Professional Documents

Culture Documents

Fabm2 Quiz

Fabm2 Quiz

Uploaded by

Xin Lou0 ratings0% found this document useful (0 votes)

17 views2 pagesDior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesFabm2 Quiz

Fabm2 Quiz

Uploaded by

Xin LouDior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

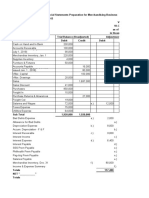

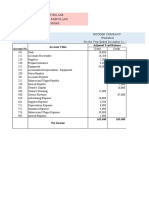

FABM2

CASH FLOW STATEMENT QUIZ FABM2

From the particulars given ahead prepare the cash flow statement as per AS-3 (Revised) using the CASH FLOW STATEMENT QUIZ

indirect method: From the particulars given ahead prepare the cash flow statement as per AS-3 (Revised) using the

Dior Clothing Corporation indirect method:

Balance Sheets As At 31 March, ..... Dior Clothing Corporation

Liabilities 2009 2008 Balance Sheets As At 31 March, .....

Equity Share Capital Php 80,000 Php 55,000 Liabilities 2009 2008

10% Preference Share Capital 20,000 25,000 Equity Share Capital Php 80,000 Php 55,000

General Reserve 7,600 4,000 10% Preference Share Capital 20,000 25,000

Profit & Loss Account 2,400 2,000 General Reserve 7,600 4,000

15% Debentures 14,000 12,000 Profit & Loss Account 2,400 2,000

Creditors 22,000 24,000 15% Debentures 14,000 12,000

Proposed Dividend 8,000 10,000 Creditors 22,000 24,000

Provision for Taxation 8,400 6,000 Proposed Dividend 8,000 10,000

1,62,400 1,38,000 Provision for Taxation 8,400 6,000

Assets 2009 2008 1,62,400 1,38,000

Fixed Assets 80,000 82,000 Assets 2009 2008

Less: Accumulated Depreciation 30,000 22,000 Fixed Assets 80,000 82,000

50,000 60,000 Less: Accumulated Depreciation 30,000 22,000

Stock 70,000 60,000 50,000 60,000

Debtors 34,400 15,000 Stock 70,000 60,000

Cash 7,000 2,400 Debtors 34,400 15,000

Prepaid Expenses 1,000 600 Cash 7,000 2,400

1,62,400 1,38,000 Prepaid Expenses 1,000 600

1,62,400 1,38,000

Additional Information:

(a) Provision for tax made Rs. 9,400. Additional Information:

(b) Fixed assets costing Rs. 20,000 (accumulated depreciation till the date of sale on them Rs. 6,000) (a) Provision for tax made Rs. 9,400.

were sold for Rs. 10,000. (b) Fixed assets costing Rs. 20,000 (accumulated depreciation till the date of sale on them Rs. 6,000)

(c) Interim dividend paid during the year Rs. 9,000. The proposed dividend of last year was declared were sold for Rs. 10,000.

and paid during the year. Ignore corporate dividend tax. (c) Interim dividend paid during the year Rs. 9,000. The proposed dividend of last year was declared

(d) New debentures were issued on 31 March 2009. and paid during the year. Ignore corporate dividend tax.

(d) New debentures were issued on 31 March 2009.

You might also like

- The School of Money by Olamide Emmanuel - Full BookDocument643 pagesThe School of Money by Olamide Emmanuel - Full Book4sygqbrg77No ratings yet

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav181% (31)

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Red Bull Case StudyDocument9 pagesRed Bull Case Studyakshay2a100% (2)

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- (Revised) - EL: BalanceDocument1 page(Revised) - EL: BalanceGopika G NairNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Answer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsDocument2 pagesAnswer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsmaryamambakhutwalaNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Get JC Plan Ch32 001Document7 pagesGet JC Plan Ch32 001Marlene BandaNo ratings yet

- Ru Advanced Accounting ExerciseDocument1 pageRu Advanced Accounting Exerciseprince matamboNo ratings yet

- Worksheet: Zainy-Arif Endaila BSA-1Document4 pagesWorksheet: Zainy-Arif Endaila BSA-1Zainy EndailaNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Acctg 153aDocument6 pagesAcctg 153aCHESTER JAN BOSONGNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Description: Tags: 668appgDocument2 pagesDescription: Tags: 668appganon-829526No ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- MC KinseyDocument2 pagesMC KinseyChandan KumarNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Journalizing Transaction (Ezekiel Lapitan)Document3 pagesJournalizing Transaction (Ezekiel Lapitan)Ezekiel LapitanNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocument2 pagesCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Ac QuestionsDocument7 pagesAc QuestionssamsherbdtamangNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Accounting Ratios - CEDocument10 pagesAccounting Ratios - CEKwan Yin HoNo ratings yet

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Document5 pagesBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieNo ratings yet

- MergersDocument2 pagesMergersbriankuria21No ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Cash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnDocument3 pagesCash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnPrashanth RNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Questions Based On Cashflow StatementDocument3 pagesQuestions Based On Cashflow StatementpuxvashuklaNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Balance Sheet 1st Year 2nd Year Rs. RsDocument1 pageBalance Sheet 1st Year 2nd Year Rs. Rsjayesh janiNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Kabi's Business PlanDocument19 pagesKabi's Business PlanAk MunnaNo ratings yet

- Privity of ContractDocument1 pagePrivity of ContractAngus NunnNo ratings yet

- p2 Exam With AnsDocument8 pagesp2 Exam With AnsEuli Mae SomeraNo ratings yet

- International Tuition Fees: Macquarie Business SchoolDocument7 pagesInternational Tuition Fees: Macquarie Business Schoolarjon ahmedNo ratings yet

- Statement of Account: Brittany Executive Village Ii B5 L16 San Isidro (Pob.) City of Antipolo RizalDocument1 pageStatement of Account: Brittany Executive Village Ii B5 L16 San Isidro (Pob.) City of Antipolo RizalJames Bryan Garcia SolimanNo ratings yet

- Big Data Analytics - National Occupational Accident and Disease Statistics 2021Document9 pagesBig Data Analytics - National Occupational Accident and Disease Statistics 2021MuhamadSadiqNo ratings yet

- Csec Poa June 2008 p2Document9 pagesCsec Poa June 2008 p2goseinvarunNo ratings yet

- Excel Template, Equipment Inventory ListDocument2 pagesExcel Template, Equipment Inventory ListiPakistan100% (1)

- Fs Idxhealth 2023 04Document3 pagesFs Idxhealth 2023 04Rahman AnshariNo ratings yet

- Catalytic Solutions IncDocument1 pageCatalytic Solutions Incdavid davidsonNo ratings yet

- Whodas Measurement Properties For Women With DysmenorrheaDocument8 pagesWhodas Measurement Properties For Women With Dysmenorrheahanna.oravecz1No ratings yet

- Business Model Innovation in The Digital AgeDocument12 pagesBusiness Model Innovation in The Digital AgeRubi ZimmermanNo ratings yet

- Conveyor Belt SplicingDocument5 pagesConveyor Belt SplicingBahador KavianiNo ratings yet

- Avigna Tutorials: by Avantika Singh & Aditya MahajanDocument13 pagesAvigna Tutorials: by Avantika Singh & Aditya Mahajanrishit gupta100% (1)

- Corporate Governance and Bank Performance: Evidence From BangladeshDocument7 pagesCorporate Governance and Bank Performance: Evidence From BangladeshRubel SahaNo ratings yet

- Postal Services in GoaDocument16 pagesPostal Services in GoaPrajot MorajkarNo ratings yet

- Satish Gaire's Story: Founder and CEO of Following CompaniesDocument6 pagesSatish Gaire's Story: Founder and CEO of Following CompaniesAmitNo ratings yet

- Sepo L2 JDDocument2 pagesSepo L2 JDPrajwa XbhNo ratings yet

- Cs-8002 Cloud Computing Cloud Interoperability and Portability B. Tech Iv YearDocument11 pagesCs-8002 Cloud Computing Cloud Interoperability and Portability B. Tech Iv YearVishal JainNo ratings yet

- What Is HR ConsultingDocument2 pagesWhat Is HR ConsultingRustashNo ratings yet

- Agile Contracts - Craig Larman - KeyDocument20 pagesAgile Contracts - Craig Larman - KeySeshadri VenkatNo ratings yet

- Geocell APTDocument13 pagesGeocell APTboper dantoNo ratings yet

- Delivery For OutSystems Specialization Detail Sheet - ENDocument3 pagesDelivery For OutSystems Specialization Detail Sheet - ENmahesh manchalaNo ratings yet

- The Effect of Customer Experience and Customer Engagement Through Customer Loyalty On Sales Revenue Achievement at PT United TractorsDocument17 pagesThe Effect of Customer Experience and Customer Engagement Through Customer Loyalty On Sales Revenue Achievement at PT United Tractorsndhlst 12No ratings yet

- AN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortDocument6 pagesAN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortNavidEhsanNo ratings yet

- ICTPMG501 Manage ICT Projects: Learner GuideDocument132 pagesICTPMG501 Manage ICT Projects: Learner Guidepramod thakuriNo ratings yet

- Crossrail Project - The Evolution of An Innovation EcosystemDocument10 pagesCrossrail Project - The Evolution of An Innovation EcosystemjamotrNo ratings yet

- The Industrial Disputes ActDocument5 pagesThe Industrial Disputes ActvaibhavNo ratings yet