Professional Documents

Culture Documents

Acc 212 - Course Outline

Acc 212 - Course Outline

Uploaded by

fbicia218Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 212 - Course Outline

Acc 212 - Course Outline

Uploaded by

fbicia218Copyright:

Available Formats

ACC 212: FINANCIAL ACCOUNTING II

i. Course title: ACC 212: FINANCIAL ACCOUNTING II

ii. Course aim: The course aims at deepening student understands on

Accounting principles and theories in the treatment of individual financial

statement items of partnerships, joint venture, companies and business

combinations

iii. Course expected learning outcome(s): At the end of a course, student should be

able to

• Analyze and report partnership transactions such as formation, dissolution,

partner changes, and earnings distribution

• Explain the meaning and types of company alongside with the common terms in

company accounting.

• Demonstrate an understanding of the Accounting for the Issue, forfeiture and re-issue

of shares.

• Prepare the reconstruction and reorganization statements with other business

transactions such as business combination, re-organization and reconstruction.

iv. Course status-core or elective: Core

v. Credit rating: 12 credit points

vi. Total hours spent: 120

vii. Course Content:

1. Partnership Accounting

• Nature of Partnership

• Partners Accounts and their usual adjustments

• Goodwill in partnership Accounts

• Admission and Retirement of a partner

• Dissolution of partnership

• Amalgamation of sole traders into partnerships and amalgamation of partnerships.

• Conversion into limited company

2. Accounting for the Issue, forfeiture and re-issue of shares

• Meaning and types of shares

• Accounting for the issue of shares.

• Pro-rata Issue of shares

• Shares issued for other consideration

• Underwriting share issue

• Forfeiture and re-issue of shares.

• Bonus share and Right Issue of shares

3. Redemption of Non -Equity shares

• Procedure and methods of redemption

• Reserves of a company

• Providing for Premium on redemption

4. Accounting for Debentures:

• Issue of Debentures

• Writing off discount allowed on debentures

• Providing for Premium on redemption

• Redemption of debentures by issuing new debenture, shares or with a sinking fund.

5. Accounting for re-organization and reconstruction

• Reasons

• Internal reconstruction

• External reconstruction

• Formulating a scheme of reconstruction

6. Accounting for Business Combinations- IFRS 3

• Nature of business combination

• Accounting in the records of acquirer

• Accounting in the records of acquire

• Business combination consideration

viii. Teaching and learning activities: Lectures, seminars, assignments and

independent study

ix. Assessment Methods: Test, Individual Assignment, Group Assignment and

Final examination

x. Reading list :

Wood, F and Alan S (2005). Business accounting, Vol. I and II. London:Longman

Advanced accounting: 2nd ed.New Delhi.

LEWIS, R. and Pendrill, D. (2004).Advanced Financial Accounting, 7thed. Prentice

Hall.

ACCA- Paper F7 (INT) (2014). Financial Reporting (International), Emile

Woolf International Publishing.

Richard E. Baker [et al].(2008).Advanced financial accounting. 7th ed.New York :

McGraw-Hill

Companies Act (2002 as amended)

You might also like

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualDocument87 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualEmilyJonesizjgp100% (17)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- ACCTG2 - Introduction To Partnership and Corporation AccountingDocument23 pagesACCTG2 - Introduction To Partnership and Corporation AccountingMaria Camille Sison0% (1)

- Cafe RomaDocument6 pagesCafe Romahmdme100% (2)

- Syl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Document9 pagesSyl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Maria Anne Genette Bañez100% (3)

- GstarCAD 2017 USER GUIDE ภาษาไทยDocument269 pagesGstarCAD 2017 USER GUIDE ภาษาไทยPhannachet RungsrikeawNo ratings yet

- Module For Fundamentals of AccountingDocument9 pagesModule For Fundamentals of AccountingJohn Rey Bantay Rodriguez50% (2)

- Course Outline ACC 212Document3 pagesCourse Outline ACC 212fbicia218No ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument11 pagesACCOUNTANCY (Code No. 055) : RationaleIshan MittalNo ratings yet

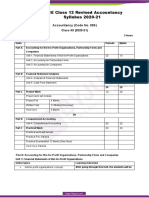

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- Acctg 2Document8 pagesAcctg 2justineNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- Reduced SyllabusDocument333 pagesReduced SyllabusRaj Rajeshwer Gupta100% (1)

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Accounting For Equities Course Outline Jan 2012Document4 pagesAccounting For Equities Course Outline Jan 2012mutaikcNo ratings yet

- CBSE Class 12 Term Wise Accountancy Syllabus 2021 22Document9 pagesCBSE Class 12 Term Wise Accountancy Syllabus 2021 22ILMA UROOJNo ratings yet

- Syllabus Accounting ClassIXDocument4 pagesSyllabus Accounting ClassIXAbid faisal AhmedNo ratings yet

- Intermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseDocument11 pagesIntermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseSZANo ratings yet

- Intro-to-Partnership-Corporation AccountingDocument11 pagesIntro-to-Partnership-Corporation AccountingknockdwnNo ratings yet

- Account SyllabusDocument5 pagesAccount Syllabusadityasinghania.gtsNo ratings yet

- Final Chapter 3.pmdDocument4 pagesFinal Chapter 3.pmdMANISH SINGHNo ratings yet

- 301 AccountancyDocument4 pages301 AccountancyAlkaNo ratings yet

- Bcom 2nd Sem Corporate AccountingDocument2 pagesBcom 2nd Sem Corporate AccountingsaamiikshaaNo ratings yet

- Final Accountancy 12 March 2023Document5 pagesFinal Accountancy 12 March 2023happilyakshitaNo ratings yet

- Intermediate Accounting II (ACCT 3368)Document9 pagesIntermediate Accounting II (ACCT 3368)abdul.fattaahbakhsh29No ratings yet

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- Accounting Basics IDocument4 pagesAccounting Basics IEvergreen StoriesNo ratings yet

- Accounting For ManagersDocument185 pagesAccounting For ManagersFenny Todarmal100% (1)

- Modul Level 3Document39 pagesModul Level 3Marta GobenaNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- Afar 2 Module CH 1Document13 pagesAfar 2 Module CH 1Razmen Ramirez PintoNo ratings yet

- Lecture 2 Nature and Objectives of Financial StatementsDocument22 pagesLecture 2 Nature and Objectives of Financial Statementsdev guptaNo ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFfrances.langley893100% (12)

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution ManualDocument91 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution Manuallaurel100% (35)

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- I 6CoprorateAccountingDocument2 pagesI 6CoprorateAccountingAsad AliNo ratings yet

- Financial Accounting WorkBook ICMRDocument368 pagesFinancial Accounting WorkBook ICMRSarthak Gupta75% (4)

- Business Activities and Overview of Financial Statements and The Reporting ProcessDocument30 pagesBusiness Activities and Overview of Financial Statements and The Reporting ProcessbailobaNo ratings yet

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- Financial AccountingDocument944 pagesFinancial Accountingsivachandirang695492% (24)

- INSEAD Master in Finance Curriculum PDFDocument25 pagesINSEAD Master in Finance Curriculum PDFLeslie Cheetah LamNo ratings yet

- III Sem BCOM Corporate Accounting SSM 1-5 ModulesDocument148 pagesIII Sem BCOM Corporate Accounting SSM 1-5 ModulesSinghan SNo ratings yet

- Lecture 3 Uses and Limitations of Financial StatementsDocument20 pagesLecture 3 Uses and Limitations of Financial Statementsdev guptaNo ratings yet

- Financial Accounting 17th Edition by Williams ISBN Solution ManualDocument90 pagesFinancial Accounting 17th Edition by Williams ISBN Solution Manualjames100% (30)

- Course Title: Financial ManagementDocument29 pagesCourse Title: Financial Managementzeleke fayeNo ratings yet

- Institute-University School of Business Department-MbaDocument12 pagesInstitute-University School of Business Department-MbaAbhishek kumarNo ratings yet

- Prachi CUET-UG AccountancyDocument22 pagesPrachi CUET-UG AccountancySmriti Saxena100% (1)

- Fundamentals of Accountancy Business and ManagementDocument86 pagesFundamentals of Accountancy Business and ManagementJosie Ann VelascoNo ratings yet

- Session 1 - Introduction To Accounting and Balance SheetDocument32 pagesSession 1 - Introduction To Accounting and Balance Sheethieucaiminh155No ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Bba Amity AccountsDocument1 pageBba Amity AccountsDeepak BatraNo ratings yet

- ACCTG2 - Introduction To Partnership and Corporation AccountingDocument13 pagesACCTG2 - Introduction To Partnership and Corporation AccountingJaylord Cruz27% (11)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- How to Optimize Your Portfolio With High-Return Dividend StocksFrom EverandHow to Optimize Your Portfolio With High-Return Dividend StocksNo ratings yet

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Topic 2Document51 pagesTopic 2fbicia218No ratings yet

- Topic 3Document29 pagesTopic 3fbicia218No ratings yet

- Topic 2-1Document35 pagesTopic 2-1fbicia218No ratings yet

- Topic 2Document58 pagesTopic 2fbicia218No ratings yet

- Topic 1Document35 pagesTopic 1fbicia218No ratings yet

- Topic 1 BDocument30 pagesTopic 1 Bfbicia218No ratings yet

- Seminar QNS Topic 1Document24 pagesSeminar QNS Topic 1fbicia218No ratings yet

- Baf PS 2BDocument5 pagesBaf PS 2Bfbicia218No ratings yet

- Course Outline + Intro To Fin System in Tz. NEWDocument10 pagesCourse Outline + Intro To Fin System in Tz. NEWfbicia218No ratings yet

- Compact Concealed Handgun Comparison Chart (Illustrated) - 2011Document10 pagesCompact Concealed Handgun Comparison Chart (Illustrated) - 2011KomodowaranNo ratings yet

- PCB Design Course - Emtech FoundationDocument6 pagesPCB Design Course - Emtech FoundationAbhishek KumarNo ratings yet

- Ome44850k VR7000 7000SDocument60 pagesOme44850k VR7000 7000SJorge OrsNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementHarshitaNo ratings yet

- Special Continuous Probability DistributionsDocument11 pagesSpecial Continuous Probability DistributionsnofacejackNo ratings yet

- Tropical Cyclones: A Preparedness GuideDocument12 pagesTropical Cyclones: A Preparedness GuideMayeth MacedaNo ratings yet

- Exxon Mobil New Refinery TrendsDocument45 pagesExxon Mobil New Refinery TrendsWong Yee Sun100% (1)

- Department of Health: Overnment OticeDocument49 pagesDepartment of Health: Overnment OticeconfithanNo ratings yet

- Ponente: Carpio-Morales, JDocument15 pagesPonente: Carpio-Morales, JCristelle Elaine ColleraNo ratings yet

- Design Frameworks: Past, Present and FuturesDocument53 pagesDesign Frameworks: Past, Present and FuturesJames Piers Taylor100% (2)

- Community Helper Coloring PagesDocument24 pagesCommunity Helper Coloring PagesJvier NathaleeNo ratings yet

- Python ProgramsDocument12 pagesPython ProgramsvijayNo ratings yet

- Earth Loop Impedance CalculationsDocument4 pagesEarth Loop Impedance Calculationsbcqbao100% (2)

- Iwc DumpDocument28 pagesIwc DumpSendy Rubio bonilla96No ratings yet

- Practice Development Guide and Evaluation Rubric - Unit 3 - Phase 4 - Practical Component - Simulated PracticesDocument7 pagesPractice Development Guide and Evaluation Rubric - Unit 3 - Phase 4 - Practical Component - Simulated PracticesMaria Jose Ramos BarcoNo ratings yet

- Heirs of Jose Lim vs. Lim, 614 SCRA 141, March 03, 2010Document13 pagesHeirs of Jose Lim vs. Lim, 614 SCRA 141, March 03, 2010raikha barraNo ratings yet

- RPT 2021 DLP Math Year 5 KSSR SemakanDocument16 pagesRPT 2021 DLP Math Year 5 KSSR SemakanShalini SuriaNo ratings yet

- Toaz - Info Solution Manual For Physical Metallurgy Principles 4th Edition by Abbaschian Sam PRDocument12 pagesToaz - Info Solution Manual For Physical Metallurgy Principles 4th Edition by Abbaschian Sam PRbunnysanganiNo ratings yet

- Case 4Document4 pagesCase 4cuong462003No ratings yet

- Collinear ReportDocument15 pagesCollinear ReportRemonIbrahimNo ratings yet

- Textbook Biscuit Cookie and Cracker Production Process Production and Packaging Equipment Second Edition Iain Davidson Ebook All Chapter PDFDocument54 pagesTextbook Biscuit Cookie and Cracker Production Process Production and Packaging Equipment Second Edition Iain Davidson Ebook All Chapter PDFmartin.hughes511100% (21)

- Medical Equipment: Www. .Co - KRDocument12 pagesMedical Equipment: Www. .Co - KRBahroel Al mukarram al hajariNo ratings yet

- Level 2 Unit 7Document10 pagesLevel 2 Unit 7Yigal AlonNo ratings yet

- The Nursing and Midwifery Content Audit Tool NMCATDocument15 pagesThe Nursing and Midwifery Content Audit Tool NMCATDan kibet TumboNo ratings yet

- POS 205 GroupDocument5 pagesPOS 205 GroupnathanharyehrinNo ratings yet

- BITS Herald Summer Issue 2013Document23 pagesBITS Herald Summer Issue 2013Bits Herald100% (1)

- "Europe Meets IEVC" Workshop: Florence, ItalyDocument11 pages"Europe Meets IEVC" Workshop: Florence, Italyvenugopalan srinivasanNo ratings yet

- Unemployment and PovertyDocument9 pagesUnemployment and PovertyRaniNo ratings yet