Professional Documents

Culture Documents

Business Case Finance

Business Case Finance

Uploaded by

kloskasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Case Finance

Business Case Finance

Uploaded by

kloskasCopyright:

Available Formats

Basics Finance Busines Case

Total Construction Wholesalers

Total Construction Wholesalers Inc.

TCW is a small chain of wholesale construction materials for SME and individual

small contractors. The company was founded by its main shareholder, John

Kemers 8 years ago, always enjoying an excellent economic and financial

situation.

Together with Mr. Kemers participate in the capital of the company, which

amounts to €180,000, the following persons:

Partner 1 Peter Catts 16.66%

Partner 2 David Simms 16.66%

Partner 3 Albert Villeneuve 16.66%

Partner 4 John Kemers 50%

TOTAL 100%

The company’s accounting systems are rinky-dink at best, as the only updated

accounting record is a cash book. This book records the collections, payments

and balance available in cash. This cash balance never fits the tonnage. Some

days the differences reach up to €120.

Mr. Kemers does not control any of the previous records. No Daily record of

banks is carried even though the movements that occur in them are important.

No one in the company controls bank statements, and no reconciliation of

accounts is made.

Also, the customer files are not updated, even though they are more than 600,

or from suppliers, or from bank records. Some of the clients must have

purchases made more than half a year ago.

Payments to providers are often made by submitting pre-dated checks, and

some of them are often presented before check date. These uncontrolled

conditions are held because of the early payment discount of 3% that suppliers

provide. Purchases must be paid on average at two weeks’ notice.

The debt with banks, destined basically to the financing of current assets, is

constituted by the following detail of accounts of credit (limits in thousands of

euros):

Bank A 90

Box B 90

Bank C 60

Bank D 60

Bank E 48

Bank F 42

Other (In total 7) 205

TOTAL 595

Although a portion of sales is also charged through advanced-date checks,

especially to low-volume customers.

The company works giving low prices to customers and leaning on strong

relationships of Mr. Kemers in the industry, often meaning customer service

goes up and above to satisfy customers based on relationships more than

profitability.

Recently tensions in current cash availability have increased its frequency, and

Mr. Kemers thinks that being his business profitable for the sector standards,

it’s well worth a shot unifying all credit lines and negotiating with one only bank

an increase of credit limit up to 800k instead of the current 500k.

What would you do?

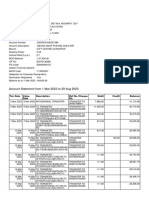

The financial statements (in thousands of euros) are attached.

PROFIT AND LOSS ACCOUNT:

P&L (thousand euros) 2004 2005 2006

Sales 5.006 5451 5944

COGS 4.321 4712 5115

Gross margin 685 739 829

Salaries 293 320 345

Overhead 34 22 25

EBITDA 358 397 459

Depreciation 24 24 30

EBIT 334 373 429

Financial results 186 210 282

Profit before taxes 148 163 147

Taxes 34 32 24

Net income 114 131 123

BALANCE SHEET STATEMENT:

Balance Sheet (1.000s) 2004 2005 2006

Fixed Assets 300 277 294,5

Stock 168 191 363,5

Receivables 1046 1070 1136

Cash 199 207,25 125,25

Current Assets 1413 1468,25 1624,75

Total Assets 1713 1745,25 1919,25

Shareholders Eq. 180 180 180

Retained Earnings 716 734 782,00

P&L 114 122,25 110,25

Equity 1010 1036,25 1072,25

ST Debt 547 493 595

Payables 156 216 252

Current Liabilities 703 709 847

Total Liabilities 1713 1745,25 1919,25

You might also like

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- Case Study Operational FinanceDocument13 pagesCase Study Operational FinanceJuan Ramon Aguirre Rondinel33% (3)

- Lobj19 - 0000052 CR Pre Sit 19 Q PDFDocument11 pagesLobj19 - 0000052 CR Pre Sit 19 Q PDFqqqNo ratings yet

- Cases Master PDFDocument11 pagesCases Master PDFSam PskovskiNo ratings yet

- Questions 1 PDFDocument10 pagesQuestions 1 PDFdkishore28100% (1)

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Financial AccountingDocument6 pagesFinancial AccountingFernando Alcantara100% (1)

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Question 2Document4 pagesQuestion 2Ahsan MubeenNo ratings yet

- Justification LetterDocument3 pagesJustification LetterAl-husaynLaoSanguilaNo ratings yet

- 3.06&3.07 - Limcoma V Republic & Lacamen V LaruanDocument1 page3.06&3.07 - Limcoma V Republic & Lacamen V LaruanKate GaroNo ratings yet

- 03RATIO ANALYSIS MbaDocument18 pages03RATIO ANALYSIS MbaAbid XargarNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- Additional Solved Problems Vit 2011Document104 pagesAdditional Solved Problems Vit 2011Vinait ThoratNo ratings yet

- Fi 410 Chapter 3Document50 pagesFi 410 Chapter 3Austin Hazelrig100% (1)

- Ey Aarsrapport 2021 22Document40 pagesEy Aarsrapport 2021 22IrinaElenaCososchiNo ratings yet

- De Torres, Kiarra Nicel R. - FABM2 W4Document4 pagesDe Torres, Kiarra Nicel R. - FABM2 W4Kiarra Nicel De TorresNo ratings yet

- Ch2 Financial Statement SDocument101 pagesCh2 Financial Statement SK60 NGUYỄN THỊ HƯƠNG QUỲNHNo ratings yet

- Financial Ratios-Hamna RizwanDocument5 pagesFinancial Ratios-Hamna RizwanHamna RizwanNo ratings yet

- Financial Accounting-2018Document30 pagesFinancial Accounting-2018Andreea Cristina DiaconuNo ratings yet

- Financial ForecastingDocument22 pagesFinancial ForecastingKaustav BanerjeeNo ratings yet

- IMT Ceres, JatinGuptaDocument10 pagesIMT Ceres, JatinGuptabhavarsoloNo ratings yet

- Commonsize StatementDocument14 pagesCommonsize StatementSimratpal SinghNo ratings yet

- A New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityDocument37 pagesA New Business Plan (Fresh Lemon Juice Company LTD.) : By: Group 8 (7 Batch) AIS Department Jagannath UniversityMd. Alif HossainNo ratings yet

- Lloyds TSB Group PLC: 2001 Interim ResultsDocument48 pagesLloyds TSB Group PLC: 2001 Interim ResultssaxobobNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- Business FinanceDocument4 pagesBusiness FinanceJinkee F. Sta MariaNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakpurnamaNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- Financial Mod Ch-4Document37 pagesFinancial Mod Ch-4zigale matebieNo ratings yet

- Team Go For It Chapter17 FIN 2600 CorrectedDocument14 pagesTeam Go For It Chapter17 FIN 2600 CorrectedThái TranNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- What Are Quantitative FactorsDocument5 pagesWhat Are Quantitative FactorsJunaid CheemaNo ratings yet

- Copy 1 ACC 223 Practice Problems For Financial Ratio AnalysisDocument3 pagesCopy 1 ACC 223 Practice Problems For Financial Ratio AnalysisGiane Bernard PunayanNo ratings yet

- Radio Shack Financial Statement Analysis Abdyldaev ArsenDocument24 pagesRadio Shack Financial Statement Analysis Abdyldaev ArsenArsen AbdyldaevNo ratings yet

- Gat Prin & Pract of Fin Acct Nov 2006Document10 pagesGat Prin & Pract of Fin Acct Nov 2006samuel_dwumfourNo ratings yet

- ProformaDocument4 pagesProformadevanmadeNo ratings yet

- Training CasesDocument5 pagesTraining CasesIvan KralchevNo ratings yet

- Kingswood Lumber Company IncDocument4 pagesKingswood Lumber Company IncDavid DeveraNo ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Week 9: Interpretation of Financial StatementsDocument47 pagesWeek 9: Interpretation of Financial StatementsUmair AshrafNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- Please Find Correct Answers (Only One Answer Is Correct)Document4 pagesPlease Find Correct Answers (Only One Answer Is Correct)kevinNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksNo ratings yet

- Credit Management in BanksDocument10 pagesCredit Management in BanksmarufNo ratings yet

- ITC January 2024 Paper 4 Question 1 Shop ItDocument6 pagesITC January 2024 Paper 4 Question 1 Shop ItfranskasangaNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- 21 Problems For CB New 3Document17 pages21 Problems For CB New 3Nguyễn Anh ThưNo ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisdora76pataNo ratings yet

- DFS December 2009 AnswersDocument12 pagesDFS December 2009 AnswersPhilemon N.MalingaNo ratings yet

- Chapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)Document10 pagesChapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)afwdemo Poppoltje1?No ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- The Profit and Loss AccountDocument19 pagesThe Profit and Loss AccountDenmark SantosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet

- KVI KVC Classification Approach MCKDocument7 pagesKVI KVC Classification Approach MCKkloskasNo ratings yet

- HBR PrpcingDocument22 pagesHBR PrpcingkloskasNo ratings yet

- Behavioral Pricing Can Open Up Additional Potential 1649943062Document16 pagesBehavioral Pricing Can Open Up Additional Potential 1649943062kloskasNo ratings yet

- Basic Finance Business CaseDocument56 pagesBasic Finance Business CasekloskasNo ratings yet

- Holy Land: The Rise of Three FaithsDocument6 pagesHoly Land: The Rise of Three FaithsGitller CarrascoNo ratings yet

- Master Proposal Form - Grameen Super Suraksha - 28022020 PDFDocument3 pagesMaster Proposal Form - Grameen Super Suraksha - 28022020 PDFmahboob aliNo ratings yet

- Latin Legal MaximsDocument3 pagesLatin Legal MaximsaxzenNo ratings yet

- Adjusting Entries Discussion ProblemsDocument2 pagesAdjusting Entries Discussion Problemsmicadeguzman.1313No ratings yet

- Hubungan Agama Dengan Kaum MilenialDocument18 pagesHubungan Agama Dengan Kaum MilenialNandyNo ratings yet

- High Current MOSFET Driver: FeaturesDocument16 pagesHigh Current MOSFET Driver: FeaturesmilivojNo ratings yet

- APUNTES DerechoDocument41 pagesAPUNTES DerechoVerónica Rueda PuyanaNo ratings yet

- People v. Mallari (Digest)Document2 pagesPeople v. Mallari (Digest)Patrick DamasoNo ratings yet

- A Challenge To The Power Over Knowledge of Traditional Security StudiesDocument2 pagesA Challenge To The Power Over Knowledge of Traditional Security StudiesYunes Aplia MustikaNo ratings yet

- Contextualized School Child Protection and Anti-Bullying PolicyDocument46 pagesContextualized School Child Protection and Anti-Bullying Policykarim100% (2)

- Consolidated Bank Vs CADocument9 pagesConsolidated Bank Vs CANicoleAngeliqueNo ratings yet

- Part 3 - InsuranceDocument11 pagesPart 3 - InsuranceJohnSmithNo ratings yet

- Mrigadhipathyam - Short Storey by NanappanDocument4 pagesMrigadhipathyam - Short Storey by NanappanthadikkaranNo ratings yet

- JCJ-2022 - Screening Test Question PaperDocument40 pagesJCJ-2022 - Screening Test Question PaperPAVANKUMAR GOVINDULANo ratings yet

- Agilent Technologies Singapore v. Integrated Silicon TechnologyDocument2 pagesAgilent Technologies Singapore v. Integrated Silicon TechnologyDerick Torres100% (1)

- When The Panchayat Raj Is Established, Public Opinion Will Do What Violence Can Never Do. - Mahatma GandhiDocument17 pagesWhen The Panchayat Raj Is Established, Public Opinion Will Do What Violence Can Never Do. - Mahatma GandhiSupriyaNo ratings yet

- GRD 11t1 Maths Literacy Finance Income Expenditure Budget BusinessDocument1 pageGRD 11t1 Maths Literacy Finance Income Expenditure Budget Businesslinda myezaNo ratings yet

- CP OdtDocument2 pagesCP OdtSITA RAM CHAUHANNo ratings yet

- Four Pillars Financial Sustainability TNCDocument29 pagesFour Pillars Financial Sustainability TNCBlack Scorpion Entertainment (BSE)No ratings yet

- Friday Bulletin 689Document8 pagesFriday Bulletin 689Jamia MosqueNo ratings yet

- Accounting GuessDocument5 pagesAccounting GuessjhouvanNo ratings yet

- ZTWD ELt Ne USogw FDocument10 pagesZTWD ELt Ne USogw FSouravDeyNo ratings yet

- Tech Specs - 11 - EquipmentDocument62 pagesTech Specs - 11 - Equipmentjkhgvdj mnhsnjkhgNo ratings yet

- AI IRIS Construction SiteDocument3 pagesAI IRIS Construction SiteNana Opoku-AmankwahNo ratings yet

- Banai Adam TenDocument19 pagesBanai Adam TenMohsin MalkiNo ratings yet

- Unlawful Appointment Article 244 219352 11 2018 PDFDocument8 pagesUnlawful Appointment Article 244 219352 11 2018 PDFMarlyn Batiller DragonNo ratings yet

- Title of MCLE Activity/Program Subject Area Provider Date of Activity Category of Participation CUDocument2 pagesTitle of MCLE Activity/Program Subject Area Provider Date of Activity Category of Participation CUNadine DiamanteNo ratings yet

- M C Q ElectromagnetismDocument30 pagesM C Q ElectromagnetismShaikh Usman AiNo ratings yet