Professional Documents

Culture Documents

Chul Min Lee HW #1

Chul Min Lee HW #1

Uploaded by

Charles Lee0 ratings0% found this document useful (0 votes)

3 views1 pageThis document contains performance metrics for various hedge fund strategies from 1994 to present. It provides the compounded annualized return, standard deviation, Sharpe ratio, skew, kurtosis, Sortino ratio, Calmar ratio, Jensen's alpha, Fama-French 3-factor and 5-factor alphas, Carhart's alpha, and Omega ratio for different hedge fund strategies including convertible arbitrage, dedicated short bias, emerging markets, equity market neutral, distressed, multi-strategy, risk arbitrage, and global macro funds.

Original Description:

Original Title

HW #1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains performance metrics for various hedge fund strategies from 1994 to present. It provides the compounded annualized return, standard deviation, Sharpe ratio, skew, kurtosis, Sortino ratio, Calmar ratio, Jensen's alpha, Fama-French 3-factor and 5-factor alphas, Carhart's alpha, and Omega ratio for different hedge fund strategies including convertible arbitrage, dedicated short bias, emerging markets, equity market neutral, distressed, multi-strategy, risk arbitrage, and global macro funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageChul Min Lee HW #1

Chul Min Lee HW #1

Uploaded by

Charles LeeThis document contains performance metrics for various hedge fund strategies from 1994 to present. It provides the compounded annualized return, standard deviation, Sharpe ratio, skew, kurtosis, Sortino ratio, Calmar ratio, Jensen's alpha, Fama-French 3-factor and 5-factor alphas, Carhart's alpha, and Omega ratio for different hedge fund strategies including convertible arbitrage, dedicated short bias, emerging markets, equity market neutral, distressed, multi-strategy, risk arbitrage, and global macro funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Chul Min Lee

HW #1

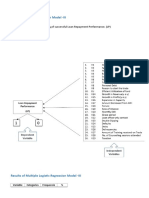

Equity Event Driven Event Driven

Convertible Dedicated Emerging Market Event Driven Multi- Risk Fixed Income Managed Multi-

Arbitrage Short Bias Markets Neutral Event Driven Distressed Strategy Arbitrage Arbitrage Global Macro Long/Short Futures Strategy

Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Hedge Fund Equity Hedge Hedge Fund Hedge Fund

Index Index Index Index Index Index Index Index Index Index Index Fund Index Index Index

Compounded Annualized Return in 12.333 years 14.65% 12.34% -9.45% 12.63% 8.25% 15.25% 17.43% 14.24% 10.75% 9.41% 19.14% 16.34% 9.90% 14.30%

Compounded Annualized Std in 12.333 years 7.02% 6.45% 16.34% 13.70% 9.48% 6.16% 6.27% 6.69% 4.00% 5.25% 9.02% 9.26% 11.55% 4.97%

Sharpe Ratio (assume Rf=2%) 1.801 1.603 -0.701 0.776 0.659 2.150 2.461 1.828 2.188 1.411 1.900 1.550 0.684 2.474

Skew -0.123 -2.634 0.715 -0.764 -12.511 -2.010 -2.020 -1.590 -0.888 -4.672 0.127 0.014 0.025 -1.713

Kurtosis 3.030 17.407 1.484 6.174 186.002 9.396 10.829 6.592 4.400 35.897 4.598 3.803 -0.108 6.814

Sortino Ratio (assume Target Rt= 8%) -0.008 -0.093 -0.876 0.069 -0.604 0.054 0.377 -0.059 -0.619 -0.560 0.668 0.185 -0.467 -0.059

Calmar Ratio(assume Rf=2%) -0.643 -0.112 0.116 -0.113 -0.068 -0.146 -0.171 -0.134 -0.095 -0.080 -0.189 -0.156 -0.085 -0.133

Jensen's Alpha (since 199401) 0.097 0.084 -0.049 0.058 0.042 0.105 0.127 0.094 0.070 0.058 0.153 0.101 0.079 0.106

Fama French 3 Fators Alpha(assume bs bv =0.5) 0.079 0.066 -0.067 0.039 0.024 0.086 0.109 0.076 0.052 0.040 0.135 0.082 0.060 0.088

Fama French 5 Fators Alpha(assume factors=0.5) 0.042 0.029 -0.104 0.002 -0.014 0.049 0.072 0.039 0.015 0.003 0.098 0.045 0.023 0.051

Carhart's Alpha(assume Fama's RWM factor is the fourth factor in Carhart) 0.059 0.046 -0.087 0.019 0.003 0.066 0.088 0.055 0.032 0.020 0.115 0.062 0.040 0.067

Omega Ratio (assume return>1 will be value of Call( r ), similarly for Put) 2.244 2.481 0.718 1.653 3.000 2.926 2.708 2.671 2.761 3.621 2.436 1.792 1.233 3.714

You might also like

- F9 - Mock A - QuestionsDocument15 pagesF9 - Mock A - Questionsshahidmustafa429No ratings yet

- Ch18Ross7edMINICASEThe Leveraged Buyout of Cheek Products LTDDocument2 pagesCh18Ross7edMINICASEThe Leveraged Buyout of Cheek Products LTDCatherine Li0% (1)

- Bond Valuation ProblemsDocument4 pagesBond Valuation ProblemsMary Justine Paquibot100% (1)

- PV and Annuity TableDocument2 pagesPV and Annuity TableChirag Kashyap100% (1)

- CF 10e Chapter 09 Excel Master StudentDocument27 pagesCF 10e Chapter 09 Excel Master StudentWalter Costa100% (1)

- Multiple Logistic Regression Model-LPDocument7 pagesMultiple Logistic Regression Model-LPmanjushreeNo ratings yet

- A Note On Optimal Capital AllocationDocument2 pagesA Note On Optimal Capital AllocationAmbuj GargNo ratings yet

- PLS AlgortihmDocument159 pagesPLS AlgortihmRAEHAN GARDHA RASPATINo ratings yet

- Liberty - March 9 2022Document1 pageLiberty - March 9 2022Lisle Daverin BlythNo ratings yet

- MA Mock - Questions S20-A21Document15 pagesMA Mock - Questions S20-A21Abdinasir HassanNo ratings yet

- Asset 1 Asset 2 Asset 3Document7 pagesAsset 1 Asset 2 Asset 3PiyushPurohitNo ratings yet

- Kalkulasi 02Document270 pagesKalkulasi 02Ukhti NajwaNo ratings yet

- PV and Annuity TableDocument2 pagesPV and Annuity TableChirag KashyapNo ratings yet

- AlgoDocument147 pagesAlgoEman MazharNo ratings yet

- CoreyExponents 4546596 03Document16 pagesCoreyExponents 4546596 03AiwarikiaarNo ratings yet

- CFA1Document213 pagesCFA1aiman MNo ratings yet

- Formulae and Discount Tables: Professional Level Examination Financial ManagementDocument2 pagesFormulae and Discount Tables: Professional Level Examination Financial ManagementClaudine CjNo ratings yet

- Kalkulasi 01Document415 pagesKalkulasi 01Ukhti NajwaNo ratings yet

- ALGORITMDocument162 pagesALGORITMSartika muslimawatiNo ratings yet

- Node L/C Force-X Force-Y Force-Z Moment-X Moment-Y Moment-Z: Job No Sheet No RevDocument4 pagesNode L/C Force-X Force-Y Force-Z Moment-X Moment-Y Moment-Z: Job No Sheet No RevGunarso NarsoNo ratings yet

- Liberty - March 10 2022Document1 pageLiberty - March 10 2022Lisle Daverin BlythNo ratings yet

- Frigate ResistanceDocument2 pagesFrigate ResistancemxNoNameNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Crossec2022.Csv - Crossec2022Document8 pagesCrossec2022.Csv - Crossec2022K04 Ferdian AlamsyahNo ratings yet

- Asset 1 Asset 2 Asset 3Document6 pagesAsset 1 Asset 2 Asset 3khprashNo ratings yet

- Liberty - September 12 2021Document1 pageLiberty - September 12 2021Lisle Daverin BlythNo ratings yet

- F9 - BPP - MOCK EXAM - QnsDocument10 pagesF9 - BPP - MOCK EXAM - QnsRaluca PanaitNo ratings yet

- Variance Explained: Dimensions / ItemsDocument12 pagesVariance Explained: Dimensions / ItemsAnurag KhandelwalNo ratings yet

- Liberty - October 17 2022Document1 pageLiberty - October 17 2022Lisle Daverin BlythNo ratings yet

- Liberty - May 12 2022Document1 pageLiberty - May 12 2022Lisle Daverin BlythNo ratings yet

- Case SCAL Minggu 1 - Ahmad Akbar - 012 - Plug GDocument57 pagesCase SCAL Minggu 1 - Ahmad Akbar - 012 - Plug GFREE ZONENo ratings yet

- Diseño HidrologicoDocument19 pagesDiseño HidrologicoCHRISTIAN ANIBAL SANTA CRUZ AVILANo ratings yet

- Liberty - October 11 2022Document1 pageLiberty - October 11 2022Lisle Daverin BlythNo ratings yet

- ADC12 Composition Check SheetDocument4 pagesADC12 Composition Check SheetevanNo ratings yet

- Resistance According To Delft Series ('98) : V V FN RF RR Rtotal PeDocument2 pagesResistance According To Delft Series ('98) : V V FN RF RR Rtotal Pegreicel marianjas sihombingNo ratings yet

- ANALYSISDocument4 pagesANALYSISjob371637No ratings yet

- EIRT Siswa EvaluasiDocument351 pagesEIRT Siswa EvaluasiDimas Fadili RohmanNo ratings yet

- FINC240 Project 2017 - Emirates AirlineDocument18 pagesFINC240 Project 2017 - Emirates AirlineUsmanNo ratings yet

- Liberty - October 4 2021Document1 pageLiberty - October 4 2021lisle blythNo ratings yet

- Liberty - December 6 2017Document1 pageLiberty - December 6 2017Tiso Blackstar GroupNo ratings yet

- Liberty - February 24 2021Document1 pageLiberty - February 24 2021Lisle Daverin BlythNo ratings yet

- AERC PresentationDocument17 pagesAERC PresentationAtiq ur Rehman QamarNo ratings yet

- TablasDocument3 pagesTablasVictor Sulca PucaNo ratings yet

- Currency (Weekly) TrendDocument3 pagesCurrency (Weekly) Trendismun nadhifahNo ratings yet

- Dados Das Figuras - v2Document15 pagesDados Das Figuras - v2Victor SumikawaNo ratings yet

- Slurry Calculation For Frac DesignDocument3 pagesSlurry Calculation For Frac DesignQaiser HafeezNo ratings yet

- Tolerance StacksDocument15 pagesTolerance StacksSanjay MehrishiNo ratings yet

- Variance Explained: Dimensions / ItemsDocument14 pagesVariance Explained: Dimensions / ItemsAditi AgrawalNo ratings yet

- 0 Cal SeismicDocument237 pages0 Cal SeismicanammominNo ratings yet

- Liberty - February 7 2022Document1 pageLiberty - February 7 2022Lisle Daverin BlythNo ratings yet

- MektanDocument4 pagesMektanricha fitamalaNo ratings yet

- Free Point Calculation v03Document2 pagesFree Point Calculation v03prasarnboonNo ratings yet

- Benda Uji Unconfined Fiberglass FixDocument9 pagesBenda Uji Unconfined Fiberglass FixRiza Maulana GhiffariNo ratings yet

- SEM DepresiDocument13 pagesSEM DepresiThojing D PallaqiNo ratings yet

- Tabel Akuaponik Dan Kolam, 2019Document5 pagesTabel Akuaponik Dan Kolam, 2019Ella IntanNo ratings yet

- Liberty - September 5 2018Document1 pageLiberty - September 5 2018Tiso Blackstar GroupNo ratings yet

- 2 The Decibel ScaleDocument10 pages2 The Decibel ScaleOscar RomeuNo ratings yet

- Rotated Component MatrixDocument4 pagesRotated Component MatrixriaNo ratings yet

- Tri Ayuning Sari - 0115030035Document60 pagesTri Ayuning Sari - 0115030035bahrulNo ratings yet

- Liberty - April 27 2022Document1 pageLiberty - April 27 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- CK Infrastructure Holdings Limited: (Note 1)Document1 pageCK Infrastructure Holdings Limited: (Note 1)WF YeungNo ratings yet

- Simple Application of Tools of Demand and SupplyDocument5 pagesSimple Application of Tools of Demand and SupplyAryan JainNo ratings yet

- L&T MF ExitsDocument1 pageL&T MF ExitsPrinceAni89No ratings yet

- Practice Midterm 1 With SolutionsDocument6 pagesPractice Midterm 1 With SolutionsDenise ChenNo ratings yet

- Dissertation On Foreign Exchange RateDocument6 pagesDissertation On Foreign Exchange RatePaySomeoneToWriteYourPaperHighPoint100% (1)

- Elliot Wave "Cheat Sheet"Document6 pagesElliot Wave "Cheat Sheet"Kevin SulaNo ratings yet

- Zto F1 PDFDocument960 pagesZto F1 PDFIshaan MittalNo ratings yet

- Corporate - TreasuryDocument49 pagesCorporate - TreasuryArif AhmedNo ratings yet

- Ichimoku - Eu: Ichimoku On High Time Frame IntervalsDocument4 pagesIchimoku - Eu: Ichimoku On High Time Frame IntervalsDiallo abassNo ratings yet

- Hedge Funds: MII Presentation September 17, 2002 Priyanka ChopraDocument28 pagesHedge Funds: MII Presentation September 17, 2002 Priyanka ChopraPriya JagasiaNo ratings yet

- Securities and Exchange Board of IndiaDocument2 pagesSecurities and Exchange Board of IndiaJanakiraman RNo ratings yet

- T. Nanda KumarDocument5 pagesT. Nanda KumarVinit SanghviNo ratings yet

- How To Download Fundamentals of Investing Pearson Series in Finance Ebook PDF Version Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Fundamentals of Investing Pearson Series in Finance Ebook PDF Version Ebook PDF Docx Kindle Full Chapterannie.root658100% (31)

- F1 Notes 1Document21 pagesF1 Notes 1rameshmbaNo ratings yet

- Chapter 05 Questions and ProblemsDocument4 pagesChapter 05 Questions and Problemsglobinho111No ratings yet

- Structuring Local Currency Transactions Case Studies v2 1Document15 pagesStructuring Local Currency Transactions Case Studies v2 1jai_tri007No ratings yet

- Adamson Brothers' Andy Altahawi Responds To Recent SEC CaseDocument3 pagesAdamson Brothers' Andy Altahawi Responds To Recent SEC CasePR.comNo ratings yet

- Commodity Market QuestionnaireDocument86 pagesCommodity Market QuestionnaireSuraj Nair67% (9)

- Depository Receipts Information Guide - CitigroupDocument58 pagesDepository Receipts Information Guide - CitigroupyasheshthakkarNo ratings yet

- Venture Capital: Rahul Shah Roll:135 MFM3-BDocument53 pagesVenture Capital: Rahul Shah Roll:135 MFM3-BParth MakwanaNo ratings yet

- Financial MarketDocument10 pagesFinancial MarketLinganagouda PatilNo ratings yet

- MSB - Market Structure BreakDocument18 pagesMSB - Market Structure BreakParaschiv Bogdan100% (9)

- Abnormal Return Saham Pada Kinerja Jangka PanjangDocument11 pagesAbnormal Return Saham Pada Kinerja Jangka PanjangLestariNo ratings yet

- Malaysia Low ResDocument9 pagesMalaysia Low ResMujahidahFaqihahNo ratings yet

- Long Term Source of FinanceDocument35 pagesLong Term Source of FinanceAditya100% (1)

- The Asset Approach To Exchange Rates and The Foreign Exchange Market!Document46 pagesThe Asset Approach To Exchange Rates and The Foreign Exchange Market!Brian LiuNo ratings yet

- AL Financial Management Nov Dec 2013Document4 pagesAL Financial Management Nov Dec 2013hyp siinNo ratings yet