Professional Documents

Culture Documents

BLT Answer Sheet-1

BLT Answer Sheet-1

Uploaded by

sofia.wahab333Copyright:

Available Formats

You might also like

- Court Bonds-How To SettleDocument6 pagesCourt Bonds-How To SettleAlberto92% (83)

- Insurance Law Aquino 2018Document528 pagesInsurance Law Aquino 2018Israel Bandonill100% (12)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- IndemnityDocument6 pagesIndemnitySasthibrata Panda 99No ratings yet

- Indemnity and Guarantee NotesDocument13 pagesIndemnity and Guarantee NotesOtim Martin LutherNo ratings yet

- Law ProjectDocument8 pagesLaw ProjectShaiviNo ratings yet

- Fybms 157 Law Project Jai LilaniDocument6 pagesFybms 157 Law Project Jai LilaniDeesha MirwaniNo ratings yet

- 3unique Legal Characteristics and Requirements of InsuranceDocument12 pages3unique Legal Characteristics and Requirements of Insurancetsioney70No ratings yet

- 3 Indemnity and Guarantee 2Document38 pages3 Indemnity and Guarantee 2taimoor akbarNo ratings yet

- Ammara (FA19-BBA-051) Assi of BLDocument6 pagesAmmara (FA19-BBA-051) Assi of BLAmmaraNo ratings yet

- Contract of Guarantee (Sec 126-147)Document9 pagesContract of Guarantee (Sec 126-147)pp3986No ratings yet

- 3unique Legal Characteristics and Requirements of InsuranceDocument12 pages3unique Legal Characteristics and Requirements of Insurancetsioney70No ratings yet

- Guarantee:: What Is A Contract of Guarantee According To Contract Act?Document10 pagesGuarantee:: What Is A Contract of Guarantee According To Contract Act?Ibrahim HassanNo ratings yet

- Bba LLB Subject: Law of Contract-II Paper Code: LLB 102: Unit-I: Indemnity, Guarantee and AgencyDocument71 pagesBba LLB Subject: Law of Contract-II Paper Code: LLB 102: Unit-I: Indemnity, Guarantee and AgencyDinesh GadkariNo ratings yet

- Law of Contract 2Document73 pagesLaw of Contract 2Neeraj DwivediNo ratings yet

- Contract of IndemnityDocument12 pagesContract of IndemnityparvathiNo ratings yet

- Contract of Indemnity and Guarantee Case LawsDocument11 pagesContract of Indemnity and Guarantee Case LawsMandira PrakashNo ratings yet

- Law of TortsDocument25 pagesLaw of TortsMD ARSAD ALAMNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Indemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.Document6 pagesIndemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.shinwarrikhanNo ratings yet

- 13, Contracts of Indemnity and GuaranteeDocument20 pages13, Contracts of Indemnity and GuaranteeGhulam Hassan0% (1)

- Contract of IndemnityDocument8 pagesContract of Indemnitybhagyesh taleleNo ratings yet

- The Phrase Indemnity MeansDocument9 pagesThe Phrase Indemnity MeansArushiNo ratings yet

- Unit 3 Contract of Indemnity and Guarantee: StructureDocument15 pagesUnit 3 Contract of Indemnity and Guarantee: StructuregaardiNo ratings yet

- Characteristics: State Etc. v. Bank of India. IDocument9 pagesCharacteristics: State Etc. v. Bank of India. IChaitu ChaituNo ratings yet

- LLB 2nd Sem PendekantiDocument69 pagesLLB 2nd Sem PendekantiTechnocrat EnterprisesNo ratings yet

- Indemnity, Contract of IndeminityDocument6 pagesIndemnity, Contract of IndeminityBoobalan RNo ratings yet

- Contract ExamDocument73 pagesContract ExamplannernarNo ratings yet

- Contract of IndemnityDocument21 pagesContract of Indemnitytanujdeswal27No ratings yet

- IndemnityDocument54 pagesIndemnityManjeev Singh SahniNo ratings yet

- LAB AssignmentDocument28 pagesLAB AssignmentMoh'ed A. KhalafNo ratings yet

- UntitledDocument43 pagesUntitledSakshi KapoorNo ratings yet

- Indemnity: Indemnitee Definition, A Person or Company That Receives IndemnityDocument4 pagesIndemnity: Indemnitee Definition, A Person or Company That Receives Indemnitymulabbi brianNo ratings yet

- Business Law GroupDocument3 pagesBusiness Law GroupNOR SURIYANI BINTI SHAFEINo ratings yet

- Contract Assignment FinalDocument6 pagesContract Assignment FinalYadav AnkitaNo ratings yet

- Law of Contract IIDocument58 pagesLaw of Contract IIranjusanjuNo ratings yet

- NotesDocument15 pagesNotesArshil ShahNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document11 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- Wa0000Document12 pagesWa0000pragya.ps267No ratings yet

- What Is Meant by Indemnity in A ContractDocument4 pagesWhat Is Meant by Indemnity in A ContractSukriti SinghNo ratings yet

- Notes IDocument11 pagesNotes IsiddhantNo ratings yet

- L 16 Contract of Indemnity and Guarantee 1Document86 pagesL 16 Contract of Indemnity and Guarantee 1Aastha AroraNo ratings yet

- Insurance ContractsDocument12 pagesInsurance ContractsJake GuataNo ratings yet

- Contract II Unit 2Document27 pagesContract II Unit 2Sadaf ShabbirNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document12 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- Capacity of PartiesDocument9 pagesCapacity of PartiesNaveen DevarasettiNo ratings yet

- Condemnity in A ContractDocument18 pagesCondemnity in A ContractShaazim ShagarNo ratings yet

- Contracts-II Notes (Sonsie)Document146 pagesContracts-II Notes (Sonsie)Shalu MandiyaNo ratings yet

- Contract IiDocument19 pagesContract IioxcelestialxoNo ratings yet

- Indemnity & GuaranteeDocument10 pagesIndemnity & GuaranteeManju UppalNo ratings yet

- Law of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Document8 pagesLaw of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Manisha PawarNo ratings yet

- Indeminity and GuaranteeDocument8 pagesIndeminity and GuaranteeAnbarasan Subu100% (2)

- ContractDocument4 pagesContractSuneet KapoorNo ratings yet

- Contract of Indemnity and Guarantee (2) (3 Files Merged)Document37 pagesContract of Indemnity and Guarantee (2) (3 Files Merged)MamthasenaNo ratings yet

- Indemnity and Guarantee Are Two Sides of The Same Coin'Document4 pagesIndemnity and Guarantee Are Two Sides of The Same Coin'anushka kashyapNo ratings yet

- Q.1 - DEFINE A CONTRACT OF GUARENTEE, Explain Its Essentials?Document10 pagesQ.1 - DEFINE A CONTRACT OF GUARENTEE, Explain Its Essentials?Rachit RathiNo ratings yet

- Contract of IndemnityDocument12 pagesContract of IndemnityKhushi KothariNo ratings yet

- Contract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheDocument9 pagesContract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheSuchitra SureshNo ratings yet

- INDEMNITY and GUARANTEEDocument11 pagesINDEMNITY and GUARANTEEAdyashaNo ratings yet

- Judiciary Notes - ContractDocument10 pagesJudiciary Notes - ContractYash SinghNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Case Digest, RutaDocument2 pagesCase Digest, RutaMayra Joei RutaNo ratings yet

- DLSL JD4 Insurance Law Case DigestsDocument100 pagesDLSL JD4 Insurance Law Case DigestsGreggy LawNo ratings yet

- Vtupulse.C: Module-5 Contract Management Post AwardDocument49 pagesVtupulse.C: Module-5 Contract Management Post AwardNayim InamdarNo ratings yet

- U1l4notes Financial Contracts of IslamDocument33 pagesU1l4notes Financial Contracts of IslamAmiraNo ratings yet

- Oblicon CasesDocument72 pagesOblicon CasessepaquidaoNo ratings yet

- Superdari Application Under CRPC S451 Release of Recovered GoodsDocument5 pagesSuperdari Application Under CRPC S451 Release of Recovered GoodsSukhamrit Singh ALS, NoidaNo ratings yet

- Pioneer Insurance & Surety Corporation vs. Court of Appeals: 668 Supreme Court Reports AnnotatedDocument12 pagesPioneer Insurance & Surety Corporation vs. Court of Appeals: 668 Supreme Court Reports AnnotatedAlexiss Mace JuradoNo ratings yet

- Pacific Tobacco V, Lorenzana PDFDocument7 pagesPacific Tobacco V, Lorenzana PDFKatrina BarrionNo ratings yet

- 04 Industrial Personnel vs. Country BankersDocument15 pages04 Industrial Personnel vs. Country BankersMichael Leandro RentozaNo ratings yet

- Contract of GuaranteeDocument9 pagesContract of Guaranteedee deeNo ratings yet

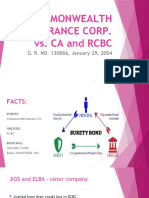

- COMMONWEALTH INSURANCE CORP vs. RCBCDocument14 pagesCOMMONWEALTH INSURANCE CORP vs. RCBCKê MilanNo ratings yet

- 40 ESCRA Imperial Insurance Inc. v. de Los AngelesDocument12 pages40 ESCRA Imperial Insurance Inc. v. de Los AngelesTenchilyn CezarNo ratings yet

- Nyayavikasini Manavanayashastra of Jayasthiti MallaDocument102 pagesNyayavikasini Manavanayashastra of Jayasthiti MallaSushanth HarshaNo ratings yet

- Contract II Questions & AnswersDocument44 pagesContract II Questions & Answersamrithaanish89No ratings yet

- 08 Lopez V Orosa and Plaza TheaterDocument3 pages08 Lopez V Orosa and Plaza TheaterJaymie ValisnoNo ratings yet

- Insurance Case Digest CompilationDocument69 pagesInsurance Case Digest CompilationKristel HipolitoNo ratings yet

- AUWC Chapter 2 PDFDocument42 pagesAUWC Chapter 2 PDFebro nNo ratings yet

- Corporation v. Allied Banking Corpora Tion (G.R. No. 187922, September 21, 2016) - YB Is Not ADocument19 pagesCorporation v. Allied Banking Corpora Tion (G.R. No. 187922, September 21, 2016) - YB Is Not ALaarni GeeNo ratings yet

- USA V Davis July 28, 2021 BondDocument2 pagesUSA V Davis July 28, 2021 BondFile 411No ratings yet

- Other References Shall Be AllowedDocument7 pagesOther References Shall Be AllowedRussel SirotNo ratings yet

- RD Trading SolutionDocument10 pagesRD Trading SolutionPurveshNo ratings yet

- Naga Development PermitDocument8 pagesNaga Development PermitAB AgostoNo ratings yet

- G.R. No. L-24835Document5 pagesG.R. No. L-24835WEDDANEVER CORNELNo ratings yet

- USA V Barnhart Conditions of ReleaseDocument4 pagesUSA V Barnhart Conditions of ReleaseFile 411No ratings yet

- Davis Wright Tremaine, LLP 920 Fifth Avenue, Ste. 3300, Seattle, Washington 98104 (206) 757-8298Document14 pagesDavis Wright Tremaine, LLP 920 Fifth Avenue, Ste. 3300, Seattle, Washington 98104 (206) 757-8298Khristopher BrooksNo ratings yet

- Practical Exercises in Civil LawDocument2 pagesPractical Exercises in Civil LawFrancis PunoNo ratings yet

- Arab Contractors Vs Acclain Constructions Supplies LTD (Civil Application No 26216 of 2023) 2023 TZCA 17788 (1 November 2023)Document14 pagesArab Contractors Vs Acclain Constructions Supplies LTD (Civil Application No 26216 of 2023) 2023 TZCA 17788 (1 November 2023)Ambakisye AsukileNo ratings yet

- Outline in Credit Transactions Law I. LOAN (1933-1961)Document36 pagesOutline in Credit Transactions Law I. LOAN (1933-1961)Salman Dimaporo RashidNo ratings yet

BLT Answer Sheet-1

BLT Answer Sheet-1

Uploaded by

sofia.wahab333Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BLT Answer Sheet-1

BLT Answer Sheet-1

Uploaded by

sofia.wahab333Copyright:

Available Formats

Name Sofia

Registration Number 301-1904081

Course Title Business Law

Session Fall 2020

Exam Terminal Exam

Write Your Answers here!

Case Study #1:

According to this case study, the right to indemnity can appear in cases of

contribution and surety ship. We can come up with the following ideas from the

above cases:

1st the purchaser impliedly agrees to indemnify the seller against the encumbrances if

the property is sold subject to encumbrance and 2nd this right of indemnity can be

applied to cases of dissolution of the partnership, surety ship, contribution, etc…

which means it's not limited to sales of immoveable property. Based on the

consideration that an obligation of the conscience should be cast on the purchaser, the

right would be applied to cases of sales of property subject to a "charge". Even

though in the case it's strongly argued that since exhibit B is only a security bond and

it doesn’t carry any responsibility to discharge the decree of the high court. However

from the author's point of view the right of indemnity exists in this case which makes

the plaintiff eligible to ask the court to enforce the law.

In law indemnity can be defined security or safety against the loss or that’s a

useful contractual agreement between 2 parties, one party accepts to pay any

damages or damages caused by the other party. The most Common example is

insurance contracts. There are 2 parties in this contact one is – indemnifier and

the 2nd party is – indemnified( indemnity holder)

Indemnifier is the person who promise or give assurance to 2nd party that compensates

for the damages.

And indemnified the person who is assured that the resulting damages will be

compensation or recover.

Ex #1: Ali took full coverage for his new car, he got into an accident and the

insurance company fully covered the repair costs and paid for the rental vehicle while

his car was being fixed.

Ex #2: Ahmad's house was damaged by a flash flooding. He had indemnity through

his insurance and he was indemnified. This means the insurance company covered the

repair costs caused by the lighting damage.

Ex #3: Vital insurance company entered into a contract with Kabul Ltd, to

compensate for loss caused by accidental fire to the company's stock of goods up to

$90,00,000 for a premium of $100,000.

Ex #4: Ahmad is a shareholder of Kabul Company Ltd. Lost his share certificate. But

on the condition that Ahmad compensates for the loss or damage to the company if a

3rd person brings the original certificate.

Ex #5: A knee brace manufacturer enters into an agreement with a large hospital to

provide 1m knee braces at a discount price. The manufacturer asks that an indemnity

clause be included in the contract, in which the hospital agrees to protect the company

from any losses and lawsuits should patients be injured while using any of knee

braces. In doing this, the hospital indemnifies the knee brace company or hospital

guarantees indemnity for any losses or injuries that many occur.

Indemnity and guarantee are type of contingent contracts, which are governed by

contract law. In other words, indemnity implies protection against loss, in terms

of money to be paid for loss. Indemnity is when one party promises to

compensate the loss occurred to the other party, due to the act of the promisor or

any other party. On the other hand, the guarantee is when a person assures the

other party that he/she will perform the promise or fulfill the obligation of the 3rd

party, in case he/she default.

In indemnify contract there are 2 In guarantee contract there are 3

parties. Indemnifier and indemnity parties. Creditor, principle debtor and

holder surety

In indemnify there is only on contract In guarantee there are 3 contracts,

it's between indemnifier and indemnity between creditor and surety. Contract

holder. between P D and creditor and between

surety and P D.

Indemnity contact based upon Guarantee contract based upon the

indemnifier's interest principle debtor's interest.

In indemnify contract there is a promise In the guarantee contract there is

to pay the losses and damages. multiple promise.

In indemnify contract the liability of In guarantee contract the liability of

the indemnifiers is primary. surety in secondary (2nd).

Examples:

Indemnity: Ahmad is shareholder of Kabul Company Ltd. Lost his share certificate. He

applies for a duplicate one. The company agrees, but on the condition that Ahmad

compensates for the loss or damage to the company if a third person bring the original

certificate.

Guarantee: Sharif takes loan from Azizi bank for which Karim has given the guarantee

that if Sharif defaults in the payment of the said amount he will discharge the liability.

Here Karim plays the rule of surety, Sharif is the principle of debtor and bank is the

creditor.

Indemnity: A knee brace manufacturer enters into an agreement with a large hospital to

provide I million knee braces at a discount price. The manufacturer asks that an

indemnity clause be included in the contract, in which the hospital agrees to protect the

company from any losses or lawsuits should patients be injured while using any of knee

braces. In doing this, the hospital indemnifies the knee brace company, or the hospital

guarantees indemnity for any losses or injuries that may occur.

Guarantee: Ahmad borrows $50,000 from\Nasim and agrees to pay the full amount and

5% interest within 2 months. Ahmad guarantees that he will pay $5,250 by contract

expiration date.

Indemnity: Ahmad's house was damaged by a flash flooding. He had indemnity through

his insurance and he was indemnified. This means the insurance company covered the

repair costs caused by the lighting damage.

Guarantee: Sarah takes student loan from Islamic back but his father cosigns the

agreement. If Sarah fails to make payments his father will be liable.

Indemnity: Ali took full coverage for his new car. He got into an accident and the

insurance company fully covered the repair costs and paid for the rental vehicle while his

car was being fixed.

Guarantee: Ahmad and Nasir enter in a stationary shop. Ahmad orders to deliver the

books to Basir on credit. The shopkeeper said that he can give book on credit provided

Ahmad gives the guarantee for the payment of books. Ahmad promises to guarantee the

payment.

Indemnity: vital insurance company entered into a contract with Kabul Ltd, to

compensat5e for loss caused by accidental fire to the company's stock of goods up to $90,

00,000 for a premium of $100,000.

Guarantee: Jamal takes loan of $1,000 from Kabul bank. Ahmad promises to Kabul

bank that if Jamal fails to repay the loan within the agreed timeframe he will pay it

interest.

Case Study #2:

Specific relief act is an act providing for an equitable remedy. In this, the court

issues an order requiring a party to perform a specific act i.e. directs performing

the contract as per the terms and conditions agreed between the parties. It's based

on the statement that there might be situations wherein the grant of the

compensation would not afford adequate relief and only specific performance of

the3 contract would render justice and provide adequate relief. By the decree for

specific performance, the court explains the real contract between the parties and

announces officially that such a contract exists and the executing court will deal

with the rest. When all the different steps can't be explained in detail, which are

necessary to implement the main part of the order directing specific performance

of the contract, then the executing courts deal with such cases to issue important

steps to be taken.

The performance of contract means the promisee and the promiser both have

fulfilled or completed their respective obligations under the contract. And when a

contract is properly fulfilled by both parties thus the contract comes to an end it

called discharged or executed. The contract must be performed at the place, time

and date with manner specified in the contract. And the promiser must has the

willingness and ability to perform the contract and delivered the goods for which

he has concluded the contract with. There are different types of performance of

contract.

- Actual performance

- Substantial performance

- Partial performance

- Attempted performance

There are many ways to terminate a contract

- By performance

It means the contract expires when the both parties have fulfilled all their obligations

under the contract, including all express and implied terms and each party performed with

complete diligence exactly as specified in the contract for example

- By agreement

It's actually variation of the contract when both parties are able and agree to terminate the

contract and when they do so their mutual obligations and contract will end. And they can

have new agreement with fresh considerations

- By gap of time

It means one of the contractor isn’t capable of starting and finishing work on time.

For example builder's team is a renovation company. They were hired to remove

Ahmad's old house within 2 months. Builds team has so many other projects ongoing and

can't dedicate a team to finish the house. Ahmad is forced terminate the contract

Case Study #3:

The case study demonstrates that the government of Maharashtra appointed a

committee to place the working conditions of security guard who are working on

contracts basis through security agencies under scrutiny. After examining and

analyzing the cases the committee came to the conclusion that the contract

framework was being utilized to misuse the circumstance of widespread

unemployment of security guards, and also the system lacks the security of

employment, healthy benefits, as well as safety measures since it is based on the

contract. To protect the security guards numbering about 70,000 employed by

about 200 to 250 security agents, the government issued a notification under the

contract labour (Regulation and Abolition) act, 1970 abrogating the contract

system of employment of security guards. Since the notification was a non-

speaking order, the court ended it officially. Therefore the government brought

independent legislation applicable to the security guards. By an ordinance issued

on 31st august 1988, the Maharashtra private security guards (Regulation Of

Employment And Welfare) ordinance, 1981 (Maharashtra Ordinance V of 1981)

and the Maharashtra Private security Guards (Regulation of Employment and

Welfare) scheme, 1981 were simultaneously brought into effect, which is referred

to as ' The Security Guards Act'.

Termination or discharge of the contract means the termination of the contract

before it's completed by the parties. In other words before the parties fulfill all the

obligations related to them that are required in the contract, their duty to fulfill

these other obligation ceases.

Generally, the effect of termination of the contract is the discharge of the parties from

their unfulfilled obligations in the contract.

There are several common reasons that a contract can be terminated between 2

parties:

- When the terms of the contract aren’t acceptable by one of the parties and if it

is not changeable so contract can be terminate.

For example Azizi bank and Vital Software Company enter into negotiation to

develop a new banking system. Vital company offers to develop the tool within

12 months for $100,000 however; Azizi bank needs the system within 2 months.

- Adverse performance of all or part of the contract by other party.

For example Kabul University signed a contract with ABC publisher to print high

quality curriculums and chapter notes. The 1st batch of materials weren't legible

and graphic quality was poor.

- Baulk (refusal) by the party to perform the contract the party may change its

mind or have another better option to do contract with.

For example in reference to the example above, Kabul University terminate the

contract with ABC publishers and seeks new vendor to print materials.

- When one of the parties no longer need goods or services or can get goods or

services more cheaply elsewhere so they can terminate the contract.

The government plans to build a new building for the ministry of interior. The

project was being funded by the USAID, however, halfway through the project

the fund was allocated to other high priority projects and building construction

work was terminated.

- When the party is facing bankruptcy (insolvency) or is no longer able to

perform the contract in the time other party can terminate the contract.

For example due to declining sales and revenues Vital bank terminates contracts

with cleaning and administrative vendors.

Case Study #4:

Agreement bailor and bailee is called bailment its form French word "Bailer"

which means hand over or delivery. Generally mean delivery of goods or item by

the owner or an individual the one who trust (bailor) to other person the one who

have the right to take items from someone or (bailee) for purpose under a

contract. 5 essential characteristics of bailment are contract, delivery of goods,

charges in possession, movable items, and return. The contract must be between 2

parties "bailor" and "bailee" and the good must deliver by one individual to

another both parties must get from it mean one is using the item and one will

receive money from that the items should be movable and the item will return

bailor and bailee can't deliver it to any other bailor. For example Sarah is parking

her car in university parking and paid a lot for. So Sarah is getting benefit from

that parking because of her car and university get benefit of the fee that is paid for

the parking.

Rights of the bailor are to terminate the contract, to take back the goods, claim to

increase the cost of goods and to perform the receiver's duties and claim damages.

Rights of the bailee are in the event of a loss due to a defective title, and claim

damages, if bailee don’t pay the charges for the stored goods so he/she can use the

right of bail i.e. storage of the goods and bailee cant mix the goods of bailor with

of his own goods etc… or another case for example Ahmad lent his jacket to Ali,

his friend for a short time use without any charges this is the bailment for the

exclusive benefit of the bailee.

You might also like

- Court Bonds-How To SettleDocument6 pagesCourt Bonds-How To SettleAlberto92% (83)

- Insurance Law Aquino 2018Document528 pagesInsurance Law Aquino 2018Israel Bandonill100% (12)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- IndemnityDocument6 pagesIndemnitySasthibrata Panda 99No ratings yet

- Indemnity and Guarantee NotesDocument13 pagesIndemnity and Guarantee NotesOtim Martin LutherNo ratings yet

- Law ProjectDocument8 pagesLaw ProjectShaiviNo ratings yet

- Fybms 157 Law Project Jai LilaniDocument6 pagesFybms 157 Law Project Jai LilaniDeesha MirwaniNo ratings yet

- 3unique Legal Characteristics and Requirements of InsuranceDocument12 pages3unique Legal Characteristics and Requirements of Insurancetsioney70No ratings yet

- 3 Indemnity and Guarantee 2Document38 pages3 Indemnity and Guarantee 2taimoor akbarNo ratings yet

- Ammara (FA19-BBA-051) Assi of BLDocument6 pagesAmmara (FA19-BBA-051) Assi of BLAmmaraNo ratings yet

- Contract of Guarantee (Sec 126-147)Document9 pagesContract of Guarantee (Sec 126-147)pp3986No ratings yet

- 3unique Legal Characteristics and Requirements of InsuranceDocument12 pages3unique Legal Characteristics and Requirements of Insurancetsioney70No ratings yet

- Guarantee:: What Is A Contract of Guarantee According To Contract Act?Document10 pagesGuarantee:: What Is A Contract of Guarantee According To Contract Act?Ibrahim HassanNo ratings yet

- Bba LLB Subject: Law of Contract-II Paper Code: LLB 102: Unit-I: Indemnity, Guarantee and AgencyDocument71 pagesBba LLB Subject: Law of Contract-II Paper Code: LLB 102: Unit-I: Indemnity, Guarantee and AgencyDinesh GadkariNo ratings yet

- Law of Contract 2Document73 pagesLaw of Contract 2Neeraj DwivediNo ratings yet

- Contract of IndemnityDocument12 pagesContract of IndemnityparvathiNo ratings yet

- Contract of Indemnity and Guarantee Case LawsDocument11 pagesContract of Indemnity and Guarantee Case LawsMandira PrakashNo ratings yet

- Law of TortsDocument25 pagesLaw of TortsMD ARSAD ALAMNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Indemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.Document6 pagesIndemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.shinwarrikhanNo ratings yet

- 13, Contracts of Indemnity and GuaranteeDocument20 pages13, Contracts of Indemnity and GuaranteeGhulam Hassan0% (1)

- Contract of IndemnityDocument8 pagesContract of Indemnitybhagyesh taleleNo ratings yet

- The Phrase Indemnity MeansDocument9 pagesThe Phrase Indemnity MeansArushiNo ratings yet

- Unit 3 Contract of Indemnity and Guarantee: StructureDocument15 pagesUnit 3 Contract of Indemnity and Guarantee: StructuregaardiNo ratings yet

- Characteristics: State Etc. v. Bank of India. IDocument9 pagesCharacteristics: State Etc. v. Bank of India. IChaitu ChaituNo ratings yet

- LLB 2nd Sem PendekantiDocument69 pagesLLB 2nd Sem PendekantiTechnocrat EnterprisesNo ratings yet

- Indemnity, Contract of IndeminityDocument6 pagesIndemnity, Contract of IndeminityBoobalan RNo ratings yet

- Contract ExamDocument73 pagesContract ExamplannernarNo ratings yet

- Contract of IndemnityDocument21 pagesContract of Indemnitytanujdeswal27No ratings yet

- IndemnityDocument54 pagesIndemnityManjeev Singh SahniNo ratings yet

- LAB AssignmentDocument28 pagesLAB AssignmentMoh'ed A. KhalafNo ratings yet

- UntitledDocument43 pagesUntitledSakshi KapoorNo ratings yet

- Indemnity: Indemnitee Definition, A Person or Company That Receives IndemnityDocument4 pagesIndemnity: Indemnitee Definition, A Person or Company That Receives Indemnitymulabbi brianNo ratings yet

- Business Law GroupDocument3 pagesBusiness Law GroupNOR SURIYANI BINTI SHAFEINo ratings yet

- Contract Assignment FinalDocument6 pagesContract Assignment FinalYadav AnkitaNo ratings yet

- Law of Contract IIDocument58 pagesLaw of Contract IIranjusanjuNo ratings yet

- NotesDocument15 pagesNotesArshil ShahNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document11 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- Wa0000Document12 pagesWa0000pragya.ps267No ratings yet

- What Is Meant by Indemnity in A ContractDocument4 pagesWhat Is Meant by Indemnity in A ContractSukriti SinghNo ratings yet

- Notes IDocument11 pagesNotes IsiddhantNo ratings yet

- L 16 Contract of Indemnity and Guarantee 1Document86 pagesL 16 Contract of Indemnity and Guarantee 1Aastha AroraNo ratings yet

- Insurance ContractsDocument12 pagesInsurance ContractsJake GuataNo ratings yet

- Contract II Unit 2Document27 pagesContract II Unit 2Sadaf ShabbirNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document12 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- Capacity of PartiesDocument9 pagesCapacity of PartiesNaveen DevarasettiNo ratings yet

- Condemnity in A ContractDocument18 pagesCondemnity in A ContractShaazim ShagarNo ratings yet

- Contracts-II Notes (Sonsie)Document146 pagesContracts-II Notes (Sonsie)Shalu MandiyaNo ratings yet

- Contract IiDocument19 pagesContract IioxcelestialxoNo ratings yet

- Indemnity & GuaranteeDocument10 pagesIndemnity & GuaranteeManju UppalNo ratings yet

- Law of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Document8 pagesLaw of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Manisha PawarNo ratings yet

- Indeminity and GuaranteeDocument8 pagesIndeminity and GuaranteeAnbarasan Subu100% (2)

- ContractDocument4 pagesContractSuneet KapoorNo ratings yet

- Contract of Indemnity and Guarantee (2) (3 Files Merged)Document37 pagesContract of Indemnity and Guarantee (2) (3 Files Merged)MamthasenaNo ratings yet

- Indemnity and Guarantee Are Two Sides of The Same Coin'Document4 pagesIndemnity and Guarantee Are Two Sides of The Same Coin'anushka kashyapNo ratings yet

- Q.1 - DEFINE A CONTRACT OF GUARENTEE, Explain Its Essentials?Document10 pagesQ.1 - DEFINE A CONTRACT OF GUARENTEE, Explain Its Essentials?Rachit RathiNo ratings yet

- Contract of IndemnityDocument12 pagesContract of IndemnityKhushi KothariNo ratings yet

- Contract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheDocument9 pagesContract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheSuchitra SureshNo ratings yet

- INDEMNITY and GUARANTEEDocument11 pagesINDEMNITY and GUARANTEEAdyashaNo ratings yet

- Judiciary Notes - ContractDocument10 pagesJudiciary Notes - ContractYash SinghNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Case Digest, RutaDocument2 pagesCase Digest, RutaMayra Joei RutaNo ratings yet

- DLSL JD4 Insurance Law Case DigestsDocument100 pagesDLSL JD4 Insurance Law Case DigestsGreggy LawNo ratings yet

- Vtupulse.C: Module-5 Contract Management Post AwardDocument49 pagesVtupulse.C: Module-5 Contract Management Post AwardNayim InamdarNo ratings yet

- U1l4notes Financial Contracts of IslamDocument33 pagesU1l4notes Financial Contracts of IslamAmiraNo ratings yet

- Oblicon CasesDocument72 pagesOblicon CasessepaquidaoNo ratings yet

- Superdari Application Under CRPC S451 Release of Recovered GoodsDocument5 pagesSuperdari Application Under CRPC S451 Release of Recovered GoodsSukhamrit Singh ALS, NoidaNo ratings yet

- Pioneer Insurance & Surety Corporation vs. Court of Appeals: 668 Supreme Court Reports AnnotatedDocument12 pagesPioneer Insurance & Surety Corporation vs. Court of Appeals: 668 Supreme Court Reports AnnotatedAlexiss Mace JuradoNo ratings yet

- Pacific Tobacco V, Lorenzana PDFDocument7 pagesPacific Tobacco V, Lorenzana PDFKatrina BarrionNo ratings yet

- 04 Industrial Personnel vs. Country BankersDocument15 pages04 Industrial Personnel vs. Country BankersMichael Leandro RentozaNo ratings yet

- Contract of GuaranteeDocument9 pagesContract of Guaranteedee deeNo ratings yet

- COMMONWEALTH INSURANCE CORP vs. RCBCDocument14 pagesCOMMONWEALTH INSURANCE CORP vs. RCBCKê MilanNo ratings yet

- 40 ESCRA Imperial Insurance Inc. v. de Los AngelesDocument12 pages40 ESCRA Imperial Insurance Inc. v. de Los AngelesTenchilyn CezarNo ratings yet

- Nyayavikasini Manavanayashastra of Jayasthiti MallaDocument102 pagesNyayavikasini Manavanayashastra of Jayasthiti MallaSushanth HarshaNo ratings yet

- Contract II Questions & AnswersDocument44 pagesContract II Questions & Answersamrithaanish89No ratings yet

- 08 Lopez V Orosa and Plaza TheaterDocument3 pages08 Lopez V Orosa and Plaza TheaterJaymie ValisnoNo ratings yet

- Insurance Case Digest CompilationDocument69 pagesInsurance Case Digest CompilationKristel HipolitoNo ratings yet

- AUWC Chapter 2 PDFDocument42 pagesAUWC Chapter 2 PDFebro nNo ratings yet

- Corporation v. Allied Banking Corpora Tion (G.R. No. 187922, September 21, 2016) - YB Is Not ADocument19 pagesCorporation v. Allied Banking Corpora Tion (G.R. No. 187922, September 21, 2016) - YB Is Not ALaarni GeeNo ratings yet

- USA V Davis July 28, 2021 BondDocument2 pagesUSA V Davis July 28, 2021 BondFile 411No ratings yet

- Other References Shall Be AllowedDocument7 pagesOther References Shall Be AllowedRussel SirotNo ratings yet

- RD Trading SolutionDocument10 pagesRD Trading SolutionPurveshNo ratings yet

- Naga Development PermitDocument8 pagesNaga Development PermitAB AgostoNo ratings yet

- G.R. No. L-24835Document5 pagesG.R. No. L-24835WEDDANEVER CORNELNo ratings yet

- USA V Barnhart Conditions of ReleaseDocument4 pagesUSA V Barnhart Conditions of ReleaseFile 411No ratings yet

- Davis Wright Tremaine, LLP 920 Fifth Avenue, Ste. 3300, Seattle, Washington 98104 (206) 757-8298Document14 pagesDavis Wright Tremaine, LLP 920 Fifth Avenue, Ste. 3300, Seattle, Washington 98104 (206) 757-8298Khristopher BrooksNo ratings yet

- Practical Exercises in Civil LawDocument2 pagesPractical Exercises in Civil LawFrancis PunoNo ratings yet

- Arab Contractors Vs Acclain Constructions Supplies LTD (Civil Application No 26216 of 2023) 2023 TZCA 17788 (1 November 2023)Document14 pagesArab Contractors Vs Acclain Constructions Supplies LTD (Civil Application No 26216 of 2023) 2023 TZCA 17788 (1 November 2023)Ambakisye AsukileNo ratings yet

- Outline in Credit Transactions Law I. LOAN (1933-1961)Document36 pagesOutline in Credit Transactions Law I. LOAN (1933-1961)Salman Dimaporo RashidNo ratings yet