Professional Documents

Culture Documents

NPS Account Statement

NPS Account Statement

Uploaded by

dinesh rajendranCopyright:

Available Formats

You might also like

- PR - 05 Competence, Training & Awareness ProcedureDocument10 pagesPR - 05 Competence, Training & Awareness ProcedureGerrit Van Heerden75% (4)

- LTA Bill Template 1 PDFDocument1 pageLTA Bill Template 1 PDF9816494828No ratings yet

- Vikas Soni HealthDocument1 pageVikas Soni HealthVikas SoniNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- PPF E-Receipt: Debit Account No Transaction Type Debit Branch NameDocument1 pagePPF E-Receipt: Debit Account No Transaction Type Debit Branch NameMohit SharmaNo ratings yet

- Finding After An Inquest Into The Death of Kate Therese BugmyDocument18 pagesFinding After An Inquest Into The Death of Kate Therese BugmyDax DaxerNo ratings yet

- Embedded Counselling in Advisory WorkDocument15 pagesEmbedded Counselling in Advisory Worksitizulaika275No ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- 15180125864942bTbD6sKH05uYfPT PDFDocument1 page15180125864942bTbD6sKH05uYfPT PDFHimanshu ChoukseyNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- PrmPayRcptSign PR0445228800021011Document1 pagePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- Atal Pension YojanaDocument1 pageAtal Pension YojanaHimanku BoraNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- Vivek LicDocument1 pageVivek Licranjeet kumarNo ratings yet

- Form-D: Pay - in - Slip For Deposits Under Senior Citizens Savings Scheme, 2004Document2 pagesForm-D: Pay - in - Slip For Deposits Under Senior Citizens Savings Scheme, 2004murugeshlpNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Bording PassDocument3 pagesBording PassSunder NingombamNo ratings yet

- Sanjay JajuDocument1 pageSanjay JajuShivangi SaxenaNo ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Account Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkNo ratings yet

- Shri Mata Vaishno Devi Shrine BoardDocument1 pageShri Mata Vaishno Devi Shrine BoardDivine NatureNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- Email Boarding Pass (Web Check In) Goindigo - inDocument1 pageEmail Boarding Pass (Web Check In) Goindigo - inSuman MandalNo ratings yet

- Eduportal - FPN School Fees Payment ReceiptFAVOURDocument1 pageEduportal - FPN School Fees Payment ReceiptFAVOURCaleb BrownNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- formFeeRecieptPrintReport Duplicate RC Book PDFDocument1 pageformFeeRecieptPrintReport Duplicate RC Book PDFsnaehalNo ratings yet

- CertificateDocument4 pagesCertificatemadhu gandheNo ratings yet

- 10th MarksheetDocument1 page10th MarksheetThe Fantabulous100% (1)

- TG1628 School Fees I PDFDocument1 pageTG1628 School Fees I PDFAnandKumarPNo ratings yet

- AEGON RELIGARE Premium Payment Receipt PDFDocument1 pageAEGON RELIGARE Premium Payment Receipt PDFe2arvindNo ratings yet

- In - Gov.transport RVCER KA08M7300Document1 pageIn - Gov.transport RVCER KA08M7300Karthik RNo ratings yet

- 02oct22 Marine Goa Mumbai To GoaDocument1 page02oct22 Marine Goa Mumbai To Goasufiyan sskNo ratings yet

- Renewal - 71131775 - 2022-10-28 11 29 51 525Document1 pageRenewal - 71131775 - 2022-10-28 11 29 51 525VASANT PatelNo ratings yet

- Demo Flight TicketsDocument2 pagesDemo Flight TicketsPraveen MalathiNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- UdyogAadharRegistrationCertificate PDFDocument1 pageUdyogAadharRegistrationCertificate PDFRajit KumarNo ratings yet

- Homeloancertificate 75543875Document1 pageHomeloancertificate 75543875Pradeep Chauhan100% (1)

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Amazon BlazerDocument1 pageAmazon BlazerRomNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- NPS Contribution T-I INR 50KDocument3 pagesNPS Contribution T-I INR 50Ksumanpal78No ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- FeeReceipt Sep2019Document1 pageFeeReceipt Sep2019KavitaNo ratings yet

- Name Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeDocument1 pageName Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeVikrant BhaleraoNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Manish RathodNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceraviNo ratings yet

- Nur 340 Research PaperDocument8 pagesNur 340 Research Paperapi-429837528No ratings yet

- Set 3 - 3-Salonga Hernandez V PascualDocument1 pageSet 3 - 3-Salonga Hernandez V Pascualcha chaNo ratings yet

- 4 02 Promotion Policy SupervisorsDocument10 pages4 02 Promotion Policy Supervisorsrajan.kumarNo ratings yet

- Administrative Law Nature of Administrative LawDocument8 pagesAdministrative Law Nature of Administrative LawSHEKINAHFAITH REQUINTELNo ratings yet

- Annabelle DDocument6 pagesAnnabelle DMagno Maria ElenaNo ratings yet

- 4178 Sds Eng Foam BriteDocument8 pages4178 Sds Eng Foam BriteFreddy FloresNo ratings yet

- HR Consult Services NewDocument37 pagesHR Consult Services NewKARTHIK RNo ratings yet

- KRA PresentationDocument23 pagesKRA PresentationSaju SaxenaNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Dionarto Q. Noblejas v. Italian Maritime Academy Philippines Inc.Document2 pagesDionarto Q. Noblejas v. Italian Maritime Academy Philippines Inc.rafael.louise.roca2244No ratings yet

- Cause 2191 of 2016Document4 pagesCause 2191 of 2016justusNo ratings yet

- Econ 601 f14 Midterm Answer Key PDFDocument5 pagesEcon 601 f14 Midterm Answer Key PDFюрий локтионовNo ratings yet

- Engelstalige Versie VWH Cao en Reglement PDFDocument44 pagesEngelstalige Versie VWH Cao en Reglement PDFBitzcomputer TechnologiesNo ratings yet

- Full CasesDocument101 pagesFull CasesFaye CordovaNo ratings yet

- People v. Naparan Jr. y NacarDocument8 pagesPeople v. Naparan Jr. y NacarKhay GonzalesNo ratings yet

- UP165 100 ManualDocument583 pagesUP165 100 ManualRodrigoNo ratings yet

- Important Changes To The Utah License or Identification Card That Will Affect You!Document2 pagesImportant Changes To The Utah License or Identification Card That Will Affect You!Logan KelleyNo ratings yet

- Desertation TopicsDocument25 pagesDesertation TopicsKarthik MorabadNo ratings yet

- A Critical Evaluation of The Social Justice Implications of The Colombian Government S English Spanish Bilingualism PoliciesDocument19 pagesA Critical Evaluation of The Social Justice Implications of The Colombian Government S English Spanish Bilingualism PoliciesLEE MACKENZIENo ratings yet

- Social0814 MlaDocument57 pagesSocial0814 MlaCoolbuster.NetNo ratings yet

- Sumary of Chapter 1-3 Bovee ThillDocument2 pagesSumary of Chapter 1-3 Bovee ThillAdinda NasutionNo ratings yet

- Examen 2 PDFDocument6 pagesExamen 2 PDFLuismi Vázquez Rodríguez100% (1)

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Merger and Accusation in Strategic AlliancesDocument83 pagesMerger and Accusation in Strategic AlliancesNilesh SahuNo ratings yet

- K00937 - 20190525081924 - C17 Human Resource Policies and Practices Robbinsjudge - Ob17 - InpptDocument37 pagesK00937 - 20190525081924 - C17 Human Resource Policies and Practices Robbinsjudge - Ob17 - InpptkxkjxnjNo ratings yet

- Diagnostic Test EntrepDocument4 pagesDiagnostic Test EntrepMaRlon Talactac Onofre100% (1)

NPS Account Statement

NPS Account Statement

Uploaded by

dinesh rajendranOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Account Statement

NPS Account Statement

Uploaded by

dinesh rajendranCopyright:

Available Formats

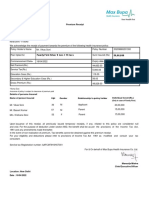

NPS TRANSACTION STATEMENT

April 01, 2023 to November 18, 2023

Statement Generation Date :November 18,

2023 07:10 PM

NPS Transaction Statement for Tier I Account

PRAN 110149300957 Registration Date 22-Aug-23

Subscriber Name SHRI DINESH R Tier I Status Active

95 Tier II Status Not Activated

3RD STREET Tier II Tax Saver Not Activated

Status

Address POONAMALLEE,,TIRUVALLUR

Tier I Virtual Account Activated

TAMIL NADU - 600056 Status

Tier II Virtual Account Not Aplicable

INDIA Status

POP-SP Registration 6396950

Mobile Number +919677224065 No

Email ID DINESHRAJENDRAN18@GMAIL.COM POP-SP Name eNPS - Online

IRA Status IRA compliant 1st Floor, Times Tower, Kamala, Mills

POP-SP Address Compound, Senapati Bapat

Marg, Lower Parel, Mumbai, 400013

POP Registration No 5000682

POP Name eNPS - Online

1st Floor, Times Tower, Kamala, Mills

POP Address Compound, Senapati Bapat

Marg, Lower Parel, Mumbai, 400013

Tier I Nominee Name/s Percentage

KAVITHA DEVAKUMAR 100%

Current Scheme Preference

Scheme Choice - MODERATE AUTO CHOICE

Investment Option Scheme Details Percentage

Scheme 1 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME E - TIER I 50.00%

Scheme 2 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME C - TIER I 30.00%

Scheme 3 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME G - TIER I 20.00%

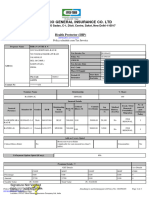

Investment Summary

Value of your Total Contribution Total Withdrawal Total Notional Withdrawal/

Holdings(Investme No of in your account as as on Gain/Loss as on deduction in units

nts) on towards Return on

Contributions November 18, November 18, Investment

as on November November 18, 2023 (in ₹) 2023 (in ₹) intermediary

18, 2023 (in ₹) 2023 (in ₹) charges (in ₹) (XIRR)

(A) (B) (C) D=(A-B)+C E

₹ 20,310.65 4 ₹ 20,000.00 ₹ 0.00 ₹ 310.65 ₹ 41.30 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

HDFC PENSION HDFC PENSION HDFC PENSION

Particulars References MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Scheme wise Value of your E=U*N 10,242.73 6,035.38 4,032.54

Holdings(Investments) (in ₹)

Total Units U 252.1542 242.1682 167.1277

NAV as on 17-Nov-2023 N 40.6209 24.9223 24.1285

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

24-Aug- By Voluntary Contributions eNPS - Online (5000682), 500.00 0.00 500.00

2023

29-Aug- By Voluntary Contributions eNPS - Online (5000682), 5,000.00 0.00 5,000.00

2023

27-Sep- By Voluntary Contributions eNPS - Online (5000682), 4,500.00 0.00 4,500.00

2023

30-Oct-2023 By Voluntary Contributions eNPS - Online (5000682), 10,000.00 0.00 10,000.00

Transaction Details

HDFC PENSION HDFC PENSION HDFC PENSION

Withdrawal/ MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

deduction in units LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Date Particulars

towards intermediary

Amount (₹) Amount (₹) Amount (₹)

charges (₹) Units Units Units

NAV (₹) NAV (₹) NAV (₹)

01-Apr-

Opening balance 0.0000 0.0000 0.0000

2023

24-Aug- 250.00 150.00 100.00

By Voluntary Contributions 6.2979 6.1112 4.1911

2023 39.6956 24.5449 23.8599

29-Aug- 2,500.00 1,500.00 1,000.00

By Voluntary Contributions 63.0948 60.9882 41.8270

2023 39.6229 24.5949 23.9080

27-Sep- 2,250.00 1,350.00 900.00

By Voluntary Contributions 55.8080 54.5465 37.4945

2023 40.3168 24.7495 24.0035

07-Oct- (20.74) (12.38) (8.18)

Billing for Q2, 2023-2024 (41.30) (0.5162) (0.5015) (0.3444)

2023 40.1776 24.6839 23.7476

30-Oct- 5,000.00 3,000.00 2,000.00

By Voluntary Contributions 127.4697 121.0238 83.9595

2023 39.2250 24.7885 23.8210

18-Nov-

Closing Balance 252.1542 242.1682 167.1277

2023

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- PR - 05 Competence, Training & Awareness ProcedureDocument10 pagesPR - 05 Competence, Training & Awareness ProcedureGerrit Van Heerden75% (4)

- LTA Bill Template 1 PDFDocument1 pageLTA Bill Template 1 PDF9816494828No ratings yet

- Vikas Soni HealthDocument1 pageVikas Soni HealthVikas SoniNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- PPF E-Receipt: Debit Account No Transaction Type Debit Branch NameDocument1 pagePPF E-Receipt: Debit Account No Transaction Type Debit Branch NameMohit SharmaNo ratings yet

- Finding After An Inquest Into The Death of Kate Therese BugmyDocument18 pagesFinding After An Inquest Into The Death of Kate Therese BugmyDax DaxerNo ratings yet

- Embedded Counselling in Advisory WorkDocument15 pagesEmbedded Counselling in Advisory Worksitizulaika275No ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- 15180125864942bTbD6sKH05uYfPT PDFDocument1 page15180125864942bTbD6sKH05uYfPT PDFHimanshu ChoukseyNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- PrmPayRcptSign PR0445228800021011Document1 pagePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- Atal Pension YojanaDocument1 pageAtal Pension YojanaHimanku BoraNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- Vivek LicDocument1 pageVivek Licranjeet kumarNo ratings yet

- Form-D: Pay - in - Slip For Deposits Under Senior Citizens Savings Scheme, 2004Document2 pagesForm-D: Pay - in - Slip For Deposits Under Senior Citizens Savings Scheme, 2004murugeshlpNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Bording PassDocument3 pagesBording PassSunder NingombamNo ratings yet

- Sanjay JajuDocument1 pageSanjay JajuShivangi SaxenaNo ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Account Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkNo ratings yet

- Shri Mata Vaishno Devi Shrine BoardDocument1 pageShri Mata Vaishno Devi Shrine BoardDivine NatureNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- Email Boarding Pass (Web Check In) Goindigo - inDocument1 pageEmail Boarding Pass (Web Check In) Goindigo - inSuman MandalNo ratings yet

- Eduportal - FPN School Fees Payment ReceiptFAVOURDocument1 pageEduportal - FPN School Fees Payment ReceiptFAVOURCaleb BrownNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- formFeeRecieptPrintReport Duplicate RC Book PDFDocument1 pageformFeeRecieptPrintReport Duplicate RC Book PDFsnaehalNo ratings yet

- CertificateDocument4 pagesCertificatemadhu gandheNo ratings yet

- 10th MarksheetDocument1 page10th MarksheetThe Fantabulous100% (1)

- TG1628 School Fees I PDFDocument1 pageTG1628 School Fees I PDFAnandKumarPNo ratings yet

- AEGON RELIGARE Premium Payment Receipt PDFDocument1 pageAEGON RELIGARE Premium Payment Receipt PDFe2arvindNo ratings yet

- In - Gov.transport RVCER KA08M7300Document1 pageIn - Gov.transport RVCER KA08M7300Karthik RNo ratings yet

- 02oct22 Marine Goa Mumbai To GoaDocument1 page02oct22 Marine Goa Mumbai To Goasufiyan sskNo ratings yet

- Renewal - 71131775 - 2022-10-28 11 29 51 525Document1 pageRenewal - 71131775 - 2022-10-28 11 29 51 525VASANT PatelNo ratings yet

- Demo Flight TicketsDocument2 pagesDemo Flight TicketsPraveen MalathiNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- UdyogAadharRegistrationCertificate PDFDocument1 pageUdyogAadharRegistrationCertificate PDFRajit KumarNo ratings yet

- Homeloancertificate 75543875Document1 pageHomeloancertificate 75543875Pradeep Chauhan100% (1)

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Amazon BlazerDocument1 pageAmazon BlazerRomNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- NPS Contribution T-I INR 50KDocument3 pagesNPS Contribution T-I INR 50Ksumanpal78No ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- FeeReceipt Sep2019Document1 pageFeeReceipt Sep2019KavitaNo ratings yet

- Name Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeDocument1 pageName Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeVikrant BhaleraoNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Manish RathodNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceraviNo ratings yet

- Nur 340 Research PaperDocument8 pagesNur 340 Research Paperapi-429837528No ratings yet

- Set 3 - 3-Salonga Hernandez V PascualDocument1 pageSet 3 - 3-Salonga Hernandez V Pascualcha chaNo ratings yet

- 4 02 Promotion Policy SupervisorsDocument10 pages4 02 Promotion Policy Supervisorsrajan.kumarNo ratings yet

- Administrative Law Nature of Administrative LawDocument8 pagesAdministrative Law Nature of Administrative LawSHEKINAHFAITH REQUINTELNo ratings yet

- Annabelle DDocument6 pagesAnnabelle DMagno Maria ElenaNo ratings yet

- 4178 Sds Eng Foam BriteDocument8 pages4178 Sds Eng Foam BriteFreddy FloresNo ratings yet

- HR Consult Services NewDocument37 pagesHR Consult Services NewKARTHIK RNo ratings yet

- KRA PresentationDocument23 pagesKRA PresentationSaju SaxenaNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Dionarto Q. Noblejas v. Italian Maritime Academy Philippines Inc.Document2 pagesDionarto Q. Noblejas v. Italian Maritime Academy Philippines Inc.rafael.louise.roca2244No ratings yet

- Cause 2191 of 2016Document4 pagesCause 2191 of 2016justusNo ratings yet

- Econ 601 f14 Midterm Answer Key PDFDocument5 pagesEcon 601 f14 Midterm Answer Key PDFюрий локтионовNo ratings yet

- Engelstalige Versie VWH Cao en Reglement PDFDocument44 pagesEngelstalige Versie VWH Cao en Reglement PDFBitzcomputer TechnologiesNo ratings yet

- Full CasesDocument101 pagesFull CasesFaye CordovaNo ratings yet

- People v. Naparan Jr. y NacarDocument8 pagesPeople v. Naparan Jr. y NacarKhay GonzalesNo ratings yet

- UP165 100 ManualDocument583 pagesUP165 100 ManualRodrigoNo ratings yet

- Important Changes To The Utah License or Identification Card That Will Affect You!Document2 pagesImportant Changes To The Utah License or Identification Card That Will Affect You!Logan KelleyNo ratings yet

- Desertation TopicsDocument25 pagesDesertation TopicsKarthik MorabadNo ratings yet

- A Critical Evaluation of The Social Justice Implications of The Colombian Government S English Spanish Bilingualism PoliciesDocument19 pagesA Critical Evaluation of The Social Justice Implications of The Colombian Government S English Spanish Bilingualism PoliciesLEE MACKENZIENo ratings yet

- Social0814 MlaDocument57 pagesSocial0814 MlaCoolbuster.NetNo ratings yet

- Sumary of Chapter 1-3 Bovee ThillDocument2 pagesSumary of Chapter 1-3 Bovee ThillAdinda NasutionNo ratings yet

- Examen 2 PDFDocument6 pagesExamen 2 PDFLuismi Vázquez Rodríguez100% (1)

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Merger and Accusation in Strategic AlliancesDocument83 pagesMerger and Accusation in Strategic AlliancesNilesh SahuNo ratings yet

- K00937 - 20190525081924 - C17 Human Resource Policies and Practices Robbinsjudge - Ob17 - InpptDocument37 pagesK00937 - 20190525081924 - C17 Human Resource Policies and Practices Robbinsjudge - Ob17 - InpptkxkjxnjNo ratings yet

- Diagnostic Test EntrepDocument4 pagesDiagnostic Test EntrepMaRlon Talactac Onofre100% (1)