Professional Documents

Culture Documents

Cdtfa230p 1

Cdtfa230p 1

Uploaded by

pritumbCopyright:

Available Formats

You might also like

- Licensed Motor Vehicle Dealer Out of State Motor Vehicle Physical InspectionDocument1 pageLicensed Motor Vehicle Dealer Out of State Motor Vehicle Physical Inspectionjohn q100% (1)

- Bill of LadingDocument1 pageBill of Ladingyesenia123433% (3)

- Notification of Change of Ownership, Sale of Motor Vehicle (Form NCO)Document2 pagesNotification of Change of Ownership, Sale of Motor Vehicle (Form NCO)Nic PaidasNo ratings yet

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyFrom EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyNo ratings yet

- Alberta Bill of Sale 2014Document2 pagesAlberta Bill of Sale 2014bigbearzukeNo ratings yet

- Alberta Bill of SaleDocument2 pagesAlberta Bill of SaleDalvinder KaurNo ratings yet

- OdometerDocument1 pageOdometervarsityrunnerNo ratings yet

- Reg668 PDFDocument1 pageReg668 PDFManny TileNo ratings yet

- DR2698Document1 pageDR2698TomNo ratings yet

- Reg 168 ADocument1 pageReg 168 AManny TileNo ratings yet

- Titulo Reassignment ETS AUTOS 2024 13155Document1 pageTitulo Reassignment ETS AUTOS 2024 13155Edgar Arturo Garcia-Granados. NajeraNo ratings yet

- RamirezDocument6 pagesRamirez5kkbjnwyxqNo ratings yet

- Collector Vehicle Affidavit: InstructionsDocument1 pageCollector Vehicle Affidavit: InstructionsMiles NicholsonNo ratings yet

- Vsa 40Document2 pagesVsa 40Dewy WildonNo ratings yet

- Vehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganDocument2 pagesVehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganTjay SlackNo ratings yet

- Titulo Reassignment ETS AUTOS 2024 G34314LDocument1 pageTitulo Reassignment ETS AUTOS 2024 G34314LEdgar Arturo Garcia-Granados. NajeraNo ratings yet

- Title CalifDocument2 pagesTitle CalifkoronagozalesNo ratings yet

- Mcafee LLC: Mercury World CargoDocument12 pagesMcafee LLC: Mercury World CargoDavidNo ratings yet

- TC 96-182Document1 pageTC 96-182Anonymous L3hKyrVEpNo ratings yet

- TITULO-DE-CALIFORNIADocument2 pagesTITULO-DE-CALIFORNIAkoronagozalesNo ratings yet

- Bill of SaleDocument2 pagesBill of SaleRebecca PenarNo ratings yet

- Motor Vehicle Title Reassignment SupplementDocument2 pagesMotor Vehicle Title Reassignment SupplementBrittney WhiteNo ratings yet

- HowDocument1 pageHowHazel-mae LabradaNo ratings yet

- Titulo Duty 2008Document2 pagesTitulo Duty 2008LM MntNo ratings yet

- Vehicle Service ContractDocument13 pagesVehicle Service ContractMaldin JeremiaNo ratings yet

- Guia DHL 03.01.2024Document1 pageGuia DHL 03.01.2024Nayelli CaleroNo ratings yet

- BUN DE MANCATDocument2 pagesBUN DE MANCATkoronagozalesNo ratings yet

- Derelict Motor Vehicle CertificateDocument1 pageDerelict Motor Vehicle CertificateAplus Recycling, LLCNo ratings yet

- DFW Permit ApplicationDocument2 pagesDFW Permit ApplicationJason LaCognataNo ratings yet

- Motorized Bicycle (Moped) Instructions/Application: Please Read All Sections Before Completing ApplicationDocument1 pageMotorized Bicycle (Moped) Instructions/Application: Please Read All Sections Before Completing ApplicationjitmarineNo ratings yet

- Titulo EdgarDocument2 pagesTitulo EdgarAdrian Juarez GomezNo ratings yet

- Affidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)Document2 pagesAffidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)tortdog100% (2)

- Application For Duplicate Motor Vehicle Certificate of Title (Fillable)Document1 pageApplication For Duplicate Motor Vehicle Certificate of Title (Fillable)Courtney LedNo ratings yet

- VEHICAL TRANSIT Form - MAHARAHTRADocument2 pagesVEHICAL TRANSIT Form - MAHARAHTRAchiragNo ratings yet

- BMV 3774Document1 pageBMV 3774LEAHNo ratings yet

- Vehicle Consignment AgreementDocument2 pagesVehicle Consignment AgreementDaren ReynaNo ratings yet

- AC8050-2 Updated PAS v4 11-02-2023Document3 pagesAC8050-2 Updated PAS v4 11-02-2023RetroSoaringNo ratings yet

- TDMV 24Document1 pageTDMV 24neovondorfmamNo ratings yet

- Reg 256 FDocument1 pageReg 256 Fgeneralpublic89No ratings yet

- Bill 3 - 10-0194 - 02Document9 pagesBill 3 - 10-0194 - 02Circuit MediaNo ratings yet

- RGD-FM-029 Rev. 00 Application For Enterprise Vehicle Sticker - FillableDocument1 pageRGD-FM-029 Rev. 00 Application For Enterprise Vehicle Sticker - Fillablecarlajoy.castillo.afabNo ratings yet

- Form 28 GURMEETDocument2 pagesForm 28 GURMEETGhanshyam SinghNo ratings yet

- Certificate of Ownership Template 03Document2 pagesCertificate of Ownership Template 03RichardwilsonNo ratings yet

- Inf1125 Req For Your Own DL Card or Vehicle Reg Info RecordDocument1 pageInf1125 Req For Your Own DL Card or Vehicle Reg Info RecordSteve SmithNo ratings yet

- Chapter FDocument20 pagesChapter FJose CeceñaNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- LBU F VL MR9 VehicleTransfer PDFDocument4 pagesLBU F VL MR9 VehicleTransfer PDFRama Moorthy JeelagaNo ratings yet

- WCSM Us Automobile Ownership 2 3Document5 pagesWCSM Us Automobile Ownership 2 3Carlos HuertasNo ratings yet

- 82042Document2 pages82042theevilpeterNo ratings yet

- Qrcar001 en PDFDocument2 pagesQrcar001 en PDFSeba311No ratings yet

- Vsa 11Document1 pageVsa 11Dewy WildonNo ratings yet

- Application FOR Refund: KHLK HLKH LKHDocument1 pageApplication FOR Refund: KHLK HLKH LKHSergio M Gabriel PNo ratings yet

- California Resale CertificateDocument1 pageCalifornia Resale CertificatejesbmnNo ratings yet

- Application For Assignmentof Special Vehicle Identification NumberDocument2 pagesApplication For Assignmentof Special Vehicle Identification NumberDaddyNo ratings yet

- BMV 3724Document1 pageBMV 3724736372696264No ratings yet

- U.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To PurchaseDocument2 pagesU.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To PurchaseCustoms FormsNo ratings yet

Cdtfa230p 1

Cdtfa230p 1

Uploaded by

pritumbOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cdtfa230p 1

Cdtfa230p 1

Uploaded by

pritumbCopyright:

Available Formats

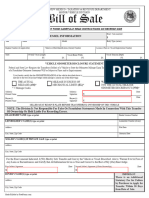

CDTFA-230-P-1 REV.

1 (9-17) STATE OF CALIFORNIA

FORM OF DECLARATION CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

PLACE OF DELIVERY OF

COMMERCIAL VEHICLES

Regulation 1823.5

DECLARATION

I HEREBY CERTIFY THAT:

(1) The

DESCRIPTION OF COMMERCIAL VEHICLE, NAME OF MANUFACTURER AND TYPE

purchased from

NAME OF SELLER

will be registered to the following address:

(2) The vehicle will be operated from the following address:

(3) The address from which the vehicle will be operated is outside the District.

(4) When not in use, the vehicle will be kept or garaged at:

(5) The vehicle will be stored, used or otherwise consumed principally outside the District.

(Check applicable box)

(6) (a) The purchaser does not hold a California seller’s permit.

(b) The purchaser holds California seller’s permit number

I understand that this declaration is for the purpose of allowing the above named seller to treat the sale of the above

described tangible personal property as exempt from the transactions (sales) tax imposed by the

District. If the property is principally stored, used or otherwise consumed in that district, the purchaser shall be liable for and

pay the use tax.

The foregoing declaration is made under penalty of perjury.

PURCHASER TITLE

SIGNATURE OF AUTHORIZED AGENT DATE

CLEAR PRINT

You might also like

- Licensed Motor Vehicle Dealer Out of State Motor Vehicle Physical InspectionDocument1 pageLicensed Motor Vehicle Dealer Out of State Motor Vehicle Physical Inspectionjohn q100% (1)

- Bill of LadingDocument1 pageBill of Ladingyesenia123433% (3)

- Notification of Change of Ownership, Sale of Motor Vehicle (Form NCO)Document2 pagesNotification of Change of Ownership, Sale of Motor Vehicle (Form NCO)Nic PaidasNo ratings yet

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyFrom EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyNo ratings yet

- Alberta Bill of Sale 2014Document2 pagesAlberta Bill of Sale 2014bigbearzukeNo ratings yet

- Alberta Bill of SaleDocument2 pagesAlberta Bill of SaleDalvinder KaurNo ratings yet

- OdometerDocument1 pageOdometervarsityrunnerNo ratings yet

- Reg668 PDFDocument1 pageReg668 PDFManny TileNo ratings yet

- DR2698Document1 pageDR2698TomNo ratings yet

- Reg 168 ADocument1 pageReg 168 AManny TileNo ratings yet

- Titulo Reassignment ETS AUTOS 2024 13155Document1 pageTitulo Reassignment ETS AUTOS 2024 13155Edgar Arturo Garcia-Granados. NajeraNo ratings yet

- RamirezDocument6 pagesRamirez5kkbjnwyxqNo ratings yet

- Collector Vehicle Affidavit: InstructionsDocument1 pageCollector Vehicle Affidavit: InstructionsMiles NicholsonNo ratings yet

- Vsa 40Document2 pagesVsa 40Dewy WildonNo ratings yet

- Vehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganDocument2 pagesVehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganTjay SlackNo ratings yet

- Titulo Reassignment ETS AUTOS 2024 G34314LDocument1 pageTitulo Reassignment ETS AUTOS 2024 G34314LEdgar Arturo Garcia-Granados. NajeraNo ratings yet

- Title CalifDocument2 pagesTitle CalifkoronagozalesNo ratings yet

- Mcafee LLC: Mercury World CargoDocument12 pagesMcafee LLC: Mercury World CargoDavidNo ratings yet

- TC 96-182Document1 pageTC 96-182Anonymous L3hKyrVEpNo ratings yet

- TITULO-DE-CALIFORNIADocument2 pagesTITULO-DE-CALIFORNIAkoronagozalesNo ratings yet

- Bill of SaleDocument2 pagesBill of SaleRebecca PenarNo ratings yet

- Motor Vehicle Title Reassignment SupplementDocument2 pagesMotor Vehicle Title Reassignment SupplementBrittney WhiteNo ratings yet

- HowDocument1 pageHowHazel-mae LabradaNo ratings yet

- Titulo Duty 2008Document2 pagesTitulo Duty 2008LM MntNo ratings yet

- Vehicle Service ContractDocument13 pagesVehicle Service ContractMaldin JeremiaNo ratings yet

- Guia DHL 03.01.2024Document1 pageGuia DHL 03.01.2024Nayelli CaleroNo ratings yet

- BUN DE MANCATDocument2 pagesBUN DE MANCATkoronagozalesNo ratings yet

- Derelict Motor Vehicle CertificateDocument1 pageDerelict Motor Vehicle CertificateAplus Recycling, LLCNo ratings yet

- DFW Permit ApplicationDocument2 pagesDFW Permit ApplicationJason LaCognataNo ratings yet

- Motorized Bicycle (Moped) Instructions/Application: Please Read All Sections Before Completing ApplicationDocument1 pageMotorized Bicycle (Moped) Instructions/Application: Please Read All Sections Before Completing ApplicationjitmarineNo ratings yet

- Titulo EdgarDocument2 pagesTitulo EdgarAdrian Juarez GomezNo ratings yet

- Affidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)Document2 pagesAffidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)tortdog100% (2)

- Application For Duplicate Motor Vehicle Certificate of Title (Fillable)Document1 pageApplication For Duplicate Motor Vehicle Certificate of Title (Fillable)Courtney LedNo ratings yet

- VEHICAL TRANSIT Form - MAHARAHTRADocument2 pagesVEHICAL TRANSIT Form - MAHARAHTRAchiragNo ratings yet

- BMV 3774Document1 pageBMV 3774LEAHNo ratings yet

- Vehicle Consignment AgreementDocument2 pagesVehicle Consignment AgreementDaren ReynaNo ratings yet

- AC8050-2 Updated PAS v4 11-02-2023Document3 pagesAC8050-2 Updated PAS v4 11-02-2023RetroSoaringNo ratings yet

- TDMV 24Document1 pageTDMV 24neovondorfmamNo ratings yet

- Reg 256 FDocument1 pageReg 256 Fgeneralpublic89No ratings yet

- Bill 3 - 10-0194 - 02Document9 pagesBill 3 - 10-0194 - 02Circuit MediaNo ratings yet

- RGD-FM-029 Rev. 00 Application For Enterprise Vehicle Sticker - FillableDocument1 pageRGD-FM-029 Rev. 00 Application For Enterprise Vehicle Sticker - Fillablecarlajoy.castillo.afabNo ratings yet

- Form 28 GURMEETDocument2 pagesForm 28 GURMEETGhanshyam SinghNo ratings yet

- Certificate of Ownership Template 03Document2 pagesCertificate of Ownership Template 03RichardwilsonNo ratings yet

- Inf1125 Req For Your Own DL Card or Vehicle Reg Info RecordDocument1 pageInf1125 Req For Your Own DL Card or Vehicle Reg Info RecordSteve SmithNo ratings yet

- Chapter FDocument20 pagesChapter FJose CeceñaNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- LBU F VL MR9 VehicleTransfer PDFDocument4 pagesLBU F VL MR9 VehicleTransfer PDFRama Moorthy JeelagaNo ratings yet

- WCSM Us Automobile Ownership 2 3Document5 pagesWCSM Us Automobile Ownership 2 3Carlos HuertasNo ratings yet

- 82042Document2 pages82042theevilpeterNo ratings yet

- Qrcar001 en PDFDocument2 pagesQrcar001 en PDFSeba311No ratings yet

- Vsa 11Document1 pageVsa 11Dewy WildonNo ratings yet

- Application FOR Refund: KHLK HLKH LKHDocument1 pageApplication FOR Refund: KHLK HLKH LKHSergio M Gabriel PNo ratings yet

- California Resale CertificateDocument1 pageCalifornia Resale CertificatejesbmnNo ratings yet

- Application For Assignmentof Special Vehicle Identification NumberDocument2 pagesApplication For Assignmentof Special Vehicle Identification NumberDaddyNo ratings yet

- BMV 3724Document1 pageBMV 3724736372696264No ratings yet

- U.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To PurchaseDocument2 pagesU.S. Customs Form: CBP Form 3347 - Declaration of Owner: For Merchandise Obtained in Pursuance of A Purchase or Agreement To PurchaseCustoms FormsNo ratings yet