Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsFinance Uts (2023)

Finance Uts (2023)

Uploaded by

clarisaisabelThe document defines the formula for return on equity (ROE) as the product of net profit margin, asset turnover, and equity multiplier. It then calculates these values for a company in 1997, 1998, and 1999 to determine the ROE for each year. In 1997, the ROE was 22.3%; in 1998 it was 34.3%; and in 1999 it was 26%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Corporate Finance - Solution For Chapter 3Document11 pagesCorporate Finance - Solution For Chapter 3Vân Anh Đỗ LêNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- CMA USA Ratio Definitions 2015Document4 pagesCMA USA Ratio Definitions 2015Shameem JazirNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Nyse Ratio AnlaysisDocument35 pagesNyse Ratio AnlaysisBasappaSarkarNo ratings yet

- Liquidity Ratios (Do Not Include Working Capital) : - Longer BetterDocument3 pagesLiquidity Ratios (Do Not Include Working Capital) : - Longer BetterAlyssa AlejandroNo ratings yet

- Corporate Finance Chapter 4Document15 pagesCorporate Finance Chapter 4Razan EidNo ratings yet

- Keyratio 2011Document6 pagesKeyratio 2011Nikhil YadavNo ratings yet

- ROEDocument2 pagesROEshaeel ashrafNo ratings yet

- Math For Financial InstitutionsDocument14 pagesMath For Financial InstitutionsMd Alim100% (3)

- CÔNG THỨC - Google Tài liệuDocument2 pagesCÔNG THỨC - Google Tài liệuGiang HoàngNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Financial Statement Annlysis DNRTmylove@..infiniteDocument18 pagesFinancial Statement Annlysis DNRTmylove@..infinitednrt09No ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- Dupont AnalysisDocument1 pageDupont AnalysisshankruthNo ratings yet

- Molla Sajidur Rahim,,,Id 181 019 811Document9 pagesMolla Sajidur Rahim,,,Id 181 019 811Shariar ShawoŋNo ratings yet

- Sears Vs Walmart - v01Document37 pagesSears Vs Walmart - v01chansjoy100% (1)

- Navana CNG Ratio AnalysisDocument6 pagesNavana CNG Ratio AnalysisMohammad AnisNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- chap5exDocument2 pageschap5exMy Duyen NguyenNo ratings yet

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesNo ratings yet

- CH03答案Document11 pagesCH03答案zmm45x7sjtNo ratings yet

- Lecture 03Document13 pagesLecture 03simraNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Liquidity Ratios: Current RatioDocument12 pagesLiquidity Ratios: Current RatioArimuthukumarNambiNo ratings yet

- ExamDocument3 pagesExamMohamad IbrahimNo ratings yet

- Capital Investment DecisionsDocument15 pagesCapital Investment DecisionsDipikaVermaniNo ratings yet

- Analysis of Financial StatementsDocument30 pagesAnalysis of Financial StatementsKaziRafiNo ratings yet

- RatioDocument2 pagesRatioAtikah AzimNo ratings yet

- RatioDocument2 pagesRatioAtikah AzimNo ratings yet

- (All Data in CR Indian Rupees) For Mar'14: (Captures The Amount of ROE That Can Be Attributed To Financial Leverage)Document3 pages(All Data in CR Indian Rupees) For Mar'14: (Captures The Amount of ROE That Can Be Attributed To Financial Leverage)himanimaheshwari03No ratings yet

- CEMEX FinancialsDocument3 pagesCEMEX FinancialsWilliam HendersonNo ratings yet

- Home Work 2Document5 pagesHome Work 2Shoaib MahmoodNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- DG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityDocument2 pagesDG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityQuran Recitation channel Alasad of QuranNo ratings yet

- CF MathDocument5 pagesCF MathArafat HossainNo ratings yet

- Shaharyar Naeem FSA AssignmentDocument1 pageShaharyar Naeem FSA AssignmentSheryar NaeemNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosAlexa Isobel TicarNo ratings yet

- Shaharyar Naeem FSA AssignmentDocument1 pageShaharyar Naeem FSA AssignmentSheryar NaeemNo ratings yet

- Profitability RatiosDocument9 pagesProfitability RatiosfasmekbakerNo ratings yet

- Amended - Presentation Ratio Analysis Nestle & Engro FoodsDocument32 pagesAmended - Presentation Ratio Analysis Nestle & Engro FoodsSaqib Mirza100% (1)

- Hyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear BelowDocument1 pageHyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear BelowKailash KumarNo ratings yet

- Basic Analisa FundamentalDocument23 pagesBasic Analisa FundamentalThomasNailNo ratings yet

- 216 Return On Investment ROIDocument4 pages216 Return On Investment ROIworkforsrvNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- Financial Management-1 Assignment Name: M.Karthikeyan Roll No.: 10AC16Document10 pagesFinancial Management-1 Assignment Name: M.Karthikeyan Roll No.: 10AC16Karthi KeyanNo ratings yet

- Measures of Firm Size, Risk, and Performance Measures of Firm SizeDocument4 pagesMeasures of Firm Size, Risk, and Performance Measures of Firm SizePhilNo ratings yet

- Assignment - Stock Market Valuation: PART-1: 1. Banque Populaire CaseDocument7 pagesAssignment - Stock Market Valuation: PART-1: 1. Banque Populaire CasePrateek MallNo ratings yet

- BEL - RatiosDocument4 pagesBEL - RatiosArtiNo ratings yet

- BT Chapter4Document3 pagesBT Chapter4Nguyen Trung Kien (K17 QN)No ratings yet

- BEL - RatiosDocument8 pagesBEL - RatiosVishal Kumar100% (1)

- Basics On Income Tax PDFDocument10 pagesBasics On Income Tax PDFHannan Mahmood TonmoyNo ratings yet

- Oil - 3LM4Document15 pagesOil - 3LM4Yannah HidalgoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet

Finance Uts (2023)

Finance Uts (2023)

Uploaded by

clarisaisabel0 ratings0% found this document useful (0 votes)

5 views1 pageThe document defines the formula for return on equity (ROE) as the product of net profit margin, asset turnover, and equity multiplier. It then calculates these values for a company in 1997, 1998, and 1999 to determine the ROE for each year. In 1997, the ROE was 22.3%; in 1998 it was 34.3%; and in 1999 it was 26%.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines the formula for return on equity (ROE) as the product of net profit margin, asset turnover, and equity multiplier. It then calculates these values for a company in 1997, 1998, and 1999 to determine the ROE for each year. In 1997, the ROE was 22.3%; in 1998 it was 34.3%; and in 1999 it was 26%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageFinance Uts (2023)

Finance Uts (2023)

Uploaded by

clarisaisabelThe document defines the formula for return on equity (ROE) as the product of net profit margin, asset turnover, and equity multiplier. It then calculates these values for a company in 1997, 1998, and 1999 to determine the ROE for each year. In 1997, the ROE was 22.3%; in 1998 it was 34.3%; and in 1999 it was 26%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

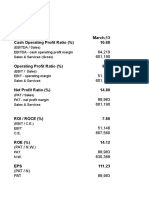

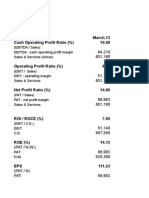

ROE = (Net Profit Margin) x (Asset Turnover) x (Equity Multiplier)

1997

Net Profit Margin (NPM):

NPM = Profit after Taxes / Net Sales

NPM = 177,813 / 691,614 = 0.257

Asset Turnover (AT):

AT = Net Sales / Average Total Assets

Average Total Assets = (Total Assets at the beginning of the year + Total Assets at the end of

the year) / 2

Average Total Assets = (1,150,158 + 1,696,984) / 2 = 1,423,571

AT = 691,614 / 1,423,571 = 0.486

Equity Multiplier (EM):

EM = Average Total Assets / Total Shareholders’ Equity

EM = 1,423,571 / 809,995 = 1.756

ROE for 1997:

ROE = 0.257 (NPM) x 0.486 (AT) x 1.756 (EM) = 0.223

1998

NPM = 518,828 / 2,034,561 = 0.254

AT = 2,034,561 / [(1,696,984 + 1,736,497) / 2] = 1.187

EM = [(1,696,984 + 1,736,497) / 2] / 1,265,040 = 1.347

ROE = 0.254 (NPM) x 1.187 (AT) x 1.347 (EM) = 0.343

1999

NPM = 318,039 / 1,694,839 = 0.188

AT = 1,694,839 / [(1,736,497 + 1,390,183) / 2] = 1.136

EM = [(1,736,497 + 1,390,183) / 2] / 1,390,183 = 1.249

ROE = 0.188 (NPM) x 1.136 (AT) x 1.249 (EM) = 0.26

You might also like

- Corporate Finance - Solution For Chapter 3Document11 pagesCorporate Finance - Solution For Chapter 3Vân Anh Đỗ LêNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- CMA USA Ratio Definitions 2015Document4 pagesCMA USA Ratio Definitions 2015Shameem JazirNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Nyse Ratio AnlaysisDocument35 pagesNyse Ratio AnlaysisBasappaSarkarNo ratings yet

- Liquidity Ratios (Do Not Include Working Capital) : - Longer BetterDocument3 pagesLiquidity Ratios (Do Not Include Working Capital) : - Longer BetterAlyssa AlejandroNo ratings yet

- Corporate Finance Chapter 4Document15 pagesCorporate Finance Chapter 4Razan EidNo ratings yet

- Keyratio 2011Document6 pagesKeyratio 2011Nikhil YadavNo ratings yet

- ROEDocument2 pagesROEshaeel ashrafNo ratings yet

- Math For Financial InstitutionsDocument14 pagesMath For Financial InstitutionsMd Alim100% (3)

- CÔNG THỨC - Google Tài liệuDocument2 pagesCÔNG THỨC - Google Tài liệuGiang HoàngNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Financial Statement Annlysis DNRTmylove@..infiniteDocument18 pagesFinancial Statement Annlysis DNRTmylove@..infinitednrt09No ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- Dupont AnalysisDocument1 pageDupont AnalysisshankruthNo ratings yet

- Molla Sajidur Rahim,,,Id 181 019 811Document9 pagesMolla Sajidur Rahim,,,Id 181 019 811Shariar ShawoŋNo ratings yet

- Sears Vs Walmart - v01Document37 pagesSears Vs Walmart - v01chansjoy100% (1)

- Navana CNG Ratio AnalysisDocument6 pagesNavana CNG Ratio AnalysisMohammad AnisNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- chap5exDocument2 pageschap5exMy Duyen NguyenNo ratings yet

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesNo ratings yet

- CH03答案Document11 pagesCH03答案zmm45x7sjtNo ratings yet

- Lecture 03Document13 pagesLecture 03simraNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Liquidity Ratios: Current RatioDocument12 pagesLiquidity Ratios: Current RatioArimuthukumarNambiNo ratings yet

- ExamDocument3 pagesExamMohamad IbrahimNo ratings yet

- Capital Investment DecisionsDocument15 pagesCapital Investment DecisionsDipikaVermaniNo ratings yet

- Analysis of Financial StatementsDocument30 pagesAnalysis of Financial StatementsKaziRafiNo ratings yet

- RatioDocument2 pagesRatioAtikah AzimNo ratings yet

- RatioDocument2 pagesRatioAtikah AzimNo ratings yet

- (All Data in CR Indian Rupees) For Mar'14: (Captures The Amount of ROE That Can Be Attributed To Financial Leverage)Document3 pages(All Data in CR Indian Rupees) For Mar'14: (Captures The Amount of ROE That Can Be Attributed To Financial Leverage)himanimaheshwari03No ratings yet

- CEMEX FinancialsDocument3 pagesCEMEX FinancialsWilliam HendersonNo ratings yet

- Home Work 2Document5 pagesHome Work 2Shoaib MahmoodNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- DG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityDocument2 pagesDG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityQuran Recitation channel Alasad of QuranNo ratings yet

- CF MathDocument5 pagesCF MathArafat HossainNo ratings yet

- Shaharyar Naeem FSA AssignmentDocument1 pageShaharyar Naeem FSA AssignmentSheryar NaeemNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosAlexa Isobel TicarNo ratings yet

- Shaharyar Naeem FSA AssignmentDocument1 pageShaharyar Naeem FSA AssignmentSheryar NaeemNo ratings yet

- Profitability RatiosDocument9 pagesProfitability RatiosfasmekbakerNo ratings yet

- Amended - Presentation Ratio Analysis Nestle & Engro FoodsDocument32 pagesAmended - Presentation Ratio Analysis Nestle & Engro FoodsSaqib Mirza100% (1)

- Hyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear BelowDocument1 pageHyrkas Corporation's Most Recent Balance Sheet and Income Statement Appear BelowKailash KumarNo ratings yet

- Basic Analisa FundamentalDocument23 pagesBasic Analisa FundamentalThomasNailNo ratings yet

- 216 Return On Investment ROIDocument4 pages216 Return On Investment ROIworkforsrvNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- Financial Management-1 Assignment Name: M.Karthikeyan Roll No.: 10AC16Document10 pagesFinancial Management-1 Assignment Name: M.Karthikeyan Roll No.: 10AC16Karthi KeyanNo ratings yet

- Measures of Firm Size, Risk, and Performance Measures of Firm SizeDocument4 pagesMeasures of Firm Size, Risk, and Performance Measures of Firm SizePhilNo ratings yet

- Assignment - Stock Market Valuation: PART-1: 1. Banque Populaire CaseDocument7 pagesAssignment - Stock Market Valuation: PART-1: 1. Banque Populaire CasePrateek MallNo ratings yet

- BEL - RatiosDocument4 pagesBEL - RatiosArtiNo ratings yet

- BT Chapter4Document3 pagesBT Chapter4Nguyen Trung Kien (K17 QN)No ratings yet

- BEL - RatiosDocument8 pagesBEL - RatiosVishal Kumar100% (1)

- Basics On Income Tax PDFDocument10 pagesBasics On Income Tax PDFHannan Mahmood TonmoyNo ratings yet

- Oil - 3LM4Document15 pagesOil - 3LM4Yannah HidalgoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet