Professional Documents

Culture Documents

Bank Statement

Bank Statement

Uploaded by

rk7vzkvh9jCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Statement

Bank Statement

Uploaded by

rk7vzkvh9jCopyright:

Available Formats

Page 1 of 3

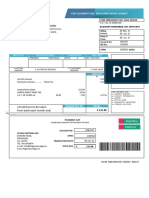

Statement number 23

Issue date 7 July 2023

MR M R ALI Write to us at Box 3 BX1 1LT

263 SETTLE STREET Call us on 0345 300 0000

BOLTON Visit us online www.lloydsbank.com

LANCASHIRE

BL3 3DW

yTPYRvyYVuyRTYyTTx

jaAP;7nScoE2OiE:oc Your Branch BOLTON HALLIWELL

uYhSgxmd4oN4Pk9HU4

oUGrB2EIAkL9gGsTSi

ocZofkCmxkON1NjK94 Sort Code 77-02-14

zzzzzzzzzzzzzzzzzz

Account Number 31829368

IBAN GB78 LOYD 7702 1431 8293 68

BIC LOYDGB21T25

CLASSIC 09 June 2023 to 07 July 2023

Your Account

Date of previous statement 08 June 2023

Balance on 09 Jun 2023 £1,132.98

Money in £2,312.54

Money out £2,142.21

Balance on 07 Jul 2023 £1,303.31

Arranged overdraft interest £0.00

You should review your account regularly to check whether it

remains appropriate for your circumstances.

Fees Explained

Club Lloyds Account Holders – The Club Lloyds maintaining the account fee will be shown in the transactions overleaf as ‘'Club Lloyds fee’. If you are eligible to have

this Maintaining the account fee waived, you will also see a transaction described as ‘'Club Lloyds waived’. This does not apply to non-Club Lloyds customers.

Other services - There are fees for other services you have asked for. You can find more details in your account conditions or at www.lloydsbank.com.

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

Things you need to know

Getting in touch

J Write to us: Lloyds Bank,

PO Box 1, BX1 1LT Q Visit us in branch K Go online:

lloydsbank.com/contactus f Call: 0345 300 0000

8am-8pm, 7 days a week

Ways to manage your account About the fees we charge if you use your card abroad

Keep track of what's going in and coming out of your account at any time using: Personal Debit and Cashpoint® Card Charges - If you use your card to withdraw

• Internet Banking – View and manage your accounts online - 24 hours a day, 7 cash or make a payment in a currency other than pounds, the amount is converted

days a week. Register at lloydsbank.com/internetbanking to pounds on the day it is processed by Visa using the Visa Payment Scheme

• Mobile Banking – Manage your account on the go with your mobile phone or exchange rate on the day. You can find the exchange rate by calling

tablet - 24 hours a day, 7 days a week. Download our app from Google Play or 0345 300 0000 (+44 1733 347 007 from overseas). If your account is held in the

the App Store. Channel Islands or Isle of Man, call 0345 744 9900 (+44 1539 736626 from

overseas). If you call before the transaction is processed the rate provided will be

• Telephone Banking – Our automated service is available 24/7, or you can talk

an indication only.

to us between 8am and 8pm, 7 days a week. Not all services are available 24

hours a day, 7 days a week. We will charge you a foreign currency transaction fee of 2.99% of the value of the

• Text Alerts – We can also send you mobile alerts. Alerts can help you manage transaction. This is a fee for the currency conversion. You can find more

your money and avoid charges. They remind you when you need to pay cleared information on our website about the exchange rates that apply to your

funds into your account. They can also help you avoid going into an transaction to help you compare them with other card issuers' rates.

unarranged overdraft or having payments refused. Unless you’ve opted out, If you use your debit card or your Cashpoint® card to withdraw cash in a currency

you’ll automatically receive alerts provided we have an up to date mobile other than pounds (at a cash machine or over the counter) we will also charge a

number for you. Find out more at lloydsbank.com/mobilealerts foreign currency cash fee of £1.50. Where you elect to allow the cash machine

operator/financial service provider to make the conversion to pounds we will only

Overdrafts - choosing the right way to borrow charge a foreign cash fee of £1.50. The provider of the foreign currency may make

An arranged overdraft can help out when you need to borrow in the short term. For a separate charge for conversion. We won't charge a foreign currency cash fee or a

example to pay an unexpected bill. But if you use it often and don’t reduce your foreign cash fee if you withdraw euro within the EEA or UK.

balance, it can turn into an expensive way to borrow. Our cost calculator, which you

can find online at lloydsbank.com/overdrafts, tells you how much an arranged Where you use your debit card to make a purchase or other transaction (not cash

overdraft costs. You should consider if an arranged overdraft facility is the most withdrawal) in a currency other than pounds, whether in person, or by internet or

suitable option for you to borrow money. If you need to borrow money for a longer phone, we will also charge a £0.50 foreign currency purchase fee. The foreign

time, there may be other options better suited to your needs. For more information currency purchase fee does not apply to the Premier and Platinum debit cards; and

visit lloydsbank.com/borrow or call us to talk through your options. will not be charged if your payment is made in euro within the EEA or UK.

We will not make a charge for the withdrawal of cash in pounds within the UK,

Check if your account is still right for you however, the owner of a non-Lloyds Bank cash machine may. Other charges apply,

Your banking needs can change over time so it’s important to check your account is please see the banking charges guide for details.

still right for you by visiting lloydsbank.com/currentaccounts to see our latest

With Travel Smart you can use your debit card abroad as often as your like with no

current accounts.

debit card fees for £7 a week. Add it to your account before you travel and it’ll start

Our interest rates on the date you tell us.

If we pay interest on your balance, your current interest rate is shown on the front of Keeping your data safe

this statement. To find out what the interest rates are on our other accounts, visit

We promise to keep your personal information safe and only use in the way you’ve

lloydsbank.com/current-accounts/rates. Alternatively ask us in branch.

asked. See our privacy notice at lloydsbank.com/privacy or call us for a copy on

0345 602 1997.

JProtecting yourself from fraud We’re here for you if something isn’t right

• Check your statements regularly - If something doesn’t look right or you We want to make sure you’re happy with the products and service we offer. But if

spot a transaction on your statement you didn’t make, call us straight away something goes wrong, let us know and we’ll do everything we can to put things

on 0800 917 7017 or +44 207 4812614 if outside the UK. We may not be right. If you’re still not happy, you can ask the Financial Ombudsman Service to look

able to refund a payment on some types of account if you tell us more than at your concerns, for free.

13 months after the date it happened.

• Keep your statements in a safe place - If you want to throw them away, you The Financial Services Compensation Scheme (FSCS)

should do it in a secure way, like shredding them – please don’t just put them The deposits you hold with us are covered by the Financial

in the bin. Services Compensation Scheme (FSCS). Every year we’ll

send you an information sheet which tells you the types of

• Helping you stay protected - We’ll do all we can to help you avoid fraud. Visit

deposits covered and the protection offered by the FSCS.

lloydsbank.com/security for ways to protect yourself and information on

For more information visit FSCS.org.uk

the latest scams.

• If your card, cheque book or PIN is lost or stolen - Call us straight away on We send statements and other communications from time to time for legal

0800 096 9779 or +44 1702 278 270 if outside the UK – lines are open reasons or to let you know about changes to your accounts or services.

24/7. When you call us your call may be monitored or recorded in case we need to check

• The freeze card feature in our Mobile Banking app lets you quickly freeze and we have carried out your instructions correctly and to help improve our quality of

unfreeze different types of transaction on your cards whenever you need to. service.

Find out more at

lloydsbank.com/help-guidance/customer-support/lost-or-stolen-cards

If your vision is impaired – please contact us for an alternative

format such as large print, Braille or audio CD.

If your hearing or speech is impaired – you can contact us using the Relay UK Service or via Textphone on 0345 300 2281 (lines are open 24 hours a

day, 7 days a week). SignVideo services are also available if you're Deaf and use British Sign Language at lloydsbank.com/signvideo

Lloyds Bank plc. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 2065 Lloyds Bank plc is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.

Fair lending – we adhere to The Standards of Lending Practice which are monitored and enforced by the LSB: www.lendingstandardsboard.org.uk

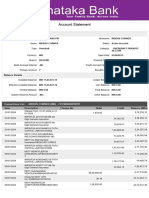

Statement No. 23 Sort Code 77-02-14

07 July 2023 Account Number 31829368

Page 3 of 3

CLASSIC

Your Transactions

Date Pmnt Details Money Out (£) Money In (£) Balance (£)

Type

08 Jun 23 STATEMENT OPENING BALANCE 1,132.98

09 Jun 23 BGC JUST EAT.CO.UK LTD 246.16 1,379.14

12 Jun 23 DEB GOOGLE *Google Sto CD 2423 10JUN23 1.59 1,377.55

12 Jun 23 FPO DANISH MUHAMMAD NA FRIEND 10JUN23 1.00 1,376.55

20:28

12 Jun 23 FPO DANISH MUHAMMAD NA FRIEND 10JUN23 500.00 876.55

20:29

12 Jun 23 DEP P.O. 45 PEEL HALL 500.00 1,376.55

15 Jun 23 FPO TOYYAB JAWED FRIEND 15JUN23 17:43 15.00 1,361.55

16 Jun 23 FPO AFTAB CURRENCY EXC A0406000021884458 280.00 1,081.55

16JUN23 13:07

16 Jun 23 FPO AFTAB CURRENCY EXC A0406000021884884 280.00 801.55

16JUN23 13:23

19 Jun 23 FPO MR M R ALI MY OTHER ACCOUNT 17JUN23 300.00 501.55

13:14

20 Jun 23 FPI AFTAB CURRENCY EXC A0406000021884458 280.00 781.55

ff7bbf2d09194064ae

22 Jun 23 FPO REMITLY UK R61297728006 22JUN23 10:04 162.99 618.56

23 Jun 23 BGC JUST EAT.CO.UK LTD 30.44 649.00

26 Jun 23 DEB HOLLYWOOD BOWL CD 2423 15.70 633.30

28 Jun 23 DEB BKW FOODSTORES LTD CD 2423 79.94 553.36

30 Jun 23 BGC JUST EAT.CO.UK LTD 80.73 634.09

30 Jun 23 FPI ALI MUHAMMAD MY ANOTHER ACCOUNT 1,000.00 1,634.09

FP23181O12713608

03 Jul 23 DEB ZEGO UK CD 2423 02JUL23 5.00 1,629.09

03 Jul 23 FPO MR MUHAMMAD AWAIS FRIEND 02JUL23 23:35 1.00 1,628.09

03 Jul 23 FPO HUSSAIN F FRIEND 03JUL23 14:56 250.00 1,378.09

04 Jul 23 FPO REMITLY UK R83542752040 04JUL23 15:47 99.99 1,278.10

05 Jul 23 FPI MUSTAFA M A FRIEND RP4659989698903300 80.00 1,358.10

05 Jul 23 FPO LEE J DUNSMORE MUHAMMAD AWAIS 05JUL23 150.00 1,208.10

19:39

07 Jul 23 BGC JUST EAT.CO.UK LTD 95.21 1,303.31

07 Jul 23 STATEMENT CLOSING BALANCE 2,142.21 2,312.54 1,303.31

Payment types:

BGC - Bank Giro Credit FPO - Faster Payment DEP - Deposit FPI - Faster Payment

DEB - Debit Card

Transaction Details

The "Details" column in your statement shows the date that a Debit Card payment has come into or out of your account only if that

happened on a weekend or a Bank Holiday.

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

You might also like

- Bank StatementDocument2 pagesBank Statementrk7vzkvh9j100% (1)

- Bill 10296080Document1 pageBill 10296080luminitamihai775No ratings yet

- ElectricDocument2 pagesElectrickasmarproNo ratings yet

- So Energy BillDocument1 pageSo Energy BillPhill LivesleyNo ratings yet

- Wells Fargo Everyday CheckingDocument8 pagesWells Fargo Everyday CheckingCharlotte Power Sports AcademyNo ratings yet

- MyTW Bill 900061048927 08 09 2023Document7 pagesMyTW Bill 900061048927 08 09 2023Âvíjít ßhãrãtìNo ratings yet

- 5 6217778743729982038 PDFDocument3 pages5 6217778743729982038 PDFdyadik24No ratings yet

- Statement 21-APR-23 AC 73219674 23081839Document3 pagesStatement 21-APR-23 AC 73219674 23081839g6psbtnb87No ratings yet

- Just Eat AugustDocument1 pageJust Eat Augustrk7vzkvh9jNo ratings yet

- Virgin Media EBillDocument9 pagesVirgin Media EBillTomNo ratings yet

- United Kingdom Scottish HydroDocument1 pageUnited Kingdom Scottish HydroNikita TishchenkoNo ratings yet

- NBS Bank Statement Dec 2022Document2 pagesNBS Bank Statement Dec 2022Eric CartmanNo ratings yet

- Gregory L Carlo Francesco Shaw - e OnDocument3 pagesGregory L Carlo Francesco Shaw - e OnMOHAMMAD NAZRUL ISLAMNo ratings yet

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocument5 pagesYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodLao TruongNo ratings yet

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocument12 pagesOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoNo ratings yet

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- Statement PDFDocument7 pagesStatement PDFSamir GhimireNo ratings yet

- Arnott +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDFDocument4 pagesArnott +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDF13KARATNo ratings yet

- Power NI: Welcome ToDocument14 pagesPower NI: Welcome TovictorcpkNo ratings yet

- Preview 2Document3 pagesPreview 2g6psbtnb87No ratings yet

- Classic 01 August 2019 To 08 August 2019: Your AccountDocument5 pagesClassic 01 August 2019 To 08 August 2019: Your AccountHuszár PicsaNo ratings yet

- Utility BillDocument2 pagesUtility BillHadi GhamarzadehNo ratings yet

- MyTW Bill 900033141206 10 12 2020Document2 pagesMyTW Bill 900033141206 10 12 2020violetaNo ratings yet

- Invoice 2024 02 02Document2 pagesInvoice 2024 02 02Vitalii PrisacariNo ratings yet

- SimiomDocument4 pagesSimiombrananton070No ratings yet

- Hello Loredana: Have You Heard The News? You'Re in Control With My EeDocument3 pagesHello Loredana: Have You Heard The News? You'Re in Control With My EeLoredana MarcelNo ratings yet

- Virgin Media Bill UKDocument2 pagesVirgin Media Bill UKwarrenad977No ratings yet

- 546480174-Bill-2021-10-04-2 2Document4 pages546480174-Bill-2021-10-04-2 2Nina StefanovaNo ratings yet

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDocument2 pagesDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNo ratings yet

- YourBTbill 15042024Document3 pagesYourBTbill 15042024tranejones763No ratings yet

- Dent Eimear LindaDocument4 pagesDent Eimear LindaITNo ratings yet

- Wiac - Info PDF Thames Water BillDocument3 pagesWiac - Info PDF Thames Water BillShiraz MushtaqNo ratings yet

- Scottishpower - Co.uk/ Getintouch 0345 270 0700: Account NumberDocument6 pagesScottishpower - Co.uk/ Getintouch 0345 270 0700: Account NumberIlluminated By LightNo ratings yet

- Norway Clean Energy Invest ASDocument1 pageNorway Clean Energy Invest ASAserNo ratings yet

- JanniDocument2 pagesJanniPedroManuelBaptista100% (1)

- Ireland Flogas Natural GasDocument1 pageIreland Flogas Natural GasMyt WovenNo ratings yet

- RevolutDocument6 pagesRevolutAndré SilvaNo ratings yet

- A 2d87ed76 175382523 1Document3 pagesA 2d87ed76 175382523 1Danut NechitaNo ratings yet

- Bill 1708790581Document2 pagesBill 1708790581NikNo ratings yet

- Account Statement - 2024 01 01 - 2024 01 31 - en Ie - 181bf2Document1 pageAccount Statement - 2024 01 01 - 2024 01 31 - en Ie - 181bf2stom41230No ratings yet

- NEW Higginbotham-Jonespreview +++ - HALIFAXDocument4 pagesNEW Higginbotham-Jonespreview +++ - HALIFAX13KARATNo ratings yet

- ViewEpsiiaEStatementDetail PDFDocument6 pagesViewEpsiiaEStatementDetail PDFsjeyarajah21No ratings yet

- Hello Derek: Have You Heard The News? You'Re in Control With My EeDocument3 pagesHello Derek: Have You Heard The News? You'Re in Control With My Eederek49cleanerNo ratings yet

- Your Electricity Bill at A Glance: Total Due 149.63Document2 pagesYour Electricity Bill at A Glance: Total Due 149.63ITNo ratings yet

- YourBTbill - 12042019 (BilDocument6 pagesYourBTbill - 12042019 (BilJN AdingraNo ratings yet

- File PDFDocument1 pageFile PDFScumpyk VioNo ratings yet

- 20 Aug 2020 Bulb StatementDocument4 pages20 Aug 2020 Bulb StatementBrandon HurstNo ratings yet

- Mobile BillDocument1 pageMobile Billvittoriogrossi87No ratings yet

- Statement 19-APR-23 AC 73929213 21041533Document3 pagesStatement 19-APR-23 AC 73929213 21041533FahimNo ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- CurentDocument3 pagesCurentOmnidesk AndroidNo ratings yet

- Silver Account 06 December 2021 To 06 June 2022: Abuzeid Huda AliDocument2 pagesSilver Account 06 December 2021 To 06 June 2022: Abuzeid Huda Alimohamed elmakhzniNo ratings yet

- My Document PDFDocument2 pagesMy Document PDFTuri TuriNo ratings yet

- Eonnext Statement 2022 12 04Document3 pagesEonnext Statement 2022 12 04ying yingNo ratings yet

- Gas Copy Copy 2Document1 pageGas Copy Copy 2Nina StefanovaNo ratings yet

- Hello Lemonia: Direct Debit - The Easy Way To Pay You'Re in Control With My EeDocument5 pagesHello Lemonia: Direct Debit - The Easy Way To Pay You'Re in Control With My EeLemonia Marina RempoutsikaNo ratings yet

- BillDocument8 pagesBilljackrobson38100% (1)

- Assured Shorthold Tenancy AgreementDocument1 pageAssured Shorthold Tenancy Agreementfuddy luziNo ratings yet

- Bill 6Document3 pagesBill 6Lee SharpNo ratings yet

- Council TaxDocument1 pageCouncil Taxsteve.hartNo ratings yet

- 11 Appendix J B 1st-31st March 2020 - 2Document2 pages11 Appendix J B 1st-31st March 2020 - 2Adita DayNo ratings yet

- AST Tenancy Agreement - TDS - Landlord RentDocument42 pagesAST Tenancy Agreement - TDS - Landlord RentGareth McKnightNo ratings yet

- Preview PDFDocument7 pagesPreview PDFBasil SrayihNo ratings yet

- Mortimer +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDFDocument4 pagesMortimer +++ 467786300-Utility-Bil-Svetlana-Koturova-1-1 PDF13KARATNo ratings yet

- Classic 07 June 2023 To 06 July 2023: Your AccountDocument5 pagesClassic 07 June 2023 To 06 July 2023: Your AccountAlexandru BuscaNo ratings yet

- Preview 11Document3 pagesPreview 11Harry TiwanaNo ratings yet

- MR RazaDocument3 pagesMR Razark7vzkvh9jNo ratings yet

- Screenshot 2022-09-05 at 13.41.55Document1 pageScreenshot 2022-09-05 at 13.41.55rk7vzkvh9jNo ratings yet

- TuesdayDocument1 pageTuesdayrk7vzkvh9jNo ratings yet

- HM Revenue 2Document1 pageHM Revenue 2rk7vzkvh9jNo ratings yet

- Your Low Driving Score Means We'll Cancel Your Policy On 15th November 2023Document2 pagesYour Low Driving Score Means We'll Cancel Your Policy On 15th November 2023rk7vzkvh9jNo ratings yet

- 0815 Drug Store & Business Management MCQ Question Bank: AnswerDocument7 pages0815 Drug Store & Business Management MCQ Question Bank: AnswerSunita Chillarge100% (1)

- MCQ FA1 TenDocument12 pagesMCQ FA1 TenZeeshan BakaliNo ratings yet

- 14 NPC MD106Document89 pages14 NPC MD106Yagya0% (1)

- Metropolitan Bank & Trust Company v. CA, GR No. 88866, February 18, 1961Document8 pagesMetropolitan Bank & Trust Company v. CA, GR No. 88866, February 18, 1961RPSA CPANo ratings yet

- MCQs - 6Document10 pagesMCQs - 6gfxexpert36No ratings yet

- Punjab National BankDocument28 pagesPunjab National Bankgauravdhawan1991No ratings yet

- Pallavi ProjectDocument44 pagesPallavi ProjectPallavi GargNo ratings yet

- Skripta Engleski Jezik 1 PDFDocument109 pagesSkripta Engleski Jezik 1 PDFOana AurelNo ratings yet

- Cash and Cash Equivalents: Philippine Accounting Standards Melanie C. LazarteDocument19 pagesCash and Cash Equivalents: Philippine Accounting Standards Melanie C. LazarteDebbie Grace Latiban LinazaNo ratings yet

- Banker-Customer RelationshipDocument17 pagesBanker-Customer RelationshipAdharsh VenkatesanNo ratings yet

- Wah Yan Credit Card Autopay FormDocument1 pageWah Yan Credit Card Autopay FormWahYanOneFamily100% (1)

- TOA Midterm Exam 2010Document22 pagesTOA Midterm Exam 2010Patrick WaltersNo ratings yet

- OpTransactionHistoryUX302 02 2024Document56 pagesOpTransactionHistoryUX302 02 2024avijitghosh775No ratings yet

- Evidence Digests Part 5Document59 pagesEvidence Digests Part 5Ahmad Arip50% (2)

- Virtual Wallet Fine PrintDocument34 pagesVirtual Wallet Fine PrintDeanthony WilliamsNo ratings yet

- .S.3 Commerce - 1630400614000Document74 pages.S.3 Commerce - 1630400614000Ssonko EdrineNo ratings yet

- Use Case DiagramDocument42 pagesUse Case DiagramUMM E RUBABNo ratings yet

- TDCT Accounts FSTDocument10 pagesTDCT Accounts FSTAlex ANo ratings yet

- B2 UNIT 5 Grammar Communication PDFDocument1 pageB2 UNIT 5 Grammar Communication PDFNuria GL100% (1)

- February 2019Document4 pagesFebruary 2019sagar manghwaniNo ratings yet

- HDFC Bank LoansDocument75 pagesHDFC Bank LoansSahil Sethi100% (2)

- A Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Document120 pagesA Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Vaibhav ShuklaNo ratings yet

- File 9222Document4 pagesFile 9222lexxusmransomNo ratings yet

- General Fees: April 2020Document114 pagesGeneral Fees: April 2020Tendências Silver LoadNo ratings yet

- A Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, ShivamoggaDocument55 pagesA Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, ShivamoggaShiva KumarNo ratings yet

- CBS Finacle EOD 2014Document42 pagesCBS Finacle EOD 2014Shan AhamdNo ratings yet