Professional Documents

Culture Documents

Act in Finance

Act in Finance

Uploaded by

Mark Oliver Hilario0 ratings0% found this document useful (0 votes)

9 views6 pagesThe document discusses agricultural finance and interviewing a businessman named Orbilly R. Hilario about borrowing money. Specifically, [1] Hilario borrowed 100,000 pesos from his sister at 1% interest to fund his business, which he needs to repay within a year. [2] Borrowing money has advantages like financial flexibility but also disadvantages like accumulating debt and interest over time. [3] Overall, borrowing can be good if done prudently but requires carefully evaluating the terms and one's ability to repay.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses agricultural finance and interviewing a businessman named Orbilly R. Hilario about borrowing money. Specifically, [1] Hilario borrowed 100,000 pesos from his sister at 1% interest to fund his business, which he needs to repay within a year. [2] Borrowing money has advantages like financial flexibility but also disadvantages like accumulating debt and interest over time. [3] Overall, borrowing can be good if done prudently but requires carefully evaluating the terms and one's ability to repay.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views6 pagesAct in Finance

Act in Finance

Uploaded by

Mark Oliver HilarioThe document discusses agricultural finance and interviewing a businessman named Orbilly R. Hilario about borrowing money. Specifically, [1] Hilario borrowed 100,000 pesos from his sister at 1% interest to fund his business, which he needs to repay within a year. [2] Borrowing money has advantages like financial flexibility but also disadvantages like accumulating debt and interest over time. [3] Overall, borrowing can be good if done prudently but requires carefully evaluating the terms and one's ability to repay.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

ACTIVITY IN AGRICULTURAL FINANCE

An Activity Presented to

the faculty of the

College of Agriculture, Forestry and Environmental Sciences

AKLAN STATE UNIVERSITY

Banga, Aklan

In Partial Fulfillments

Of the Requirement for the Degree

BACHELOR OF SCIENCE IN AGRICULTURE

(Agricultural Economics)

By

Mark Oliver T. Hilario

I. RATIONALE:

Borrowing money refers to the act of obtaining funds from a

lender, often a financial institution or an individual, with the

understanding that the borrowed funds will be repaid at a later

date, usually with interest or other agreed-upon terms. People

borrow money for various reasons, such as purchasing a house,

starting a business, paying for education, or covering unexpected

expenses. When it comes to borrowing money, there are different

types of loans Such as; Personal Loans, Mortgage Loans, Auto

Loans, Student Loans and Business Loans. It is crucial to

consider several factors When borrowing money such as its

Interest Rates, Repayment Terms, Fees, Charges, Creditworthiness

and Repayment Capability

Borrowing money should be done responsibly, with careful

consideration of your financial situation, repayment

capabilities, and long-term goals.

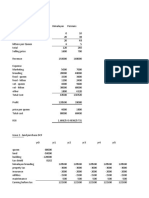

II. DEMOGRAPIC PROFILE OF THE INTERIEWEE

NAME: Orbilly R. Hilario

AGE: 44

OCCUPATION: Businessman

YEAR IN BUSINESS: 14 Years

III. INTERVIEW SCHENDULE

1. How much Amount of Borrowed Money did you Borrowed?

HE BORROWED THE AMOUNT OF P100,000.00 FROM MERICRIS RAMIREZ

(SISTER) SINCE JANUARY 2022

2. Where di you use the Borrowed Money

THE PURPOSE OF BORROWING IS TO CONTINUOUSLY OPERATE HIS

BUSINESS IN ORDER TO GENERATE INCOME IN ORDER TO SUPPORT

EVERYDAY NEEDS

3. What are the interest charge and duration of due of your

borrowed money?

THE INTEREST CHARGED WILL BE 1% WHICH IS WORTH P1000.00 OF

INTEREST AND TO BE PAID WITHIN 1 YEAR

IV. ADVANTAGES AND DISADVANTAGES

ADVANTAGES:

It allows you to bridge the gap between your financial needs

and your available resources. Financial Flexibility makes a

significant purchases or investments that may not be

feasible with your current savings.

In such situations, borrowing money can be a lifeline to

cover unexpected expenses, such as medical bills, urgent

Infrastructure repairs, or car repairs.

Through borrowing, you can leverage your resources and

potentially achieve higher returns on your investments.

Borrowing money can provide opportunities for growth, such

as starting or expanding a business, investing in education,

or purchasing a property.

Responsible borrowing and timely repayments can help you

build a positive credit history. A good credit score can be

advantageous when applying for future loans, as it

demonstrates your creditworthiness to lenders, potentially

leading to better interest rates and loan terms.

DISADVANTAGES:

Failure to make loan repayments can lead to a growing debt

burden, accumulating interest, late payment fees, and damage

to your credit score. Borrowing money means taking on debt,

and it's important to consider your ability to repay the

borrowed amount.

Interest rates can vary, and if they are high, it can

significantly increase the total cost of borrowing, making

it more challenging to repay the loan. When borrowing money,

you must repay not only the principal amount but also the

interest charged by the lender.

Borrowing money comes with financial obligations, such as

monthly repayments. These obligations can put added strain

on your budget, reducing your disposable income and limiting

your financial flexibility. It is essential to evaluate your

current and future financial situation to ensure you can

comfortably meet the repayment obligations.

Lenders may also have conditions, collateral requirements,

or eligibility criteria that you need to meet, which can

limit your options. Borrowing money requires finding a

willing lender. Depending on the type of loan and your

creditworthiness, it may be challenging to secure favorable

loan terms or even obtain a loan at all.

Borrowing money can divert a portion of your income towards

loan repayments, potentially affecting your ability to save

for long-term goals, such as retirement or education. It is

crucial to consider the impact of borrowing on your overall

financial plan and ensure that it aligns with your goals.

CONCLUSION

To Sum up, borrowing money can be advantageous when used

prudently and responsibly, but it also comes with potential

drawbacks. It is important to carefully assess your financial

situation, consider the alternatives, and evaluate the terms and

conditions of borrowing before making a decision.

You might also like

- N26 - OverviewDocument25 pagesN26 - OverviewGajendra AudichyaNo ratings yet

- CHAPTER 1 - The Nature and Role of CreditDocument4 pagesCHAPTER 1 - The Nature and Role of Creditdoray100% (1)

- Final Amul ReportDocument39 pagesFinal Amul ReportTeena Varma36% (11)

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk AnalyticsAkshitNo ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk Analyticsblack canvasNo ratings yet

- Mastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtFrom EverandMastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtNo ratings yet

- Loan Discounts Finance 7Document41 pagesLoan Discounts Finance 7Elvie Anne Lucero ClaudNo ratings yet

- Bank Credit Loans TrustDocument8 pagesBank Credit Loans TrustN.O. Vista100% (1)

- Credit SystemDocument57 pagesCredit SystemHakdog CheeseNo ratings yet

- What Is A Loan?: Open-Ended Line of CreditDocument13 pagesWhat Is A Loan?: Open-Ended Line of CreditJohn Matthew JoboNo ratings yet

- Nature of CreditDocument6 pagesNature of CreditMikk Mae GaldonesNo ratings yet

- BEDM311 RuthDocument7 pagesBEDM311 RuthNgonidzashe DzekaNo ratings yet

- Unit 1 Consumer Credit & DebtDocument9 pagesUnit 1 Consumer Credit & DebtDanoNo ratings yet

- Activity 2 - Credit and CollectionDocument3 pagesActivity 2 - Credit and CollectionMichael John GarciaNo ratings yet

- Krishna ProjectDocument32 pagesKrishna Projectprashant mhatreNo ratings yet

- Different Types OF: Loans and AdvancesDocument19 pagesDifferent Types OF: Loans and Advancesharesh KNo ratings yet

- Overview of CreditDocument24 pagesOverview of CreditJanell AgananNo ratings yet

- Economics Ip AkDocument13 pagesEconomics Ip Akkamalia2308No ratings yet

- Good LendingDocument35 pagesGood LendingSirsanath Banerjee100% (7)

- Document (1)Document6 pagesDocument (1)hetalkarliNo ratings yet

- Print - AamirDocument19 pagesPrint - AamirAamir BasraiNo ratings yet

- Chapter TwoDocument10 pagesChapter TwoMitiku GemechuNo ratings yet

- Overview of CreditDocument15 pagesOverview of CreditJohn Daniel BerdosNo ratings yet

- 2 Principles+of+LendingDocument25 pages2 Principles+of+LendingBratati SahooNo ratings yet

- Loan and Discount FunctionsDocument2 pagesLoan and Discount FunctionsMegan Adeline Hale100% (2)

- Understanding Credit - Oral PresentationDocument13 pagesUnderstanding Credit - Oral PresentationAna Rey RuizNo ratings yet

- BANKING Philippine Credit SystemDocument13 pagesBANKING Philippine Credit SystemTim MagalingNo ratings yet

- ProjectDocument8 pagesProjectYograj PawarNo ratings yet

- Debt FinancingDocument4 pagesDebt FinancingUmair IftakharNo ratings yet

- Financial Literacy MaterialsDocument5 pagesFinancial Literacy MaterialsStanley JoeNo ratings yet

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaNo ratings yet

- LoanDocument7 pagesLoanAnish RIngeNo ratings yet

- Banking FinanceDocument9 pagesBanking FinanceAstik TripathiNo ratings yet

- Debt Management: Handle With CareDocument8 pagesDebt Management: Handle With CareCarlos AndradeNo ratings yet

- Classification of CreditDocument25 pagesClassification of CreditJohn Nikko LlaneraNo ratings yet

- Written Report in Entreprenuerial MindDocument21 pagesWritten Report in Entreprenuerial MindAndrea OrbisoNo ratings yet

- Written Report in Entreprenuerial MindDocument21 pagesWritten Report in Entreprenuerial MindAndrea OrbisoNo ratings yet

- The Financial Kaleidoscope - May 2018Document8 pagesThe Financial Kaleidoscope - May 2018Deepthi PNo ratings yet

- TYPES OF CREDIT Week13Document61 pagesTYPES OF CREDIT Week13Richard Santiago JimenezNo ratings yet

- 3 Dec.... 3 ArticlesDocument5 pages3 Dec.... 3 Articlesavinash sharmaNo ratings yet

- Develop and Use A Savings Plan MaterialDocument9 pagesDevelop and Use A Savings Plan MaterialDo DothingsNo ratings yet

- Personal Debt Vs Corp DebtDocument1 pagePersonal Debt Vs Corp DebtAlaissaNo ratings yet

- What Is A Nonperforming Loan NPLDocument6 pagesWhat Is A Nonperforming Loan NPLJacksonNo ratings yet

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Module 4 - Credit, Its Uses, Classifications and Risks PDFDocument17 pagesModule 4 - Credit, Its Uses, Classifications and Risks PDFRodel Novesteras Claus0% (1)

- Real EstateDocument9 pagesReal EstateAmanuel EristuNo ratings yet

- Finance 313Document8 pagesFinance 313Charina Jane CatallaNo ratings yet

- Credit Distinguished From DebtDocument3 pagesCredit Distinguished From DebtDIASANTA Gene Kenneth C.No ratings yet

- FM6 HYBRID PORTFOLIO FinalDocument25 pagesFM6 HYBRID PORTFOLIO FinalOlamit, Gelyn Mae BeluanNo ratings yet

- Webinar ReportDocument10 pagesWebinar Reportmohd ChanNo ratings yet

- Cash Flow CorrelationDocument18 pagesCash Flow CorrelationopulencefinservNo ratings yet

- FinanceDocument2 pagesFinanceJulie Ann VergadoNo ratings yet

- FinalDocument17 pagesFinalRamakrishna BalijepalliNo ratings yet

- LoansDocument7 pagesLoansmba departmentNo ratings yet

- Fima30063-Lect1-Overview of CreditDocument24 pagesFima30063-Lect1-Overview of CreditNicole Lanorio100% (1)

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- Lecture Note 4 - Basics of Bank Lending PDFDocument11 pagesLecture Note 4 - Basics of Bank Lending PDFphillip chirongweNo ratings yet

- 07 PFM Chapter 6 Establishing Consumer CreditDocument4 pages07 PFM Chapter 6 Establishing Consumer CreditLee K.No ratings yet

- Unit 1 Finacial CreditDocument21 pagesUnit 1 Finacial Creditsaurabh thakurNo ratings yet

- FINANCIAL CREDIT RISK ANALYTICS - Unit 1Document11 pagesFINANCIAL CREDIT RISK ANALYTICS - Unit 1Mansi sharmaNo ratings yet

- 07 - Consumer CreditDocument23 pages07 - Consumer Creditjay-ar dimaculanganNo ratings yet

- Impact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEDocument12 pagesImpact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEYounes HouryNo ratings yet

- Macro Essential QuestionsDocument3 pagesMacro Essential QuestionsChinmay PanhaleNo ratings yet

- Samara University College of Business and Economics: Department of Management EntrepreneurshipDocument54 pagesSamara University College of Business and Economics: Department of Management Entrepreneurshipfentaw melkie100% (1)

- Pre Board: Subject - Social Science Maximum Marks: 80 Class - X Time: 3 HoursDocument3 pagesPre Board: Subject - Social Science Maximum Marks: 80 Class - X Time: 3 HoursAnivesh MudgalNo ratings yet

- Hyundai Motor India ParkDocument30 pagesHyundai Motor India ParkMir HassanNo ratings yet

- Unit Iii Consumption FunctionDocument16 pagesUnit Iii Consumption FunctionMaster 003No ratings yet

- High Rise Smart Eco - City - Inner City Development ProjectDocument62 pagesHigh Rise Smart Eco - City - Inner City Development ProjectJaspergroup 15No ratings yet

- Asia Pacific Licensure ExaminationDocument12 pagesAsia Pacific Licensure ExaminationTGiF TravelNo ratings yet

- Resume Rida PiraniDocument4 pagesResume Rida PiraniRenitaNo ratings yet

- LiuMeihan PC#4Document4 pagesLiuMeihan PC#4MeihanNo ratings yet

- Sustainable Reverse LogisticsDocument13 pagesSustainable Reverse LogisticsDaniela LouraçoNo ratings yet

- Read Legislative Text of Senate GOP's Tax Overhaul LegislationDocument515 pagesRead Legislative Text of Senate GOP's Tax Overhaul Legislationkballuck1100% (1)

- Bai Tap HPDocument5 pagesBai Tap HPKhánh HưngNo ratings yet

- Membership Interest Pledge AgreementDocument6 pagesMembership Interest Pledge AgreementKnowledge Guru100% (1)

- Oppo Ecno Buds 2Document2 pagesOppo Ecno Buds 2patelsingh638No ratings yet

- Session1 Problem SetDocument1 pageSession1 Problem SetPattyNo ratings yet

- Role of Functional StrategyDocument10 pagesRole of Functional StrategyAlyssa TiadNo ratings yet

- Book Economics Organization and ManagementDocument635 pagesBook Economics Organization and ManagementHoBadalaNo ratings yet

- Business Economics MCQDocument14 pagesBusiness Economics MCQPriti ParmarNo ratings yet

- Green HR Management (Chat GPT)Document2 pagesGreen HR Management (Chat GPT)esa arimbawaNo ratings yet

- The Digital Divide and Its Impact On Economic DevelopmentDocument2 pagesThe Digital Divide and Its Impact On Economic DevelopmentntanirudaNo ratings yet

- Economy of Pakistan Course OutlineDocument2 pagesEconomy of Pakistan Course OutlineFarhan Sarwar100% (1)

- Axis Bank Debit and Credit Card1234Document81 pagesAxis Bank Debit and Credit Card1234VaishnaviNo ratings yet

- Kieni Dairy Brief Company Profile 2023Document2 pagesKieni Dairy Brief Company Profile 2023Solomon MainaNo ratings yet

- Strategic Sourcing Procurement Manager in Raleigh Durham RTP NC Resume Genevia LiuDocument3 pagesStrategic Sourcing Procurement Manager in Raleigh Durham RTP NC Resume Genevia LiuGeneviaLiu100% (1)

- Scope and RelevanceDocument8 pagesScope and RelevanceParul JainNo ratings yet

- CHAPTER 1 Financial Reporting-ShareDocument3 pagesCHAPTER 1 Financial Reporting-ShareCahyo PriyatnoNo ratings yet

- Ias 33 - EpsDocument26 pagesIas 33 - Epsnissiem10% (1)