Professional Documents

Culture Documents

Index Model

Index Model

Uploaded by

VISHAL PATILCopyright:

Available Formats

You might also like

- Assignment 5 of Porfolio ManagementDocument8 pagesAssignment 5 of Porfolio ManagementfacticalNo ratings yet

- Calculo de BetaDocument6 pagesCalculo de BetaCristian VallaNo ratings yet

- 11 - Ubaid Dhansay-Sapm AssignDocument5 pages11 - Ubaid Dhansay-Sapm Assign077 - Ubaid dhansayNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceDessiree ChenNo ratings yet

- AssignmentDocument16 pagesAssignmentMinza JahangirNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- FMT Project - ACC CementDocument7 pagesFMT Project - ACC CementMridula HariNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- 1-Data For Health FinancingDocument19 pages1-Data For Health FinancingMuhammad Asif Khan KhattakNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- Defaultable Fixed Coupon Bond: PricingDocument10 pagesDefaultable Fixed Coupon Bond: PricinggiulioNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- RocketDocument4 pagesRocketKhánh TrânNo ratings yet

- CAPM ExamenDocument5 pagesCAPM ExamenDenisse Liliana Melgar ValenzuelaNo ratings yet

- EBLSL Daily Market Update 4th August 2020Document1 pageEBLSL Daily Market Update 4th August 2020Moheuddin SehabNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Neha (31) ICICI BankDocument2 pagesNeha (31) ICICI BankNeha ChauhanNo ratings yet

- Solución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Document6 pagesSolución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Yessica MacedaNo ratings yet

- Aluminum 360Document12 pagesAluminum 360SaurabhNo ratings yet

- BAJAJ HEALTHCARE LTD. - PurveeshaDocument44 pagesBAJAJ HEALTHCARE LTD. - PurveeshaShree KhandelwalNo ratings yet

- Tarea Finanzas CorporativasDocument70 pagesTarea Finanzas CorporativasFabián Mauricio Riquet BastidasNo ratings yet

- HomeworkDocument27 pagesHomeworkHồ Ngọc HàNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Casagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)Document5 pagesCasagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)DannyNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Group 07 22657 Sandeep S SDocument21 pagesGroup 07 22657 Sandeep S SSandeep ShirasangiNo ratings yet

- Wusen Js ExcelDocument5 pagesWusen Js ExcelDessiree ChenNo ratings yet

- Midterm - Invest & Port MGTDocument11 pagesMidterm - Invest & Port MGTMohamed HelmyNo ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- s&p500 Rentab S&P Date Bancolombia Rentab BancolDocument4 pagess&p500 Rentab S&P Date Bancolombia Rentab Bancolanonimo centenarioNo ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Death Claims - Upto March 2022 - WebsiteDocument4 pagesDeath Claims - Upto March 2022 - WebsiteKunal Abhilashbhai DelwadiaNo ratings yet

- Session 11 Portfolio OptimizationDocument6 pagesSession 11 Portfolio Optimizationpayal mittalNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Regression Chart: Date BSE Titan BSE Return Titan ReturnDocument5 pagesRegression Chart: Date BSE Titan BSE Return Titan ReturnPranjal GuptaNo ratings yet

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocument12 pagesCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Campaign Report: All TimeDocument1 pageCampaign Report: All TimeRestorani za Svadbe i ostale proslaveNo ratings yet

- Exogenous Driver Analysis Driver Relative GDP GrowthDocument107 pagesExogenous Driver Analysis Driver Relative GDP GrowthBhagya FoodsNo ratings yet

- Determinar WaccDocument5 pagesDeterminar WaccLisbeth CarrascoNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Ejemplo de Acciones Con S&PDocument6 pagesEjemplo de Acciones Con S&PBruce Williams AstoNo ratings yet

- Table Showing Closing Price, Dividend, Rate of Return and VarianceDocument5 pagesTable Showing Closing Price, Dividend, Rate of Return and VarianceShreyangan SarmaNo ratings yet

- Beta CalculationDocument14 pagesBeta CalculationShraman SinglaNo ratings yet

- GDP Velocity MZM 5-30-10Document2 pagesGDP Velocity MZM 5-30-10JaphyNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- FIM TPDocument7 pagesFIM TPAfroza VabnaNo ratings yet

- EBLSL Daily Market Update - 22nd July 2020Document1 pageEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabNo ratings yet

- Walmart WaccDocument10 pagesWalmart WaccNusrat papiyaNo ratings yet

- Apollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsDocument23 pagesApollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsShubham MehrotraNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Performance Measures (Excel)Document3 pagesPerformance Measures (Excel)VISHAL PATILNo ratings yet

- Calculate Beta (3 Different Methods)Document10 pagesCalculate Beta (3 Different Methods)VISHAL PATILNo ratings yet

- Lecture 5Document23 pagesLecture 5VISHAL PATILNo ratings yet

- Indian Financial System NewDocument171 pagesIndian Financial System NewVISHAL PATILNo ratings yet

- Lecture 3Document32 pagesLecture 3VISHAL PATILNo ratings yet

- RISK MANAGEMENT - ERASMUS - 2019 - BplusDocument61 pagesRISK MANAGEMENT - ERASMUS - 2019 - BplusVISHAL PATILNo ratings yet

- New Coast SheetDocument2 pagesNew Coast SheetVISHAL PATILNo ratings yet

- Exercise 01Document4 pagesExercise 01VISHAL PATILNo ratings yet

- Formula Sheet DerivativesDocument5 pagesFormula Sheet DerivativesVISHAL PATILNo ratings yet

- CA FC Accounts SolutionDocument36 pagesCA FC Accounts SolutionVISHAL PATILNo ratings yet

- Yields and ReturnsDocument1 pageYields and ReturnsVISHAL PATILNo ratings yet

- Dividend Discount Model: Constant Dividend: NextDocument2 pagesDividend Discount Model: Constant Dividend: NextVISHAL PATILNo ratings yet

- 0 20211022172336present Value of BondDocument1 page0 20211022172336present Value of BondVISHAL PATILNo ratings yet

- CCRA Training Session 11Document21 pagesCCRA Training Session 11VISHAL PATILNo ratings yet

- Blank WorkbookDocument2 pagesBlank WorkbookVISHAL PATILNo ratings yet

- ResultDocument1 pageResultVISHAL PATILNo ratings yet

- 0 20211022172312preparing PL Account Balance Sheet Cash Flow 3Document6 pages0 20211022172312preparing PL Account Balance Sheet Cash Flow 3VISHAL PATILNo ratings yet

- CCRA Session 8Document18 pagesCCRA Session 8VISHAL PATILNo ratings yet

- CCRA Training Session 12Document17 pagesCCRA Training Session 12VISHAL PATILNo ratings yet

- CCRA Session 13Document19 pagesCCRA Session 13VISHAL PATILNo ratings yet

- CCRA Session 18Document15 pagesCCRA Session 18VISHAL PATILNo ratings yet

- CCRA Session 19Document19 pagesCCRA Session 19VISHAL PATILNo ratings yet

- CCRA Session 16Document14 pagesCCRA Session 16VISHAL PATILNo ratings yet

- TAMO - Ratio Analysis - SolutionDocument10 pagesTAMO - Ratio Analysis - SolutionVISHAL PATILNo ratings yet

- Start Cash Flow Statement - v2Document6 pagesStart Cash Flow Statement - v2VISHAL PATILNo ratings yet

- CCRA Session 15Document27 pagesCCRA Session 15VISHAL PATILNo ratings yet

- Quick Calculation of Balance Sheet RatiosDocument2 pagesQuick Calculation of Balance Sheet RatiosVISHAL PATILNo ratings yet

- READDocument1 pageREADVISHAL PATILNo ratings yet

- Altman Z Score ModelDocument20 pagesAltman Z Score ModelVISHAL PATILNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- SAPM TYBBI Internal Exam - Google FormsDocument6 pagesSAPM TYBBI Internal Exam - Google Formsshraddha shuklaNo ratings yet

- Financial Management Unit 3 DR Ashok KumarDocument65 pagesFinancial Management Unit 3 DR Ashok Kumarsk tanNo ratings yet

- Assessment 3 2024 Financial AssetDocument9 pagesAssessment 3 2024 Financial AssetAlthea mary kate MorenoNo ratings yet

- Contoh Soal Mutual Holding Pendekatan KonvensionalDocument10 pagesContoh Soal Mutual Holding Pendekatan KonvensionalPutri ShaniaNo ratings yet

- CF CH 2Document45 pagesCF CH 2AbelNo ratings yet

- Dwnload Full Essentials of Corporate Finance 8th Edition Ross Test Bank PDFDocument35 pagesDwnload Full Essentials of Corporate Finance 8th Edition Ross Test Bank PDFoutlying.pedantry.85yc100% (14)

- Full Download PDF of (Ebook PDF) Principles of Finance 6th Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Principles of Finance 6th Edition All Chapterchuilakkawi19100% (10)

- Interim Financial Statements For Quarter Ended 30th Chaitra 2079Document20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2079AaluNo ratings yet

- Revision No AnswerDocument12 pagesRevision No AnswerQuang Nguyễn ThếNo ratings yet

- CFAS SolMan Robles Part 1Document9 pagesCFAS SolMan Robles Part 1Fiel Marie SateraNo ratings yet

- Nuveen Mutual Fund Capabilities OverviewDocument2 pagesNuveen Mutual Fund Capabilities Overviewmadhav kaliaNo ratings yet

- Vientam Container Shipping 2Document10 pagesVientam Container Shipping 2Tony ZhangNo ratings yet

- Ishares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualDocument4 pagesIshares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualAbduRahman ZakariaNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 6Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 6LaVida LocaNo ratings yet

- Sums On Cash Flow StatementDocument5 pagesSums On Cash Flow StatementAstha ParmanandkaNo ratings yet

- Report PT SBL and Subsidiaries Dec 31 2021Document85 pagesReport PT SBL and Subsidiaries Dec 31 2021Duwi AtikaNo ratings yet

- Valuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul KhoiriyahDocument10 pagesValuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul Khoiriyahferdin sitinjakNo ratings yet

- QuizDocument41 pagesQuizbar barNo ratings yet

- FinmgtDocument92 pagesFinmgtMary Elisha PinedaNo ratings yet

- FRS 8 Ig (2016)Document4 pagesFRS 8 Ig (2016)David LeeNo ratings yet

- SK Biotek Ireland Limited FsDocument33 pagesSK Biotek Ireland Limited Fssonika.anand11No ratings yet

- Holdings XL7509Document27 pagesHoldings XL7509Sandeep Konapur M KNo ratings yet

- Kết Quả Khảo Thí Giữa Kỳ Môn F7 Lớp F702.19: Test analysis belowDocument24 pagesKết Quả Khảo Thí Giữa Kỳ Môn F7 Lớp F702.19: Test analysis belowGenoso OtakuNo ratings yet

- Retained Earnings Short TestDocument2 pagesRetained Earnings Short TestAngelica CastilloNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Unit 2 (Notes 2) - Relative ValuationDocument9 pagesUnit 2 (Notes 2) - Relative ValuationhriddhvpatelNo ratings yet

- Annual Report 2022 2023 258 264 1 2Document2 pagesAnnual Report 2022 2023 258 264 1 2jagu6143No ratings yet

- Course of Financial AnalysisDocument34 pagesCourse of Financial AnalysisSherlock HolmesNo ratings yet

- Capital Budgeting SolutionDocument36 pagesCapital Budgeting SolutionMadhav SoodNo ratings yet

Index Model

Index Model

Uploaded by

VISHAL PATILOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index Model

Index Model

Uploaded by

VISHAL PATILCopyright:

Available Formats

Index Model

1.) Visit this link to download market return data (using the SPY index). Choose "Frequency: Monthly" and Time Period: "5Y".

Link: https://finance.yahoo.com/quote/SPY/history?p=SPY

2.) Paste the Dates and Adj Close values from step 1 into Columns 1 and 2 below.

3.) Type in a stock ticker, and visit the link that generates below.

Ticker: WMT Link: https://finance.yahoo.com/quote/WMT/history?p=WMT

4.) Download the historical data, choosing "Frequency: Monthly" and Time Period: "5Y"

5.) Paste the Adj Close values from step 4 into Column 3.

6.) Visit this link to obtain monthly risk-free rates (in the RF column). Paste these values in Column 4

Link: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/ftp/F-F_Research_Data_Factors_CSV.zip

7.) The excess returns of the market and stock will generate in columns 5 and 6 and the scatter plot will update.

8.) Verify your beta by comparing to that listed on Yahoo! Finance's website for your stock.

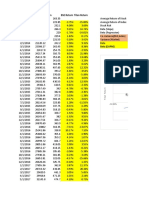

(1) (2) (3) (4) (5) (6) Stock's Beta 0.49

Mkt Adj. Close Market Excess Stock Excess Slope: the systematic risk, sensitivity to market.

Date WMT Adj. Close Monthly RF Rate

(SPY) Return* Return Stock's Alpha 0.01

9/1/2016 197.13 64.97 0.02 Intercept: E(r) beyond that consistent with its beta and market excess return.

10/1/2016 194.69 63.07 0.02 -1.3% -2.9% R-squared 0.18

11/1/2016 201.87 63.44 0.02 3.7% 0.6% Proportion of total variance explained by the market.

### 12/1/2016 204.75 62.26 0.01 1.4% -1.9%

### 1/1/2017 209.64 60.55 0.03 2.4% -2.8%

2/1/2017 217.88 64.35 0.04 3.9% 6.2% Scatter Plot of Asset and Market Excess Returns

3/1/2017 217.21 65.39 0.04 -0.3% 1.6% 15.0%

4/1/2017 220.32 68.71 0.03 1.4% 5.0%

5/1/2017 223.43 71.83 0.05 1.4% 4.5% 10.0%

6/1/2017 223.76 69.63 0.06 0.1% -3.1%

7/1/2017 229.47 73.59 0.06 2.5% 5.6% f(x)0.4860580542 0.0073659

= 0.486058054218999 x + 0.00736589895019014

5.0%

8/1/2017 230.14 71.83 0.07 0.2% -2.5% R² =0.1405530165 0.0065811

0.178602195945787

3 9/1/2017 233.62 72.34 0.09 1.4% 0.6% 0.1786021959 0.0475039

0.0%

10/1/2017 240.31 80.83 0.09 2.8% 11.6% -15.0% 11.959029752

-10.0% -5.0% 55

0.0% 5.0% 10.0% 15.0%

11/1/2017 247.66 90.02 0.09 3.0% 11.3% 0.0269870315 0.1241143

12/1/2017 249.39 91.42 0.08 0.6% 1.5% -5.0%

1/1/2018 264.79 99.21 0.09 6.1% 8.4%

Stock Excess Returns

2/1/2018 255.16 83.77 0.11 -3.7% -15.7% -10.0%

3/1/2018 247.18 82.80 0.11 -3.2% -1.3%

4/1/2018 249.45 82.82 0.12 0.8% -0.1% -15.0%

5/1/2018 255.51 77.28 0.14 2.3% -6.8%

6/1/2018 255.84 80.69 0.14 0.0% 4.3% -20.0%

7/1/2018 266.50 84.07 0.14 4.0% 4.0%

8/1/2018 275.01 90.31 0.16 3.0% 7.3% Market Excess Returns

9/1/2018 275.40 88.99 0.16 0.0% -1.6%

10/1/2018 257.53 95.03 0.15 -6.6% 6.6%

11/1/2018 262.31 92.53 0.19 1.7% -2.8%

12/1/2018 237.82 88.27 0.18 -9.5% -4.8%

1/1/2019 258.36 91.31 0.19 8.4% 3.2%

2/1/2019 266.74 94.32 0.21 3.0% 3.1%

3/1/2019 270.38 92.93 0.18 1.2% -1.7%

4/1/2019 282.66 98.51 0.19 4.4% 5.8%

5/1/2019 264.63 97.17 0.21 -6.6% -1.6%

6/1/2019 281.68 106.40 0.21 6.2% 9.3%

7/1/2019 287.33 106.30 0.18 1.8% -0.3%

8/1/2019 282.52 110.03 0.19 -1.9% 3.3%

9/1/2019 286.69 114.85 0.16 1.3% 4.2%

10/1/2019 294.38 113.48 0.18 2.5% -1.4%

11/1/2019 305.04 115.25 0.15 3.5% 1.4%

12/1/2019 312.37 115.01 0.12 2.3% -0.3%

1/1/2020 313.77 111.29 0.14 0.3% -3.4%

2/1/2020 288.93 104.67 0.13 -8.0% -6.1%

3/1/2020 251.38 110.45 0.12 -13.1% 5.4%

4/1/2020 284.96 118.68 0.12 13.2% 7.3%

5/1/2020 298.54 121.13 0 4.8% 2.1%

6/1/2020 302.50 117.47 0.01 1.3% -3.0%

7/1/2020 321.73 126.90 0.01 6.3% 8.0%

8/1/2020 344.18 136.17 0.01 7.0% 7.3%

9/1/2020 329.98 137.77 0.01 -4.1% 1.2%

10/1/2020 323.04 136.63 0.01 -2.1% -0.8%

11/1/2020 358.17 150.45 0.01 10.9% 10.1%

12/1/2020 369.87 141.95 0.01 3.3% -5.7%

1/1/2021 367.66 138.85 0.01 -0.6% -2.2%

2/1/2021 377.88 128.40 0 2.8% -7.5%

3/1/2021 393.75 134.24 0 4.2% 4.5%

4/1/2021 415.94 138.85 0 5.6% 3.4%

5/1/2021 418.67 140.96 0 0.7% 1.5%

6/1/2021 426.66 140.50 0 1.9% -0.3%

*You could simply use the MKT-RF column of returns instead of the SPY from the Ken French data.

▲Top

© Joseph Farizo

You might also like

- Assignment 5 of Porfolio ManagementDocument8 pagesAssignment 5 of Porfolio ManagementfacticalNo ratings yet

- Calculo de BetaDocument6 pagesCalculo de BetaCristian VallaNo ratings yet

- 11 - Ubaid Dhansay-Sapm AssignDocument5 pages11 - Ubaid Dhansay-Sapm Assign077 - Ubaid dhansayNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceDessiree ChenNo ratings yet

- AssignmentDocument16 pagesAssignmentMinza JahangirNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- FMT Project - ACC CementDocument7 pagesFMT Project - ACC CementMridula HariNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- 1-Data For Health FinancingDocument19 pages1-Data For Health FinancingMuhammad Asif Khan KhattakNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- Defaultable Fixed Coupon Bond: PricingDocument10 pagesDefaultable Fixed Coupon Bond: PricinggiulioNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- RocketDocument4 pagesRocketKhánh TrânNo ratings yet

- CAPM ExamenDocument5 pagesCAPM ExamenDenisse Liliana Melgar ValenzuelaNo ratings yet

- EBLSL Daily Market Update 4th August 2020Document1 pageEBLSL Daily Market Update 4th August 2020Moheuddin SehabNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Neha (31) ICICI BankDocument2 pagesNeha (31) ICICI BankNeha ChauhanNo ratings yet

- Solución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Document6 pagesSolución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Yessica MacedaNo ratings yet

- Aluminum 360Document12 pagesAluminum 360SaurabhNo ratings yet

- BAJAJ HEALTHCARE LTD. - PurveeshaDocument44 pagesBAJAJ HEALTHCARE LTD. - PurveeshaShree KhandelwalNo ratings yet

- Tarea Finanzas CorporativasDocument70 pagesTarea Finanzas CorporativasFabián Mauricio Riquet BastidasNo ratings yet

- HomeworkDocument27 pagesHomeworkHồ Ngọc HàNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Casagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)Document5 pagesCasagrc1 Casagrc1 S&P/BVL Peru General Index TR (PEN) S&P/BVL Peru General Index TR (PEN)DannyNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Group 07 22657 Sandeep S SDocument21 pagesGroup 07 22657 Sandeep S SSandeep ShirasangiNo ratings yet

- Wusen Js ExcelDocument5 pagesWusen Js ExcelDessiree ChenNo ratings yet

- Midterm - Invest & Port MGTDocument11 pagesMidterm - Invest & Port MGTMohamed HelmyNo ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- s&p500 Rentab S&P Date Bancolombia Rentab BancolDocument4 pagess&p500 Rentab S&P Date Bancolombia Rentab Bancolanonimo centenarioNo ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Death Claims - Upto March 2022 - WebsiteDocument4 pagesDeath Claims - Upto March 2022 - WebsiteKunal Abhilashbhai DelwadiaNo ratings yet

- Session 11 Portfolio OptimizationDocument6 pagesSession 11 Portfolio Optimizationpayal mittalNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- Regression Chart: Date BSE Titan BSE Return Titan ReturnDocument5 pagesRegression Chart: Date BSE Titan BSE Return Titan ReturnPranjal GuptaNo ratings yet

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocument12 pagesCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Campaign Report: All TimeDocument1 pageCampaign Report: All TimeRestorani za Svadbe i ostale proslaveNo ratings yet

- Exogenous Driver Analysis Driver Relative GDP GrowthDocument107 pagesExogenous Driver Analysis Driver Relative GDP GrowthBhagya FoodsNo ratings yet

- Determinar WaccDocument5 pagesDeterminar WaccLisbeth CarrascoNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Ejemplo de Acciones Con S&PDocument6 pagesEjemplo de Acciones Con S&PBruce Williams AstoNo ratings yet

- Table Showing Closing Price, Dividend, Rate of Return and VarianceDocument5 pagesTable Showing Closing Price, Dividend, Rate of Return and VarianceShreyangan SarmaNo ratings yet

- Beta CalculationDocument14 pagesBeta CalculationShraman SinglaNo ratings yet

- GDP Velocity MZM 5-30-10Document2 pagesGDP Velocity MZM 5-30-10JaphyNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- FIM TPDocument7 pagesFIM TPAfroza VabnaNo ratings yet

- EBLSL Daily Market Update - 22nd July 2020Document1 pageEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabNo ratings yet

- Walmart WaccDocument10 pagesWalmart WaccNusrat papiyaNo ratings yet

- Apollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsDocument23 pagesApollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsShubham MehrotraNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Performance Measures (Excel)Document3 pagesPerformance Measures (Excel)VISHAL PATILNo ratings yet

- Calculate Beta (3 Different Methods)Document10 pagesCalculate Beta (3 Different Methods)VISHAL PATILNo ratings yet

- Lecture 5Document23 pagesLecture 5VISHAL PATILNo ratings yet

- Indian Financial System NewDocument171 pagesIndian Financial System NewVISHAL PATILNo ratings yet

- Lecture 3Document32 pagesLecture 3VISHAL PATILNo ratings yet

- RISK MANAGEMENT - ERASMUS - 2019 - BplusDocument61 pagesRISK MANAGEMENT - ERASMUS - 2019 - BplusVISHAL PATILNo ratings yet

- New Coast SheetDocument2 pagesNew Coast SheetVISHAL PATILNo ratings yet

- Exercise 01Document4 pagesExercise 01VISHAL PATILNo ratings yet

- Formula Sheet DerivativesDocument5 pagesFormula Sheet DerivativesVISHAL PATILNo ratings yet

- CA FC Accounts SolutionDocument36 pagesCA FC Accounts SolutionVISHAL PATILNo ratings yet

- Yields and ReturnsDocument1 pageYields and ReturnsVISHAL PATILNo ratings yet

- Dividend Discount Model: Constant Dividend: NextDocument2 pagesDividend Discount Model: Constant Dividend: NextVISHAL PATILNo ratings yet

- 0 20211022172336present Value of BondDocument1 page0 20211022172336present Value of BondVISHAL PATILNo ratings yet

- CCRA Training Session 11Document21 pagesCCRA Training Session 11VISHAL PATILNo ratings yet

- Blank WorkbookDocument2 pagesBlank WorkbookVISHAL PATILNo ratings yet

- ResultDocument1 pageResultVISHAL PATILNo ratings yet

- 0 20211022172312preparing PL Account Balance Sheet Cash Flow 3Document6 pages0 20211022172312preparing PL Account Balance Sheet Cash Flow 3VISHAL PATILNo ratings yet

- CCRA Session 8Document18 pagesCCRA Session 8VISHAL PATILNo ratings yet

- CCRA Training Session 12Document17 pagesCCRA Training Session 12VISHAL PATILNo ratings yet

- CCRA Session 13Document19 pagesCCRA Session 13VISHAL PATILNo ratings yet

- CCRA Session 18Document15 pagesCCRA Session 18VISHAL PATILNo ratings yet

- CCRA Session 19Document19 pagesCCRA Session 19VISHAL PATILNo ratings yet

- CCRA Session 16Document14 pagesCCRA Session 16VISHAL PATILNo ratings yet

- TAMO - Ratio Analysis - SolutionDocument10 pagesTAMO - Ratio Analysis - SolutionVISHAL PATILNo ratings yet

- Start Cash Flow Statement - v2Document6 pagesStart Cash Flow Statement - v2VISHAL PATILNo ratings yet

- CCRA Session 15Document27 pagesCCRA Session 15VISHAL PATILNo ratings yet

- Quick Calculation of Balance Sheet RatiosDocument2 pagesQuick Calculation of Balance Sheet RatiosVISHAL PATILNo ratings yet

- READDocument1 pageREADVISHAL PATILNo ratings yet

- Altman Z Score ModelDocument20 pagesAltman Z Score ModelVISHAL PATILNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- SAPM TYBBI Internal Exam - Google FormsDocument6 pagesSAPM TYBBI Internal Exam - Google Formsshraddha shuklaNo ratings yet

- Financial Management Unit 3 DR Ashok KumarDocument65 pagesFinancial Management Unit 3 DR Ashok Kumarsk tanNo ratings yet

- Assessment 3 2024 Financial AssetDocument9 pagesAssessment 3 2024 Financial AssetAlthea mary kate MorenoNo ratings yet

- Contoh Soal Mutual Holding Pendekatan KonvensionalDocument10 pagesContoh Soal Mutual Holding Pendekatan KonvensionalPutri ShaniaNo ratings yet

- CF CH 2Document45 pagesCF CH 2AbelNo ratings yet

- Dwnload Full Essentials of Corporate Finance 8th Edition Ross Test Bank PDFDocument35 pagesDwnload Full Essentials of Corporate Finance 8th Edition Ross Test Bank PDFoutlying.pedantry.85yc100% (14)

- Full Download PDF of (Ebook PDF) Principles of Finance 6th Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Principles of Finance 6th Edition All Chapterchuilakkawi19100% (10)

- Interim Financial Statements For Quarter Ended 30th Chaitra 2079Document20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2079AaluNo ratings yet

- Revision No AnswerDocument12 pagesRevision No AnswerQuang Nguyễn ThếNo ratings yet

- CFAS SolMan Robles Part 1Document9 pagesCFAS SolMan Robles Part 1Fiel Marie SateraNo ratings yet

- Nuveen Mutual Fund Capabilities OverviewDocument2 pagesNuveen Mutual Fund Capabilities Overviewmadhav kaliaNo ratings yet

- Vientam Container Shipping 2Document10 pagesVientam Container Shipping 2Tony ZhangNo ratings yet

- Ishares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualDocument4 pagesIshares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualAbduRahman ZakariaNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 6Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 6LaVida LocaNo ratings yet

- Sums On Cash Flow StatementDocument5 pagesSums On Cash Flow StatementAstha ParmanandkaNo ratings yet

- Report PT SBL and Subsidiaries Dec 31 2021Document85 pagesReport PT SBL and Subsidiaries Dec 31 2021Duwi AtikaNo ratings yet

- Valuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul KhoiriyahDocument10 pagesValuasi Ekonomi Penambangan Sumberdaya Belerang Kawah Ijen, Desa Tamansari, Kabupaten Banyuwangi, Provinsi Jawa Timur Latifatul Khoiriyahferdin sitinjakNo ratings yet

- QuizDocument41 pagesQuizbar barNo ratings yet

- FinmgtDocument92 pagesFinmgtMary Elisha PinedaNo ratings yet

- FRS 8 Ig (2016)Document4 pagesFRS 8 Ig (2016)David LeeNo ratings yet

- SK Biotek Ireland Limited FsDocument33 pagesSK Biotek Ireland Limited Fssonika.anand11No ratings yet

- Holdings XL7509Document27 pagesHoldings XL7509Sandeep Konapur M KNo ratings yet

- Kết Quả Khảo Thí Giữa Kỳ Môn F7 Lớp F702.19: Test analysis belowDocument24 pagesKết Quả Khảo Thí Giữa Kỳ Môn F7 Lớp F702.19: Test analysis belowGenoso OtakuNo ratings yet

- Retained Earnings Short TestDocument2 pagesRetained Earnings Short TestAngelica CastilloNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Unit 2 (Notes 2) - Relative ValuationDocument9 pagesUnit 2 (Notes 2) - Relative ValuationhriddhvpatelNo ratings yet

- Annual Report 2022 2023 258 264 1 2Document2 pagesAnnual Report 2022 2023 258 264 1 2jagu6143No ratings yet

- Course of Financial AnalysisDocument34 pagesCourse of Financial AnalysisSherlock HolmesNo ratings yet

- Capital Budgeting SolutionDocument36 pagesCapital Budgeting SolutionMadhav SoodNo ratings yet