Professional Documents

Culture Documents

Business+tax+guide 2

Business+tax+guide 2

Uploaded by

Aristeia NotesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business+tax+guide 2

Business+tax+guide 2

Uploaded by

Aristeia NotesCopyright:

Available Formats

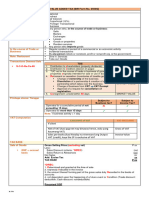

DETERMINATION OF Business *Some Importations are automatically

Transaction subject to VAT even if not for business

APPLICABLE BUSINESS TAX

The transaction must be related to business i.e. *Use the flowchart for each transaction.

regularly sold in the course of business A taxpayer can have a mix of VAT

exempt transactions, VATable

CVGCastro 2S 2022-2023 transactions, and OPT transactions

Yes Specifically

Ex. No business tax Listed as VAT Unless a limit is specifically

Agricultural food exempt? provided, the amount does

products in original state not matter, as long as it is

Sale by cooperatives specifically listed.

No

Even if the transactions

Ex. exceed 3,000,000, they will be

Banks/quasi-banks Subject to OPT Yes Specifically

classified as VAT exempt or

Int'l carriers listed under

but never VAT OPT as applicable.

Amusement taxes OPT?

Radio franchise

Gas and water utility

No

All transactions from this point are

called VATable Transactions: VATable gross

transactions that are NOT VAT registered No No General

annual sales

specifically VAT exempt and NOT business? OPT

exceed 3M?

specifically OPT

To determine the July 1, 2020 -

Yes 3M threshold, Yes June 30, 2023: 1%

If the business exceeds 3M total ALL VATable

threshold, it MUST be registered. Transactions July 2023 onward:

(exclude 3%

Businesses may voluntarily register exempt/OPT)

even if threshold not reached

Subject to VAT

Sale to

Determine VAT

Government 12% VAT

treatment

and GOCCs

Gov't withholds 5% of base price

as Creditable Withholding VAT

Zero rated 0% VAT

output VAT

Direct export Sale to specifically

Sale to economic zones Zero rated Effectively

listed entities. Ex:

and tourism zones Export sales zero rated

Sale to persons engaged ADB

in international shipping IRRI

or air transport UN

You might also like

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Percentage TaxDocument3 pagesPercentage TaxTrisha Mae BoholNo ratings yet

- Vat PDFDocument28 pagesVat PDFJovelyn Villasenor33% (3)

- Op-Ed 1Document3 pagesOp-Ed 1api-302030134No ratings yet

- McDonald's Lean ToolsDocument10 pagesMcDonald's Lean Toolsomar salinasNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- TAXATION 2 Chapter 10 Value Added TaxDocument7 pagesTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoNo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- TAXATION II KMA PREFINALS VAT EditedDocument14 pagesTAXATION II KMA PREFINALS VAT Editedethel hyuga0% (1)

- Other Percentage Taxes PDFDocument16 pagesOther Percentage Taxes PDFJociel De GuzmanNo ratings yet

- OPT TransactionsDocument7 pagesOPT TransactionsSAMANTHA GEL SABELA PANLILEONo ratings yet

- Business Tax Chapter 7 ReviewerDocument2 pagesBusiness Tax Chapter 7 ReviewerMurien LimNo ratings yet

- Tax 301 - Midterm Activity 1Document4 pagesTax 301 - Midterm Activity 1Nicole TeruelNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- Module 2 Intro To Business TaxationDocument33 pagesModule 2 Intro To Business TaxationHeart Lissie SantosNo ratings yet

- Chapter 3 ReviewDocument6 pagesChapter 3 Reviewmy miNo ratings yet

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara Angeles0% (1)

- At A GlanceDocument22 pagesAt A GlanceThakur RinkiNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- Intro To Business TaxDocument5 pagesIntro To Business TaxLove RosalunaNo ratings yet

- Vatable Transactions PDFDocument5 pagesVatable Transactions PDFJester LimNo ratings yet

- Lesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXDocument2 pagesLesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXRachelle Mae NagalesNo ratings yet

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara AngelesNo ratings yet

- Chapter 11 - VATDocument29 pagesChapter 11 - VATThiên KimNo ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- Cameroon - Country Key FeaturesDocument5 pagesCameroon - Country Key FeaturesTheo HendricksNo ratings yet

- VAT HandoutDocument34 pagesVAT HandoutAira Mae MendozaNo ratings yet

- Value Added TaxASDASDocument7 pagesValue Added TaxASDASJohn Lester LantinNo ratings yet

- Business TaxDocument24 pagesBusiness TaxKassandra Mari LucesNo ratings yet

- Sales Tax - VATDocument6 pagesSales Tax - VATSAJNo ratings yet

- Introduction To Business TaxDocument8 pagesIntroduction To Business TaxMichael Dave ClarionNo ratings yet

- Consumption TaxDocument6 pagesConsumption TaxSha MagondacanNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Concept of Business and Business TaxesDocument3 pagesConcept of Business and Business TaxesHazel Joy DemaganteNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- VAT Outline: Shashi Jayatissa Acca, Mba (Uk)Document23 pagesVAT Outline: Shashi Jayatissa Acca, Mba (Uk)ashfaqNo ratings yet

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- Excess Input and Senior Citizen and PWDDocument9 pagesExcess Input and Senior Citizen and PWDsahitariosoNo ratings yet

- Aiias Economy Pt365 2022Document63 pagesAiias Economy Pt365 2022Ismart ShankarNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Value Added Tax (VAT) in UAE: Some Important Matters Pertaining To VATDocument2 pagesValue Added Tax (VAT) in UAE: Some Important Matters Pertaining To VATraseemjaleelNo ratings yet

- Pdfcoffee Problems On VatDocument30 pagesPdfcoffee Problems On Vatjohnfrancissegarra1105No ratings yet

- Pdfcoffee Problems On VatDocument30 pagesPdfcoffee Problems On VatJunmar AMITNo ratings yet

- Tax ReviewerDocument6 pagesTax Reviewerlazalitakurtacer17No ratings yet

- CPAR VAT (Batch 93) - HandoutDocument38 pagesCPAR VAT (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- UAE Comprehensive VAT GuideDocument19 pagesUAE Comprehensive VAT GuidefasmekbakerNo ratings yet

- Vat Summary Notes Business TaxationDocument34 pagesVat Summary Notes Business TaxationNinNo ratings yet

- Notes in Value-Added TAXDocument9 pagesNotes in Value-Added TAXESTRADA, Angelica T.No ratings yet

- Introduction To Business TaxationDocument12 pagesIntroduction To Business TaxationMariel CadayonaNo ratings yet

- Quick Notes - Business TaxDocument20 pagesQuick Notes - Business TaxClaire GumasingNo ratings yet

- Consumption Is The Usage or Utilization of Goods or Services by PurchaseDocument7 pagesConsumption Is The Usage or Utilization of Goods or Services by PurchaseNicole ReintegradoNo ratings yet

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamNo ratings yet

- Value Added Tax Get The MaxDocument23 pagesValue Added Tax Get The MaxSubhash SahuNo ratings yet

- CPAR VAT (Batch 92) - HandoutDocument38 pagesCPAR VAT (Batch 92) - HandoutVan DahuyagNo ratings yet

- This Study Resource Was: IAC 17 - Integrated Review Course in TaxationDocument8 pagesThis Study Resource Was: IAC 17 - Integrated Review Course in TaxationVince ManahanNo ratings yet

- VAT Overview - RevDocument62 pagesVAT Overview - RevZachary BañezNo ratings yet

- Impact Post GST: Net Excise Duty Net Input Taxes Pre GSTDocument7 pagesImpact Post GST: Net Excise Duty Net Input Taxes Pre GSTAyushi MehtaNo ratings yet

- Accounting For All - (Chapter 4 Introduction To VAT)Document14 pagesAccounting For All - (Chapter 4 Introduction To VAT)Teboho TshisaNo ratings yet

- Input Vat On Capital Goods, Transitional Vat, and Presumptive TaxDocument4 pagesInput Vat On Capital Goods, Transitional Vat, and Presumptive Taxyes it's kaiNo ratings yet

- Other Percentage Taxes Summary: From UnderDocument4 pagesOther Percentage Taxes Summary: From UnderZee GuillebeauxNo ratings yet

- An Introduction to the German Accountancy System: All you need - and not too muchFrom EverandAn Introduction to the German Accountancy System: All you need - and not too muchNo ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- Income Taxation - Regular Income TaxDocument4 pagesIncome Taxation - Regular Income TaxDrew BanlutaNo ratings yet

- Income Taxation - Rules of Income TaxDocument2 pagesIncome Taxation - Rules of Income TaxDrew BanlutaNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Income Taxation - Final Taxes and CGTDocument3 pagesIncome Taxation - Final Taxes and CGTDrew BanlutaNo ratings yet

- Ecsalao BlogspotDocument70 pagesEcsalao BlogspotDrew BanlutaNo ratings yet

- Business Tax - Applicable Business Tax PracticeDocument3 pagesBusiness Tax - Applicable Business Tax PracticeDrew BanlutaNo ratings yet

- Business Tax - VATable Transactions PracticeDocument2 pagesBusiness Tax - VATable Transactions PracticeDrew BanlutaNo ratings yet

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- Lesson1 ObliconDocument4 pagesLesson1 ObliconDrew BanlutaNo ratings yet

- Midterm ExamDocument14 pagesMidterm ExamDrew BanlutaNo ratings yet

- Corporation Is An Artificial Being, Invisible, Intangible and Existing Only in Contemplation of Law. It Has Neither A Mind Nor A Body of Its OwnDocument7 pagesCorporation Is An Artificial Being, Invisible, Intangible and Existing Only in Contemplation of Law. It Has Neither A Mind Nor A Body of Its OwnDrew BanlutaNo ratings yet

- Lesson 2-ObliconDocument14 pagesLesson 2-ObliconDrew BanlutaNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- End-Term Assessment Subject: Economics (GE-O) Marks: 30 Submission: 02/03/2022 Type of Submission: Short Film/Video InstructionsDocument2 pagesEnd-Term Assessment Subject: Economics (GE-O) Marks: 30 Submission: 02/03/2022 Type of Submission: Short Film/Video InstructionsTANISHA GOYALNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.No ratings yet

- Build Relationship With CustomersDocument69 pagesBuild Relationship With CustomersFelekePhiliphosNo ratings yet

- Edited 12Document74 pagesEdited 12Mikiyas TeshomeNo ratings yet

- Inflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalDocument24 pagesInflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalpriyanshuNo ratings yet

- Interview of Tata CfoDocument18 pagesInterview of Tata CfoAabir AhmadNo ratings yet

- Hologic May 2017 Corporate Presentation FinalDocument55 pagesHologic May 2017 Corporate Presentation FinalmedtechyNo ratings yet

- Evidencia 2 Workshop Products and ServicesDocument3 pagesEvidencia 2 Workshop Products and ServicesJeisson Niño67% (6)

- Job Description - Head ChefDocument3 pagesJob Description - Head ChefberdaespassiaNo ratings yet

- Draft LPG Policy, 2021Document14 pagesDraft LPG Policy, 2021Najaf MalikNo ratings yet

- INSPECTIONDocument43 pagesINSPECTIONdharampurhaNo ratings yet

- Abdul Basit Ali-CV.Document2 pagesAbdul Basit Ali-CV.asiforacleNo ratings yet

- HRF44 Manpower Request Form Rev 02Document1 pageHRF44 Manpower Request Form Rev 02Ulhas KavathekarNo ratings yet

- A20 BasicDocument8 pagesA20 BasicAguilan, Alondra JaneNo ratings yet

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaNo ratings yet

- Supply Chain Management - Future Trends. Prihor AdinaDocument11 pagesSupply Chain Management - Future Trends. Prihor AdinaAdinaOanaPrihor100% (2)

- 1702 Ghai2011Document5 pages1702 Ghai2011Janice CarridoNo ratings yet

- Long Lived Assets (Peserta)Document23 pagesLong Lived Assets (Peserta)bush0275No ratings yet

- Seminar 04Document15 pagesSeminar 04api-3695734No ratings yet

- Salary CertificateDocument1 pageSalary CertificateselvaNo ratings yet

- HBLDocument15 pagesHBLmariasalahuddinNo ratings yet

- Sri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Document4 pagesSri Lankan Economy Contracted by 1.5 Percent - Census & Statistics Dept.Ada DeranaNo ratings yet

- Tax-Interview LandingDocument3 pagesTax-Interview LandingDeven GuptaNo ratings yet

- 0306220035case Studies of Fpos in India 2019 21Document391 pages0306220035case Studies of Fpos in India 2019 21Saikrishna VaidyaNo ratings yet

- SubmitDocument266 pagesSubmitNitika GuptaNo ratings yet

- ACCA F2 December 2015 NotesDocument188 pagesACCA F2 December 2015 NotesOpenTuition.com100% (2)

- Application of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewDocument25 pagesApplication of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewVitor PontesNo ratings yet