Professional Documents

Culture Documents

FABM 2 Finals Reviewer

FABM 2 Finals Reviewer

Uploaded by

Herzens brecherOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FABM 2 Finals Reviewer

FABM 2 Finals Reviewer

Uploaded by

Herzens brecherCopyright:

Available Formats

FABM 2

Credit:

Elements in Income Statement: Withdrawals account

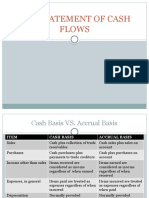

Net Sales = Gross Sales/Sales - Sales returns and allowances -

Sales discounts Statement of Cash Flows

Gross Sales/Sales = Net Sales + Sales returns and allowances Cash Flows from Operating Activities (Current Assets and

+ Sales discounts Current Liabilities, Income and Expenses)

Net Purchases = Purchases - Purchases returns and Cash Inflows:

allowances - Purchases discounts Receipts from sale of goods and performances of

services

Net Cost of Purchases = Net Purchases + Transportation In Receipts from royalties, fees, commissions and other

revenues

Goods Available for Sale = Beginning Inventory + Net Cost of

Purchases Cash Outflows:

Payments to suppliers of goods and services

Cost of Sales/Cost of Goods Sold = Goods Available for Sale - Payments to employees

Ending Inventory Payments for taxes

Payments for interest expense

Gross Profit = Net Sales - Cost of Goods Sold Payments for other operating expenses

Operating Profit = Gross Profit - Total Operating Expenses Cash Flows from Investing Activities (Non-current Assets)

Cash Inflows:

Closing Entries: Receipts from sale of property and equipment

Receipts from sale of investments in debt or equity

First Entry: securities

Receipts from collections on notes receivable

Debit:

Ending balance of inventory (Merchandise Inventory, Cash Outflows:

End) Payments to acquire property and equipment

Temporary Accounts with credit balances (Sales, Payments to acquire debt or equity securities

Purchases returns and allowances, purchase discounts) Payments to make loans to others generally in the form

of notes receivable

Credit:

Income Summary Cash Flows from Financing Activities (Non-current Liabilities

and Owner’s Equity)

Second Entry:

Cash Inflows:

Debit: Receipts from investments by owners

Income Summary Receipts from issuance of notes payable

Credit: Cash Outflows:

Beginning balance of inventory (Merchandise Inventory, Payments to owners in the form of withdrawals

Beginning) Payments to settle notes payable

Temporary accounts with debit balances (Expenses,

sales returns and allowances, sales discount, purchases, Cash Flows from Operating Activities:

transportation in, transportation out)

Direct Method

Third Entry: Add individual operating cash inflows

Subtract individual operating cash outflows

Debit: Receipts are added

Income summary Expenses are deducted

Credit: Indirect Method:

Capital account Increase in current asset (negative)

Decrease in current asset (positive)

Fourth Entry: Increase in current liabilities (positive)

Decrease in current liabilities (negative)

Debit: Non-cash expenses are added

Capital Account Non-cash income are deducted

You might also like

- Accounting Principles: Second Canadian EditionDocument38 pagesAccounting Principles: Second Canadian EditionErik Lorenz PalomaresNo ratings yet

- 5008S Fresenuis Service ManualDocument318 pages5008S Fresenuis Service ManualEslam Karam100% (10)

- Ias 7 Statement of Cashflows (F2)Document7 pagesIas 7 Statement of Cashflows (F2)Tawanda Tatenda Herbert100% (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- A Learning Plan in Grade 8 PersuasiveDocument6 pagesA Learning Plan in Grade 8 PersuasiveYannah Jovido50% (2)

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- Tally AssignmentDocument90 pagesTally AssignmentSHAHULNo ratings yet

- ACC1002X Cheat Sheet 2Document2 pagesACC1002X Cheat Sheet 2Paul DavisNo ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- Chapter 11 Lecture 2018Document62 pagesChapter 11 Lecture 2018Johnny Sins100% (1)

- Cash Flow StatementDocument16 pagesCash Flow StatementSagnik Sharangi100% (1)

- Tally NotesDocument21 pagesTally NotestrustfarNo ratings yet

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- Tally AssignmentDocument90 pagesTally AssignmentASHOK RAJ100% (2)

- Cash FlowsDocument4 pagesCash FlowsGelai BatadNo ratings yet

- Module 2: Conceptual Framework For Financial ReportingDocument5 pagesModule 2: Conceptual Framework For Financial Reportingmonsta x noona-yaNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementanuhyaextraNo ratings yet

- Basic Concept of AccountingDocument13 pagesBasic Concept of Accountingsunil kumarNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementSyed Adnan HossainNo ratings yet

- CHAPTER 4 Types of Major AccountsDocument4 pagesCHAPTER 4 Types of Major AccountsUnah Ysabelle ValdonNo ratings yet

- Basic AccountingDocument13 pagesBasic AccountingArchana DeyNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- CashFlowZadani28 3 2022Document10 pagesCashFlowZadani28 3 2022Nguyen GiangNo ratings yet

- Basic Concept of AccountingDocument19 pagesBasic Concept of Accountingddnc gstNo ratings yet

- تلخيص لغة تانيه 20233Document4 pagesتلخيص لغة تانيه 20233magdy kamelNo ratings yet

- Schubert Case - 2Document1 pageSchubert Case - 2Magloire HiolNo ratings yet

- Basic AccountingDocument22 pagesBasic AccountingJEE ARWALNo ratings yet

- Cashflow ExampleDocument6 pagesCashflow ExamplecoolyouhiNo ratings yet

- CH 16Document57 pagesCH 16Liony KalaloNo ratings yet

- Basic AccountingDocument21 pagesBasic AccountingdmniitddnNo ratings yet

- Back End PaperDocument14 pagesBack End PaperDai LuuNo ratings yet

- Unit 10 Master Budget - Financial StatementsDocument16 pagesUnit 10 Master Budget - Financial StatementsAshish Sharma PokhrelNo ratings yet

- The Statement of Cash FlowsDocument12 pagesThe Statement of Cash Flowshamida saripNo ratings yet

- F1 Chapter 4 PDFDocument20 pagesF1 Chapter 4 PDFAchiek JamesNo ratings yet

- accountingDocument22 pagesaccountingrituNo ratings yet

- Cash Flow Statement in A NutshellDocument2 pagesCash Flow Statement in A NutshellJuan SalazarNo ratings yet

- Tally - ERP9 Book With GSTDocument1,843 pagesTally - ERP9 Book With GSThatim100% (1)

- Cash Flow TemplateDocument19 pagesCash Flow TemplateRyou ShinodaNo ratings yet

- Group BDocument37 pagesGroup BHashen BandaraNo ratings yet

- Lesson 04 - Cash Flow StatementDocument5 pagesLesson 04 - Cash Flow Statementpulitha kodituwakkuNo ratings yet

- Lesson 4 Statement of Cash Flows StudentDocument7 pagesLesson 4 Statement of Cash Flows StudentFood EyeNo ratings yet

- FABM2 - Q1 - V2a Page 59 69Document11 pagesFABM2 - Q1 - V2a Page 59 69joiNo ratings yet

- Tally Assignment 12Document90 pagesTally Assignment 12Kaushal SharmaNo ratings yet

- Cash Flow Statement 1220159910575245 9Document17 pagesCash Flow Statement 1220159910575245 9duyphung1234No ratings yet

- Tally4555885589725 PDFDocument90 pagesTally4555885589725 PDFRamesh ShriNo ratings yet

- Tally AssignmentDocument90 pagesTally AssignmentM Keerthana100% (1)

- E Business Accounting Tally Notes IV SemDocument90 pagesE Business Accounting Tally Notes IV SemPrajwalNo ratings yet

- Chapter 4 Part III (FS) - 8ce3edc9 f156 4d72 896a 8753c46fcd2aDocument11 pagesChapter 4 Part III (FS) - 8ce3edc9 f156 4d72 896a 8753c46fcd2aBHAWNANo ratings yet

- Cash Flows Chap-13Document52 pagesCash Flows Chap-13nina0301100% (1)

- Cash FlowDocument6 pagesCash FlowKhaneik KingNo ratings yet

- Cash Flow Statement Notes.12Document12 pagesCash Flow Statement Notes.12Sarthak PatilNo ratings yet

- Class 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeDocument4 pagesClass 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeKevin ChengNo ratings yet

- Ia2 Current LiabilitiesDocument26 pagesIa2 Current LiabilitiesNicole Ann MercurioNo ratings yet

- SodaPDF Converted Cash To AccrualDocument7 pagesSodaPDF Converted Cash To AccrualestesgadzNo ratings yet

- Ias 7 Cash Flow Statement ContinuedDocument8 pagesIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- Act 500Document1 pageAct 500Tayar ElieNo ratings yet

- Financial Statement Construction ExerciseDocument3 pagesFinancial Statement Construction Exercisesuresh sivadasanNo ratings yet

- The Statement: Statements and The Annual ReportDocument58 pagesThe Statement: Statements and The Annual Reportsaad107100% (1)

- Conceptual Framework Module 9Document5 pagesConceptual Framework Module 9Jaime LaronaNo ratings yet

- Harrison Chapter 10 Student 6 CeDocument36 pagesHarrison Chapter 10 Student 6 CeAliyan AmjadNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- AfPS&CS Ch-01Document10 pagesAfPS&CS Ch-01Amelwork AlchoNo ratings yet

- Checkpoint Enterprise Security Framework Whitepaper v2Document34 pagesCheckpoint Enterprise Security Framework Whitepaper v2hoangtruc.ptitNo ratings yet

- The Laws On Local Governments SyllabusDocument4 pagesThe Laws On Local Governments SyllabusJohn Kevin ArtuzNo ratings yet

- GraphsDocument18 pagesGraphssaloniNo ratings yet

- Sandy Point Brochure 2016Document7 pagesSandy Point Brochure 2016miller999No ratings yet

- SPB ClientDocument4 pagesSPB ClientRKNo ratings yet

- 1951 1obli ChronicleDocument18 pages1951 1obli Chronicleapi-198872914No ratings yet

- The Strategy of Successful Total ProductDocument10 pagesThe Strategy of Successful Total ProductPham GHNo ratings yet

- Jyotish - Hindu Panchangam & MuhurtasDocument40 pagesJyotish - Hindu Panchangam & MuhurtasSamir Kadiya100% (1)

- UM 2008 Lightning MechanismDocument22 pagesUM 2008 Lightning Mechanismcik_sya87No ratings yet

- Cell Theory Refers To The Idea That: MicrographiaDocument5 pagesCell Theory Refers To The Idea That: MicrographiadeltasixNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- 1231.322 323 MSDS Sabroe 1507-100 MSDSDocument6 pages1231.322 323 MSDS Sabroe 1507-100 MSDSzhyhhNo ratings yet

- BGR AnuualReport 2022-23Document88 pagesBGR AnuualReport 2022-23Rk SharafatNo ratings yet

- OpenFOAM编程指南Document100 pagesOpenFOAM编程指南Feishi XuNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- 9th Biology NotesDocument12 pages9th Biology Notesramaiz darNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- South Oil Company (SOC) : SOC Contract No.: CSSP-ITT-04Document19 pagesSouth Oil Company (SOC) : SOC Contract No.: CSSP-ITT-04Kingsley BaptistaNo ratings yet

- API BasicsDocument6 pagesAPI BasicsSrinivas BathulaNo ratings yet

- HCI 2008 Promo W SolutionDocument12 pagesHCI 2008 Promo W SolutionMichael CheeNo ratings yet

- Electrical Circuit Lab ManualDocument38 pagesElectrical Circuit Lab Manualecessec67% (3)

- Pre-Lab: Microscopes II: Plant Cells and OsmosisDocument2 pagesPre-Lab: Microscopes II: Plant Cells and Osmosisapi-234540318No ratings yet

- Rahmania Tbi 6 D Soe...Document9 pagesRahmania Tbi 6 D Soe...Rahmania Aulia PurwagunifaNo ratings yet

- Science TE804Document15 pagesScience TE804carolynhart_415No ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- FracShield Composite Frac PlugDocument3 pagesFracShield Composite Frac PlugJOGENDRA SINGHNo ratings yet