Professional Documents

Culture Documents

Swiggy Financial Statements

Swiggy Financial Statements

Uploaded by

Kunal ChaudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swiggy Financial Statements

Swiggy Financial Statements

Uploaded by

Kunal ChaudharyCopyright:

Available Formats

Swiggy financial statements pdf

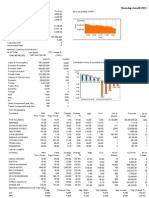

Hot Deals: a v thomas 15,555.00 (3.70 %) adtech 29.10 (0.34 %) agarwal bolts 1,210.00 (0.75 %) amol minechem 620.00 (1.64 %) anand i-power 20.00 anglo french 370.00 (-2.37 %) apl metals 42.01 (0.02 %) arkfin investments 50.00 arohan 118.00 (-1.67 %) assam carbon 205.00 (-1.44 %) atlas copco 10,000.00 (1.01 %) auckland international 129.00

(-0.77 %) axles 171.00 (0.59 %) balmer lawrie 199.00 (1.02 %) bharat hotels 144.00 (-0.69 %) bima mandi 700.00 bira 600.00 (-2.44 %) boat 715.00 (-1.38 %) c & s electric 505.00 (1.00 %) cable corporation 15.00 capgemini 10,500.00 (-0.94 %) care health 150.00 (1.35 %) carrier aircon 260.00 (1.96 %) cial 163.00 (1.24 %) csfbl 378.00 (0.80 %) csk

157.00 (-1.88 %) dalmia refract 130.00 (4.00 %) dfm foods 467.00 dsp merrill lynch 1,000.00 east india pharma 48.00 (2.13 %) eaton fluid 440.00 (-2.22 %) electronica plastic 4,100.00 (-0.24 %) elgi ultra 400.00 elofic 1,900.00 (2.70 %) esl steel 32.00 (-3.03 %) fincare business 43.00 fincare sfbl 191.00 (0.53 %) finopaytech 119.00 (-0.83 %) flipkart

india 231,001.00 (0.00 %) frick india 3,500.00 (2.94 %) gkn drive 1,090.00 (-0.91 %) go digit general insurance ltd 354.00 (1.14 %) godavari bio 71.00 (1.43 %) hdb financial 640.00 (0.79 %) hdfc ergo 370.00 (1.70 %) hdfc securities 10,111.00 (2.13 %) hella india 400.00 (2.56 %) hero fincorp 1,000.00 (1.01 %) hexaware 515.00 (0.98 %) hicks 1,700.00

(-0.58 %) hira ferro 120.00 (-0.83 %) honeywell electrical 3,333.00 (-1.97 %) icex 0.10 (-0.10 %) incred financial 100.00 india carbon 945.00 (-0.53 %) india exposition 144.00 (-1.37 %) indian potash 1,390.00 (-0.71 %) indofil 710.00 (-2.34 %) infinite computer 405.00 (1.25 %) inkel 12.00 (-1.64 %) ixigo 88.00 (-1.12 %) jana sfbl 75.00 kel 530.00 (-1.85

%) kial 104.00 (-0.95 %) klm axiva 17.50 (-1.13 %) kurlon limited 310.00 (1.31 %) lava 97.00 (-5.83 %) manipal housing 72.50 (0.69 %) manjushree tech 930.00 (3.33 %) martin & harris 1,080.00 (-1.82 %) merino 2,530.00 (-0.78 %) minosha 282.00 (0.71 %) mitsubishi heavy 355.00 (1.43 %) mkcl 345.00 (1.47 %) mobikwik 360.00 (2.86 %) mohan

meakin 1,450.00 (3.57 %) mohfl 11.00 (3.77 %) msei 0.91 (-1.09 %) msil 55.00 (1.85 %) nayara energy 180.00 (2.86 %) nayara energy ncd 255.00 (-1.92 %) ncdex 275.00 ncl buildtek 215.00 (2.38 %) ncl holdings 60.00 (3.45 %) nse 3,100.00 (-0.80 %) orbis financial 82.00 (2.50 %) oswal minerals 65.00 (1.56 %) otis 3,500.00 (-2.78 %) oyo 64.00 (-1.54

%) panasonic appliances 295.00 (0.68 %) panasonic avc 29.10 (0.34 %) paymate india 530.00 (-1.85 %) pharmeasy 22.00 (-2.22 %) philips 980.00 (0.10 %) philips domestic 550.00 (0.92 %) pnb metlife 70.00 proyuga adtech 25.00 purity flexpack 20.00 ramaraju surgical 320.00 (3.23 %) rasoi 31,500.00 (0.32 %) reliance gic 340.00 resins plastics 420.00

(2.44 %) ring plus 404.00 (-0.25 %) rrl 2,450.00 (2.08 %) sab miller 305.00 (0.66 %) sbi amc 900.00 (-1.10 %) scottish assam 443.00 (-1.56 %) shriram life 261.00 (0.38 %) sigachi lab 39.00 (-2.74 %) signify 1,300.00 (4.00 %) simpson & company 1,000,000.00 smile micro 52.00 (-1.89 %) sportskeeda 3,303.00 sterlite power 470.00 (2.17 %) studds

790.00 (-1.25 %) svsml 430.00 (-2.27 %) swiggy 361.00 (0.28 %) t stanes 750.00 (2.74 %) tata capital 175.00 (2.94 %) tata tech 855.00 (0.59 %) teesta agro 81.00 (1.25 %) trl krosaki 1,255.00 (0.40 %) utkarsh core 135.00 (-1.46 %) vikram solar 350.00 (2.94 %) Swiggy, India’s top food delivery startup, has raised $700 million in a new financing round,

just six months after securing $1.25 billion, as it aggressively expands its offerings, including the instant-delivery service in the South Asian market. Invesco led the Bengaluru-headquartered startup’s Series K round, which according to a source familiar with the matter values the seven-year-old startup at $10.7 billion. Swiggy was valued at $5.5

billion in July last year. At a $10.7 billion valuation, Swiggy has surpassed the valuation of its 13-year-old chief rival Zomato, which went public last year and whose market cap has shrunk to less than $10 billion. New investors Baron Capital Group, Sumeru Venture, IIFL AMC Late Stake Tech Fund, Kotak, Axis Growth, Sixteenth Street Capital,

Ghisallo, Smile Group and Segantii Capital as well as existing backers including Prosus Ventures, Alpha Wave Global, Qatar Investment Authority and ARK Impact also invested in the new round. TechCrunch reported in late September that Invesco was in talks to lead an investment of over $500 million in Swiggy. The new funding follows a strong

year of growth for Swiggy in which the startup nearly doubled its food delivery business’ gross order value, it said. oxo meat thermometer manual Instamart, Swiggy’s instant delivery service, is set to reach an annual GMV run rate of $1 billion in the next three quarters, the startup said. Instamart has become one of the major focus areas for Swiggy

in the past year and a half. 45575681059.pdf The startup, which operates in more than 500 Indian cities, said last year that it plans to invest $700 million to scale Instamart’s offerings and reach. The quick delivery space, which has made inroads in several markets in recent years, is becoming competitive in India, too. Y Combinator Continuity Fund

led the Mumbai-headquartered 10-minute-delivery service Zepto’s $100 million funding late last year. Zomato-backed BlinkIt (formerly known as Grofers), which like Swiggy is also backed by SoftBank, pivoted to instant delivery space last year. “As long-term investors, the Invesco Developing Markets fund seeks investment opportunities in the best

companies in the world, led by world-class management teams, and that have the potential for long-term structural growth,” Justin Leverenz, chief investment officer at Invesco Developing Markets Fund, said in a statement. “Our investment in Swiggy represents such an investment.” Sriharsha Majety, co-founder and chief executive of Swiggy, said

Instamart has reached a GMV in just 17 months what it took the core food delivery business 40 months to deliver. “Our goal is to make Swiggy the platform that 100 million consumers can use 15 times a month.

We will continue to invest in our people, products, and partners to create a positive impact on the ecosystem and accelerate the digital transformation in food and grocery delivery and other on-demand services,” he added. At stake is India’s food services market, which is expected to reach $97 billion by March of 2026, analysts at Bernstein wrote in a

report to clients last year.

“India food services market is large and expected to reach $97 billion by FY25. Organized food service is growing faster and expected to reach 55% market share by FY25. We expect online penetration to expand to 20% by FY25 and market size to reach $20 billion growing at 46% CAGR. Significant part of the growth will be driven by new customer

acquisition and penetration into smaller markets. Zomato had 10 million monthly transacting users (MTU) in FY20, expected to increase 5x by FY25 to ~50 million,” they wrote. Amazon, a third player, has also entered the food delivery space in India in recent years, but, as a Zomato executive mentioned in a public forum last year, the American e-

commerce group has yet to make inroads in this category.

You might also like

- E-Commerce Start-Up Business PlanDocument45 pagesE-Commerce Start-Up Business PlanFawad Ahmad Khan50% (2)

- ID VC DatabaseDocument106 pagesID VC DatabaseAnthony RezaNo ratings yet

- Is Starting A Business Right For YouDocument33 pagesIs Starting A Business Right For YouSorom ComputerNo ratings yet

- Group1 - Balkrishna Industries TyresDocument6 pagesGroup1 - Balkrishna Industries TyresparthkosadaNo ratings yet

- Click2Clinic Malaysia - IMDocument61 pagesClick2Clinic Malaysia - IMAnonymous RxWzgONo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- ET Sample Questions - SolnDocument4 pagesET Sample Questions - SolnShivamNo ratings yet

- Bse Midcap SelectDocument3 pagesBse Midcap SelectYatrikNo ratings yet

- Daily Trade Journal - 30.01.2014Document6 pagesDaily Trade Journal - 30.01.2014Randora LkNo ratings yet

- Narnolia Securities Limited Market Diary 13.1.2014Document6 pagesNarnolia Securities Limited Market Diary 13.1.2014Narnolia Securities LimitedNo ratings yet

- Market Outlook 29th August 2011Document4 pagesMarket Outlook 29th August 2011Angel BrokingNo ratings yet

- FCF AnalysisDocument2 pagesFCF AnalysisSeulgi MoonNo ratings yet

- Equity Premium Daily Journal-1st November 2017, WednesdayDocument13 pagesEquity Premium Daily Journal-1st November 2017, WednesdaySiddharth PatelNo ratings yet

- Current Holding ReportDocument1 pageCurrent Holding Reportnikhilesh singhNo ratings yet

- Conceptual AssignmentDocument3 pagesConceptual AssignmentAmitavNo ratings yet

- Porfolio Rebalancing ReportDocument3 pagesPorfolio Rebalancing ReportAayushi ChandwaniNo ratings yet

- MOJO Stock SmallcapDocument3 pagesMOJO Stock SmallcapAnonymous Clm40C1No ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- Market 1Document2 pagesMarket 1YatrikNo ratings yet

- MarutiSuzuki Financial AnalysisDocument20 pagesMarutiSuzuki Financial AnalysisSushant TanejaNo ratings yet

- English: Log in Sign UpDocument24 pagesEnglish: Log in Sign Upanon_267862261No ratings yet

- Sectors That'll Perform Considering All The Macro-Economic FactorsDocument11 pagesSectors That'll Perform Considering All The Macro-Economic FactorsADITYA RANJANNo ratings yet

- Fin Analysis - Tvs Motor CompanyDocument16 pagesFin Analysis - Tvs Motor Companygarconfrancais06No ratings yet

- Daily Trade Journal - 19.08.2013Document6 pagesDaily Trade Journal - 19.08.2013Randora LkNo ratings yet

- Titan Industries Limited: 5 August 2009Document51 pagesTitan Industries Limited: 5 August 2009dilippalaiNo ratings yet

- Daily Trade Journal - 27.03.2014Document6 pagesDaily Trade Journal - 27.03.2014Randora LkNo ratings yet

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkNo ratings yet

- Enigma PitchDocument17 pagesEnigma PitchUmangNo ratings yet

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Daily Trade Journal - 31.10.2013Document6 pagesDaily Trade Journal - 31.10.2013Randora LkNo ratings yet

- Accounts - TATA GroupDocument66 pagesAccounts - TATA GroupluvjandialNo ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- Final Year Project NiftyDocument16 pagesFinal Year Project NiftyManish BarnwalNo ratings yet

- Project Report at Market ReserchDocument179 pagesProject Report at Market ReserchGagan preetNo ratings yet

- Corporate 1Document10 pagesCorporate 1Adeel AhmadNo ratings yet

- ICICI Prudential Life InsuranceDocument3 pagesICICI Prudential Life InsuranceArjun BhatnagarNo ratings yet

- Weekly Foreign Holding Update - 11 01 2013Document2 pagesWeekly Foreign Holding Update - 11 01 2013ran2013No ratings yet

- Teaching Board Unit 2Document15 pagesTeaching Board Unit 2Rashi Aneja 2027455No ratings yet

- Daily Trade Journal - 29.07.2013Document6 pagesDaily Trade Journal - 29.07.2013Randora LkNo ratings yet

- Operations Management Issues For A Sanitary Napkin MakerDocument18 pagesOperations Management Issues For A Sanitary Napkin Makerpulakguy100% (1)

- Daily Trade Journal - 10.02.2014Document6 pagesDaily Trade Journal - 10.02.2014Randora LkNo ratings yet

- Cse Daily On 28 06 2012Document15 pagesCse Daily On 28 06 2012colomboanalystNo ratings yet

- Daily Trade Journal - 26.08.2013Document6 pagesDaily Trade Journal - 26.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 11.03.2014Document6 pagesDaily Trade Journal - 11.03.2014Randora LkNo ratings yet

- SFAD Excel Project SheetDocument14 pagesSFAD Excel Project SheetMansoor ArshadNo ratings yet

- Investment Scenario in Indian Auto Auto Ancillary Industry/1057Document4 pagesInvestment Scenario in Indian Auto Auto Ancillary Industry/1057Koustav S Mandal0% (1)

- Barings To Miami Pension PlanDocument25 pagesBarings To Miami Pension Planturnbj75No ratings yet

- Stock Market Today Before Opening Position As of 26th Dec 2013 With Top NEWS DetailsDocument4 pagesStock Market Today Before Opening Position As of 26th Dec 2013 With Top NEWS DetailsNarnolia Securities LimitedNo ratings yet

- Daily Trade Journal - 31.01.2014Document6 pagesDaily Trade Journal - 31.01.2014Randora LkNo ratings yet

- Daily Trade Journal - 22.04.2014Document6 pagesDaily Trade Journal - 22.04.2014Randora LkNo ratings yet

- Ipo Performance of BDDocument17 pagesIpo Performance of BDAbhijit SahaNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- IIFL Report Top Large Cap Mid Cap Dark Horse StocksDocument27 pagesIIFL Report Top Large Cap Mid Cap Dark Horse StockspuneetdubeyNo ratings yet

- Crossings Boosted Turnover Adding 75% Amidst ASPI RallyDocument6 pagesCrossings Boosted Turnover Adding 75% Amidst ASPI RallyRandora LkNo ratings yet

- BSE Top 100 CompaniesDocument2 pagesBSE Top 100 CompaniesYatrikNo ratings yet

- Weekly Special Report of CapitalHeight 23 July 2018Document11 pagesWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNo ratings yet

- Capital Market PDF IndiaDocument24 pagesCapital Market PDF India187190No ratings yet

- No Company Name (Company Code) NSE Price BSE PriceDocument6 pagesNo Company Name (Company Code) NSE Price BSE PriceDr.Nilesh NakhawaNo ratings yet

- Private Entity Report On Nelcast Courtesy - RMSDocument26 pagesPrivate Entity Report On Nelcast Courtesy - RMSNag Raj RagamNo ratings yet

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- Unit-5 New Venture Expansion Strategies & IssuesDocument26 pagesUnit-5 New Venture Expansion Strategies & IssuesHimadhar SaduNo ratings yet

- Summer Internship Report: Richa Gupta (MBA 2 Year)Document11 pagesSummer Internship Report: Richa Gupta (MBA 2 Year)Gitanjali SinghNo ratings yet

- Business Studies Student GuideDocument69 pagesBusiness Studies Student GuideVivienne WrightNo ratings yet

- BhavikaDocument32 pagesBhavikasarthakNo ratings yet

- HM Group Sustainability Disclosure 2021Document74 pagesHM Group Sustainability Disclosure 2021Joaquin Cercado AparicioNo ratings yet

- Canadian Entrepreneurship and Small Business Management Canadian 9th Edition Balderson Test BankDocument36 pagesCanadian Entrepreneurship and Small Business Management Canadian 9th Edition Balderson Test Bankaliasfranklawxexb3x100% (28)

- ENTREP EXAM QUARTER 2 2023 2024 For PrintDocument6 pagesENTREP EXAM QUARTER 2 2023 2024 For Printcarlo deguzmanNo ratings yet

- Mobilising Resources MinakshiDocument23 pagesMobilising Resources MinakshimalarshinesNo ratings yet

- Series A, B, C Funding: How It WorksDocument2 pagesSeries A, B, C Funding: How It WorksSachin KhuranaNo ratings yet

- The Data-Driven Enterprise: by Mark Schwartz, Enterprise Strategist, AWSDocument18 pagesThe Data-Driven Enterprise: by Mark Schwartz, Enterprise Strategist, AWSSridhar KrishnamurthiNo ratings yet

- L3-O'reilly, Binns - 2019 - The Three Stages of Disruptive Innovation Idea Generation, Incubation, and ScalingDocument24 pagesL3-O'reilly, Binns - 2019 - The Three Stages of Disruptive Innovation Idea Generation, Incubation, and ScalinghuangNo ratings yet

- Powerpoint Business PlanDocument19 pagesPowerpoint Business PlanMoslimahNo ratings yet

- Level 5 Diploma in Business and Enterprise (Marketing Management)Document5 pagesLevel 5 Diploma in Business and Enterprise (Marketing Management)GibsonNo ratings yet

- What Causes Small Businesses To Fail?: Eleven Common Causes of FailureDocument11 pagesWhat Causes Small Businesses To Fail?: Eleven Common Causes of FailureZelalem JemereNo ratings yet

- Final Examination For Entrepreneurship: Micro Link Information Technology & Business College Department of ManagementDocument6 pagesFinal Examination For Entrepreneurship: Micro Link Information Technology & Business College Department of ManagementHenok AliNo ratings yet

- Marketing For StartupDocument489 pagesMarketing For StartupakhilkgNo ratings yet

- Critial Startup SucessDocument6 pagesCritial Startup SucessFull SheBang FuntimeNo ratings yet

- Kerala Industrial and Commercial PolicyDocument40 pagesKerala Industrial and Commercial PolicySAURAV AJAINo ratings yet

- Example of Business Plan in Ethiopia PDFDocument22 pagesExample of Business Plan in Ethiopia PDFfikru Assegid100% (2)

- EGBS4 KolchinskyDocument98 pagesEGBS4 Kolchinskyswapnil_sahoo_1No ratings yet

- 3rd Semester SyllabusDocument40 pages3rd Semester SyllabusVkook ForeverNo ratings yet

- SHGDocument4 pagesSHGsurya_rathiNo ratings yet

- What Is A StartupDocument2 pagesWhat Is A StartupStevenNo ratings yet

- Niir Mumbai Companies Directory Database XLSX Excel Format 5th EditionDocument2 pagesNiir Mumbai Companies Directory Database XLSX Excel Format 5th Editionphone25hire phone25hireNo ratings yet

- Assignment 1 Front SheetDocument18 pagesAssignment 1 Front SheetKhanh LynhNo ratings yet

- Entrepreneurship - Chapter 1 - Introduction and Background ConceptsDocument23 pagesEntrepreneurship - Chapter 1 - Introduction and Background Conceptsrita tamohNo ratings yet