

foreign currency transaction

Overdrafts and related services

• Arranged Overdraft Interest Service not

Arranged overdraft

available

Unarranged overdraft • Unarranged Overdraft Interest 0%

Refusing a payment due to lack • Unpaid Transaction Fee No fee

of funds

Allowing a payment despite lack No fee

of funds

Other services

Service not

Cancelling a cheque

available

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

10

P0556282.indd 10 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: REWARD

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

• Monthly account fee £2

Maintaining the account

• Total annual fee £24

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

11

P0556282.indd 11 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a • Non-Sterling Transaction Fee 2.75% of

foreign currency transaction

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 39.49% EAR

• Unarranged Overdraft Interest 39.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period)

• Unpaid Transaction Fee £2.15*

Charged if you instruct a

Refusing a payment due to lack payment that would create an

of funds unarranged overdraft and we

decide not to make the

payment (1 fee per charging

period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

12

P0556282.indd 12 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: REWARD SILVER

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

• Monthly account fee £10

Maintaining the account

• Total annual fee £120

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

13

P0556282.indd 13 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign • Non-Sterling Transaction Fee 2.75% of

currency outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a No fee

foreign currency

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 39.49% EAR

• Unarranged Overdraft Interest 39.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period)

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

14

P0556282.indd 14 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: REWARD PLATINUM

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

• Monthly account fee £20

Maintaining the account

• Total annual fee £240

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

15

P0556282.indd 15 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a No fee

foreign currency

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 39.49% EAR

• Unarranged Overdraft Interest 39.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period)

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

16

P0556282.indd 16 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: REWARD BLACK

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

• Monthly account fee £31

Maintaining the account

• Total annual fee £372

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK

• Payments over £100 Euro – no fee

Non-Euro – £7

17

P0556282.indd 17 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a No fee

foreign currency

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 19.49% EAR

• Unarranged Overdraft Interest 19.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period).

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

18

P0556282.indd 18 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Fee Information Document

Name of the account provider: The Royal Bank of Scotland plc

Account name: PREMIER SELECT

Date: The information in this Fee Information Document is correct as of 21 May 2021

• This document informs you about the fees for using the main services linked to the payment account.

It will help you to compare these fees with those of other accounts.

• Fees may also apply for using services linked to the account which are not listed here.

Full information is available in Your Current Account Terms or at www.rbs.co.uk.

• A glossary of the terms used in this document is available free of charge.

Service Fee

General account services

Maintaining the account No fee

Payments (excluding cards)

Direct Debit No fee

Standing Order No fee

• Faster Payment (pounds) No fee

Sending money within the UK

• CHAPS (pounds) £20

• By mobile or digital banking All currencies

(Standard) – no fee

All currencies

(Urgent) – £15

• By telephone, post/fax, Euro

or in branch (Standard) – no fee

Sending money outside the UK

Non-Euro

(Standard) – £22

Euro

(Urgent) – £20

Non-Euro

(Urgent) – £30

• Payments under £100 Euro – no fee

Non-Euro – £1

Receiving money from outside the UK • Payments over £100 Euro – no fee

Non-Euro – £7

19

P0556282.indd 19 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

Cards and cash

Cash withdrawal in pounds in the UK No fee

Cash withdrawals in foreign currency • Non-Sterling Transaction Fee 2.75% of

outside the UK withdrawal

Debit card payment in pounds No fee

Debit card payment in a No fee

foreign currency

Overdrafts and related services

Arranged overdraft • Arranged Overdraft Interest 19.49% EAR

• Unarranged Overdraft Interest 19.49% EAR*

Unarranged overdraft

(Maximum charge of £17.25 per

charging period).

• Unpaid Transaction Fee £2.15*

Charged if you instruct a payment

Refusing a payment due to lack

that would create an unarranged

of funds

overdraft and we decide not to

make the payment (1 fee per

charging period (£2.15)).

Allowing a payment despite lack No fee

of funds

*We won’t charge you more than £19.40 in a monthly charging period for an unarranged overdraft

or any unpaid transactions.

Other services

Cancelling a cheque No fee

If you would like this information in Braille, large print or audio format, please contact us on

03457 24 24 24 (Relay UK 18001 03457 24 24 24).

20

P0556282.indd 20 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

P0556282.indd 21 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

The Royal Bank of Scotland plc. Registered in Scotland No. SC083026. Registered Office: 36 St. Andrew Square,

Edinburgh EH2 2YB. Financial Services Firm Reference Number 114724.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

RBS03670 June 2023 P0556282

P0556282.indd 22 23/06/2023 17:00

Generated at: Fri Jun 23 12:35:58 2023

You might also like

- Bank Statment Wells 2024Document4 pagesBank Statment Wells 2024artrevia100% (1)

- 2 - Credit Card Math Life Skills ActivitiesDocument64 pages2 - Credit Card Math Life Skills ActivitiesDayana Coronado100% (3)

- Transaction Monitoring Analyst Assessment TestDocument11 pagesTransaction Monitoring Analyst Assessment TestSreenivasulu Bodolla50% (2)

- Classic Account 24 December 2021 To 21 January 2022Document4 pagesClassic Account 24 December 2021 To 21 January 2022blinkleyNo ratings yet

- Current Account Statement - 14012021Document3 pagesCurrent Account Statement - 14012021Vassilios VarotsisNo ratings yet

- Statement PDFDocument7 pagesStatement PDFSamir GhimireNo ratings yet

- Hiwalah in Shariah and Its Rules and AppDocument11 pagesHiwalah in Shariah and Its Rules and AppShehzad HaiderNo ratings yet

- NW Fee Information DocumentDocument22 pagesNW Fee Information DocumentAnca ONo ratings yet

- Basic Account Fee Information DocumentDocument2 pagesBasic Account Fee Information DocumentGZMO GroupNo ratings yet

- Fee Information DocumentDocument2 pagesFee Information DocumentJaviMartínezNo ratings yet

- Fee Information DocumentDocument2 pagesFee Information DocumentGsz Eli WongNo ratings yet

- FeeInformation FlexibleDocument2 pagesFeeInformation Flexiblekagiyir157No ratings yet

- FeeInformation StudentAdditionsDocument2 pagesFeeInformation StudentAdditionskagiyir157No ratings yet

- FeeInformation PremierCurrentAccountDocument2 pagesFeeInformation PremierCurrentAccountkagiyir157No ratings yet

- FeeInformation BarclaysOfferAccountDocument2 pagesFeeInformation BarclaysOfferAccountkagiyir157No ratings yet

- FeeInformation MortgageCurrentAccountDocument2 pagesFeeInformation MortgageCurrentAccountkagiyir157No ratings yet

- FeeInformation HigherEducationAccountDocument2 pagesFeeInformation HigherEducationAccountkagiyir157No ratings yet

- Fee Information Document PDFDocument3 pagesFee Information Document PDFYulyana StoianNo ratings yet

- FeeInformation BarclaysBasicAccountDocument2 pagesFeeInformation BarclaysBasicAccountkagiyir157No ratings yet

- Fee Information DocumentDocument2 pagesFee Information Documentkagiyir157No ratings yet

- Cater Allen - Banking TariffDocument4 pagesCater Allen - Banking TariffAygul ZagidullinaNo ratings yet

- Fee Information Document: Service Fee General Account ServicesDocument8 pagesFee Information Document: Service Fee General Account ServicesAndreea SaftaNo ratings yet

- Fid FlexdirectDocument2 pagesFid FlexdirectVasy VaSyNo ratings yet

- 2019-09-27 - Bank Account Fee Information DocumentDocument2 pages2019-09-27 - Bank Account Fee Information DocumentMarisac MihaiNo ratings yet

- Fee Information Document: Service Fee General Account ServicesDocument7 pagesFee Information Document: Service Fee General Account ServicesAndreea SaftaNo ratings yet

- PreviewDocument5 pagesPreviewDiogo MaiaNo ratings yet

- iGB Personal Bank Account Fee Information Document 31mar2023Document2 pagesiGB Personal Bank Account Fee Information Document 31mar2023chen jam (1314)No ratings yet

- Statement of FeesDocument4 pagesStatement of FeesErika RaulNo ratings yet

- PreviewDocument5 pagesPreviewDiogo MaiaNo ratings yet

- Fee Information DocumentDocument2 pagesFee Information Documentdd.de.appsNo ratings yet

- International Banking Tariff GuideDocument26 pagesInternational Banking Tariff Guidebupinda singh100% (1)

- PreviewDocument4 pagesPreviewAlex ElenaNo ratings yet

- Monzo Plus Fee Information 1.4Document3 pagesMonzo Plus Fee Information 1.4abi1234mimi123No ratings yet

- Statement of FeesDocument4 pagesStatement of Feesibrahimalferjani74No ratings yet

- Epayments Prepaid Mastercard Card Fees: Transaction FeeDocument2 pagesEpayments Prepaid Mastercard Card Fees: Transaction FeeMadhie SupandriNo ratings yet

- Statement of Fees20-FEB-23 AC 43727343 22041846Document3 pagesStatement of Fees20-FEB-23 AC 43727343 22041846Nina StefanovaNo ratings yet

- Schedule of International Transaction ChargesDocument28 pagesSchedule of International Transaction Chargesaiss.ay.moussNo ratings yet

- Vivid Money SA Retail Fees and Withdrawal RightsDocument4 pagesVivid Money SA Retail Fees and Withdrawal RightsdavidoffsmiNo ratings yet

- BOC UK 2013 ChargesDocument4 pagesBOC UK 2013 ChargesDimitra XaxaxouxaNo ratings yet

- Using Your Debit and Credit Card Abroad MoreinformationDocument2 pagesUsing Your Debit and Credit Card Abroad MoreinformationJanine Rey - EraNo ratings yet

- BT PhoneTariff ResidentialDocument167 pagesBT PhoneTariff Residentialece142No ratings yet

- TSB12319 You and Your Money Abroad 0120Document8 pagesTSB12319 You and Your Money Abroad 0120Dawn SimcockNo ratings yet

- Fee Information DocumentDocument4 pagesFee Information DocumentFrank AmoakoNo ratings yet

- BAR 9909360.p1 LoDocument4 pagesBAR 9909360.p1 LoOxiu LinaNo ratings yet

- HSBCnet Charges To Schools - Feb22Document2 pagesHSBCnet Charges To Schools - Feb22Vinothini RasamanicamNo ratings yet

- Business-Bank-Account MetroDocument3 pagesBusiness-Bank-Account Metroussef oblivion0% (1)

- Bank Account Fee Information DocumentDocument2 pagesBank Account Fee Information Documentsalesuse2shopNo ratings yet

- Entgeltinformation Studentenkonto enDocument2 pagesEntgeltinformation Studentenkonto enrenhouzenNo ratings yet

- TRADEO Fees-14032k19 PDFDocument1 pageTRADEO Fees-14032k19 PDFSivakumar NatarajanNo ratings yet

- UK Lloyds BankDocument3 pagesUK Lloyds BankflaviofernandezfigueiredoNo ratings yet

- Visa Prepaid Card RatesDocument2 pagesVisa Prepaid Card RatesAmiruddin IslamNo ratings yet

- VMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevDocument5 pagesVMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevtereveNo ratings yet

- Cib TriffDocument1 pageCib TriffJack AdamNo ratings yet

- Schedule of Charges Valid From 31 July 2023Document7 pagesSchedule of Charges Valid From 31 July 2023hackeransh00No ratings yet

- Bitwala Pricing enDocument2 pagesBitwala Pricing entitoNo ratings yet

- Revolut Bank UAB FID 8 July 2022 ENGDocument3 pagesRevolut Bank UAB FID 8 July 2022 ENGDan LindbergNo ratings yet

- Statement of Fees 07 Sep 2021Document5 pagesStatement of Fees 07 Sep 2021ken gardnerNo ratings yet

- Monte SEPASWIFT (1) - 1Document1 pageMonte SEPASWIFT (1) - 1irynaNo ratings yet

- Fees and ChargesDocument2 pagesFees and ChargesАртём КондратюкNo ratings yet

- Graduate Account Fee Information DocumentDocument2 pagesGraduate Account Fee Information Documentpriyadevelops8No ratings yet

- PNB Notes For ClassDocument6 pagesPNB Notes For ClassmankNo ratings yet

- NW Bus Current Account ChargesDocument2 pagesNW Bus Current Account Chargessamsingh5692No ratings yet

- PAD Pricelist EngDocument11 pagesPAD Pricelist EngBshirNo ratings yet

- What Are The Functions, Attributes And, Kinds of MoneyDocument2 pagesWhat Are The Functions, Attributes And, Kinds of MoneyAngelie JalandoniNo ratings yet

- Nomura, SBI Caps, IDFC, Wellington Are in Talks To Buy 10% Stake For Rs 1000 CR in Kerala-Based ManappuramDocument2 pagesNomura, SBI Caps, IDFC, Wellington Are in Talks To Buy 10% Stake For Rs 1000 CR in Kerala-Based ManappuramRaghu.GNo ratings yet

- 0.60 Malaysian Ringgit: 1 Chinese Yuan EqualsDocument2 pages0.60 Malaysian Ringgit: 1 Chinese Yuan EqualszeroNo ratings yet

- Republic Day ' Cashback Offer On INTEL Laptops Terms & ConditionsDocument3 pagesRepublic Day ' Cashback Offer On INTEL Laptops Terms & ConditionsMonuNo ratings yet

- Lessons Learned From Decentralised Finance (Defi)Document22 pagesLessons Learned From Decentralised Finance (Defi)alexander benNo ratings yet

- Statement - 2Document4 pagesStatement - 2Gavin GoodNo ratings yet

- Money and CreditDocument7 pagesMoney and CreditSunil Sharma100% (1)

- Discuss What Is The Shariah Advisory Council of Bank Negara MalaysiaDocument2 pagesDiscuss What Is The Shariah Advisory Council of Bank Negara Malaysiaotaku himeNo ratings yet

- SNGPL - Web BillDocument1 pageSNGPL - Web Billtech damnNo ratings yet

- CV Loan AgreementDocument17 pagesCV Loan AgreementankitNo ratings yet

- Seabank Statement Arifwijaksono 20230102Document6 pagesSeabank Statement Arifwijaksono 20230102MiskaNo ratings yet

- JBSC BPi YEtrb 5 BaDocument8 pagesJBSC BPi YEtrb 5 Bamexop31426No ratings yet

- Lista Tranzactii: George Alexandru David RO76BRDE030SV04277010300 RON George Alexandru DavidDocument5 pagesLista Tranzactii: George Alexandru David RO76BRDE030SV04277010300 RON George Alexandru DavidDavid GeorgeNo ratings yet

- Knitwell Apparels FpiDocument1 pageKnitwell Apparels Fpislim_incNo ratings yet

- Comparison of Saving Accounts of Different Banks in Jaipur"Document89 pagesComparison of Saving Accounts of Different Banks in Jaipur"Akhil AgarwalNo ratings yet

- APPL WLA - Interoperable Cash Deposit ProcessDocument10 pagesAPPL WLA - Interoperable Cash Deposit ProcessRajesh Kannan100% (1)

- TEST As Accounting Double EntryDocument1 pageTEST As Accounting Double EntryEdu TainmentNo ratings yet

- Chapter 04Document7 pagesChapter 04SHANTANU KHARENo ratings yet

- Account StatementDocument8 pagesAccount StatementPvvn rcNo ratings yet

- HR51AW3973 FASTag Statement 1682006955810Document2 pagesHR51AW3973 FASTag Statement 1682006955810sonu singhNo ratings yet

- Anmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .Document87 pagesAnmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .ANMOLNo ratings yet

- Bank Chapter OneDocument8 pagesBank Chapter OnebikilahussenNo ratings yet

- Launching A Consumer Bank in India: Group 1Document34 pagesLaunching A Consumer Bank in India: Group 1ankurdhaliwalNo ratings yet

- Unit 2Document15 pagesUnit 2nothinghereguyzNo ratings yet

- Equitable PCI BankDocument9 pagesEquitable PCI Bankfay garneth buscatoNo ratings yet

- Checking Summary: You Now Have More Time To Let Us Know About Certain Check Errors On Your AccountDocument6 pagesChecking Summary: You Now Have More Time To Let Us Know About Certain Check Errors On Your Accountbbizzle121927No ratings yet