Professional Documents

Culture Documents

Ey Aarsrapport 2021 22 23

Ey Aarsrapport 2021 22 23

Uploaded by

Ronald Runruil0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

ey-aarsrapport-2021-22-23

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageEy Aarsrapport 2021 22 23

Ey Aarsrapport 2021 22 23

Uploaded by

Ronald RunruilCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

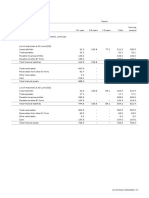

Note 2

Accounting estimates and judgements

Estimation uncertainty Leases and lease and licence agreement

The calculation of the carrying amount of certain assets and Reference is made to the description in the accounting

liabilities requires assessments, estimates and assumptions policies and note 12 regarding the estimate to treat the lease

concerning future events. and licence agreement as a sub-lease where the conditions in

the underlying agreements, including lease terms, are used

The estimates and assumptions made are based on for recognition in accordance with IFRS 16.

historical experience and other factors that Management

finds reasonable in the circumstances, but which are Trade receivables

inherently uncertain and unpredictable. The assumptions The write-down is based on historical data based on expected

may be incomplete or inaccurate, and unexpected events losses over the total term of the receivable, corrected for

or circumstances may arise. Moreover, the Group is estimates of the effect of expected changes in relevant

subject to risks and uncertainties that may entail those parameters such as economic development.

actual results differ from these estimates. EY Godkendt

Revisionspartnerselskab’ special risks are described in Reference is made to the description in notes 14 and 25

the Management’s review and note 25 to the consolidated regarding the risk in connection with trade receivables.

financial statements and the parent company financial

statements. Professional liability claims

For professional liability claims, a provision has been made

It may be necessary to change previous estimates due to for losses on known and potential claims for damages based

changes in the conditions on which these previous estimates on an assessment of the known facts of the individual cases.

were based or due to new knowledge or subsequent events. The provision relates to both assurance engagements and

consultant’s liability and is a result of either a judgment or

Estimates that are significant to the financial reporting are criticism from a public authority.

made by determining revenue and selling price on contract

The outcome and timing of the completion of compensation

Recognition of revenue and selling price of contract cases are inherently uncertain.

assets

Contract assets relating to services agreed but not completed

are measured at the balance sheet date at the selling price

of the work performed based on the stage of completion of

the services, which is determined based on time spent and

an assessment of the fee value thereof. The assessment of

the stage of completion and thus revenue relating to contract

assets are part of the continuous management control and

budgetary control over the individual projects, which reduces

the uncertainty related to the determination thereof.

Reference is made to note 15 for an overview of contract

assets at 30 June.

Annual Report 2021/2022 | 23

You might also like

- Role of Torts in The Protection of The EnvironmentDocument5 pagesRole of Torts in The Protection of The EnvironmentShreyasree PaulNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-8Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-8Ronald RunruilNo ratings yet

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

- SSS R1A FormDocument20 pagesSSS R1A FormAna Padrillan50% (10)

- Ar-18 7Document5 pagesAr-18 7jawad anwarNo ratings yet

- HDEC 2021 Annual ReportDocument174 pagesHDEC 2021 Annual Reportagust.abcNo ratings yet

- SECL - Audit Report - FY22 - Sign - ENGDocument101 pagesSECL - Audit Report - FY22 - Sign - ENGJAMES ANDROE TANNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Accounting Standard (AS) 29Document30 pagesProvisions, Contingent Liabilities and Contingent Assets: Accounting Standard (AS) 29Altamash ShaikhNo ratings yet

- Accounting PronouncementDocument179 pagesAccounting PronouncementAbhishek KaskarNo ratings yet

- Spotlight On Key Judgements and EstimatesDocument11 pagesSpotlight On Key Judgements and EstimatesMiko Duano SinagaNo ratings yet

- EIA (Assignment 02)Document7 pagesEIA (Assignment 02)Eshfaque Alam DastagirNo ratings yet

- HSS (F) 18/2000: FRS 12 Provisions, Contingent Liabilities and Contingent Assets: Applicability To HSS BodiesDocument29 pagesHSS (F) 18/2000: FRS 12 Provisions, Contingent Liabilities and Contingent Assets: Applicability To HSS BodiesAndrij Lebid'No ratings yet

- Accounting Implications of The Impacts of COVID 19.Document18 pagesAccounting Implications of The Impacts of COVID 19.nouman shakeelNo ratings yet

- Bms 1a Parangat Kapur 18100Document24 pagesBms 1a Parangat Kapur 18100Parangat KapurNo ratings yet

- SARHAD OpinionDocument2 pagesSARHAD OpinionExtra KhanNo ratings yet

- Reliance General Insurance Company Limited 2020-21Document70 pagesReliance General Insurance Company Limited 2020-21yaminp292No ratings yet

- CFAP 6 Winter 2021Document10 pagesCFAP 6 Winter 2021os96529No ratings yet

- PwC's Business Combinations and Noncontrolling InterestsDocument394 pagesPwC's Business Combinations and Noncontrolling InterestsVinayak SatheeshNo ratings yet

- Provisions, Contingent Liabilities and Contingent AssetsDocument36 pagesProvisions, Contingent Liabilities and Contingent Assetspks009No ratings yet

- Accounting Standard 4Document9 pagesAccounting Standard 4api-3828505No ratings yet

- Dongyue Report 2023 + UpdateDocument85 pagesDongyue Report 2023 + UpdateRobert ManjoNo ratings yet

- AuditingDocument115 pagesAuditingWen Xin GanNo ratings yet

- 2021 LG Chem Consolidated Financial Statements enDocument113 pages2021 LG Chem Consolidated Financial Statements enAyushika SinghNo ratings yet

- Auditors Report StandaloneDocument12 pagesAuditors Report StandalonezendeexNo ratings yet

- Us 2018 20 Long Duration Contracts Asu 2018 12 PDFDocument110 pagesUs 2018 20 Long Duration Contracts Asu 2018 12 PDFfsdNo ratings yet

- Lecture - 14 - Letter of Representation For Co. BangladeshDocument4 pagesLecture - 14 - Letter of Representation For Co. BangladeshSourav MahadiNo ratings yet

- Audit-Report-Sena KaylanDocument50 pagesAudit-Report-Sena KaylanSohag AMLNo ratings yet

- Hyundai Motor Company Annual 2022 Consolidated FinalDocument92 pagesHyundai Motor Company Annual 2022 Consolidated Finalsreejithbhasi128No ratings yet

- Pwcinsurguide 0323Document395 pagesPwcinsurguide 0323DanahNo ratings yet

- Independent Auditors' Report: Basis For OpinionDocument10 pagesIndependent Auditors' Report: Basis For OpiniondeepakNo ratings yet

- Audit, Assurance and Related Services: Page 1 of 10Document10 pagesAudit, Assurance and Related Services: Page 1 of 10ANo ratings yet

- LG Chem 2020 Contingent Financial StatementsDocument102 pagesLG Chem 2020 Contingent Financial StatementsAyushika SinghNo ratings yet

- LG Electronics Inc.: Separate Financial Statements December 31, 2022 and 2021Document117 pagesLG Electronics Inc.: Separate Financial Statements December 31, 2022 and 2021ramannamj4No ratings yet

- Long Term Debt ProgramDocument10 pagesLong Term Debt ProgramSyarif Muhammad Hikmatyar100% (1)

- As 29Document13 pagesAs 29Mansi NigadeNo ratings yet

- 2021 Audit ReportDocument79 pages2021 Audit ReportvishalNo ratings yet

- 5.19 (S) Commitments: Page 1 of 5 Print Documents... Printer FriendlyDocument5 pages5.19 (S) Commitments: Page 1 of 5 Print Documents... Printer FriendlysahnojNo ratings yet

- 1a. Insurance-Contracts-Accounting-Guide PWCDocument375 pages1a. Insurance-Contracts-Accounting-Guide PWCctprimaNo ratings yet

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- 15 Completing The Audit and Post Audit Responsibilities Final PDFDocument9 pages15 Completing The Audit and Post Audit Responsibilities Final PDFLaezelie PalajeNo ratings yet

- Group Accounting Principles and NotesDocument8 pagesGroup Accounting Principles and Notesفراس عبدالله نجمNo ratings yet

- Financial Instruments: A IntroductionDocument78 pagesFinancial Instruments: A IntroductionMeeroButtNo ratings yet

- Hyundai Motor Company Annual 2021 Consolidated FinalDocument91 pagesHyundai Motor Company Annual 2021 Consolidated Finalgarysingh187westNo ratings yet

- Selina Investor PresentationDocument63 pagesSelina Investor PresentationLewisNo ratings yet

- Common ASC 606 Issues Asset ManagementDocument11 pagesCommon ASC 606 Issues Asset ManagementDenzCruzNo ratings yet

- Audit AssignmentDocument8 pagesAudit AssignmentLoVe CoOkinGNo ratings yet

- Accounting Standard (AS) 29 Provisions, Contingent Liabilities and Contingent AssetsDocument21 pagesAccounting Standard (AS) 29 Provisions, Contingent Liabilities and Contingent AssetsBrijesh MeenaNo ratings yet

- AS 4 Contingencies and Events Occurring After The Balance Sheet DateDocument8 pagesAS 4 Contingencies and Events Occurring After The Balance Sheet DateChandan KumarNo ratings yet

- Audit and AssuranceDocument11 pagesAudit and AssurancequratulainNo ratings yet

- Aaa Standards by BeingaccaDocument9 pagesAaa Standards by Beingaccakshama3102100% (1)

- Ias 37 - Provisions Contingent Liabilities and Student VersionDocument7 pagesIas 37 - Provisions Contingent Liabilities and Student Versionbianca8abrahamNo ratings yet

- Bankruptcies and Liquidations - 2022Document120 pagesBankruptcies and Liquidations - 2022Vinayak SatheeshNo ratings yet

- 7 Liability Recognition and Nonowner FinancingDocument69 pages7 Liability Recognition and Nonowner FinancingSysy VizirNo ratings yet

- 66638bos53803 cp1Document170 pages66638bos53803 cp1417 Rachit SinglaNo ratings yet

- Ian - Chapter 3 #11 ValuationDocument11 pagesIan - Chapter 3 #11 ValuationBae Xu KaiNo ratings yet

- Notes To Financial StatementDocument3 pagesNotes To Financial StatementDawn Juliana AranNo ratings yet

- AS29Document19 pagesAS29sonuNo ratings yet

- Auditing 4 Chapter 4Document6 pagesAuditing 4 Chapter 4Mohamed DiabNo ratings yet

- AF304 Major Assignment DraftDocument25 pagesAF304 Major Assignment DraftShilpa KumarNo ratings yet

- FR RTP Nov 23Document66 pagesFR RTP Nov 23Kartikeya BansalNo ratings yet

- PSAK 72 - Revenue From Contracts With Customers: A Comprehensive Look at The New Revenue ModelDocument23 pagesPSAK 72 - Revenue From Contracts With Customers: A Comprehensive Look at The New Revenue ModelvarenmoNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Ey Aarsrapport 2021 22 39Document1 pageEy Aarsrapport 2021 22 39Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 40Document1 pageEy Aarsrapport 2021 22 40Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 36Document1 pageEy Aarsrapport 2021 22 36Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 35Document1 pageEy Aarsrapport 2021 22 35Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 38Document1 pageEy Aarsrapport 2021 22 38Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 37Document1 pageEy Aarsrapport 2021 22 37Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 11Document1 pageEy Aarsrapport 2021 22 11Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 14Document1 pageEy Aarsrapport 2021 22 14Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 10Document1 pageEy Aarsrapport 2021 22 10Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 7Document1 pageEy Aarsrapport 2021 22 7Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Brand Plan Workshop 2Document1 pageBrand Plan Workshop 2Ronald RunruilNo ratings yet

- Brand Plan Workshop 8Document1 pageBrand Plan Workshop 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-5Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-5Ronald RunruilNo ratings yet

- BrandVal JBM10Document37 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- Brand Plan Workshop 4Document1 pageBrand Plan Workshop 4Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-4Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-4Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-45Document1 page(ES) +Mr+Jeff +Business+in+a+Box-45Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-1Document1 page(ES) +Mr+Jeff +Business+in+a+Box-1Ronald RunruilNo ratings yet

- BPTECHENDocument2 pagesBPTECHENRonald RunruilNo ratings yet

- BrandVal JBM10Document38 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- Academic Workbook Meddent v1.3 1Document52 pagesAcademic Workbook Meddent v1.3 1Ronald RunruilNo ratings yet

- Workbook User Guide en 2023Document27 pagesWorkbook User Guide en 2023Ronald RunruilNo ratings yet

- Risk Management PowerpointDocument51 pagesRisk Management PowerpointAbdul Jalil Sohel100% (1)

- Refugee ProtectionDocument21 pagesRefugee ProtectionGyzylgul MamedovaNo ratings yet

- Garcia Vs VazquezDocument1 pageGarcia Vs VazquezAbrahamNo ratings yet

- Experiencing The Border The Lushai Peopl-1Document17 pagesExperiencing The Border The Lushai Peopl-1new backupNo ratings yet

- Classroom Objects Vocabulary Esl Crossword Puzzle Worksheets For KidsDocument4 pagesClassroom Objects Vocabulary Esl Crossword Puzzle Worksheets For KidsVIVIANANo ratings yet

- Philippine Bank of Communications v. CIRDocument3 pagesPhilippine Bank of Communications v. CIRDaLe AparejadoNo ratings yet

- Contract DoDocument2 pagesContract DoLeu SantosNo ratings yet

- Code Description Remark 4 3 3 2 3 2 3Document1 pageCode Description Remark 4 3 3 2 3 2 3Aljo FernandezNo ratings yet

- SEBI Grade A Phase I and Phase II Course: Facebook: TelegramDocument15 pagesSEBI Grade A Phase I and Phase II Course: Facebook: TelegramartizutshiNo ratings yet

- Hse ManualDocument10 pagesHse ManualJkNo ratings yet

- Week 6Document2 pagesWeek 6Izabella KoontzNo ratings yet

- Using Statutory and Case Law, Discuss in Details The Principle of Relevancy. (25 Marks)Document7 pagesUsing Statutory and Case Law, Discuss in Details The Principle of Relevancy. (25 Marks)Brian Abaga100% (2)

- Solution Manual For Advanced Accounting 7th Edition Debra C Jeter Paul K ChaneyDocument29 pagesSolution Manual For Advanced Accounting 7th Edition Debra C Jeter Paul K Chaneybraidscanty8unib100% (45)

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Ja ANNULMENTDocument4 pagesJa ANNULMENTChameh EstebaNo ratings yet

- English Diary 2021Document166 pagesEnglish Diary 2021Akash guptaNo ratings yet

- Essay On Counsel de OfficioDocument1 pageEssay On Counsel de OfficioYanaKarununganNo ratings yet

- The Holy Prophet (SAW) As PeacemakerDocument2 pagesThe Holy Prophet (SAW) As Peacemakerwaqar100% (3)

- Wills and Succession 2Document22 pagesWills and Succession 2lex omniaeNo ratings yet

- USA V Johnson Indictment NMDocument3 pagesUSA V Johnson Indictment NMFile 411No ratings yet

- Mgt211 Updated Quiz 1 2021 We'Re David WorriorsDocument18 pagesMgt211 Updated Quiz 1 2021 We'Re David WorriorsDecent RajaNo ratings yet

- Graphical Solution of LP in Two Variables Example 1 (3.1-9)Document4 pagesGraphical Solution of LP in Two Variables Example 1 (3.1-9)Sahil PuniaNo ratings yet

- Virtue Ethics in NursingDocument4 pagesVirtue Ethics in NursingChubs Riego100% (1)

- $aneen ProjectDocument16 pages$aneen ProjectFirasNo ratings yet

- რბილი ძალაDocument177 pagesრბილი ძალაKoba KereselidzeNo ratings yet

- Ajay Sharma Anticipatory Bail Sonika 2017Document31 pagesAjay Sharma Anticipatory Bail Sonika 2017Anirudh Kaushal50% (2)

- Tradt Strategic StudiesDocument11 pagesTradt Strategic StudiesCtAtiqahNo ratings yet

- Vacancy For A Technician LumwanaDocument3 pagesVacancy For A Technician LumwanaMorassa ChonaNo ratings yet